Score

AJS

Hong Kong|5-10 years|

Hong Kong|5-10 years| http://www.ajsecurities.com.hk

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Hong Kong 2.47

Hong Kong 2.47Contact

Single Core

1G

40G

1M*ADSL

- This broker exceeds the business scope regulated by China Hong Kong SFC(license number: AGL798)SFC-Dealing in securities Non-Forex License. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed AJS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

ajsecurities.com.hk

Server Location

Japan

Website Domain Name

ajsecurities.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

104.215.19.131

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

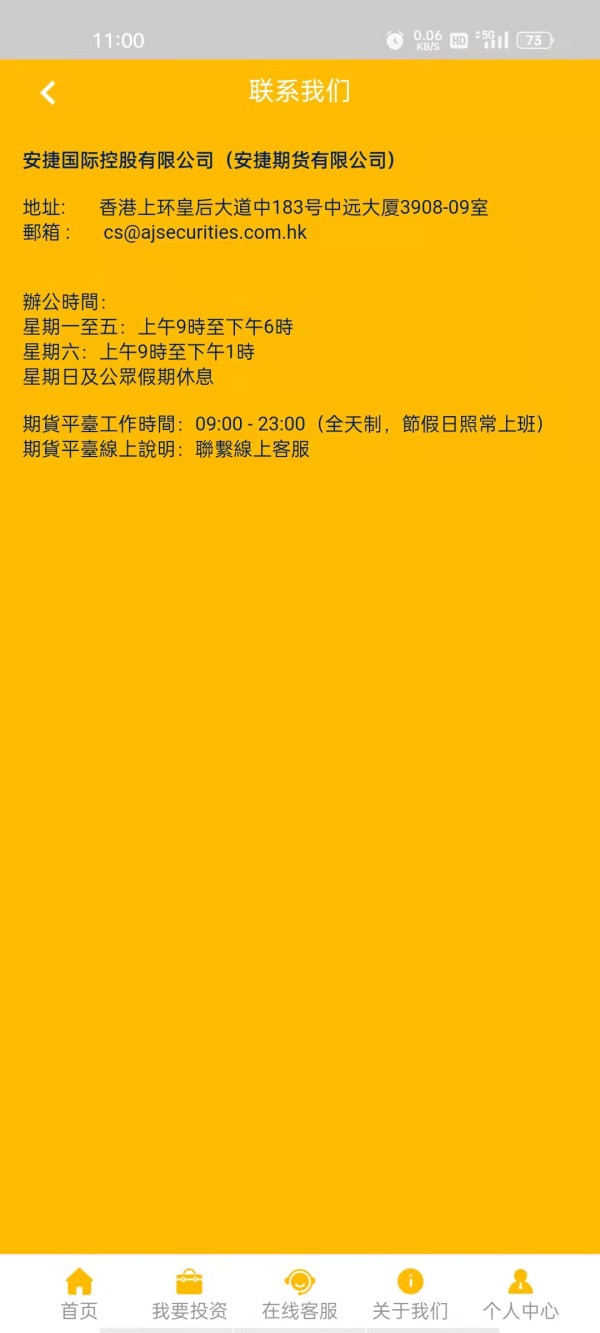

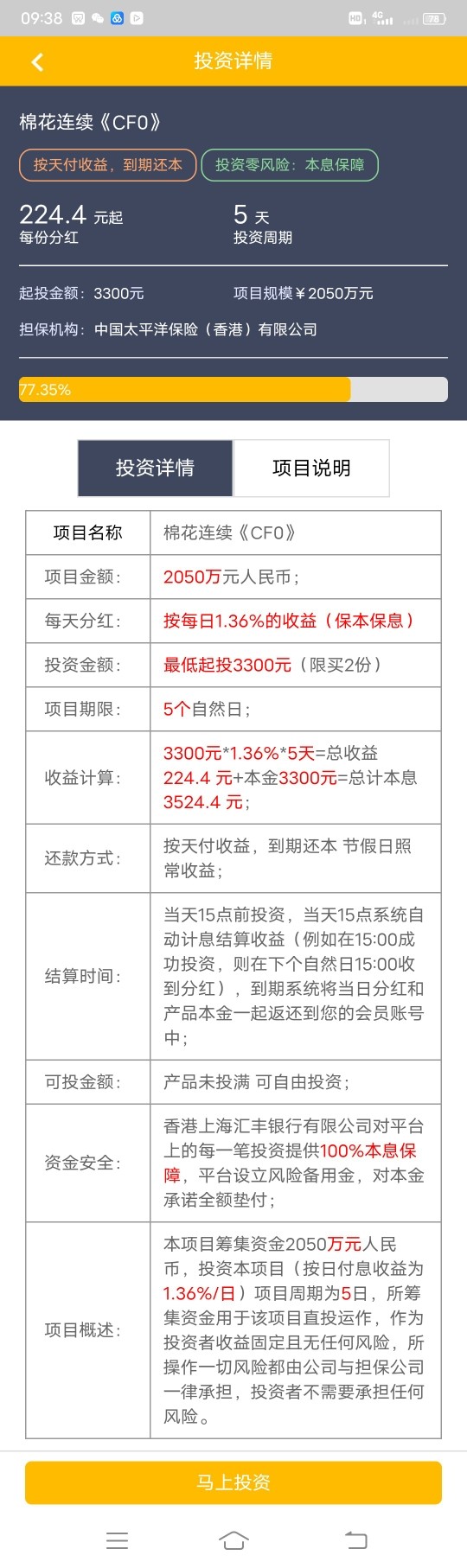

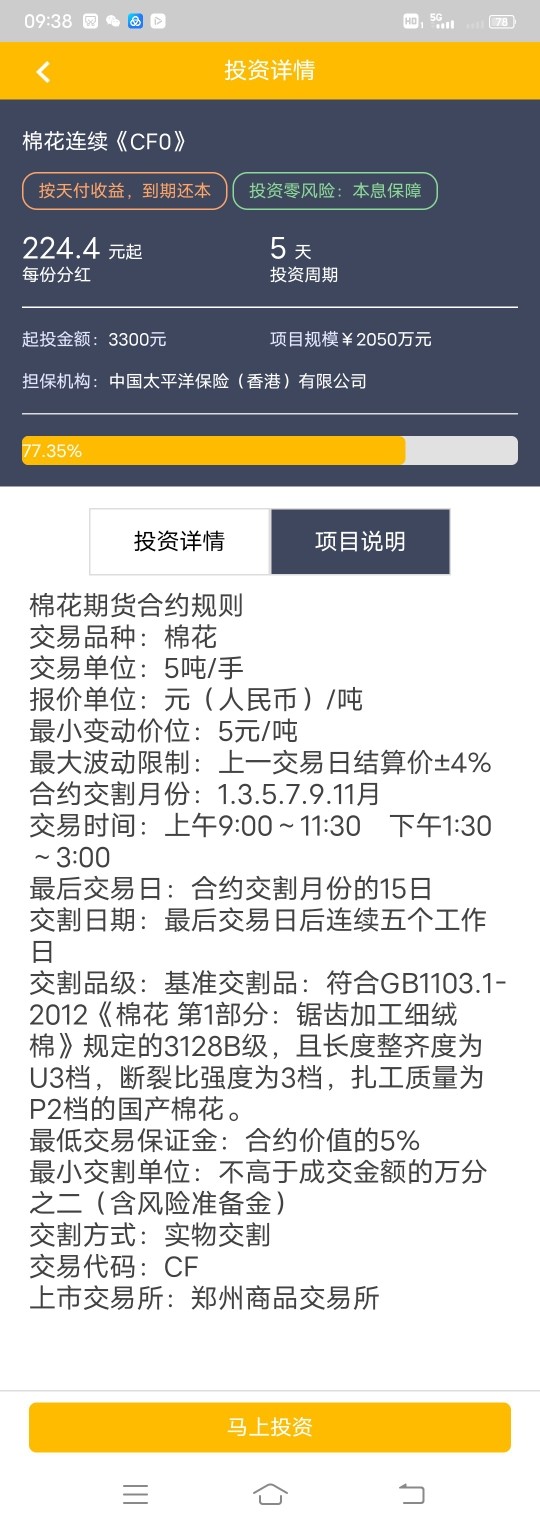

| AJS | Basic Information |

| Company Name | AJ International Holdings Limited |

| Founded in | 2000 |

| Regisetered Country/Region | Hong Kong |

| Offcial Website | https://www.ajsecurities.com.hk/ |

| Regulated By | Securities and Futures Commission (SFC) of Hong Kong |

| Services Offered | Securities brokerage, investment banking, asset management, corporate finance, wealth management, and financial advisory services |

| Markets Covered | Hong Kong, China, and global markets |

| Trading Platforms | Not specified on website |

| Minimum Deposit | Not specified on website |

| Account Types | cash accounts, custodian accounts and margin accounts |

| Customer Support | Telepone, Email, Fax, Sina, Wechet |

| Education/Resources | Not specified on website |

Overview of AJS

AJ International Holdings Limited is a securities broker company established in 2000 and based in Hong Kong. As a financial institution, they provide a range of services such as wealth management, securities trading, investment banking, and corporate finance.

AJ International Holdings Limited has a strong reputation in the financial industry with over two decades of experience in serving local and international clients. Their team of experts includes professionals with extensive knowledge of finance, economics, and investment, providing clients with personalized solutions that fit their unique needs.

As a securities broker company, AJ International Holdings Limited is regulated by the Securities and Futures Commission of Hong Kong (SFC). The SFC is responsible for overseeing the securities and futures markets in Hong Kong, ensuring the fair and transparent operation of these markets. This regulation adds a layer of security for clients, assuring them that they are working with a company that follows industry standards and practices.

Is AJS regulated?

As a regulated entity, AJ Futures Limited is required to comply with the SFO and the regulations set forth by the SFC. This includes adhering to rules related to capital requirements, risk management, client protection, disclosure, reporting, and record-keeping. The SFC also conducts regular audits and inspections to ensure compliance and may take enforcement action if violations are discovered.

By being regulated by the SFC, AJ Futures Limited demonstrates a commitment to operating with transparency, accountability, and in accordance with legal requirements. For investors, this provides a level of assurance that the company is subject to oversight and can be held accountable for any misconduct.

Pros and Cons of AJS

AJ International Holdings Limited is a Hong Kong-based financial authority that provides various financial services to its clients. It is an established company that has been operating in the industry for several years. Like any other financial service provider, AJ International Holdings Limited has its pros and cons that potential clients should be aware of before deciding to do business with them.

One of the advantages of working with AJ International Holdings Limited is that it is regulated by a reputable financial authority in Hong Kong, which ensures that it operates within a legal framework and complies with strict regulations. The company offers a wide range of financial services, including asset management, investment banking, securities brokerage, and wealth management, among others. Clients can benefit from the company's extensive experience and expertise in the financial sector, as well as its global network of partners and affiliates.

However, one of the drawbacks of working with AJ International Holdings Limited is that its services may not be suitable for everyone. The company caters mainly to high net worth individuals and institutional clients, which means that its services may not be accessible to the average retail trader or investor.

| Pros | Cons |

| Offers a wide range of investment products and services, including securities, futures, and options trading | Limited educational resources compared to some other brokers |

| User-friendly trading platform with advanced features | Relatively high commission fees and minimum deposit requirements |

| Regulated by the Securities and Futures Commission of Hong Kong | Limited presence outside of Hong Kong |

| Access to global markets | Limited customer support options outside of regular business hours |

| Offers both individual and corporate accounts | Caters mainly to high net worth individuals and institutional clients |

| Limited research resources compared to some other brokers |

Products and Services

AJ Securities is a Hong Kong-based securities brokerage firm that offers a wide range of products and services to its clients. Let's take a closer look at what they offer:

Securities Trading: AJ Securities offers securities trading services for equities and bonds listed on the Hong Kong Stock Exchange (HKEX), as well as for global stocks and bonds.

Futures and Options Trading: They also provide futures and options trading services for HKEX-listed futures and options, as well as for global futures and options.

Wealth Management Services: AJ Securities offers wealth management services to help clients manage their assets and investments. These services include financial planning, investment advice, and portfolio management.

Margin Financing: The company provides margin financing services to help clients finance their investments.

IPO Subscriptions: AJ Securities also provides initial public offering (IPO) subscription services, allowing clients to subscribe for new shares in upcoming IPOs.

Research Reports: They offer daily and weekly research reports, providing clients with up-to-date information on market trends, investment opportunities, and economic developments.

Online Trading Platform: AJ Securities provides an online trading platform, allowing clients to access their accounts and trade securities, futures, and options from anywhere in the world.

Account Types

AJ International Holdings offers a wide range of securities accounts to cater to the diverse needs of their clients. These accounts include cash accounts, custodian accounts, and margin accounts.

Cash accounts:

A cash account is a type of securities account that requires investors to pay for securities in full at the time of purchase. This means that investors cannot use borrowed funds to purchase securities. Cash accounts are typically used by conservative investors who are looking to buy and hold securities for the long term. Cash accounts do not allow investors to engage in margin trading or short selling.

If there is any outstanding balance in the cash account, the credit department will send a letter to the customer requesting payment and apply an interest rate of Prime rate + 6% per year (For information about the Prime rate, kindly get in touch with this company's Customer Services Officer).

Custodian accounts:

A custodian account is a type of securities account where an intermediary holds and manages an investor's securities on their behalf. Custodian accounts are commonly used by institutional investors, such as pension funds or mutual funds, to hold their investments. The custodian is responsible for safeguarding the investor's assets and ensuring that the investor's instructions are followed. Custodian accounts can also be used by individual investors who may not have the knowledge or expertise to manage their own investments.

If there are any outstanding balances in the cash account, the credit department will send a payment request letter to the customer and apply interest charges at a rate of Prime rate + 6% per year. To obtain information about the Prime rate, please reach out to this company' Customer Services Officer.

Margin accounts:

A margin account is a type of securities account that allows investors to borrow funds from their broker to purchase securities. Margin trading can increase potential profits, but it also increases the risk of losses. Investors using margin accounts must meet certain requirements, such as maintaining a minimum amount of equity in their account, and they may be subject to margin calls if the value of their securities falls below a certain level. Margin accounts can also be used for short selling, which involves borrowing securities from the broker and selling them with the expectation that the price will fall, allowing the investor to buy back the securities at a lower price and return them to the broker.

The annual interest rate for margin accounts is calculated as Prime rate plus 1.5%, and customers can obtain the current Prime rate by contacting the Customer Service Officer.

Account Opening

To open an account with AJ International Holdings, you will need to follow a straightforward process that involves a few simple steps.

Visit the company's official website or contact their customer support to initiate the account opening process.

Fill out the required application forms and provide all necessary personal information, such as name, address, and identification documents.

Choose the type of securities account you want to open (cash account, custodian account, or margin account ) or any other account, Individual/Joint Name account, Institutional Professional Investor Account, Cooperate account.

Provide funding for your account by transferring money from a bank account or through other accepted payment methods.

Wait for your account to be approved, which may involve a review of your application and personal information.

Once your account is approved, you will receive login credentials to access the online trading platform and start trading.

Fees

Here is a breakdown of the fees charged by AJ International Holdings Limited:

Brokerage Fees: AJ Securities charges a brokerage fee on every trade executed on behalf of clients. The fee varies based on the type of securities traded, the trading volume, and other factors.

Custodian Fees: If you hold securities in a custodian account, AJ Securities will charge a custodian fee. The fee varies based on the value of your securities holdings.

Margin Interest: If you trade on margin, you will be charged margin interest. The rate of interest varies based on the current prime rate and other factors.

Account Maintenance Fees: AJ Securities may charge an account maintenance fee to cover the costs of maintaining your account.

Transaction Fees: Depending on the securities you trade and the exchanges on which you trade them, you may be charged transaction fees.

Other Fees: AJ Securities may also charge other fees, such as wire transfer fees, statement fees, and research fees.

The fees charged by AJ Securities may vary based on a number of factors, including the type of account you have, the securities you trade, and the volume of your trading activity. You should carefully review the fee schedule provided by AJ Securities and consult with a customer service representative if you have any questions about the fees associated with your account.

Trading Software

AJ International Holdings Limited developed a proprietary trading platform called AJST (AJ Securities Trading System). This trading platform is designed to cater to the needs of various types of traders, including retail traders, institutional investors, and professional traders.

AJST offers a wide range of features and functionalities, including real-time market data, customizable charts and indicators, technical analysis tools, risk management tools, order management tools, and more. Traders can access the trading platform via desktop or mobile devices, ensuring that they can trade at any time and from anywhere.

One of the notable features of AJST is its advanced order types, which include limit orders, market orders, stop-loss orders, and trailing stop-loss orders. These order types can help traders manage their positions and risks more effectively.

Another advantage of AJST is its user-friendly interface, which allows traders to easily navigate and access various features of the trading platform. Additionally, the platform offers a high level of security to protect traders' personal and financial information.

Deposits and Withdrawals

AJS offers various deposit and withdrawal methods to its clients, including local bank transfers, overseas telegraphic transfers, and check payments. Clients can choose the method that best suits their needs and preferences. It is important to note that some methods may have associated fees or processing times, which can vary depending on the specific circumstances. Clients are advised to check with AJS for the most up-to-date information on deposit and withdrawal methods and any related fees or requirements.

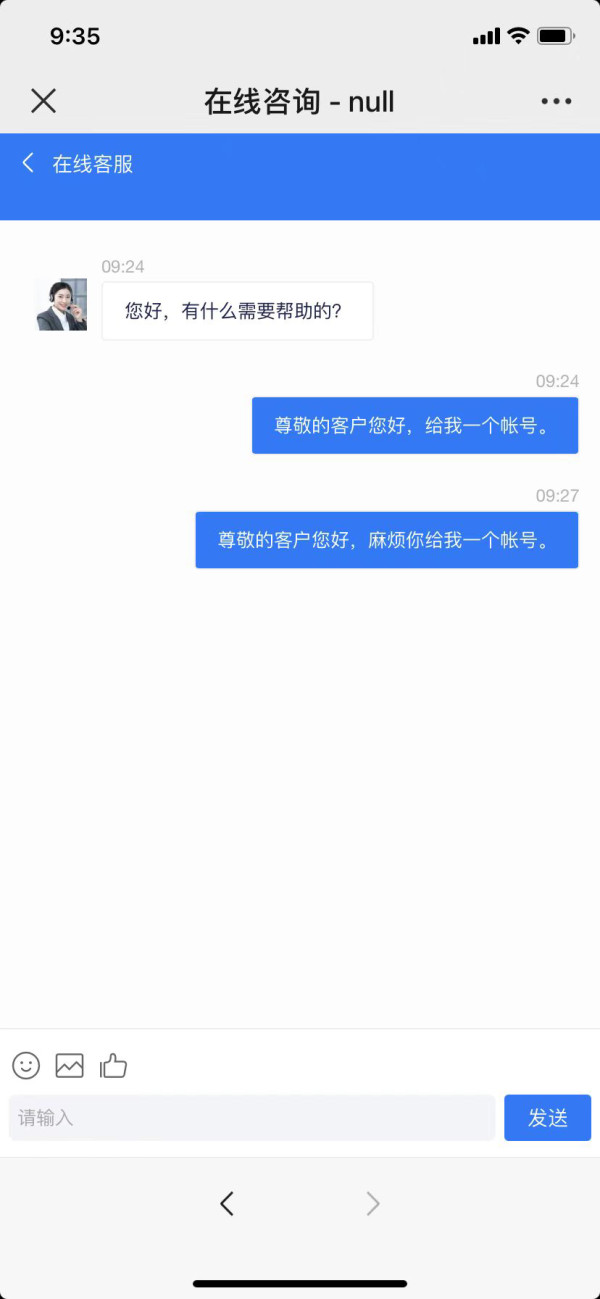

Customer Support

AJ International Holdings Limited provides various customer support options to its clients, including email support, phone support, and a dedicated customer service center. Clients can contact the customer service center during regular business hours from Monday to Friday. Additionally, AJ International provides a FAQ section on their website that covers a range of topics, from account opening procedures to trading-related questions. The customer support team is knowledgeable and helpful, and they are able to assist clients with any questions or issues they may have. Overall, AJ International provides excellent customer support to its clients.

Educational Resources

Based on the information provided on AJ Securities' website, they do not seem to offer educational resources for their clients. However, they do provide research notes and market analysis reports that can be accessed by their clients. These reports cover a wide range of topics such as market trends, economic news, and specific company analysis. Additionally, their clients can contact their customer support team for assistance with any trading-related inquiries.

Conclusion

AJ International Holdings Limited is a regulated financial institution based in Hong Kong that offers a range of products and services to its clients. With a focus on securities trading, AJ International provides its clients with a proprietary trading platform, AJST, and access to markets in Hong Kong, China, and the United States. In addition to securities accounts, AJ International also offers individual, joint, institutional, and corporate accounts. While the company does not provide extensive educational resources, it does offer research notes and market analysis to help clients make informed investment decisions.

FAQs

Q: Is AJ International Holdings regulated by any financial authorities?

A: Yes, AJ International Holdings is regulated by the Hong Kong Securities and Futures Commission (SFC).

Q: What services does AJ International Holdings offer?

A: AJ International Holdings offers a range of financial services, including securities brokerage, futures brokerage, corporate finance, asset management, and investment advisory.

Q: What type of clients does AJ International Holdings cater to?

A: AJ International Holdings caters to both individual and institutional clients, including high net worth individuals, corporations, and institutional investors.

Q: What trading platforms does AJ International Holdings offer?

A: AJ International Holdings offers its clients access to a range of trading platforms, including AJ Global Trader, AJ Pro Trader, and AJ Web Trader.

Q: What are the minimum account requirements to open an account with AJ International Holdings?

A: The minimum account requirements vary depending on the type of account and the services requested. Clients are advised to contact AJ International Holdings directly for more information.

Q: What are the fees and commissions charged by AJ International Holdings?

A: The fees and commissions charged by AJ International Holdings vary depending on the type of service and the specific investment products traded. Clients are advised to contact AJ International Holdings directly for more information.

Q: How can I contact AJ International Holdings if I have questions or need assistance?

A: AJ International Holdings provides several methods of contact, including email, phone, and live chat on their website. Clients can also visit one of their physical offices in Hong Kong or China.

Keywords

- 5-10 years

- Regulated in Hong Kong

- Dealing in futures contracts

- Dealing in securities

- Suspicious Scope of Business

- Suspicious Overrun

- Medium potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

别BL

Malaysia

I can't withdraw the money for two days. I was able to withdraw the money the day before, and the money will arrive in the account. Now I have waited for two days and it hasn't arrived.

Exposure

2022-07-06

035427

Hong Kong

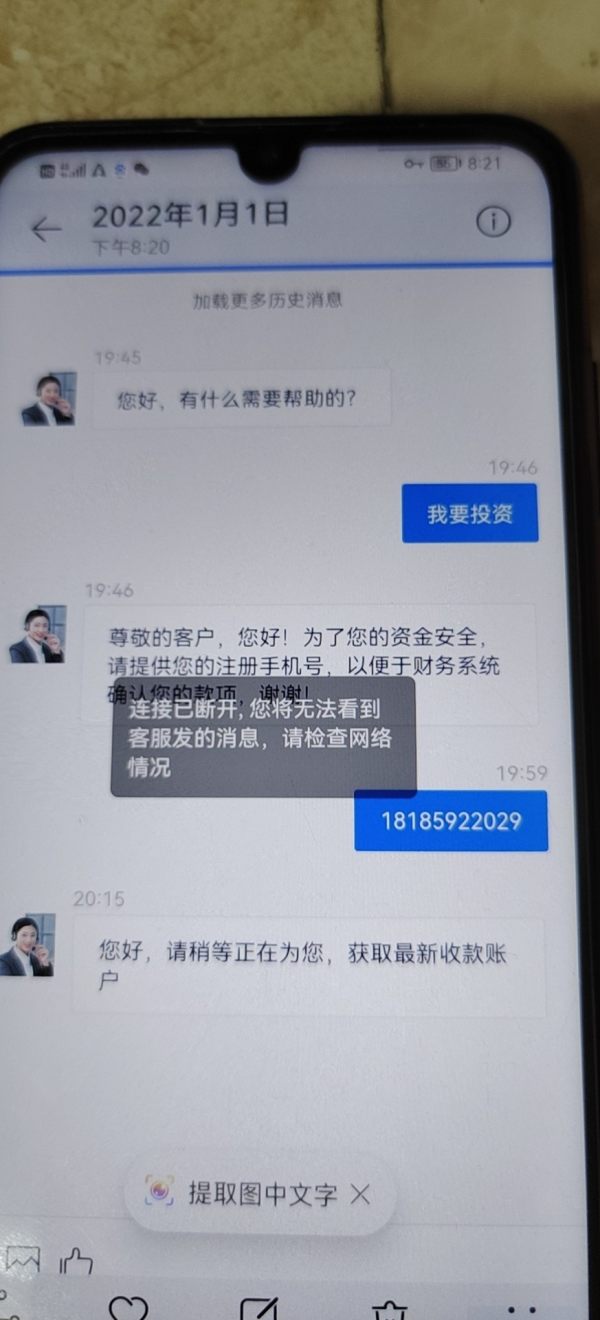

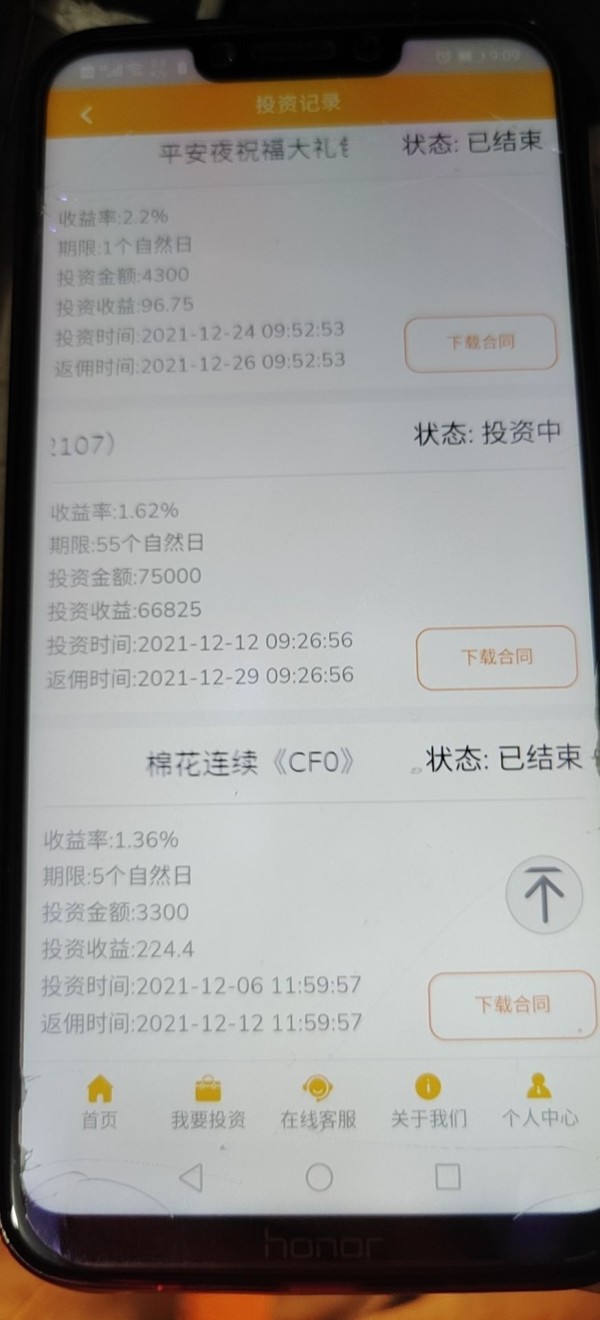

I joined AJS future platform on Dec. 14 with a total investment of over 600000. During the New Year period, I want to withdraw my principle, but it does not process for over 24 hours. The platform suddenly shutted down and cannot find anyone. The people in group were under panic and realized that we were deceived. Return our hard-earning money. We strive for several years to earn them and it is all deceived by them. I hope to expose them and arrest these scaming group as sson as possible

Exposure

2022-01-09

艳儿便利店

Hong Kong

AJS future contract cannot withdraw after making deposit. The platform is shutted down. I got a heavy loss of over 490000 CNY.

Exposure

2022-01-09

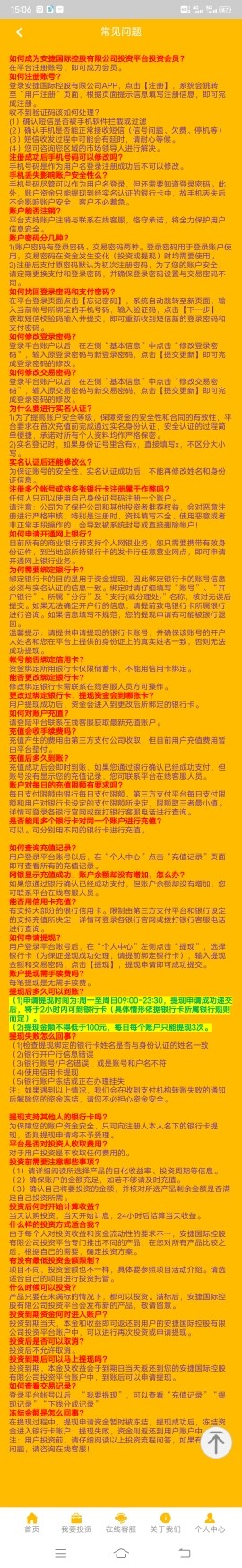

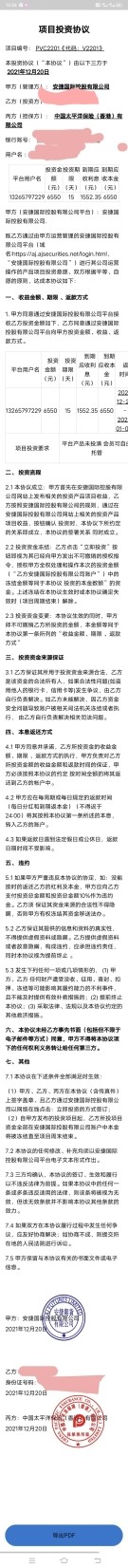

【高明】高月

Hong Kong

I joined AJ Future Contract Trusteeship on November 22. From the beginning, I scanned the code to register with my mobile phone number, entered the ID upper-level invitation code, and bound the bank card with real-name authentication (face recognition authentication). You can withdraw cash earlier. When the amount invested is large, the withdrawal will be delayed and the account will be delayed. In the end, the withdrawal will not be able to arrive. The network is closed, and there is no way to log in. The third party inside: Pacific (Hong Kong) Insurance Company is all fake, belongs to group crime. Hundreds of people were deceived, and the loss was as high as 900,000. I hope that these people will be brought to justice in the morning and the victims will be compensated accordingly.

Exposure

2022-01-09

Alexander G

New Zealand

Orders usually go through pretty quickly, but when the market's on fire, you can get burned by slippage.

Neutral

08-07

มิ้นท์

Thailand

Hello, thanks for doing a better job.

Neutral

2022-10-09

Jimmy

Hong Kong

I find AJS of reliable source very friendly and positive look forward, towards customer service experience, and any problems with deposits are sorted out very quickly within days.

Positive

2023-02-24

睿泽天下

Argentina

This Hong Kong company is very good, and the transactions are normal. But I saw someone on wikifx saying this is a scam? I'm thinking about withdrawing my money, wondering if they will reject my withdrawal.

Positive

2022-12-20