Score

Headway

South Africa|1-2 years|

South Africa|1-2 years| https://hw.international/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

Licenses

Licenses

Licensed Institution:JAROCEL PTY LTD

License No.:52108

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

South Africa

South AfricaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Headway also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

hw.site

Server Location

United States

Website Domain Name

hw.site

Server IP

104.26.13.138

hw.online

Server Location

United States

Website Domain Name

hw.online

Server IP

104.21.75.147

hw.international

Server Location

United States

Website Domain Name

hw.international

Server IP

104.21.17.50

Company Summary

| Aspect | Information |

| Registered Country/Area | South Africa |

| Founded Year | 2021 |

| Company Name | Headway |

| Regulation | Under scrutiny for using a suspicious license |

| Minimum Deposit | Cent Account: $1 Standard Account: $10 Pro Account: $100 |

| Maximum Leverage | Up to 1:200 |

| Spreads | Cent Account: Starting from 0.3 pips Standard Account: Starting from 0.3 pips Pro Account: Starting from 0.0 pips |

| Trading Platforms | MetaTrader 4 (MT4) MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Commodities, Indices, Stocks |

| Account Types | Cent Account, Standard Account, Pro Account |

| Customer Support | Limited contact options, no phone number or WhatsApp |

| Payment Methods | Bank Wire Transfer, Credit Card, E-Wallets (PayPal, Neteller) |

| Educational Tools | Absence of educational resources |

| Website Status | Inaccessible |

| Reputation (Scam or Not) | Under regulatory scrutiny, exercise caution |

Overview

Headway, a South African brokerage founded in 2021, is currently under regulatory scrutiny due to suspicions surrounding its license, casting doubt on its legitimacy. The broker offers various account types, but lacks transparency on crucial details like commission rates. While it provides access to MetaTrader 4 and 5, its range of tradable assets is standard.

Customer support options are limited, with no phone or WhatsApp contact. Educational resources are absent, which hampers traders' ability to gain necessary knowledge. The inaccessible website adds to concerns about reliability.

Given these issues and the regulatory scrutiny, caution is strongly advised when considering Headway as a brokerage option.

Regulation

Headway has come under scrutiny for allegedly using a suspicious license while operating as a broker. The licensing concerns have raised questions about the legitimacy and credibility of their brokerage activities. Regulatory authorities and industry experts are closely monitoring the situation to ensure compliance with legal and ethical standards. Investors and clients are advised to exercise caution and conduct thorough due diligence when dealing with Headway.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Headway faces significant regulatory concerns and suspicions regarding its license usage, which raises doubts about its credibility and legitimacy as a brokerage. While it offers a diverse range of market instruments and multiple account types, the lack of transparency on key details such as leverage, commission rates, and supported currencies is a drawback. Additionally, the broker's customer support, online presence, and educational resources are lacking, potentially hindering traders' growth and communication. The inaccessibility of their website further adds to the uncertainty, and traders are advised to exercise caution when considering Headway as their brokerage choice.

Market Instruments

Headway offers a diverse range of market instruments to cater to the preferences and investment strategies of its clients. These instruments encompass:

Forex (Foreign Exchange): Headway provides access to the forex market, allowing clients to trade various currency pairs. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs.

Commodities: Clients can trade a variety of commodities, such as gold, silver, crude oil, natural gas, and agricultural products like wheat and corn. Commodity trading offers diversification and exposure to global economic trends.

Indices: Headway enables clients to trade stock market indices from around the world. This includes popular indices like the S&P 500, Dow Jones Industrial Average, NASDAQ Composite, FTSE 100, and many others. Index trading allows investors to speculate on broader market trends.

Stocks: Headway offers access to a wide range of individual stocks from various global exchanges. Clients can trade shares of publicly listed companies, allowing for stock-specific investments and potential capital appreciation.

By offering this comprehensive array of market instruments, Headway aims to provide its clients with the opportunity to create diversified portfolios and pursue various trading and investment strategies across different asset classes. This diversification can help mitigate risk and align with individual financial goals.

Account Types

This brokerage offers three distinct account types designed to accommodate a diverse range of traders:

Cent Account:

Minimum Deposit:$1

Minimum Spread:Starting from 0.3 pips

Products:This account type caters to traders interested in forex, cryptocurrencies, metals, and energies. It provides accessibility with a minimal deposit requirement and a minimum position size of 0.01 lots, making it suitable for beginners or those with limited capital. Specific information regarding maximum leverage, supported currency, depositing, and withdrawal methods is not provided.

Standard Account:

Minimum Deposit:$10

Minimum Spread:Starting from 0.3 pips

Products:The Standard Account offers a broader selection of trading instruments, including forex, cryptocurrencies, metals, energies, stocks, indices, and FX indices. With a minimum position size of 0.01 lots, this account type caters to traders seeking a diversified portfolio. Similar to the Cent Account, specific details regarding maximum leverage, supported currency, depositing, and withdrawal methods are not specified.

Pro Account:

Minimum Deposit:$100

Minimum Spread:Starting from 0.0 pips

Products:The Pro Account is tailored for experienced traders looking for potentially tighter spreads. It encompasses a wide range of products, such as forex, cryptocurrencies, metals, energies, stocks, indices, and FX indices. Traders can initiate positions with a minimum size of 0.1 lots and are supported in the use of Expert Advisors (EAs). Additionally, this account type incurs a commission of $1.5 each side per lot. However, specific information about maximum leverage, supported currency, depositing, and withdrawal methods is not provided.

Prospective clients are encouraged to reach out to the broker directly to obtain comprehensive details on leverage, currency options, and deposit/withdrawal methods, as these specifics are not outlined in the provided information.

Leverage

This broker offers a maximum trading leverage of up to 1:200. Leverage is a powerful tool that allows traders to control a larger position size with a relatively smaller amount of capital. With a leverage of 1:200, for every $1 of their own capital, traders can control positions worth up to $200. While higher leverage can amplify potential profits, it also increases the level of risk, as losses are similarly magnified. Therefore, traders should exercise caution and have a solid risk management strategy when utilizing high leverage to trade in financial markets.

Spreads and Commissions

Based on the information provided, this brokerage offers variable spreads and commissions that vary depending on the specific account type chosen:

Cent Account:

Minimum Spread: Starting from 0.3 pips

Commission: Not specified

Standard Account:

Minimum Spread: Starting from 0.3 pips

Commission: Not specified

Pro Account:

Minimum Spread: Starting from 0.0 pips

Commission: $1.5 each side per lot

The Cent and Standard accounts appear to have similar minimum spreads starting at 0.3 pips, with no specified commission mentioned. On the other hand, the Pro Account offers potentially tighter spreads starting from 0.0 pips but does involve a commission of $1.5 per lot traded on each side.

Notably, while the minimum spreads are specified, commissions may be associated with some account types, but specific details about commission rates for the Cent and Standard accounts are not provided. Traders should carefully consider the cost structure associated with their chosen account type, as spreads and commissions can significantly impact trading costs and profitability. Additionally, reaching out to the broker directly for a complete fee schedule is advisable for a more accurate understanding of costs.

Deposit & Withdrawal

This broker offers a variety of deposit and withdrawal methods to cater to the diverse needs of its clients. Traders can fund their accounts and withdraw their profits using several secure options.

Bank Wire Transfer: Bank wire transfer is a method for both depositing funds and withdrawing profits. Clients can initiate wire transfers from their bank accounts to the broker's designated bank account. This method may take a bit longer for funds to be processed compared to some other options but is known for its security and is suitable for larger transactions.

Credit Card: The broker accepts credit card payments for deposits, allowing clients to use their Visa, MasterCard, or other major credit cards to fund their accounts instantly. It offers convenience and speed, making it a choice for many traders. Additionally, it simplifies the process of withdrawing profits back to the same credit card used for the deposit, streamlining financial transactions.

E-Wallets (PayPal, Neteller): For those seeking faster transactions, the broker also supports e-wallet services like PayPal and Neteller. Clients can link their e-wallet accounts to their trading accounts, making deposits and withdrawals efficient. E-wallets are known for their convenience and broad acceptance, making them a choice for many traders in the digital age.

By offering this range of deposit and withdrawal methods, this broker aims to ensure that clients have flexibility and accessibility when managing their funds, aligning with their preferences and geographical locations. It underscores the broker's commitment to providing a trading environment.

Trading Platforms

This broker provides access to two widely acclaimed trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both equipped with an extensive array of tools and features. MT4 is renowned for its user-friendly interface and robust charting capabilities, making it ideal for traders of all levels. It offers a wide range of technical indicators, automated trading through Expert Advisors (EAs), and a mobile app for on-the-go trading. MT5, on the other hand, builds upon MT4's foundation by offering additional timeframes, more technical indicators, and an economic calendar, making it suitable for traders with more diverse strategies. Both platforms provide access to various asset classes, including forex, commodities, indices, and stocks, ensuring that traders have the tools they need to make informed trading decisions.

Customer Support

The company's customer support falls short in several aspects. Firstly, the absence of a provided phone number or WhatsApp contact raises concerns about their accessibility for clients in need of immediate assistance. Additionally, the lack of a Twitter presence deprives clients of a platform for timely updates and communication. While they have a Facebook page, Instagram account, and YouTube channel, their activity and responsiveness on these social media platforms are questionable, leaving clients with limited avenues to seek help or clarification. Moreover, the solitary company address in South Africa raises doubts about their global reach and physical presence for clients elsewhere. Overall, the company's customer support and online presence leave room for improvement, potentially frustrating clients seeking effective assistance and communication.

Educational Resources

It appears that this brokerage lacks educational resources, which can be a significant drawback for traders, especially those who are new to the financial markets or looking to enhance their trading knowledge. Without educational materials such as tutorials, webinars, or educational articles, clients may face challenges in acquiring the necessary skills and knowledge to make informed trading decisions. An absence of educational resources can hinder traders' growth and limit their ability to navigate the complexities of the financial markets effectively.

Summary

Headway faces serious concerns regarding its regulatory compliance, with allegations of using a suspicious license as a broker. This has cast doubt on the legitimacy and credibility of their operations, prompting regulatory authorities and industry experts to closely monitor the situation. Clients are advised to exercise caution and perform thorough due diligence when considering Headway as their brokerage choice. In addition to regulatory issues, the broker's customer support and online presence leave much to be desired, lacking essential contact options and responsiveness. Furthermore, the absence of educational resources hampers traders' ability to improve their skills and knowledge. To add to the uncertainty, the broker's website is currently inaccessible, raising further suspicions about its reliability and trustworthiness. Traders are strongly urged to exercise extreme caution when dealing with Headway.

FAQs

Q: How can I contact Headway's customer support?

A: Headway's contact options are limited, and specific contact information is not provided on their website. It's advisable to reach out through their social media profiles or any available email address for assistance.

Q: What is the minimum deposit required to open an account with Headway?

A: Headway offers different account types with varying minimum deposit requirements. These range from as low as $1 for the Cent Account to $100 for the Pro Account. Specifics can be found on their website.

Q: Are there educational resources available for traders?

A: Unfortunately, Headway does not offer educational resources on its website. Traders looking for educational materials should consider external sources to enhance their trading knowledge.

Q: What trading platforms does Headway provide?

A: Headway offers access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both popular trading platforms known for their technical analysis tools and capabilities. These platforms are accessible for traders of all experience levels.

Q: What are the regulatory concerns surrounding Headway?

A: Headway has faced regulatory scrutiny for allegedly using a suspicious license while operating as a broker. This has raised questions about the legitimacy and credibility of their brokerage activities. Regulatory authorities and industry experts are closely monitoring the situation. Investors and clients are advised to exercise caution and conduct thorough due diligence when dealing with Headway.

Keywords

- 1-2 years

- Suspicious Regulatory License

- MT4 Full License

- MT5 Full License

- Global Business

- Suspicious Overrun

- High potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

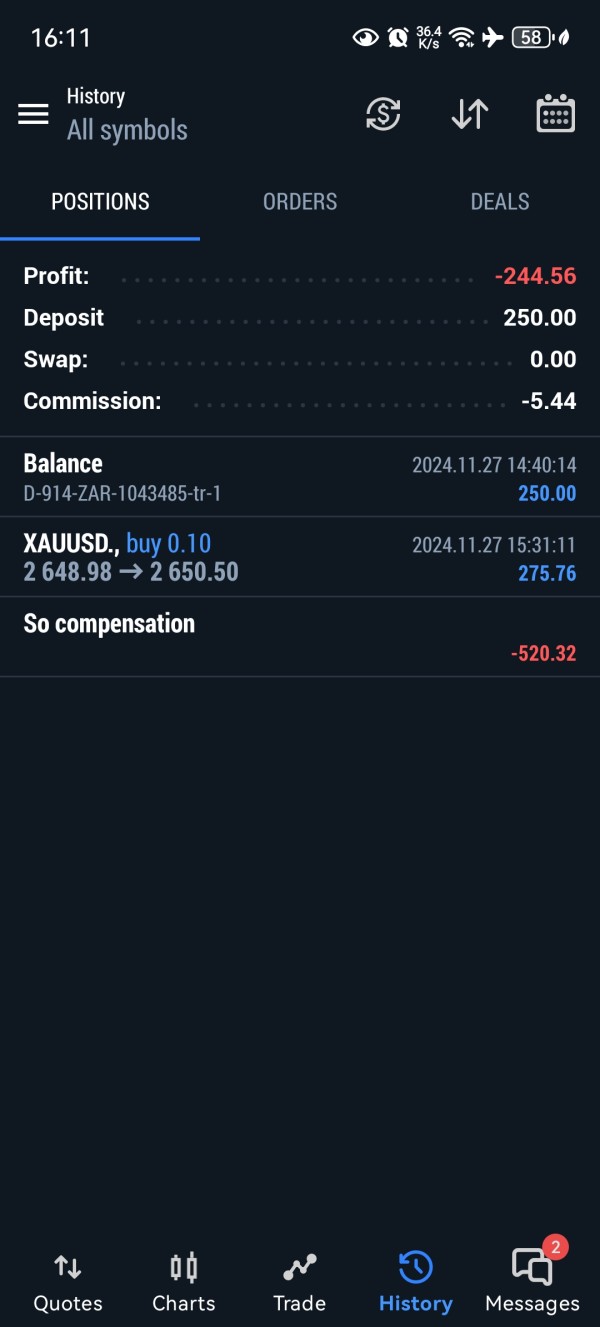

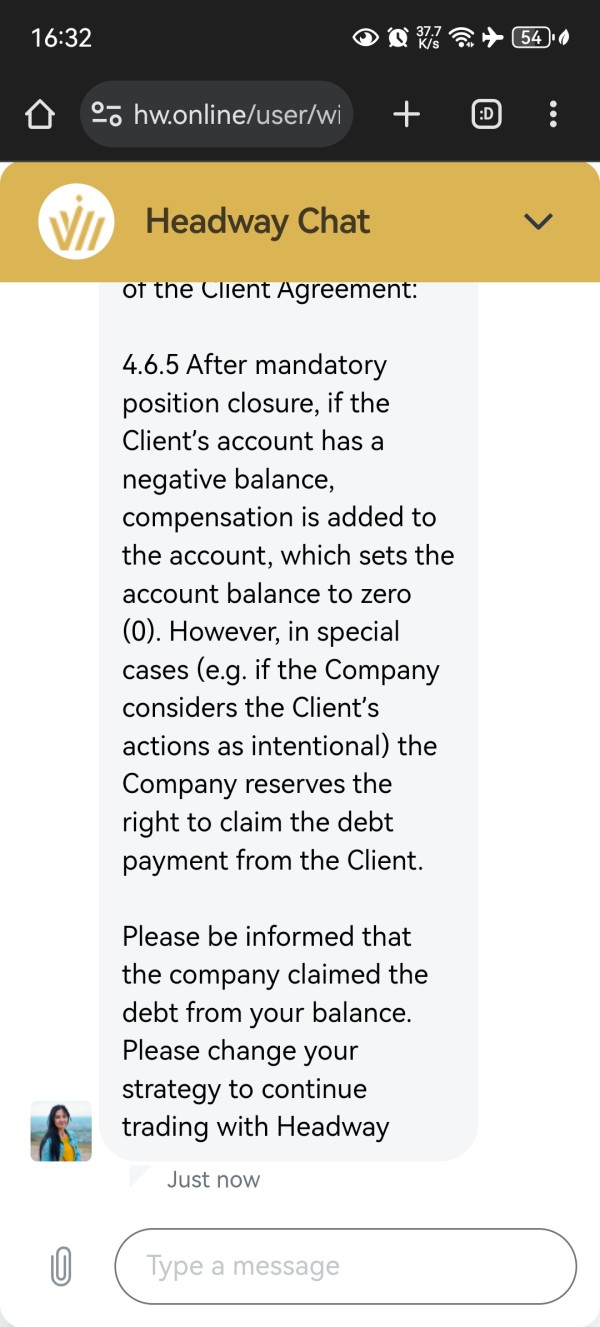

Malenga

South Africa

Stay away from this broker if you don't want to lose you money They took my funds after trying to withdrawal claiming that I'm owing then

Exposure

11-27

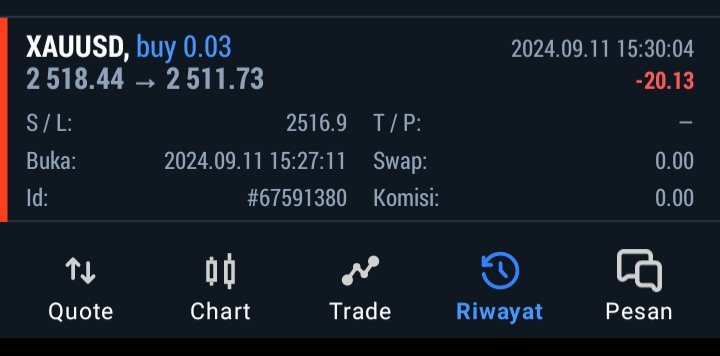

Rabatefx

Indonesia

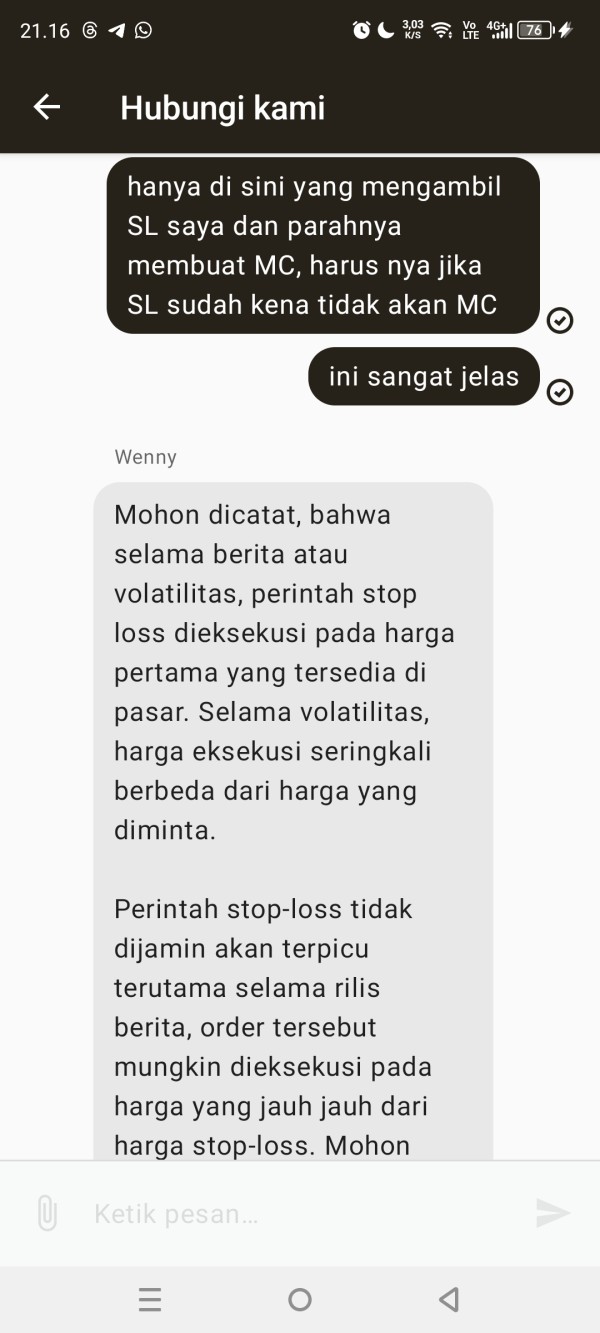

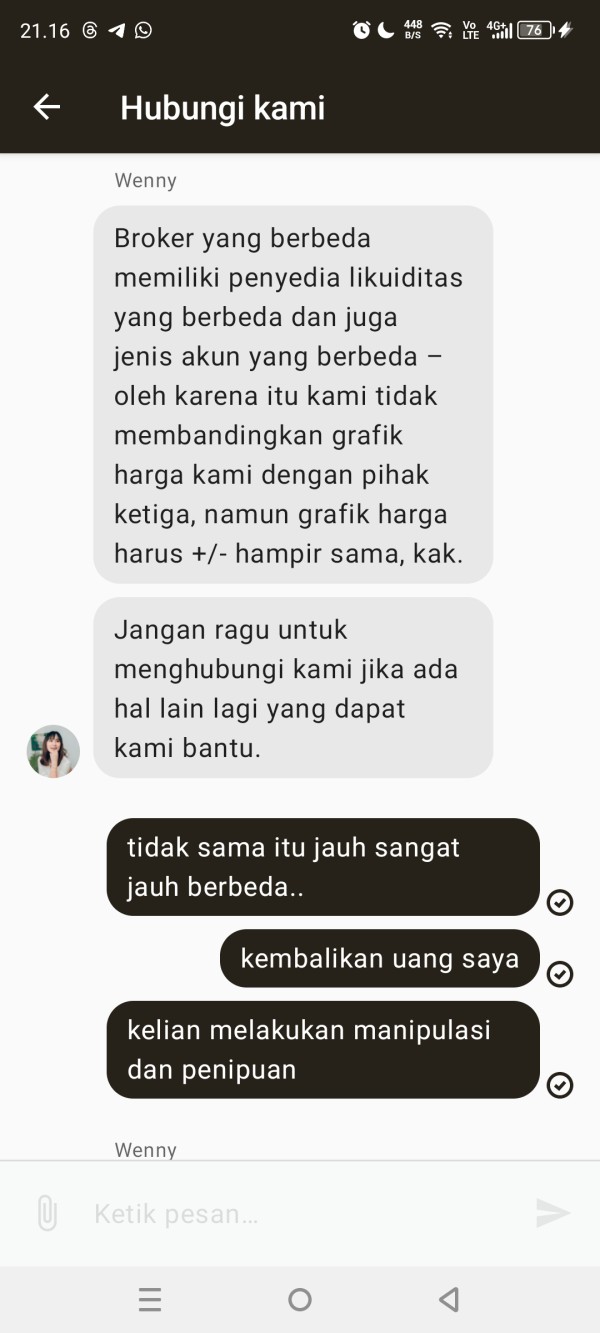

Be careful trading with broker Headway, the slippage is terrible. My account was automatically cut, even though I only had a position of 0.03 with a balance of $514, floating $414, and equity $100. It was immediately cut, resulting in a total loss of $1013. # Broker Headway is garbage

Exposure

09-11

chika8335

Indonesia

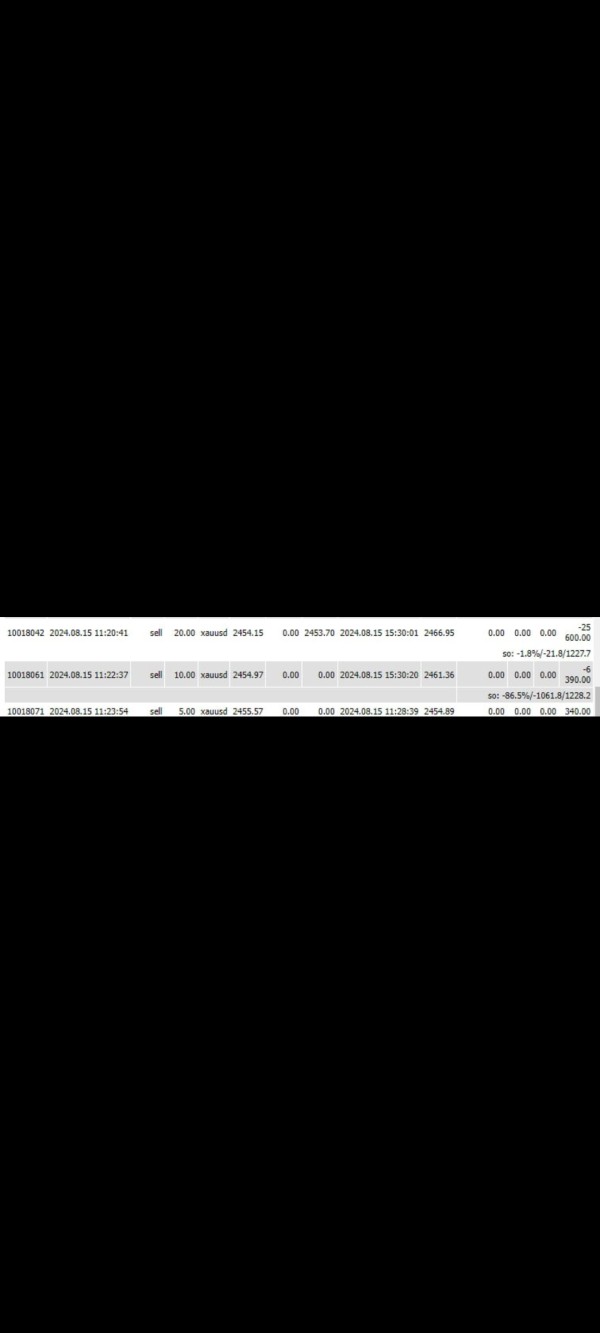

Last night my account was made MC without clarity, I request assistance, I really don't accept this, my margin is still there but suddenly I MC, if I MC it should be in the position of the candle 5 minutes earlier I already MC, equity from the peak point is still there for 100 pips

Exposure

08-16

artexe

Indonesia

Intentionally made MC. Even SL does not immediately function. This broker is crazy; SL is removed immediately and made MC. when complaints are unilaterally closed.

Exposure

07-18

Rudi 3214

Indonesia

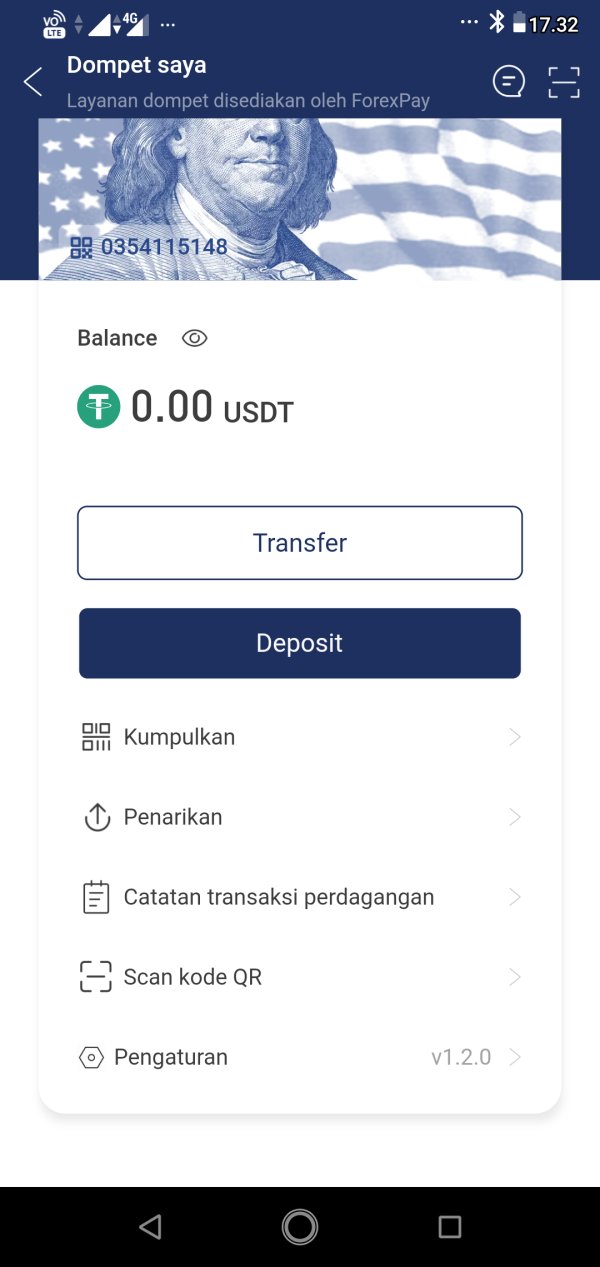

The USDT prize has not yet entered my account.

Exposure

04-27

Jirayupentiya

Thailand

My money doesn't credit to my account. What should I do?

Exposure

01-14

Álvaro Amir

Colombia

I haven't had any major issues with them, but there haven't been any wow moments either. Just kind of...average. The trading app offers basic charting tools, but for serious technical analysis, you might need to a more advanced app.

Neutral

07-10

Qutancl

Belarus

Very easy and customer friendly platform. It's also cost effective and has access to multiple different investments which makes it unbeatable. The only downside is that there is no SIPP yet but I hope this will come soon. I would like to see a cost effective SIPP with option to invest from business account (ltd).

Positive

06-21