Score

Tradear

Vanuatu|5-10 years|

Vanuatu|5-10 years| https://tradear.com/en/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Argentina 6.91

Argentina 6.91Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Vanuatu

VanuatuUsers who viewed Tradear also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

tradear.com

Server Location

United States

Website Domain Name

tradear.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2002-10-17

Server IP

172.67.68.162

Company Summary

| Aspect | Information |

| Company Name | Tradear |

| Registered Country/Area | Vanuatu |

| Founded Year | 2015 |

| Regulation | Not regulated |

| Market Instruments | Currencies, indices, commodities, and CFDs |

| Account Types | Trade, Infinite, Advanced |

| Minimum Deposit | $250 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 0.0pips |

| Trading Platforms | A web-based trading platform |

| Customer Support | Contact number: +1 3 (712) 674 22 42, Email: support@Infinitemanfsm.com |

| Deposit & Withdrawal | Bank transfer and credit card |

Overview of Tradear

Tradear, established in 2015 and headquartered in Vanuatu, offers a range of trading assets, including currencies, indices, commodities, and CFDs. The platform provides multiple account types such as Trade, Infinite, and Advanced for varying trader preferences. With a minimum deposit requirement of $250 and leverage up to 1:500, it targets both experienced traders and those entering the market.

Advantages of Tradear include competitive spreads starting from 0.0 pips, fostering a cost-effective trading environment. The platform's support for the widely used MT4 trading platform enhances accessibility for traders. However, a notable disadvantage is the absence of regulatory oversight, potentially impacting user confidence. While the platform offers a range of customer support options, including a contact number and email, traders should carefully consider the lack of regulatory regulation when making their investment decisions.

Is Tradear legit or a scam?

Tradear operates without regulation from any governing authority, potentially prompting issues regarding transparency and oversight. Unregulated exchanges, like Tradear, lack the essential safeguards and legal protections enforced by regulatory bodies. This absence of oversight heightens the risk of fraud, market manipulation, and security vulnerabilities.

Users will encounter difficulties in seeking remedies or resolving disputes in the absence of proper regulation. Furthermore, the dearth of regulatory supervision contributes to a less transparent trading environment, challenging users to accurately assess the exchange's legitimacy and reliability.

Pros and Cons

| Pros | Cons |

| 1000+ Trading Assets | Not Regulated |

| Competitive Spreads | Limited Educational Resources |

| High Leverage | High Minimum Deposit |

Pros:

1.1000+ Trading Assets: Tradear offers a range of over 1000 trading assets, providing users with extensive options to diversify their portfolios. This allows traders to explore various markets, including stocks, commodities, and cryptocurrencies.

2. Competitive Spreads: The platform boasts competitive spreads, enhancing cost-effectiveness for traders. Tight spreads contribute to reduced transaction costs, making it attractive for users to optimize their trading expenses.

3. High Leverage: Tradear provides high leverage, allowing traders to amplify their market exposure. High leverage can potentially enhance profit potential, making it suitable for experienced traders comfortable with leveraged trading strategies.

Cons:

1.Not Regulated: Tradear operates without regulatory oversight.The absence of regulation poses potential risks for traders as they lack the legal safeguards provided by regulatory authorities.

2. Limited Educational Resources: The platform offers limited educational resources, which can be a drawback for users seeking comprehensive learning materials. Adequate educational support is essential for traders, especially those new to the financial markets.

3. High Minimum Deposit: Tradear imposes a high minimum deposit requirement, potentially restricting access for traders with smaller budgets. A lower minimum deposit would provide a more inclusive entry point for a broader range of users.

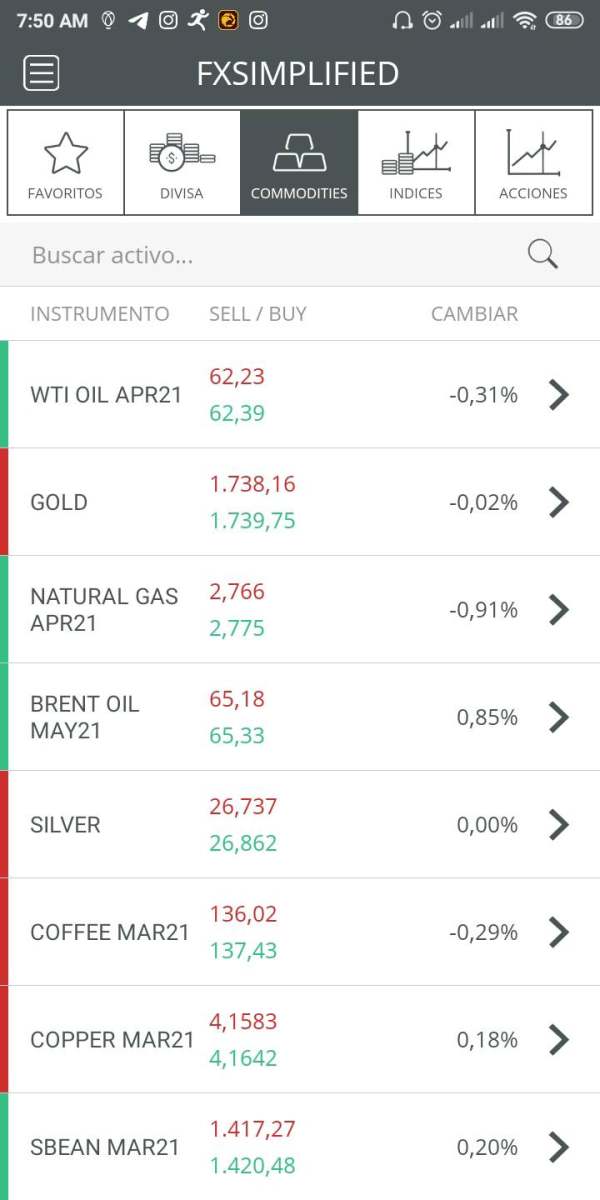

Market Instruments

Tradear offers investors a range of market instruments for trading and investment. With a selection of 49 currency pairs, users can effectively diversify their portfolios across different regions, providing enhanced exposure to global markets. The platform extends its versatility by enabling trading in 25 significant indices, allowing traders to capitalize on various world markets and leverage global economic trends.

In addition to currencies and indices, Tradear grants access to 51 Exchange-Traded Funds (ETFs). This feature allows investors to participate in various asset classes bundled into a single security. The platform further expands its offerings with 22 commodities, covering precious metals, energies, and soft commodities. Moreover, featuring over 800 Share Contracts for Difference (CFDs), users can invest in leading companies without the necessity of physically owning the shares.

Account Types

Tradear has strategically designed a variety of account types to accommodate the preferences and requirements of traders.

The Trade Account, characterized by spreads starting from 0.0 pips and commissions from $1.5 per lot per side, is tailored for seasoned traders who prioritize tight spreads and are comfortable with a higher initial deposit of $250. This account type offers direct market access and enhanced trading conditions, providing a sophisticated trading environment for experienced individuals.

For traders seeking competitive conditions with a more accessible entry point, Tradear introduces the Infinite Account. Boasting spreads starting from 0.0 pips and commissions from $3 per lot per side, this account requires a lower minimum deposit of $5,000. It serves both experienced traders and those entering the market, striking a balance between tight spreads and a relatively more manageable initial investment.

The Advanced Account, featuring spreads starting from 1.0 pips and no commissions, positions itself as a straightforward option for traders valuing simplicity and avoiding additional costs. With a minimum deposit requirement of $15,000, this account type, offering leverage up to 1:500, accommodates a broader user group. It is well-suited for individuals new to trading or those who prefer a commission-free structure while still enjoying competitive trading conditions.

| Account Type | Spreads | Commissions | Minimum Deposit | Leverage |

| Trade | Tradear | $1.5 per lot per side | $250 | Up to 1:500 |

| Infinite | From 0.0 pips | $3 per lot per side | $5,000 | Up to 1:500 |

| Advanced | From 1.0 pips | No commissions | $15,000 | Up to 1:500 |

Leverage

Tradear offers leverage 1:500. Leverage represents the ratio of borrowed funds to the trader's own capital, allowing them to control a larger position size in the market. The maximum leverage of 1:500 implies that traders can control a position size up to 500 times the amount of their own capital.

It's important to note that while leverage can amplify potential profits, it also increases the level of risk. Higher leverage magnifies both gains and losses, making risk management a critical aspect of trading.

Spreads & Commissions

Tradear offers a variety of account types, each with distinct spreads and commission structures to the preferences of traders. In the Trade Account, traders can benefit from spreads starting from 0.0 pips, with commissions priced at $1.5 per lot per side. This account is for experienced traders seeking tight spreads, and its higher initial deposit requirement of $5,000 appeals to those comfortable with a more significant entry point.

The Infinite Account also provides spreads starting from 0.0 pips, coupled with commissions from $3 per lot per side. With a lower minimum deposit requirement of $10,000, this account type attracts traders prioritizing tight spreads but with a more accessible entry threshold. It suits both experienced traders and those looking for a competitive trading environment without a significantly high initial investment.

For traders valuing simplicity and a commission-free structure, the Advanced Account features spreads starting from 1.0 pips, and there are no additional commissions.

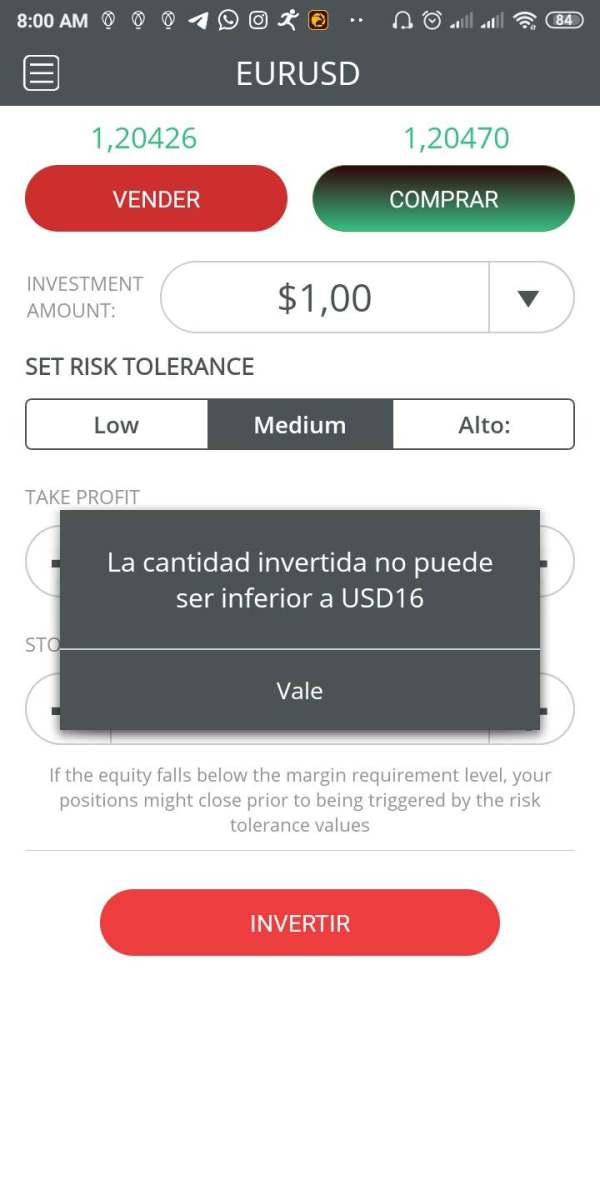

Trading Platform

Tradear offers a web-based trading platform for users to execute financial transactions. The platform's architecture allows traders to access it directly through web browsers, eliminating the need for software downloads. The web-based interface typically provides essential features for trading, including real-time market data, order placement, and portfolio tracking. This format allows for flexibility as users can log in from various devices with internet access.

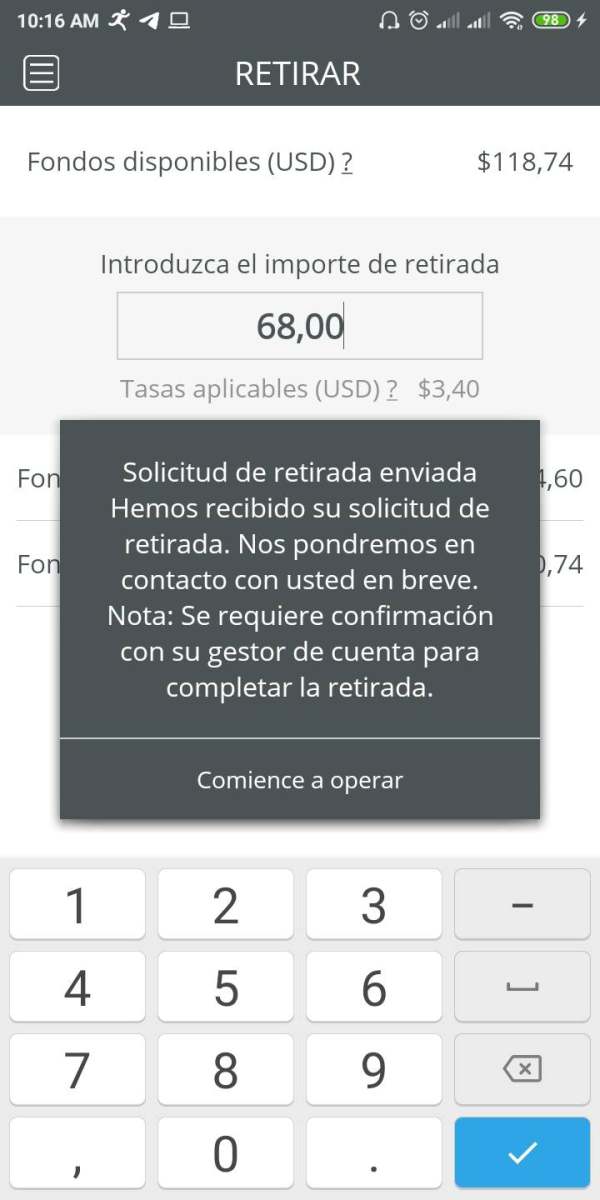

Deposit & Withdrawal

Tradear supports payments through two main methods: bank transfer and credit card. The inclusion of both bank transfer and credit card options enhances user flexibility, allowing them to choose the payment method that best suits their preferences and convenience. This dual-payment approach reflects Tradear's commitment to accommodating a range of traders and ensuring a good onboarding process for those looking to initiate their trading journey on the platform

Customer Support

Tradear's customer support is accessible through the English language, and users can contact them via phone at +52 55 8920 2443. This designated contact number serves as a direct communication channel for addressing inquiries, providing assistance, and resolving concerns related to the platform or trading activities.

The availability of phone support adds a real-time dimension to customer assistance, for users who prefer immediate and direct engagement. This contact method aligns with Tradear's commitment to supporting users by offering a direct and efficient means of communication for their English-speaking clientele.

Conclusion

In conclusion, Tradear presents itself as a platform with notable strengths and areas for improvement. The extensive offering of over 1000 trading assets is a clear advantage, providing users with wide options for building their investment portfolios. The competitive spreads contribute to cost-effectiveness, potentially benefiting traders seeking efficient transaction costs. Additionally, the availability of high leverage serves experienced traders looking to maximize their market exposure.

However, the absence of regulatory oversight is a significant drawback, as it raises issues about transparency and user protection. Regulatory frameworks provide essential safeguards, and the lack thereof could pose risks for traders. Furthermore, the limited educational resources will hinder the learning experience for users, especially those seeking comprehensive guidance in navigating the complexities of financial markets.

FAQs

Q: What account types does Tradear offer?

A: Tradear offers Trade, Infinite, and Advanced accounts, each tailored to varying trader preferences and experience levels.

Q: What is the minimum deposit requirement on Tradear?

A: The minimum deposit starts at $250.

Q: How can I contact Tradear customer support?

A: You can reach Tradear customer support at +52 55 8920 2443.

Q: What payment methods are available for deposits on Tradear?

A: Tradear facilitates deposits through bank transfer and credit card options.

Q: Is Tradear regulated?

A: No, Tradear is not regulated by any regulatory authority.

Q: What trading platform does Tradear use?

A: Tradear utilizes the MT4 trading platform for its services.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now