Score

IPCAPITAL

Canada|2-5 years|

Canada|2-5 years| https://iprimecapital.com/full/en

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Ecuador 4.08

Ecuador 4.08Contact

Licenses

Licenses

Licensed Institution:INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD

License No.:001294622

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Canada

CanadaUsers who viewed IPCAPITAL also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

iprimekapital.com

Website Domain Name

iprimekapital.com

Server IP

104.21.42.126

lprimecapital.com

Server Location

Germany

Website Domain Name

lprimecapital.com

Server IP

92.249.45.32

intelligenceprimecapital-bot.com

Server Location

United States

Website Domain Name

intelligenceprimecapital-bot.com

Server IP

35.209.7.171

Company Summary

| Aspect | Information |

| Registered Country/Area | Canada |

| Founded Year | 1-2 years |

| Company Name | IPCAPITAL |

| Regulation | Regulated by the Australian Securities & Investment Commission (ASIC) |

| Minimum Deposit | Not specified |

| Maximum Leverage | Up to 400:1 |

| Spreads | Not specified |

| Trading Platforms | MT4, WebTrader, IPCAPITALgO, IPCSocial App, ZuluTrade, DupliTrade |

| Tradable Assets | Forex currency pairs, cryptocurrencies, stocks, commodities, indices |

| Account Types | SMART BOT, BRILLIANT BOT, GENIUS BOT |

| Demo Account | Not specified |

| Customer Support | Online chat, email, social media, Chinese (Simplified) phone number |

| Payment Methods | Not specified |

| Trading Tools | AIA BOT system, IPCCLOUD |

General Information

IPCAPITAL is a financial institution operating under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD. It is regulated by the Australian Securities & Investment Commission (ASIC) and holds an Appointed Representative (AR) license. However, IPCAPITAL has received a significant number of complaints according to WikiFX, a platform that tracks complaints and provides risk assessments for brokers. It is listed in their complaint blacklist, and caution is advised when dealing with them.

IPCAPITAL offers a range of market instruments, including forex currency pairs, cryptocurrencies, stocks, commodities, and indices. They provide different account types with varying features, such as the SMART BOT, BRILLIANT BOT, and GENIUS BOT subscriptions, which claim to offer different levels of returns on investment.

The broker offers leverage of up to 400:1 for forex and indices trading, allowing traders to control larger positions with a smaller amount of capital. However, the specific details of spreads and commissions are not mentioned.

There is no specific information about the minimum deposit requirement or supported payment methods for IPCAPITAL.

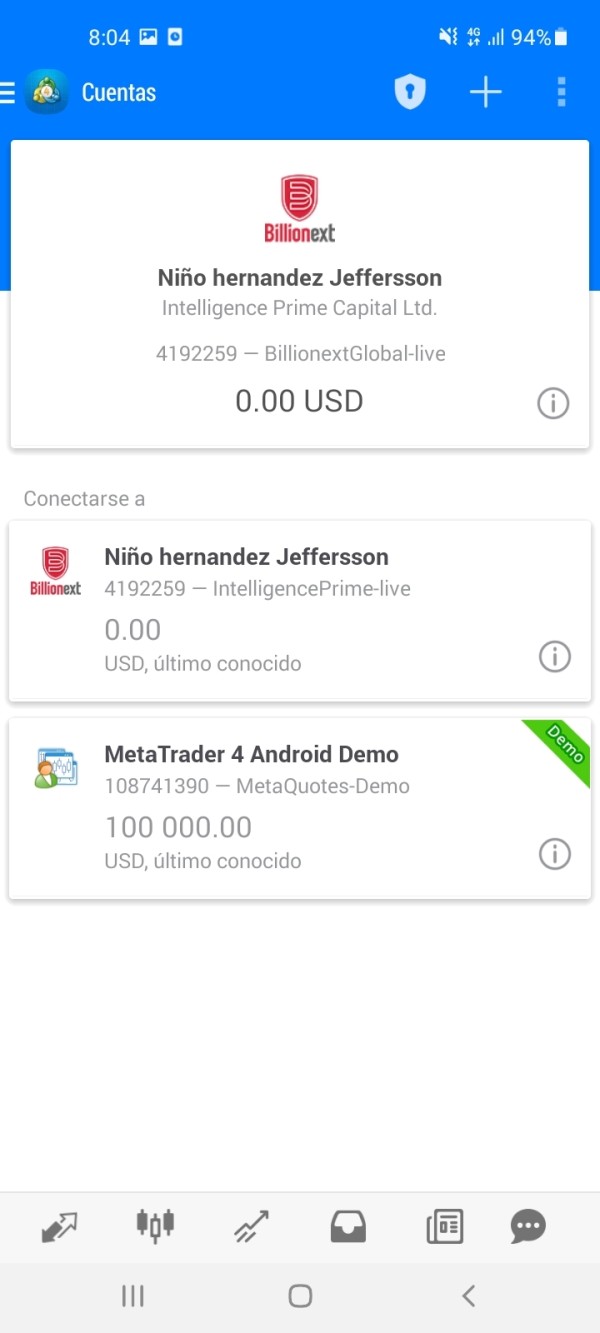

Traders can choose from various trading platforms, including MT4, WebTrader, IPCAPITALgO, IPCSocial App, ZuluTrade, and DupliTrade. These platforms cater to different trading preferences and offer features such as charting tools, real-time market data, and social trading options.

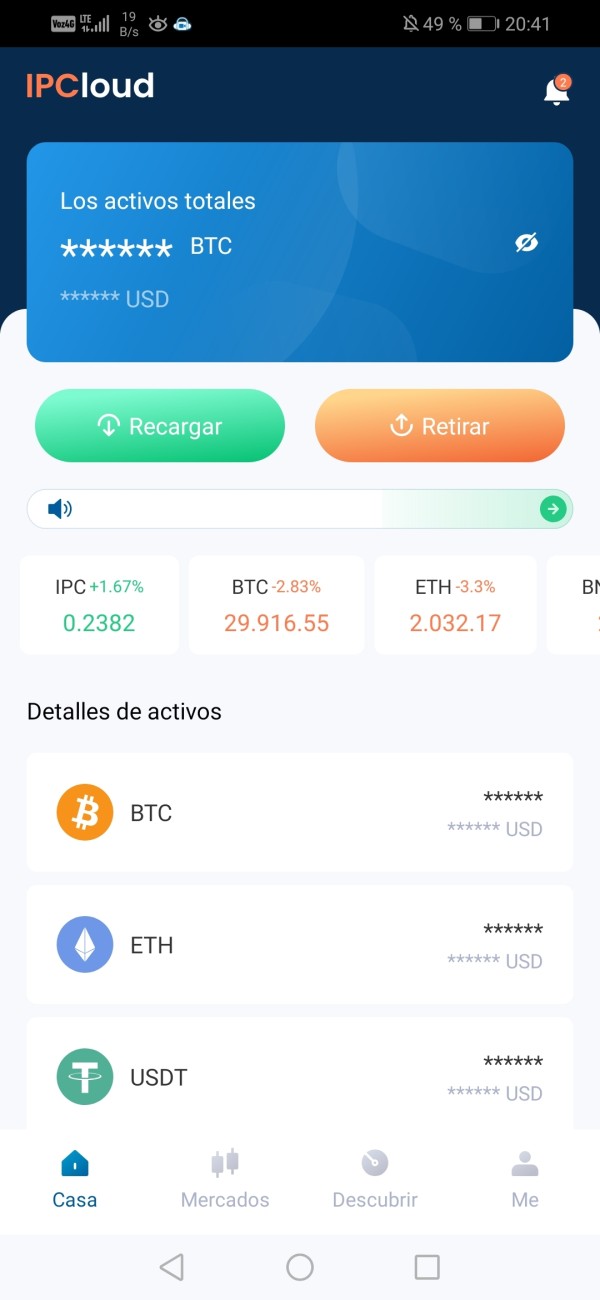

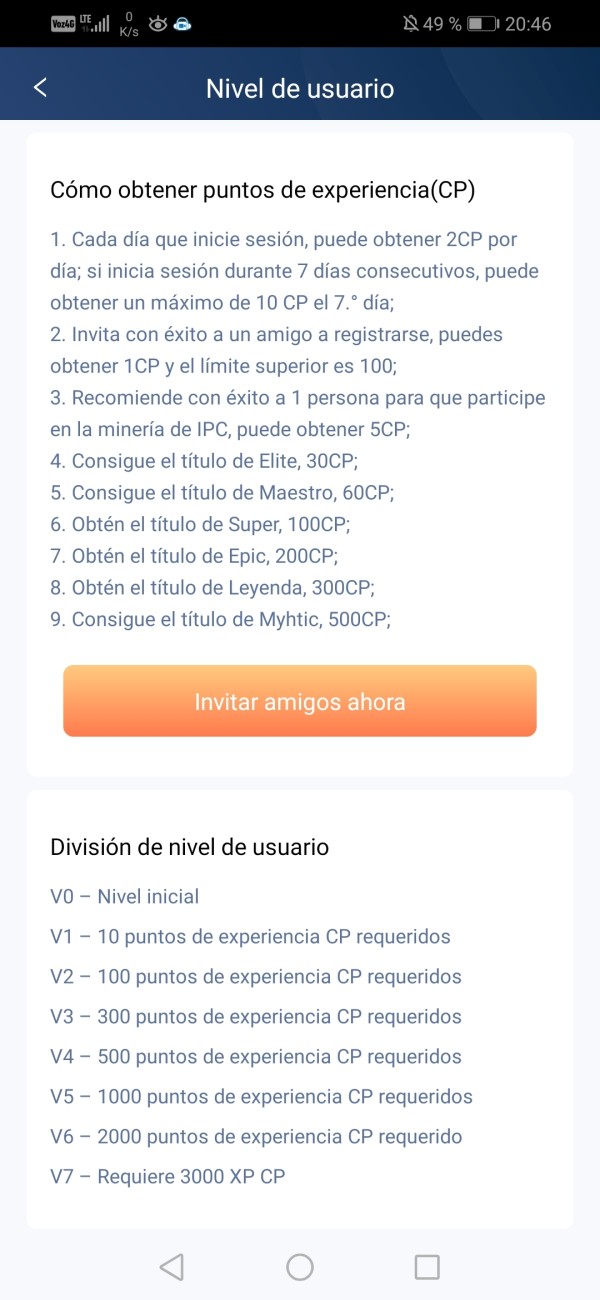

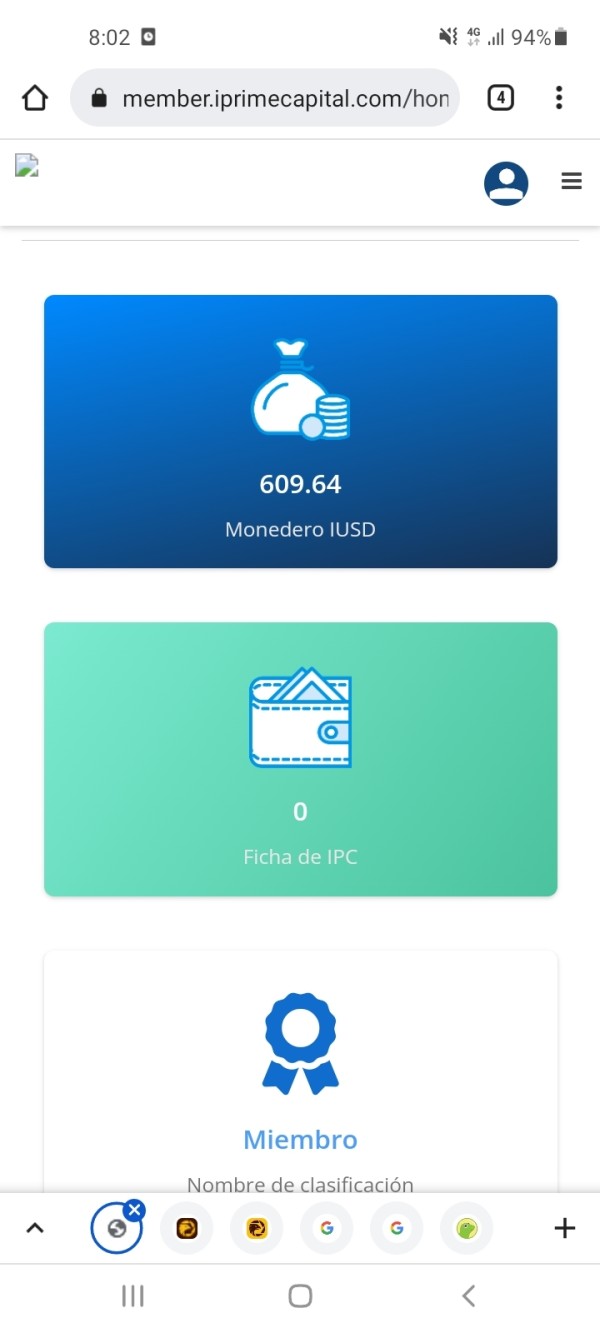

IPCAPITAL provides trading tools such as the AIA BOT system, which utilizes AI algorithms, and IPCCLOUD, a diversified asset management platform.

Customer support is available through online chat, email, and social media platforms. However, negative reviews suggest difficulties with fund withdrawals, lack of communication channels, and allegations of fraudulent activities.

Pros and Cons

IPCAPITAL has both pros and cons that should be considered before engaging with their services. On the positive side, they offer a diverse range of market instruments, including forex, cryptocurrencies, stocks, commodities, and indices. Their leverage of up to 400:1 provides traders with the opportunity to control larger positions with a smaller capital investment. IPCAPITAL also offers a variety of trading platforms, including popular options like MT4, WebTrader, and IPCSocial App. Additionally, their trading tools, such as the AIA BOT system and IPCCLOUD, aim to enhance trading decisions and provide asset management options.

However, there are some concerning aspects. IPCAPITAL has received a significant number of complaints, as listed on WikiFX's complaint blacklist, which raises doubts about their reliability. The lack of specific information regarding spreads, commissions, and minimum deposit requirements makes it challenging to assess the trading costs involved. Negative reviews suggest difficulties in fund withdrawals and a lack of communication channels, which may leave traders feeling frustrated and dissatisfied. It is crucial to carefully consider these pros and cons and conduct thorough research before making any investment decisions.

| Pros | Cons |

| Regulated by ASIC | Numerous complaints and negative reviews on fund withdrawals |

| Wide range of market instruments | Lack of communication channels for addressing concerns |

| Multiple trading platforms | Allegations of fraudulent activities |

| High leverage potential | Lack of specific information on Spreads & Commissions and Deposit & Withdraw |

| AIA BOT system and IPCCLOUD platform |

Is IPCAPITAL Legit?

Based on the information provided, it appears that IPCAPITAL, operating under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD, is regulated by the Australian Securities & Investment Commission (ASIC). They hold an Appointed Representative (AR) license and their license number is 001294622. The effective date of their license is December 20, 2021.

However, it is important to note that the information also indicates a warning from WikiFX, a platform that tracks complaints and provides risk assessments for brokers. According to WikiFX, IPCAPITAL has received a significant number of complaints (319 in the past 3 months) and is listed in their complaint blacklist. The warning suggests being cautious and aware of the potential risks and the possibility of it being a scam.

Market Instruments

IPCAPITAL provides traders with a wide range of market instruments to trade. Here is a breakdown of the market instruments available:

1. Forex Currency Pairs: Traders can trade major, minor, and exotic currency pairs. This includes pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/CAD, and many more.

2. Cryptocurrencies: IPCAPITAL offers trading in various cryptocurrencies, allowing traders to participate in the cryptocurrency market. This may include popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and others.

3. Stocks: IPCAPITAL provides access to a selection of stocks from different global markets. Traders can trade stocks of well-known companies listed on major stock exchanges. These may include stocks from companies like Apple, Google, Amazon, Microsoft, and more.

4. Commodities: Traders can also trade a range of commodities, including precious metals, energy products, agricultural products, and more. Examples of commodities available for trading may include gold, silver, crude oil, natural gas, wheat, corn, coffee, and others.

5. Indices: IPCAPITAL offers trading in various indices, representing baskets of stocks from specific markets or sectors. Popular indices such as the S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, DAX, and others may be available for trading.

| Pros | Cons |

| Wide range of market instruments available | Potential risk associated with trading volatile instruments |

| Opportunities to trade major, minor, and exotic currency pairs | Market fluctuations can impact investment performance |

| Access to cryptocurrencies, including popular ones like Bitcoin and Ethereum | Lack of specific information on trading conditions and fees |

| Availability of stocks from well-known global companies | Regulatory restrictions or limitations in certain markets |

| Opportunity to trade a variety of commodities | Market complexities may require in-depth research and analysis |

Account Types

IPCAPITAL offers different types of AIA Bot subscriptions. Here is a breakdown of the account types and their associated features:

1. SMART BOT: This subscription costs $19.90 as a one-time fee. It claims to offer a return on investment (ROI) of up to 15% per month. The details of the subscription's features and trading strategy are not specified.

2. BRILLIANT BOT: The Brilliant Bot subscription is priced at $39.90 as a one-time fee. It promises a higher ROI of up to 30% per month. The specific trading approach or strategy employed by this bot is not mentioned.

3. GENIUS BOT: The Genius Bot subscription is the highest-tier option, priced at $99.90 as a one-time fee. It claims to provide a potential ROI of up to 45% per month. However, it's important to note that such high monthly returns are unrealistic and may raise suspicions.

It is crucial to exercise caution and skepticism when encountering claims of guaranteed or exceptionally high returns, as they may indicate a potential scam or unrealistic promises.

Furthermore, the information indicates that payments for these subscriptions must be made in cryptocurrencies such as Bitcoin or Tether. Additionally, IPCAPITAL imposes a 20% fee on generated returns, and withdrawals are apparently only allowed on weekends.

It's advisable to carefully assess the legitimacy and credibility of any investment service, especially when they make extraordinary claims or offer high returns with low risks. Conducting thorough research, seeking professional advice, and considering the risks involved are important steps before engaging with such offerings.

| Pros | Cons |

| Provides different account types with varying ROI potential | Lack of transparency in subscription features and strategies |

| Offers a range of price options for subscriptions | Unrealistic and potentially suspicious high ROI claims |

| Allows traders to choose a subscription based on their preferences | Potential risk of misleading investors |

Leverage

IPCAPITAL offers leverage to traders for forex and indices trading, with a maximum leverage of up to 400 times. Leverage allows traders to control a larger position in the market with a smaller amount of capital.

A leverage ratio of 400:1 means that for every dollar of the trader's capital, they can control a position worth up to 400 dollars. This can potentially amplify both profits and losses. While higher leverage can increase the potential for larger gains, it also exposes traders to higher risks.

Spreads & Commissions

According to the information provided, there is no specific mention of trading costs such as spreads and commissions on the IPCAPITAL website. The absence of this information makes it difficult to provide specific details regarding the spreads charged for trading instruments or any commissions associated with trading activities.

Deposit & Withdrawal

There is no specific mention of the minimum deposit requirement for IPCAPITAL. Therefore, it is unclear what the minimum amount is to fund an account with IPCAPITAL.

Additionally, the information does not specify the payment methods supported by IPCAPITAL for depositing funds into trading accounts. It's important to note that payment methods can vary among brokers and may include options such as bank transfers, credit/debit cards, e-wallets, or cryptocurrencies. To obtain accurate and up-to-date information on the available payment methods, it is recommended to contact IPCAPITAL directly or consult their official website.

Trading Platform Available

IPCAPITAL provides traders with a range of trading platforms to suit their preferences and trading styles. Here is a description of the trading platforms available:

1. MT4 (MetaTrader 4): MT4 is a popular and widely used manual trading platform in the industry. It offers a user-friendly interface, advanced charting tools, technical analysis indicators, and the ability to execute trades directly from the platform. Traders can access a wide range of financial instruments and employ various trading strategies. MT4 also supports automated trading through the use of expert advisors (EAs).

2. WebTrader: IPCAPITAL offers a web-based trading platform that allows traders to access their accounts and trade directly from their web browsers without needing to download or install any software. WebTrader provides similar functionality to MT4, including real-time market quotes, charting tools, and order execution capabilities.

3. IPCAPITALgO: IPCAPITALgO is a proprietary manual trading platform developed by IPCAPITAL. It is designed to provide a user-friendly trading experience and is optimized for mobile devices. Traders can access their accounts, view real-time market data, place trades, and manage their portfolios on the go.

4. IPCSocial App: IPCAPITAL offers an innovative trading platform called IPCSocial App. This platform incorporates social trading features, allowing traders to follow and copy the trades of successful traders. It combines social interaction with trading, enabling users to interact with other traders, share insights, and benefit from collective trading wisdom.

5. ZuluTrade and DupliTrade: IPCAPITAL supports third-party automated trading platforms such as ZuluTrade and DupliTrade. These platforms allow traders to automatically copy the trades of experienced traders, known as signal providers. By connecting their accounts to these platforms, traders can replicate the trades of signal providers and potentially benefit from their expertise.

| Pros | Cons |

| Variety of trading platforms to suit different preferences | Limited information on platform features and customization |

| MT4 offers advanced charting tools and automated trading options | Potential learning curve for new users |

| WebTrader allows trading directly from web browsers without downloads | Limited platform-specific educational resources |

| IPCAPITALgO provides a user-friendly mobile trading experience | Limited customization options for IPCAPITALgO |

| IPCSocial App incorporates social trading and collective wisdom | Reliance on signal providers' performance in ZuluTrade/DupliTrade |

Trading Tools

IPCAPITAL offers the following trading tools:

1. AIA BOT SYSTEM: AIA BOT is IPCAPITAL's proprietary AI (Artificial Intelligence) trading system. It utilizes advanced algorithms and machine learning to analyze large volumes of data from various sources. The system's robo-advisers process this data to identify potential trading opportunities and execute trades at what is deemed to be the optimal price. The aim is to leverage AI technology to enhance trading decisions and potentially improve trading outcomes.

2. IPCCLOUD: IPCCLOUD is a diversified asset management platform provided by IPCAPITAL. The platform allows users to manage and monitor their investment portfolios, providing access to a range of financial instruments and strategies.

These trading tools, the AIA BOT system, and IPCCLOUD, are intended to support traders and investors in their decision-making and management of investment portfolios.

| Pros | Cons |

| AIA BOT SYSTEM utilizes advanced algorithms and machine learning to analyze data for potential trading opportunities and optimal execution | Limited transparency on the specifics of the AI algorithms used |

| Provides access to a range of financial instruments and strategies | Limited information on the platform's features and capabilities |

| The aim is to enhance trading decisions and potentially improve trading outcomes | Lack of independent verification or performance data |

| Limited user reviews or feedback on the effectiveness |

Customer Support

IPCAPITAL provides customer support services through various channels. Here is a description of the customer support options available:

1. Online Chat: Traders can access customer support through an online chat feature available on the IPCAPITAL official website. To initiate a chat, users are typically required to fill in their name and email address. This allows them to directly interact with a customer support representative in real-time, addressing any inquiries or concerns they may have.

2. Email: IPCAPITAL offers email support for customers. Traders can reach out to the support team by sending an email to support@iprimecapital.com. This allows for more detailed communication and the opportunity to provide attachments or documents, if needed.

3. Social Media Platforms: IPCAPITAL maintains a presence on various social media platforms, including Twitter and YouTube. Traders can follow their Twitter account, which can be found at https://twitter.com/IPCOfficial2?s=09, to stay updated on company announcements, news, and potentially reach out to them through direct messaging. Their YouTube channel, accessible at https://www.youtube.com/channel/UCfg8l66I86oHL2aUfJuVx6g, may contain educational resources, tutorials, or promotional content.

4. Chinese (Simplified) Phone Number: The information provided includes a phone number for Chinese (Simplified) support, which is listed as +6046158137. Traders who prefer phone communication may utilize this number to seek assistance from the IPCAPITAL support team.

Negative Reviews

Based on the negative reviews on WikiFX, it appears that there are several complaints regarding the inability to withdraw funds from IPCAPITAL. Traders have reported experiencing difficulties in withdrawing their profits or investments, with some alleging that their funds were stolen or converted to a different currency without their consent. There are also allegations of fraudulent activities, including the promotion of a token and wallet.

Additionally, some reviews suggest that IPCAPITAL lacks communication channels and support, leaving investors without any means to address their concerns or retrieve their investments. The negative reviews indicate frustration and dissatisfaction with the broker's practices, with accusations of scams and pyramid schemes being raised.

It's important to note that these reviews represent the experiences and opinions of individual users, and it's always recommended to conduct thorough research and exercise caution when dealing with any financial service provider.

Conclusion

In conclusion, IPCAPITAL is a brokerage firm operating under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD, regulated by the Australian Securities & Investment Commission (ASIC). However, caution is advised as IPCAPITAL has received a significant number of complaints, as reported by WikiFX. These complaints raise concerns about difficulties in withdrawing funds, allegations of fraudulent activities, and poor communication and support. The broker offers a range of market instruments, leverage of up to 400:1, and multiple trading platforms, including MT4 and proprietary platforms. They also provide AI-based trading tools and customer support through online chat, email, and social media. However, the lack of transparency regarding trading costs, minimum deposit requirements, and payment methods is a drawback. Negative reviews and allegations of scams indicate potential risks and suggest the need for thorough research and caution before engaging with IPCAPITAL.

FAQs

Q: Is IPCAPITAL a legitimate investment company?

A: IPCAPITAL operates under the licensed institution INTELLIGENCE PRIME CAPITAL FINANCIAL ADVISORY PTY LTD and is regulated by the Australian Securities & Investment Commission (ASIC). However, it has received a significant number of complaints and is listed in the complaint blacklist by WikiFX, a platform that tracks complaints and provides risk assessments for brokers. Exercise caution and be aware of the potential risks.

Q: What market instruments can I trade with IPCAPITAL?

A: IPCAPITAL offers a variety of market instruments, including forex currency pairs, cryptocurrencies, stocks, commodities, and indices. You can trade major, minor, and exotic currency pairs, popular cryptocurrencies like Bitcoin and Ethereum, stocks of well-known companies, various commodities such as gold and crude oil, and indices like the S&P 500 and Dow Jones Industrial Average.

Q: What are the different account types offered by IPCAPITAL?

A: IPCAPITAL offers three AIA Bot subscriptions: SMART BOT, BRILLIANT BOT, and GENIUS BOT. These subscriptions come with different one-time fees and claim to offer varying returns on investment (ROI) per month. However, be cautious of claims of exceptionally high returns, as they may be unrealistic or indicate potential scams.

Q: What is the leverage offered by IPCAPITAL?

A: IPCAPITAL offers leverage for forex and indices trading, with a maximum leverage of up to 400 times. Leverage allows traders to control larger positions in the market with a smaller amount of capital, but it also amplifies both profits and losses.

Q: What trading platforms are available at IPCAPITAL?

A: IPCAPITAL offers multiple trading platforms, including MT4 (MetaTrader 4), WebTrader, IPCAPITALgO, IPCSocial App, and third-party platforms like ZuluTrade and DupliTrade. These platforms cater to different trading preferences, providing features such as real-time market quotes, charting tools, and order execution capabilities.

Q: What trading tools are provided by IPCAPITAL?

A: IPCAPITAL offers the AIA BOT system, which utilizes AI technology for trading decisions, and IPCCLOUD, a diversified asset management platform.

Q: How can I contact IPCAPITAL's customer support?

A: IPCAPITAL provides customer support through online chat on their website, email support at support@iprimecapital.com, and their presence on social media platforms such as Twitter and YouTube. They also offer a Chinese (Simplified) phone number for support inquiries.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Australia Appointed Representative(AR) Revoked

- High potential risk

Review 334

Content you want to comment

Please enter...

Review 334

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

chans7414

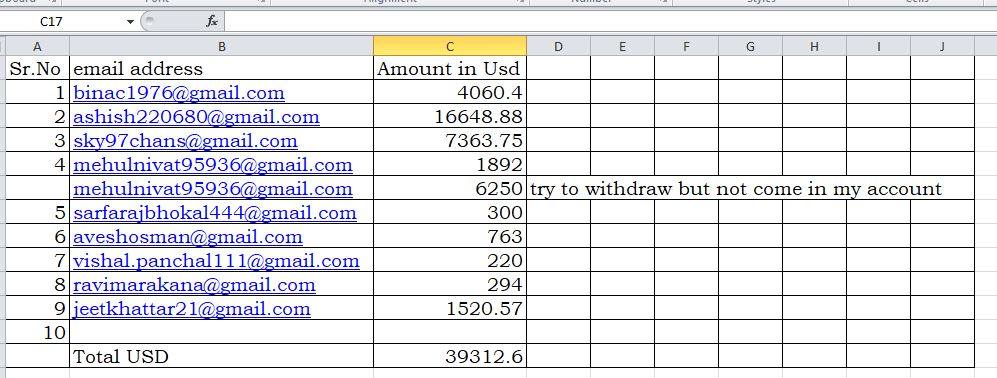

India

Appeal for refund of our money from Intelligence Prime Capital ltd. We all invested table wise USD in IPcapital for forex trading but without our concern the company changed trading from forex to crypto . Now we don’t want to continue service from intelligence prime capital ltd.According to agreement and clause no. 17 we want to discontinue the service and refund money.Sir, this is my humble request to Please guide us what to do? And oblige.The copy of agreement is attached herewith for your ready reference.

Exposure

2023-07-12

FX4068365519

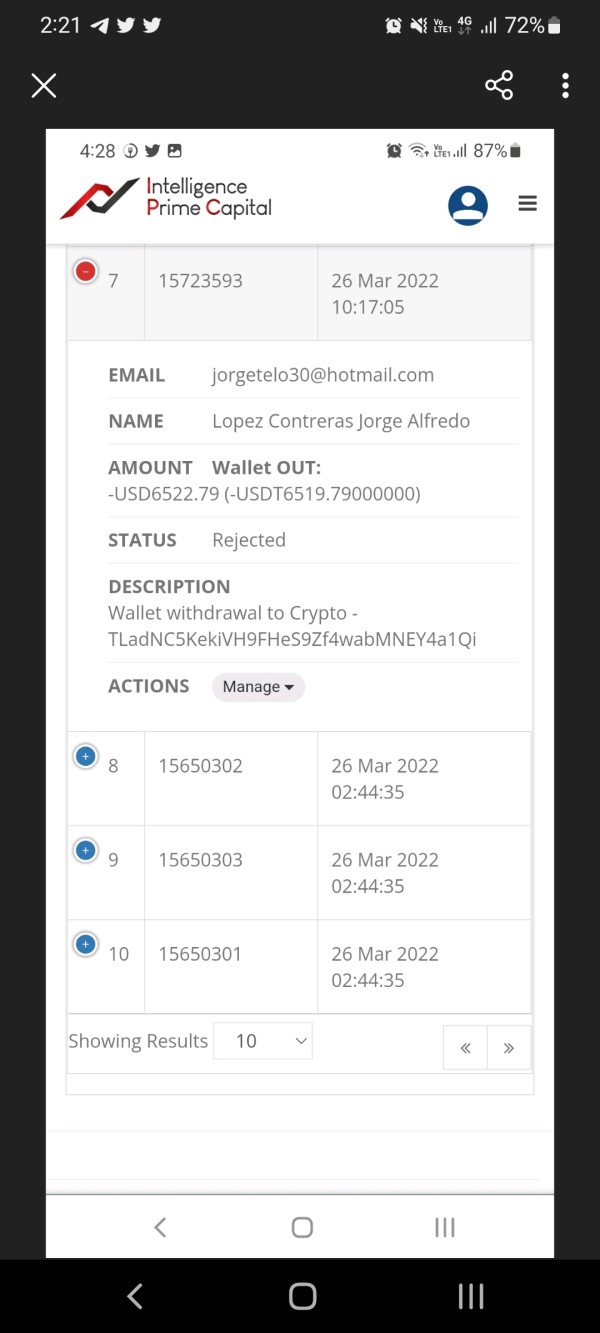

Colombia

I stopped paying and allowing withdrawals. I requested a withdrawal of 6522 dollars and it was rejected and I still have 7593 dollars left there frozen since March 26

Exposure

2022-07-19

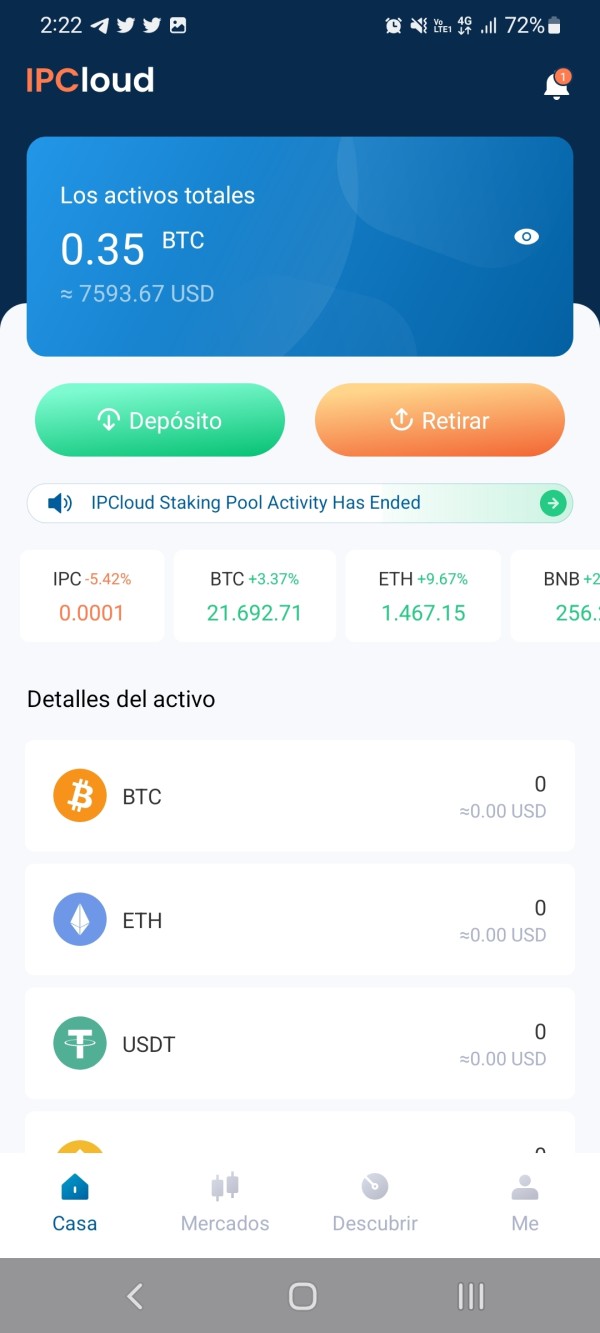

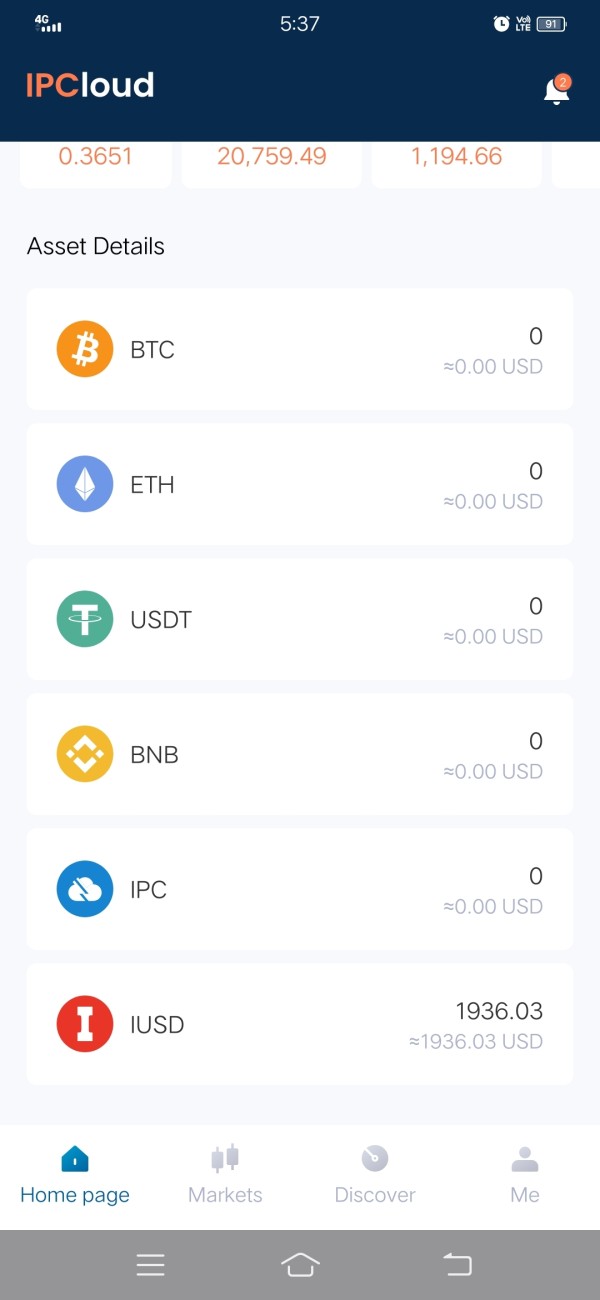

FX2392674048

India

unable to withdraw my 1936 dollar from ipc cloud

Exposure

2022-06-28

Santiago Salazar9744

Ecuador

The new IPCLOUD APP is aimed at continuing to deposit money, without any assurance that the existing one will be returned. It encourages unsuspecting investors to continue to be invited, without even having solved all the problems of this broker. I still can't withdraw my money. IPC SCAMMERS.

Exposure

2022-05-17

FX4169716254

Colombia

It does not allow withdrawals since March 27. The withdrawal was rejected for 247 dollars and it did not return to the wallet. I have not been able to withdraw 856 dollars in my account. The mt4 stopped operating and they changed the currency without prior notice or authorization

Exposure

2022-05-13

FX1977111235

Colombia

They made a fake application to pay and it does not allow any movement and everything is frozen

Exposure

2022-05-13

FX1732453226

Colombia

My money was stolen, my capital is disappeared. Help

Exposure

2022-05-06

FX4772983272

Saudi Arabia

I’m investor on IPCAPITAL with MT4 account #4176772. I placed a withdraw on 27th March 2022, transaction number 15767366, in USDT TRC20 from IPCAPITAL to my Binance wallet address TTgvTstH626kNi2Uq24FaCqK8wshBkKWWs in amount of USD4000 expecting to receive in my Binance account USDT399700000000 and was rejected and desapear, not reflecting neither on IPCAPITAL wallet and Binance wallet or MT4 account. I hereby appeal that my withdraw must be approved to my Binance account mentioned above. You can see the proof of my rejected transactions. Now I’m willing to withdraw all my funds remaining my IPCAPITAL account in total amount of IUSDT2776.48 as they stopped all transactions from IPCAPITAL.

Exposure

2022-05-06

FX3551120968

United States

Like all the people here, since March 25, my capital cannot be withdrawn. The company has not said anything about it and there is no communication channel with them

Exposure

2022-05-04

FX2688676609

Colombia

Does not allow withdrawal of profits or investment

Exposure

2022-05-01

FX1891927072

United States

this company has taken out the option to withdraw funds and also forced us all into a 3 months lock down from getting our funds and they have been no update about withdrawals. instead they came out with thier coin and forcing us to buy

Exposure

2022-04-30

camilo niño

Colombia

Ipcapital hasn't paid for a month and a half without allowing the investment to be withdrawn. They took the investment out of mt4 and the bot hasn't worked for a week, we don't have anyone and no email or support to respond to us. now they tell us that they convert our investment into a currency called IUSD that doesn't even exist, they also promoted a token and a wallet (idclaud) they have been deceiving us like this and they don't come out with anything. Please someone who can help us recover the investment of more than 250,000 investors

Exposure

2022-04-29

Rockevin

Mexico

investment of 1111.06 dollars is unable to withdraw!!!! I want my money back!!!!

Exposure

2022-04-29

Khadar Mohamed

Somalia

IPC is scammer company. please requesting our intervention while they are uploading our funds. they took all money in the system using these below listed wallet addresses. refer the attached pictures. TUEgUZh24tA48EXiAQjA6Qf6rSS7bJKQ6g TRoEvpi67ZA5F1u7bGcAe1v37h3UYdx9Ee TAzsQ9Gx8eqFNFSKbeXrbi45CuVPHzA8wr TSM1puzhnNyYPjomRP1pUeWd5PDv7gEmPg TXWmdMZkLA45WPiKqTMeLvcHPeZSj1npdp TXHW7VX2TGLdL92XXzPqavhQtwewpSGK8S TGGUCScTw2VrD7RP7pxQwm5FmRwh5SmJps

Exposure

2022-04-29

FX7153171812

India

sir I am from India, I was join IPC in Feb ,i had not taken any withdra from this company ,i trusted them lot in aai BOT TRADINGE ,but now a days no trade no withdraw they change our currency in USDT to IUSD...and also no withdraw ,sir plz help and give our withdrawals

Exposure

2022-04-28

FX1187265288

India

Hi Team,Website : https://iprimecapital.com User Name : santhoshkumarmrec@gmail.com The company promised to perform Weekly 5 days forex trade and will provide profit & 80% capital investment as withdrawl every weekend Saturday & Sunday. There are 2 wallets, USDT wallet & MT4 wallet. USDT wallet - This is used to deposit USDT crypto & withdraw USDT crypto. MT4 wallet - This is the capital investment which will be used for Forex trading. on 27-Mar 2022, I have placed transfer of 50 USDT from MT4 wallet to USDT wallet. The company didnt transferred those 50 USDT to USDT wallet and stopped withdrawls. Here is the proof 1 screenshot. From 28-Mar 2022, Company changed the decision to convert into crypto trading instead of forex trading. Also stopped all kinds of withdrawls. Now they have renamed 2 wallets into IUSD wallet & IPC Token wallet. Currently I have 348.06 USDT in the IUSD wallet. Here is the proof 2, screenshot. Company stopped all withdrawls. As mentioned above they have never returned 50 USDT. So Company stopped my withdrawl 348.06 USDT + 50 USDT.

Exposure

2022-04-27

FX1509402639

Nigeria

I invested with IPC since January 19, 2022. all of a sudden they converted my USDT balance to IUSD. I don't know what IUSD is. I want my money back in USDT. thanks.

Exposure

2022-04-27

FX6911274020

Colombia

It does not let you withdraw the balance and it is zero in the MT4.

Exposure

2022-04-27

FX1173540632

United States

since March 25 I requested a wall of my capital and they never paid it

Exposure

2022-04-26

DarwinEC

Ecuador

The Intelligence Prime Capital company has withheld my capital, which is 4,844 USDT, and now I exchange it to IUSD, in addition, it does not manifest itself in payments and is delayed, it does not provide solutions or notices, and it does not have a customer service or email to which they respond.

Exposure

2022-04-26