Score

Sunton Capital

China|2-5 years|

China|2-5 years| https://www.suntonfx.top/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

China

ChinaUsers who viewed Sunton Capital also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

suntonfx.top

Server Location

United States

Website Domain Name

suntonfx.top

Server IP

198.44.228.91

Company Summary

| Aspect | Information |

| Company Name | Sunton Capital |

| Registered Country/Area | China |

| Founded Year | 2016 |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:500 |

| Spreads | Variable |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Tradable Assets | Forex, CFDs on stocks, indices, commodities, and cryptocurrencies |

| Account Types | Standard, ECN, VIP |

| Demo Account | Yes |

| Customer Support | 24/5 Live Chat, Email, Phone |

| Deposit & Withdrawal | Credit/debit cards, e-wallets, bank transfers |

| Educational Resources | Limited |

Overview of Sunton Capital

Sunton Capital is a forex and CFD broker founded in 2016 and registered in China. Despite their claims, they do not hold any regulatory licenses from recognized financial authorities, making them an unregulated broker. This lack of regulation presents significant risks for potential clients, including increased fraud risk, no protection of client funds, and limited recourse in case of disputes.

Sunton Capital offers trading on a variety of assets, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies. They provide access to the popular MetaTrader 4 and MetaTrader 5 platforms, and the minimum deposit requirement is $100. While they offer a demo account, customer support, and various deposit and withdrawal methods, their educational resources are limited.

Regulatory Status

Sunton Capital does not hold any regulatory licenses from any recognized financial authority. This means that their activities are not overseen by any government agency, and they are not subject to any financial regulations.

While Sunton Capital claims to have a “financial license,” this is most likely a reference to their incorporation in Saint Vincent and the Grenadines. Incorporation does not grant any financial authority or regulatory oversight.

Pros and Cons

| Pros | Cons |

| Low minimum deposit ($100) | Unregulated |

| Access to popular trading platforms (MT4, MT5) | Limited educational resources |

| Demo account available | High maximum leverage (1:500) |

| 24/5 customer support | Variable spreads |

| Multiple deposit and withdrawal methods | No segregated client accounts |

Pros:

Low minimum deposit ($100): This makes Sunton Capital accessible to traders with limited capital.

Access to popular trading platforms (MT4, MT5): MetaTrader 4 and MetaTrader 5 are widely used and trusted platforms, offering a familiar and user-friendly trading experience.

Demo account available: This allows traders to practice their trading strategies and familiarize themselves with the platform before risking real money.

24/5 customer support: Sunton Capital offers customer support via live chat, email, and phone, ensuring that traders can get help when needed.

Multiple deposit and withdrawal methods: Sunton Capital provides various convenient methods for depositing and withdrawing funds, including credit/debit cards, e-wallets, and bank transfers.

Cons:

Unregulated: This is a major concern, as unregulated brokers are not subject to any financial oversight and pose significant risks for investors.

Limited educational resources: Sunton Capital does not offer a comprehensive selection of educational resources, which may be a disadvantage for new or inexperienced traders.

High maximum leverage (1:500): This can lead to significant losses if used improperly, especially by inexperienced traders.

Variable spreads: This can make it difficult for traders to predict their trading costs accurately.

No segregated client accounts: This means that client funds are not kept separate from the broker's own funds, increasing the risk of loss if the broker becomes insolvent.

Market Instruments

While Sunton Capital primarily focuses on two main product categories - forex and CFDs, their offerings delve deeper into various sub-products within each category. Let's explore each in detail:

Forex Trading:

Currency Pairs: Sunton Capital provides access to major, minor, and exotic currency pairs, allowing traders to speculate on exchange rate movements.

Trading Options: They offer various order types, including market orders, limit orders, stop orders, and trailing stops, allowing traders to execute their trading strategies effectively.

CFDs:

Underlying Assets: Sunton Capital offers CFDs on various underlying assets, including:

Stocks: Trade shares of publicly traded companies from various global markets.

Indices: Gain exposure to stock market performance through major indices like S&P 500, FTSE 100, etc.

Commodities: Speculate on the price movements of commodities like gold, silver, oil, and natural gas.

Cryptocurrencies: Trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Overall, Sunton Capital offers a diverse range of products for forex and CFD trading. However, it's crucial to remember that their lack of regulation poses significant risks, and investors should carefully consider these risks before trading with Sunton Capital.

Account Types

Sunton Capital offers three different account types to cater to varying trading needs and experience levels:

Standard Account:

This account is suitable for beginners and less experienced traders. It features a minimum deposit of $100, access to all tradable assets, and variable spreads. While leverage up to 1:500 is available, it's recommended to use caution with high leverage, especially for beginners. Customer support is readily available to assist with any questions or issues.

ECN Account:

Designed for experienced traders seeking tighter spreads and faster execution speeds, the ECN account offers direct market access (DMA), allowing you to trade at the best available market prices. A minimum deposit of $5,000 is required, and commissions are charged per trade. This account type provides a more professional trading environment suitable for active traders.

VIP Account:

Sunton Capital offers exclusive VIP accounts for high-volume traders with significant capital. These accounts offer personalized services, dedicated account managers, access to exclusive trading signals and analysis, and potentially even better spreads and commissions. The specific benefits and requirements for VIP accounts are not publicly disclosed and require individual inquiries with Sunton Capital.

| Feature | Standard Account | ECN Account | VIP Account |

| Minimum deposit | $100 | $5,000 | N/A (by invitation) |

| 24/7 Live video chat support | Yes | Yes | Yes |

| Withdrawals | Processing time within 2 business days | Processing time within 1 business day | Priority processing and personalized support |

| Demo account | Yes | Yes | Yes |

| Copy Trading tool | Yes | Yes | Yes |

| Bonus | Welcome bonus up to 50% | N/A | Customized bonus offers |

| Other features | Variable spreads | Direct market access (DMA), tighter spreads, commissions per trade | Personalized services, dedicated account manager, exclusive trading signals and analysis |

How to Open an Account?

Visit the Sunton Capital website and click on the “Open Account” button.

Choose the account type that best suits your needs and trading experience.

Fill out the online application form with your personal information, including your full name, email address, phone number, and proof of identity.

Verify your identity by uploading the required documents, such as a passport or government-issued ID.

Fund your account using one of the available deposit methods, such as credit/debit cards, e-wallets, or bank transfers.

Download and install the MetaTrader 4 or MetaTrader 5 trading platform.

Log in to your account and start trading!

Leverage

Sunton Capital offers a maximum leverage of 1:500 for both forex and CFD trading. This means that for every $1 you deposit, you can control a position worth up to $500.

While high leverage can amplify potential profits, it also significantly magnifies potential losses. This makes it a highly risky option, especially for inexperienced traders.

Therefore, it's crucial to understand the risks associated with high leverage and use it cautiously. Only experienced traders who fully understand the risks and have implemented proper risk management strategies should consider using high leverage.

Sunton Capital Leverage Table

| Asset | Maximum Leverage |

| Forex | 1:500 |

| CFDs on Stocks | 1:500 |

| CFDs on Indices | 1:500 |

| CFDs on Commodities | 1:500 |

| CFDs on Cryptocurrencies | 1:500 |

Spreads & Commissions

Spreads:

Forex: The average spread for major forex pairs is around 1.5 pips, while exotic pairs may have wider spreads of 5 pips or more.

CFDs: Spreads for CFDs vary depending on the underlying asset. For example, the spread for CFDs on stocks may be 0.1%, while the spread for CFDs on cryptocurrencies may be 3%.

Commissions:

Standard and ECN Accounts: These accounts do not charge any commissions.

VIP Accounts: Commissions are charged per trade and may be negotiated based on your trading volume.

| Account Type | Asset | Spread | Commission |

| Standard | Forex (Major Pairs) | 1.5 pips | no |

| Standard | Forex (Exotic Pairs) | 5 pips | no |

| Standard | CFDs (Stocks) | 0.10% | no |

| Standard | CFDs (Crypto) | 3% | no |

| ECN | Forex (All Pairs) | Variable | no |

| ECN | CFDs (All) | Variable | no |

| VIP | All | Variable | Negotiable |

Trading Platform

Sunton Capital offers two popular trading platforms for accessing their various financial instruments:

MetaTrader 4 (MT4):

Widely used and trusted: MT4 is a well-established platform used by millions of traders worldwide, making it a familiar and user-friendly option for both beginners and experienced traders.

Charting and technical analysis tools: MT4 offers extensive charting capabilities with various indicators and drawing tools for technical analysis, allowing users to identify trading opportunities and make informed decisions.

Automated trading: MT4 supports automated trading through Expert Advisors (EAs), which are custom-built algorithms that execute trades based on predetermined rules.

Mobile trading: MT4 is available as a mobile app for iOS and Android devices, allowing traders to monitor their positions and execute trades on the go.

MetaTrader 5 (MT5):

More advanced features: MT5 builds upon the foundation of MT4 and offers additional features, including a built-in market depth window, improved charting capabilities, and support for more complex order types.

Faster processing and execution: MT5 boasts faster processing speeds and trade execution compared to MT4, making it suitable for high-frequency trading.

Additional asset classes: MT5 supports a wider range of asset classes than MT4, including futures and options contracts.

Both MT4 and MT5 offer a range of features that cater to different trading styles and needs. Ultimately, the choice between the two platforms depends on your individual preferences and trading experience.

Deposit & Withdrawal

Sunton Capital offers various payment methods for depositing and withdrawing funds, but it's important to note that fees may apply.

Deposit Methods:

Credit/Debit Cards: Deposits are processed instantly and may incur a processing fee of 2-3%.

E-wallets: Deposits are processed quickly and generally free of charge. Supported e-wallets include Skrill, Neteller, and WebMoney.

Bank Transfers: Deposits may take several business days to process and may incur a wire transfer fee ranging from $15 to $50.

Withdrawal Methods:

Credit/Debit Cards: Withdrawals can be processed within 2-5 business days and may incur a processing fee similar to deposits.

E-wallets: Withdrawals are usually processed within 1 business day and are generally free of charge.

Bank Transfers: Withdrawals can take several business days to process and may incur a wire transfer fee.

Additional Fees:

Inactivity Fees: Sunton Capital charges an inactivity fee of $10 per month if an account is inactive for more than 3 months.

Account Closure Fees: A fee of $25 may be charged for closing an account.

| Payment Method | Deposit | Withdrawal | Possible Additional Fees |

| Credit/Debit Cards | Instant, 2-3% processing fee | 2-5 business days, possible fees | $25 Account closure fee |

| E-wallets (Skrill, Neteller, WebMoney) | Fast, Free | Within 1 business day, Free | $10/month Inactivity fee |

| Bank Transfers | Several business days, 15−15−50 fee | Several business days, possible fees |

Customer Support

Sunton Capital offers customer support through various channels:

24/5 Live Chat: Available directly on their website for immediate assistance with queries and troubleshooting.

Email: Submit your inquiry through their email address for detailed and non-urgent issues.

Phone: Contact their support hotline for direct interaction with customer service representatives.

Overall, Sunton Capital provides customer support through various channels, including 24/5 live chat, email, and phone. However, their customer support may not be as reliable and responsive as regulated brokers due to potential limitations in resources and infrastructure.

Educational Resources

Sunton Capital provides a limited selection of educational resources compared to many other brokers. Their offerings primarily consist of:

FAQ Section: A comprehensive list of frequently asked questions and answers covering basic trading concepts, account management, and platform features.

Blog Articles: Occasional blog posts discussing general market trends, trading strategies, and financial news.

Video Tutorials: A limited number of video tutorials demonstrating basic platform functionalities and trading order types.

Conclusion

While Sunton Capital offers a variety of trading instruments, popular platforms, and customer support channels, their lack of regulation presents significant risks for investors. Concerns regarding fraud, limited recourse in case of disputes, and potential fund loss outweigh the potential benefits of variable spreads, low minimum deposit, and demo accounts. Choosing a regulated broker with a proven track record provides a safer and more reliable trading environment, even if it comes with higher fees or limited platform options. Ultimately, prioritizing safety and security should outweigh any potential short-term benefits offered by unregulated brokers like Sunton Capital.

FAQs

Q: Is Sunton Capital regulated?

A: No, Sunton Capital is not regulated by any major financial regulatory body. This raises concerns about the company's legitimacy and the safety of your funds.

Q: Are my funds safe with Sunton Capital?

A: Due to their lack of regulation, the safety of your funds with Sunton Capital cannot be guaranteed. There is no regulatory oversight to protect your interests in case of disputes or company insolvency.

Q: What trading platforms does Sunton Capital offer?

A: Sunton Captial offers both MetaTrader 4 and MetaTrader 5, which are popular and widely used trading platforms.

Q: What are the minimum deposit and withdrawal amounts?

A: The minimum deposit for a Standard account is $100. The minimum withdrawal amount depends on the chosen payment method.

Q: Does Sunton Capital offer educational resources?

A: Sunton Capital offers a limited selection of educational resources, including a FAQ section, blog articles, and some video tutorials. However, these resources may not be sufficient for comprehensive learning about trading.

Q: What are the fees associated with trading with Sunton Capital?

A: Sunton Capital charges variable spreads and commissions depending on the asset and account type. Additionally, fees are charged for deposits and withdrawals.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 24

Content you want to comment

Please enter...

Review 24

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Killy Killy

Taiwan

I paid lots of money. Is there any way to solve it please? I paid lots of money.

Exposure

2022-01-11

Spike61682

Hong Kong

I made profits by normal way but could not withdraw. The platform did not explain it. Please help.

Exposure

2021-11-02

crystals

Japan

He was a businessman from Hong Kong named as Zhao Ziyang or Zhang Haoyu as the picture showed. He cheated of 300,000 yuan with romance scam. He refused to take video call because he was afraid of being cheated. He introduced the customer service. Now the account and the platform was disabled. At first, small withdrawal could be made. He continued to cheated me and persuaded me to deposit more. Then he and the platform disappeared.

Exposure

2021-10-20

william sugiarto

Indonesia

Can't Withdraw , they Take your money With manipulate price... scam

Exposure

2021-10-19

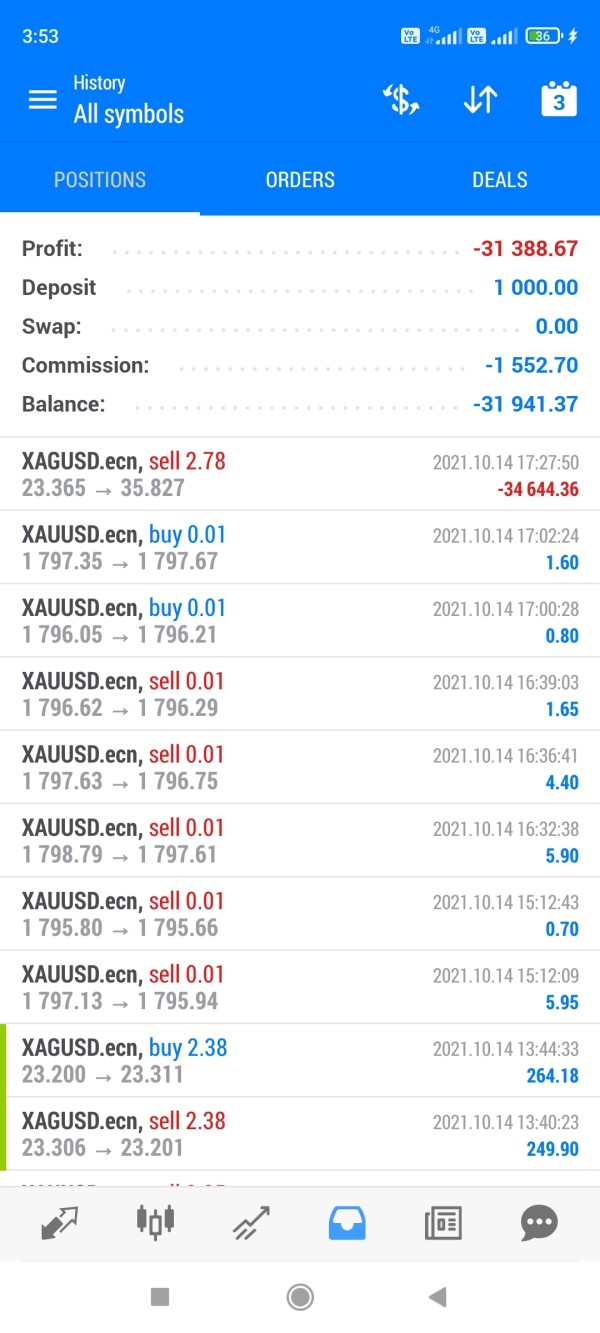

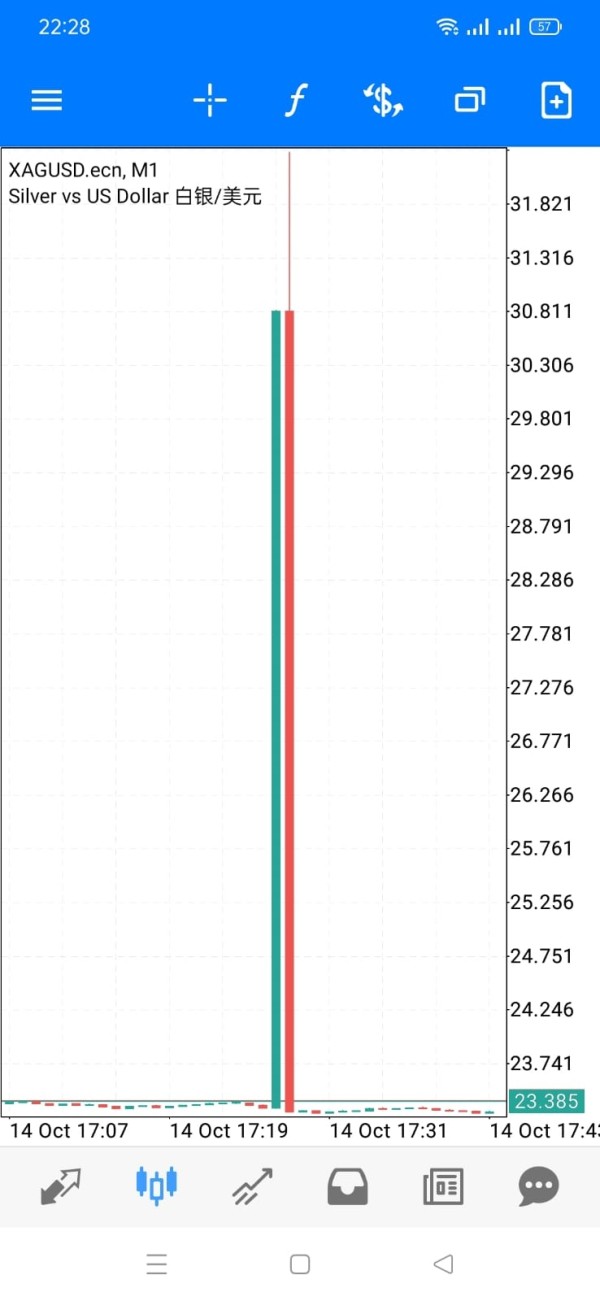

FX2501471542

Indonesia

All the users of membership lost a lot according to the fake candle charts. The left credit was unable to withdraw. Stay away from it.

Exposure

2021-10-16

Abe Tan

Malaysia

A large number of us being scammed by this scammer before under their name of Sunton Capital. I’m not sure why they’re able to switch a name and on MT5 within just a short time. please be aware and help to report this scammer!

Exposure

2021-10-16

FX3794464852

Hong Kong

Fraud platform. He cheated you with many scams and persuaded you to deposit. But you were unable to withdraw.

Exposure

2021-09-22

FX3794464852

Hong Kong

A man called Zhang Haowu led me to deposit on sunton capital with trading information. But I was unable to withdraw. Beware.

Exposure

2021-09-21

Kyle Loh

Malaysia

i start trading at last month , its easy to get profit but when it come to withdraw it always pending!

Exposure

2021-09-16

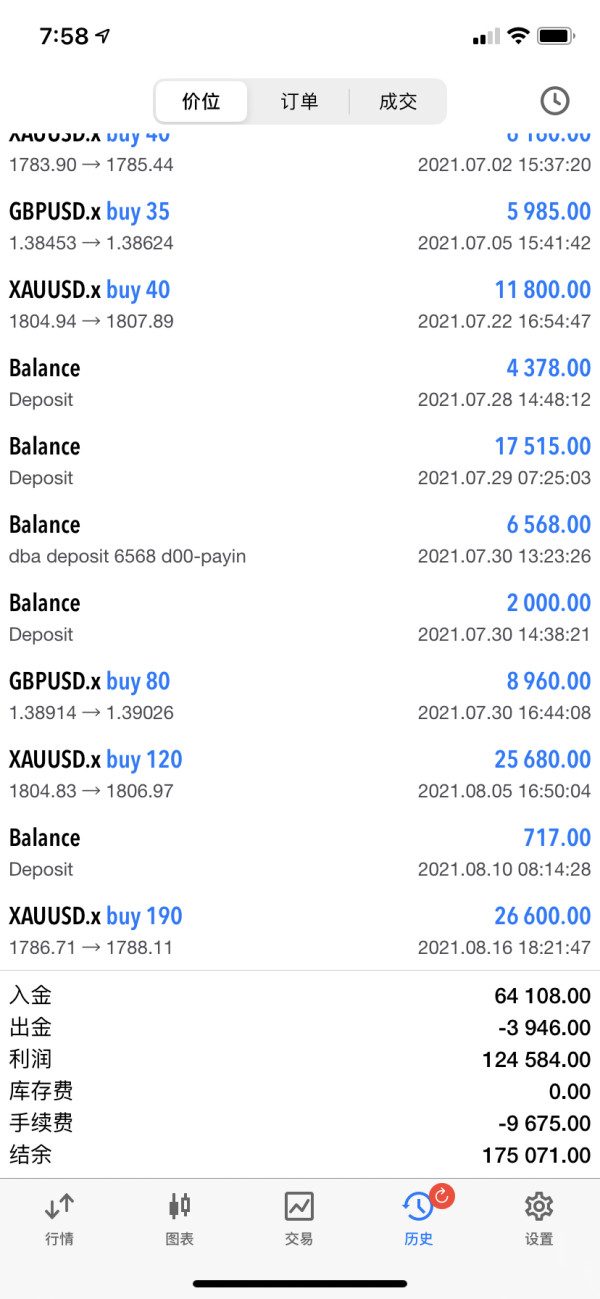

FX2046354843

Philippines

Sunton Capital (SuntonFX) contacts victims on dating websites and lures potential investors to WhatsApp where they are convinced to make investments. Like many other scam brokers, this company is not registered or regulated by any Securities Commission and once a deposit is made investors are asked to pay taxes and other fees to make a withdraw. Victims are given excuse after excuse for why a withdraw cannot be made and eventually are stuck with all investments lost. The scammers running this website have a long history of other scam websites including Jinlong, AF Index, Rich Fund Tech Group, Furion Global and several others (see the chart below). This is a WARNING not to do any business with this company or you will lose any money sent to them.

Exposure

2021-09-15

SAMUEL OLUWASEYI PAUL9121

Nigeria

I was introduced to this app by a friend, I was told this app can be Trusted and reliable without me knowing all was not true, unfortunately I was told to deposit some safemoon coin to the wallet address I was given, and since then they never reply my messages again, they just vanished, pls beware of scammers!!!

Exposure

2021-09-11

Rey

Philippines

This trader is unwilling to let me get my money back. If you want to withdraw, you have to pay them more. My 2100$ has not been returned to my wallet yet, and now I have been told that it is not over yet. I gave up.

Exposure

2021-09-08

黄先生-Winson

Hong Kong

The company was a scammer. It said I could withdraw on July 25 but ran away now. No reply from the customer service.

Exposure

2021-07-27

FX2945402140

Thailand

It was of no transparency and disappeared silently.

Exposure

2021-07-26

FFXXX60067

Japan

I added a man on Weibo, who claims to be from Sichuan doing real estate investment in Hong Kong. He said that his stepdad had a position in the bank and had a lot of inside information, and from time to time he revealed how handsome he is. He said that his ex-wife threw the child downstairs to death during the video with him because of drug abuse. Because there was a shadow in his heart, he refused my video and audio calls, and went into a rage whenever I mentioned the video. At the beginning, he pretended to fall in love with me and then induced me to log in and register on this platform. He even asked me to deposit. After that, I had to log in and make a deposit every day. As long as I didn't follow his request, he would furiously yell at me. His impatient appearance reminded me so that I was not fooled. I hope everyone will pay more attention not to be deceived.

Exposure

2021-07-25

FX4286811490

Japan

Unable to with draw and Scam

Exposure

2021-07-24

FX2234522019

Indonesia

Already profit. And want to withdraw. Then suddenly they banned ur account

Exposure

2021-07-14

FX1988713678

Indonesia

i try to WD myfunds,but the sunton said it cant be WD. i have yo inject fund 50.000 US if me and other member wanna WD. And i've tried to WD, and untill now, it cant be. please help me. Thanks

Exposure

2021-07-05

FX2288837766

Indonesia

Everything went smoothly at first, and the recharge or withdrawal went smoothly. I want to withdraw until June 28, 2021, but I can’t. CS explained that I had no transaction before, and I had to withdraw the transaction the night before. Finally, I traded on the evening of June 29, 2021.

Exposure

2021-07-01

FX3832329968

Indonesia

I think I was cheated. I have money from this broker, but I can’t withdraw it. I was forced to increase my balance, if I want to withdraw money. I tell you to stop the activity. By the way, if I think There is a problem with the event, I must be able to enter 50,000 USD to stop the event

Exposure

2021-06-30