Score

Raymond James Financial

United States|1-2 years|

United States|1-2 years| https://www.rjffx.com/index.html

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed Raymond James Financial also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

rjffx.com

Server Location

United States

Website Domain Name

rjffx.com

Server IP

104.21.75.213

Company Summary

| Raymond James Financial | Basic Information |

| Company Name | Raymond James Financial |

| Founded | 2021 |

| Headquarters | United States |

| Regulations | Not regulated (NFA: Unauthorized) |

| Products and Services | Investment and Financial Planning, Investment Banking, Asset Management, Retail Banking, Commercial Banking, Insurance Services, Private Equity, Equities and Funds Trading, Forex, Energy-Related Businesses |

| Fees | No fees for opening an FX account. Other potential costs may include spreads, commissions, or overnight financing charges. Transparent information provided by Raymond James Financial. |

| Minimum Deposit | 30,000 yen |

| Leverage | Up to 300:1 |

| Trading Platforms | Award-winning platforms compatible with iOS, Android, and Mac. Feature-rich experience with rapid trade execution, customizable layouts, and advanced charting tools. Supports order placement. |

| Customer Support | Location: 1-8-23 Konan, Minato-ku, Tokyo. Additional contact details not provided. |

| Education Resources | Comprehensive educational program covering FX fundamentals, basics for beginners, getting started, avoiding mistakes, differences and advantages of FX and stocks, understanding swap points, types of FX orders, and definition of pips. |

Overview of Raymond James Financial

Raymond James Financial, established in 2021, has swiftly emerged as a prominent player in the financial industry, boasting a diverse array of services and a commitment to transparency. Headquartered in St. Petersburg, Florida, this multinational independent investment bank and financial services company operates globally, catering to the financial needs of individuals, corporations, and municipal authorities. Despite its relatively recent inception, Raymond James Financial has positioned itself as a comprehensive financial solutions provider, offering services such as investment and financial planning, investment banking, asset management, retail and commercial banking, insurance, private equity, and involvement in energy-related businesses.

The company stands out for its customer-friendly approach, particularly in the realm of foreign exchange (Forex) trading. With a focus on transparency, Raymond James Financial imposes no fees for opening an FX account, making it an attractive option for those entering the FX market. The availability of award-winning and user-friendly trading platforms, compatible with various operating systems, underscores its commitment to providing a versatile and accessible trading experience. As a newcomer in the financial landscape, Raymond James Financial positions itself not only as a service provider but also as an educator, offering a comprehensive program to empower traders with the knowledge and skills essential for navigating the complexities of the FX market successfully.

Is Raymond James Financial Legit?

Raymond James Financial claims to be regulated by the National Futures Association (NFA) in the United States, holding license number 0558555. However, it's important to note that the regulatory status is currently abnormal, and the official designation is listed as Unauthorized. This suggests a deviation from typical regulatory compliance. Individuals should exercise heightened caution and carefully assess associated risks before engaging in any financial activities with Raymond James Financial.

Pros and Cons

Raymond James Financial presents a compelling mix of advantages and considerations. On the positive side, the company stands out for its diverse range of financial services, spanning from investment and financial planning to asset management, private equity, and Forex trading. One notable advantage is the absence of fees for opening an FX account, aligning with a customer-friendly approach. The provision of transparent information on potential costs, including spreads and commissions, adds to its appeal. Additionally, Raymond James Financial takes strides in user experience with award-winning and user-friendly trading platforms, catering to traders on various operating systems. The company's commitment to education is evident through its comprehensive resources designed to empower traders with FX market knowledge.

However, it's crucial to be mindful of certain considerations. The abnormal regulatory status, marked as Unauthorized, raises cautionary flags, urging potential clients to carefully assess associated risks. Limited information on customer support channels, coupled with the scarcity of contact details, may pose challenges in seeking assistance when needed. While Raymond James Financial emphasizes a customer-friendly account setup with no fees, the lack of specific details on deposit methods may leave some traders wanting more clarity. It's advised to approach the platform with regulatory caution and seek additional information to ensure a well-informed trading experience.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Products and Services

Raymond James Financial, Inc. is a prominent multinational independent investment bank and financial services company headquartered in St. Petersburg, Florida, USA. The company, through its subsidiaries, offers a diverse range of financial products and services to individuals, corporations, and municipal authorities.

1. Investment and Financial Planning:

Raymond James provides comprehensive investment and financial planning services. This includes personalized advice and strategies to help individuals and businesses achieve their financial goals. The company's financial planning services cover areas such as retirement planning, estate planning, and wealth management.

2. Investment Banking:

As an investment bank, Raymond James engages in various investment banking activities. This involves facilitating capital raising for businesses through activities like underwriting and issuing securities. The company also provides merger and acquisition advisory services to corporate clients.

3. Asset Management:

Raymond James is actively involved in asset management, offering a range of investment management services. This includes the management of investment portfolios for individuals, institutional investors, and corporate clients. The goal is to optimize returns while managing risk.

4. Retail Banking:

The company operates in the retail banking sector, providing a variety of banking services to individual clients. These services may include savings accounts, checking accounts, loans, and other financial products tailored for retail customers.

5. Commercial Banking:

In addition to retail banking, Raymond James is engaged in commercial banking activities. This involves providing financial services and products to businesses, including loans, treasury management, and other commercial banking solutions.

6. Insurance Services:

Raymond James offers insurance products, including life insurance and annuities. These products are integrated into the overall financial planning and wealth management services provided by the company.

7. Private Equity:

The company is involved in private equity investments, participating in the private placement of securities in non-publicly traded companies. This allows clients to access investment opportunities in private companies.

8. Equities and Funds Trading:

Raymond James facilitates the trading of equities (stocks) and funds, providing clients with access to the financial markets. This includes buying and selling stocks and participating in investment funds.

9. Foreign Exchange (Forex):

The company offers foreign exchange services, allowing clients to engage in currency trading. This involves the exchange of different currencies in the foreign exchange market.

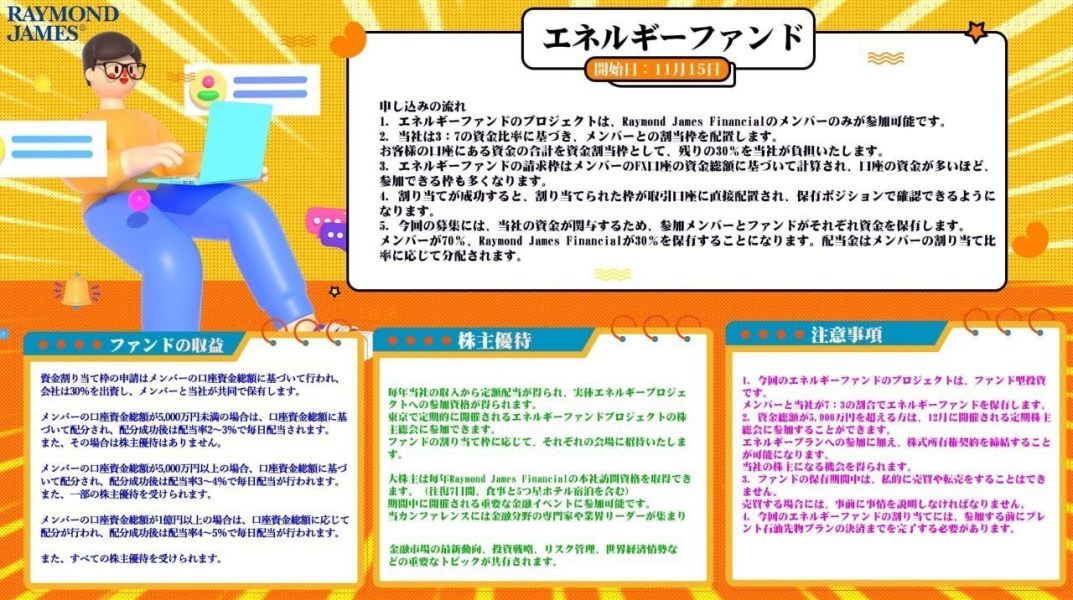

10. Energy-Related Businesses:

Raymond James is involved in businesses related to the energy sector. This may include providing financial services to companies in the energy industry and participating in energy-related investment opportunities.

Raymond James Financial, with its diverse range of products and services, aims to cater to the varied financial needs of its clients, offering both traditional banking services and sophisticated financial solutions.

Here is a comparison table of products and services offered by different companies:

| Products | Forex | CFDs | Crypto | Stocks | Commodities | Indices | ETFs | Options |

| Raymond James Financial | Yes | No | No | Yes | Yes | Yes | No | No |

| Exnova | Yes | Yes | Yes | Yes | Yes | No | Yes | Yes |

| Tickmill | Yes | No | Yes | Yes | No | No | No | No |

| GO Markets | Yes | Yes | Yes | No | Yes | Yes | No | No |

| Capital Bear | Yes | Yes | Yes | Yes | Yes | No | Yes | Yes |

| Quadcode Markets | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Deriv | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

How to Open an Account?

Opening an account with Raymond James Financial FX involves three straightforward steps. Follow the numbered process below:

1. Online Application:

Complete the online application form on the Raymond James Financial FX website. Provide accurate personal information.

2. Document Submission:

Upload necessary identification and tax number documents for verification. This includes a government ID and proof of address.

3. Fund Your Account:

Once verified, deposit funds into your trading account using available methods. Start trading on the Raymond James Financial FX platform.

Fees

Raymond James Financial adopts a customer-friendly approach by not charging any fees for opening an FX account. The process of establishing an account with the company is devoid of associated costs, allowing individuals to initiate their FX trading journey without incurring any financial burden during the account setup.

It's important to note that while the account opening process is fee-free, traders should be mindful of potential costs associated with other aspects of their FX trading activities. These may include spreads, commissions, or overnight financing charges, which are common in the FX industry. Raymond James Financial typically provides transparent information about these costs, enabling traders to make informed decisions and manage their expenses effectively while engaging in the dynamic FX market.

Leverage

Raymond James Financial offers a maximum leverage of up to 300 times, allowing traders to amplify their market exposure significantly with a relatively smaller capital investment. This leverage ratio of 300:1 means that for every unit of capital, traders can control positions in the market equivalent to 300 times that amount. While higher leverage can potentially magnify profits, it's crucial for traders to approach it with caution due to the increased risk of losses.

The specified maximum leverage of 300:1 positions Raymond James Financial as a platform catering to traders seeking enhanced market exposure in their FX trading endeavors. However, it's essential for traders to exercise prudent risk management strategies and be aware of the potential volatility in the FX market. Understanding the implications of leverage and its impact on trading positions is crucial for maintaining a balanced and responsible approach to FX trading on the Raymond James Financial platform.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | Raymond James Financial | Capital Bear | Quadcode Markets | Deriv |

| Maximum Leverage | 1:300 | 1:5 | 1:30 | 1:1000 |

Deposit & Withdraw Methods

Raymond James Financial FX provides a straightforward and accessible approach to trading by allowing users to initiate trades with a minimum deposit of 30,000 yen. Although the official website does not explicitly outline the deposit methods, it emphasizes the flexibility in starting trading with smaller amounts, making it particularly attractive for beginners or those looking to manage their risks more conservatively.

Trading Platforms

Raymond James Financial FX provides a range of award-winning trading platforms designed to offer users a rich trading environment and user-friendly interfaces. These platforms have garnered popularity among clients due to their ease of use, extensive trading features, and the inclusion of automated trading capabilities. Raymond James Financial FX takes pride in its platform's versatility, which has grown from serving individual traders to fostering an international trading community.

The trading platforms are compatible with various operating systems, including iOS, Android, and Mac. This compatibility ensures that traders can access the platforms seamlessly across different devices, enhancing flexibility in their trading activities. The platforms also support order placement, allowing users to execute buy and sell trades efficiently.

For Android users, the Raymond James Financial FX platform offers a feature-rich experience. It provides rapid trade execution, one-touch trading capabilities, and customizable screen layouts. Traders can view and analyze trade history data, utilize advanced charting tools, and access more than 30 indicators for market analysis. The Android version also supports account management and trading across all available products on the platform.

The user-friendly interface includes a concise guide screen, icons displaying trading levels and volumes, an offline mode for viewing price and chart data, and the ability to download the app for free from the App Store. Raymond James Financial FX continues to enhance the trading experience by partnering with various technology providers to offer next-generation trading platforms that meet the innovative needs of its clients.

Customer Support

Raymond James Financial FX provides customer support to its users from its location at 1-8-23 Konan, Minato-ku, Tokyo. While the company's physical address is mentioned, additional details about the specific customer support channels, such as telephone numbers, email addresses, or other means of communication, are not provided in the given information. Accessible and responsive customer support is crucial for traders, and users are encouraged to seek more detailed information directly from Raymond James Financial FX to ensure they have comprehensive assistance when needed.

Educational Resources

Raymond James Financial provides a comprehensive educational program designed to guide individuals, including beginners, through the intricacies of FX trading. The educational resources include:

1. Introduction to FX:

Learn the fundamentals of FX trading, understanding what FX is, and exploring various strategies for both earning and trading.

2. FX Basics for Beginners:

Tailored for newcomers, this section covers the foundational aspects of FX trading, offering insights into the basic knowledge required for successful participation.

3. Getting Started with FX:

A beginner-friendly guide explaining what FX is, providing essential knowledge, and outlining the steps for those venturing into FX trading for the first time.

4. Avoiding Mistakes for FX Beginners:

Practical tips and strategies are offered to help FX beginners avoid common pitfalls and make informed decisions throughout their trading journey.

5. Differences and Advantages of FX and Stocks:

Understand the distinctions and advantages of trading FX compared to stocks, providing valuable insights for those considering different investment options.

6. Understanding Swap Points:

Gain knowledge about swap points in FX trading, an essential aspect for traders looking to optimize their positions and manage risks effectively.

7. Types of FX Orders and Their Uses:

Explore the various types of FX orders and learn how to strategically use them, providing a comprehensive understanding of order execution.

8. Definition of Pips:

Delve into the concept of pips, a fundamental unit in FX trading, and understand its significance in measuring price movements and determining profits or losses.

Raymond James Financial's educational resources aim to empower traders with the knowledge and skills necessary to navigate the FX market successfully.

Conclusion

In conclusion, Raymond James Financial presents a multifaceted landscape with both advantages and disadvantages. On the positive side, the company boasts a diverse array of financial services, user-friendly platforms, and a commitment to educating traders. The absence of fees for opening an FX account and transparent information on potential costs contribute to its customer-friendly image. However, caution is warranted due to the abnormal regulatory status, marked as Unauthorized, signaling a deviation from typical compliance. Limited information on customer support and contact details, coupled with the lack of specificity on deposit methods, may pose challenges for users seeking comprehensive assistance. As traders consider Raymond James Financial, a balanced evaluation of its offerings, regulatory standing, and support infrastructure is crucial to making informed decisions.

FAQs

Q: Is Raymond James Financial regulated?

A: Raymond James Financial is regulated by the National Futures Association (NFA) in the United States; however, its current regulatory status is marked as Unauthorized, signaling a deviation from typical compliance.

Q: Are there fees for opening an FX account with Raymond James Financial?

A: No, Raymond James Financial adopts a customer-friendly approach by not charging any fees for opening an FX account.

Q: What financial services does Raymond James Financial offer?

A: Raymond James Financial provides a diverse range of financial services, including investment and financial planning, investment banking, asset management, retail banking, commercial banking, insurance services, private equity, equities and funds trading, Forex, and energy-related businesses.

Q: How can I open an account with Raymond James Financial?

A: To open an account, complete the online application form on the Raymond James Financial FX website, submit necessary identification and tax documents for verification, and fund your account once verified.

Q: What is the maximum leverage offered by Raymond James Financial?

A: Raymond James Financial offers a maximum leverage of up to 300 times, allowing traders to amplify their market exposure with a relatively smaller capital investment.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now