Score

gt.io

Seychelles|2-5 years|

Seychelles|2-5 years| https://gt.io/en

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:GT Global Ltd

License No.:SD019

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Seychelles

SeychellesAccount Information

Users who viewed gt.io also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

gt.io

Server Location

Germany

Website Domain Name

gt.io

Server IP

5.189.174.111

Company Summary

The website of gt.io, found at https://gt.io/en, is presently experiencing functional difficulties.

| Aspect | Information |

| Company Name | gt.io |

| Registered Country/Area | Seychelles |

| Years | 2-5 years |

| Regulation | Regulated by FSA (Suspicious Clone) |

| Market Instruments | FX Majors, FX Minors, Exotics CFD Indices, Metals, Energies CFD Stocks CFD Cryptos, Synthetic Cryptos GTi12 Index |

| Account Types | ECN Account, Standard FX Account, Cent Account, Standard Account, and Mini Account |

| Minimum Deposit | N/A |

| Maximum Leverage | 1:1000 |

| Spreads | From 0 |

| Trading Platforms | MT5 |

| Customer Support | Email: support@gt.io, Twitter: https://twitter.com/gt_io_Global, and Facebook: https://www.facebook.com/gtioglobal/ |

| Deposit & Withdrawal | Bank transfers, VISA, MasterCard and e-wallets such as Neteller, Skrill and PayPal, and Cryptocurrencies |

Overview of gt.io

gt.io is a trading company registered in Seychelles, operating in the financial market for 2-5 years. It is regulated by the FSA, although there are concerns regarding its legitimacy as a suspicious clone.

The company offers a wide range of market instruments, including FX Majors, FX Minors, Exotics, CFD Indices, Metals, Energies, Stocks, Cryptos, and the Synthetic Cryptos GTi12 Index. Various account types are available, including ECN, Standard FX, Cent, Standard, and Mini accounts, with no specified minimum deposit. The maximum leverage offered is 1:1000, and spreads start from 0. Trading is conducted through the MT5 platform.

Customer support is provided via email, Twitter, and Facebook. Deposit and withdrawal options include bank transfers, VISA, MasterCard, e-wallets such as Neteller, Skrill, PayPal, and cryptocurrencies.

If you're intrigued, we invite you to explore our upcoming article. In it, we'll thoroughly assess the broker from various angles, providing you with organised and succinct insights.

Regulatory Status

There are significant concerns regarding gt.io as a broker. The Seychelles Financial Services Authority regulation associated with their license appears to be a suspected clone, which raises suspicions about their legitimacy. (License Type: Retail Forex License; License Number: SD019)

Moreover, the inability to access their official website casts doubts on the reliability and credibility of their trading platform. Consequently, investing with gt.io entails increased risk owing to these circumstances.

Pros and Cons

| Pros | Cons |

| Wide Range of Market Instruments | FSA (Suspicious Clone) |

| Multiple Account Types | Higher risk |

| Zero Spreads | Inaccessible website |

| Availability of MT5 Platform | Risk of High Leverage |

Pros:

Wide Range of Market Instruments: gt.io offers a diverse selection of market instruments, including major and minor FX pairs, exotic currencies, CFDs on indices, metals, energies, stocks, cryptocurrencies, and a synthetic crypto index, providing traders with ample trading opportunities.

Multiple Account Types: With options like ECN, Standard FX, Cent, Standard, and Mini accounts, gt.io caters to the varying needs and preferences of different traders, offering flexibility in account selection.

Zero Spreads: Starting from zero spreads can be advantageous for traders, as it reduces their trading costs and enhances their overall profitability, particularly for high-frequency traders and scalpers.

Availability of MT5 Platform: The availability of the MT5 trading platform offers advanced trading features, tools, and analysis, providing traders with a comprehensive trading experience.

Cons:

FSA (Suspicious Clone): Cloned brokers may offer unstable online platforms or abruptly close their websites, complicating access to vital information or trade execution for investors.

Heightened Risk: Being labeled a “Suspicious Clone” suggests NeithFX may present increased risks to investors. Such brokers often imitate legitimate firms while potentially engaging in fraudulent activities or disregarding regulatory norms.

Website Unavailability: This lack of access may impede investors' ability to oversee their investments efficiently and intensify doubts regarding the broker's authenticity.

Risk of High Leverage: While high leverage can amplify potential profits, it also magnifies the risk of losses, especially for inexperienced traders who may not fully understand the risks associated with leveraged trading.

Market Instruments

FX Majors: These are the most heavily traded currency pairs in the forex market, comprising the most liquid and widely traded currencies globally. Examples include EUR/USD, USD/JPY, GBP/USD, and USD/CHF.

FX Minors: Also known as minor currency pairs, these include currency pairs that don't involve the US dollar but still feature major currencies. Examples include EUR/GBP, AUD/NZD, and EUR/JPY.

Exotics: Exotic currency pairs consist of one major currency and one currency from a developing or emerging market economy. These pairs typically have lower liquidity and higher spreads compared to majors and minors. Examples include USD/TRY (US Dollar/Turkish Lira) and EUR/TRY (Euro/Turkish Lira).

CFD Indices: Contracts for Difference (CFDs) based on indices allow traders to speculate on the price movements of stock market indices without owning the underlying assets. Examples include the S&P 500, FTSE 100, and DAX 30.

Metals: Trading metals involves speculating on the prices of precious metals like gold, silver, platinum, and palladium. These assets are often considered safe-haven investments and are traded for hedging purposes or as a store of value.

Energies: Energy commodities include crude oil, natural gas, heating oil, and gasoline. Trading energy products allows investors to profit from fluctuations in global energy prices influenced by factors such as geopolitical tensions, supply and demand dynamics, and economic indicators.

CFD Stocks: Contracts for Difference on stocks enable traders to speculate on the price movements of individual company shares without owning the underlying stock.

CFD Cryptos: Cryptocurrency CFDs allow traders to speculate on the price movements of cryptocurrencies like Bitcoin, Ethereum, Ripple, and Litecoin without owning the actual coins.

Synthetic Cryptos GTi12 Index: This index represents a synthetic portfolio of cryptocurrencies, offering exposure to a diversified range of digital assets in a single instrument.

Account Types

gt.io offers five types of accounts: ECN Account, Standard FX Account, Cent Account, Standard Account, and Mini Account.

ECN Account: Offers maximum leverage of 1:1000 with a minimum spread of 0 points.

Standard FX Account: Provides maximum leverage of 1:1000 with a minimum spread of 15 points.

Cent Account: Features maximum leverage of 1:1000 and a minimum spread of 19 points.

Standard Account: Offers maximum leverage of 1:1000 with a minimum spread of 15 points.

Mini Account: Provides maximum leverage of 1:1000 with a minimum spread of 10 points.

| Account Type | Maximum Leverage | Minimum Spread |

| ECN Account | 1:1000 | 0 points |

| Standard FX Account | 1:1000 | 15 points |

| Cent Account | 1:1000 | 19 points |

| Standard Account | 1:1000 | 15 points |

| Mini Account | 1:1000 | 10 points |

How to Open an Account?

Opening an account with gt.io is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the gt.io website and click “Open Account.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: gt.io offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the gt.io trading platform and start making trades.

Trading Platform

MT5 is a powerful and versatile trading platform that offers a wide range of features and tools designed to enhance the trading experience. It is the successor to the highly popular MetaTrader 4 (MT4) platform and provides several improvements and additional functionalities.

MT5 supports algorithmic trading through the use of Expert Advisors (EAs) and custom indicators. Traders can develop their automated trading strategies or choose from a vast library of pre-built EAs available in the MetaTrader Market.

Deposit & Withdrawal

gt.io provides a range of deposit and withdrawal options to accommodate the varying preferences and needs of its traders.

Bank Transfers: Bank transfers allow traders to securely deposit and withdraw funds directly from their bank accounts to their gt.io trading accounts. This traditional payment method provides a reliable and convenient way for traders to transfer larger sums of money with confidence.

VISA and MasterCard: gt.io accepts deposits and withdrawals via major credit and debit cards, including VISA and MasterCard.

E-wallets (Neteller, Skrill, and PayPal): E-wallets such as Neteller, Skrill, and PayPal offer traders an efficient and secure method for depositing and withdrawing funds to and from their gt.io accounts.

Cryptocurrencies: gt.io supports deposits and withdrawals in cryptocurrencies, providing traders with a decentralized and borderless payment option. Traders can deposit and withdraw funds using popular cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and others, leveraging the benefits of blockchain technology, including fast transactions and low fees.

Customer Support

gt.io offers multiple channels for customer support, ensuring timely assistance and resolution of inquiries. Here's an introduction to the customer support options provided by gt.io:

Email Support: Traders can reach out to gt.io's customer support team via email at support@gt.io. Email support offers a convenient way for traders to communicate their questions, concerns, or issues to the support team.

Twitter Support: gt.io maintains an active presence on Twitter at https://twitter.com/gt_io_Global. Traders can engage with the company's Twitter account to receive updates, announcements, and support-related information.

Facebook Support: Additionally, gt.io has a presence on Facebook at https://www.facebook.com/gtioglobal/. Traders can connect with the company's Facebook page to access support resources, engage with other traders, and stay updated on news and developments related to the platform.

Conclusion

In conclusion, gt.io offers a range of advantages such as market instruments, multiple account types, zero spreads, and access to the MT5 platform. However,its website inaccessible.

FAQs

Question: What market instruments can I trade on gt.io?

Answer: gt.io offers a wide range of market instruments, including FX majors, FX minors, exotics, CFD indices, metals, energies, stocks, cryptocurrencies, and the synthetic cryptos GTi12 Index.

Question: What account types does gt.io offer?

Answer: gt.io offers multiple account types, including ECN Account, Standard FX Account, Cent Account, Standard Account, and Mini Account.

Question: What is the maximum leverage offered by gt.io?

Answer: The maximum leverage offered by gt.io is 1:1000 across all account types.

Question: What are the spreads on gt.io?

Answer: Spreads on gt.io vary depending on the account type, ranging from zero spreads for certain accounts to a minimum spread of 19 points for others.

Question: What trading platform does gt.io use?

Answer: gt.io uses the MetaTrader 5 (MT5) trading platform, which is known for its advanced features, comprehensive charting tools, and automated trading capabilities.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

甘苦人生

Taiwan

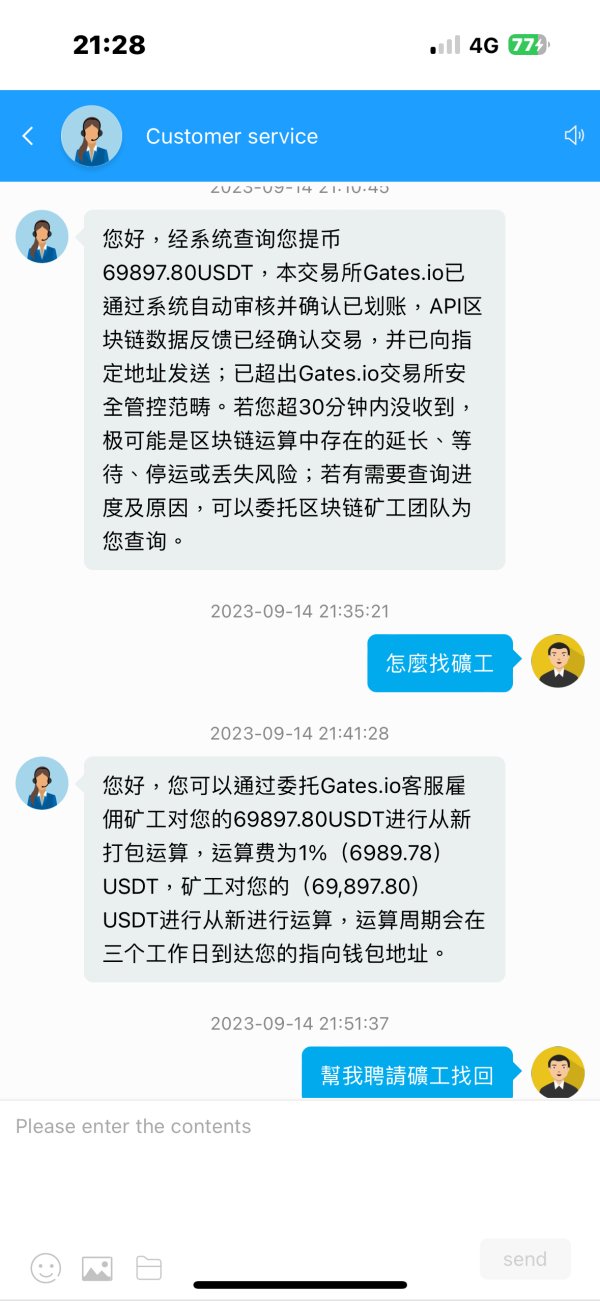

I finished trading futures and couldn't withdraw money after making a profit. It is required to pay 30% tax after deducting the tax exemption before withdrawing money. The platform that the master asked me to download at the beginning said that he had been using it when he was in London, and the version I had was different from his. https://www.gateio-coin.com/download This is the platform address they gave me. Currently the principal cannot be withdrawn, please help me.

Exposure

05-17

文茜

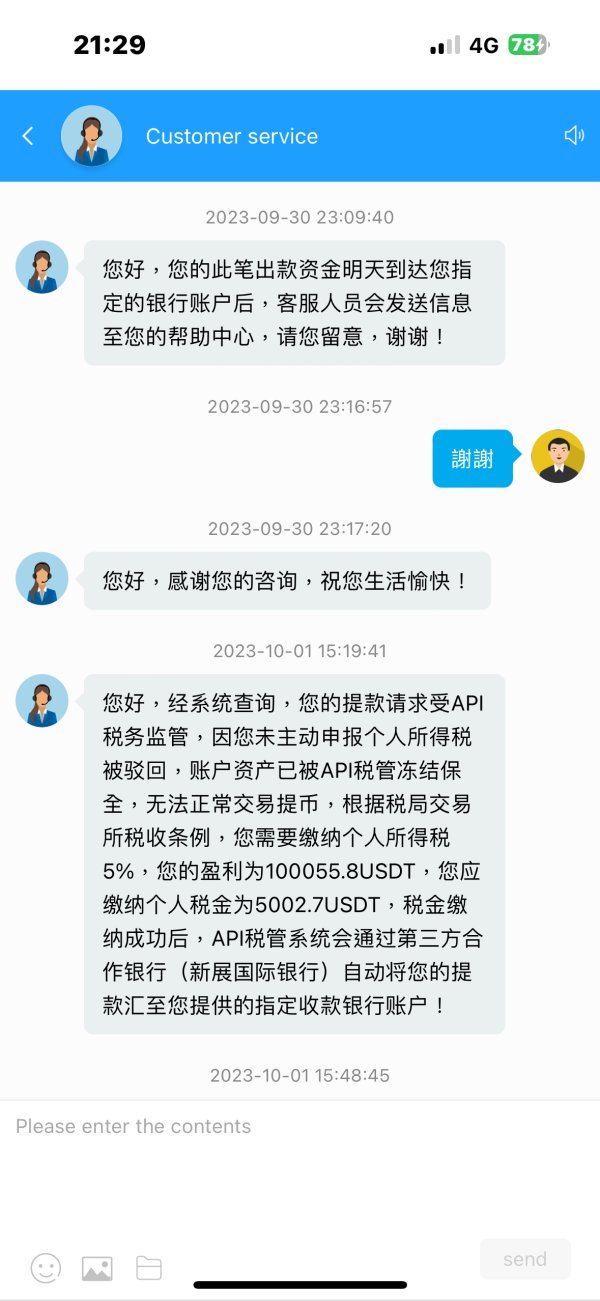

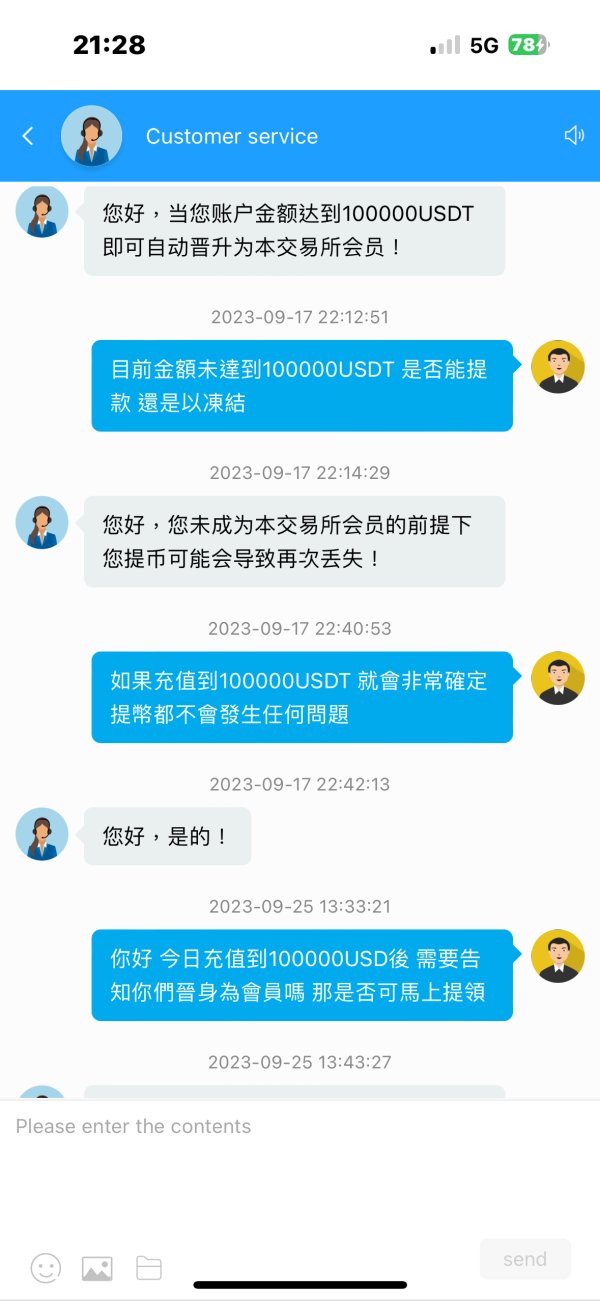

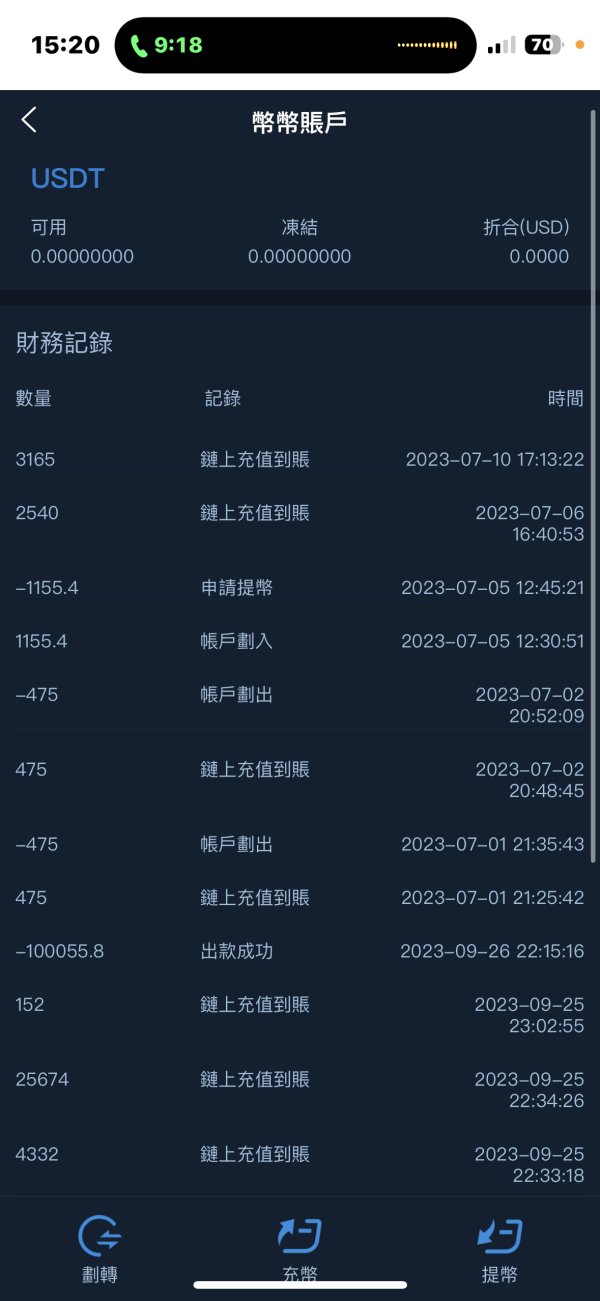

Taiwan

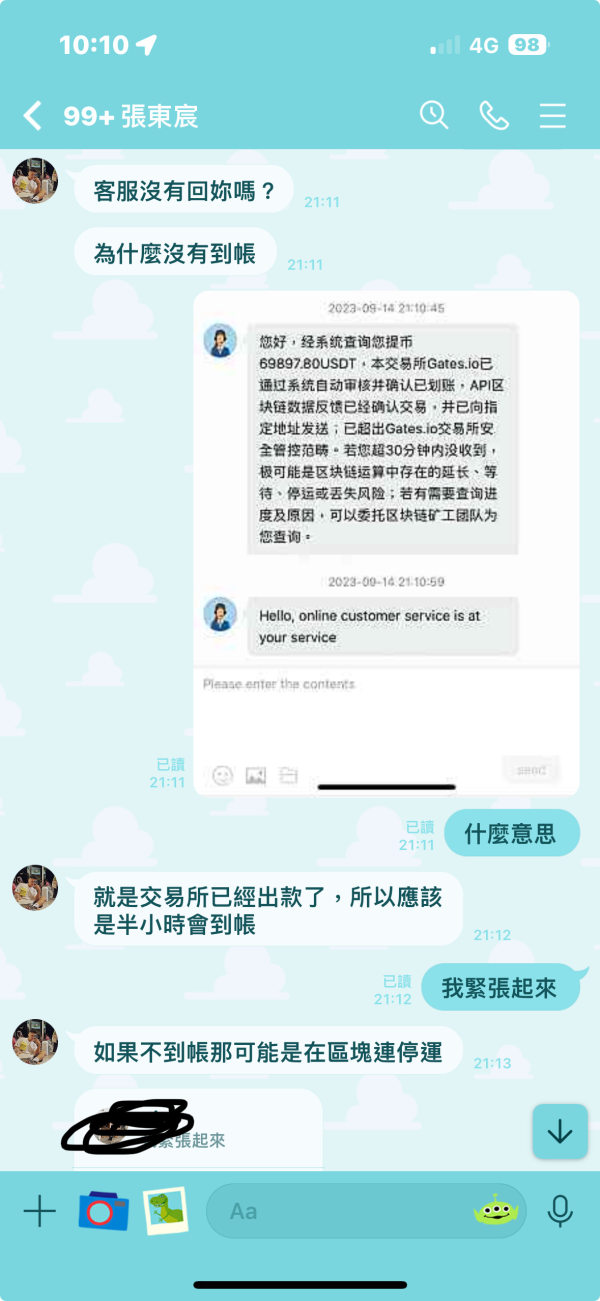

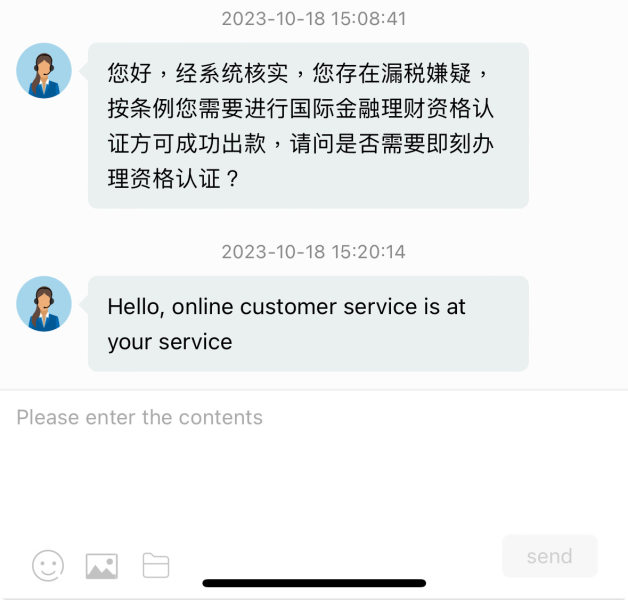

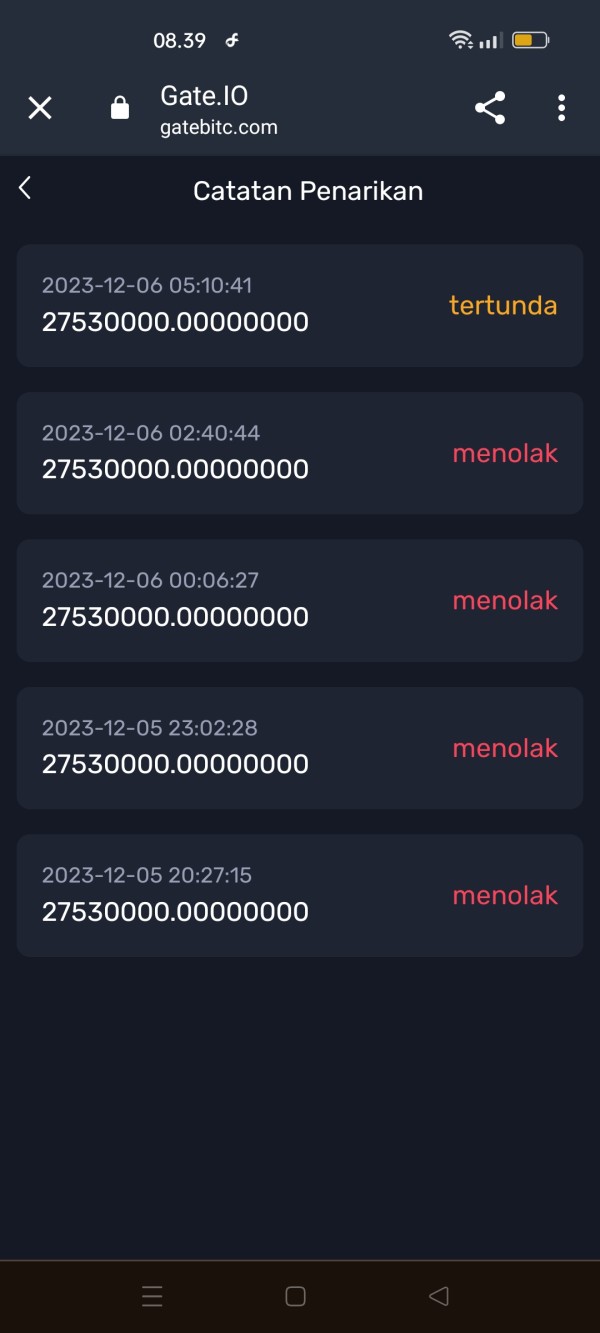

Last year, I met someone on IG who claimed that her mother is Taiwanese and her father is from Mainland China. Currently, she works in South Korea. Her job description is an import and export wine merchant. At first, she would intentionally or unintentionally mention that she was doing a side job, but I didn’t take it seriously. He would also ask about my monthly income from my profession. Did you buy additional funds or something? If you were deceived later, it was because he wanted us to be better off because of getting married (and he also said that the whole family would move back to Taiwan in the second half of the year). But because I have a boyfriend, he used another person as the reason. One way is to have your own private money so that you won't be abandoned by your boyfriend one day. If you lose both your life and money, I am very sure that it was downloaded through his guidance. In the beginning, I only invested 500 US dollars to try it out. He kept saying that the amount was too much. The fluctuations were small and the fluctuations were very high. He wanted to operate such sad cards that it was really hard for me to make money. The first time he wanted me to invest at least 10,000 US dollars. When he knew I had no money, he asked me to borrow a lot of money. Later, he also borrowed a lot of money because of his words. In the meantime, he withdrew nearly 300,000 yuan. In the end, he wanted to go back to the mainland because he was already working. He was afraid that I would have no money, so he asked me to withdraw all the money from the exchange at once. After withdrawing it, a series of additional burdens began. What happened? 1. The money mysteriously disappeared after applying for withdrawal 2. For safety reasons, the amount in the account needs to be supplemented to 100,000 US dollars before the withdrawal can be made. 3. A guarantee fee needs to be provided. 4. A personal income tax needs to be paid. 5 . It was later said that I was suspected of tax evasion and needed to pay an amount for the International Financial Management Qualification Certification Certificate 6. When I couldn’t pay, the other party didn’t say anything and kept dragging me until now. Recently, I have been borrowing money from close friends everywhere. I invested more than 700,000 yuan to withdraw it as soon as possible, but I was repeatedly blocked from withdrawing money. Only then did I realize that I was deceived. I recently came to consult with your company.

Exposure

03-21

icank

Indonesia

Until now funds cannot be withdrawn

Exposure

02-26

AUSS

United Kingdom

Caution is advised. While the zero spreads and variety of account options are appealing, the website's frequent inaccessibility and the suspicious regulation are drawbacks that can't be overlooked.

Neutral

08-16

卓勇

New Zealand

A total joke, inaccessible official website, unreachable customer service… I guess no one would trade with it, its spreads so high… I cannot figure out why this platform can defraud so many investors?

Neutral

2022-11-24