Score

IDX

Indonesia|5-10 years|

Indonesia|5-10 years| https://www.idx.co.id/en

Website

Rating Index

Influence

Influence

A

Influence index NO.1

Indonesia 9.03

Indonesia 9.03Surpassed 15.10% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+62 81181150515

0800-100-9000

Other ways of contact

Broker Information

More

Indonesia Stock Exchange

IDX

Indonesia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed IDX also viewed..

XM

VT Markets

FXCM

EC Markets

Sources

Language

Mkt. Analysis

Creatives

IDX · Company Summary

| Aspect | Information |

| Company Name | IDX |

| Registered Country/Area | Indonesia |

| Founded Year | 5-10 years |

| Regulation | Unregulated |

| Tradable Assets | Stocks,Bonds,Mutual Funds,ETF,REITS & DINFRA,Deriatives,Structured Warrants,Index,Islamic Products(Stocks,Stock index) |

| Trading Platform | IDX Mobile APP and IDX Online Trading Platform |

| Customer Support | Phone:+6281181150515,Email:contactcenter@idx.co.id |

IDX Information

IDX is an unregulated financial services company based in Indonesia, established between 5-10 years ago. The company offers a diverse range of tradable assets including stocks, bonds, mutual funds, ETFs, REITS & DINFRA, derivatives, structured warrants, and indices, along with Islamic products like stocks and stock indices.

IDX provides its services through both an IDX Mobile App and an IDX Online Trading Platform, meeting its customers' needs with a support system accessible via phone and email. This setup allows IDX to offer a broad spectrum of financial products to its clients in a technologically convenient manner.

Regulation Status

IDX operates as an unregulated financial services company in Indonesia. This lack of regulatory oversight means that while it offers a wide array of financial products and services, it does not adhere to the typical standards and safeguards imposed by financial regulatory authorities.

Pros and Cons

Pros:

IDX offers a array of trading products, including Forex, CFDs, shares, metals, oil, bonds, and cryptocurrencies, attracting traders with diverse investment interests. Additionally, the platform is equipped with advanced trading tools and a variety of educational resources, which can enhance the trading experience by providing valuable insights and facilitating better trading decisions.

Cons:

Despite its wide range of offerings, IDX operates as an unregulated platform, which exposes traders to increased risks and fewer protections. The absence of diverse account options could limit traders' ability to tailor their trading strategies to their individual risk tolerances and investment preferences. Furthermore, the potential for hidden fees could lead to unexpected costs, complicating financial planning and potentially eroding profits.

| Pros | Cons |

| Wide range of trading products | Unregulated platform |

| Offers Forex, CFDs, Shares, Metals, Oil, Bonds, and Cryptocurrencies | No Diverse Account |

| Advanced trading tools and educational resources | Possible Hidden Fees |

Market Instruments

IDX offers a diverse range of trading instruments including Forex, CFDs, shares, metals, oil, bonds, and cryptocurrencies, equipped with advanced trading tools and educational resources, though it operates as an unregulated platform.

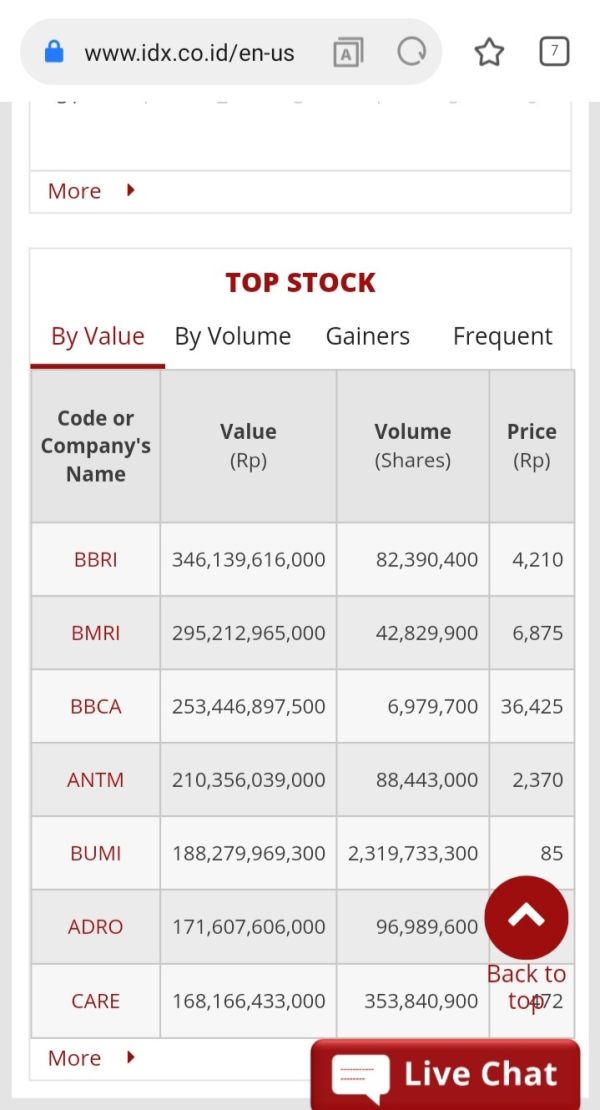

Stocks:

IDX allows trading in individual stocks, giving investors the opportunity to purchase shares in specific companies and benefit from potential dividends and stock price increases.

Bonds:

Investors can also trade bonds on IDX, engaging with debt securities that are issued by governments and corporations to raise capital, which are considered a more stable investment compared to stocks.

Mutual Funds:

IDX provides access to mutual funds, which pool money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by professional fund managers.

ETFs:

Exchange-Traded Funds (ETFs) are available on IDX, offering traders a way to buy and sell funds that track indexes, commodities, or baskets of assets like a stock but trade like a single stock on a stock exchange.

REITs & DINFRA:

Real Estate Investment Trusts (REITs) and infrastructure funds (DINFRA) are part of IDXs offerings, allowing investors to invest in portfolios of real estate properties or infrastructure projects, typically generating income through rent or tolls.

Derivatives:

Derivatives trading is also facilitated on IDX, including options and futures, allowing traders to speculate on the future price movements of underlying assets or hedge against potential losses.

Structured Warrants:

Structured warrants, which are a type of option, are available for trading, giving investors the right, but not the obligation, to buy or sell a specific amount of a principal security at a predetermined price before the warrant expires.

Indices:

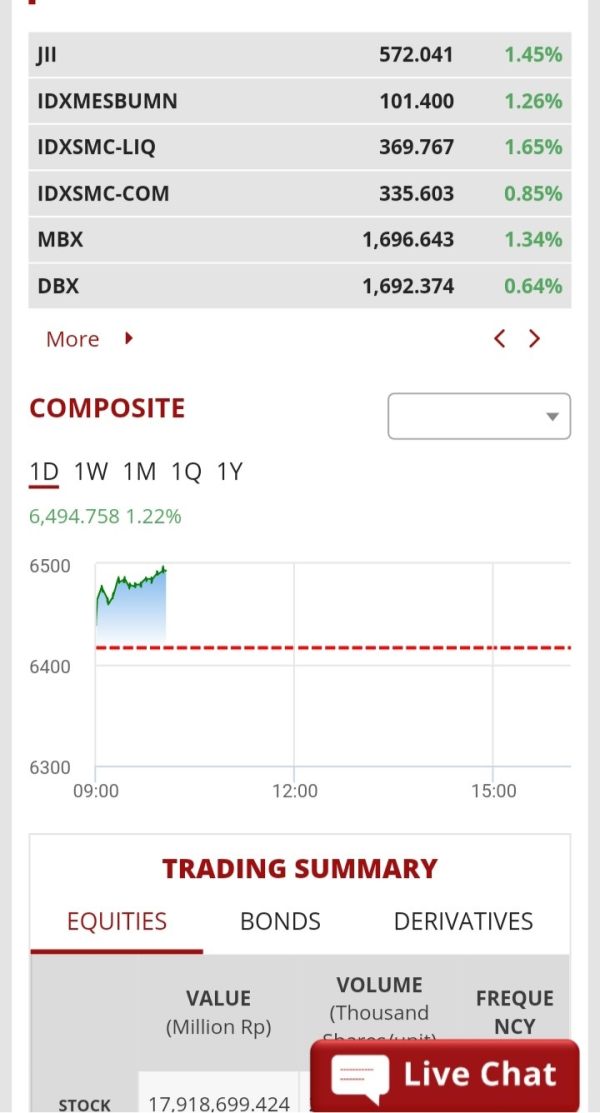

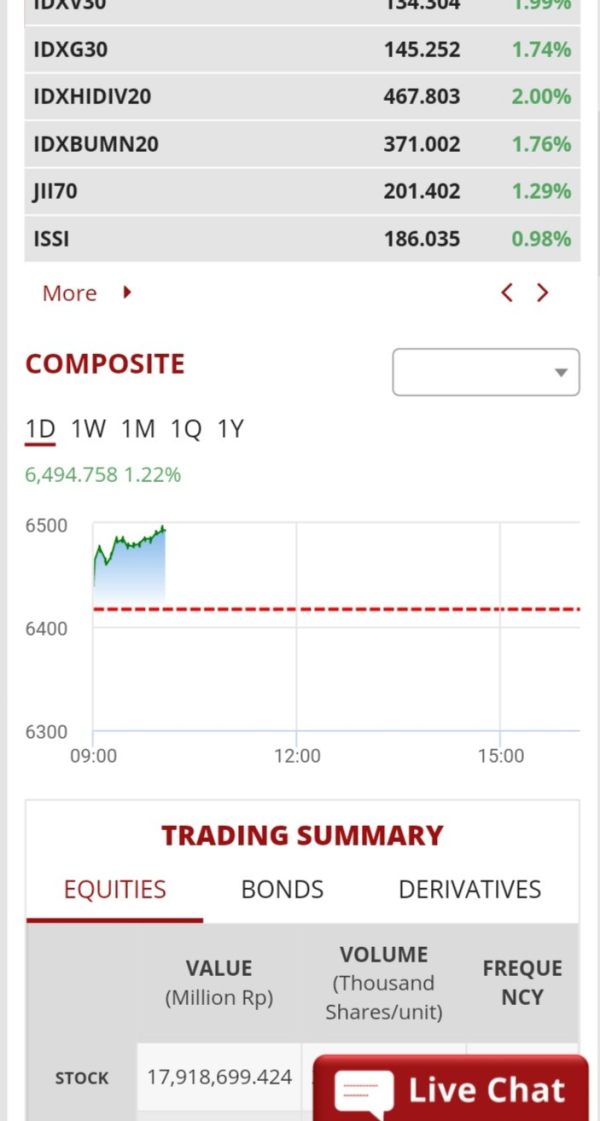

IDX enables trading on stock indices, which are indicators of the performance of a specific set of stocks, representing various sectors or the market as a whole.

Islamic Products:

For those seeking Sharia-compliant investments, IDX offers Islamic products, including stocks and stock indices that adhere to Islamic investment principles.

Trading Platform

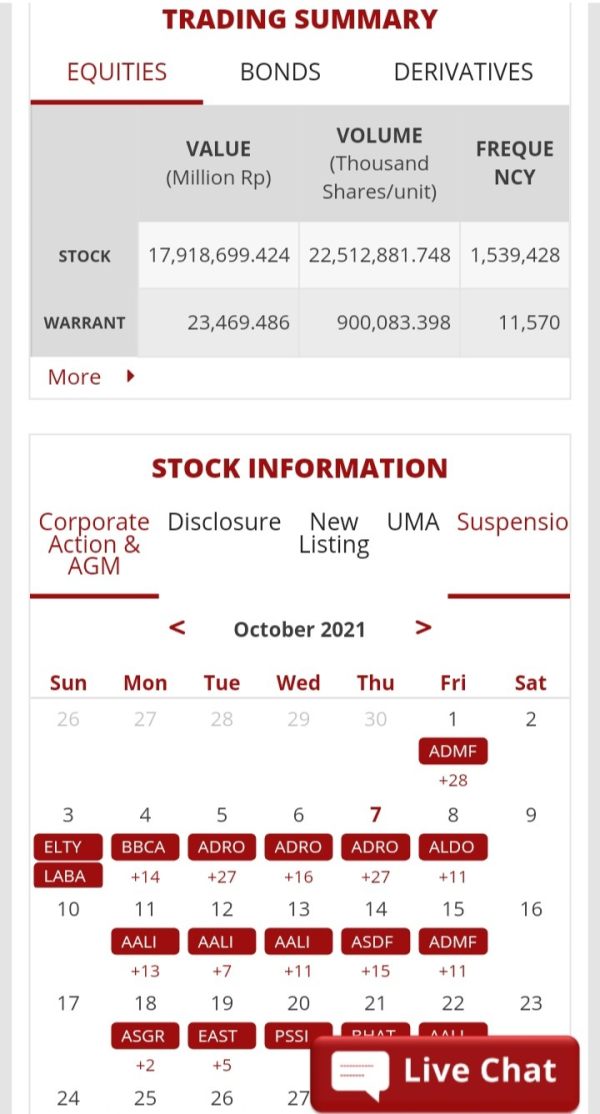

The IDX Mobile app, provided by PT. Bursa Efek Indonesia, is a trading platform designed for the Indonesian stock market.

It offers users real-time market data, news updates, company announcements, and all pertinent information regarding the Indonesian stock markets directly on their mobile devices. The app supports virtual trading, operational trading, and features like a stock heatmap to assist users in making informed trading decisions.

Additionally, it is accessible on various devices, ensuring a flexible trading experience. The new version of IDX Mobile also includes enhanced security measures and improved stability for a more reliable and safe user experience.

Customer Support

The Indonesia Stock Exchange (IDX) offers customer support accessible through multiple channels. Clients can contact IDX via phone at +6281181150515 or through email at contactcenter@idx.co.id.

Additionally, IDX maintains a strong presence across various regions with dedicated representative offices, each providing localized support via telephone and email, ensuring that assistance is readily available for diverse customer needs across Indonesia.

Conclusion

IDX, the Indonesia Stock Exchange, serves as a crucial platform for financial trading in Indonesia, offering a wide range of tradable assets including stocks, bonds, mutual funds, and more.

It operates from its main office in Jakarta and extends its reach through numerous regional offices across the country. Despite being an unregulated entity, IDX provides trading tools, educational resources, and a robust customer support system, making it a central hub for investors looking to engage with the Indonesian market.

FAQs

- What types of financial products can I trade on IDX?

- You can trade a variety of financial products on IDX including stocks, bonds, mutual funds, ETFs, REITs, derivatives, structured warrants, and Islamic financial products.

- How can I contact IDX for support?

- You can reach IDX customer support by calling +6281181150515 or by emailing contactcenter@idx.co.id. Additionally, each regional office provides localized support.

- Is IDX regulated?

- No, IDX operates as an unregulated platform, which means it does not follow the regulatory frameworks typically associated with financial trading platforms.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now