简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

OPEC Signals Bearish Crude Oil Outlook, GBP Corrects Higher - US Market Open

Abstract:OPEC Signals Bearish Crude Oil Outlook, GBP Corrects Higher - US Market Open

MARKET DEVELOPMENT – OPEC Highlights Bearish Crude Oil Outlook, Euro Softer on QE Talk

DailyFX 2019 FX Trading Forecasts

EUR: Commentary from one of the most dovish ECB members, Olli Rehn, has pushed the Euro lower with the rate setter noting that the ECB should over-deliver with rate cuts and a restarting of QE. As it stands, money markets expect 15bps worth of easing in the depo rate, however, the focus will be on the composition of QE2 in September. Alongside this, eyes will be on the other ECB members to gauge the consensus pertaining to an ECB QE package in September. Elsewhere, Italian political risks could keep the Euro on the backfoot amid the potential no-confidence vote on Tuesday.

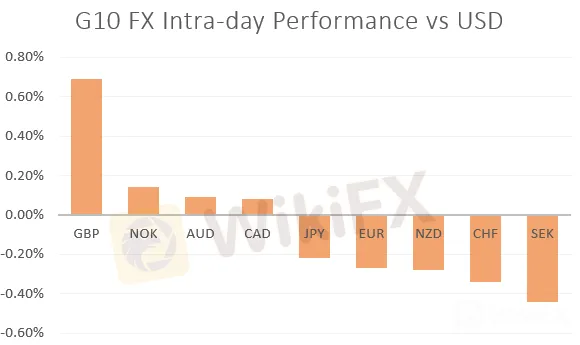

GBP: The Pound is notably firmer this morning with gains largely stemming from the corrective pullback observed in EURGBP, which trades lower by 1%. The absence of notable Brexit related news flow has kept the modest Sterling uptrend intact.

Oil: OPEC lowered their global oil demand forecast for 2019 by 40kbpd to 1mbpd. Alongside this, they highlighted that the outlook is likely to be bearish throughout the remainder of the year, consequently sparking a pullback in the energy complex.

Source: DailyFX

IG Client Sentiment

WHATS DRIVING MARKETS TODAY

“US Dollar, Euro Technical Outlook: Poised for Larger Breakout” by Paul Robinson, Currency Strategist

“ECB and Fed Monetary Shifts Have Outsized Global Influence” by Nick Cawley, Market Analyst

“Most Volatile Currencies Next Week - Japanese Yen Volatility Highest Since Flash Crash” by Justin McQueen, Market Analyst

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

EBC Global Focus | Oil climbs amid Europe and Middle East gloom

Demand expectations strengthen, driving up oil prices. Shale oil production activities slow down, leading to increased divergence between the International Energy Agency and OPEC.

GEMFOREX - weekly analysis

The week ahead: Top 5 things to watch

British Pound Technical Analysis - GBP/USD, EUR/GBP

BRITISH POUND, GBP/USD, EUR/GBP - TALKING POINTS

US Dollar Flexes Against British Pound Ahead of the Fed and BoE. Where to for GBP/USD?

US DOLLAR, BRITISH POUND, GBP/USD, BOE, FED,CHINA, AUD/USD - TALKING POINTS

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator