Score

Forex Limited

New Zealand|10-15 years|

New Zealand|10-15 years| http://www.forexltd.co.nz/Article.aspx?ID=441

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Philippines 2.50

Philippines 2.50Contact

Licenses

Licenses

Licensed Institution:Forex Limited

License No.:4041

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 6 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

New Zealand

New ZealandAccount Information

Users who viewed Forex Limited also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Company Summary

| Company Name | Forex Limited |

| Headquarters | Auckland, New Zealand |

| Years Operating | 30 years |

| Regulations | Regulated by FMA (Financial Markets Authority) |

| Market Instruments | Currency exchange, forward foreign exchange, hedging, limit orders, market reports, expert advisory services |

| Account Types | Standard, Gold, VIP, ECN |

| Spread | N/A |

| Minimum Deposit | Starts from $100 for Standard account |

| Deposit/Withdraw Methods | N/A |

| Trading Platforms | External platforms (no proprietary platform) |

| Customer Support | Phone and email support available |

| Educational Resources | N/A |

Overview of Forex Limited

Forex Limited is a brokerage firm headquartered in New Zealand, offering its services in the global financial markets. Forex Limited is regulated by the Financial Markets Authority (FMA) of New Zealand. While specializing primarily in currency exchange, Forex Limited provides a diverse array of trading instruments to suit various investment strategies. Notably, their offering includes forward foreign exchange, hedging, limit orders, market reports, and expert advisory services.

Clients have the flexibility to choose from different types of accounts such as Standard, Gold, VIP, and ECN, each tailored to different trading preferences. Forex Limited does not provide a proprietary trading platform, meaning traders need to rely on external platforms for their trading activities.

Is Forex Limited regulated?

Forex Limited is a regulated broker operating within the foreign exchange trading market, overseen by New Zealand's Financial Markets Authority (FMA). Holding license number 4041, issued on December 5, 2014, Forex Limited follows the Straight Through Processing (STP) model, streamlining trade execution.

This regulatory status ensures adherence to FMA's guidelines, fostering a secure and equitable trading environment that safeguards the interests of investors and clients. As individuals consider engaging with Forex Limited's services, prudent research is advised, encompassing an understanding of the broker's terms, reputation, and potential risks associated with forex trading.

Pros and Cons

Forex Limited offers a regulated trading environment under the oversight of the Financial Markets Authority (FMA) of New Zealand, instilling a sense of security for clients. Their diverse account types cater to varying trading preferences, and the provision of Straight Through Processing (STP) execution can lead to efficient trade execution. The broker's focus on risk management and hedging services, led by a Certified Treasury Professional, is advantageous for businesses seeking comprehensive financial solutions. Furthermore, Forex Limited's global outreach is demonstrated through its international contact number, accommodating traders beyond New Zealand.

One notable drawback is the absence of disclosed fee information, particularly spreads and trading costs, which could hinder potential clients' ability to accurately assess trading affordability. The lack of educational resources is also a downside, especially for novice traders who often rely on educational materials to enhance their trading knowledge and skills. Additionally, the limited availability of depositing and withdrawal methods might inconvenience certain clients. The absence of a proprietary trading platform raises concerns about the trading experience, as a dedicated platform can enhance execution and analysis capabilities.

| Pros | Cons |

| Regulated by FMA, offering security | Undisclosed fee information, potential cost confusion |

| Diverse account types for varied preferences | Lack of educational resources for traders |

| STP execution for efficient trades | Limited deposit and withdrawal methods |

| Expertise in risk management and hedging | Absence of proprietary trading platform |

| International contact number for global reach |

Products and Services

Forex Limited offers a comprehensive range of products and services to cater to the diverse needs of its clients in the financial markets. Here is their main scope of business and advisory service:

Currency Exchange: Forex Limited facilitates seamless currency exchange, enabling clients to efficiently convert one currency into another, whether it's for travel, business transactions, or investment purposes.

Forward Foreign Exchange: The broker provides forward foreign exchange services, allowing clients to lock in exchange rates for future transactions. This assists in mitigating potential currency fluctuations and managing foreign exchange risk.

Hedging: Forex Limited offers hedging solutions to help clients safeguard against potential losses resulting from unfavorable market movements. This can be particularly useful for businesses and investors with international exposure.

Fast International Transfers: Forex Limited facilitates fast and efficient international money transfers, enabling clients to move funds across borders with ease and convenience.

Risk Management: Crafting plans and offering advice to manage financial risks.

Predicting Market Trends: Providing insights into market movements for informed decision-making.

Committee Representation: Acting as an independent member of a company's finance committee.

Outsourced Treasury Management: Taking care of risk management so businesses can focus on growth.

Account Types

Forex Limited offers a range of account types tailored to meet the varying needs of its clients, each characterized by specific features and requirements. These account types cater to a spectrum of trading preferences, from the Standard Account suited for those starting with a lower deposit, to the ECN Account designed for more experienced traders looking for potentially tighter spreads and willing to trade with higher initial deposits. In the table is shown a comparison between each account type:

| Standard | Gold | VIP | ECN | |

| Maximum Leverage | 200:1 | 200:1 | 200:1 | 100:1 |

| Minimum Deposit | $100 | $1,000 | $5,000 | $10,000 |

| Minimum Spread | 1.57 | 1.17 | 0.77 | 0.17 |

| Minimum Position | 0.01 lot | 0.01 lot | 0.01 lot | 0.01 lot |

| Supported EA | Yes | Yes | Yes | Yes |

| Commission | No | No | No | Yes |

How to open an account in Forex Limited?

The process of trading with Forex Limited can only begin once you open an account. To open an account with Forex Limited, follow these simple steps:

Begin the process by visiting the official website of Forex Limited.

Click on the “Open an Account” or “Sign Up” button to initiate the account creation process.

Fill out the required personal and contact information in the provided online form.

Select the preferred account type from the options available, such as Standard, Gold, VIP, or ECN.

Review and agree to the terms and conditions, as well as any risk disclosures presented by Forex Limited.

Complete the verification process, which may involve submitting identification documents, and await confirmation from Forex Limited regarding the successful opening of your account.

Spread and Commission Fees

The absence of information regarding spreads and trading fees on Forex Limited's website has created a situation where potential clients lack clarity on these crucial financial aspects. The transparency of spread costs and trading fees is pivotal for traders to make informed decisions, evaluate the affordability of trades, and accurately gauge the overall cost-effectiveness of the broker's services. The availability of such details is fundamental in allowing traders to determine the true value of their potential engagement with Forex Limited and to align their trading strategies accordingly.

Trading Platform

Forex Limited, unfortunately, does not offer its own proprietary trading software. This is raising concerns about potential impacts on the trading experience. Traders rely on dedicated platforms for seamless execution, analysis, and customization. Without such software, there's a risk of reduced control, integration challenges, and potential security and support uncertainties, prompting traders to carefully assess how this limitation aligns with their trading needs.

Customer Support

Forex Limited offers comprehensive customer support to cater to its client's needs effectively. New Zealand-based clients can take advantage of a toll-free helpline (0800 427 722) available on weekdays, showcasing the broker's commitment to local accessibility during regular business hours. For international clients, an alternative contact number (+64 4 472 9236) is provided, reflecting Forex Limited's global outreach and dedication to serving a diverse clientele.

The broker extends its support through written communication as well. Clients can submit general inquiries through email, with a commitment to respond within two working days. A secure online contact form is available for queries, ensuring data protection and discouraging the sharing of sensitive information over email. Moreover, a physical office address is offered.

Educational Resources

It is unfortunate that Forex Limited, despite being a regulated broker, does not offer any educational resources to its clients. Educational materials play a crucial role in empowering traders with the knowledge and skills to navigate the complexities of the financial markets effectively. The absence of educational resources could potentially limit the ability of clients, especially those new to trading, to make informed decisions and develop successful trading strategies.

Educational materials not only contribute to clients' trading proficiency but also reflect a broker's commitment to fostering a supportive trading environment. It's important for traders to have access to resources that help them build a solid foundation in trading and make informed decisions, and the absence of such resources with a regulated broker like Forex Limited may be disappointing for those seeking a well-rounded trading experience.

Conclusion

Forex Limited, headquartered in New Zealand, operates as a brokerage firm in the global financial landscape. With a primary focus on currency exchange, the company offers an array of trading instruments, including forward foreign exchange, hedging, limit orders, market reports, and expert advisory services. Forex Limited provides a variety of account types, such as Standard, Gold, VIP, and ECN, tailored to diverse trading preferences.

However, a notable concern revolves around the lack of transparency regarding their fee structure, which encompasses spreads and trading costs. Additionally, the absence of a proprietary trading platform could impact the trading experience. As such, potential clients are advised to consider these factors carefully when evaluating Forex Limited as their trading partner.

FAQs

Q: What is the regulatory status of Forex Limited?

A: Forex Limited is regulated by the Financial Markets Authority (FMA) of New Zealand.

Q: What services does Forex Limited offer?

A: Forex Limited provides a range of services, including currency exchange, forward foreign exchange, hedging, limit orders, market reports, and expert advisory services.

Q: How is customer support handled?

A: Forex Limited offers customer support via phone and email.

Q: Does Forex Limited have its own trading platform?

A: No, Forex Limited does not provide a proprietary trading platform.

Q: What is the minimum deposit requirement?

A: The minimum deposit requirement varies depending on the account type. It starts from $100 for the Standard account and goes up for higher-tier accounts like Gold, VIP, and ECN.

Keywords

- 10-15 years

- Regulated in New Zealand

- Straight Through Processing(STP)

- Suspicious Scope of Business

- High potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

WikiFXMalaysia

Malaysia

I thought this was the most profitable way to make money online, but then I found out that I was cheated and lost more than $12,000. The company runs on Telegram and Whats App with no registered address. They provide free signals and seem to be more profitable than any other trading company in the world. These people treated you as if you were their god before you paid their expenses, but after that hey ignored you. They use "SIR" all the time in their conversations. They can pre-collect profit sharing fees from you, and then randomly place transactions in your account. Some transactions have no stop loss. Be careful that their system looks real, but they are scammers.

Exposure

2021-09-25

FX5944873722

Malaysia

My withdrawal took more than 2 months.

Exposure

2021-09-25

FX5944873722

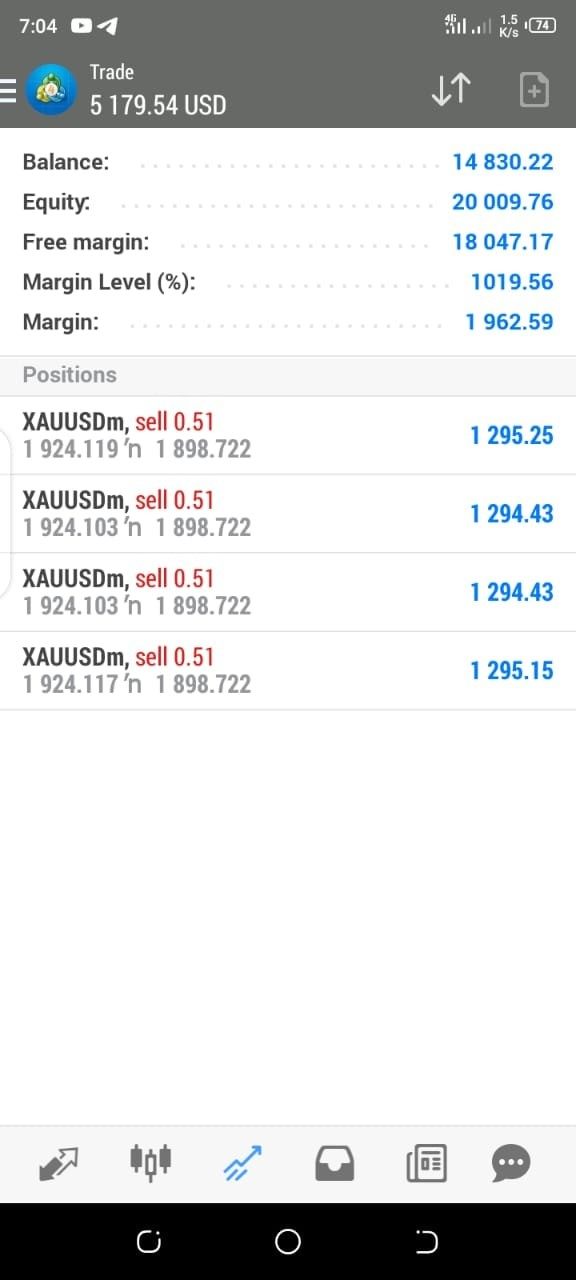

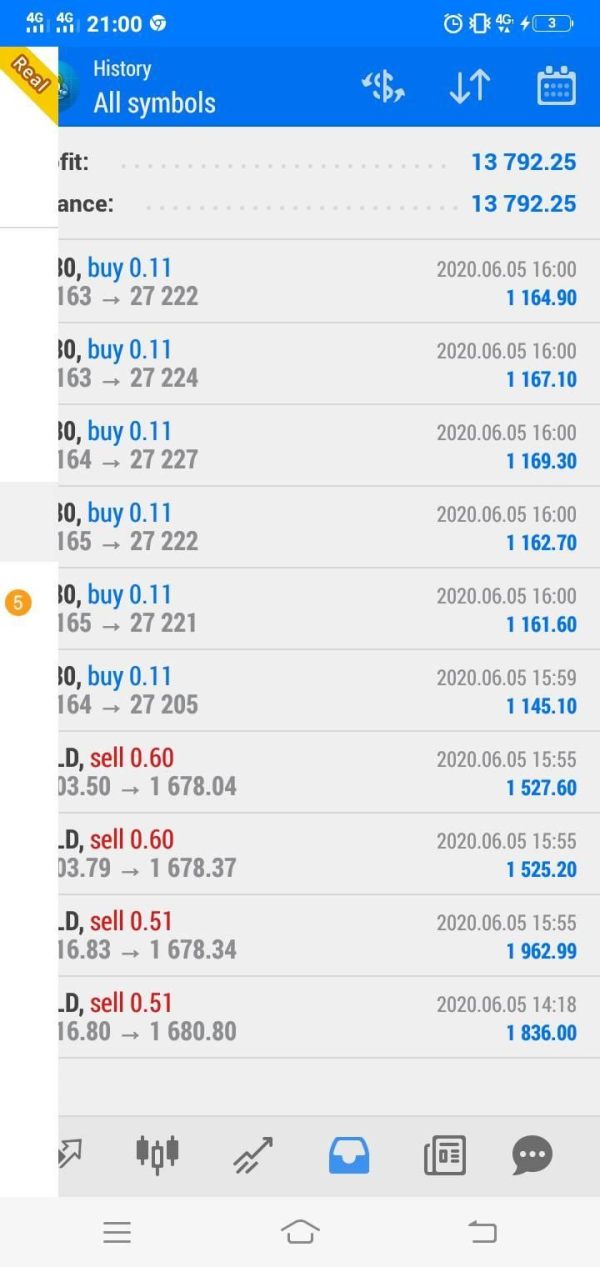

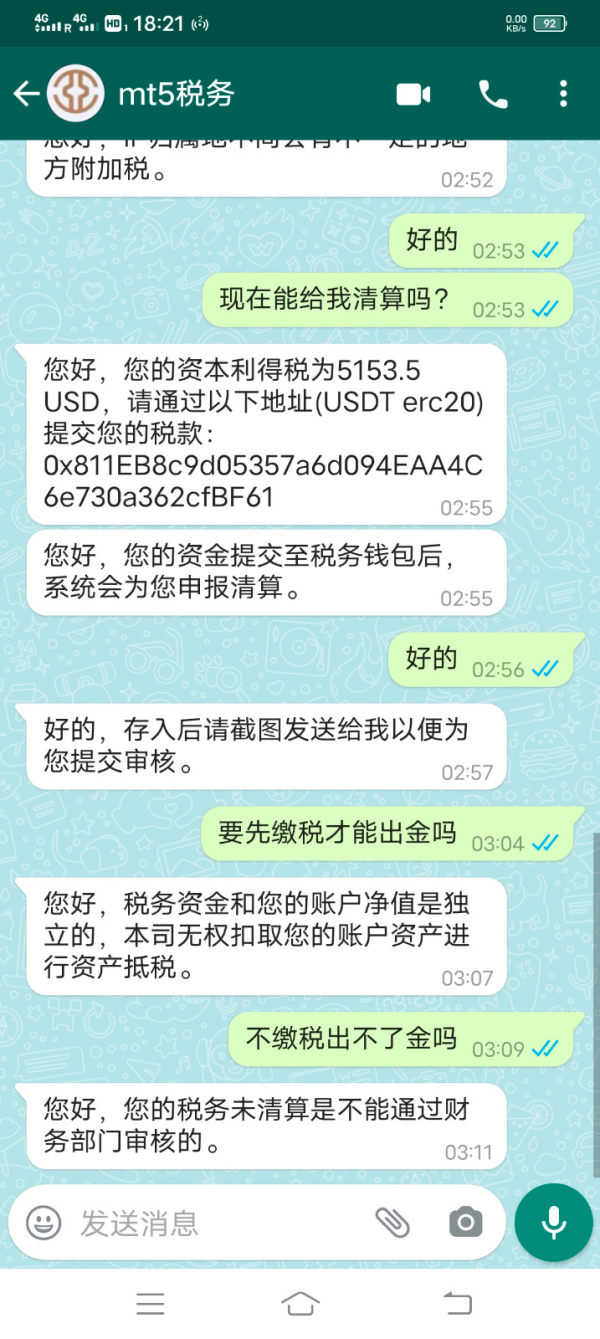

Malaysia

The man introduced MT5 to me and led me to deposit 5000. At first I gained $1100 and he persuaded me to deposit more. On September 13, I gained $11000 but when I tried to withdraw, the customer service told me to pay 30% personal tax. Otherwise my account would be locked. Beware.

Exposure

2021-09-23

FX3739673730

Philippines

I also just got scam by this broker steady168, met some guy online said from hongkong, we talked and he introduce me to MT5 and steady 168. I first deposit 5k and on my first trade i made 1100$. I able to with 2 twice, first 500$ then 4500$. Then this guy keep encourage me to deposit more and more money in which i said i cant, he transfer me 2000$ from his account which i got a message from customer services saying i have to deposit 3000$ for risk deposit. I did and on monday sep 13 with this guy instruction again, i made 11k in profit and want to withdraw money out and customer service said now i have to pay personal income tax 30% of the profit. That trigger my suspicion because I never heard a thing as such paying personal income tax before withdrawing. Then i search on google and found this post. Now i cant withdraw any money out. My account will be freeze and deduct 10% if i do not pay the personal income taxes. Now i lost my 11k, feel so shitty to get scam

Exposure

2021-09-23

FX4111098624

Sri Lanka

She asked me to pay taxes before I withdraw money. I didn't do as she told. I made money in the account exact the same as the deposit. And she kept saying it was still in the process of inquiring and unable to withdraw. The woman in the picture, from Chongqing, China, lived in Chicago, she said her brother who worked in financial industry had a team. Every time you did as she told, you can make money, but she asked you to withdraw when the profit is higher than the deposit, and you have to pay taxes before that. Do not believe in her! Their data on MT5 platform is fake, their company isForex Limited.

Exposure

2021-09-10

FX4381686212

Hong Kong

Foreword: All kinds of futures trading platforms on the Internet have not obtained the approval of the financial regulatory authorities. They have not established relevant institutions to provide business services in China, and have not filed with the telecommunications department according to law,all of them are illegal exhibitions. Moreover, all types of entities involved in the futures trading platform, including domestic agents, propaganda agencies and investors, are required to bear corresponding legal responsibilities. That is to say, even if it is a legal foreign regulated institution, it is at least illegal to conduct business in China. The futures trading model carried out by Dogan International is a market-making trading, which is different from the futures and stocks, and one party will buy the corresponding party. Dogan International is suspected of providing illegal futures trading platforms to the public, and may even be a party to direct trading. It is considered to be a serious violation of the law, both as an athlete and as a referee. Remind everyone that the current futures virtual currency trading platform, especially some unknown foreign exchange platforms, often pretend to be advanced official website by buying relevant licenses and renting a server. Trading software is also counterfeit, costing a few thousand dollars per month. For traders who have not been exposed to foreign exchange and want to trade are doomed to fall into their pitfalls.In this April,I received a phone call from Dagon’s salesman,which I didn’t notice.They kept calling me and added,advising me to follow them on Wechat rather than follow their operations.At that time,I regarded it as a reference.Actually,I have stepped into their pitfalls.I found that the recommended stock was really on the rise.Since I was still vigilant,I have only deposited 50000 RMB.With teacher’s instruction,I made some profits of 20000 RMB.One day,they suddenly ceased.I asked what happened and they said that the company only allowed them to trade in the internal news shares instead of instructing clients.The benefit of short term was 20%-25% with 3-5 days delivery,but the threshold is 200000 RMB.I joined.At that time,the stock market was volatile,I made a loss of hundreds thousand of yuan.The teacher treated me perfunctorily with grinding reasons.Two days later,that teacher advised us to trade CHINA50, Hu shen 300 and Forex Limited to recover the losses.We were pulled into a live-broadcasting room without knowing that the member were all fraudsters.Then I made a loss of more than 100000 RMB within a week.They kept asking me add fund to earn doubly.I deposited more than 500000 RMB in all,keeping constant losses.I felt something wrong because the withdrawal was unavailable.

Exposure

2019-11-14

Omotehin

United States

You can actually invest in this broker

Neutral

2022-12-09

FX1046772946

Venezuela

I am very happy to share my opinion about Forex Limited with you. Although I haven't really traded Forexlimited yet, and don't plan to, I still want to say a few words. First of all, the information provided on their website is very little and there is no basic information such as minimum deposit and leverage. The second is that I saw a lot of negative reviews on wikifx, presumably this broker is not worth trading.

Neutral

2022-11-25