Score

Luno TradeFx

China|2-5 years|

China|2-5 years| https://lunotradefx.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaUsers who viewed Luno TradeFx also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

lunotradefx.com

Server Location

United States

Website Domain Name

lunotradefx.com

Server IP

198.54.114.159

Company Summary

| Information | Details |

| Company Name | Luno TradeFx |

| Registered Country/Region | China |

| Established for | 1-2 years |

| Regulation | Not regulated |

| Tradable Instruments | Mainly on tradable assets like Bitcoin and other cryptocurrencies |

| Trading Platforms | N/A |

| Minimum Deposit | No requirement |

| Maximum Leverage | N/A |

| Account Types | Beginner (24 hours), Pro (2 days), Gold (3 days), and Ultimate (3 days) |

| Bonus | A two-level referral commission structure of 4% and 1% |

| Deposit & Withdrawal | Not charge withdrawal fees |

| Customer Support | N/A |

Due to Luno TradeFxs official website (https://lunotradefx.com/) is temporarily closed, we can only collect related information from other sites, having a general understanding of this broker.

Overview of Luno TradeFx

Luno TradeFx is a China-based trading platform that has been established for 1-2 years. It offers a wide range of tradable instruments, with a primary focus on assets like Bitcoin and other cryptocurrencies. Luno TradeFx offers different account types without any minimum deposit requirement to cater to various trading needs. Additionally, Luno TradeFx provides a two-level referral commission structure of 4% and 1% for users who refer others to the platform. When it comes to deposit and withdrawal processes, Luno TradeFx claims that it does not charge any withdrawal fees.

Since its official website is closed and it is a newly established dealer, there is little information about it on the Internet, so it is difficult for us to grasp specific details about trading platforms, maximum leverage, spreads, commission fees, and deposit & withdrawal methods.

Please note that as Luno TradeFx is not regulated, it is essential to conduct thorough research and consider the associated risks before engaging in any trading activities on this platform.

Is Luno TradeFx legit or a scam?

Since the official website of Luno TradeFx is currently inaccessible, we have limited information available. However, it is important to note that the legitimacy and credibility of a broker are typically determined by their regulatory status. Reputable brokers are usually regulated by recognized regulatory agencies such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC).

It is crucial to emphasize that Luno TradeFx is not authorized or regulated by any regulatory authorities. Therefore, it is advised to avoid trading with this broker as their lack of regulation raises concerns about the safety and security of funds. Unregulated brokers often operate anonymously and can potentially disappear without notice, putting investors at significant risk.

To protect your funds and ensure a secure trading experience, it is strongly recommended to exercise a higher level of caution when dealing with unregulated brokers. Conduct thorough due diligence, research, and consider alternative regulated brokers before making any investments. Your financial safety should always be a top priority.

Pros and Cons

Luno TradeFx is a Forex broker that offers a wide range of trading instruments. However, Luno TradeFx has multiple drawbacks that should be considered. Firstly, the accessibility of the official Luno TradeFx website may be an issue. If the website is inaccessible or unreliable, it can significantly hinder traders' ability to access their accounts, perform transactions, and obtain important information. This can lead to frustration and inconvenience for users.

Additionally, the platform lacks specific regulations, which can raise concerns about the safety and security of traders' funds. Without proper oversight from a reputable regulatory body, there may be increased risks associated with financial transactions and potential lack of investor protection.

The platform lacks essential information on crucial aspects such as minimum deposit requirements, spreads, and maximum leverage. This lack of transparency makes it difficult for traders to assess the costs and risks associated with their trades accurately.

Lastly, the platform's customer support is limited, which can be problematic for traders who require timely assistance or have urgent inquiries. Insufficient customer support may result in delays in issue resolution or lack of satisfactory responses to users' concerns.

| Pros | Cons |

| Wide range of trading instruments available | No specific regulation |

| Not charge withdrawal fees | lack of essential information on spreads, and maximum Leverage |

| Diverse account types | Inaccessible official website |

| No requirement of minimum deposit | Limited customer support |

Market Instruments

Luno TradeFx positions itself as a comprehensive trading platform that grants users access to multiple exchanges and markets, with a particular emphasis on tradable assets such as Bitcoin and other cryptocurrencies. While Luno TradeFx does not explicitly outline its offerings, it may be helpful to consider some commonly available trading products offered by other platforms as reference:

1. Forex Currency Pairs: Traders can take advantage of the dynamic forex market to speculate on currency exchange rate movements and potentially profit from fluctuations in currency values.

2. Indices: Traders have the opportunity to trade on the price movements of various indices, allowing them to diversify their investments and capitalize on broader market trends.

3. Commodities: This category encompasses a range of tradable assets, including precious metals like gold and silver, energy resources such as oil and natural gas, agricultural products, and more. Traders can benefit from price fluctuations in commodities and potentially leverage market trends to their advantage.

4. Shares: Trading shares enables traders to participate in equity markets, allowing them to take positions based on their analysis of specific companies' performance and prevailing market conditions.

5. Futures: Trading futures contracts provides opportunities for hedging, speculation, or risk management. Traders can engage in contracts that obligate them to buy or sell assets at predetermined prices and dates, offering potential profit opportunities from price movements.

Account Types

Luno TradeFx offers four distinct mining plans instead of traditional account types. These plans are designed to cater to different investment preferences and time frames. The available plans include Beginner (24 hours), Pro (2 days), Gold (3 days), and Ultimate (3 days). Each plan requires a specific minimum initial deposit: $500 for Beginner, $1,000 for Pro, $5,000 for Gold, and $10,000 for Ultimate. Additionally, there are maximum deposit limits associated with each plan: $10,000 for Beginner, $30,000 for Pro, $100,000 for Gold, and unlimited for Ultimate.

How to Open an Account?

Since Luno TradeFxs official website is inaccessible now, and how to open an account is also hard to explain clearly. It is recommended to cooperate with other brokers with clear information. Here are the general steps for opening an account.

1. Visit the website: Go to the official brokers website using your web browser. Make sure you are using the correct website address to avoid any potential phishing scams.

2. Sign up for an account: Look for the “Sign Up” or “Register” button on the brokers homepage and click on it. You will typically be prompted to enter your email address and create a password for your account.

3. Verify your email: After signing up, the broker will send a verification email to the email address you provided during the registration process. Check your email inbox and click on the verification link to confirm your email.

4. Complete the KYC process: Most reputable cryptocurrency exchanges have a Know Your Customer (KYC) process in place. This process usually requires you to provide identification documents to verify your identity. Follow the instructions provided by the broker to complete the KYC process.

5. Set up two-factor authentication (2FA): Two-factor authentication adds an extra layer of security to your account. It typically involves linking your account to a mobile app, such as Google Authenticator or Authy, to generate a unique code for login verification. Enable 2FA to enhance the security of the brokers account.

6. Deposit funds: Once your account is verified, you can proceed to deposit funds into your account.

7. Start trading: After depositing funds, you can explore the trading features. You can buy, sell, and trade cryptocurrencies based on the available options on the platform.

Commissions

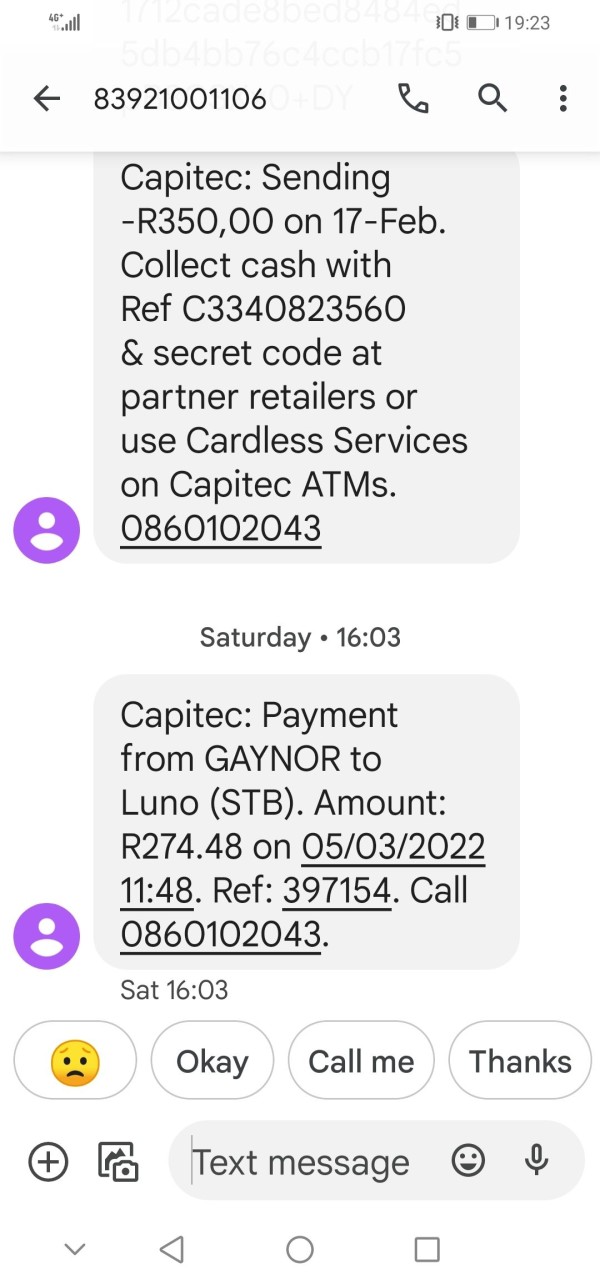

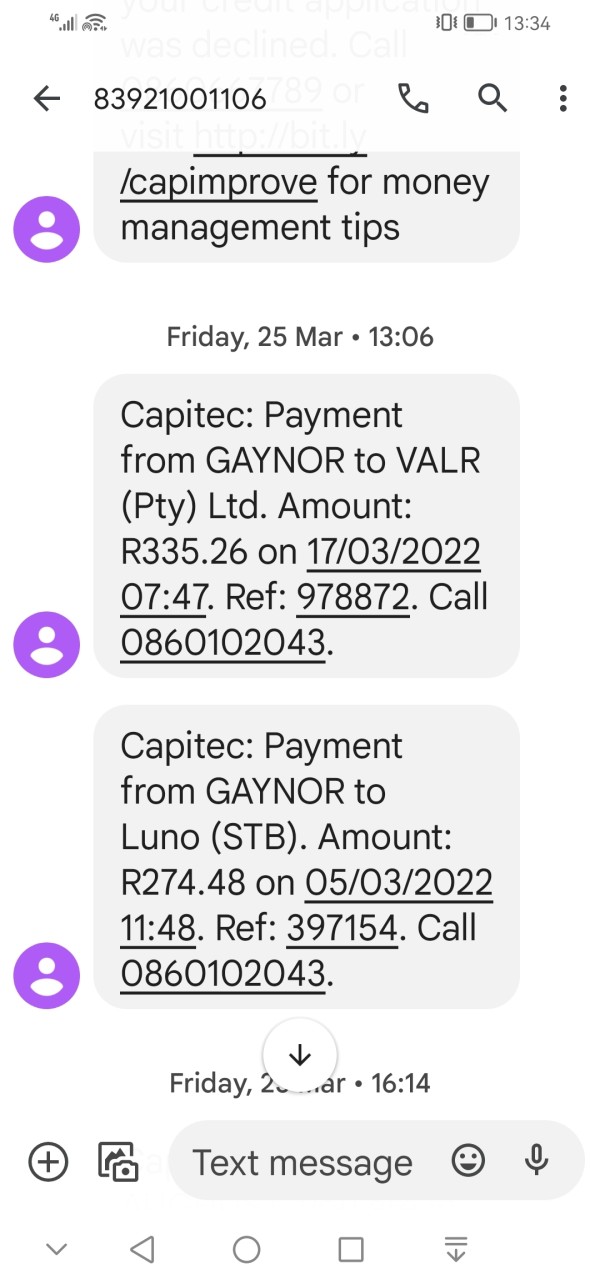

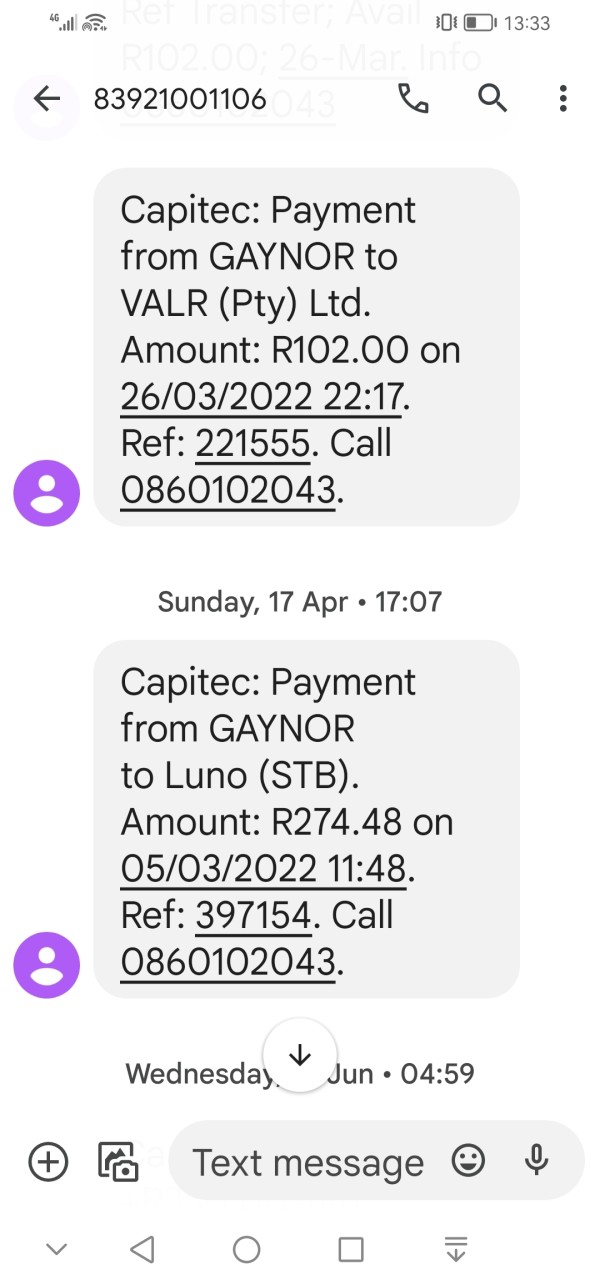

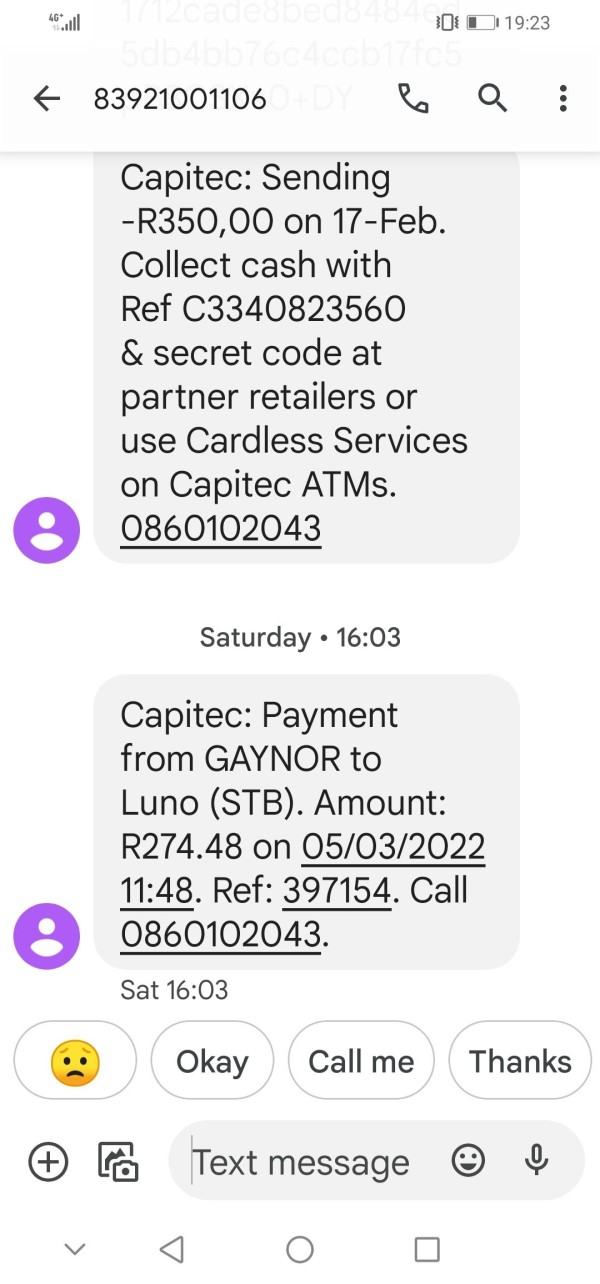

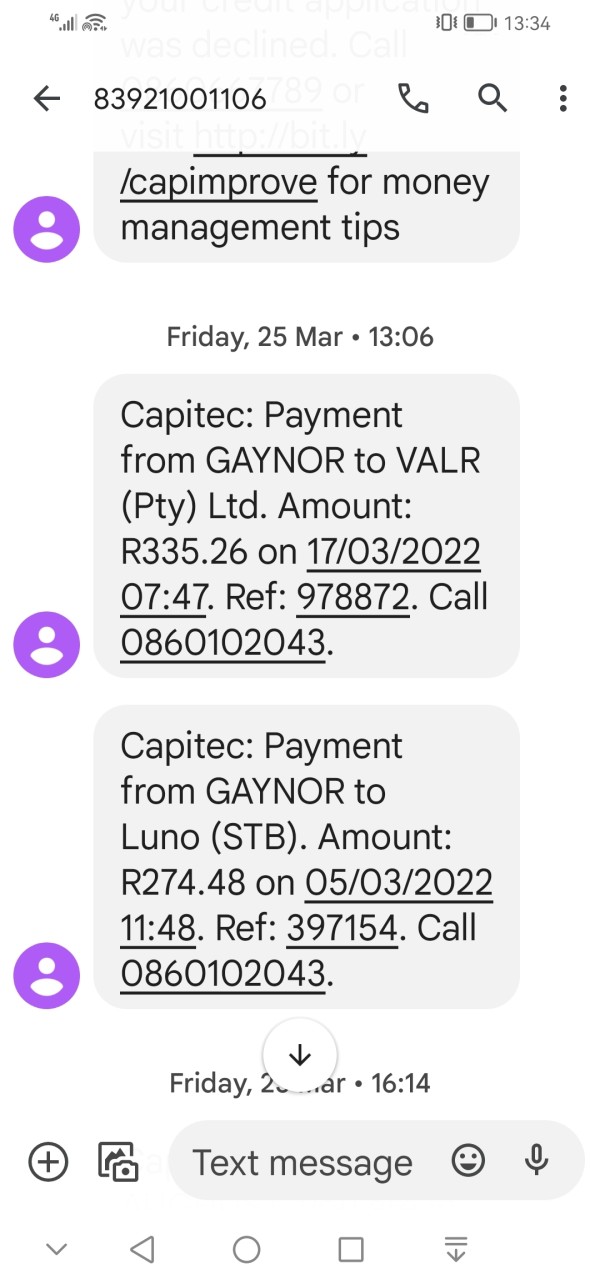

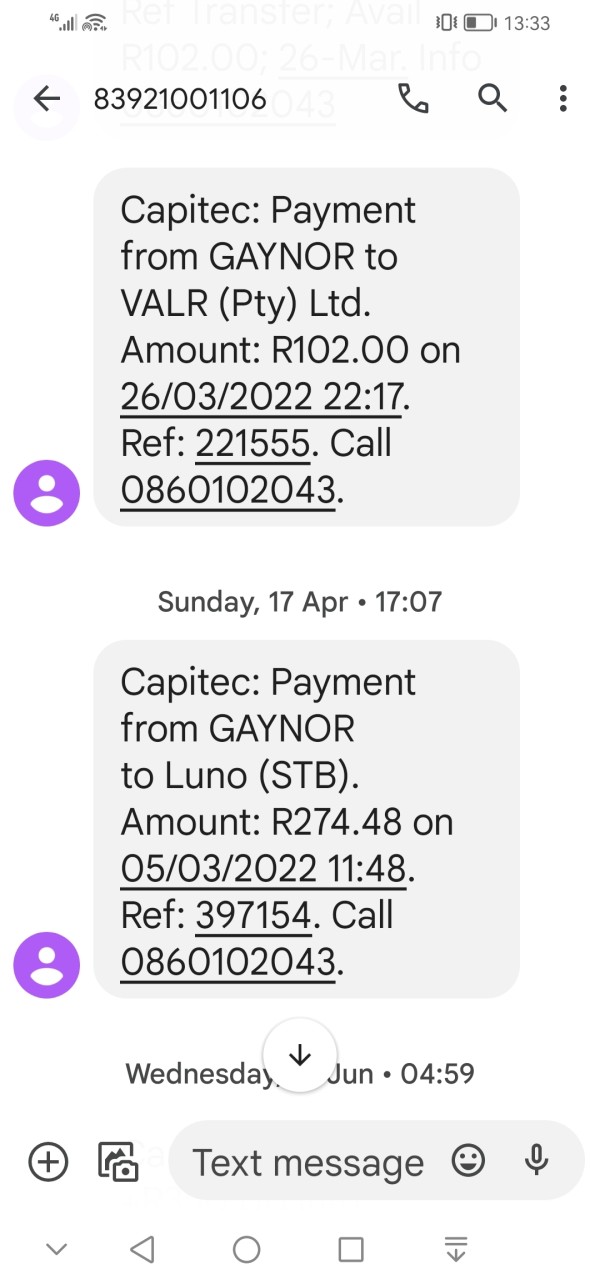

Luno TradeFx's official website indicates that it offers a two-level referral commission structure. The first level provides a referral commission of 4%, while the second level offers a lower commission of 1%. The broker emphasizes that when an individual registers through your referral link, they become your direct referral. Consequently, you will receive a 4% referral commission for every deposit made by your direct referral from their wallet.

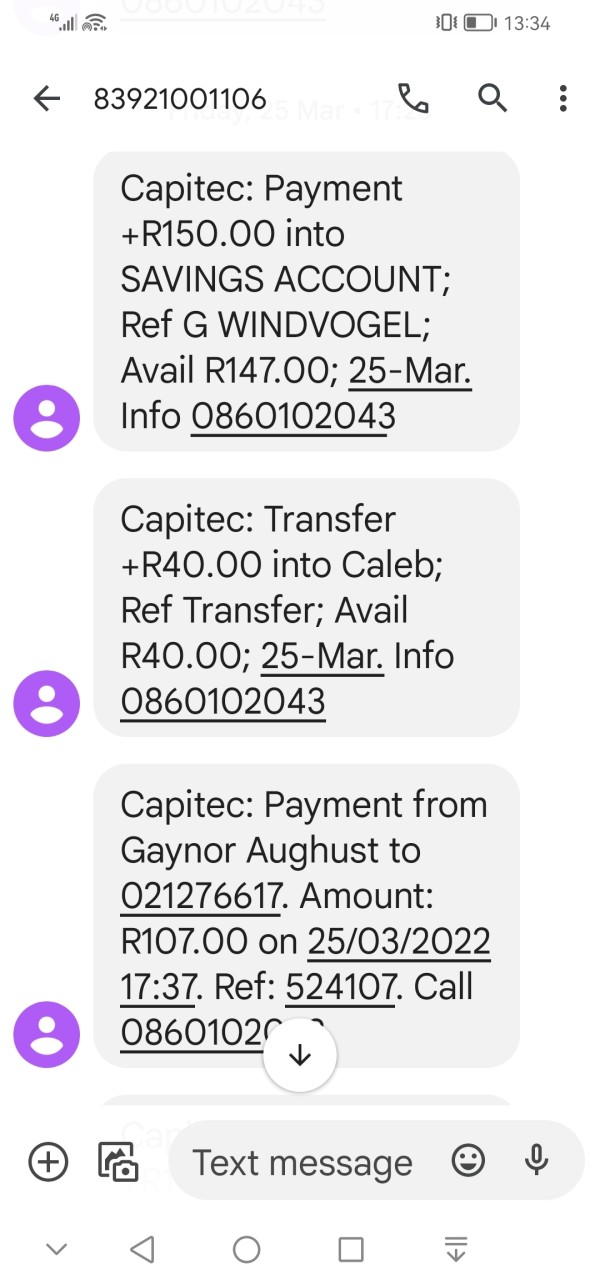

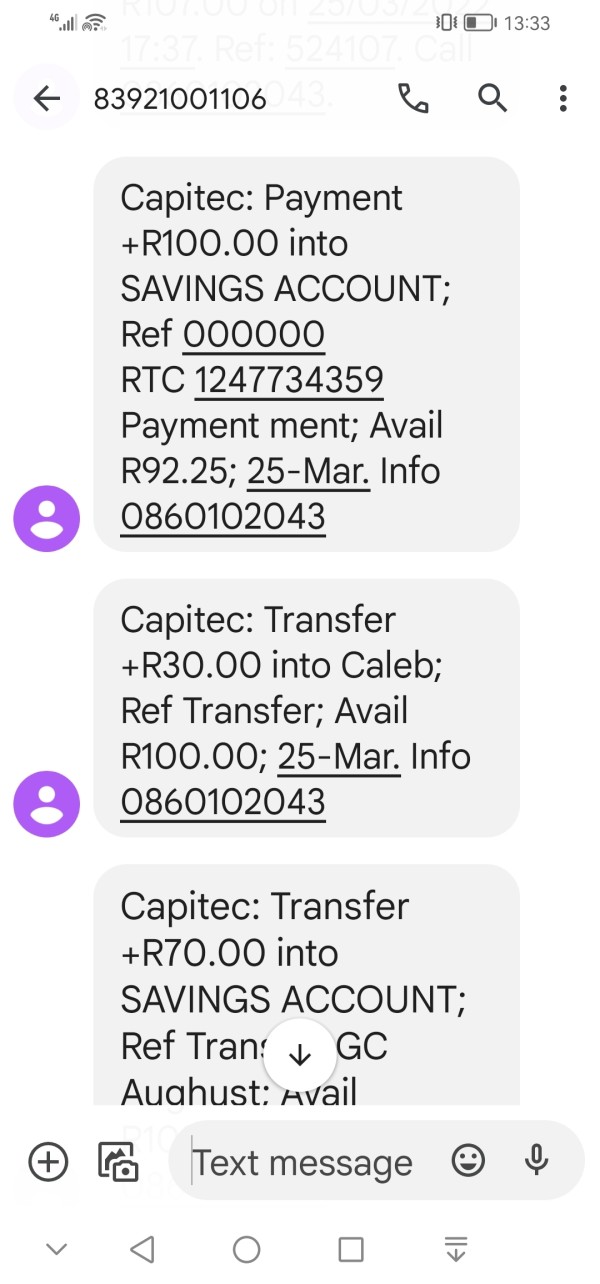

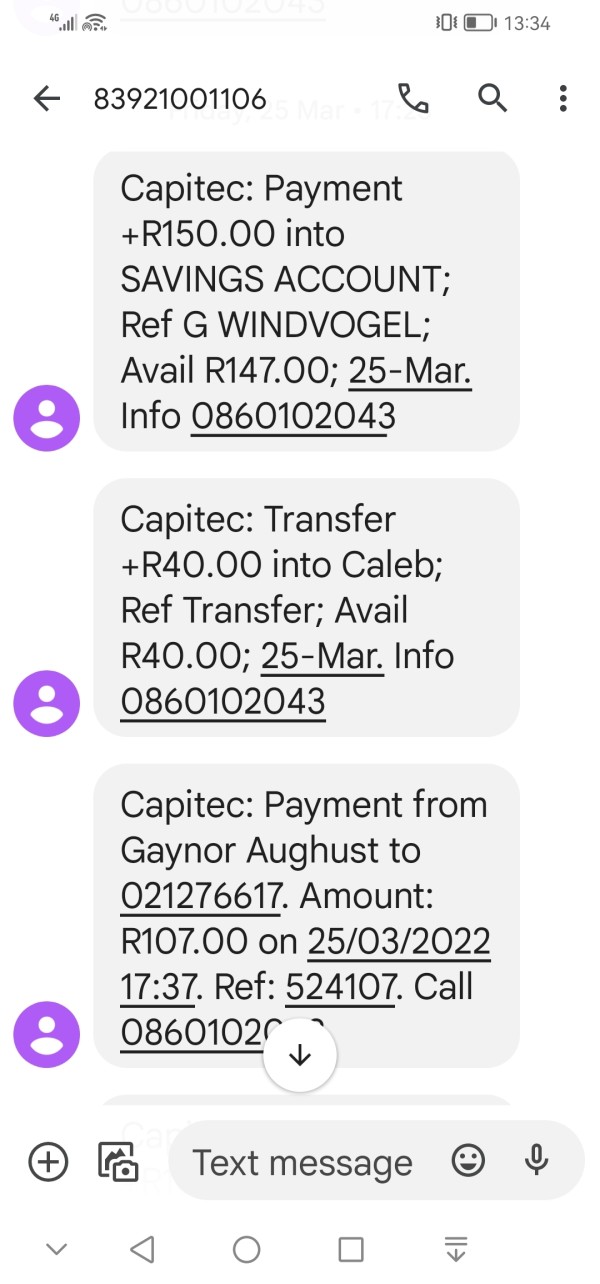

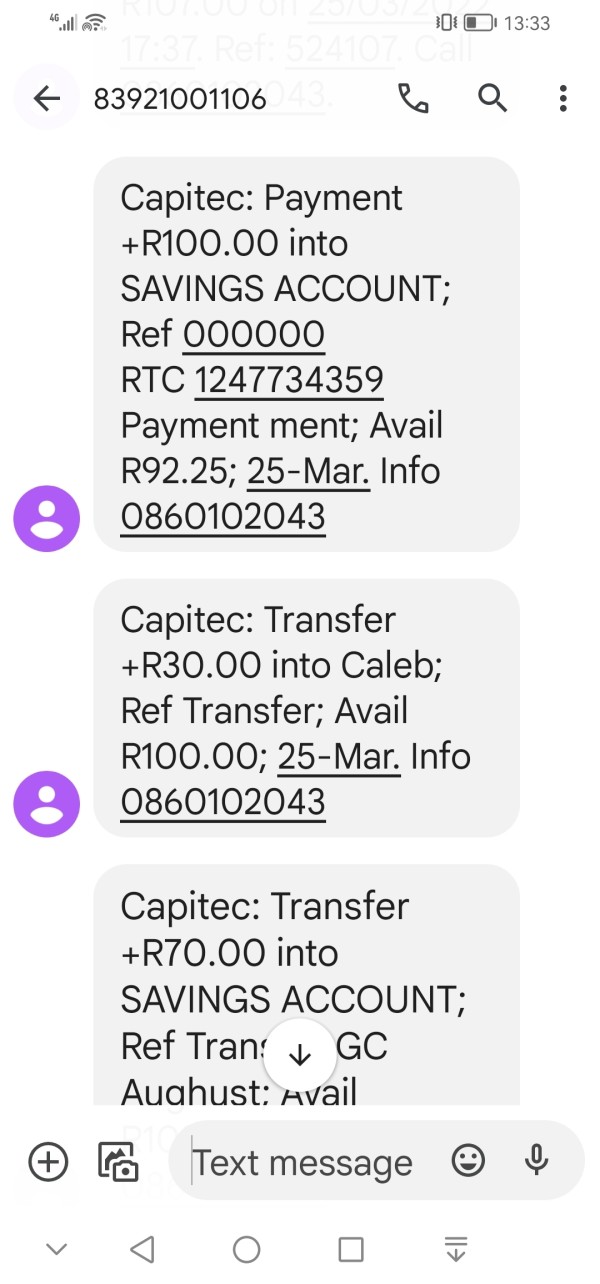

Deposit & Withdrawal

It seems that specific information regarding deposit and withdrawal methods is not readily available on Luno TradeFx's official website without logging in. However, according to the information provided on the website, the broker claims to offer instant withdrawals with no minimum withdrawal amount and no fees for withdrawals of hourly interest.

It is important to note that while this information is stated on the website, it is advisable to exercise caution and conduct thorough research before engaging with any broker. It is recommended to review the terms and conditions, as well as user reviews, to ensure transparency and reliability of the broker's services, including their deposit and withdrawal processes.

Additionally, it is always a good practice to verify the information by contacting the broker directly or seeking clarification through their customer support channels to confirm the specific details and requirements related to deposits and withdrawals.

Conclusion

Overall, while Luno TradeFx offers a diverse range of trading instruments, it is important to consider the lack of specific regulation, incomplete information, limited website accessibility, and customer support as potential drawbacks when evaluating the platform. Traders should carefully weigh these factors against their individual needs and preferences before deciding to use the platform for their trading activities.

FAQs

Q: What is Luno TradeFx?

A: Luno TradeFx is an online trading platform that allows users to trade various financial instruments, including cryptocurrencies, forex, commodities, and indices.

Q: Can I trade cryptocurrencies on Luno TradeFx?

A: Yes, Luno TradeFx supports cryptocurrency trading. You can trade popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more.

Q: How do I sign up for Luno TradeFx?

A: As its website is difficult to access, it is advisable for you to choose other brokers which are more reliable.

Q: Is there a minimum deposit required to start trading on Luno TradeFx?

A: No, there is not a minimum deposit requirement to start trading on Luno TradeFx.

Q: What payment methods are accepted on Luno TradeFx?

A:As its website is difficult to access, we can not get any specific information about its payment methods.

Q: Does Luno TradeFx provide customer support?

A: As its website is difficult to access, we can not get any specific information about its customer support.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now