Score

FX-Farms

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://fxfarms.com

Website

Rating Index

Contact

Licenses

Licenses

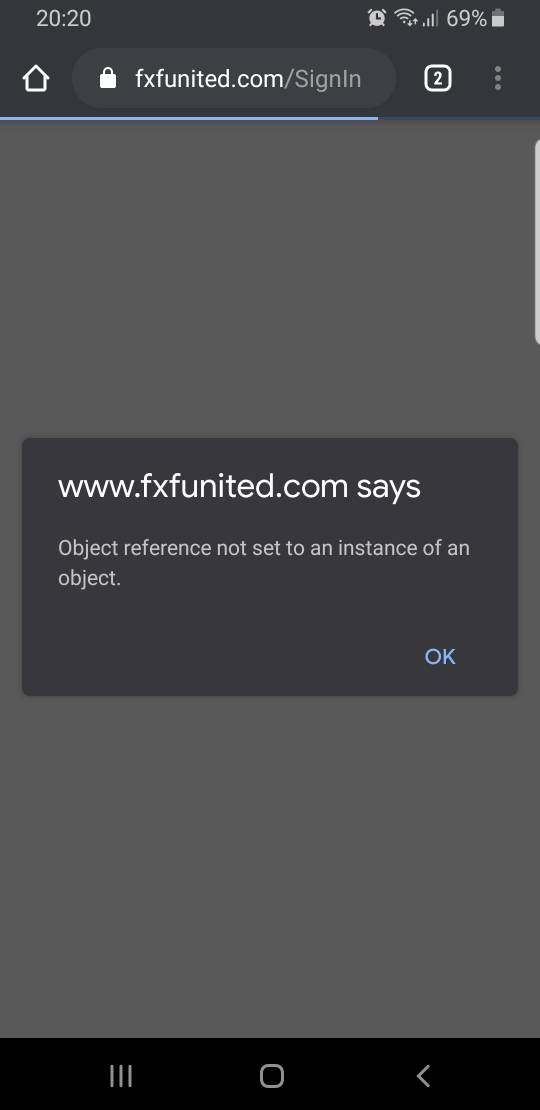

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed FX-Farms also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Ukraine

Russia

United States

fxfarms.com

Server Location

United States

Most visited countries/areas

United States

Website Domain Name

fxfarms.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2019-11-18

Server IP

104.24.105.45

Company Summary

| Aspect | Information |

| Company Name | FX Farms |

| Registered Country/Area | United Kingdom |

| Founded Year | 2021 |

| Regulation | Not Regulated |

| Market Instruments | Agriculture, Real Estate, Cryptocurrency Trading, Retirement Income, Forex Trading, Oil & Gas |

| Account Types | Base, Trader, Lead, Eagle, President |

| Minimum Deposit | $200 |

| Commission | 20% commission on additional packages |

| Trading Platforms | N/A |

| Demo Account | Not available |

| Customer Support | Email (support@fx-farms.com) |

| Deposit & Withdrawal | Bitcoin wallets |

| Educational Resources | Ebooks, videos, webinars, market reviews, economic calendars, news updates |

Overview of FX-Farms

FX Farms, a UK-based company founded in 2021, operates without regulation. It offers a variety of investment options including agriculture, real estate, cryptocurrency trading, retirement income solutions, forex, and oil & gas. Account types range from Base to President, with a minimum deposit of $200 and a 20% commission on additional packages. Deposit and withdrawal methods are limited to Bitcoin wallets, and customer support is available via email. Though lacking demo accounts, FX Farms provides educational resources such as ebooks, videos, webinars, and market updates.

Pros and Cons

| Pros | Cons |

| Diverse range of investment options | Lack of regulation |

| Multiple account types | Limited deposit and withdrawal options |

| Competitive daily returns and referral bonuses | No demo accounts available |

| Transparent fee structure with no hidden charges | Limited customer support options |

| Comprehensive educational resources |

Pros:

Diverse Range of Investment Options: FX Farms offers a variety of investment products across different asset classes, including agriculture, real estate, cryptocurrency, retirement income, forex trading, and oil & gas. This allows investors to diversify their portfolios and potentially reduce risk.

Multiple Account Types: FX Farms provides five account types with varying minimum deposits, features, and potential returns. This satisfies different investor needs and risk tolerances, allowing beginners to start small and experienced investors to access potentially higher returns.

Competitive Daily Returns and Referral Bonuses: The advertised daily returns for their accounts range from 2.0% to 4.15%, which are higher than what some traditional investment options offer. Additionally, they provide referral bonuses for attracting new investors.

Transparent Fee Structure with No Hidden Charges: FX Farms claims no hidden charges, maintenance fees, or withdrawal fees. This can be appealing to investors who want to understand the full cost of investing.

Comprehensive Educational Resources: FX Farms offers educational resources like ebooks, videos, and webinars to equip traders of all levels. This can be helpful for beginners who want to learn more about investing before putting their money at risk.

Cons:

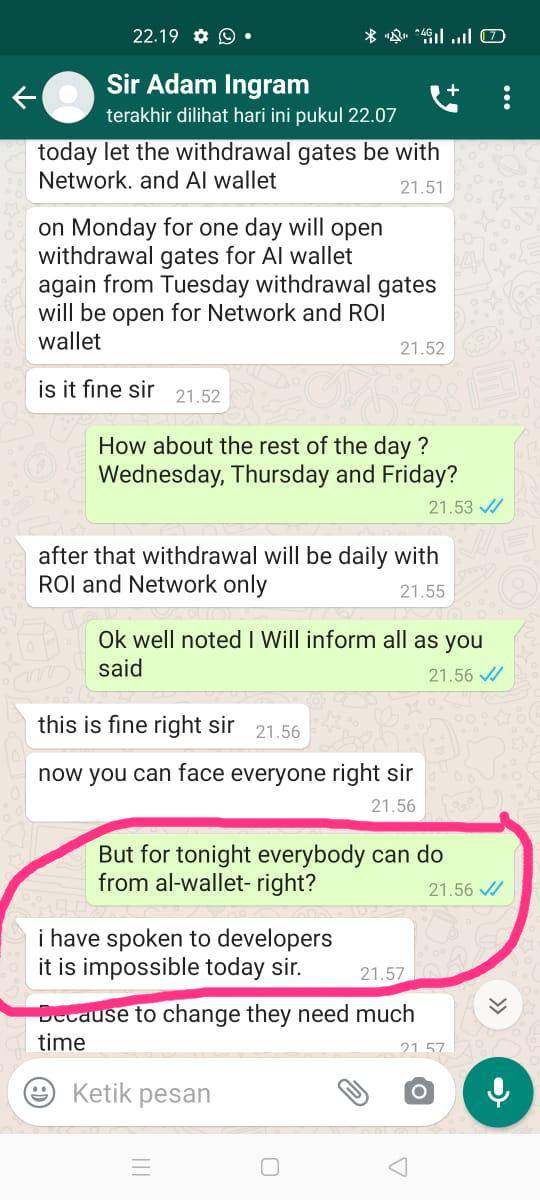

Lack of Regulation: A major concern is the lack of information regarding any regulatory licenses held by FX Farms. Regulation helps protect investors by ensuring brokers adhere to certain standards and guidelines. Without regulatory oversight, there's an increased risk of fraud and a lack of established dispute resolution processes.

Limited Deposit and Withdrawal Options: The information currently available suggests FX Farms only accepts deposits and withdrawals through Bitcoin wallets. This will limit some investors who prefer using traditional payment methods.

No Demo Accounts Available: Demo accounts allow potential investors to practice trading with virtual funds before committing real money. The absence of demo accounts at FX Farms makes it difficult to assess their platform's functionality and suitability for your trading style.

Limited Customer Support Options: Currently, their customer support seems limited to email communication. This is not ideal for investors who prefer phone support or live chat options for faster resolution of inquiries.

Regulatory Status

FX Farms operates without regulated licenses. As such, it's important to note that the company does not fall under the oversight or regulation of any financial regulatory authority. While this lack of regulation provides flexibility.

Market Instruments

FX-Farms offers a variety of investment products across different asset classes:

In agriculture, they focus on empowering existing farmers, leveraging their expertise and dedication for profitable returns.

Their real estate ventures involve strategic partnerships with seasoned developers, targeting properties in high-growth areas to enhance neighborhood values.

In cryptocurrency trading, they capitalize on the booming market, facilitating trades in bitcoin and altcoins for potential high returns.

Retirement income solutions satisfy both employers and employees, offering stability and flexibility in defined contribution retirement plans.

In forex trading, they tap into the world's largest and most liquid market, providing access to global trading centers for informed investment decisions.

Lastly, in oil and gas, they prioritize transparency, offering investors access to critical information and educational resources to navigate the complexities of the industry effectively.

Account Types

FX Farms offers five investment account types with varying minimum deposits, maximum deposits, daily returns, and features.

Base:

This is the entry-level account with a minimum deposit of $200 and a maximum of $5,000. It offers a daily return of 2.0% and a referral bonus of 7%. The arbitrage duration is 7 days, and interest does not compound. This account is suitable for beginners and private investors.

Trader:

This account requires a minimum deposit of $5,001 and offers a slightly higher daily return of 2.25% with the same 7% referral bonus as the Base account. Similar to Base, the arbitrage duration is 7 days, and interest does not compound. This account is also suited for private investors and expands to entrepreneurs.

Lead:

This is the first tier that offers compounding interest. With a minimum deposit of $10,001 and a maximum of $25,000, it boasts a daily return of 2.50% and an increased referral bonus of 8%. The arbitrage duration extends to 10 days. This account is geared towards wealth managers due to its focus on low-frequency algorithmic trading strategies.

Eagle:

This account satisfies a wider audience, including private investors, entrepreneurs, and portfolio managers. It requires a minimum deposit of $25,100 and offers the highest daily return among non-President accounts at 3.50%. The referral bonus remains at 10%, and the arbitrage duration increases significantly to 21 days with compounding interest. Investors also gain access to a dedicated financial consultant for portfolio building managed by third-party professionals.

President:

The top-tier President account has no upper limit on investment amounts and offers the highest daily return of 4.15%. It comes with a 10% referral bonus and the longest arbitrage duration of 45 days with compounding interest. Similar to the Eagle account, clients receive a dedicated financial consultant and access to third-party portfolio management services. This account is suitable for private investors, institutional investors, portfolio managers, and entrepreneurs.

How to Open an Account?

Here's a breakdown of how to open an FX Farms account:

Visit the FX Farms Website: The first step is to navigate to the FX Farms website (https://fx-farms.com/en/index.php). They have a registration button on the main page.

Complete the Registration Form: Clicking the register button should lead you to a registration form. Fill out this form accurately, ensuring all required fields are completed.

Choose an Investment Plan: Once your registration is complete, explore the available investment plans (Base, Trader, Lead, Eagle, President). Select the plan that best suits your investment goals and risk tolerance. Consider factors like minimum deposit, daily return, and features like compounding interest and arbitrage duration.

Fund Your Account: After selecting your plan, you'll need to fund your new FX Farms account. Their website should outline the accepted deposit methods.

Start Earning Returns: With your account funded, you can begin earning daily returns based on your chosen plan.

Spreads & Commissions

At FX Farms, trading commissions apply to additional packages beyond our standard plans and are borne by investors at a rate of 20%.

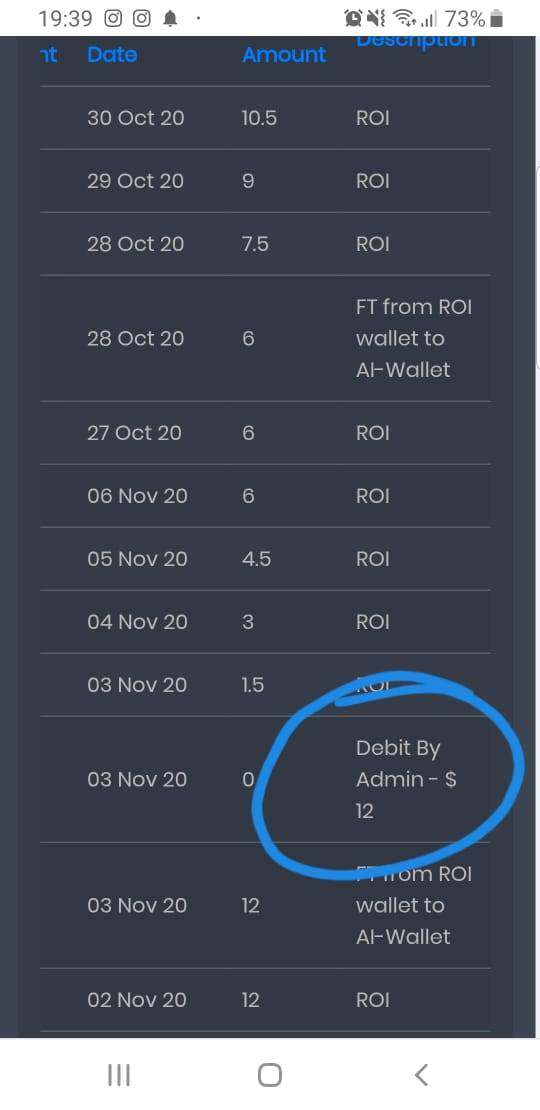

Deposit & Withdrawal

FX Farms prioritizes transparency and efficiency in its payment methods and fees. There are no hidden charges, maintenance fees, or withdrawal fees, aligning with the company's commitment to transparency and integrity. Investors can expect instant funding, with all funding options, including deposits and payouts, processed swiftly to minimize delays and enable quick transaction closure.

Additionally, FX Farms facilitates transactions through Bitcoin wallets, providing investors with a secure and convenient payment method that supports fast.

Customer Support

FX Farms provides robust customer support via email at support@fx-farms.com, ensuring assistance is available around the clock, 24/7, to address any queries or concerns.

Educational Resources

Fx-farms offers a comprehensive educational system to equip traders of all levels. They provide ebooks, videos, and webinars covering various topics needed for successful trading. This includes market reviews, economic calendars, and news updates, all designed to help you make informed investment decisions.

Conclusion

FX Farms offers a tempting array of investment options across various asset classes and boasts features like transparency and educational resources. However, the lack of regulatory oversight presents a significant risk. While the advertised returns and account features are attractive, the limited information on crucial aspects like fees, leverage, and deposit methods raises concerns. Carefully consider the potential drawbacks alongside the advertised benefits before investing with FX Farms.

FAQs

Question: What investment options does FX Farms offer?

Answer: FX Farms offers a diverse range of investment products, including agriculture, real estate, cryptocurrency, retirement income plans, forex trading, and even oil & gas.

Question: Are there different account types available?

Answer: Yes, FX Farms provides five account tiers (Base, Trader, Lead, Eagle, President) with varying minimum deposits, features, and potential returns.

Question: How much do I need to start investing with FX Farms?

Answer: The minimum deposit for an FX Farms account is $200 for their Base tier.

Question: Are there any hidden fees with FX Farms?

Answer: FX Farms claims to have no hidden charges, maintenance fees, or withdrawal fees.

Question: Does FX Farms offer any educational resources?

Answer: FX Farms provides educational resources like ebooks, videos, and webinars to help investors of all experience levels.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now