Score

CK Markets

Saint Vincent and the Grenadines|5-10 years|

Saint Vincent and the Grenadines|5-10 years| https://ckmarkets.com/

Website

Rating Index

MT4/5 Identification

MT4/5

White Label

CKMarkets-Demo

Influence

C

Influence index NO.1

Malaysia 3.84

Malaysia 3.84MT4/5 Identification

MT4/5 Identification

White Label

Singapore

SingaporeInfluence

Influence

C

Influence index NO.1

Malaysia 3.84

Malaysia 3.84Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed CK Markets also viewed..

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

ckmarkets.com

Server Location

Singapore

Website Domain Name

ckmarkets.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2017-12-07

Server IP

206.189.87.181

Company Summary

| CK Markets | Basic Information |

| Registered Country/Region | Belize |

| Regulations | N/A |

| Tradable Assets | Forex, Stocks, Futures, Indices, Metals, Energies, Cryptocurrencies |

| Account Types | Cent Account, Standard Account, ECN ccount |

| Minimum Deposit | $30 |

| Maximum Leverage | Unlimited |

| Deposit & Withdrawal | Local Bank, Credit/Debit Cards, E-Wallets, Bankwire, Cryptocurrency |

| Trading Platforms | MetaTrader 4 |

| Customer Support | Phone, Email |

| Education Resources | None |

General Information

CK Markets is a financial brokerage firm that provides trading services to individuals and institutions in the global markets. With a focus on transparency and client satisfaction, CK Markets offers a range of trading instruments, including forex currency pairs, commodities, indices, and cryptocurrencies. Traders can access a variety of trading platforms and tools to execute their strategies effectively. CK Markets aims to provide competitive spreads and fast trade execution to enhance the trading experience. Additionally, the company offers educational resources and market analysis to help traders stay informed and make informed trading decisions.

Market Intruments

CK Markets offers a diverse range of market instruments to cater to the trading needs of its clients. Here's a brief overview of the market instruments available:

Forex Currency Pairs: CK Markets provides access to a wide selection of forex currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs. Traders can take advantage of the global forex market and speculate on the exchange rate movements between different currencies.

Metals: CK Markets offers trading opportunities in precious metals such as gold, silver, platinum, and palladium. Traders can participate in the price movements of these metals, which are often considered safe-haven assets and can provide diversification to a trading portfolio.

Energies: CK Markets allows traders to trade energies, including oil and gas. Traders can speculate on the price fluctuations of these energy commodities, taking advantage of global supply and demand dynamics and geopolitical factors influencing energy markets.

Equity Indices: CK Markets provides access to a variety of equity indices, representing the performance of stock markets from different regions. Traders can speculate on the overall movement of these indices, such as the S&P 500, FTSE 100, or Nikkei 225, without having to trade individual stocks.

Stock Trading: CK Markets offers stock trading services, allowing traders to invest in individual stocks of companies listed on major stock exchanges. Traders can take positions on the price movements of stocks and potentially profit from company-specific events or broader market trends.

Cryptocurrencies: CK Markets enables traders to trade popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more. Traders can participate in the volatile cryptocurrency markets and potentially generate profits through buying and selling digital currencies.

Pros and Cons

Pros:

Diverse range of market instruments: CK Markets offers a wide variety of trading instruments, including forex currency pairs, metals, energies, equity indices, stock trading, and cryptocurrencies. This allows traders to diversify their portfolios and explore different markets.

Flexible leverage options: CK Markets provides flexible leverage options ranging from 1:100 to unlimited leverage. Traders have the ability to control larger positions with a smaller amount of capital, potentially amplifying their profits.

Multiple account types: CK Markets offers different account types, including Cent, Standard, and ECN accounts. This allows traders to choose an account type that aligns with their trading preferences, experience level, and risk tolerance.

Comprehensive trading platform: CK Markets utilizes the MetaTrader 4 (MT4) platform, known for its robust features and advanced trading tools. Traders can access real-time market quotes, interactive charts, technical analysis tools, and customizable indicators for effective trading.

Multi-channel customer support: CK Markets offers customer support through various channels, including email and phone. Traders can reach out to the support team for assistance, inquiries, or concerns, ensuring a responsive and accessible support system.

Cons :

Lack of transparent Spreads & Commissions information: CK Markets does not provide specific details about their spreads and commissions on their official website. This lack of transparency can make it challenging for traders to accurately assess the trading costs associated with different instruments.

Lack of educational resources: Unfortunately, CK Markets does not offer educational resources or a dedicated educational section on their website. This may limit the availability of educational materials and tools for traders who seek to enhance their trading knowledge and skills.

Risks associated with leverage usage: While CK Markets offers flexible leverage options, it's important to note that trading with leverage carries inherent risks. Traders must exercise caution and carefully manage their risk exposure to avoid potential losses.

Inability to access specific Spreads & Commissions data: Due to the lack of detailed information on spreads and commissions, traders may find it challenging to compare CK Markets' trading costs with other brokers or assess the competitiveness of their pricing.

| Pros | |

| Diverse range of market instruments | Lack of transparent Spreads & Commissions information |

| Flexible leverage options | Lack of educational resources |

| Multiple account types | Risks associated with leverage usage |

| Comprehensive trading platform | Inability to access specific Spreads & Commissions data |

| Multi-channel customer support |

Account Types

CK Markets offers different account types to cater to the varying needs and preferences of traders. Here's a brief overview of the account types available:

Cent Account: CK Markets offers a Cent Account suitable for beginner traders. It requires a minimum deposit of $30.00 and offers competitive spreads starting from 2.5 pips. Traders can access a variety of instruments, including major, minor, and exotic currency pairs, precious metals, energies, and indices. The account also provides the option for Swap-Free trading.

Standard Account: CK Markets provides a Standard Account for traders with some experience. The minimum deposit is $100.00, and spreads start from 1.3 pips. Traders can access major, minor, and exotic currency pairs, precious metals, energies, indices, stocks, and cryptocurrencies. The account also offers the Swap-Free trading option.

ECN Account: The ECN Account is designed for advanced traders seeking direct market access and tighter spreads. It requires a minimum deposit of $100.00, and spreads start from 0 pips. Traders can access major, minor, and exotic currency pairs, precious metals, energies, and indices. The ECN Account does not provide access to stocks or cryptocurrencies but offers the Swap-Free trading option.

Each account type may have specific features, trading conditions, and minimum deposit requirements. It is advisable to visit CK Markets' official website or contact their customer support for detailed information on each account type, including leverage options, commission structures, and any additional benefits or restrictions associated with each account.

How to open an account?

The account opening process with CK Markets typically involves the following steps:

Online Registration: Visit the official CK Markets website and locate the account registration page. Fill out the online registration form by providing your personal information, including your full name, email address, phone number, and any other required details.

Account Verification: After submitting the registration form, you will need to complete the account verification process. This typically involves providing identification documents such as a valid passport or driver's license, as well as proof of address such as a utility bill or bank statement. Follow the instructions provided by CK Markets to submit the necessary documents.

Account Selection: Once your account is verified, you will need to choose the type of trading account that best suits your needs. CK Markets may offer different account options, including Cent, Standard, and ECN accounts. Consider factors such as account features, trading conditions, and minimum deposit requirements when selecting your account type.

Deposit Funds: After selecting your account type, you will be prompted to deposit funds into your trading account. CK Markets may offer various payment methods, including bank transfers, credit/debit cards, or digital payment systems. Follow the instructions provided by CK Markets to initiate the deposit process.

Start Trading: Once your account is funded, you can access the trading platform provided by CK Markets. Download any necessary software or log in to the web-based platform to start trading. Familiarize yourself with the platform's features, place trades, and manage your account according to your trading strategy.

It's important to note that the actual account opening process with CK Markets may vary, and it is advisable to visit their official website or contact their customer support for specific instructions and the most up-to-date information on account opening procedures.

Leverage

CK Markets offers flexible leverage options to its clients, providing traders with the ability to control larger positions with a smaller amount of capital. The leverage range at CK Markets typically starts from 1:100 and can go up to unlimited leverage, allowing traders to amplify their potential profits or losses. It's important to note that the specific leverage offered may vary depending on the type of trading account and the amount of funds deposited. Different account types may have different leverage ratios assigned based on the account balance or trading volume. Traders should carefully consider their risk tolerance and trading strategy when utilizing leverage, as higher leverage can increase both potential gains and losses.

Spreads & Commissions (Trading Fees)

CK Markets offers competitive spreads and commissions across its account types. The Cent Account requires a minimum deposit of $30.00, with spreads starting from 2.5 pips. The Standard Account has a minimum deposit of $100.00, with spreads starting from 1.3 pips. The ECN Account, requiring a minimum deposit of $100.00, offers spreads starting from 0 pips. Additionally, the ECN Account charges a commission of $3 per round turn lot. CK Markets also provides a swap-free feature. Spreads are floating and may increase during specific periods of the day, depending on market conditions. CK Markets aims to provide transparent pricing and competitive trading conditions for its clients. For accurate and up-to-date information on spreads, commissions, and other trading fees, it is advisable to visit CK Markets' official website or contact their customer support.

Trading Platform

CK Markets provides traders with a comprehensive and user-friendly trading platform, primarily utilizing the MetaTrader 4 (MT4) platform. MT4 is a widely recognized and popular trading platform in the industry, known for its robust features and advanced trading tools. It offers a range of functionalities, including real-time market quotes, interactive charts, technical analysis tools, and customizable indicators. Traders can access the platform on various devices, including desktop computers, as well as mobile devices running on Android and iOS operating systems. The mobile versions of MT4, known as MetaTrader 4 for Android and MetaTrader 4 for iOS, enable traders to manage their accounts, monitor market conditions, execute trades, and access account information while on the go. The CK Markets trading platform, powered by MT4, ensures a seamless and efficient trading experience for traders, allowing them to execute trades and implement their trading strategies with ease and convenience.

Deposit & Withdrawal

CK Markets offers a variety of convenient deposit and withdrawal methods to cater to the needs of its clients. Traders can choose from several options, including local bank transfers, credit/debit cards, e-wallets, bank wire transfers, and cryptocurrencies. Local bank transfers allow traders to directly transfer funds from their local bank accounts to their CK Markets trading accounts. Credit/debit cards offer a quick and secure way to deposit funds, with popular card options accepted. E-wallets provide an electronic payment solution, allowing for swift and hassle-free transactions. Bank wire transfers enable traders to transfer funds internationally, ensuring a reliable and secure transfer process. Additionally, CK Markets accepts cryptocurrencies as a payment method, providing traders with the flexibility to deposit and withdraw funds using digital currencies. With a diverse range of deposit and withdrawal options, CK Markets aims to accommodate the preferences and needs of its clients, making the process efficient and convenient.

Customer Support

CK Markets offers customer support to its clients through various channels, including email, phone. Traders can reach out to CK Markets' customer support team via email and phone. By contacting the dedicated email support, clients can submit their inquiries, concerns, or requests for assistance, and expect a prompt response from the support team. Alternatively, traders can utilize the provided phone support to directly communicate with a representative who can address their questions or provide guidance. CK Markets understands the importance of responsive and accessible customer support, aiming to ensure a positive trading experience for its clients.

Educational Resources

Unfortunately, it seems that CK Markets does not provide any educational resources for its clients. There is no dedicated educational section on the broker's website.

Conclusion

Overall, CK Markets is a financial brokerage firm that offers trading services to individuals and institutions worldwide. They provide a range of trading instruments, including forex currency pairs, metals, energies, equity indices, stock trading, and cryptocurrencies. The company offers different account types, including Cent, Standard, and ECN accounts, catering to various trading needs. The account opening process involves online registration, account verification, account selection, depositing funds, and starting to trade. CK Markets offers flexible leverage options, allowing traders to control larger positions with a smaller capital amount. The broker utilizes the popular MetaTrader 4 platform, offering a user-friendly trading experience on desktop and mobile devices. Traders can make deposits and withdrawals using local bank transfers, credit/debit cards, e-wallets, bank wire transfers, and cryptocurrencies. CK Markets provides customer support through email and phone channels to address client inquiries and concerns. However, there are no educational resources available on their website.

FAQs

Q: Is CK Markets a regulated broker?

A: No, CK Markets is not a regulated broker.

Q: What is the minimum deposit required to open an account with The Traders Domain?

A: The minimum deposit required to open an account with CK Markets is $30 for all account types.

Q: What is the maximum leverage offered by The Traders Domain?

A: The maximum leverage offered by CK Markets is unlimited.

Q: Does CK Markets offer a demo account?

A: Yes, CK Markets offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

Q: What payment methods does CK Markets accept?

A: CK Markets accepts a wide range of payment methods, including local banks, credit cards, e-wallets, bankwire, cryptocurrency.

Q: What trading platforms does CK Markets offer?

A: CK Markets offers MetaTrader 4 platforms.

Q: Does CK Markets offer educational resources for traders?

A: No, CK Markets does offer educational resources for traders.

Keywords

- 5-10 years

- Suspicious Regulatory License

- White label MT4

- Regional Brokers

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Danny Goh

Malaysia

No regulator Can deposit but can’t withdraw money Never use this platform

Exposure

2020-11-25

FX2456841364

Malaysia

High deposit rate, extreme low withdrawal rate...slow withdrawal more than 1 months. Irresponsible management and master. Make investor lose money more than earn within a day.[d83d][de21]

Exposure

2020-09-12

FX1024206872

Malaysia

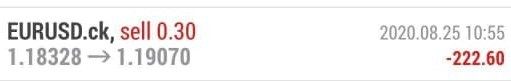

They are manipulating the price!!!! 2020.08.25 10:55 close a EURUSD sell position at market price when it is profiting. When the position is closed, profit became loss, and the closing price is 1.19070. However the market at that time should be around 1.18270+-.

Exposure

2020-09-08

FX1666798481

Malaysia

It is a serious scam broker, money in with no money out; we tried to do Malaysia Local Withdrawal and Neteller, but toth were rejected. They also made fake transaction in my trading account in order to cut down my fund balance, I could clearly see this in MT4. Do not risk your funds!

Exposure

2020-06-13