简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

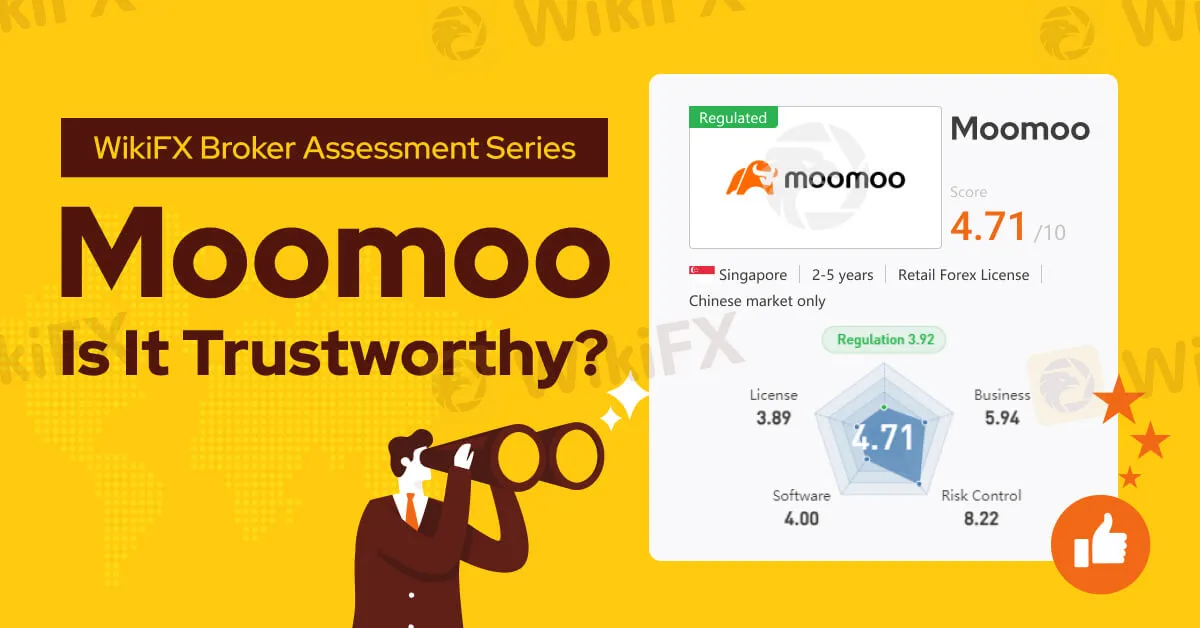

WikiFX Broker Assessment Series | Moomoo: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Moomoo, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Moomoo, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Moomoo, established in California in 2018, swiftly became a leading solution for investors' needs, offering professional-grade trading services and data solutions.

In 2022, Moomoo expanded its footprint to Australia, where it introduced intelligent-assisted technology for investment analysis. This innovation earned the platform four prestigious awards from Wemoney. The following year, Moomoo continued its growth by launching its cutting-edge platform in Malaysia and Japan, providing extensive market information, investor education, and interactive community features.

Moreover, Moomoo set its sights on transforming the investment landscape in Canada. The platform aimed to empower Canadian investors with detailed market insights and educational tools, enabling them to navigate the market effectively and capitalize on opportunities.

Moomoo differentiates itself by offering commission-free trading on stocks and ETFs in the United States, Singapore, Hong Kong (SAR), and China. This can be a major advantage for active traders who place a high volume of trades. In addition, Moomoo allows traders to invest in fractional shares of stocks. This can be a good way to invest in expensive stocks or to dollar-cost average into your investments. Although traders on Moomoo do not have direct access to Forex, commodities, or bonds, they can invest in over 3,000 ETFs that encompass these asset classes.

Types of Accounts:

There are no account variants listed on Moomoos website. Therefore, it seems that Moomoo simplifies its operations by offering only one type of trading account, which covers the trading of all the assets provided by Moomoo, with the option to add a margin account.

Deposits and Withdrawals:

Moomoo offers a range of payment options, including bank transfers, FAST, credit cards, debit cards, PayNow, Wise, ACH transfer, and additional methods. While Moomoo asserts a policy of not imposing any commission or fees for deposits and withdrawals, it is important to note that any fees levied by third-party providers shall be the responsibility of the trading client.

Trading Platforms:

Moomoo offers a user-friendly trading platform available on both desktop and mobile devices, featuring streaming quotes, Level 2 market data, customizable charts, technical indicators, fundamental analysis tools, and paper trading.

Research and Education:

While there do not seem to be educational resources found on Moomoos official website, the Moomoo investment community resembles a social media platform such as Facebook or Instagram, allowing users to like and comment on posts and follow discussion threads. Moomoo always provides financial news and market highlights from their editorial team around the clock, as well as an economic calendar for free.

Customer Service:

Moomoo provides customer support through phone, email, and live chat. Representatives are available to assist from Monday to Friday, between 8:30 AM and 5:30 PM EST.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Moomoo a WikiScore of 4.71 out of 10.

Upon examining Moomoos licenses, WikiFX found that the broker is regulated by the Monetary Authority of Singapore (MAS) with license number CMS101000.

However, the United States NFA regulation (license number: 0523957) claimed by this broker is suspected to be a clone.

Therefore, WikiFX would urge our users to opt for a broker that has a higher WikiScore for better protection.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator