Score

cwg

China|2-5 years|

China|2-5 years| https://www.cwgforextws.com/index/index/index/token/a596f2ca3bd7934e3707ea0db276525c.html

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaUsers who viewed cwg also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

cwgforextws.com

Server Location

United States

Website Domain Name

cwgforextws.com

Server IP

172.67.163.18

Company Summary

| Aspect | Information |

| Company Name | CWG Markets |

| Registered Country/Area | China |

| Founded Year | 2020 |

| Regulation | Operates without specific regulatory oversight |

| Market Instruments | Forex, CFDs on stocks, indices, commodities, precious metals, cryptocurrencies |

| Account Types | Standard, ECN Prime, Islamic |

| Minimum Deposit | USD $200 |

| Maximum Leverage | Varies across account types |

| Spreads | Variable, starting from 1.2 pips |

| Trading Platforms | MT4, MT5, CWG WebTrader |

| Customer Support | Available 24/5 via live chat, phone |

| Deposit & Withdrawal | Various methods including cards, bank transfers, e-wallets |

| Educational Resources | Limited educational materials |

Overview of CWG

CWG Markets, established in 2020, operates from China without specific regulatory oversight. The platform offers a diverse array of market instruments encompassing Forex, CFDs on stocks, indices, commodities, precious metals, and cryptocurrencies. Traders can choose from multiple account types—Standard, ECN Prime, and Islamic—with a low minimum deposit requirement of USD $200. Maximum leverage varies across these accounts, providing flexibility to suit different trading preferences.

Spreads are variable, commencing from 1.2 pips. Users access trading via well-known platforms like MT4, MT5, and CWG WebTrader, ensuring versatility and convenience. Customer support is available 24/5 through live chat and phone channels. CWG Markets facilitates various deposit and withdrawal methods, including cards, bank transfers, and e-wallets.

Is CWG legit or a scam?

CWG operates without regulation from any regulatory authority, potentially raising concerns about the transparency and oversight of the exchange. Unregulated platforms lack the essential oversight and legal protections offered by regulatory authorities. This absence increases the risk of encountering fraud, market manipulation, and security breaches. Moreover, without proper regulation, users might encounter difficulties in seeking remedies or resolving disputes. The lack of regulatory oversight further contributes to a less transparent trading environment, making it challenging for users to evaluate the exchange's legitimacy and reliability.

Pros and Cons

| Pros | Cons |

| Multiple account types available | Limited educational resources |

| Variety of payment methods | Lack of regulatory oversight |

| Low minimum deposit requirement | Potential withdrawal fees |

| 24/5 customer support | Limited market analysis tools |

| Not available in some countries or regions |

Pros:

1.Multiple account types available: CWG offers various account types like Standard, ECN Prime, and Islamic accounts, catering to diverse trading needs. Each account type comes with different features, allowing users to choose based on their preferences and trading strategies. These options provide flexibility for traders to select the account that best suits their requirements.

2. Variety of payment methods: CWG supports multiple payment methods, including credit/debit cards, bank transfers, and e-wallets like Skrill and Neteller. This diversity allows users to fund their accounts conveniently using their preferred payment option.

3. Low minimum deposit requirement: With a minimum deposit of just USD $200, CWG ensures accessibility for traders with varying financial capabilities. This lower entry barrier encourages more individuals to explore trading without the need for a substantial initial investment.

4. 24/5 customer support: CWG offers responsive customer support accessible throughout the trading week. Their availability via live chat, phone, and email ensures users can seek assistance promptly regarding account-related queries, technical issues, or trading guidance.

Cons:

1.Limited educational resources: CWG lacks comprehensive educational materials such as user guides, video tutorials, live webinars, and detailed blogs. This absence can hinder new users' understanding of the platform functionalities and trading strategies, potentially leading to errors or losses.

2. Lack of regulatory oversight: The platform operates without specific regulatory oversight, which may raise concerns about transparency and user protection. This lack of regulation could potentially expose users to certain risks in an unmonitored trading environment.

3. Potential withdrawal fees: While CWG typically doesn't charge deposit fees, users might encounter withdrawal fees, especially with certain payment methods or under specific circumstances. These fees, if not transparently communicated, can impact users' profitability.

4. Limited market analysis tools: CWG might offer limited tools or insights for market analysis and research. This limitation could pose challenges for traders who heavily rely on in-depth analysis or market insights to make informed trading decisions.

5. Not available in some countries or regions: CWG's services may not be accessible in certain countries or regions due to regulatory restrictions or other limitations, potentially limiting the platform's reach and user base.

Market Instruments

CWG provides a diverse array of trading assets, encompassing various financial instruments to cater to traders' preferences.

Within its offerings, CWG includes access to the Forex market, enabling users to trade currency pairs and engage in foreign exchange trading.

Additionally, CWG facilitates trading in Contracts for Difference (CFDs) on stocks, allowing users to speculate on the price movements of individual stocks without owning the underlying assets. Traders can explore indices, representing baskets of stocks or securities, enabling them to speculate on the performance of entire markets or sectors rather than individual stocks.

The platform also extends its offerings to commodities, encompassing assets such as energies, agricultural products, and metals.

Moreover, CWG provides opportunities for trading in precious metals, enabling users to engage in the market for metals like gold, silver, platinum, and palladium, which often serve as safe-haven assets or have industrial uses, diversifying the range of available investment options.

Account Types

CWG offers three types of trading accounts: Standard Account,ECN Prime Account and Islamic Account . Both accounts offer attractive trading conditions and provide a wide range of base currencies to suit the preferences of different traders.

Standard Account:

The Standard Account at CWG is designed to cater to traders seeking a versatile and accessible trading experience. With leverage offered up to 500:1, users can amplify their trading positions. The spreads are variable, starting from 1.2 pips, providing flexibility in trading costs. A commission of $3 per trade is applied, and the minimum deposit required to open this account type is USD $200. Withdrawals are processed within 24 hours, ensuring efficient access to funds.

ECN Prime Account:

CWG's ECN Prime Account caters to traders seeking direct market access and raw spreads. With leverage up to 400:1, users can engage in trading with a higher capital efficiency. The spreads offered are raw, although a commission of $5 per $100,000 traded is applied. The minimum deposit required for this account type is higher at USD $5,000, targeting more experienced or high-volume traders.

Islamic Account:

The Islamic Account, also known as a Swap-free account, is tailored for traders adhering to Islamic finance principles. This account type offers leverage up to 500:1, similar to the Standard Account. The spreads are variable, starting from 1.2 pips, providing flexibility in trading costs. Notably, there is no commission applied to trades within this account type. The minimum deposit required is USD $200, similar to the Standard Account, ensuring accessibility for users following Islamic finance principles.

| Account Type | Leverage | Spreads | Commission | Minimum Deposit |

| Standard | Up to 500:1 | From 1.2 pips | $3 per trade | $200 |

| ECN Prime | Up to 400:1 | Raw | $5 per $100,000 traded | $5,000 |

| Islamic | Up to 500:1 | From 1.2 pips | None | $200 |

How to Open an Account?

Here is a step-by-step guide to opening an account with CWG:

Step 1: Visit the CWG Official Website

Go to the official CWG website and locate the “Open Account” or “Sign Up” section. Typically, this can be found in the top menu or as a prominent button on the homepage.

Step 2: Choose Account Type

Select the type of account that aligns with your trading preferences and financial capabilities. CWG offers different account types tailored to varying trading needs, such as Standard, ECN Prime, or Islamic accounts.

Step 3: Fill in Personal Information

Complete the registration form with accurate personal details. This usually includes your full name, email address, contact number, country of residence, and any other required information as indicated.

Step 4: Verify Identity

Provide the necessary identification documents for verification purposes. This typically includes a government-issued ID (such as a passport or driver's license) and proof of address (like a utility bill or bank statement). Follow the instructions provided to upload these documents securely.

Step 5: Deposit Funds

Fund your newly created trading account by selecting a preferred payment method from the available options. CWG typically accepts various methods, including credit/debit cards, bank transfers, or e-wallets. Ensure you meet the minimum deposit requirement for the chosen account type.

Step 6: Start Trading

Once your account is verified and funded, you can start trading. Download the trading platform (such as MT4, MT5, or CWG WebTrader) provided by CWG. Log in with your credentials and start exploring the platform's features, familiarize yourself with the tools, perform analysis, and execute trades as per your trading strategy.

Remember to familiarize yourself with the platform's functionalities and terms of service to ensure a smooth trading experience. If you encounter any issues or require assistance during the account opening process, CWG typically offers customer support via live chat, phone, or email to address your inquiries.

Leverage

At CWG, the maximum leverage provided differs among its account types.

The Standard Account offers traders leverage of up to 500:1, allowing them to amplify their trading positions significantly. In contrast, the ECN Prime Account presents a slightly lower leverage, capping at 400:1, suitable for traders seeking direct market access with enhanced capital efficiency. The Islamic Account aligns with the Standard Account in terms of leverage, providing traders adhering to Islamic finance principles with access to leverage of up to 500:1 for their trading activities.

Spreads & Commissions

CWG offers a variety of account types with distinct fee structures, catering to the diverse preferences and trading styles of its users.

The Standard Account provides leverage of up to 500:1, with spreads starting from 1.2 pips. Traders using this account are subject to a fixed commission of $3 per trade. With a relatively low minimum deposit requirement of $200, the Standard Account is designed to be accessible for a wide range of traders, including beginners and those looking for a straightforward fee model.

For traders seeking raw spreads, the ECN Prime Account offers leverage of up to 400:1, with no specified spread as it operates on a raw spread basis. Instead, traders pay a commission of $5 per $100,000 traded. This account type is tailored for those who prioritize tight spreads and are comfortable with a commission-based fee structure. With a higher minimum deposit of $5,000, the ECN Prime Account is better suited for experienced traders or those with a more substantial trading capital.

The Islamic Account, with spreads starting from 1.2 pips, stands out for its commission-free structure. This account is designed to align with Islamic finance principles, making it suitable for traders who adhere to specific ethical considerations. With a minimum deposit requirement of $200, the Islamic Account provides an inclusive option for traders seeking a fee model without commissions.

| Account Type | Spreads | Commission |

| Standard Account | Variable, from 1.2 pips | $3 per trade |

| ECN Prime Account | Raw spreads (commission applies) | $5 per $100,000 traded |

| Islamic Account | Variable, from 1.2 pips | $0 |

Trading Platform

CWG offers multiple trading platforms to cater to different preferences and trading styles:

MetaTrader 4 (MT4):

MT4 is a widely acclaimed and user-friendly platform known for its robust features. It provides an extensive range of tools for technical analysis, customizable charts, various timeframes, and a plethora of built-in indicators. MT4 supports multiple order types and allows automated trading through Expert Advisors (EAs). It's suitable for both novice and experienced traders due to its intuitive interface and comprehensive functionalities.

MetaTrader 5 (MT5):

Similar to MT4, MT5 is a powerful platform offering advanced trading features. It includes an expanded toolkit, additional timeframes, more technical indicators, and improved analytical tools compared to its predecessor. MT5 supports more markets and asset classes, making it suitable for traders seeking a broader range of instruments to trade.

CWG WebTrader:

CWG also provides the WebTrader platform, a web-based solution that allows traders to access the markets directly from their internet browsers without the need for software downloads. It offers a user-friendly interface, real-time quotes, and accessibility from any device with internet access. WebTrader allows users to manage their accounts, execute trades, and perform analysis conveniently.

These platforms—MT4, MT5, and CWG WebTrader—offer traders versatility, a wide array of tools for analysis, and ease of access to execute trades across various financial instruments provided by CWG. Each platform caters to different trading preferences, ensuring that traders can choose the interface that best aligns with their strategies and preferences.

Deposit & Withdrawal

CWG provides a range of payment methods for funding trading accounts, offering both classic and modern options. Users can choose from conventional methods such as credit cards and bank transfers, as well as modern e-wallets including Visa, Mastercard, Skrill, and Neteller. This diverse selection allows traders to select the payment method that aligns with their preferences and convenience for both deposits and withdrawals.

CWG has set a relatively low minimum deposit of USD $200. This inclusive approach aims to accommodate a wide range of traders, from beginners exploring the world of trading to seasoned professionals. The accessible minimum deposit enhances the platform's user-friendly appeal.

In terms of payment processing time, CWG emphasizes efficiency. Most deposits are processed instantly, enabling traders to swiftly fund their accounts and engage in trading activities without unnecessary delays. While some methods, like bank transfers, may take up to 24 hours, CWG's commitment to minimizing waiting times contributes to a smooth and timely trading experience for its users.

Customer Support

CWG safeguards your trading voyage with round-the-clock, multi-lingual customer support. Seasoned traders and newcomers alike have access to a responsive team reachable via live chat, phone, or email. Quick queries find immediate solutions through live chat, while technical issues are swiftly resolved via phone support.

Educational Resources

CWG faces a deficit in educational resources, creating hurdles for new users aiming to grasp platform functionalities and cryptocurrency trading. The absence of vital resources such as a comprehensive user guide, video tutorials, live webinars, and informative blogs limits avenues for learning. Consequently, this scarcity can complicate the learning curve, potentially resulting in errors and financial losses for inexperienced users. The dearth of robust educational materials might dissuade newcomers from actively participating in trading, potentially undermining their confidence and discouraging their involvement in the cryptocurrency market through the platform.

Conclusion

CWG presents a platform offering multiple account types, a variety of payment methods, a low minimum deposit requirement, and responsive 24/5 customer support.

However, the platform faces limitations in educational resources, lacking comprehensive guides and tools, potentially hindering new users' learning curves. Additionally, the absence of regulatory oversight and potential withdrawal fees raise concerns about transparency and user protection. The platform's limited market analysis tools further challenge traders who heavily rely on detailed insights for informed decisions. Despite these drawbacks, CWG's diverse account options and accessible customer support contribute to its appeal for traders seeking flexibility and responsive assistance.

FAQs

Q: What account types does CWG offer?

A: CWG provides various account options including Standard, ECN Prime, and Islamic accounts to suit different trading preferences.

Q: Are there fees for deposits and withdrawals on CWG?

A: CWG typically doesn't charge fees for deposits, but withdrawal fees might apply based on the chosen method or specific circumstances.

Q: Is CWG regulated by any financial authority?

A: CWG operates without specific regulatory oversight, which might raise concerns about transparency and user protection.

Q: What is the minimum deposit required to start trading on CWG?

A: CWG has a low minimum deposit requirement of just USD $200, enabling accessibility for traders with varying financial capacities.

Q: How can I contact CWG's customer support?

A: CWG's customer support is available 24/5 through live chat and phone for assistance with queries or technical issues.

Q: Does CWG offer comprehensive educational resources?

A: CWG faces a limitation in educational materials, lacking comprehensive guides and tools for new users aiming to understand the platform and trading strategies.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

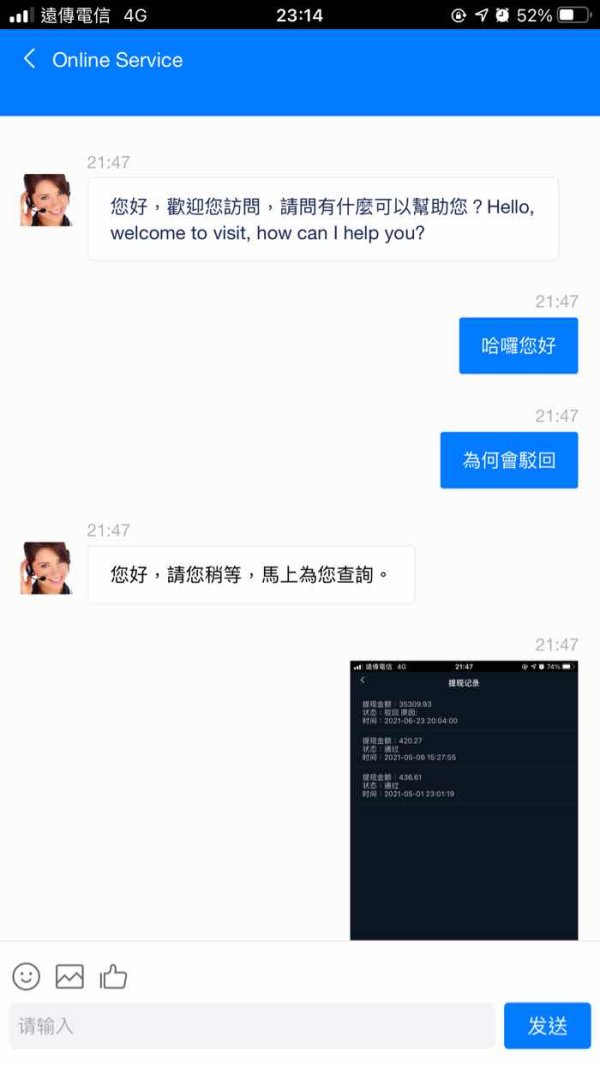

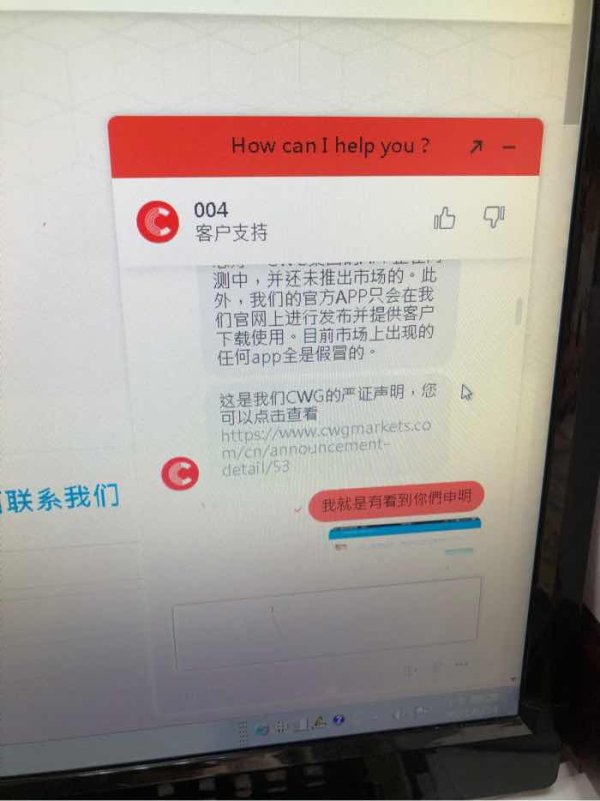

黃珊寶

Taiwan

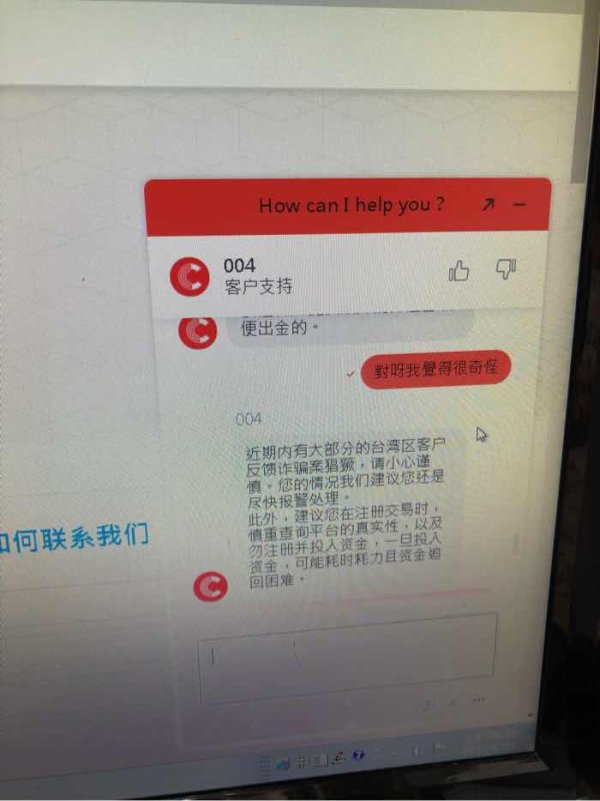

Later, I found the real broker and knew that this broker is a clone

Exposure

2021-06-24

FX3615760799

Taiwan

https://www.cwgforextws.com/index/index/index/token/60f55e4b0167b5c9b751d53d2160ad99.html

Exposure

2021-06-17

Dhe Eurh

Taiwan

This must be a scam to cheat my money

Exposure

2021-06-17

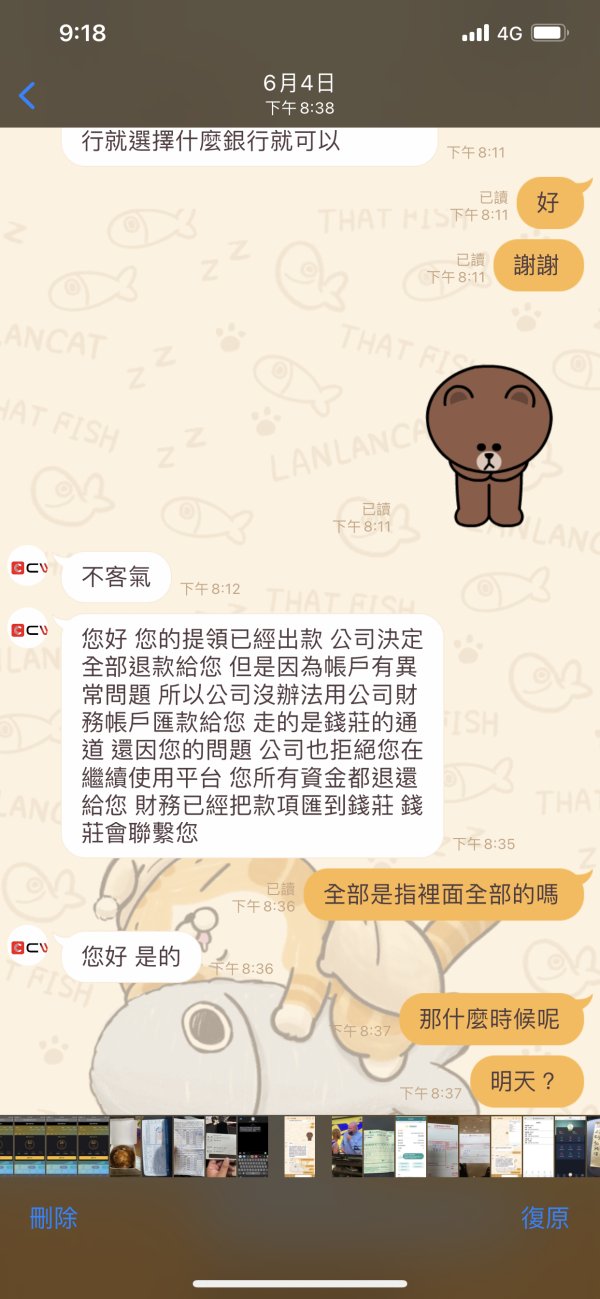

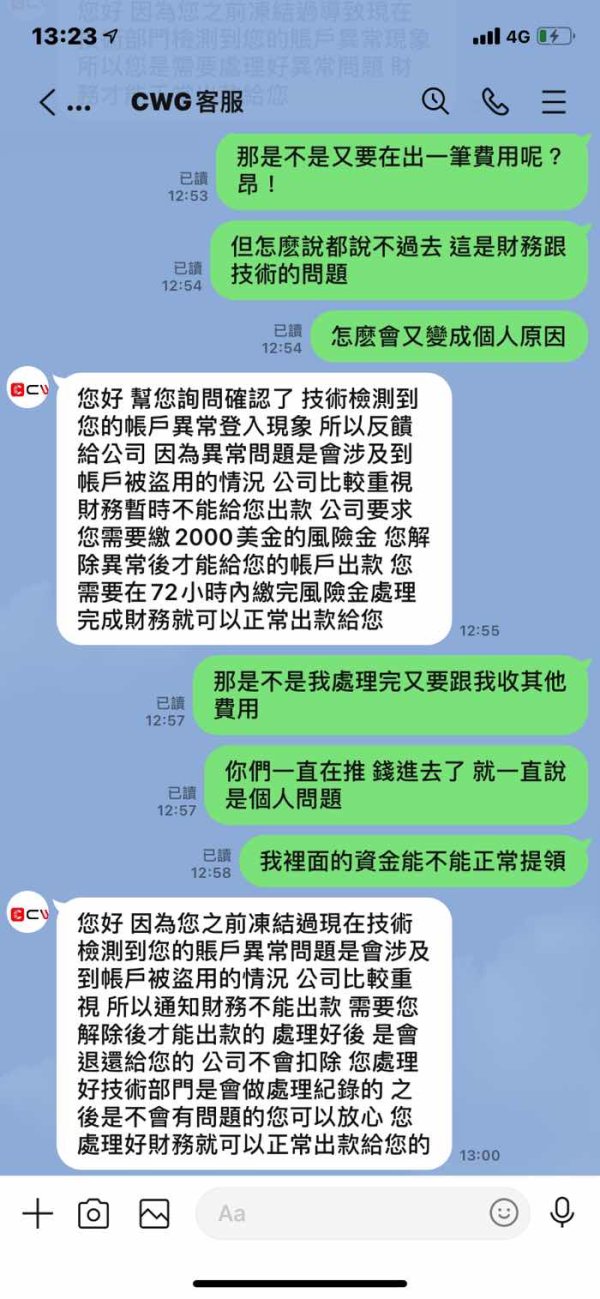

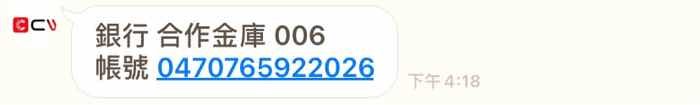

吳建成

Taiwan

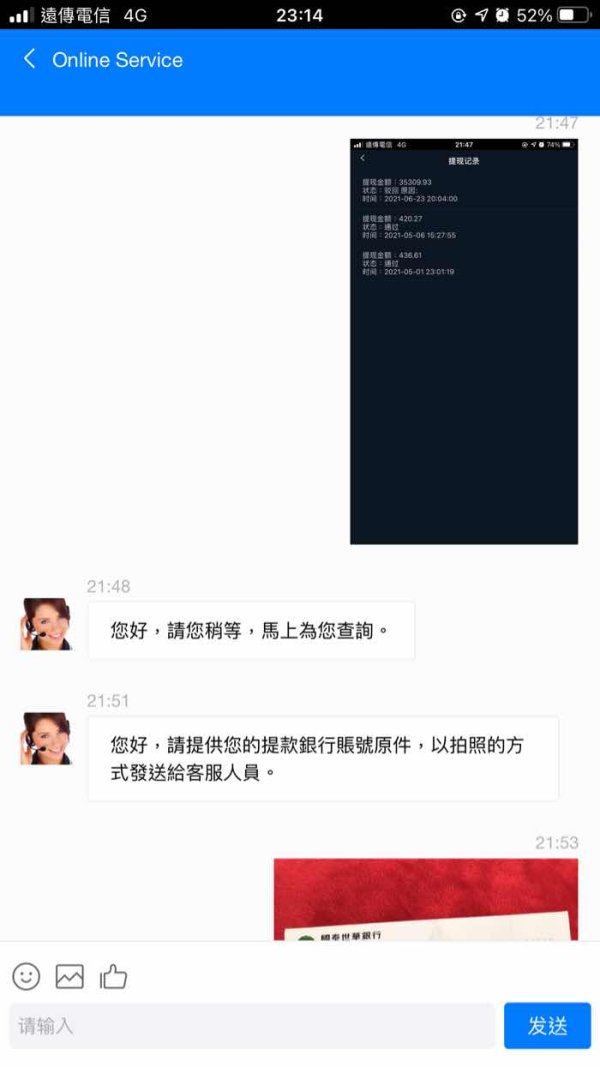

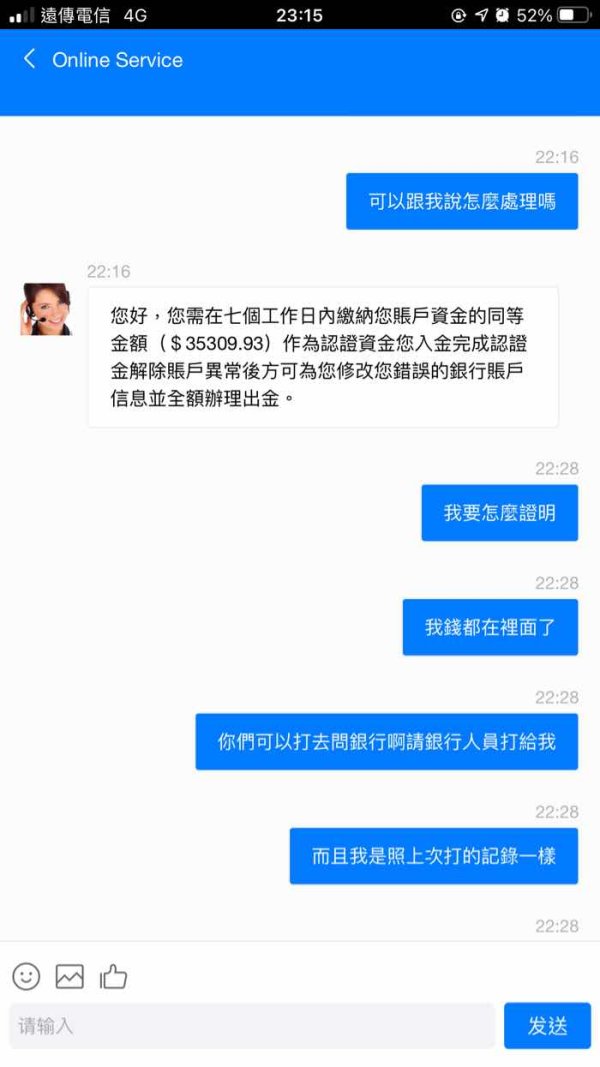

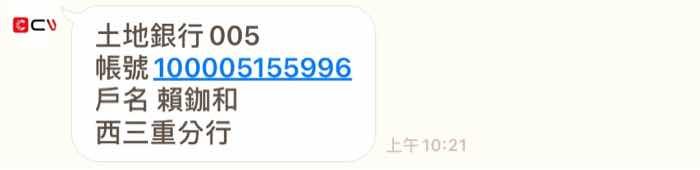

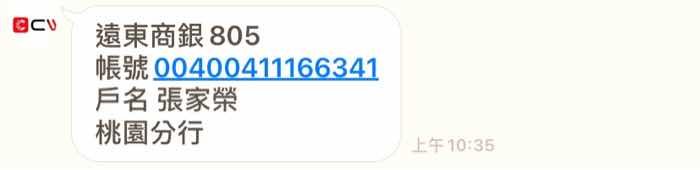

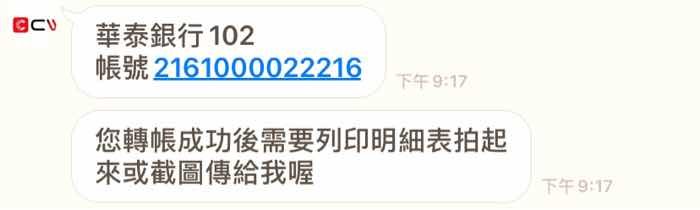

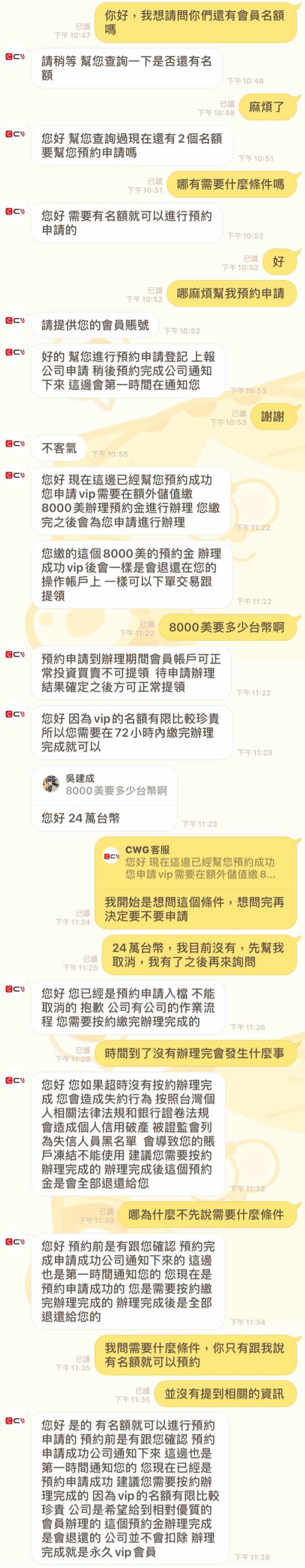

For the first time, I said that my account will be frozen if I make a mistake, and a deposit of 5,000 US dollars is needed to unfreeze. This will be unfrozen after the remittance is completed. For the second time, I asked about the membership system and what conditions are needed. The customer service only said that it would be fine to make an appointment. When I said, please make an appointment for me, they will start to pay a deposit of 8,000 US dollars according to the company's regulations, and they can help you. Application, and cannot be cancelled, and threatened that if you don’t complete it, it will damage your personal credibility. There is also the next third time, really good, with various names, I have already given 18,000 US dollars (this is plus the initial 5,000 US dollars), is it not enough?

Exposure

2021-06-05

吳建成

Taiwan

You can’t modify the wrong account when you wanna withdraw if you don’t pay a margin of $5,000. They promised that they would return your margin after unfreezing your account along with your account balance

Exposure

2021-05-28

Maximilian 111

Nigeria

Can you believe it? I didn't notice that this broker is unregulated, for I found it easy to use, with competitive spreads, stable MT4 performance, and I even made some profits. However, I guess I won't trade it for any more. Lucky me, stupid me!

Neutral

08-07