简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scope Markets Review: Trustworthy or Risky?

Abstract:Established in 2014 and regulated in multiple jurisdictions, Scope Markets is a part of the Rostro Group, a leading fintech and financial services provider. Scope Markets provides access to over 40,000 financial instruments, including equities, forex, commodities, and indices through popular powerful trading platforms like MT4, MT5, CQG, IRESS, and Bloomberg.

About Scope Markets

Established in 2014 and regulated in multiple jurisdictions, Scope Markets is a part of the Rostro Group, a leading fintech and financial services provider. Scope Markets provides access to over 40,000 financial instruments, including equities, forex, commodities, and indices through popular powerful trading platforms like MT4, MT5, CQG, IRESS, and Bloomberg.

Is Scope Markets Legit?

Scope Markets is a regulated financial institution under the Cyprus Securities and Exchange Commission. It operates under the license number 339/17. Scope Markets is a brand name used by RS Global Ltd, a company authorized and regulated by the Financial Services Commission of Belize (“FSC”) under the Securities Industry Act 2021 with registration number 000274/2.

Market Instruments

Scope Markets offers a wide range of trading products, including Forex CFDs, Index CFDs, Energy CFDs, Metal CFDs, Share CFDs, Commodity CFDs, Fractional Shares, and Futures CFDs.

Account Types

Scope Markets has merged all our accounts into One Account – One Account combines the benefits of all their old accounts with simple, competitive, and transparent pricing to allow you to focus on what really matters – trading and investing.

One Account:

The One Account offered by Scope Markets operates on the MetaTrader 5 trading platform. It presents spreads from 0.7 pips and supports account currencies in USD, EUR, and GBP. The minimum starting deposit is $200, with a maximum leverage of 1:30. This account type allows for micro lot trading (0.01) and has a stop-out level set at 50%. Commission per lot per side is $0, and it should be noted that this doesn't apply to CFD shares.

Plus Account:

The Plus Account, available on the MetaTrader 5 platform, showcases spreads starting from 0.6 pips. It offers account currencies in USD, EUR, and GBP, with a higher starting deposit of $10,000. The maximum leverage is 1:30, and micro lot trading (0.01) is supported.

Demo Account:

Scope Markets also offers a demo account option for traders. This allows individuals to practice and familiarize themselves with the trading platform and its features without using real money.

Deposit & Withdrawal

Scope Markets offers deposit and withdrawal options for its clients. Bank transfers have a processing time of 3-5 working days for both deposits and withdrawals, with no fees. The minimum deposit is 200 USD, while there is no maximum deposit limit. For withdrawals, the minimum is 100 USD or equivalent, with unlimited maximum withdrawals.

Nuvei (formerly Safecharge), VISA, and Mastercard transactions are usually processed within 10 minutes for deposits and take 3-5 working days for withdrawals. There are no fees, and the minimum deposit and withdrawal amounts are 200 USD and 100 USD, respectively. The maximum deposit per transaction is 10,000 USD, while the maximum withdrawal per day is 50,000 USD.

Trading Platforms

Scope Markets offers MT5 & MT4. MetaTrader 4 is a popular and established trading platform offering diverse financial instruments. MT4 can be downloaded on your desktop or mobile platform for on-the-go trades. Meta Trader 5 offers the leading trading and analytical technologies, as well as additional services. It has everything that you need for Forex trading:

Spreads & Commissions

Scope Markets provides spreads starting from 0.7 pips for the One Account and 0.6 pips for the Plus Account. There is no commission for both account types, with the exception that the commission does not apply to CFD shares. Scope Markets sets a minimum deposit requirement of 200 USD for various account types.

Trading Tools

1. PIP Calculator:

Scope Markets offers a pip calculator that enables traders to calculate the pip value for their chosen trading currency. This tool assists in evaluating the potential risk associated with each trade.

2. Margin Calculator:

The margin calculator provided by Scope Markets aids traders in determining the margin requirements necessary to initiate and maintain trading positions. It serves as an indicator for maintaining sufficient margin in the trading account to cover ongoing trades.

3. Swap Calculator:

Scope Markets presents a swap calculator to compute the interest rate difference between the two currencies in an open trade currency pair. This tool calculates the overnight interest credited or debited directly to trades, impacting the overall account balance.

4. Economic Calendar

Scope Markets provides an Economic Calendar to inform traders about upcoming events, report releases, and announcements that could impact the markets. The calendar is a valuable tool for traders to track scheduled economic events, gain insights into market changes and understand the reasons behind these changes.

Customer Support

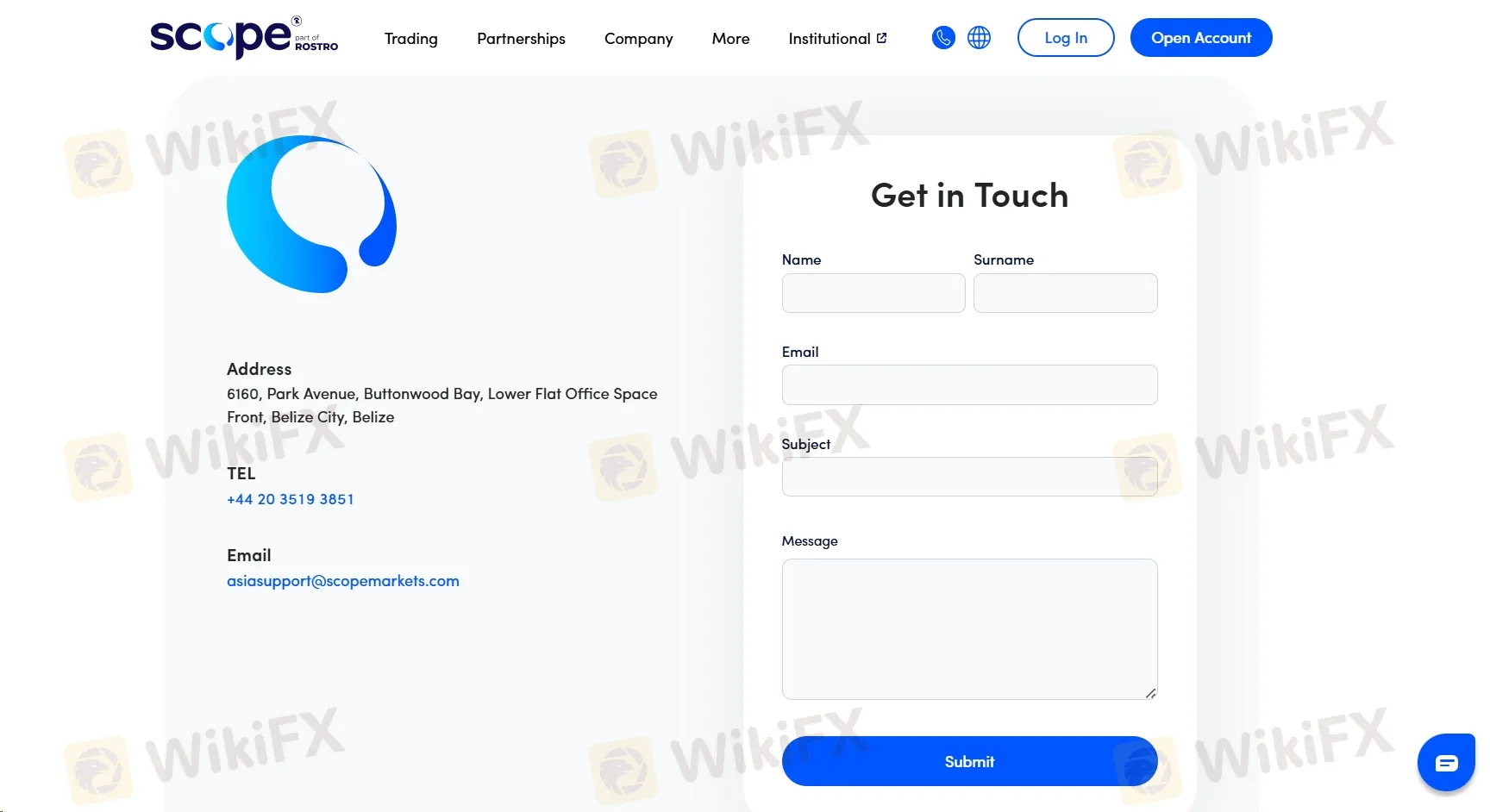

Scope Markets provides accessible customer support through various channels. Clients can reach out via email to support@scopemarkets.eu or info@scopemarkets.eu for assistance. Additionally, customer inquiries can be directed to +357 25281811. The company's physical address is Doma Building 1st floor, 227 Archeipiskopou Makariou III Avenue, 3105 Limassol, Cyprus.

Conclusion

In conclusion, Scope Markets is a regulated financial institution. It offers a range of market instruments, including forex, indices, futures, spot energies, metals, shares, cryptocurrencies, and ETFs. The company provides different account types, including the One Account and Plus Account, with varying starting deposits and leverage options. Traders can access the MetaTrader 5 trading platform, along with web and mobile versions. Scope Markets offers useful trading tools like pip, margin, swap, and profit calculators, aiding traders in risk assessment and performance evaluation.

Why settle for an app with limited features? WikiFX offers everything you need—the latest market news, broker evaluations, reviews, and reliability checks, all in one place. Visit WikiFX now and improve your trading experience.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

WikiFX Review: Is IQ Option trustworthy?

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Quadcode Markets: Trustworthy or Risky?

5 Questions to Ask Yourself Before Taking a Trade

Avoid Fake Websites of CPT Markets

Webull Canada Expands Options Trading to TFSAs and RRSPs

Currency Calculator