Score

VANGUARD TRADING

Barbados|2-5 years|

Barbados|2-5 years| https://vtrading-group.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Barbados

BarbadosUsers who viewed VANGUARD TRADING also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

vtrading-group.com

Server Location

United States

Website Domain Name

vtrading-group.com

Server IP

172.67.153.12

Company Summary

| Aspect | Information |

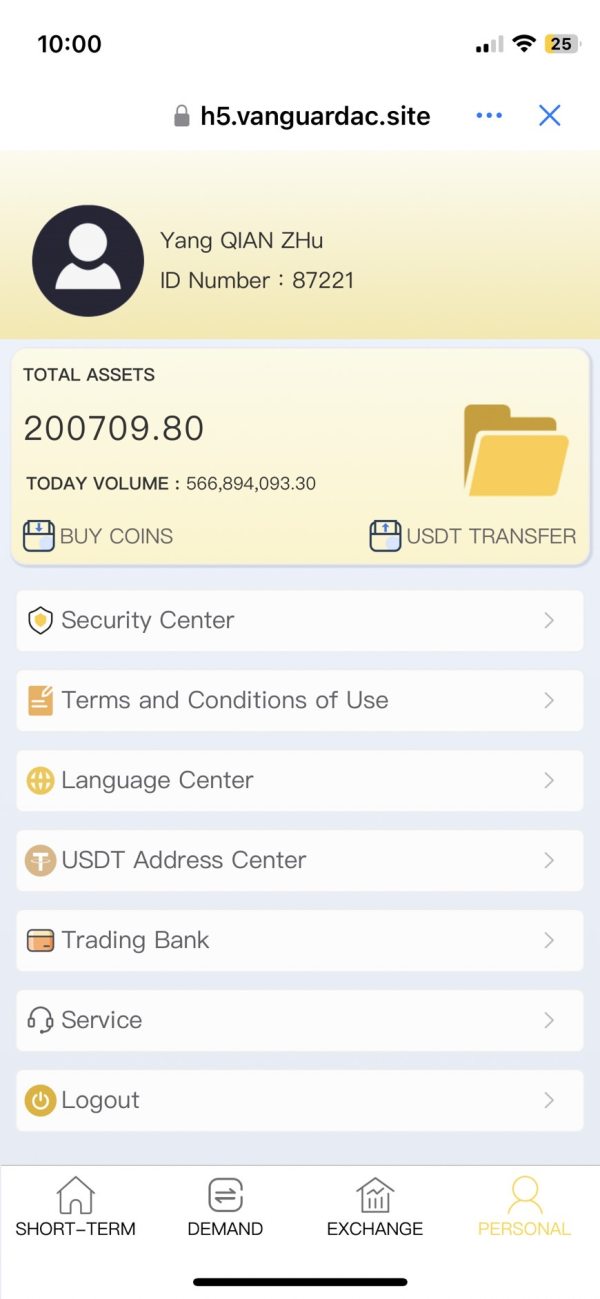

| Company Name | VANGUARD TRADING |

| Registered Country/Area | China |

| Years | 2-5 years |

| Regulation | Unregulated |

| Market Instruments | Mutual funds, ETFs, Money market, Stocks, Certificates of Deposit (CDs), and Bonds |

| Account Types | IRAs, Individual & joint brokerage, 529 savings, and Small business |

| Minium Product Fees | $0 |

| Demo Account | Yes |

| Customer Support | Email support@vtrading-group.com, Twitter, FaceBook, and Instagram |

| Educational Resources | Articles |

Overview of VANGUARD TRADING

Vanguard Trading, operating in China for 2-5 years, offers investment opportunities in Mutual Funds, Exchange-Traded Funds (ETFs), Money Market products, Stocks, Certificates of Deposit (CDs), and Bonds.

Despite being unregulated, the platform provides a variety of account types, including Individual Retirement Accounts (IRAs), Individual and joint Brokerage accounts, 529 Savings plans, and Small Business accounts. With no minimum product fees, Vanguard Trading ensures flexibility for investors of all sizes. The primary trading platform, Vanguard Online, enables convenient access and management of investments, complemented by the availability of a Demo Account for users to practice trading.

Vanguard Trading also emphasizes investor education, offering valuable insights through articles to assist users in making informed decisions about their financial portfolios.

Regulatory Status

VANGUARD TRADING runs as an unregulated trading platform. Traders and investors need to note that the lack of regulatory scrutiny may introduce heightened risks. In unregulated environments, clients may find themselves with limited avenues for recourse and protection in the face of disputes or unexpected issues.

Pros and Cons

| Pros | Cons |

| Low Fees | Unregulated Status |

| Different Investment Options | Limited Trading Platforms |

| Educational Resources | Restricted Availability |

| Customer Support Channels | No Personalized Financial Advice |

| Demo Account | Potential Lack of Research Tools |

Pros of VANGUARD TRADING:

Low Fees: VANGUARD TRADING offers competitive fee structures, including zero fees for certain types of transactions such as Vanguard ETFs and mutual funds, making it cost-effective for investors.

Different Investment Options: The platform provides a wide range of investment options, including ETFs, mutual funds, stocks, options, CDs, and bonds, allowing investors to diversify their portfolios according to their financial goals.

Educational Resources: VANGUARD TRADING offers educational articles that cover various topics such as news, taxes, retirement, education savings, and tools & calculators. This can be beneficial for investors seeking to enhance their financial knowledge.

Customer Support Channels: With multiple customer support channels, including email and social media platforms like Twitter, Facebook, and Instagram, VANGUARD TRADING ensures accessible and varied avenues for addressing customer inquiries and concerns.

Demo Account: The availability of a demo account allows users to practice trading strategies and familiarize themselves with the platform's features before engaging in actual trades, promoting a risk-free learning environment.

Cons of VANGUARD TRADING:

Unregulated Status: VANGUARD TRADING operates as an unregulated platform, which may pose additional risks for traders, including limited recourse and protection in case of disputes or unforeseen issues.

Limited Trading Platforms: While VANGUARD TRADING provides an online trading platform, the absence of information about additional platforms may limit options for traders who prefer alternative interfaces or features.

Restricted Availability: The platform's services might be limited to specific regions or countries, potentially restricting access for some potential users.

No Personalized Financial Advice: VANGUARD TRADING may not offer personalized financial advice or assistance, which could be a drawback for investors seeking more hands-on guidance.

Potential Lack of Research Tools: Depending on the user's preferences and requirements, the platform may have limited research tools compared to other brokerage services, potentially impacting the depth of analysis for investment decisions.

Market Instruments

Vanguard Trading provides a robust array of market instruments for investor preferences and strategies.

Mutual Funds, a cornerstone of its offerings, enable investors to pool their funds, benefiting from professional management and diversified portfolios. Exchange-Traded Funds (ETFs) offer flexibility, combining features of stocks and mutual funds, providing intraday trading options on stock exchanges.

The Money Market options provide a haven for short-term investments, typically offering low-risk and highly liquid assets. For investors seeking direct ownership in companies, Vanguard Trading provides access to Stocks, allowing individuals to buy and sell shares in publicly traded companies.

Certificates of Deposit (CDs) and Bonds, on the other hand, offer fixed-income securities. CDs provide a secure investment with a predetermined interest rate and maturity date, while Bonds encompass a variety of debt instruments offering regular interest payments and return of principal at maturity.

Account Types

Vanguard Trading supports a comprehensive suite of account types to accommodate various investor needs and financial goals.

Individual Retirement Accounts (IRAs) serve as a cornerstone, offering tax-advantaged savings for retirement. Whether opting for Traditional or Roth IRAs, investors benefit from unique tax structures that align with their preferences and financial circumstances.

The platform extends its services to Individual and joint Brokerage accounts, facilitating direct ownership of financial instruments, including stocks, bonds, and exchange-traded funds (ETFs). These accounts offer flexibility and control over investment choices.

For education-focused savings, Vanguard Trading offers 529 Savings plans. These accounts are designed to help investors save for qualified higher education expenses, providing tax advantages and flexibility in investment choices.

Small Business accounts appeal to entrepreneurs and small business owners, offering a platform for managing business-related investments and providing potential tax benefits.

Fees

Vanguard Trading offers a transparent fee structure for various investment types through both online and phone transactions.

For Exchange-Traded Funds (ETFs) and Mutual Funds, transactions involving Vanguard products incur no fees, providing cost-effective options for investors.

Stocks transactions are similarly cost-efficient, with no charges for online trades and a minimal online rate plus a $25 broker-assisted fee for phone transactions on investments below $1 million, while investments totaling $1 million or more enjoy fee-free phone transactions.

Options trading follows a tiered structure, with investors holding less than $1 million paying $0 plus a $1-per-contract fee, while those with $1 million to $5 million benefit from the first 25 trades being fee-free, followed by $0 plus a $1-per-contract fee thereafter. For investments exceeding $5 million, the first 100 trades are fee-free, with subsequent trades incurring $0 plus a $1-per-contract fee.

In the realm of Certificates of Deposit (CDs) and Bonds, online transactions for various securities, including U.S. Treasury securities, Municipal bonds, and Unit Investment Trusts (UITs), involve minimal or no fees, while phone transactions incur reasonable charges, such as $35 per trade for Mortgage-backed securities. This fee structure provides investors with flexibility and clarity as they navigate Vanguard Trading's investment offerings.

| Investment Type | Online | By Phone | |

| ETFs | Vanguard ETFs | $0 | $0 |

| Mutual Funds | Vanguard ETFs | $0 | $0 |

| Assets invested in Vanguard ETFs & mutual funds | Online | By Phone | |

| Stocks | Less than $1 million | $0 | Online rate + $25 broker-assisted fee |

| $1 million or more | $0 | $0 | |

| Assets invested in Vanguard ETFs & mutual funds | Online or by phone | ||

| Options | Less than $1 million | $0 + $1-per-contract fee | |

| $1 million to $5 million | $0 for first 25 trades;* $0 + $1-per-contract fee thereafter | ||

| $5 million or more | $0 for first 100 trades;* $0 + $1-per-contract fee thereafter | ||

| Investment Type | New Issues | Secondary market* | |

| CDs & Bonds | CDs, U.S. government agency securities, and corporate bonds | $0 | $1 per $1,000 face amount ($250 maximum) |

| U.S. Treasury securities | $0 | $0 | |

| Municipal bonds | $0 | $1 per $1,000 face amount ($250 maximum) | |

| Mortgage-backed securities | N/A | $35 per trade | |

| Unit Investment Trusts (UITs) | N/A | $35 per trade | |

How to Open an Account?

Opening an account with VANGUARD TRADING is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the VANGUARD TRADING website and click “Open an Account.”

Fill out the online application form: The form will request your personal information, financial details, and trading experience. Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: VANGUARD TRADING offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the VANGUARD TRADING trading platform and start making trades.

Customer Support

Vanguard Trading prioritizes accessible customer support channels.

For direct communication, investors can reach out via email at support@vtrading-group.com, offering a traditional yet efficient means of resolving queries or seeking assistance. Additionally,

Vanguard Trading is actively present on social media platforms, including Twitter, Facebook, and Instagram. These platforms serve as valuable channels for customer support, enabling users to engage with the company, stay informed about updates, and receive timely responses to their inquiries.

Educational Resources

Vanguard Trading recognizes the importance of empowering its traders with valuable information, and to this end, the platform offers a rich array of articles covering a wide range of topics.

Traders can delve into the latest market developments and insights through the “News & Perspectives” section, providing them with a comprehensive understanding of the financial landscape.

The platform also delves into the intricacies of taxation within the investment realm through articles on “Taxes,” offering guidance on optimizing tax strategies and understanding the implications of various investment decisions.

Planning for retirement is a crucial aspect of any investor's journey, and Vanguard Trading supports its traders by offering insightful articles on “Retirement.” These resources guide on retirement planning, investment strategies, and navigating the complexities of post-employment financial management.

Additionally, the platform recognizes the importance of education planning and offers valuable content on “Education Savings.” Traders can access information on 529 savings plans, investment strategies for educational expenses, and insights into optimizing their financial approach to support academic pursuits.

Furthermore, Vanguard Trading provides a suite of “Tools & Calculators” that go hand-in-hand with educational articles. These tools empower traders to make informed decisions by offering calculators for retirement planning, investment projections, and tax estimations.

Conclusion

VANGUARD TRADING has its perks, like low fees and a variety of investment options. The educational resources and demo account are also helpful for users. However, it's crucial to be cautious because the platform is not regulated, which means there's less oversight and potential risks. Limited availability and trading platforms might be a drawback, and there's no personalized financial advice. Also, for users who rely heavily on research tools, VANGUARD TRADING may not be the most robust option.

It's a good choice for cost-conscious investors, but users need to be aware of the trade-offs and assess their comfort with the platform's limitations.

FAQs

Q: What's the minimum requirement to start investing?

A: You can buy a Vanguard ETF® for as little as $1, regardless of the ETF's share price. All stocks and non-Vanguard ETFs must be bought at market share prices. Both Vanguard and non-Vanguard mutual fund minimum investment amounts vary by fund.

Q: How are fees calculated?

A: Expense ratios on mutual funds and ETFs are calculated by dividing the fund's operational expenses by its average net assets.

Q: What are some less risky investment options?

A: Lower-risk products, including certificates of deposits (CDs) and money market funds, aim to protect your principal; but pay lower interest rates.

Q: How do I decide on an asset mix for my portfolio?

A: Consider your investment goal, time frame for needing the money, and overall risk tolerance to determine an appropriate asset allocation. Then, pick a proportion of stock, bond, and cash investments to build a portfolio that matches your target asset mix.

Q: Can I get a complete, diversified portfolio with just 1 investment?

A: We offer several low-cost, all-in-one funds that invest in multiple asset classes to help simplify how you manage your portfolio.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now