简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Mastering Order Blocks in Trading: A Rule-Based Approach

Abstract:Unlock the power of order blocks in trading! Learn to spot, analyze, and trade these crucial zones for success in financial markets.

Introduction

Trading in financial markets is both an art and a science. It's an art because it requires intuition, strategy, and adaptability, and it's a science because it relies on data, analysis, and precise execution. Amidst the complexities of trading, one concept has stood out as a game-changer: order blocks. In this comprehensive guide, we will delve deep into the world of order blocks, unveiling their significance in trading, understanding the conditions that make them valid, mastering the art of marking them on charts and incorporating them with crucial market structure concepts. Whether you're a novice trader looking to enhance your skills or a seasoned pro seeking a fresh perspective, this article will equip you with the knowledge and strategies you need to thrive in the financial markets.

Understanding Order Blocks in Trading

To embark on our journey of mastering order blocks, it's essential to start with a solid foundation. Order blocks are pivotal areas in trading where significant buying or selling orders have previously triggered substantial price movements. When the price revisits these levels, it often reacts once more, making them intriguing points of interest for traders. However, not all supply and demand areas are created equal, and distinguishing valid order blocks from the rest is crucial.

Conditions for Valid Order Blocks

Inefficiency, Imbalance, and Fair Value Gaps: Let's demystify these terms. Inefficiency occurs when a large influx of capital disrupts the equilibrium between buyers and sellers, resulting in gaps between candlesticks. These gaps signify the presence of smart money in the market. When prices return to these gaps, they tend to absorb remaining orders, presenting a promising trading opportunity.

Breaking Market Structure: Market structure serves as the backbone of technical analysis. In an uptrend, a price movement breaking the latest market structure and closing above the recent high signifies the presence of a robust demand area. Conversely, in a downtrend, breaking the latest market structure to the downside indicates a formidable supply zone.

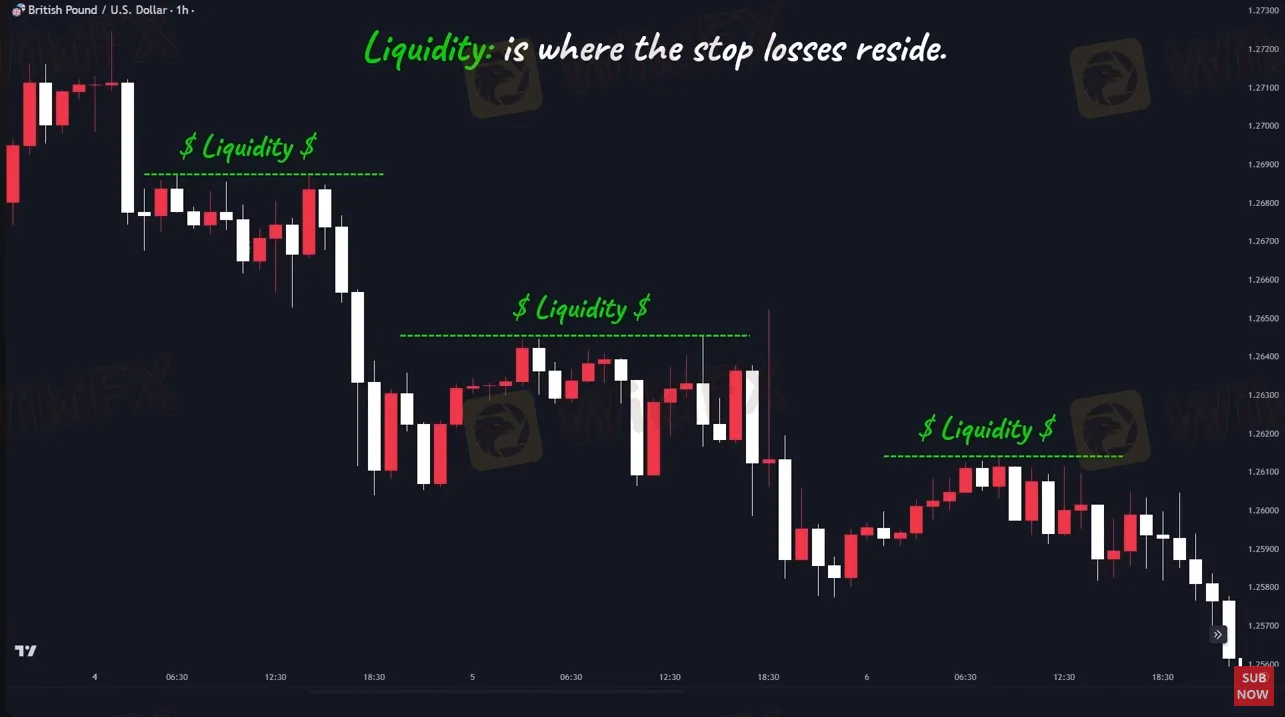

Liquidity Grab Patterns: Liquidity, often represented by stop-loss orders, plays a crucial role in market dynamics. Recognizing liquidity grab patterns can enhance trading strategies. These patterns include:

A gap appears below a demand area.

Equal lows form beneath a demand area.

Equal highs emerge above a supply area.

Marking Order Blocks on the Chart

Effectively marking order blocks on your trading chart is pivotal for successful execution. The cornerstone of this process is identifying the last candlestick before a significant price move. This candlestick represents a critical juncture where influential decisions were made. However, there are scenarios where further adjustments are necessary.

Here's how:

Using the ATR Indicator: The Average True Range (ATR) indicator measures market volatility by providing the average size of the previous 14 candles. If the range of the order block is less than 60% of the ATR, it's advisable to extend the zone to one ATR from both sides. This adjustment minimizes the risk of falling victim to a liquidity grab.

Types of Order Blocks in Trading

Understanding the different types of order blocks is essential for crafting a well-rounded trading strategy:

Continuation Order Blocks: These order blocks align harmoniously with the dominant trend. Consequently, they boast a higher probability of success and are favored by many traders.

Reversal Order Blocks: While riskier, these order blocks offer substantial risk-to-reward ratios when identified correctly. They mark potential turning points in the market.

Ranging Order Blocks: These unique blocks form within a trading range, signaling potential breakout opportunities. Trading within a range can be profitable, but it requires careful analysis.

Enhancing Analysis with a Top-Down Approach

Trading isn't just about spotting entry points; it's about comprehending the broader context of the market. A top-down analysis involves considering multiple timeframes, starting with the 4-hour chart to identify the overarching trend, significant levels, and supply and demand zones. Next, zoom in to the 1-hour chart for a more detailed analysis. Finally, scrutinize the 15-minute chart for confirmation and execution.

Back-Testing Your Order Block Strategy

Back-testing is the process of evaluating your trading strategy using historical data. While it can be time-consuming, tools like Trader Edge can streamline the process. Remember, adapting your trading system based on your findings is essential for long-term success.

Continuing Education: Resources for Traders

The world of trading is in a perpetual state of evolution. To stay ahead of the curve, consider the following:

Fast: This website provides a plethora of trading tools, including a highly accurate economic calendar and 24/7 live streaming of economic news and fundamental analysis. Staying informed about market events is crucial for making informed trading decisions.

Engaging with Trading Communities: Joining trading communities and seeking guidance from experienced traders can significantly accelerate your learning curve. Networking with fellow traders can offer valuable insights and support.

Bottom Line

Mastering order blocks in trading is a journey that requires dedication, continuous learning, and strategic refinement. By identifying valid order blocks, effectively marking them on charts, and integrating them with market structure concepts, you can significantly enhance your trading skills. Remember that trading is not a destination; it's an ongoing process of growth and adaptation in the ever-changing financial markets. As you embark on this journey, keep honing your skills and staying informed to achieve success in your trading endeavors.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Discover how CySEC resolved compliance issues with Charlgate Ltd, the operator of Fxview, through a €50,000 settlement. Explore the investigation, regulatory measures, and CySEC's new website designed for improved accessibility and transparency.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Scope Markets Review: Trustworthy or Risky?

Currency Calculator