Score

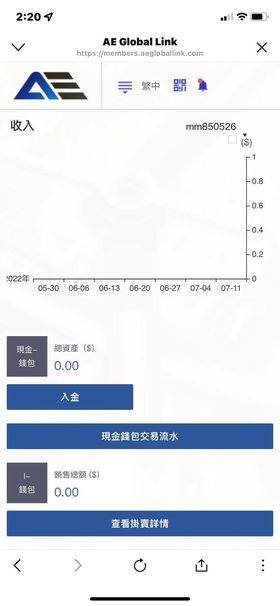

AE GLOBAL

United Kingdom|5-10 years|

United Kingdom|5-10 years| --

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed AE GLOBAL also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded year | 2-5 years |

| Company Name | AE GLOBAL |

| Regulation | Unregulated |

| Minimum Deposit | $1,000 |

| Maximum Leverage | 1:50 - 1:200 |

| Spreads | Varies (specific rates not provided) |

| Trading Platforms | Meta Trader 4 (MT4) |

| Tradable assets | Equity instruments, debt instruments, derivative instruments, real estate instruments |

| Account Types | Standard Account, Premium Account, Corporate Account |

| Demo Account | Not specified |

| Customer Support | Phone: 0044 2084 323 088, Email: support@ae-globall.com |

| Payment Methods | Bank transfers, credit/debit cards, digital payment methods |

| Educational Tools | Tutorials, guides, webinars, workshops |

Overview of AE GLOBAL

AE GLOBAL is a financial entity operating in the United Kingdom that has raised concerns due to its lack of regulatory oversight. This absence of clear guidelines and authorities overseeing its operations creates doubts about the reliability and security of its financial offerings. Investors and individuals may be vulnerable to potential risks as there is no established framework to ensure transparency, accountability, and investor protection.

AE GLOBAL provides a variety of market instruments, including equity instruments like common and preferred stocks, equity index funds, debt instruments like government and corporate bonds, derivative instruments such as options contracts and futures contracts, and real estate instruments like Real Estate Investment Trusts (REITs) and mortgage-backed securities (MBS). These instruments offer investment opportunities across different sectors.

While AE GLOBAL offers different account types, such as standard, premium, and corporate accounts, the lack of regulatory scrutiny makes it important for individuals and corporations to exercise caution and conduct thorough research. The trading platforms provided by AE GLOBAL, including the Meta Trader 4 (MT4) and mobile trading options. Negative reviews regarding withdrawal issues also raise concerns about the company's handling of investors' funds.

Pros and Cons

AE GLOBAL presents a range of financial instruments, including equity, debt, derivative, and real estate options, offering investors opportunities for diversification. It also provides leverage options to amplify trading positions and spreads with commissions for its trading services. AE GLOBAL offers educational resources such as tutorials, webinars, and workshops to enhance users' understanding of the financial markets. The platform utilizes Meta Trader 4 (MT4), a widely recognized trading platform. However, it is important to note the lack of regulatory oversight and transparency, which raises concerns about the reliability and security of the company's operations. Multiple users have reported withdrawal issues, and the mobile trading platform has limited features and functionality. Specific information about account types and advantages is also lacking, and there is a minimum deposit requirement of $1,000.

| Pros | Cons |

| Offers a range of equity, debt, derivative, and real estate instruments | Lack of regulatory oversight and transparency |

| Provides leverage options for magnifying trading positions | Withdrawal issues reported by multiple users |

| Offers spreads and commissions for trading services | Limited features and functionality on mobile trading platform |

| Provides educational resources such as tutorials, webinars, and workshops | Lack of specific information about account types and advantages |

| Utilizes Meta Trader 4 (MT4) as a widely recognized trading platform | Minimum deposit requirement of $1,000 |

Is AE GLOBAL Legit?

AE GLOBAL, an entity operating in the financial sector, has drawn attention due to the lack of regulatory oversight. Concerns have been raised regarding its operations, as there are no clear guidelines or authorities overseeing its activities. The absence of regulatory measures leaves individuals and investors vulnerable to potential risks, as there is no established framework to ensure transparency, accountability, and investor protection. The unregulated nature of AE GLOBAL raises doubts about the reliability and security of its financial offerings.

Market Instruments

Equity Instruments: AE GLOBAL offers a range of equity instruments, allowing investors to buy shares in various companies across different industries. These equity instruments include common stocks of well-known corporations like XYZ Inc., ABC Corp., and DEF Ltd. Additionally, investors can access preferred stocks, which offer fixed dividends, from companies such as GHI Corp. and JKL Ltd. Furthermore, AE GLOBAL provides access to equity index funds, allowing investors to gain exposure to a diversified portfolio of stocks without the need to buy individual shares.

Debt Instruments: AE GLOBAL offers debt instruments that provide fixed-income opportunities to investors. These instruments include government bonds issued by reputable entities, such as national treasuries and municipal bonds issued by local governments. In addition to government bonds, AE GLOBAL offers corporate bonds from established companies like MNO Corp. and PQR Ltd. Investors can also access various types of fixed-income securities like certificates of deposit (CDs) from reliable financial institutions.

Derivative Instruments: AE GLOBAL provides a range of derivative instruments, enabling investors to speculate on price movements and manage risks. These include options contracts on major indices like the S&P 500 and the Nasdaq, allowing investors to hedge against market volatility. Moreover, investors can trade futures contracts on commodities like gold, silver, and crude oil, as well as on agricultural products like wheat and corn. Additionally, AE GLOBAL offers swap agreements, allowing investors to exchange cash flows based on variables like interest rates and currencies.

Real Estate Instruments: AE GLOBAL offers real estate investment opportunities, giving investors the chance to invest in properties without direct ownership. These instruments include Real Estate Investment Trusts (REITs) that own and operate income-generating properties, such as shopping malls, office buildings, and residential complexes. Furthermore, investors can access real estate funds, offering diversification across different types of properties and geographical regions. AE GLOBAL also offers mortgage-backed securities (MBS), providing investors exposure to a pool of residential or commercial mortgages.

Pros and Cons

| Pros | Cons |

| Provides access to a range of equity instruments | Lack of information regarding the specific advantages of these instruments |

| Offers debt instruments for fixed-income opportunities | Lack of transparency in the selection and evaluation process |

| Provides derivative instruments for price speculation | Potential risk associated with derivative trading |

| Offers real estate investment opportunities | Lack of direct ownership and control over the properties |

Account Types

1. STANDARD ACCOUNT:

AE GLOBAL offers a standard account type to its clients. This account option provides basic features and functionality for individuals looking to engage in financial activities with the company. While details about the specific benefits and terms of the standard account are not readily available, it is important to note that this type of account may have limitations compared to other account options offered by regulated entities. Clients should exercise caution and conduct thorough research before opting for a standard account with AE GLOBAL.

2. PREMIUM ACCOUNT:

AE GLOBAL also offers a premium account option for clients seeking enhanced services and privileges. The premium account may provide additional features and benefits compared to the standard account, but the exact details and advantages of this account type are not clearly specified. As AE GLOBAL operates outside regulatory oversight, it is crucial for individuals considering a premium account to carefully evaluate the risks and potential drawbacks associated with investing in an unregulated financial entity.

3. CORPORATE ACCOUNT:

For corporate clients, AE GLOBAL presents a corporate account type that caters to their specific needs. However, the specifics and advantages of this account option are not well-defined, given the lack of regulatory scrutiny. Corporations should exercise caution and perform extensive due diligence before entrusting their funds with AE GLOBAL, as the absence of regulatory oversight raises concerns about the reliability and security of their financial services.

Pros and Cons

| Pros | Cons |

| Standard account provides basic features and functionality for individuals | Limitations compared to account options offered by regulated entities |

| Premium account may offer additional features and benefits | Lack of clear details and advantages specified for the premium account |

| Corporate account caters to the specific needs of corporate clients | No demo account |

Leverage

AE GLOBAL offers leverage options to its users, allowing them to magnify their trading positions. With leverage ratios ranging from 1:50 to 1:200, users have the potential to control larger positions in the market with a relatively smaller amount of capital.

Spreads & Commissions

AE GLOBAL offers spreads and commissions for its trading services. The exact spreads and commission rates may vary depending on the specific financial instruments and account types.

Minimum Deposit

AE GLOBAL requires a minimum deposit of $1,000 for users to open an account and start trading. It is important for potential investors to be aware of this specific deposit requirement before considering engaging with AE GLOBAL's services.

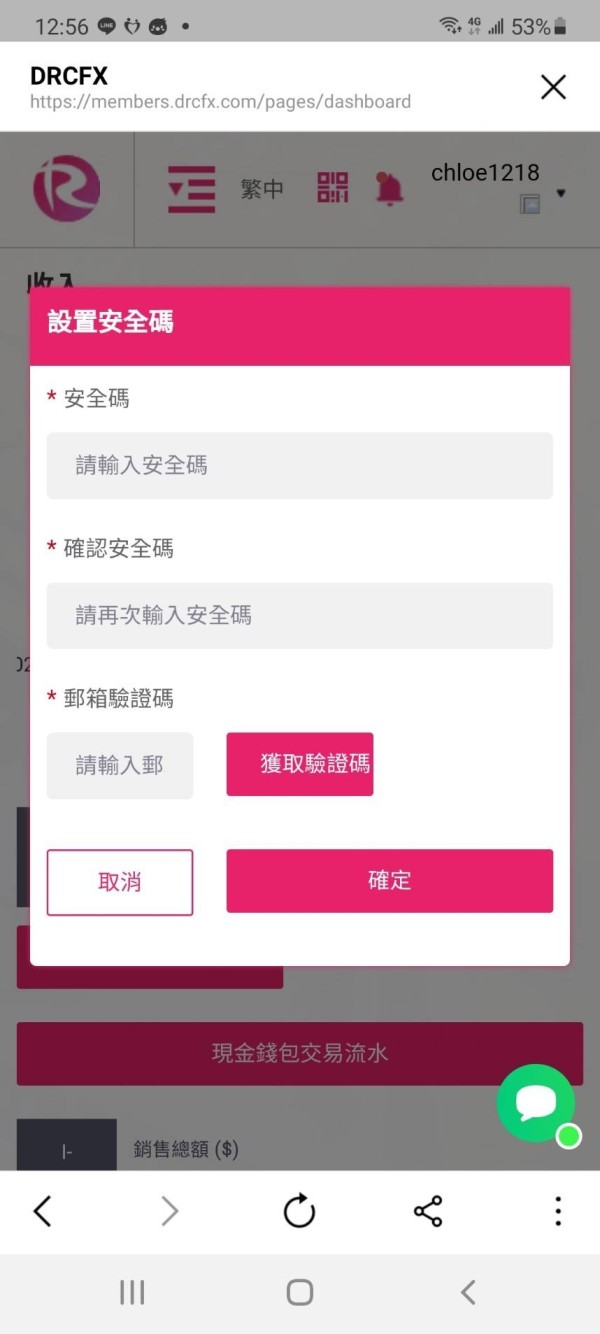

Deposit & Withdrawal

DEPOSIT: AE GLOBAL offers a variety of deposit options to its customers. Users can deposit funds into their AE GLOBAL accounts through bank transfers, credit/debit cards, and various digital payment methods. However, it's important to note that the specific details and terms of these deposit options, such as processing times and fees, may vary and should be thoroughly understood by users before making any deposits.

WITHDRAWAL: AE GLOBAL allows customers to withdraw their funds through several channels. Withdrawals can be made via bank transfers, digital wallets, or other designated payment methods. The withdrawal process typically involves submitting a withdrawal request, which is then processed by AE GLOBAL. It's worth mentioning that withdrawal fees and processing times may apply, and these details should be carefully considered by users. It's essential to review AE GLOBAL's withdrawal policies to ensure a smooth and hassle-free withdrawal experience.

Pros and Cons

| Pros | Cons |

| Offers a variety of deposit options including bank transfers, credit/debit cards, and digital payment methods | Specific details and terms of deposit options may vary, requiring thorough understanding by users |

| Allows users to submit withdrawal requests for processing by AE GLOBAL | Withdrawal fees and processing times may apply, requiring careful consideration by users |

| Lack of information regarding the withdrawal process and policies, potentially causing confusion for users |

Trading Platforms

AE GLOBAL's trading platform offers the Meta Trader 4 (MT4) as its primary software. MT4 is a well-known platform widely used in the industry, but AE GLOBAL's implementation of it appears to be average and lacks any notable enhancements or distinctive features. The platform is designed for Windows operating systems, limiting its compatibility with other operating systems. While the MT4 platform itself is a popular choice among traders, AE GLOBAL's utilization of the platform does not demonstrate any significant improvements or added value.

In addition to the MT4 platform, AE GLOBAL also provides a mobile trading option. However, the mobile trading platform offered by AE GLOBAL has limited features, which may hinder traders who prefer to execute trades on the go or those who heavily rely on mobile devices for their trading activities.

Pros and Cons

| Pros | Cons |

| Utilizes Meta Trader 4 (MT4) platform | Average implementation without notable enhancements or distinctive features |

| Offers a mobile trading option | Limited features and functionalities on the mobile platform |

| Designed primarily for Windows operating systems, limiting compatibility with other systems |

Educational Resources

AE GLOBAL offers various educational resources to its users. One of the types of resources provided is comprehensive tutorials and guides. These resources help educate users about the basics of trading, investment strategies, and market analysis. For example, users can access tutorials on technical analysis, risk management, and trading psychology. These materials serve to enhance users' understanding of the financial markets and equip them with essential knowledge to make informed decisions.

Another type of educational resource offered by AE GLOBAL is interactive webinars and workshops. These sessions provide users with the opportunity to learn directly from experienced traders and industry experts. Through live presentations, demonstrations, and Q&A sessions, users can gain insights into advanced trading techniques, market trends, and risk mitigation strategies. Webinars and workshops enable users to expand their knowledge and stay updated with the latest developments in the financial industry.

Customer Support

AE GLOBAL offers customer support services to address user queries and concerns. Users can reach out to the customer support team through various channels, including a phone line at 0044 2084 323 088. Additionally, users can contact the support team via email at support@ae-globall.com. These contact options provide users with direct means of communication to seek assistance and resolve any issues they may encounter while using AE GLOBAL's services.

Reviews

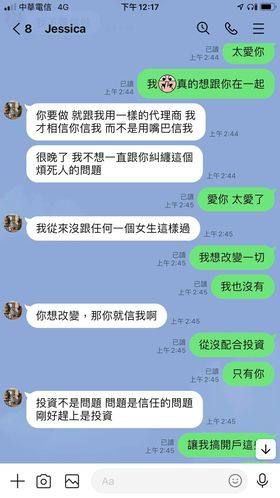

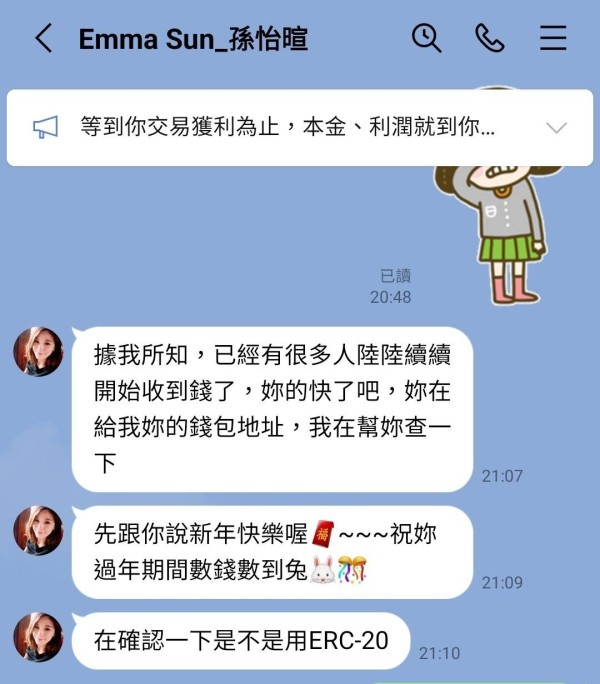

According to reviews on WikiFX, AE GLOBAL has received negative exposure with multiple complaints regarding withdrawal issues. Traders have reported being unable to withdraw their funds, even after waiting for several months or more than a year. One reviewer mentioned the name change from HiiFX to AE GLOBAL and the change in withdrawal methods to OKEX and USDT, which further complicated the withdrawal process. Another review highlighted how a couple encouraged them to invest, but the broker continually delayed their withdrawal application and referred them back to the couple for assistance. These reviews suggest a recurring problem with withdrawal delays and raise concerns about the company's handling of investors' funds.

Conclusion

In conclusion, AE GLOBAL operates in the financial sector without regulatory oversight, which raises concerns about transparency, accountability, and investor protection. While AE GLOBAL offers a variety of market instruments such as equity, debt, derivative, and real estate instruments, the absence of regulatory measures casts doubt on the reliability and security of its financial offerings. AE GLOBAL provides different types of accounts, including standard, premium, and corporate accounts, but the lack of clear information about their specific benefits and limitations is a drawback. The leverage options offered by AE GLOBAL allow users to magnify their trading positions, but the exact spreads, commissions, and withdrawal fees are not clearly specified. The minimum deposit requirement of $1,000 should be considered by potential investors. AE GLOBAL's trading platforms, including Meta Trader 4 (MT4) and the mobile trading option, lack notable enhancements and may not meet the expectations of traders who seek comprehensive features and compatibility across different operating systems. Despite offering educational resources like tutorials, webinars, and workshops, AE GLOBAL has received negative reviews on WikiFX, with complaints regarding withdrawal issues and delays. These concerns about the company's handling of investors' funds highlight potential risks associated with investing in an unregulated financial entity.

FAQs

Q: Is AE GLOBAL a legitimate financial entity?

A: AE GLOBAL operates without regulatory oversight, raising concerns about its reliability and security.

Q: What market instruments does AE GLOBAL offer?

A: AE GLOBAL provides equity, debt, derivative, and real estate instruments for investment.

Q: Does AE GLOBAL offer leverage options?

A: Yes, AE GLOBAL offers leverage ratios ranging from 1:50 to 1:200 for magnifying trading positions.

Q: What are the deposit and withdrawal options with AE GLOBAL?

A: AE GLOBAL accepts deposits through bank transfers, credit/debit cards, and digital payment methods. Withdrawals can be made via bank transfers, digital wallets, or designated payment methods.

Q: What trading platforms does AE GLOBAL provide?

A: AE GLOBAL primarily offers the Meta Trader 4 (MT4) platform, but its implementation lacks notable enhancements. It also has a limited-feature mobile trading platform.

Q: What educational resources are available at AE GLOBAL?

A: AE GLOBAL offers tutorials, guides, webinars, and workshops to educate users about trading and market analysis.

Q: How can I contact AE GLOBAL's customer support?

A: Users can reach AE GLOBAL's customer support team through phone at 0044 2084 323 088 or email at support@ae-globall.com.

Q: What do reviews say about AE GLOBAL?

A: Reviews mention negative experiences with withdrawal issues, including delays and complications in the withdrawal process.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Amber287

Taiwan

This has been going on for a while. I was in a long-distance relationship online, and I was suspected of being scammed. He claimed that he was from Hong Kong and had been dating me for a month, and then persuaded me to invest in the foreign exchange platform AE global, saying that he had strong technology to guarantee success. It was profitable, but because there were too many fraud incidents, I only deposited more than 30,000 yuan. Later, when the position was liquidated, he asked me to make up more money. He cursed me and said that I didn't believe him, so he blocked me. To this day I’m not sure if it’s a scam. 😭

Exposure

2024-03-18

莊敬程

Taiwan

After I made a deposit, this broker kept delaying my withdrawal application and said that if there was any problem, I could go to this couple to deal with it. And when I went to the briefing, I found that the couple knew the speaker, who I thought was also an internal member. I have been waiting for 3 to 6 months for the approval of the withdrawal, and when the time comes, they say that it will be delayed for another half a year...I still haven't received the withdrawal...I heard that the couple bought a house recently...I don't know if they have used the money of investors to buy the house.

Exposure

2023-05-31

峰回路转81601

Hong Kong

Can't withdraw! Said to tell us to wait a few months! I wait for half a year! Still can't withdraw

Exposure

2022-10-16

KK4911

Hong Kong

It used to be called HiiFX, but now it has become AE. It used to be able to withdraw to bank cards. Later, it was changed to OKEX, and it was converted into USDT and then exchanged. The withdrawal has not withdrawn for more than a year

Exposure

2022-07-26

9527001

Hong Kong

nbg

Positive

2022-11-10