Score

Rainbow

India|5-10 years|

India|5-10 years| https://www.rainbowindia.co.in

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

India

IndiaUsers who viewed Rainbow also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Company Summary

| Rainbow Review Summary | |

| Registered Country/Region | India |

| Regulation | Unregulated |

| Products & Services | Equity, Derivatives, Currency Broking, Mutual Fund, IPOs, Bonds, Fixed Deposit, National Pension Scheme and Depository Participant (CDSL) |

| Demo Account | Unavailable |

| Trading Platforms | N/A |

| Minimum Deposit | N/A |

| Customer Support | Telephone, email, Twitter, Facebook and Linkedin |

What is Rainbow?

Rainbow is a financial services provider operating in India, offering a wide range of investment products and services. While Rainbow provides a diverse array of investment options, it operates in an unregulated environment. They provide robust customer support through telephone, email, Twitter, Facebook, and Linkedin channels.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

- Diverse Range of Investment Products: Rainbow offers a wide array of investment options, allowing investors to diversify their portfolios according to their preferences and risk tolerance.

- Multiple Contact Channels: Rainbow provides various communication channels such as telephone, email, Twitter, Facebook, and LinkedIn, ensuring clients can easily reach out for assistance or inquiries.

Cons:

- Unregulated Environment: The absence of regulatory oversight poses a risk factor for investors, potentially impacting the security and reliability of the platform.

- Demo Account Unavailability: The lack of a demo account deprives potential users of the opportunity to explore the platforms features and assess its suitability before making real investments.

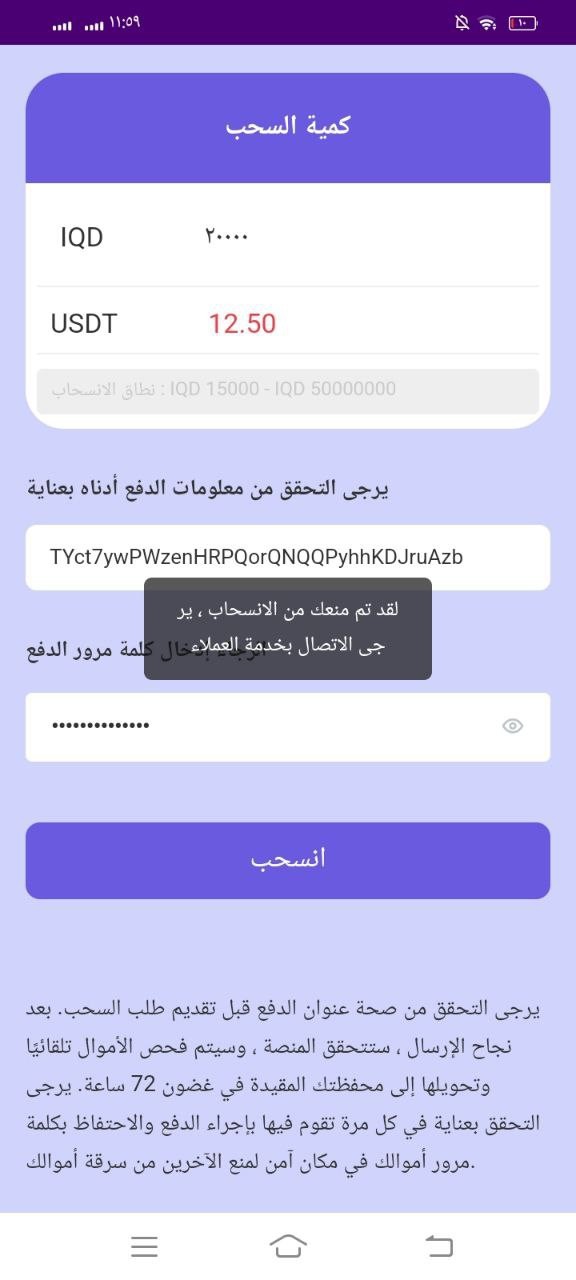

- Reports of Unable to Withdraw: Instances of customers facing difficulties in withdrawing funds could indicate operational issues or challenges with Rainbows services.

- Limited Information on the Website: Insufficient information on the website will hinder users‘ ability to make well-informed decisions and fully understand the platform’s offerings and terms.

Is Rainbow Legit or a Scam?

Rainbow's current lack of valid regulation implies a significant level of risk for investors. Without governmental or financial authority oversight, the platform's operations remain unchecked, potentially exposing investors to various dangers. One of the primary concerns is the absence of accountability—since there are no regulatory standards to adhere to, the individuals managing Rainbow could misuse investors' funds without consequences. This creates a scenario where the platform's operators could unlawfully pocket investors' money, leaving investors vulnerable and bearing the brunt of any criminal actions.

Products & Services

Rainbow offers a diverse array of financial products and services to cater to the needs of investors across various asset classes:

- Equity Broking: Rainbow facilitates the buying and selling of shares, allowing investors to acquire ownership stakes in publicly traded companies.

- Bonds & Fixed Deposits: Investors can invest in corporate bonds and corporate fixed deposits through Rainbow, potentially earning higher returns compared to government bonds while understanding the additional risk involved.

- Currency Broking: Rainbow provides access to the foreign exchange market, allowing investors to trade currencies globally, providing opportunities for speculation or managing currency risks.

- Mutual Funds: Rainbow offers a platform for investing in mutual funds, enabling investors to access diversified portfolios managed by professional fund managers. Its crucial to choose the right scheme based on investment goals and risk tolerance.

- Depository Participant Services (CDSL): Rainbow serves as a Depository Participant with CDSL, offering investors a secure platform for holding and transacting in dematerialized securities. A demat account acts like a bank account for securities, holding stocks, bonds, and mutual fund units electronically.

- Initial Public Offerings (IPOs): Rainbow provides access to IPOs, allowing investors to participate in the initial issuance of shares by companies entering the stock market for the first time. Investing in IPOs requires careful consideration and analysis.

- National Pension Scheme (NPS): Rainbow offers the National Pension Scheme, a government-sponsored pension scheme designed to help investors save for retirement and receive regular pension income post-retirement.

How to Open an Account?

To open an account with Rainbow, please follow these steps:

| Step 1 | Visit Rainbow‘s official website. |

| Step 2 | Navigate to the registration page. |

| Step 3 | Fill in the required details: |

| - Name | |

| - Email Id | |

| - City | |

| - State | |

| - Mobile number | |

| - Are you already a sub-broker/AP? (YES or NO) | |

| Step 4 | Submit the form after providing all information. |

| Step 5 | Await further instructions from Rainbow. |

| Step 6 | Follow instructions for account setup and verification. |

| Step 7 | Upon successful verification, start using Rainbow’s services. |

User Exposure on WikiFX

On our website, you can see reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +91-033-22135183 / 5184, + 91-9330997282, +91-033-22134943

Email: rainbow@rainbowindia.co.in

Address: 21, Hemant Basu Sarani, 3rd Floor, Room No.305, Kolkata - 700001, West Bengal, India

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook and Linkedin.

Conclusion

In conclusion, Rainbow offers a diverse range of investment products and accessible customer support channels, making it a convenient choice for investors looking to diversify their portfolios and seek assistance when needed.

However, operating in an unregulated environment poses inherent risks, and the absence of a demo account limits users' ability to thoroughly assess the platform before investing. Additionally, reports of withdrawal issues and limited information on the website are areas of concern that potential investors should carefully evaluate.

Ultimately, individuals considering Rainbow as their investment platform should conduct thorough research, weigh the pros and cons, and consider their risk tolerance and investment goals before making any decisions.

Frequently Asked Questions (FAQs)

| Question 1: | Is Rainbow regulated by any financial authority? |

| Answer 1: | No. It has been verified that this broker currently has no valid regulation. |

| Question 2: | How can I contact the customer support team at Rainbow? |

| Answer 2: | You can contact via telephone: +91-033-22135183 / 5184, + 91-9330997282, and +91-033-22134943, email: rainbow@rainbowindia.co.in, Twitter, Facebook and Linkedin. |

| Question 3: | Does Rainbow offer demo accounts? |

| Answer 3: | No. |

| Question 4: | What services and products Rainbow provides? |

| Answer 4: | It provides Equity, Derivatives, Currency Broking, Mutual Fund, IPOs, Bonds, Fixed Deposit, National Pension Scheme and Depository Participant (CDSL). |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now