Score

Blackrock

Hong Kong|Above 20 years|

Hong Kong|Above 20 years| https://www.blackrock.com/corporate/en-gb/?switch=y

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Guernsey 4.74

Guernsey 4.74Contact

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

Hong Kong

Hong KongUsers who viewed Blackrock also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Hong Kong

Singapore

Canada

blackrock.com

Server Location

United States

Most visited countries/areas

France

Website Domain Name

blackrock.com

Website

WHOIS.MARKMONITOR.COM

Company

MARKMONITOR, INC.

Domain Effective Date

0001-01-01

Server IP

69.52.2.199

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Blackrock Review Summary | |

| Founded | 1988 |

| Registered Country/Region | Hong Kong |

| Regulation | MAS, SFC |

| Services | Investment, advisory and risk management solutions |

| Customer Support | Phone, email, Twitter, Facebook, and YouTube |

What is Blackrock?

BlackRock is a globally recognized investment management corporation that provides a comprehensive range of services and products to its clients. With a strong regulatory framework overseen by MAS and SFC, which serves as the integrated regulator and supervisor of financial institutions in Singapore, BlackRock maintains compliance with industry standards. While it is important to note that there have been reports of license exceedances with regulatory bodies such as ASIC and FCA. BlackRock offers various means of contact tailored to different regions and services. Traders are encouraged to select their respective locations from the BlackRock or iShares tab on the company's website to gain access to the appropriate products, tools, insights, and avenues for communication relevant to their specific regions.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • MAS and SFC regulated | • No live chat support |

| • A range of financial services | • The website is complex to understand |

| • Multilingual support | |

| • Social media presence |

Blackrock Alternative Brokers

There are many alternative brokers to Blackrock depending on the specific needs and preferences of the trader. Some popular options include:

PI Financial - An independent investment dealer founded in 1982 that offers a wide range of investment products and services to individual, corporate and institutional investors

LONGRUN FINANCIAL - A global securities company that provides traders with access to financial products and services.

Lydya Financial – A company providing unparalleled financial services and up-to-date investment opportunities in the capital markets.

Is Blackrock Safe or Scam?

Blackrock is regulated by Monetary Authority of Singapore (MAS) which is the integrated regulator and supervisor of financial institutions in Singapore and the Securities and Futures Commission (SFC, No. AFF275), which is an independent statutory body set up in 1989 to regulate Hong Kong's securities and futures markets.

But The broker exceeds the business scope regulated by Australia ASIC (license number: 230523) and by United Kingdom FCA (license number: 178638). Also, there are reports of being unable to withdraw. Therefore, though Blackrock is regulated, traders should be careful because of its negative reports.

As with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Services & Products

Blackrock is a global investment management corporation that offers a wide range of services and products to its clients. Here are the key offerings provided by BlackRock:

Investment Management:

BlackRock is primarily known for its expertise in investment management. They offer a diverse set of investment strategies across various asset classes, including equities, fixed income, multi-asset, alternatives, and index funds. They manage portfolios for institutional clients, such as pension funds, insurance companies, and sovereign wealth funds, as well as individual investors.

Advisory Services:

BlackRock provides advisory services to institutions, governments, and individual clients. They offer customized investment advice based on clients' unique goals, risk tolerance, and time horizon. Their advisory services cover areas like asset allocation, portfolio construction, and manager selection.

Risk Management Solutions:

BlackRock offers risk management solutions to help clients mitigate and manage investment risks. They provide comprehensive risk analytics, portfolio stress testing, and risk assessment tools. These solutions assist clients in understanding potential risks, optimizing their investment strategies, and ensuring compliance with regulatory requirements.

Technology and Aladdin Platform:

BlackRock's Aladdin platform is a cutting-edge technology platform that provides investment professionals with tools for portfolio management, risk analysis, trading, and operational efficiency. It integrates data, analytics, and technology to enable better decision-making and streamline investment processes.

Wealth Management:

BlackRock offers wealth management solutions to individual investors through various channels. They provide financial planning services, investment products, and digital platforms to help clients achieve their financial goals and optimize their wealth.

ETFs and Index Funds:

BlackRock is a leading provider of exchange-traded funds (ETFs) and index funds. They offer a wide range of funds that track various indices across different asset classes and investment themes. These passive investment products provide investors with efficient and cost-effective access to diversified portfolios.

Last but not least, Blackrocks services and products are vary according to regions. Traders can visit the website and choose their regions to learn about the specific services and products provided by Blackrock.

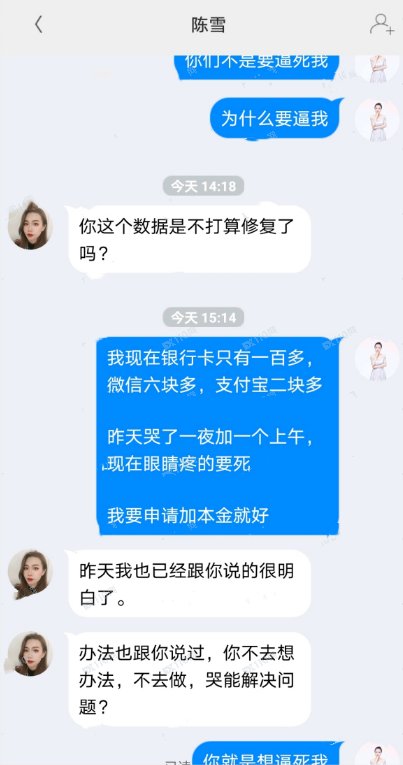

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw. Traders are encouraged to carefully review the available information and consider the risks associated with trading on an unregulated platform. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

BlackRock offers different contact ways according to different regions and services. Traders can choose their locations from the BlackRock or iShares tab to access the right products, tools, insights and ways to contact in their regions.

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: 470-520-5000 (English)

02-751-0500 (Korean)

03 - 6703 - 4 100 (Japanese)

01 56 43 29 00 (French)

+49(0)69 50 500 3111 (German)

Email: clientservice.asiapac@blackrock.com

france@blackrock.com

germany@blackrock.com

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, and YouTube.

Twitter: https://twitter.com/blackrockhttps://twitter.com/blackrockDE

Facebook: https://www.facebook.com/blackrock

YouTube: https://www.youtube.com/channel/UC4mxyB0DHnJlqlDUq0aGtDw

Conclusion

In conclusion, BlackRock is an investment management corporation that offers a wide range of services and products to its clients. Despite being regulated by MAS and SFC, there have been reports of license exceedances with regulatory bodies such as ASIC and FCA. While BlackRock provides various means of contact based on different regions and services. The company emphasizes its commitment to acting as a fiduciary for its clients, investing for the future, inspiring its employees, and supporting local communities.

Frequently Asked Questions (FAQs)

| Q 1: | Is Blackrock regulated? |

| A 1: | Yes. It is regulated by MAS and SFC. |

| Q 2: | How can I contact the customer support team at Blackrock? |

| A 2: | You can contact via telephone: 470-520-5000 (English), 02-751-0500 (Korean), 03 - 6703 - 4 100 (Japanese), 01 56 43 29 00 (French) and +49(0)69 50 500 3111 (German) and email, clientservice.asiapac@blackrock.com, france@blackrock.com, germany@blackrock.com. |

| Q 3: | What services Blackrock provides? |

| A 3: | It provides investment, advisory and risk management solutions. |

| Q 4: | Is Blackrock a good broker for beginners? |

| A 4: | Yes. It is a good choice for beginners because it is regulated well and offers various services. But it is noted that there are reports of inability to withdraw from the broker. |

Keywords

- Above 20 years

- Regulated in Hong Kong

- Regulated in Singapore

- Regulated in Australia

- Regulated in United Kingdom

- Dealing in futures contracts

- Retail Forex License

- Investment Advisory License

- Suspicious Overrun

- High potential risk

News

News BlackRock established its presence in Abu Dhabi

Newyork based Blackrock has officially received a business license to operate in Abu Dhabi. Abu Dhabi is renowned for its digital assets.

2024-11-19 14:24

News BlackRock ETF Filing Ignites Bullish Sentiment, Resulting in $16M Loss for Bitcoin Shorts

BlackRock's Bitcoin ETF filing sparks bullish sentiment, resulting in $16M loss for Bitcoin shorts. Rebounding Bitcoin erases recent losses, while other tokens see minor gains. BlackRock's involvement adds new dimension to spot Bitcoin ETF proposals. Traders eagerly await SEC decision.

2023-06-16 16:32

News BlackRock Applies to Launch a Bitcoin Spot ETF, Marking a Potential First in the US

BlackRock proposes the US's first Bitcoin spot ETF, aiming to simplify direct Bitcoin investments. Approval still pending from the SEC.

2023-06-16 15:41

News BlackRock Reportedly Sells FutureAdvisor's Direct-to-Consumer Business to Ritholtz Wealth Management

According to the report, BlackRock, the world’s largest asset management company, sold FutureAdvisor’s direct-to-consumer business to an investment advisory company called Ritholtz Wealth Management.

2023-03-01 17:03

News According To The CFO, BlackRock Has Frozen Hiring And Reduced Spending

BlackRock Inc Chief Financial Officer Gary Shedlin said that his company is halting most employment and cutting spending.

2022-12-08 12:03

Review 10

Content you want to comment

Please enter...

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

tombita

Peru

Withdrawal that should be given to me. But they tell me that I must make another, large amount withdrawal.

Exposure

01-10

FX3644586767

Taiwan

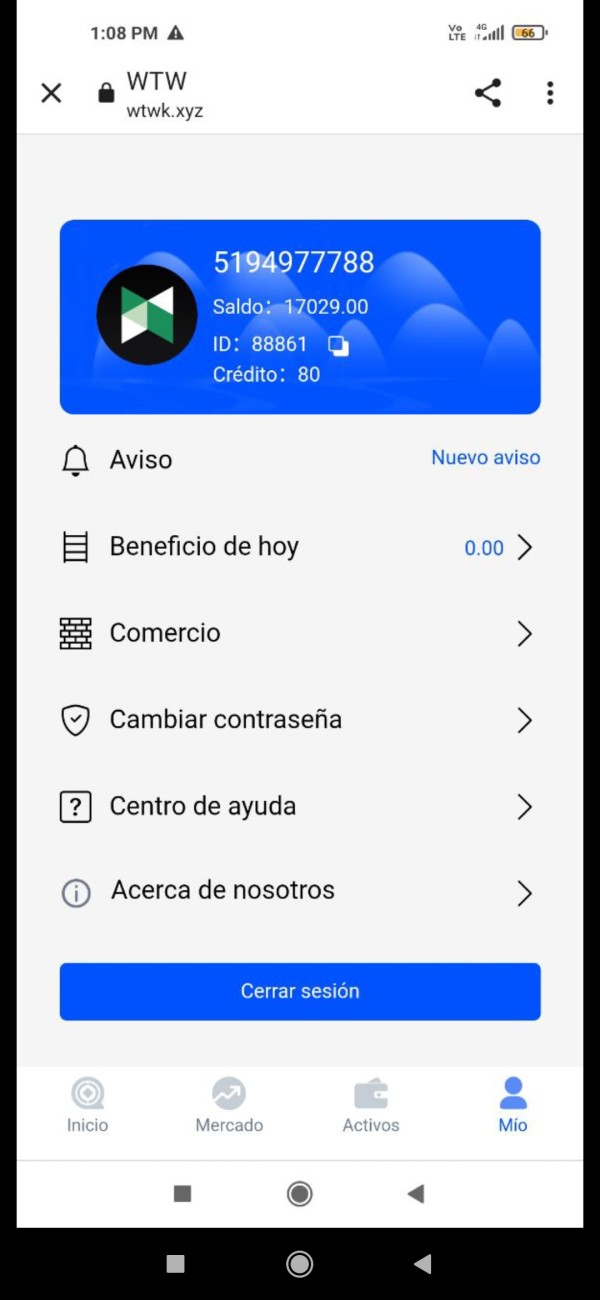

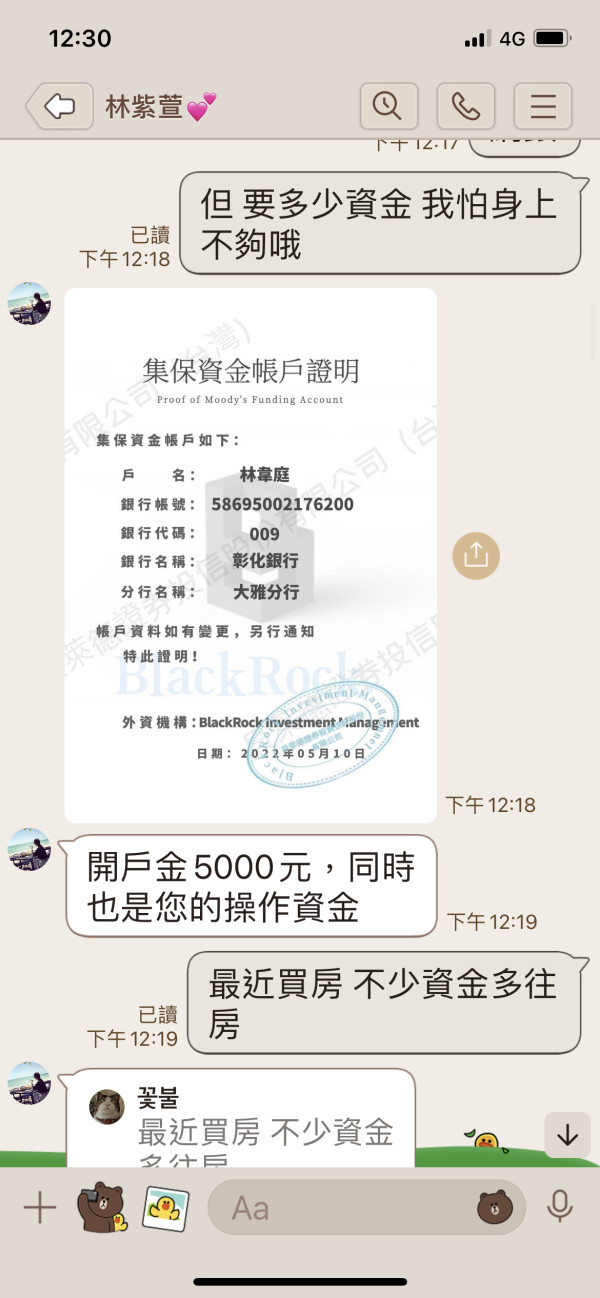

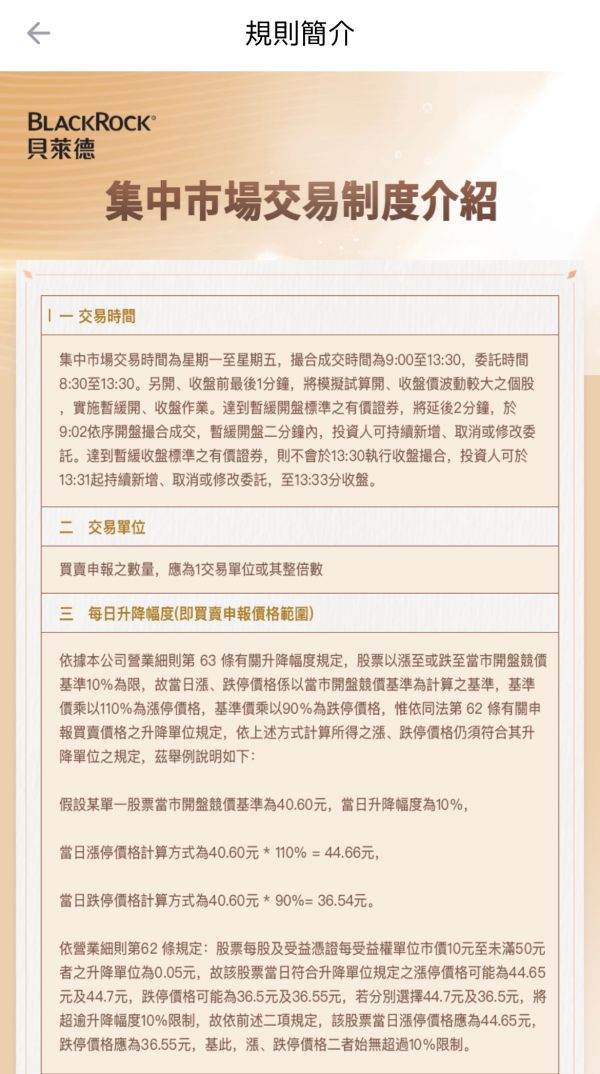

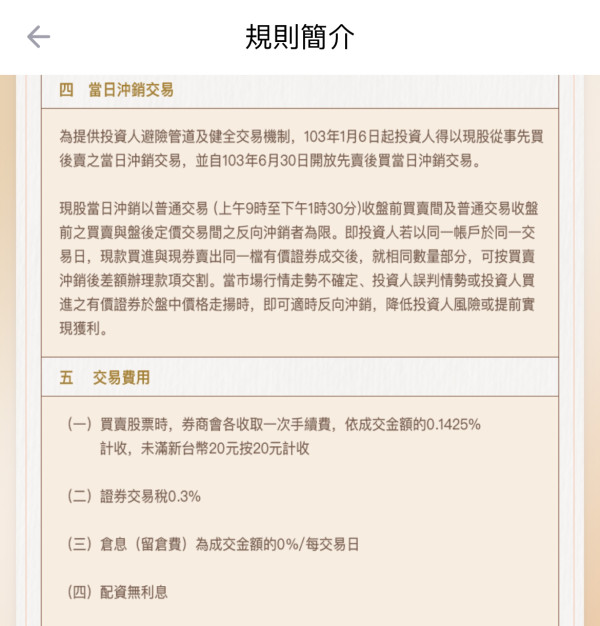

Beware of fake investment, real fraud. Requrie 5,000 deposit to open an account, and then redemption the next day, lottery shares and huge amounts, and then circle buy again, and keep forcing the victim to deposit money. When you want to withdraw money, you say that there is a problem with the other party's account and you need to pay a deposit or you cannot withdraw money for various reasons.

Exposure

2022-07-12

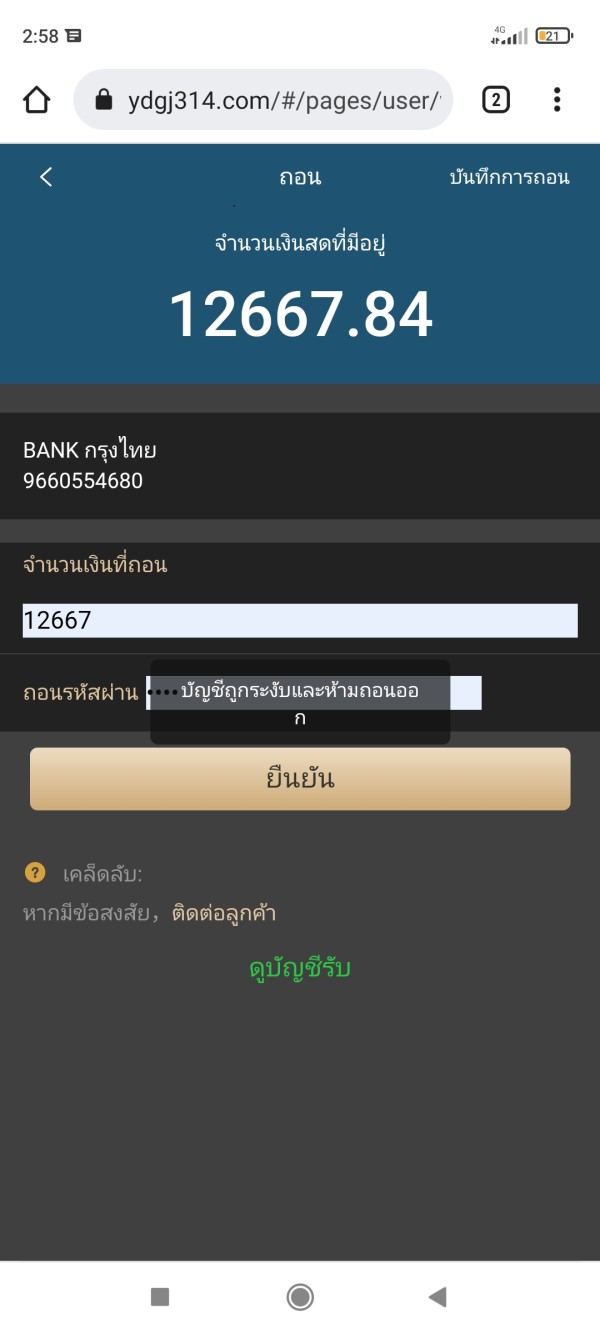

FX4802127712

Thailand

How can my id be suspended? then you say again 3 months, I will be able to withdraw. In conclusion, will I get a refund or not, or will the 12667? You tell yourself that it's removable.

Exposure

2022-06-27

FX1305625852

Malaysia

Beware of it. The customer service asked you to deposit more money. Stay away.

Exposure

2021-09-18

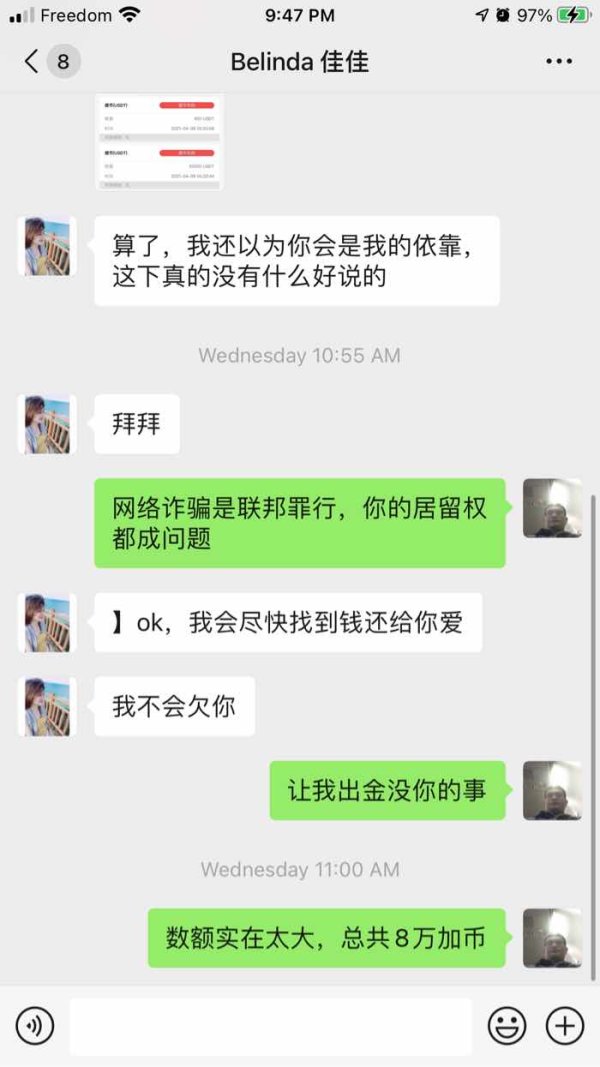

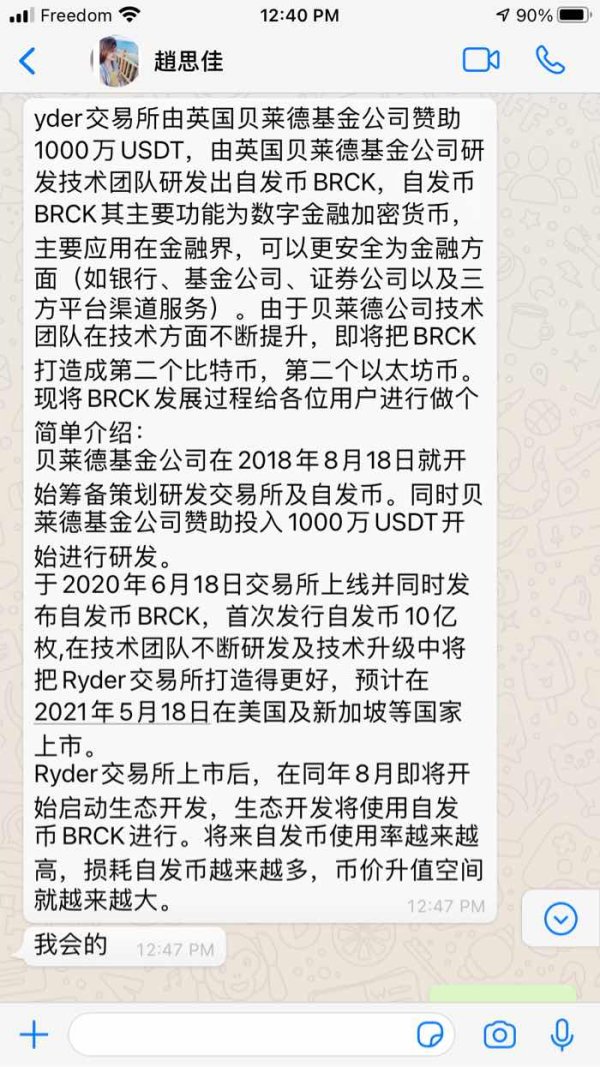

FX3248546053

Canada

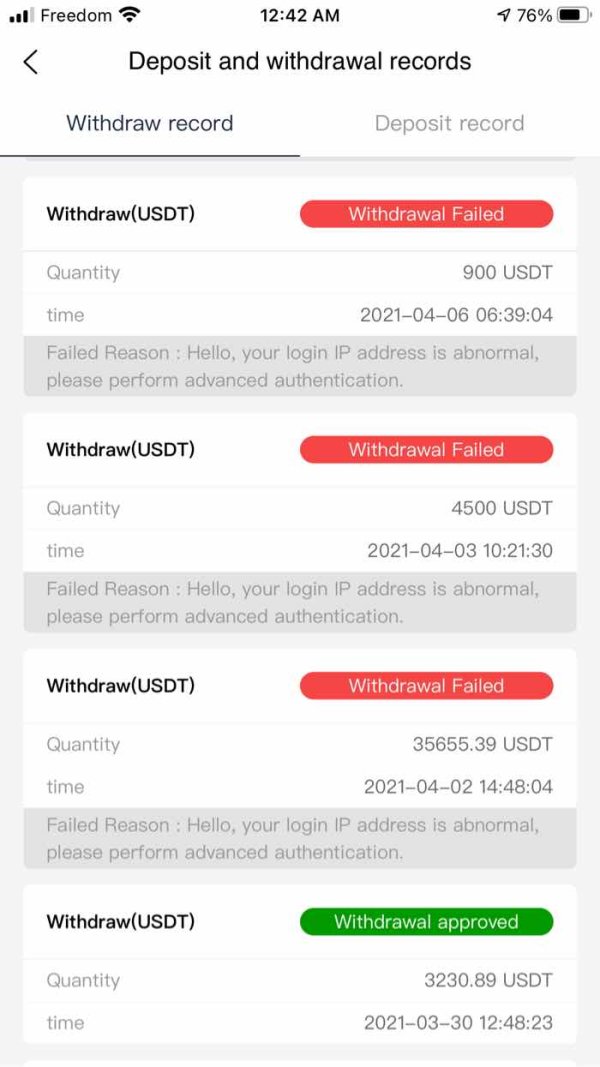

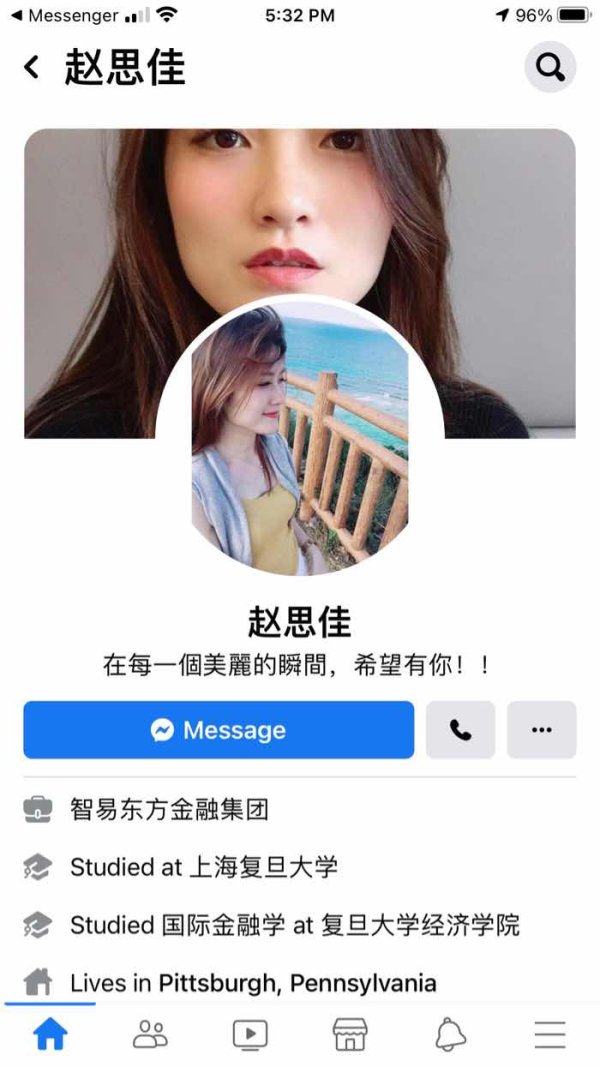

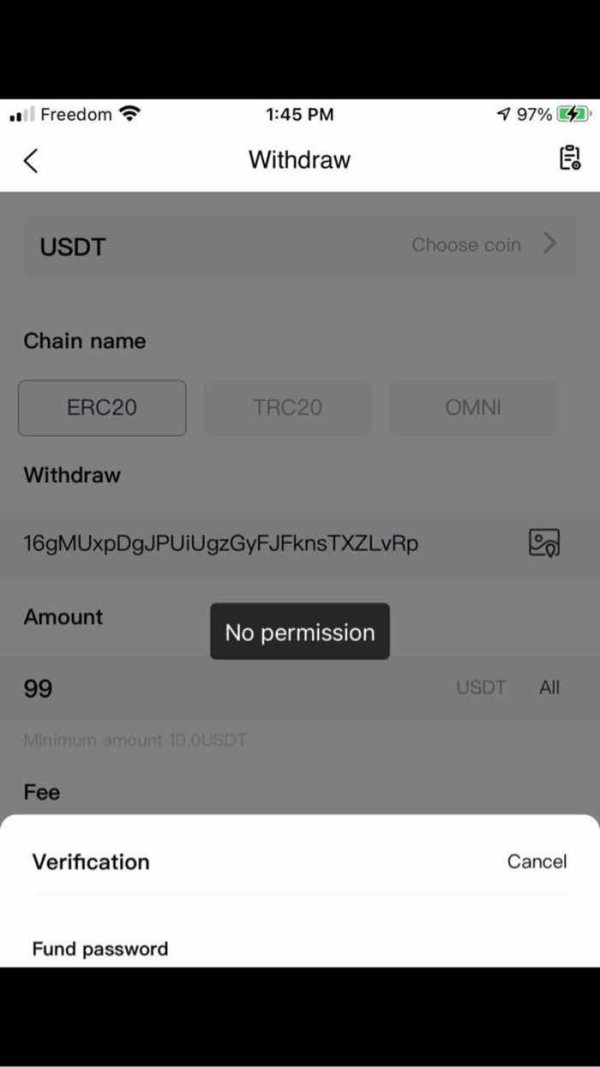

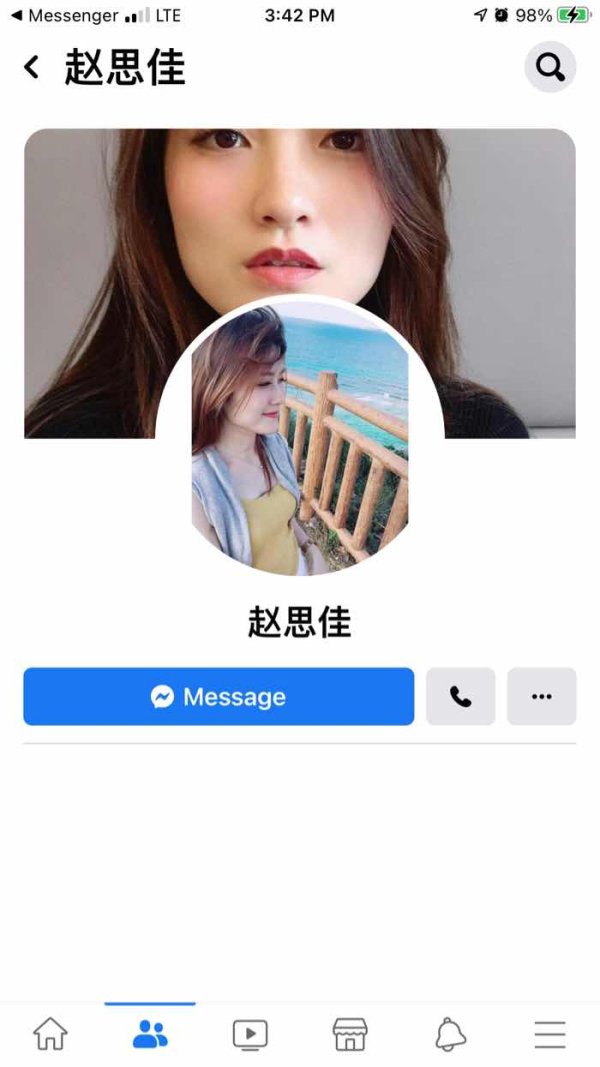

I met "赵思佳" on Facebook, She recommended Ryder Exchange,I deposited 1700 USDT then successfully withdrew 500 USDT; I deposited 15000 USDT then successfully withdrew 1300 USDT.When my total assets were 50000 USDT and successfully withdrew 3200 USDT . When my total assets were 80000 USDT and failed to withdraw 32000 USDT.after I successfully completed advanced certification, I failed to withdraw 900 USDT and then no permission to withdraw.

Exposure

2021-05-02

FX3248546053

Canada

She lives near Chinatown in Pittsburgh, Pennsylvania, USA, claiming that the Ryder is supported 10 million USDT by a British company and the BRCK/USDT will be launched in May.

Exposure

2021-04-14

FX3248546053

Canada

Nationality: Canada. I live in Calgary and knew Sijia Zhao via Facebook at the end of February of 2021. Her nationality is China and lives in America. We’ve changed our phone numbers. Hers is +1(412)313-1039. The platform she recommended: https://www.ryderexchange.site/wap, called 111. And they claimed it would list in May. I deposited 1,700 USDT and succeeded in withdrawing 500 USDT. I deposited 15,000 USDT and withdrew1,300USDT afterwards. Sijia Zhao asked me about the amount of my assets on grounds of building relationship with me. And I was asked to deposit 300,000 USDT an out common assets. I withdrew 3,200 USDT when my total account balance was 50,000 USDT. But I failed in withdrawing 32,000 USDT when my account balance was 80,000 USDT on grounds of abnormal IP address. So I have to verify my ID. After that, I was asked to pay 22,000 USDT as a tax fee to withdraw funds. Sijia Zhao told me that her money was also unable to withdraw. She said she called the local police and FBI. But then when I asked her gain, she said she withdrew many times. This is so paradox. So I asked for the screenshot about calling the police. No response. She ended our relationship on grounds of distrust. I recharged over 80,000 Canadian dollars till that time. She is a fraud, claiming that her father had a building company and the phone number of her doesn’t belong to her ID.

Exposure

2021-04-12

United States

This company is regulated by FCA, please look at the following picture

Exposure

2020-11-26

FX1245234069

United States

It's hard to believe that this company that has been around for over 15 years is also a scammer. To be honest, if I hadn't habitually checked wikifx, I would have foolishly invested here.

Neutral

2023-02-17

FX1025518937

Australia

Customer support so terrible, they deliberately suspend my account, so shameless, why would this happen? No one answers me…

Neutral

2022-11-22