Score

TRADE BINANCE

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://tradebiance.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed TRADE BINANCE also viewed..

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

tradebiance.com

Server Location

United States

Website Domain Name

tradebiance.com

Server IP

8.39.235.63

Company Summary

Note: TRADE BINANCE's official website - https://tradebiance.com/ is currently inaccessible normally.

| TRADE BINANCE Review Summary | |

| Founded | 2023 |

| Registered Country/Region | United Kingdom |

| Regulation | No Regulation |

| Market Instruments | Cryptocurrencies, Forex |

| Demo Account | / |

| Leverage | Up to 1:150 |

| Spread | / |

| Trading Platform | Binance Exchange |

| Min Deposit | $1 000 |

| Customer Support | Email: support@tradebiance.com |

Founded in 2023 and headquartered in the United Kingdom, TRADE BINANCE is an unregulated broker offering a tiered selection of accounts (Silver, Gold, and Premium), featuring different leverage, spreads, and minimum deposit requirements, beginning at $1,000. TRADE BINANCE extends leverage up to 1:150 and offers variable spreads that are tailored to the account type chosen by the trader. It provides the Binance Exchange trading platform.

Pros and Cons

| Pros | Cons |

| Flexible leverage ratios | Non-functional website |

| Popular payment options | No regulation |

| Limited tradable asset classes | |

| No MT4/5 | |

| High minimum deposit | |

| Only email support |

Is TRADE BINANCE Legit?

At present, TRADE BINANCE lacks valid regulation. Our advice for you is to look for other regulated brokers with functional websites.

What Can I Trade on TRADE BINANCE?

| Tradable Instruments | Supported |

| Forex | ✔ |

| Cryptocurrencies | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

| Account Type | Min Deposit |

| SILVER | $1 000 |

| GOLD | $2 500 |

| PREMIUM | $3 500 |

Leverage

The maximum leverage is 150:1, not very high actually. Lower leverage is safer to some extent because leverage can amplify both profits and losses.

| Account Type | Max Leverage |

| SILVER | 5:1 |

| GOLD | 125:1 |

| PREMIUM | 150:1 |

Spread and Commission

| Account Type | Spread | Commission |

| SILVER | Variable | 0.1% |

| GOLD | 0.04% | |

| PREMIUM | 0.02% |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Binance Exchange | ✔ | Mobile, web | Experienced traders |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |

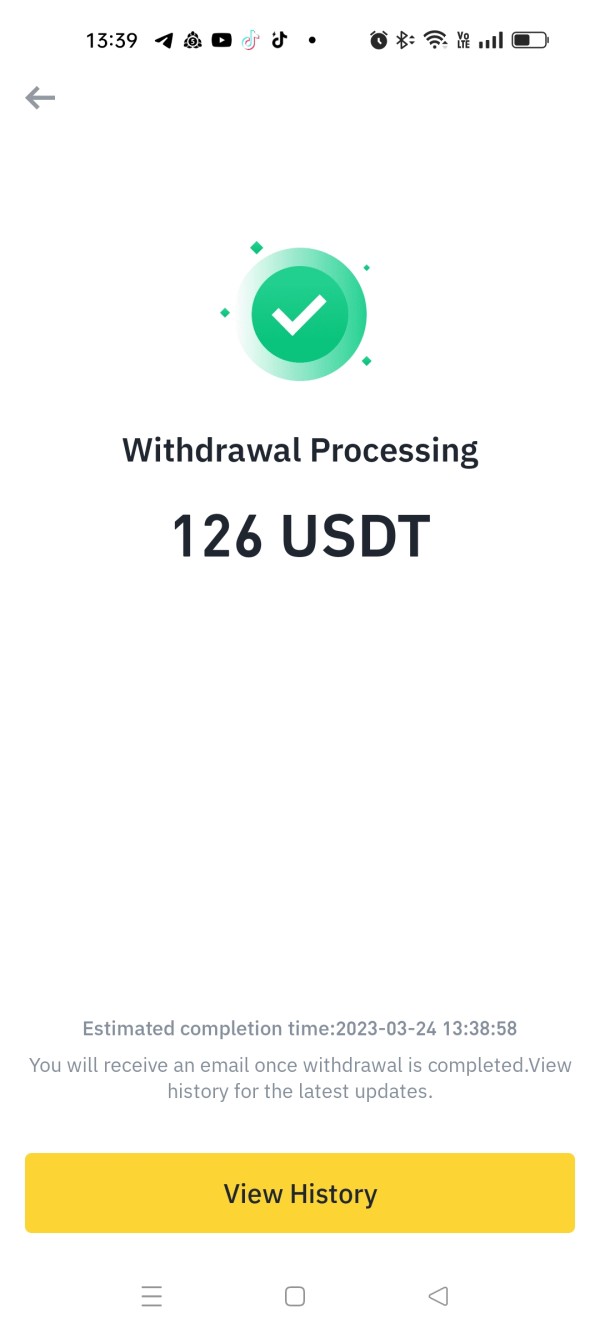

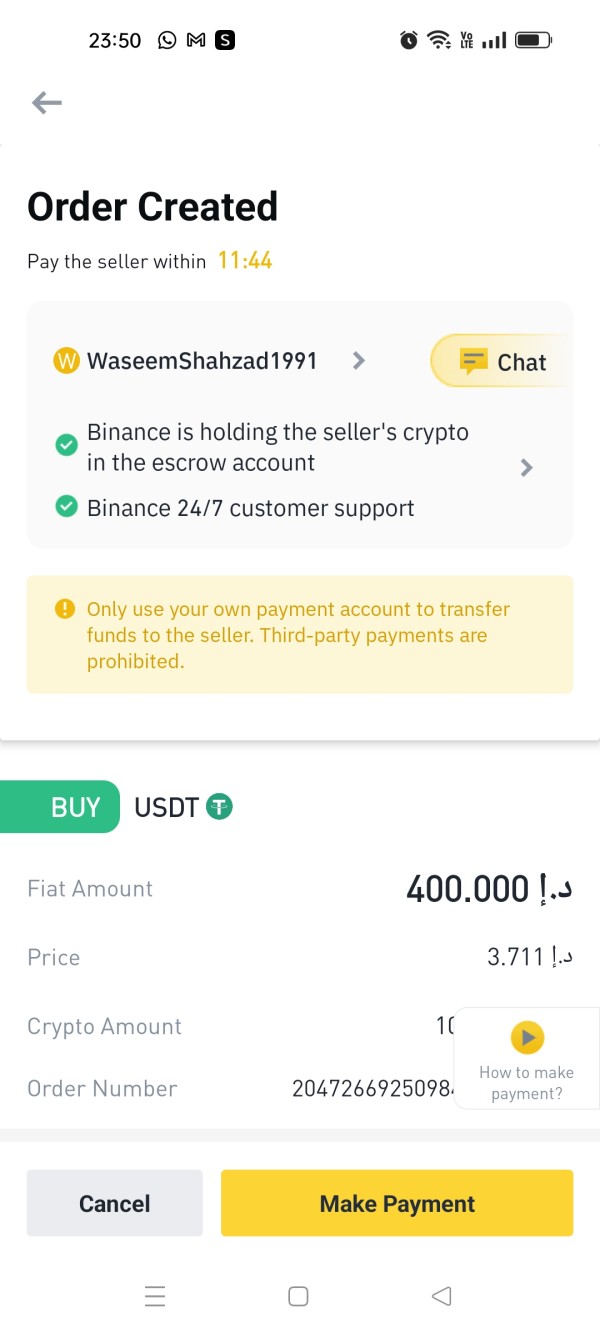

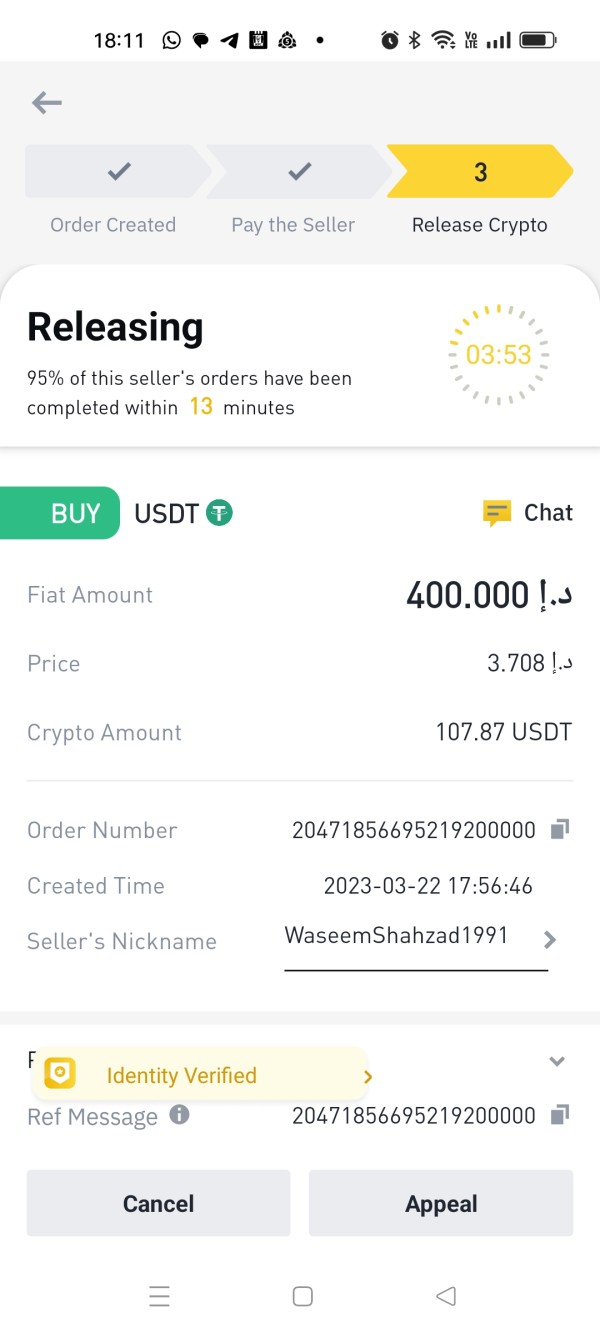

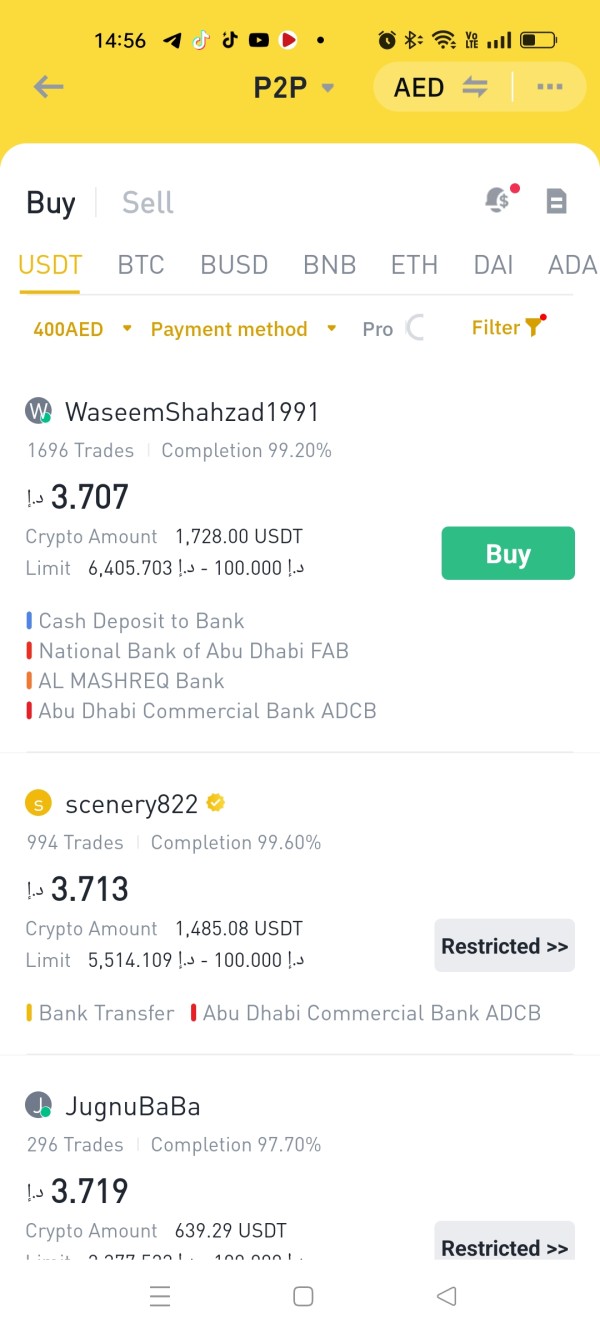

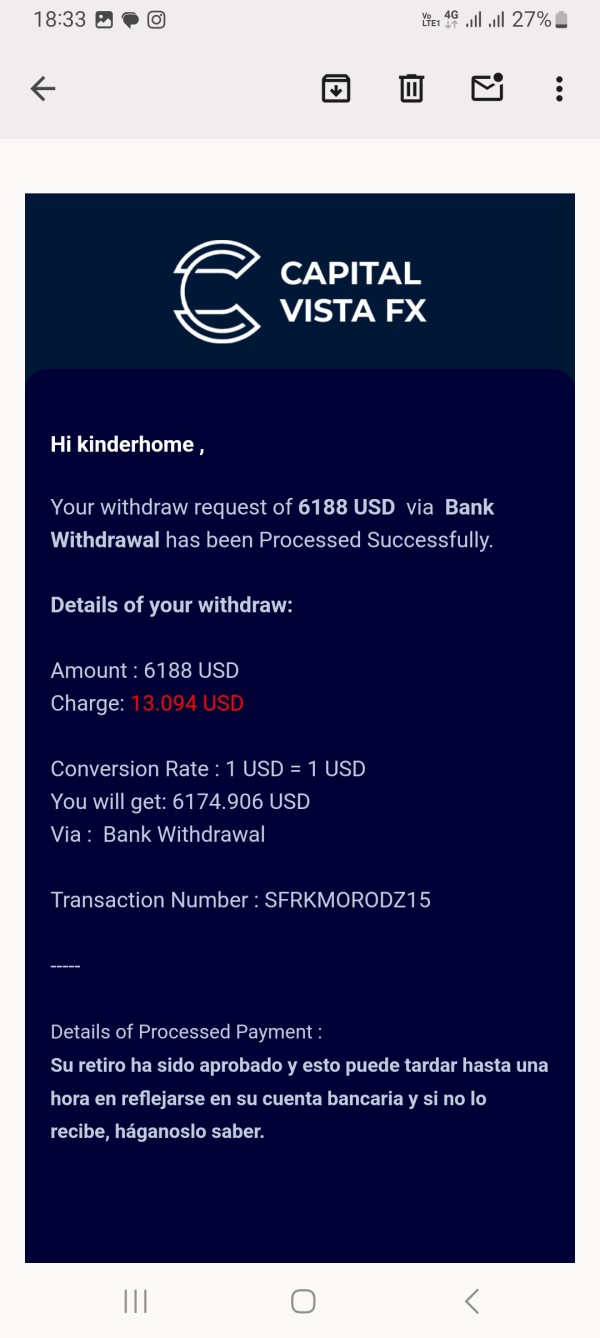

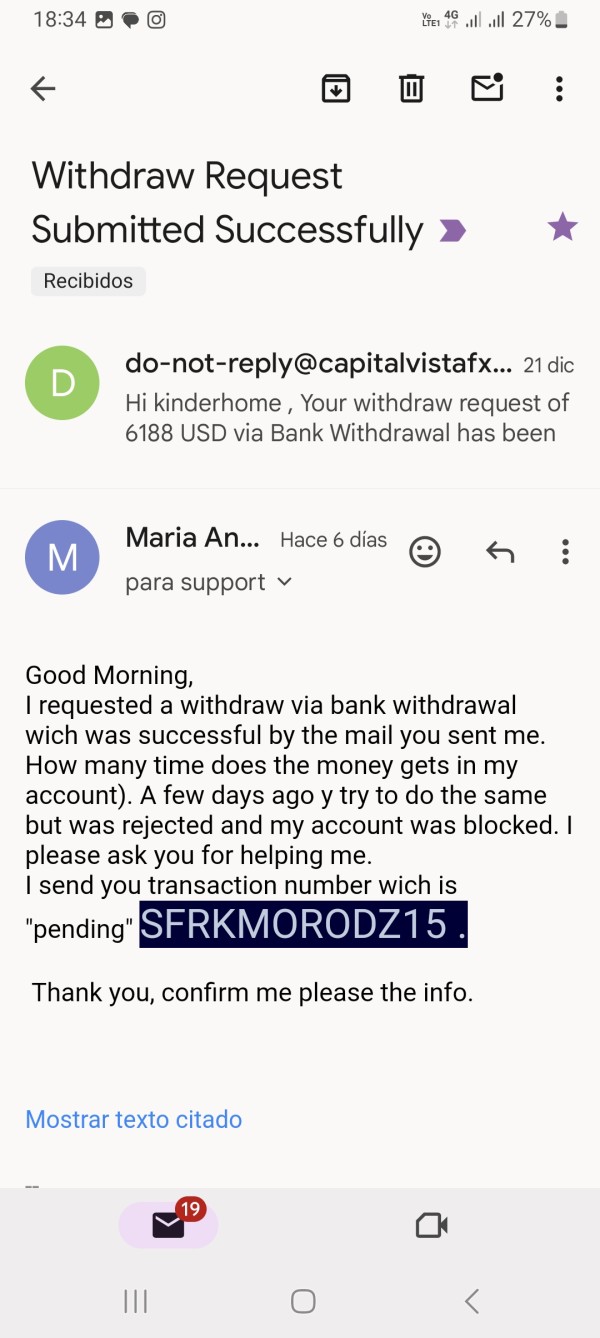

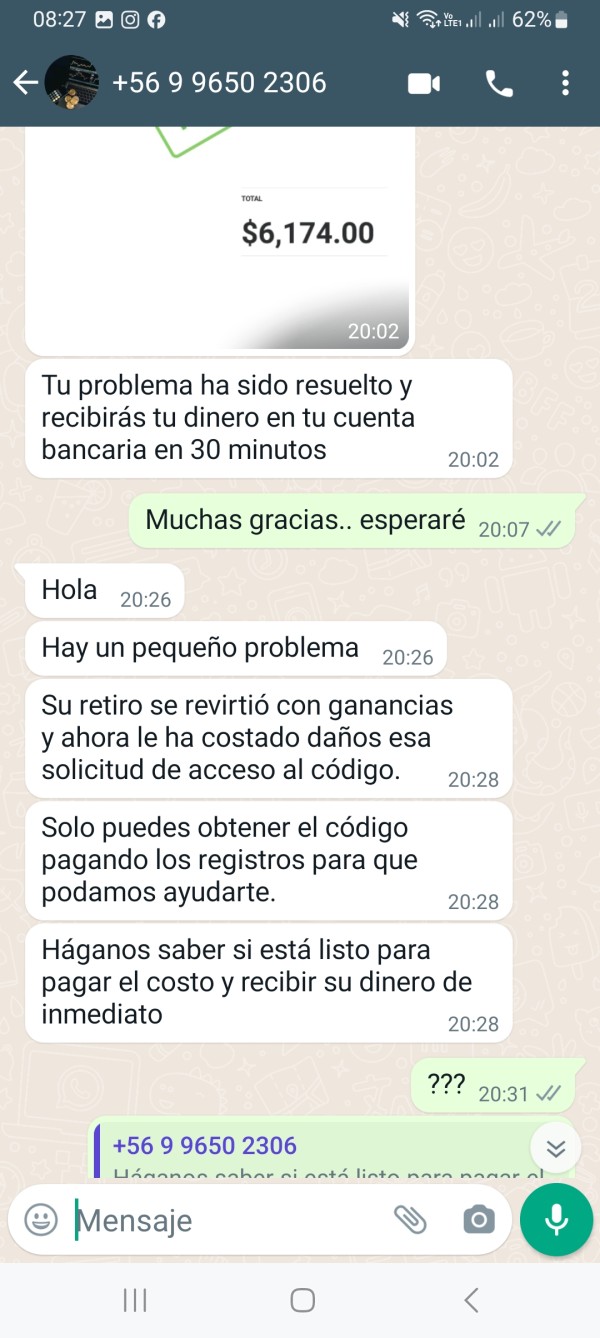

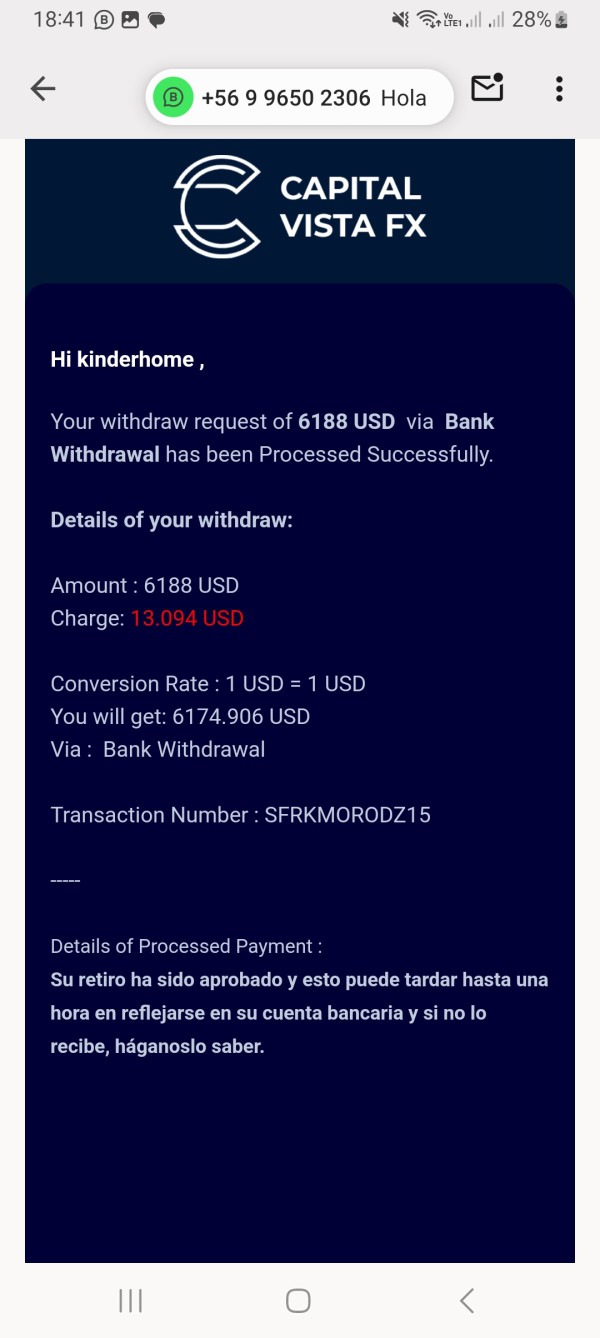

Deposit and Withdrawal

TRADE BINANCE provides several payments like bank transfers, credit or debit cards, and other third-party payment processors. Moreover, depending on regional availability, e-wallets or cryptocurrency deposits may also be supported for account funding.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

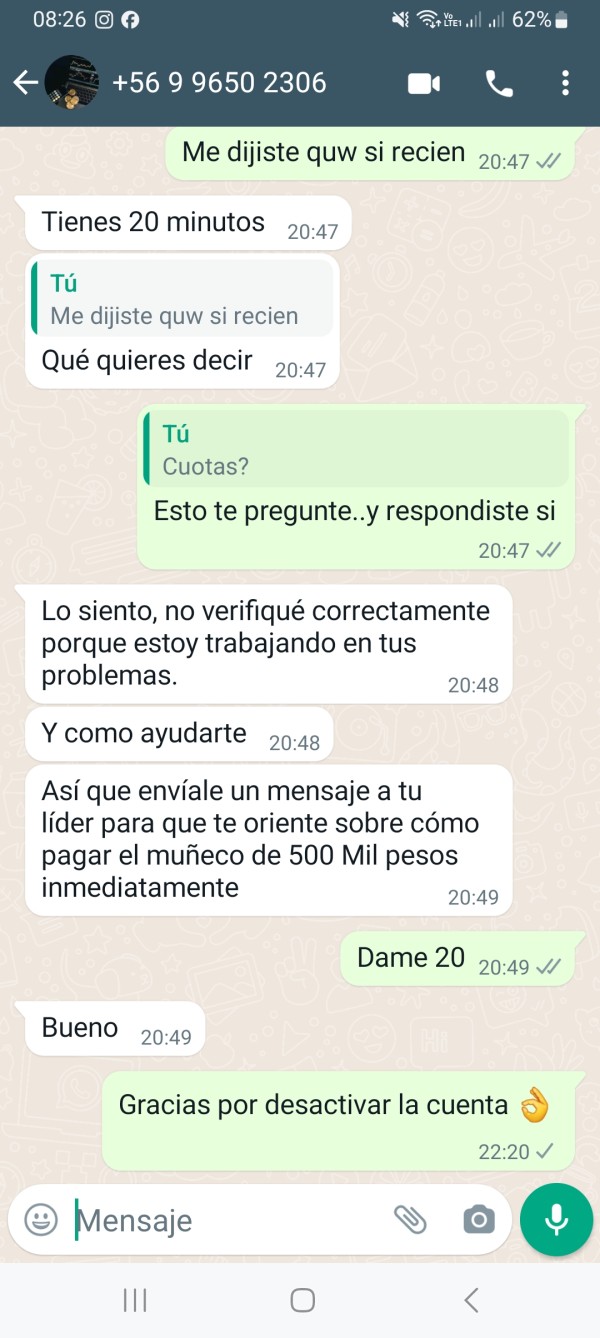

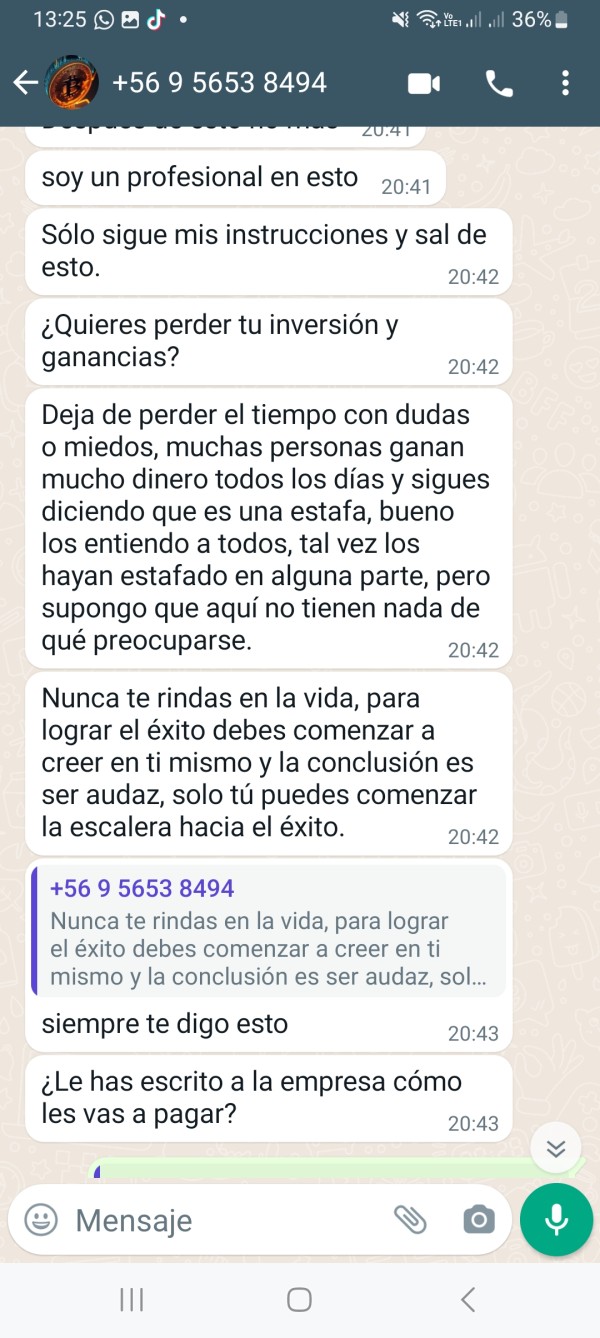

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now