Score

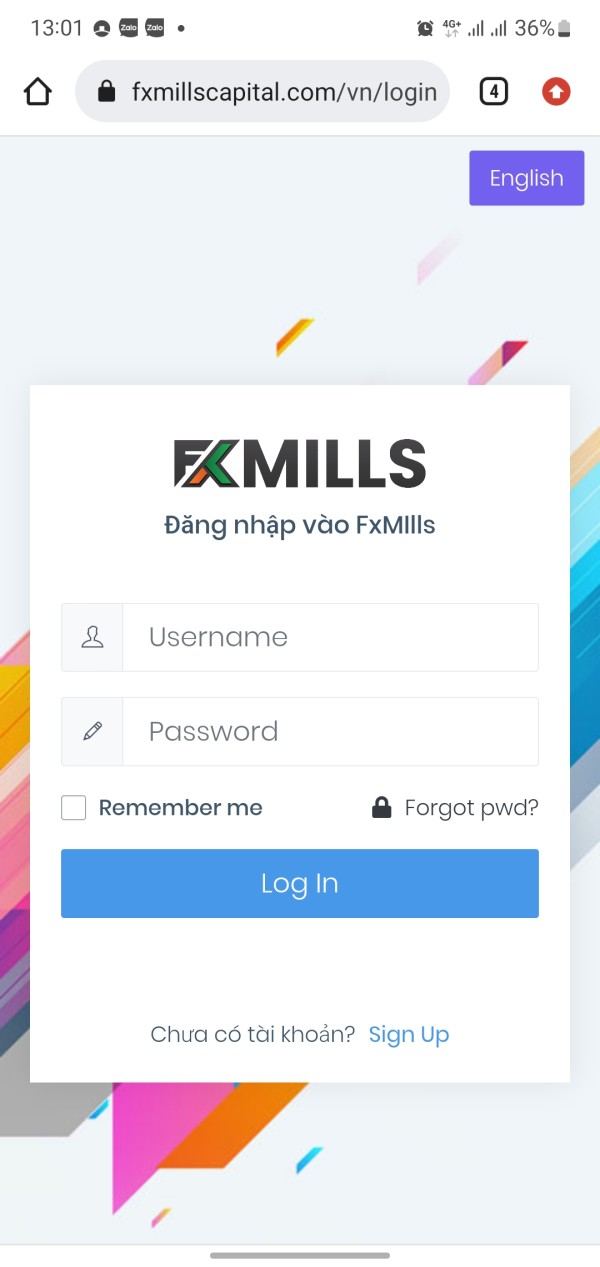

FXMILLS

Saint Lucia|1-2 years|

Saint Lucia|1-2 years| https://www.fxmills.com/index.php

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Lucia

Saint LuciaAccount Information

Users who viewed FXMILLS also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

fxmills.com

Server Location

United States

Website Domain Name

fxmills.com

Server IP

82.180.174.32

Company Summary

Note: FXMILLS' official website: https://www.fxmills.com is currently inaccessible normal.

| FXMILLSReview Summary | |

| Founded | 2023 |

| Registered Country/Region | Saint Lucia |

| Regulation | Not regulated |

| Market Instruments | Forex, commodities, indices, stocks, and cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | From 1.8 pips (Elite Account) |

| From 1.5 pips (Elite Plus account) | |

| From 0.5 pips (VIP account) | |

| Trading Platform | MT5 |

| Min Deposit | $100 |

| Customer Support | Contact form |

| Tel: +91 224 1703 098 | |

| Email: support@fxmills.com, info@fxmills.com | |

| Registered Address: Ground Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O Box 838, Castries, Saint Lucia | |

| Physical Address: Shop No 138, First Floor, Raghulela Mall, Behind Poisar Depot, Kandivali West, Mumbai-400067 | |

| Regional Restrictions | The United States, Cuba, Iraq, Myanmar, North Korea, and Sudan |

Founded in 2023, FXMILLS, a Saint Lucia-registered forex broker, offers various trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Besides, FXMILLS offers three account types: Elite, Elite Plus, and VIP, with minimum deposits $100. However, it is not regulated.

Pros and Cons

| Pros | Cons |

| Various trading assets | Newly established |

| Demo accounts | Not regulated |

| Multiple account types | Unclear payment methods |

| No commissions | Regional restrictions |

| Popular trading platform MT5 |

Is FXMILLS Legit?

No, FXMILLS is not regulated by any financial authorities. Traders should be cautious when trading.

What Can I Trade on FXMILLS?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

FXMILLS offers three account types: Elite Account, Elite Plus Account, and VIP Account.

| Account Type | Min Deposit |

| Elite | $100 |

| Elite Plus | $500 |

| VIP | $10,000 |

Leverage

FXMILLS's leverage is up to 1:500 for all account types. High leverage always comes with high profits and high losses.

Spread and Commission

| Account Type | Spread | Commission |

| Elite | From 1.8 pips | ❌ |

| Elite Plus | From 1.5 pips | ❌ |

| VIP | From 0.5 pips | ❌ |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Web, Desktop, Mobile | Experienced traders |

| MT4 | ❌ | / | Beginners |

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX2783203464

Vietnam

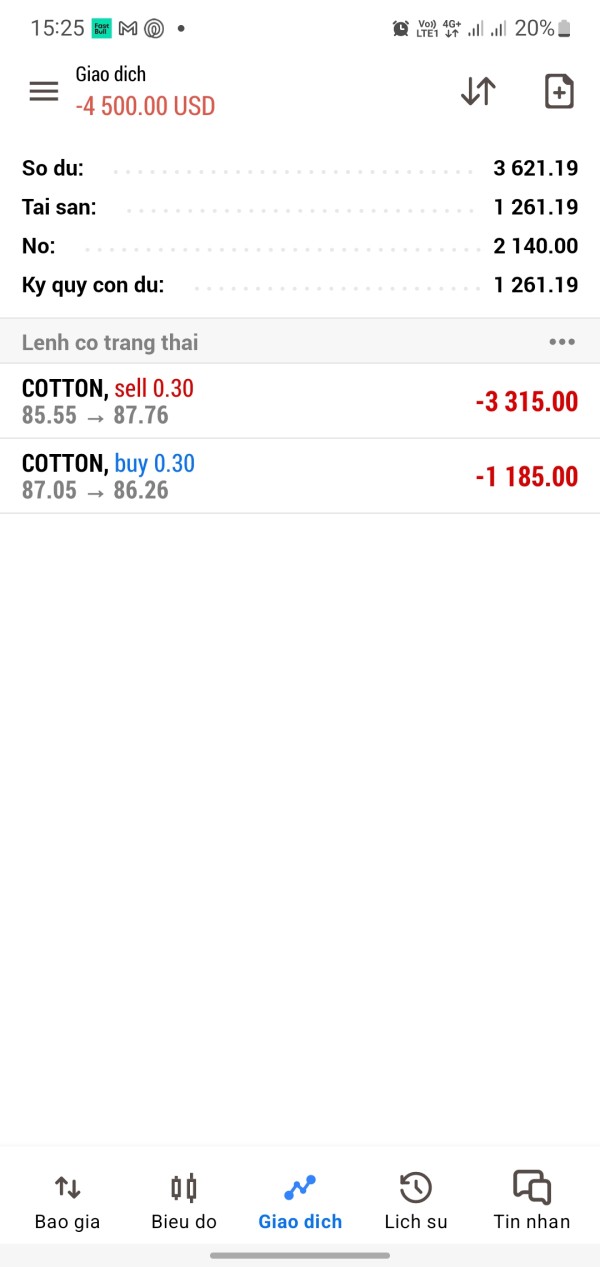

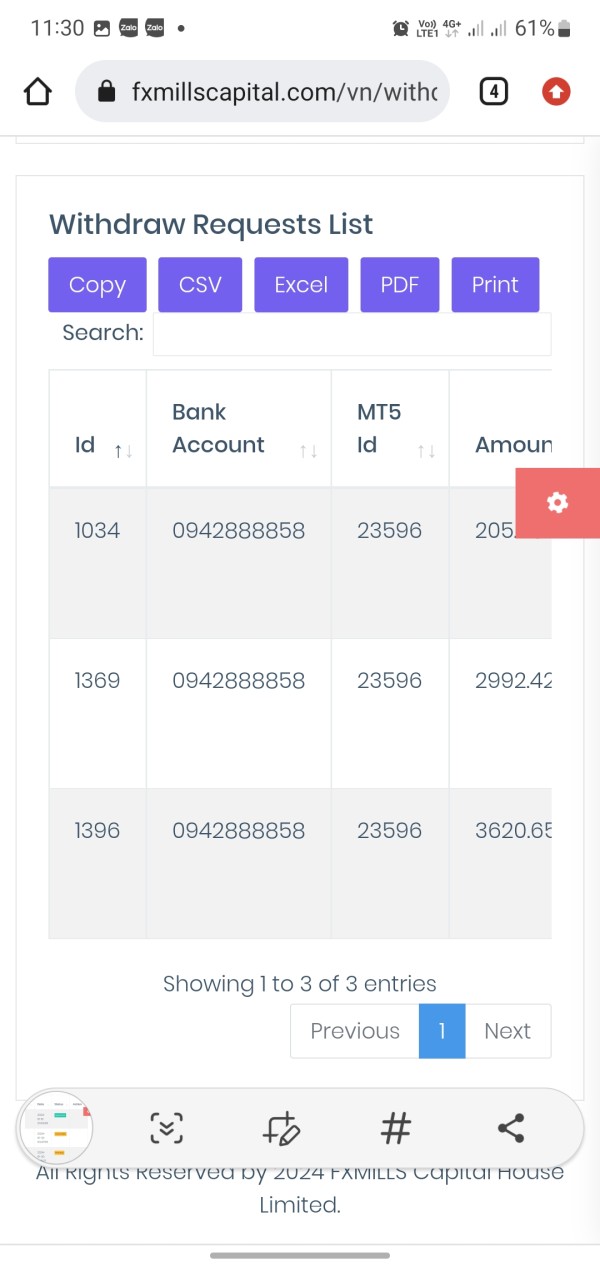

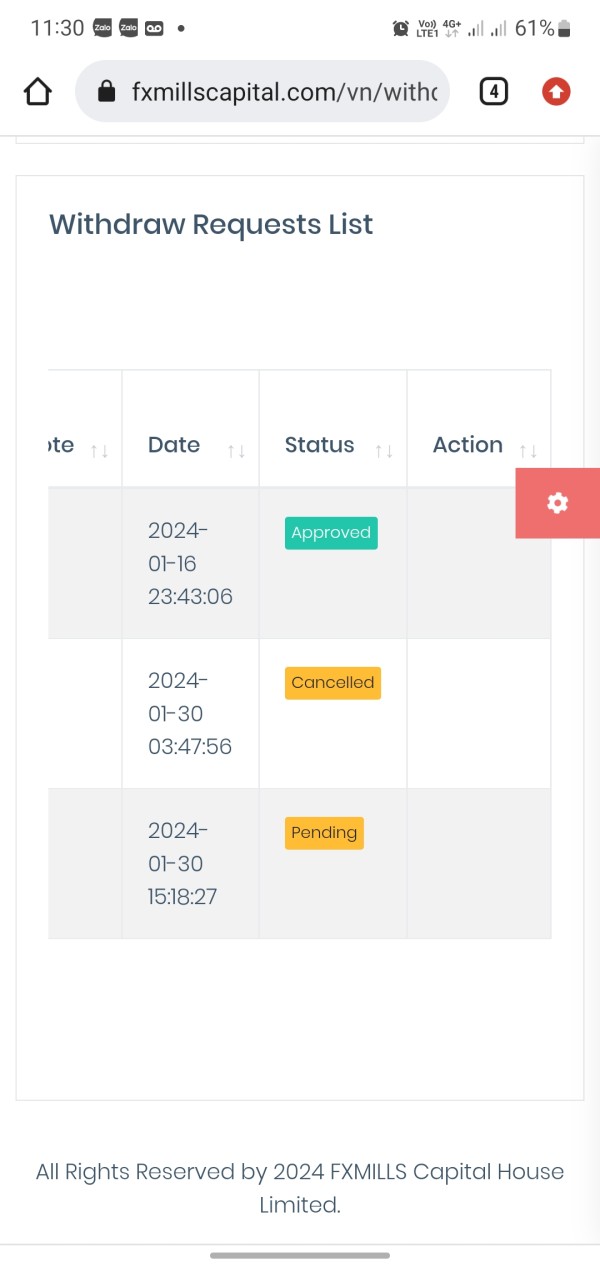

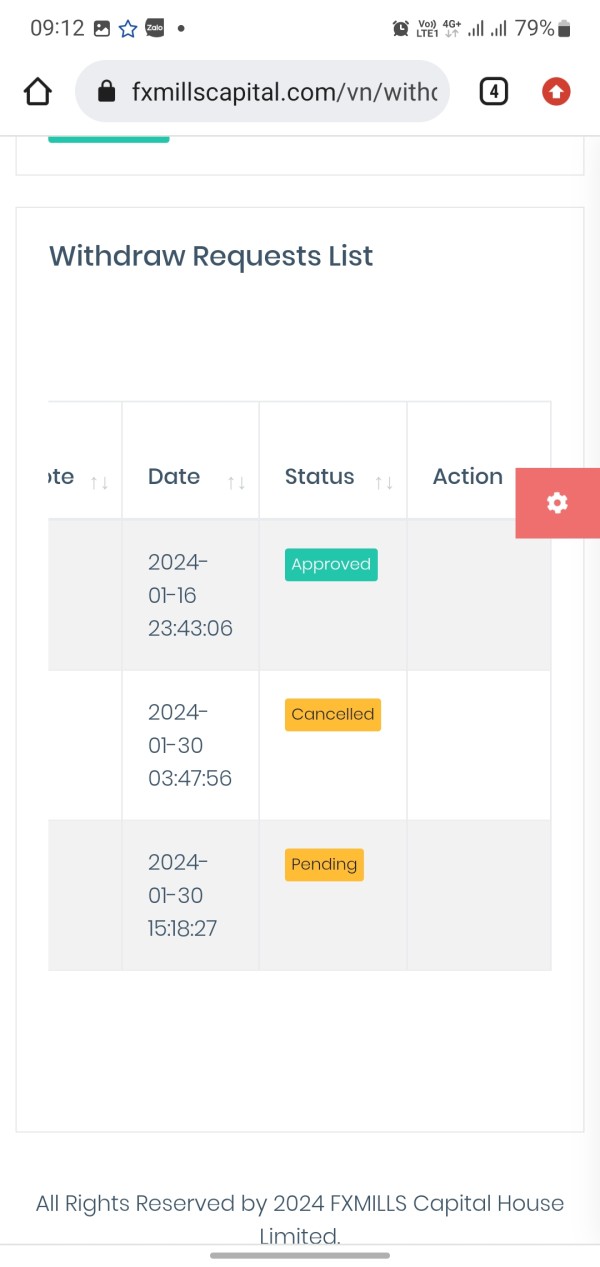

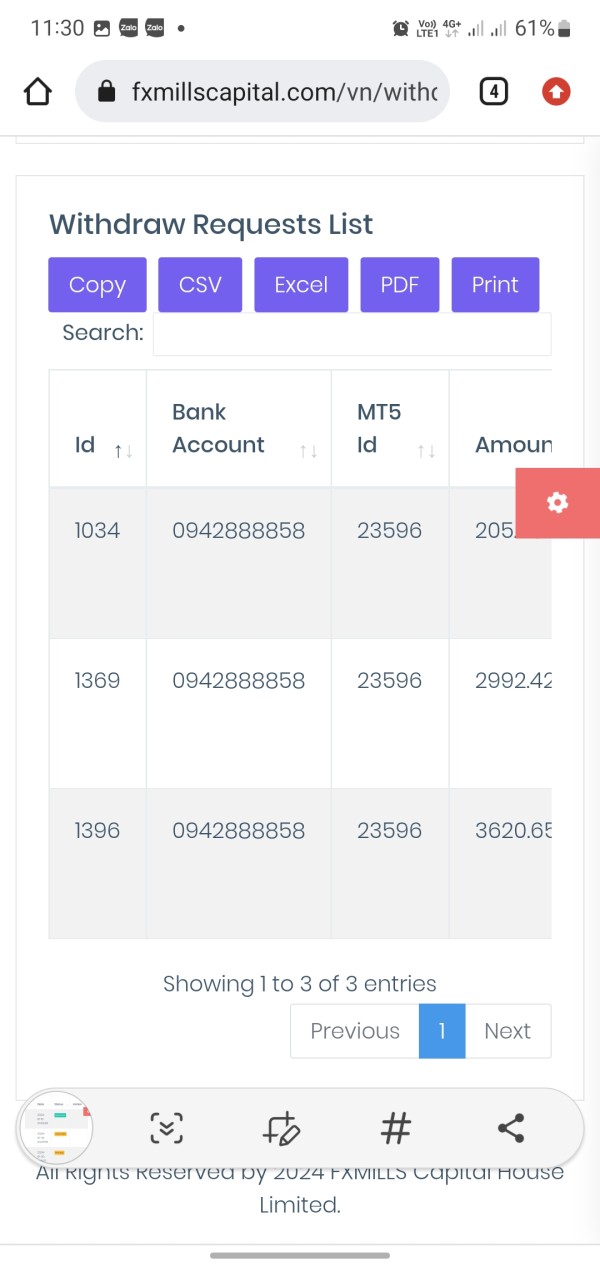

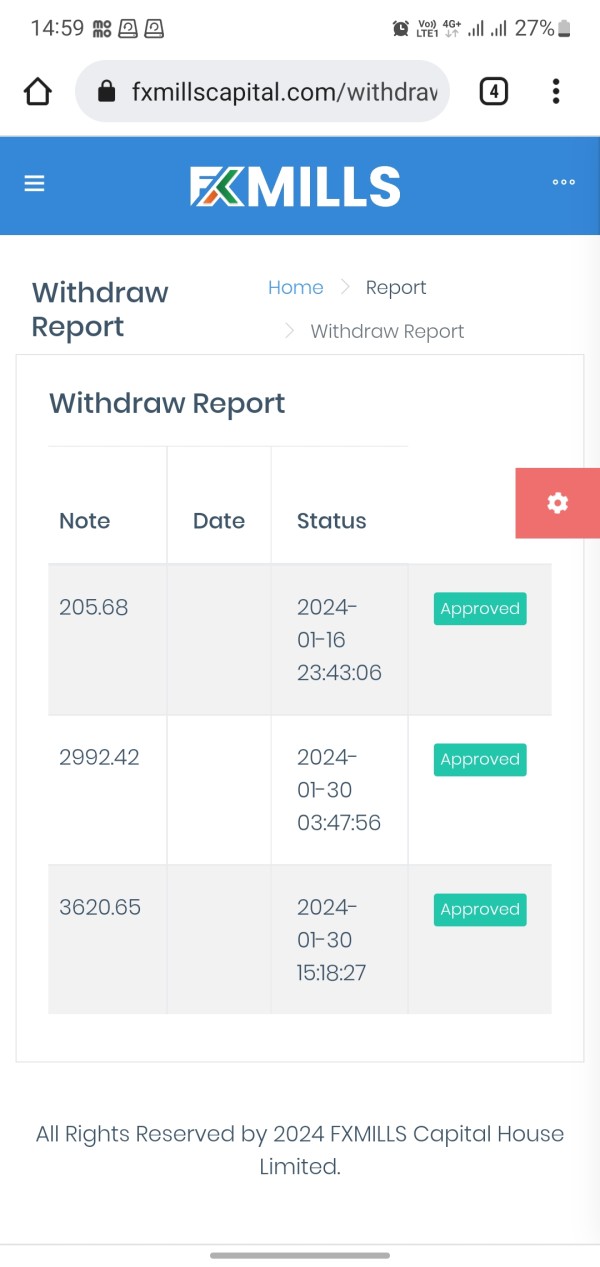

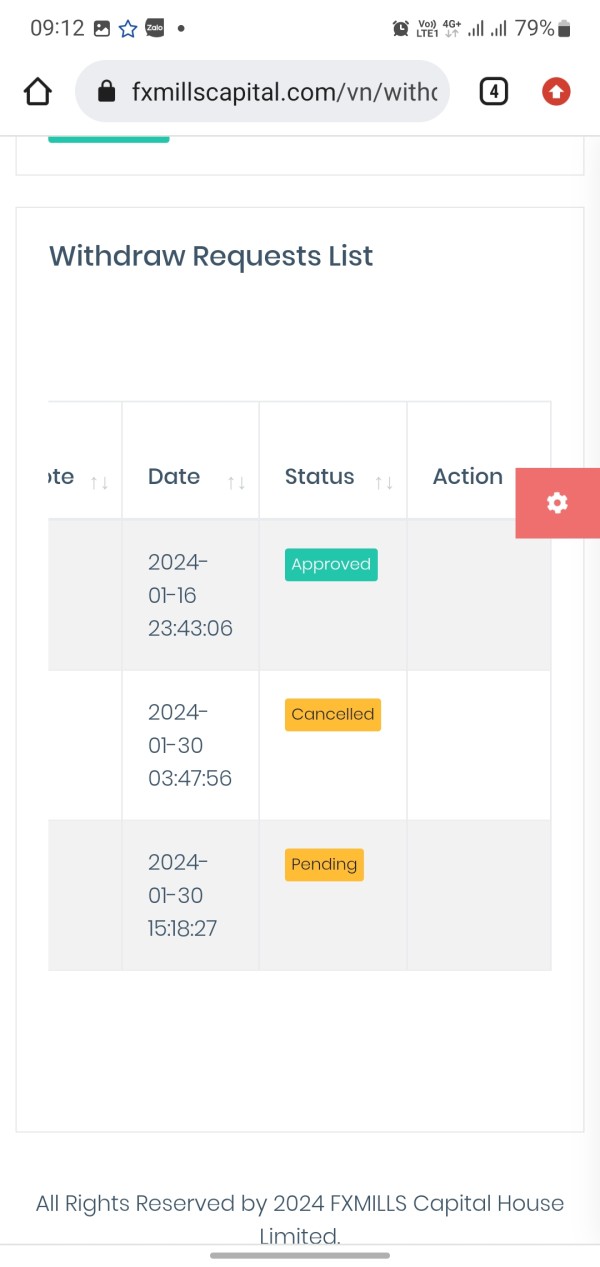

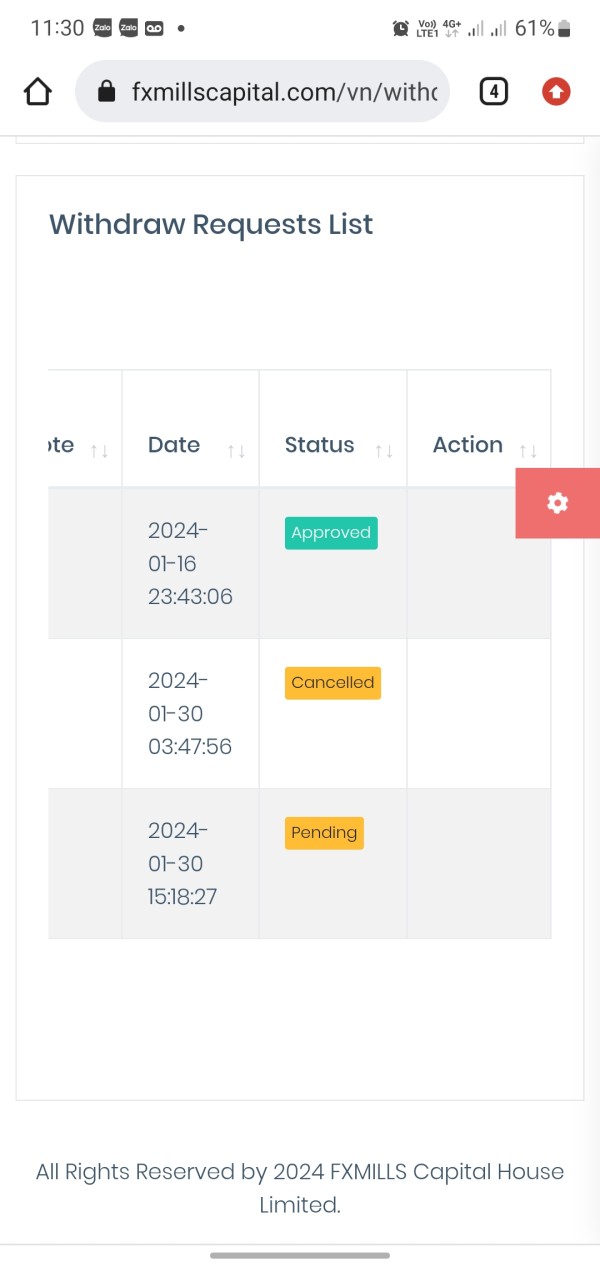

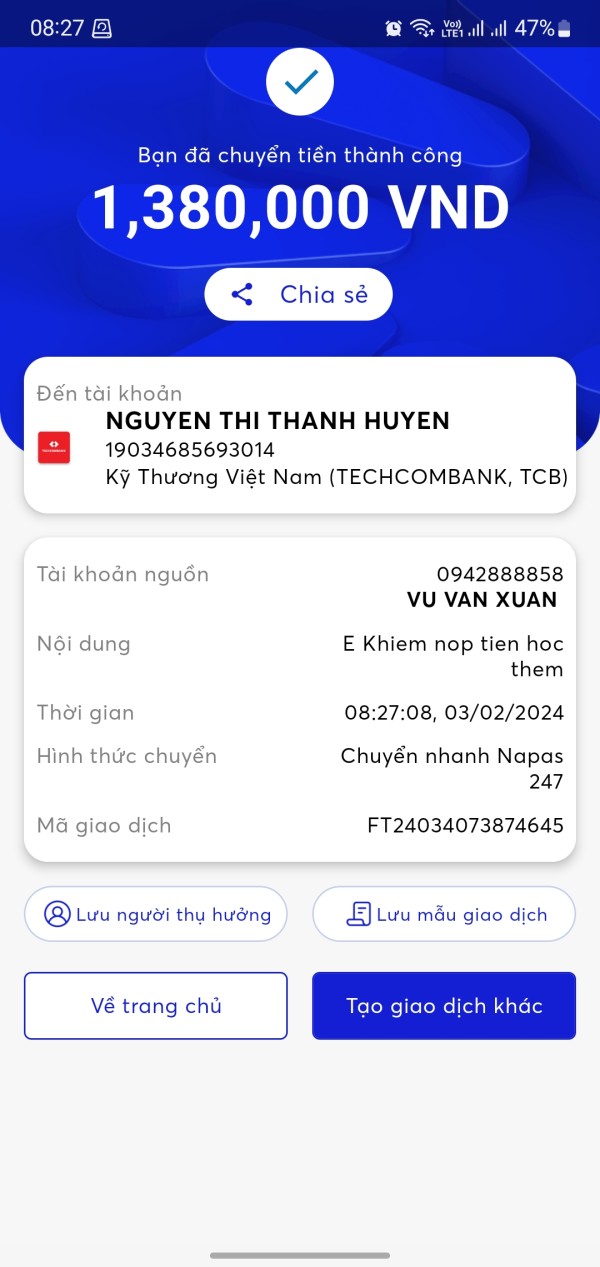

ID: 23596, FXmills floor, I was solicited by this group to join the exchange from January 8, 2024, with a capital of 2040$, to receive dividends from the stock code DEQ, but when dividends were distributed, the floor counted them. The closing price and the order entry price were wrong, so my dividends were deducted. Luckily I closed quickly or my account would go negative. Then I called the support staff, Lam Nhat, and it couldn't be resolved. I had to regret losing money because the floor was dirty. From then on until January 30, 2024, I made a profit and principal transaction of $3621.19. I placed a withdrawal order of $3620.65 from 10:00 pm on January 30, 2024, until February 2, 2024 I still have not received the money back to my account. After talking with support person Lam Nhat, he told me to call the floor to ask. Then someone called me at 0598400723 and said that the withdrawal transaction was slow due to going through some withdrawal gate and the fee was very high, up to 40%, so they told me to follow their method to withdraw without any fees. This person told me to buy and sell 0.3 lots of COTTON code. After 15 minutes, these 2 orders will be cleared. I still didn't trust it so I didn't follow through and called the support hotline number: 1900252238 to verify if the floor staff was correct. The floor agent told me to check, then the next day they still didn't call back to confirm whether it was someone from the floor or not. I called back the switchboard but couldn't get through. At that moment, the deposit and withdrawal support staff called me and urged me to enter 2 buy and sell orders of 0.3 lot code COTTON so they could help withdraw the money. Because I couldn't contact the operator to verify this employee, I had to accept the order as they said. After I entered the order, the status was negative $4,500, but now it's still hanging and I don't dare to cut it. After that, my support person told me that if I wanted to withdraw money, you have to deposit another $4,500 to balance the negative balance, and then withdraw the money. I found it very unreasonable and did not follow it. So I hope ADDMIN WiKIFX can help me get back the $3620 that FXMILLS deliberately did not let me withdraw. Thank you very much. Through this, I also hope that everyone will boycott these Scam floors and Scam teams, and then they will also receive retribution for stealing customers' dirty money.

Exposure

02-05

FX2783203464

Vietnam

I was solicited by this group to join the exchange from January 8, 2024 with a capital of $2,040, with the intention of receiving dividends from the stock code DEQ, but when the dividend was distributed, the exchange incorrectly calculated the closing price and the order entry price. so my dividends were deducted. Luckily I closed quickly or my account would go negative. Then I called the support staff, Lam Nhat, and it couldn't be resolved. I had to regret losing money because the floor was dirty. From then on until January 30, 2024, I made a profit and principal transaction of $3621.19. I placed a withdrawal order of $3620.65 from 10:00 pm on January 30, 2024, until February 2, 2024 I still have not received the money back to my account. After talking with support person Lam Nhat, he told me to call the floor to ask. Then someone called me at: 0598400723 and said that the withdrawal transaction was slow due to going through some withdrawal gate and the fee was very high, up to 40%, so they told me to follow their method to withdraw without any fees. This person told me to buy and sell 0.3 lots of COTTON code. After 15 minutes, these 2 orders will be cleared. I still didn't trust it so I didn't follow through and called the support hotline number: 1900252238 to verify if the floor staff was correct. The floor agent told me to check, then the next day they still didn't call back to confirm whether it was really someone from the floor or not. I called back the switchboard but couldn't get through. At that moment, the deposit and withdrawal support staff called me and urged me to enter 2 buy and sell orders of 0.3 lot code COTTON so they could help withdraw the money. Because I couldn't contact the operator to verify this employee, I had to accept the order as they said. After I entered the order, the status was negative $4,500, but now it's still hanging and I don't dare to cut it. After that, my support person told me that if you want to withdraw money, you have to deposit another $4,500 to balance the negative balance, then withdraw money. I found it very unreasonable and did not follow it.

Exposure

02-05

linh nguyen5337

Vietnam

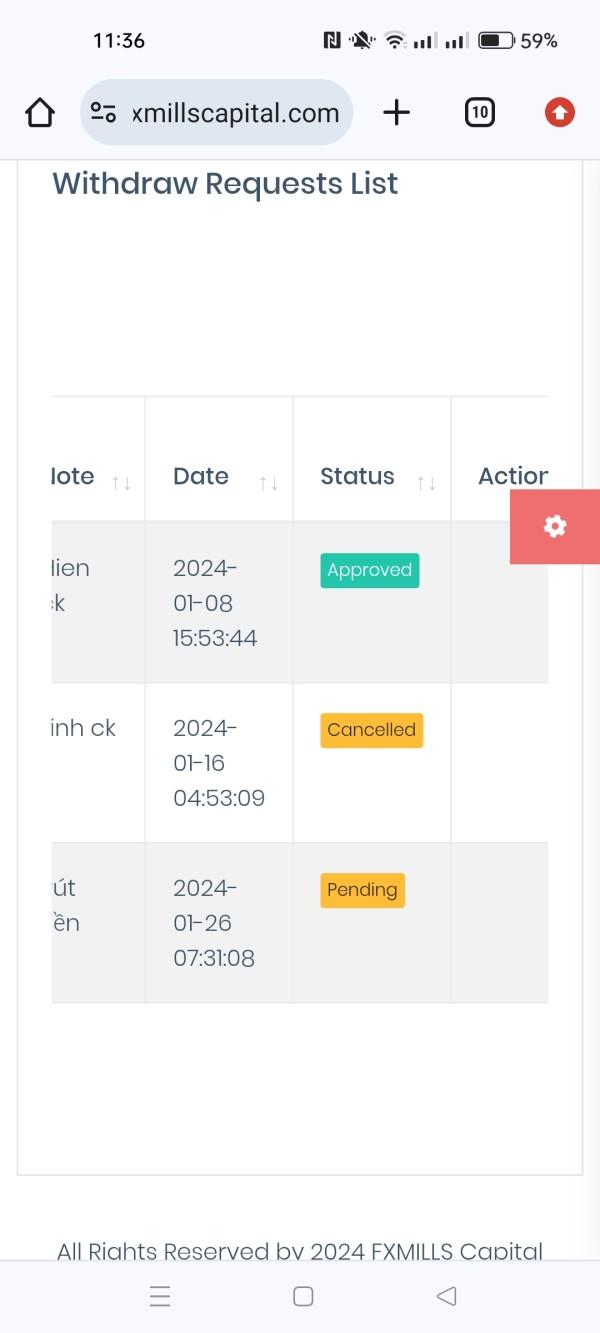

I am Nguyen Van Linh. I started participating in FXMILL on January 6, 2024, through my friend MAI TRANG -Andy. I deposited 3 times for a total of 9.6k USD. After a period of trading. Maybe I'm not lucky. Now I still have 3.4k. I want to withdraw 3k, but it is not approved. January 26, 2024. January 30, 2024. Now when I call, no one answers or supports me. Only when people refer to complain, someone will listen. Now I don't know to find whom to ask. LOOKING FOR SUPPORT. MY ID. 24003

Exposure

01-30

HJBNM

Nigeria

Professional and honest broker! never have a problem with withdraw funds, support team is excellent as well!, the only concern ther spreads could little bit lower,and ofcourse should be always upgreat the security level against DDoS Attacks! it should always priority! overall you can trust this broker!!

Positive

07-04

hdafdv

Malaysia

Started trading with FXMills not too long ago and honestly, it's been pretty solid. The MT5 platform is slick and easy to get the hang of. Spreads could be better

Positive

06-21