简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Reviews IC Markets

Abstract:In today's comprehensive review, WikiFX will delve into the details of IC Markets, a well-established forex broker within the industry.

With a global reach, WikiFX is a regulatory query platform for forex brokers, having scrutinized and evaluated over 47,000 brokers while maintaining close collaboration with more than 30 national regulators. For a deeper understanding of the security and credibility of your chosen brokers, we encourage you to visit www.wikifx.com or download our free app from Google Play or the App Store.

IC Markets' official website is https://www.icmarkets.com/global/en.

Our WikiFX database states that IC Markets has a relatively high WikiScore of 8.91, meaning it is a relatively low-risk and reliable broker.

Headquartered in Sydney, Australia, IC Markets has established itself as a leading global provider of forex CFDs, facilitating a daily trade volume exceeding $15 billion through the execution of over 500,000 orders each day. With regulatory oversight from the Cyprus Securities and Exchange Commission and the Australian Securities and Investments Commission, IC Markets proudly serves clients from more than 140 countries worldwide, catering to over 100,000 active traders.

Distinguishing itself in the market, IC Markets offers its users highly competitive variable spreads, commencing from an impressively low 0.0 pips on major FX pairs. The broker's reputation for ultra-swift order execution, processing trades under 40 milliseconds, positions it as an ideal platform for high-frequency trading, algorithmic strategies, and institutional investors.

Market instruments:

Unlike other brokers, IC Markets has a more focused selection of financial instruments available for investment, primarily focusing on CFDs. Within the realm of CFDs, traders can choose from approximately 2,200 different options encompassing various asset classes:

Currency pairs: A selection of 60 CFDs on different currency pairs.

Company shares: Over 2,100 CFDs on company shares.

Commodities: 20 CFDs on commodities.

Indices: CFDs on various indices.

Currency pairs and crypto: 20 CFDs on currency pairs and cryptocurrencies.

Debt bond CFDs: 9 debt bond CFDs.

Futures CFDs: 4 futures CFDs.

It's important to note that IC Markets focuses exclusively on CFD trading and does not provide access to non-CFD assets. Therefore, if you were considering investing in mutual funds, real shares, or ETFs, these options would not be available through IC Markets.

Types of accounts:

IC Markets offers three different types of accounts, which are illustrated below:

Trading platforms:

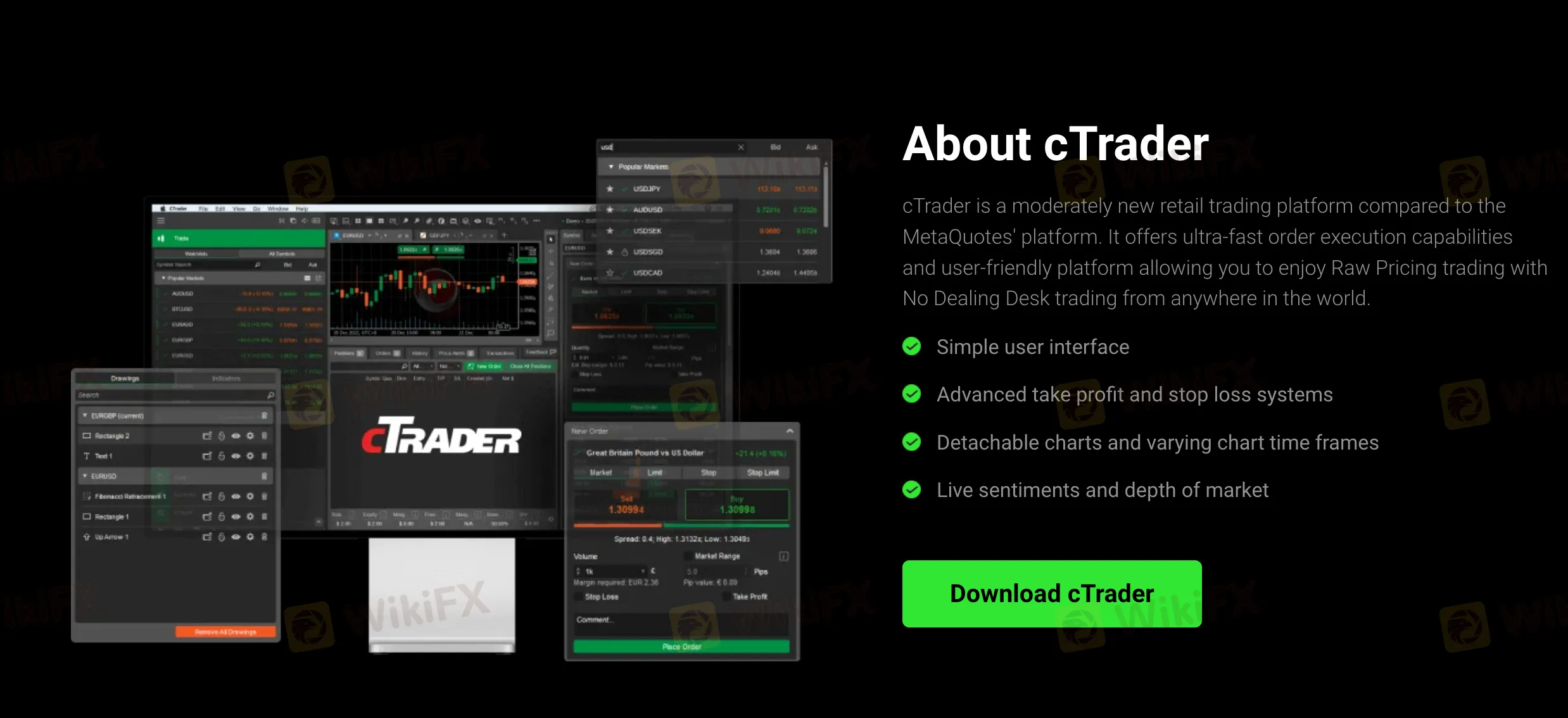

IC Markets offers its users a comprehensive selection of three prominent trading platforms: cTrader, MetaTrader 4, and MetaTrader 5. These platforms are not only accessible via desktop applications but are also available through web browsers and mobile devices connected to the internet. IC Markets provides dedicated mobile apps for Android and iOS devices for added convenience.

Renowned for their exceptional order execution speed, the broker's platforms are recognized for their ultra-low latency. IC Markets maintains connectivity with two Equinix data centres in London and New York, ensuring reliable and secure trading for its clientele. Leveraging dedicated fibre-optic networks, these data centres enable instant order execution with minimal slippage, guaranteeing a seamless trading experience.

Deposit and withdrawal methods:

A minimum deposit of $200 is required to begin trading with IC Markets. The broker offers several convenient deposit options, including bank transfers, Visa, and MasterCard. Electronic payment methods such as Neteller, PayPal, Skrill, Klarna, and Rapid Transfer are also available. The availability of specific options may vary depending on your country of residence, such as within the EU and your access to different deposit methods. It's worth noting that IC Markets does not charge any fees for these deposit methods.

Regarding withdrawals, IC Markets allows you to use the same methods as your deposits, and no fees are imposed. However, a fee may be levied for transferring the funds from IC Markets' bank to your own if you withdraw funds via bank transfer. It typically takes 3-5 days for withdrawals to be processed, although in some cases, it may take up to ten days to receive your funds.

Customer Service:

Operating around the clock, IC Markets prides itself on its dedicated customer service team, guaranteeing swift resolution of any concerns or inquiries that may arise.

The highly responsive customer service team is equipped to assist clients in multiple languages, and they can be reached through various communication channels such as phone, email, and convenient web chat options. In addition to these direct avenues, IC Markets offers an invaluable FAQ section on its website, featuring comprehensive and detailed responses to pertinent questions. This resource is informative and easily searchable, enabling clients to swiftly locate the specific information they require.

Overall, IC Markets is a good choice for traders looking for a well-established and reputable broker with a wide range of market instruments and trading platforms. The company is regulated by several financial authorities, which gives traders peace of mind knowing their funds are safe.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator