简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Dollar Turns to GDP Data & Fed Rate Cut Bets

Abstract:With US GDP data on deck for Friday's trading session, forex market participants will likely scrutinize the report for insight into the Fed's upcoming policy decision and its impact on the US Dollar.

US DOLLAR EYES Q2 GDP REPORT & JULY FED MEETING

USD currency traders will turn to upcoming Q2 US GDP slated for release Friday at 12:30 GMT

US GDP data has potential to impact the Feds monetary policy update next week and looks to weigh on rate cut expectations

Join DailyFXs Senior Currency Strategist Chris Vecchio, CFA for live webinar coverage of the Q2 US GDP Data Report

The US Dollar is set to take the spotlight during Friday‘s trading session with currency traders awaiting the release of GDP data from the world’s largest economy. Q2 US GDP is expected to cross the wires at an annualized growth rate of 1.8% according to Bloomberg‘s median estimate, which compares to last quarter’s red-hot print of 3.1% and last years Q2 reading of 4.2%.

Q1 US GDP came in noticeably above consensus for the headline figure, but the underlying details revealed a bleaker depiction of the US economy with large inventory builds, higher than expected government outlays and weaker imports could drag on output the rest of the year.

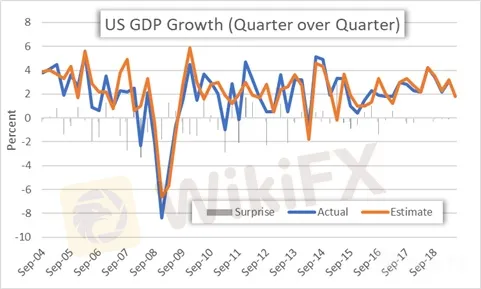

US GDP GROWTH (QUARTER OVER QUARTER)

While the latest IMF World Economic Outlook report indicated a 0.3% upward revision to its 2019 US GDP growth forecast, the organization highlighted that domestic demand was somewhat softer than expected and the aforementioned developments point to slowing momentum.

That said, recent US nonfarm payroll data, retail spending and durable goods orders data provide hope for the economy to rebound later this year. The improvement in economic data over the last month is also reflected by the Citi Economic Surprise Index rising substantially.

US ECONOMIC DATA SURPRISE INDEX (CITI)

If Friday‘s US GDP report does in fact surprise to the upside – or the closely watched components show improvement – the Federal Reserve (Fed) could find itself in a difficult position with little economic evidence supporting an interest rate cut at next week’s July FOMC meeting.

Markets have priced in lofty rate cut bets, driven largely by slowing global GDP growth and trade policy uncertainty, which could see a sharp repricing if a robust GDP report crosses the wires and provides the Fed with another reason to not capitulate.

FED INTEREST RATE PROBABILITIES (JULY FOMC MEETING)

Currently, overnight swaps are pricing in a Fed rate cut next week as a near certainty with the probability of a 25-basis point reduction sitting at 84.5% whereas the probability of a 50-basis point reduction resting at 15.5%. If Friday‘s Q2 US GDP data comes in better than expected, the probability of a 0.5% cut to Fed’s policy interest rate could be priced out by markets which poses an upside risk to the US Dollar.

Conversely, a downbeat Q2 US GDP report could encourage markets to anticipate a more aggressive ‘insurance cut’ from the Fed and would likely drag the greenback lower.

US DOLLAR INDEX PRICE CHART: DAILY TIME OCTOBER 30, 2018 TO JULY 25, 2019)

For in-depth USD technical analysis, check out the latest US Dollar Price Action Setups from DailyFX Currency Strategist James Stanley.

Even though Fridays GDP data report is a high-impact event listed on the economic calendar, currency option traders are downplaying its impact on the US Dollar seeing that DXY overnight implied volatility trades right at its 12-month average.

US DOLLAR OVERNIGHT IMPLIED VOLATILITY

The table above is a list of closely monitored USD currency pairs and their respective overnight implied volatility readings as well as estimated trading ranges. Using the derived implied volatility from at-the-money overnight currency option contracts, the implied trading range can be calculated with a 68% statistical probability (i.e. 1-standard deviation move in spot).

FOREX TRADING RESOURCES

Download our US Dollar Forecast for comprehensive fundamental and technical outlook

New to trading or simply looking to brush up on the basics of forex? Download this free educational guide on Forex Trading for Beginners

Find out how IG Client Sentiment can be used to identify the bullish and bearish biases of forex traders and reveal potential forex trading opportunities

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Eye on Today’s U.S. GDP

Nvidia's highly anticipated earnings report was released yesterday, but despite the numbers beating market consensus, the performance lacked a "wow" factor for investors. As a result, the market seemed to have already priced in the earnings, leading to a decline in all three major indexes on Wall Street. Despite yesterday's technical correction, Nvidia's strong earnings suggest that the tech industry remains robust, with ongoing demand for Nvidia's chips potentially driving future gains

KVB Market Analysis | 7 August: AUD/USD Recovers Above 0.6500 Amidst RBA Hawkish Hold and Commodity Price Gains

Following fresh 2024 lows near 0.6350, AUD/USD bounced back above 0.6500 on Tuesday, returning to positive weekly territory. The pair remains focused on the 200-day SMA at 0.6592, with a negative bias expected below this level. The recovery was supported by rising copper and iron ore prices and a hawkish hold from the RBA.

KVB Market Analysis | 6 August: USD/JPY Recovers from January Lows Amid Recession Fears and Fed Rate Cut Speculation

The USD/JPY pair has rebounded to around 145.40 after dropping to its lowest level since January at 141.68, amid early Asian trading. The US Dollar's decline was driven by recession fears and expectations of significant Federal Reserve rate cuts. The rise in the US Unemployment Rate in July has heightened concerns about a recession, leading markets to anticipate rate cuts of 50 basis points in September and November, and an additional 25 basis points in December.

Key Economic Calendar Events for This Week (August 5-9, 2024)

This week's economic events include: Japan's Monetary Policy Minutes and U.S. Services PMI on Monday, impacting JPY and USD. Tuesday's RBA Interest Rate Decision affects AUD, with German Factory Orders influencing EUR. Wednesday sees German Industrial Production and U.S. Crude Inventories impacting EUR and USD. Thursday: RBA Governor speaks, with U.S. Jobless Claims. Friday: China's CPI and Canada's Unemployment Rate affect CNY and CAD.

WikiFX Broker

Latest News

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Bitcoin in 2025: The Opportunities and Challenges Ahead

BI Apprehends Japanese Scam Leader in Manila

Big News! UK 30-Year Bond Yields Soar to 25-Year High!

SQUARED FINANCIAL: Your Friend or Foe?

Join the Event & Level Up Your Forex Journey

Currency Calculator