简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Top Forex Brokers in the Asia Pacific

Abstract:Check out our top picks for Forex brokers in the Asia Pacific (APAC). We've carefully reviewed their regulations, trading platforms, and customer support to help you find the right fit.

When it comes to Forex trading in Asia Pacific (APAC), selecting the correct broker might be the difference between success and failure. The region's different market characteristics make it more challenging to identify a reliable broker. While not regulated locally, some brokers have established great reputations as a result of offshore regulation by reputable bodies such as the FCA in the United Kingdom or ASIC in Australia, which adds another degree of complication to your selection.

Our comprehensive evaluation of the leading Forex brokers in Asia Pacific will assist you in navigating this complex industry. We painstakingly researched each broker, taking into account crucial elements such as regulatory compliance, customer support, and overall trading experience, to give you a comprehensive list of the top alternatives in this competitive market.

Who Are the Most Reliable Forex Brokers in the Asia Pacific?

The APAC area is a thriving center for Forex trading, with plenty of possibilities but also some concerns. The brokers we suggest have established their dependability by adhering to tight laws, having sophisticated trading platforms, and delivering excellent customer support. These brokers provide reasonable spreads, a diverse choice of trading instruments, and personalized services to fit the requirements of both beginner and experienced Asia Pacific traders.

FXCM

FXCM, also known as Forex Capital Markets, is a global online broker with a strong reputation for providing retail traders with a comprehensive range of trading services. Established in 1999, FXCM has grown to become one of the leading players in the forex and CFD markets. The company is committed to delivering a seamless trading experience by offering cutting-edge trading platforms, innovative trading tools, and a variety of educational resources. FXCM is particularly noted for its transparency and client-centric approach, which has helped it build a loyal client base over the years. The broker caters to a diverse group of traders, from beginners to seasoned professionals, by offering flexible account types, competitive spreads, and robust customer support.

· Regulatory Bodies: FXCM is regulated by several authorities, including the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Financial Sector Conduct Authority (FSCA) in South Africa.

· WikiFX Rating: 9.45

· Leverage: Up to 1:30 (FCA), up to 1:500 (ASIC, FSCA)

· Minimum Spreads: From 1.3 pips on major currency pairs

· Minimum Deposit: $50

· Trading Platforms: Trading Station, MetaTrader 4, NinjaTrader, ZuluTrade

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Access to proprietary trading tools, free educational resources, and competitive pricing.

IC Markets Global

IC Markets is a globally recognized forex and CFD broker renowned for its commitment to providing a top-tier trading experience to retail and institutional clients. Established in 2007, IC Markets has positioned itself as one of the world's largest and most trusted brokers by offering superior trading conditions, including ultra-low spreads, lightning-fast execution speeds, and a broad range of trading instruments. The broker is top-rated among high-frequency traders, scalpers, and automated trading systems due to its deep liquidity and direct market access (DMA). IC Markets prides itself on its transparency and high standards of client service, ensuring that traders can operate in a secure and efficient trading environment.

· Regulatory Bodies: IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Seychelles Financial Services Authority (FSA).

· WikiFX Rating: 9.06

· Leverage: Up to 1:30 (ASIC), up to 1:500 (FSA)

· Minimum Spreads: From 0.0 pips (Raw Spread accounts)

· Minimum Deposit: $200

· Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

· Customer Support: 24/7 support via live chat, phone, and email

· Customer Benefits: Ultra-low spreads, fast execution, and advanced trading platforms.

XM

XM is a well-known online broker that has made its mark on the global trading scene by offering a client-focused approach and a broad range of trading products. Since its inception in 2009, XM has grown rapidly, now serving millions of clients across over 190 countries. The broker is highly regarded for its transparent business practices, competitive trading conditions, and comprehensive educational resources. XM offers a diverse array of account types to cater to different trading needs and preferences, from micro accounts for beginners to zero-spread accounts for professional traders. The broker's commitment to ethical trading and customer satisfaction has earned it numerous awards and a strong reputation in the industry.

· Regulatory Bodies: XM is regulated by the International Financial Services Commission (IFSC) in Belize, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

· WikiFX Rating: 9.04

· Leverage: Up to 1:30 (ASIC, CySEC), up to 1:1000 (IFSC)

· Minimum Spreads: From 0.6 pips on major currency pairs

· Minimum Deposit: $5

· Trading Platforms: MetaTrader 4, MetaTrader 5, XM WebTrader

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Low minimum deposit, negative balance protection, and free access to educational webinars and seminars.

EC Markets

EC Markets is a professional-grade online trading broker that offers a wide range of trading products and services tailored to meet the needs of both retail and institutional clients. With a strong focus on transparency, efficiency, and customer satisfaction, EC Markets has established itself as a reliable and trusted partner for traders seeking a high-quality trading environment. The broker is known for its competitive pricing, direct market access (DMA), and robust trading infrastructure, which ensures that clients can execute trades quickly and efficiently. EC Markets also places a strong emphasis on client education and support, providing a variety of resources to help traders improve their skills and make informed decisions.

· Regulatory Bodies: EC Markets is regulated by the Financial Conduct Authority (FCA) in the UK.

· WikiFX Rating: 9.04

· Leverage: Up to 1:30 (FCA)

· Minimum Spreads: From 0.5 pips on major currency pairs

· Minimum Deposit: £200

· Trading Platforms: MetaTrader 4, MetaTrader 5

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Direct market access (DMA), tight spreads, and a strong regulatory framework.

GO Markets

GO Markets is a prominent Australian-based online broker that has been serving traders since 2006. Renowned for its reliability, GO Markets provides a diverse range of trading instruments, including forex, commodities, indices, and cryptocurrencies, catering to both retail and institutional clients. The broker is well-regarded for its competitive trading conditions, exceptional customer service, and robust trading platforms. GO Markets places a strong emphasis on providing a secure and user-friendly trading experience, making it an attractive choice for traders of all experience levels. The broker's commitment to client education, coupled with its innovative trading tools, has earned it a solid reputation in the global trading community.

· Regulatory Bodies: GO Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC) in Mauritius.

· WikiFX Rating: 8.98

· Leverage: Up to 1:30 (ASIC), up to 1:500 (FSC)

· Minimum Spreads: From 0.0 pips on major currency pairs (GO Plus+ account)

· Minimum Deposit: $200

· Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

· Customer Support: 24/5 support via live chat, phone, and email

· Customer Benefits: Access to educational resources, tight spreads, and various trading tools, including Autochartist and VPS hosting.

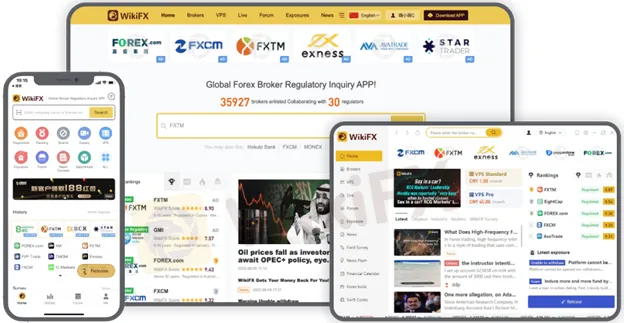

When choosing a reliable forex broker, the WikiFX App is your go-to tool. It offers real-time regulatory data, broker ratings, and user reviews, making it easier to find trustworthy options in the Forex market.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator