Score

Bftbot

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://bftbot.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed Bftbot also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

bftbot.com

Server Location

United States

Website Domain Name

bftbot.com

Server IP

162.0.215.180

Company Summary

| Bftbot | Basic Information |

| Company Name | Bftbot |

| Founded | 2017 |

| Headquarters | United Kingdom |

| Regulations | Not regulated |

| Tradable Assets | Varied |

| Account Types | Standard, Premium, VIP |

| Minimum Deposit | £100 - £10,000 |

| Maximum Leverage | 1:100 |

| Spreads | Variable |

| Commission | Variable |

| Deposit Methods | Cards, Bank Wire, E-Wallets |

| Trading Platforms | MT4, Bftbot WebTrader |

| Customer Support | Phone, Email |

| Education Resources | Webinars, Tutorials, Blog, Glossary |

| Bonus Offerings | None |

Overview of Bftbot

Bftbot, founded in 2017 and headquartered in the United Kingdom, is an online trading platform that offers access to a diverse range of financial instruments, including forex, cryptocurrencies, commodities, indices, and shares. While it provides traders with a variety of account types and the widely-used MetaTrader 4 (MT4) platform, a significant concern lies in its lack of regulation. Operating without oversight from recognized financial regulatory authorities, Bftbot raises doubts about the safety of traders' investments and the transparency of its business practices.

The broker caters to traders of different experience levels, offering accounts with varying minimum deposit requirements, spreads, and leverage options. It also provides educational resources, such as webinars, tutorials, a trading blog, and a glossary, to help traders enhance their skills. However, the absence of regulation remains a substantial drawback, as it may limit the avenues for dispute resolution and hinder the establishment of trust with potential clients. Consequently, those considering Bftbot as their trading platform should exercise caution and conduct thorough research before engaging with its services.

Is Bftbot Legit?

Bftbot is not regulated by any recognized financial regulatory authority. As an unregulated broker, it operates without oversight from regulatory bodies that are responsible for ensuring compliance with industry standards and protecting the interests of traders. This lack of regulation raises concerns about the safety and security of funds, as well as the transparency of the broker's business practices.

Trading with an unregulated broker like Bftbot carries inherent risks. Without regulatory supervision, there may be limited avenues for dispute resolution, and traders may face challenges in seeking recourse in case of any issues or disputes. Additionally, unregulated brokers may not be subject to stringent financial and operational standards, potentially leading to inadequate client fund protection and unfair trading practices.

Pros and Cons

Bftbot offers a mix of advantages and disadvantages for traders to consider. On the positive side, the platform provides a wide selection of trading instruments, encompassing major asset classes like forex, cryptocurrencies, and commodities. Additionally, traders can choose from different account types that cater to varying experience levels and trading preferences. However, significant concerns revolve around the lack of regulation, which raises questions about the security of funds and the transparency of business practices. Spreads can also be unpredictable, potentially impacting the cost of trading, and commissions vary depending on the asset and account type. While Bftbot offers educational resources to help traders improve their skills, the absence of regulation remains a substantial drawback that traders should carefully weigh before engaging with this platform.

| Pros | Cons |

|

|

|

|

|

|

|

Trading Instruments

Bftbot provides a diverse selection of trading instruments, allowing traders to explore various financial markets and diversify their portfolios. The available trading instruments encompass the following categories:

1. Forex: Bftbot offers an extensive range of over 60 currency pairs for Forex trading. Traders can engage in trading major currency pairs like EUR/USD and USD/JPY, as well as minor and exotic pairs. This variety allows traders to participate in global Forex markets and potentially benefit from currency price movements.

2. Indices: Bftbot provides access to trading various stock indices, including well-known indices like the US S&P 500, the UK FTSE 100, and the German DAX. Trading indices enables traders to speculate on the performance of a basket of stocks, reflecting the overall health of the associated markets.

3. Commodities: Bftbot offers trading opportunities in the commodities market. Traders can engage in trading popular commodities like gold, silver, oil, and gas. The ability to trade commodities allows traders to diversify their portfolios and take positions on the price fluctuations of these valuable assets.

4. Cryptocurrencies: Bftbot caters to cryptocurrency enthusiasts by offering a selection of cryptocurrencies for trading. This includes well-known digital assets like Bitcoin, Ethereum, and Litecoin. Cryptocurrency trading provides exposure to the highly volatile and rapidly evolving crypto market.

5. Shares: Bftbot offers a broad array of shares, encompassing stocks from the US, UK, and Europe. Trading shares allows traders to speculate on the performance of individual companies or corporations, contributing to portfolio diversification.

The availability of these trading instruments ensures that traders can explore and adapt to various financial markets, each with its unique characteristics and opportunities. This diversity is beneficial for traders seeking to develop well-rounded portfolios and engage in different trading strategies.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | CFDs | Crypto | Stocks | Commodities | Indices | ETFs | Options |

| Bftbot | Yes | No | Yes | Yes | Yes | Yes | No | No |

| Exnova | Yes | Yes | Yes | Yes | Yes | No | Yes | Yes |

| Tickmill | Yes | No | Yes | Yes | No | No | No | No |

| GO Markets | Yes | Yes | Yes | No | Yes | Yes | No | No |

Account Types

Bftbot offers a range of account types to cater to the diverse needs and preferences of traders. These account types come with varying features and benefits, allowing traders to choose the one that aligns with their experience level and trading goals:

1. Standard Account: The Standard Account is tailored for new traders and those operating on a budget. It features a minimum deposit requirement of £100, with spreads starting from 3 pips. Traders with a Standard Account can access all available trading instruments and leverage of up to 1:100. This account type serves as an entry point for individuals looking to initiate their trading journey.

2. Premium Account: The Premium Account is designed for more experienced traders seeking tighter spreads and increased leverage. Traders with a Premium Account are required to make a minimum deposit of £500. Spreads on this account type start from 2 pips, providing traders with a more competitive trading environment. The Premium Account offers leverage of up to 1:200 and grants access to all trading instruments, along with premium trading tools and resources to support traders in their strategies.

VIP Account: The VIP Account is the top-tier option, intended for highly experienced traders who require the tightest spreads and maximum leverage. To open a VIP Account, traders must make a minimum deposit of £10,000. Spreads for this account type start from just 1 pip, making it suitable for traders who prioritize cost efficiency. The VIP Account offers leverage of up to 1:300, providing experienced traders with enhanced capital control. Like the Premium Account, VIP Account holders have access to all trading instruments and premium trading tools, in addition to the advantage of a dedicated account manager who can offer personalized support.

Leverage

Bftbot offers a maximum leverage of up to 1:100. Leverage is a financial concept that involves borrowing money to invest or expand a business's operations. In this case, for every $1 of equity that Bftbot invests, it can borrow an additional $99 from lenders, effectively having $100 to work with.

A high leverage ratio, as in the case of Bftbot, offers several potential advantages. Firstly, it enables the company to engage in more projects and investment opportunities than it could with its own equity alone. This increased capital can lead to faster business growth and potentially higher profits. Secondly, leverage can magnify the impact of small changes in the company's profitability. For instance, if Bftbot's profits increase by 1%, the effect of leverage might result in a much more substantial increase in net income, thanks to the multiplying effect of borrowed funds.

It's important to note that while leverage can enhance potential returns, it also comes with increased risk. Borrowed money must be repaid, and if the investments do not perform as expected, the company may face financial difficulties. Therefore, businesses like Bftbot must carefully manage their leverage to balance the potential benefits and risks associated with it.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Bftbot | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:100 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions

Bftbot offers spreads on various assets, encompassing forex, cryptocurrencies, and commodities. However, it's vital to note that these spreads can be unpredictable and may deviate from the advertised averages. For instance, the average spread for the EUR/USD currency pair is listed as 0.3 pips. Yet, traders may experience spreads that vary from this average, potentially leading to heightened trading costs. In the case of cryptocurrencies, spreads are acknowledged as generally elevated, accentuating the potential for substantial expenses associated with trading these digital assets.

In addition to spreads, Bftbot also applies commissions for its trading services. The specific commission charges are contingent upon the type of asset being traded and the chosen account type. For instance, when trading forex, Bftbot levies a commission of $0.10 per lot traded. When it comes to cryptocurrencies, the commission amounts to 0.1% of the total trade value. These commission fees are an important aspect for traders to consider when calculating the overall expenses associated with their trading activities.

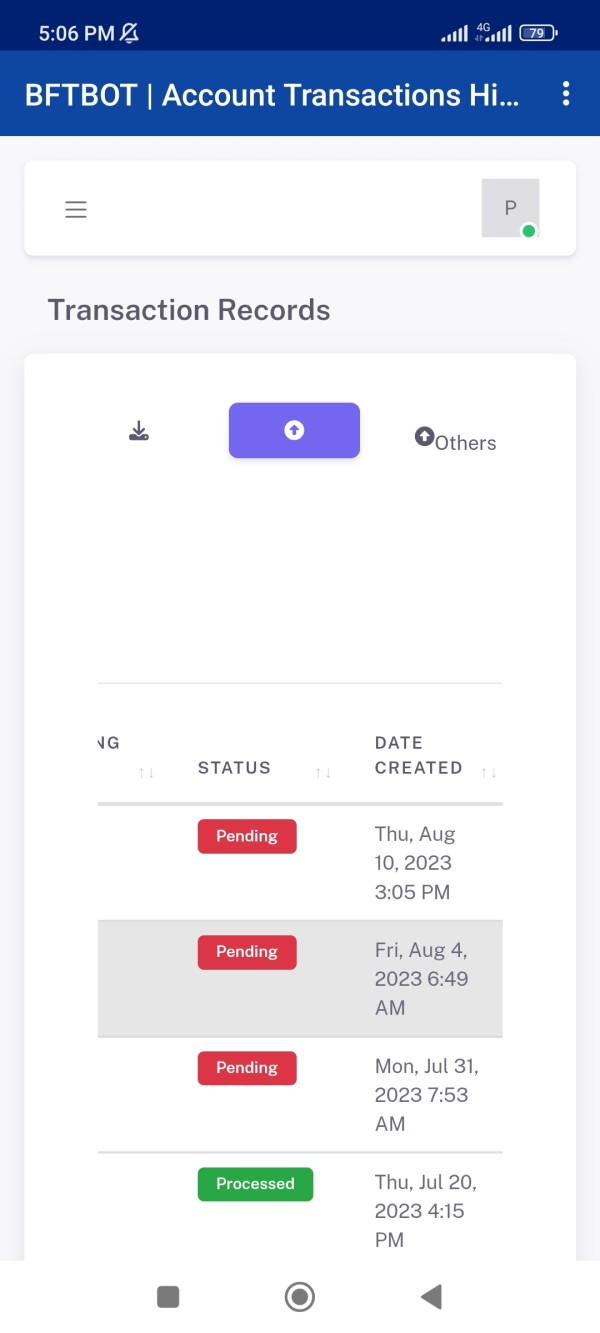

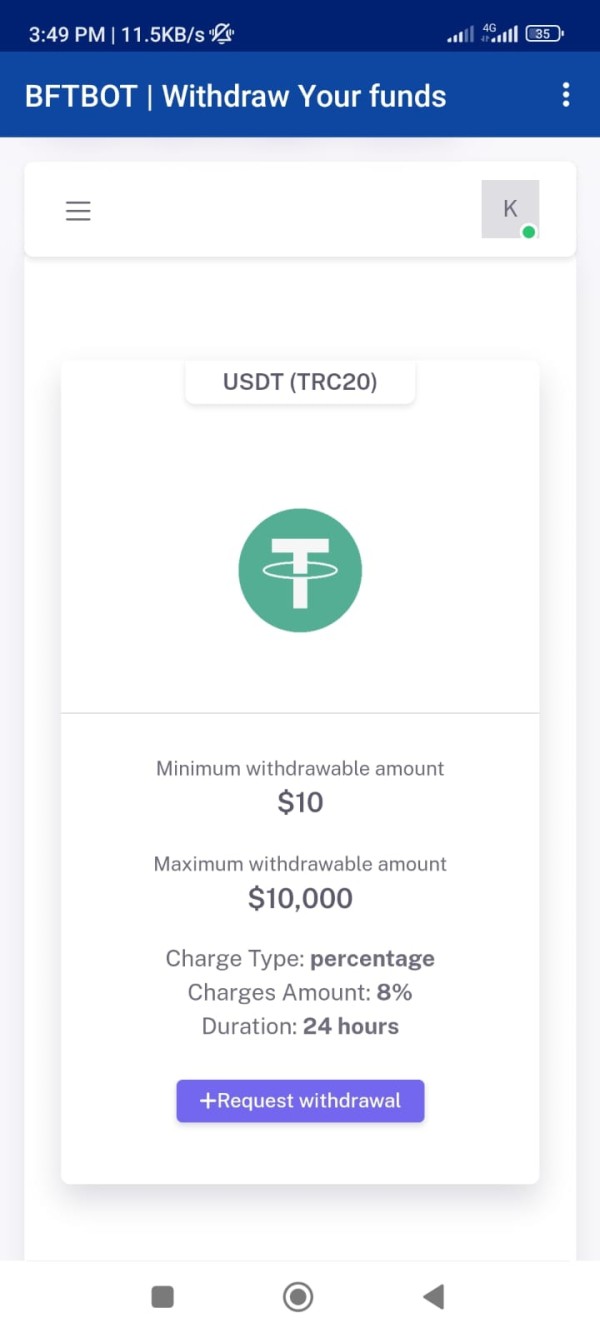

Deposit & Withdraw Methods

Bftbot offers a diverse range of deposit and withdrawal methods, ensuring flexibility and convenience for its users. These methods include credit and debit cards, bank wire transfers, and e-wallets:

1. Credit and Debit Cards: Bftbot accepts most major credit and debit cards, such as Visa, Mastercard, and American Express. One of the notable advantages of this method is the speed of processing; deposits made with credit and debit cards are typically processed immediately. This means that traders can swiftly access their deposited funds and commence trading without any delay.

2. Bank Wire Transfer: Bank wire transfers are another viable option for depositing funds with Bftbot. While this method may take a bit longer to process, typically ranging from 1 to 2 business days, it is known for its reliability. Bank wire transfers are particularly suitable for larger deposits or for traders who prefer a more traditional banking approach.

3. E-Wallets: Bftbot also accommodates various e-wallets like Skrill, Neteller, and PayPal. E-wallets are lauded for their convenience and immediacy in processing deposits. When you deposit funds via an e-wallet, they are usually available for trading instantly. This swift access to your funds can be especially advantageous for traders who value speed and efficiency in their trading activities.

Trading Platforms

Bftbot provides traders with two distinct trading platforms to cater to their diverse needs and preferences: the MetaTrader 4 (MT4) platform and the Bftbot WebTrader platform.

MetaTrader 4 (MT4): MT4 stands as one of the most widely used trading platforms globally, trusted by millions of traders. It offers a versatile and comprehensive trading experience across desktop, web, and mobile devices. Key features of MT4 include a rich set of technical analysis tools, a variety of order types for executing trades, support for automated trading through Expert Advisors, and the ability to conduct backtesting and forward testing. This platform's popularity is attributed to its robust features, making it a go-to choice for traders seeking advanced analysis and trading capabilities.

Bftbot WebTrader: The Bftbot WebTrader platform, in contrast, is an intuitive web-based trading solution. It distinguishes itself by being easily accessible without requiring any downloads or installations. The platform's user-friendly interface ensures a seamless trading experience, catering to traders of all levels. Among its notable features are live market quotes to keep traders informed in real-time, a variety of order types for executing trades, an array of technical analysis tools for decision-making, and social trading features. This accessibility and ease of use make it a practical choice for traders who prefer a hassle-free trading environment without the need for software installations.

Customer Support

Bftbot offers customer support through multiple channels to ensure traders can reach out for assistance and inquiries.

Contact Phone Number: For those who prefer direct phone communication, Bftbot provides a contact phone number: +44 7389 644059. This option allows traders to speak with a representative for real-time assistance, inquiries, or problem resolution.

Email Support: Traders can also contact Bftbot via email at contact@bftbot.com. Email support offers a convenient way to communicate questions, concerns, or requests in a written format. This method provides detailed explanations and documentation for any inquiries, making it a valuable channel for addressing various trading-related matters.

Educational Resources

Bftbot provides a range of educational resources designed to assist traders in improving their trading knowledge and skills:

Webinars: Bftbot regularly hosts webinars that cover a diverse array of trading topics, including technical analysis, fundamental analysis, and risk management. These webinars are typically presented by experienced traders and market analysts, making them a valuable source of insights and strategies for traders seeking to enhance their trading proficiency.

Tutorials: For traders looking to become proficient with the MetaTrader 4 (MT4) trading platform and to explore different asset classes like forex, stocks, and cryptocurrencies, Bftbot offers a variety of tutorials. These tutorials are available in various formats, including text, video, and audio, catering to different learning preferences. They provide step-by-step guidance to help traders understand the platform and master the art of trading in various markets.

Trading Blog: Bftbot maintains an informative trading blog that keeps traders updated with the latest market news and analysis. The blog is regularly updated with articles and videos, making it a valuable resource for staying informed about market trends and events that could impact trading decisions.

Glossary: For new traders and those looking to expand their trading vocabulary, Bftbot offers a comprehensive glossary of trading terms. This glossary provides clear definitions of key trading concepts and terms, such as “pip,” “margin,” and “take profit,” which can be immensely helpful for those looking to navigate the trading world effectively.

Conclusion

In conclusion, Bftbot offers a diverse range of trading instruments, catering to traders looking to explore various financial markets. With multiple account types and educational resources available, it seeks to accommodate traders of different experience levels. However, the lack of regulatory oversight raises concerns about fund security and transparency. Spreads can be unpredictable, and the variable commission charges add to the complexity of trading costs. Traders considering Bftbot should weigh the advantages of a broad asset selection and educational support against the disadvantages associated with regulatory concerns and uncertain trading expenses.

FAQs

Q: Is Bftbot regulated by any financial authority?

A: No, Bftbot operates without regulatory oversight.

Q: What types of trading instruments are available on Bftbot?

A: Bftbot offers Forex, indices, commodities, cryptocurrencies, and shares for trading.

Q: What are the minimum and maximum leverage ratios on Bftbot?

A: The maximum leverage on Bftbot is 1:100, but the minimum leverage may vary depending on the account type.

Q: Can I access educational resources on Bftbot?

A: Yes, Bftbot provides webinars, tutorials, a trading blog, and a glossary for educational purposes.

Q: What deposit and withdrawal methods does Bftbot accept?

A: Bftbot accepts credit and debit cards, bank wire transfers, and e-wallets as deposit and withdrawal methods.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now