Score

COPYFX

Cyprus|5-10 years|

Cyprus|5-10 years| https://www.copyfx.com/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

Germany 6.83

Germany 6.83Contact

Single Core

1G

40G

1M*ADSL

- The claimed BelizeFSC regulation (license number: IFSC/60/271/TS/17) is verified as a clone firm. Please pay attention to the risk!

Basic information

Cyprus

CyprusUsers who viewed COPYFX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Russia

Iran

copyfx.com

Server Location

United States

Most visited countries/areas

Iran

Website Domain Name

copyfx.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2010-08-09

Server IP

104.28.24.78

Company Summary

| Aspect | Information |

| Registered Country/Area | Cyprus |

| Founded year | 2014 |

| Company Name | RoboForex Ltd. |

| Regulation | Not Regulated |

| Spreads | Floating spreads from 0 pips |

| Trading Platforms | MetaTrader 4, MetaTrader 5, and R Trader |

| Customer Support | 24/7 customer support via email, phone, and live chat |

| Fees and Commissions | Performance fee, volume fee, and no commission options |

| Account Types | Prime, ECN, ProCent, Pro, Cent Affiliate, Pro-Affiliate and ECN Affiliate |

| Investments | CopyFX investment system and MQL5 Signals |

| Market Instruments | Not Specified |

Overview of CopyFX

CopyFX is a trading platform that offers forex copy trading services to investors and traders. The platform is operated by RoboForex Ltd, a company that is regulated by the Financial Services Commission of Belize (FSC). The platform provides its clients with access to seven different account types, including Prime, ECN, ProCent, Pro, Cent Affiliate, Pro-Affiliate, and ECN Affiliate, which require a minimum initial deposit amount of $100.

CopyFX offers clients the ability to trade on the popular MetaTrader4 and MetaTrader5 platforms, which are known for their stability, trustworthiness, and advanced trading tools. The platforms enable clients to use Expert Advisors, Algo trading, Complex indicators, and Strategy testers. Additionally, the MetaTrader marketplace has over 10,000 trading apps that traders can use to improve their performance.

CopyFX's customer support team is available 24/7 via telephone, email, live chat, and social media platforms, including Twitter, Facebook, Instagram, and YouTube. The company's website contains a risk warning that alerts clients to the high level of risk involved in trading leveraged products such as Forex/CFDs, and advises them not to trade more than they can afford to lose.

Overall, CopyFX provides clients with a convenient, practical, and transparent trading experience. The platform enables clients to choose successful traders and copy trades from their accounts, while providing them with advanced trading tools and access to customer support. However, clients should be aware of the risks involved in trading and should only invest money that they can afford to lose

Pros and Cons

| Pros | Cons |

| Easy to use: CopyFX's copy trading feature makes it easy for beginners to start trading forex by following the trades of experienced traders. | Risky: Trading leveraged products such as forex and CFDs carries a high level of risk, and clients can potentially lose more than their initial investment. |

| Wide range of account types: CopyFX offers seven different account types, allowing clients to choose the one that best fits their trading needs. | Limited market instruments: There is no clear information available about the range of financial instruments that CopyFX offers for trading. |

| Advanced trading tools: CopyFX's integration with the MetaTrader4 and MetaTrader5 platforms provides traders with access to advanced trading tools such as Expert Advisors and strategy testers. | No regulation in major jurisdictions: CopyFX is registered in Belize, which may not be as stringent in its regulatory oversight as other major jurisdictions such as the UK or US. |

| Customer support: CopyFX offers 24/7 customer support via phone, email, and live chat. | Limited educational resources: The platform does not provide as many educational resources as some other forex brokers, which may make it harder for beginners to learn how to trade effectively. |

| Transparency: CopyFX's commission structure is transparent, and traders can choose whether to receive a fixed commission per profitable transaction or a percentage of the investor's total profit. | No trading bonuses: CopyFX does not offer trading bonuses or promotions, which may be a drawback for some traders who are looking for incentives to start trading. |

Is CopyFX Legit or Scam?

Based on the information provided, CopyFX claims to be regulated by the Belize Financial Services Commission (license number: IFSC/60/271/TS/17) and the Cyprus Securities and Exchange Commission (license number: 191/13). However, it is important to note that there are suspicious indications suggesting that CopyFX could be a clone firm. The regulatory status and validity of these licenses are questionable.

It is advisable to exercise caution when dealing with entities that have suspicious regulatory information or clone firm warnings. It is recommended to conduct thorough research and due diligence before engaging in any financial activities with CopyFX or any other similar entity. Verifying the authenticity of regulatory licenses and seeking information from reputable financial regulatory authorities is crucial to ensure the legitimacy and regulatory compliance of a company.

Account Types

CopyFX offers seven different live trading accounts to its clients. Here is a brief introduction to each account type:

1. Prime: The Prime account is designed for experienced traders who want to benefit from CopyFX's social trading platform. It offers access to all market instruments and allows traders to copy trades from other successful traders.

2. ECN: The ECN account is for traders who prefer to trade using the Electronic Communication Network (ECN) model. It offers fast execution and low spreads, but requires a higher minimum deposit than the Prime account.

3. ProCent: The ProCent account is suitable for beginner traders who want to start trading with small amounts. It allows traders to start trading with as little as $10 and offers tight spreads and low commissions.

4. Pro: The Pro account is designed for more experienced traders who prefer fixed spreads and low commissions. It requires a higher minimum deposit than the ProCent account.

5. Cent Affiliate: The Cent Affiliate account is designed for partners who want to earn commissions by referring new clients to CopyFX. It offers a commission of up to 10% on the spreads paid by the referred clients.

6. Pro-Affiliate: The Pro-Affiliate account is similar to the Cent Affiliate account, but is designed for partners who refer clients who trade larger volumes. It offers a commission of up to 50% on the spreads paid by the referred clients.

7. ECN Affiliate: The ECN Affiliate account is designed for partners who refer clients who prefer to trade using the ECN model. It offers a commission of up to 50% on the spreads paid by the referred clients.

Each account type has its own unique features and benefits, and traders can choose the account that best suits their trading style and preferences.

| Account Type | Pros | Cons |

| Prime | Low spreads | High initial deposit requirement |

| ECN | Tight spreads | Commission-based fees |

| ProCent | Lower risk due to smaller trade size | Limited range of trading instruments |

| Pro | No commissions, fixed spreads | High initial deposit requirement |

| Cent Affiliate | Suitable for new traders, lower risk | Limited range of trading instruments |

| Pro-Affiliate | No commissions, fixed spreads, suitable for experienced traders | High initial deposit requirement |

| ECN Affiliate | Suitable for experienced traders, tight spreads | Commission-based fees, high initial deposit requirement |

Trading Platform

CopyFX supports trading on several popular trading platforms, including:

1. MetaTrader 4 (MT4): MT4 is a well-known and widely used trading platform that offers a range of tools and features for technical analysis, automated trading, and customization. Traders and Investors can use the MT4 platform to monitor their accounts, view statistics, and execute trades.

2. MetaTrader 5 (MT5): MT5 is the latest version of the MetaTrader platform and includes advanced features such as an economic calendar, depth of market, and a built-in strategy tester. MT5 also supports the hedging position accounting system, which allows traders to open multiple positions on the same instrument simultaneously.

3. R StocksTrader: R StocksTrader is a mobile trading platform that allows traders to monitor their accounts and execute trades on-the-go. The platform is available for both iOS and Android devices.

In addition to these trading platforms, CopyFX also provides a web-based platform that can be accessed through any modern web browser. The platform allows traders and investors to monitor their accounts, view statistics, and execute trades without the need to download or install any software.

Overall, CopyFX supports a range of trading platforms that cater to the needs of different types of traders and investors. Whether you prefer to trade on a desktop, mobile, or web-based platform, you can find a suitable option on CopyFX.

| Platform | Pros | Cons |

| MetaTrader 4 (MT4) | Widely used and familiar to many traders | Limited functionality compared to newer platforms |

| MetaTrader 5 (MT5) | More advanced features and better performance than MT4 | Less popular among traders than MT4 |

| R StocksTrader | Mobile app allows for trading on-the-go | Limited functionality compared to desktop platforms |

| CopyFX web platform | No need to download and install any software | Limited functionality compared to desktop trading platforms |

Investments

CopyFX is a copy trading investment system that allows Investors to copy the trading transactions of successful Traders, and Traders to receive commission from Investors subscribed to their accounts. The system places no restrictions on the role you may choose in the system, and all traders of Forex market may operate both as Investors and as Traders.

There are several ways of investing in CopyFX, including:

1. CopyFX system: Investors can copy the transactions of successful Traders in the system, and pay them a commission for the total amount of copied transactions made during a particular period of time.

2. MQL5 signals: Investors can subscribe to trading signals from successful Traders, and copy their transactions on their own trading accounts.

3. Open CopyFX account: Traders can open a CopyFX account and attract Investors to their accounts, receiving commission for the transactions copied by the Investors.

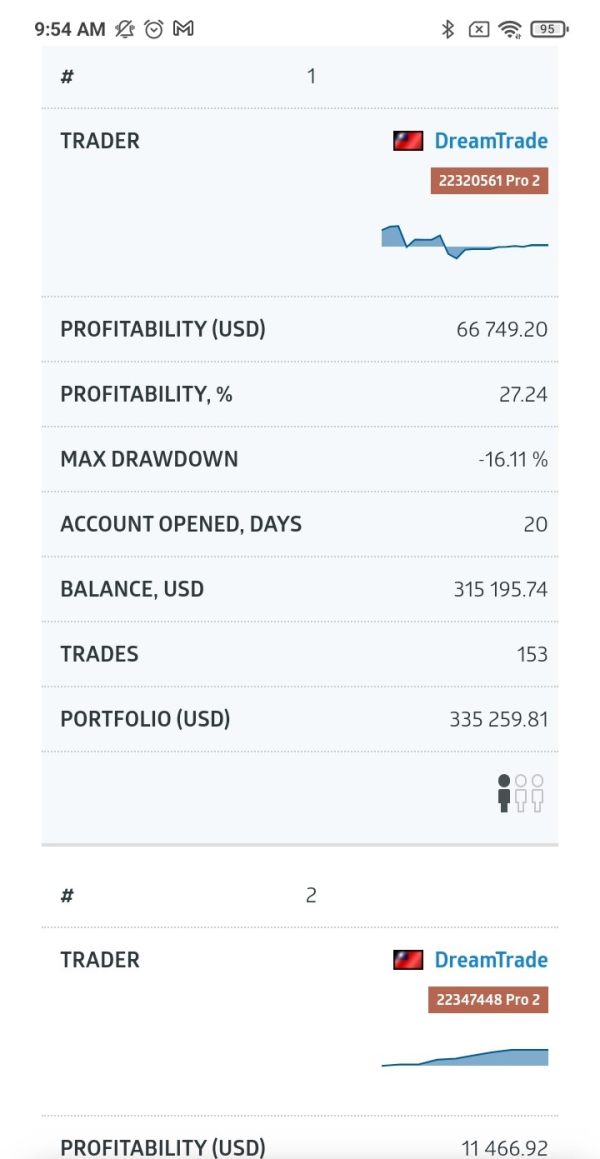

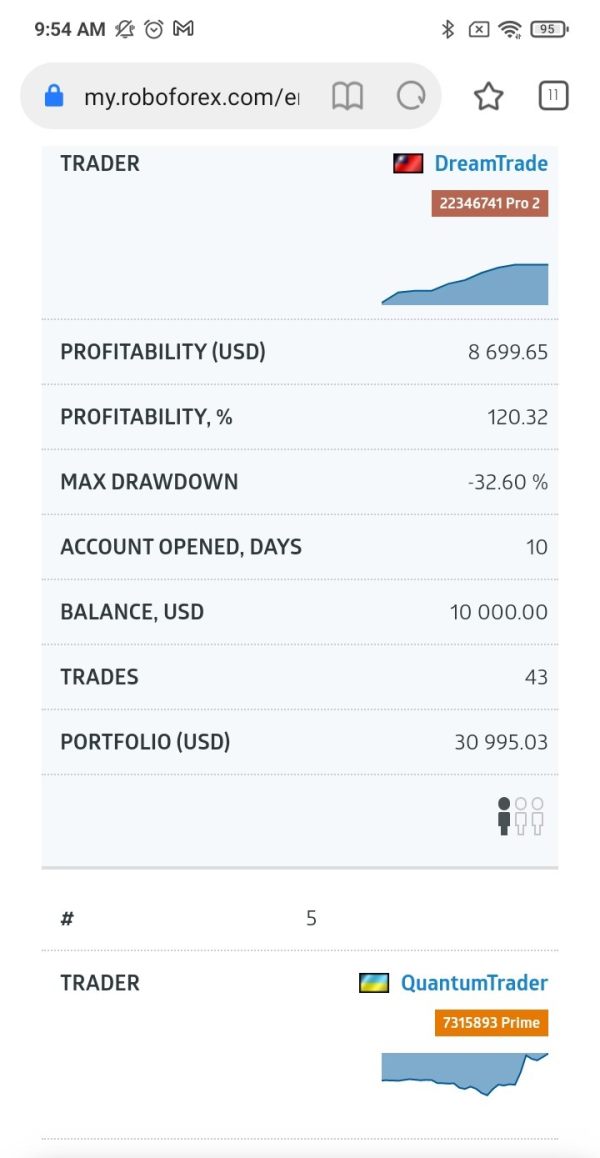

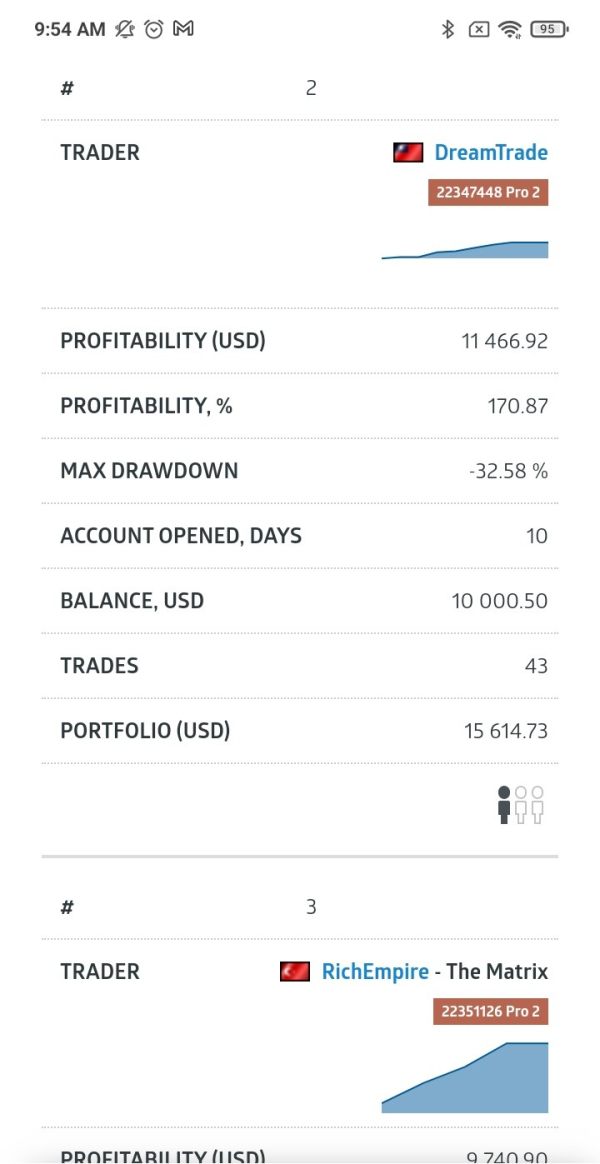

4. Rating Traders: Investors can browse through the rating of successful Traders in the system and select the ones that fit their investment strategy.

CopyFX is profitable for Investors and Traders due to its transparency, cross-copying system, variety of account types, and the ability for Investors to cancel or modify transactions copied from Traders. Additionally, Traders are free to set their own working conditions, and their trading activity is not interfered with from the outside.

| Pros | Cons |

| Access to a variety of successful traders and their strategies | No guarantee of profits, and potential losses |

| Investors can choose to copy only profitable trades | Investors must pay fees and/or commissions to traders |

| Transparency in all transactions for both investors and traders | Copying trades is not a substitute for learning and understanding how the market works |

| Cross-copying feature allows investors to copy trades from different account types | Dependence on the success of individual traders |

| Multiple account types available for different trading strategies and experience levels | Limited to Forex market |

| Investors can cancel or modify copied trades | Limited to MetaTrader 4 and MetaTrader 5 platforms |

| Traders have freedom to set their own commission rates and trading conditions | Trading involves risk and may not be suitable for all investors |

Fees and Commissions

CopyFX charges both Investors and Traders fees for their services. The fees and commissions of CopyFX include:

1. Performance Fee: Traders receive a percentage of the commission from the Investor's total profit. This fee structure encourages Traders to generate profits for their Investors.

2. Volume Fee: Traders receive a fixed commission for each profitable transaction. This fee structure is suitable for Traders who make a large volume of trades.

3. Without Commission: Some Traders do not charge any commission for their services, and in turn, Investors do not pay any commission for copying their trades. This fee structure is suitable for new Traders who want to attract Investors to their accounts.

The fees and commissions charged by Traders are transparent and disclosed on their CopyFX account's conditions. Investors can choose a Trader based on their fee structure and track their performance before investing in their account. CopyFX also offers a rating system that helps Investors find successful Traders with a proven track record of generating profits.

CopyFX customer service is available 24/5 and can be reached through various communication channels, including live chat, email, and phone. The support team is responsive and knowledgeable, providing assistance to Investors and Traders with any questions or issues they may have.

In summary, CopyFX charges various fees and commissions, and the fee structure depends on the Trader's preference. Additionally, the customer service team is available to assist Investors and Traders with any queries.

| Pros | Cons |

| Performance fee allows Traders to earn more profits | High fees for Investors with some Traders |

| Volume fee ensures that Traders are rewarded fairly | Performance fee may lead to overtrading and high risk |

| Fixed commission provides predictable costs for Investors | Volume fee can be costly for high-volume Investors |

| No commissions for new Users may attract more Investors to CopyFX | Fixed commission can limit Traders' earnings potential |

| Fees are transparent and clearly stated | |

| Traders can set their own fees according to their preferences | |

| Different fee structures available for different account types and trading strategies |

Customer Support

CopyFX provides a comprehensive customer service to ensure that their users have a smooth experience with their platform.

Here are some of the customer service features provided by CopyFX:

1. 24/7 Support: CopyFX offers round the clock customer support to its users. You can contact them anytime, and they will get back to you promptly.

2. Live Chat: CopyFX offers a live chat option for instant assistance. This is a convenient way to get quick answers to your questions.

3. Email Support: You can also send an email to the CopyFX support team. They respond to emails within a reasonable time frame.

4. Knowledge Base: CopyFX has a comprehensive knowledge base with frequently asked questions (FAQs) and articles on how to use their platform. You can find answers to most of your questions in this section.

5. Video Tutorials: CopyFX has a collection of video tutorials that help users to understand the platform better. These tutorials cover various topics, including how to use CopyFX as an investor or trader, how to create an account, and how to copy trades.

6. Social Media: CopyFX is active on social media platforms such as Facebook and Twitter. You can follow them to stay updated on the latest news and updates.

Overall, CopyFX provides excellent customer service to its users. They offer multiple channels of communication and have a helpful knowledge base and video tutorials. The only drawback is that their support is only available in English, which may be a challenge for some users who do not speak the language.

Conclusion:

CopyFX is a social trading platform that offers convenience and profitability to traders of all levels. Its advantages include various account types, competitive fees, a wide range of trading instruments, regulation, and reliable customer support. Traders can learn and improve their skills by copying successful traders' trades. However, it's important to note that there are suspicions regarding its regulatory status as a clone firm, which introduces a potential risk. Despite this, CopyFX remains an innovative and valuable platform for those interested in social trading.

1. Q: What is CopyFX?

A: CopyFX is an investment platform that allows traders to copy the trades of successful traders and investors. It offers a range of account types and investment opportunities, as well as advanced trading tools and analysis.

2. Q: Is CopyFX regulated?

A: CopyFX claims to be regulated by the Belize Financial Services Commission (IFSC) and the Cyprus Securities and Exchange Commission (CySEC), but there are suspicions that it may be a clone firm, so its regulatory status is questionable.

3. Q: What is the minimum deposit to open an account with CopyFX?

A: The minimum deposit required to open an account with CopyFX is $100 or equivalent in the account currency.

4. Q: What types of accounts are available on CopyFX?

A: CopyFX offers seven different live trading accounts, including Prime, ECN, ProCent, Pro, Cent Affiliate, Pro-Affiliate, and ECN Affiliate.

5. Q: What fees and commissions does CopyFX charge?

A: CopyFX charges different fees and commissions depending on the account type and trading activity. For example, some accounts may have a performance fee, while others may charge a volume fee or a fixed commission per trade.

6. Q: Does CopyFX offer customer support?

A: Yes, CopyFX offers customer support via email, phone, and live chat. The support team is available 24/5 to assist with any questions or issues.

7. Q: What markets can I trade on CopyFX?

A: CopyFX offers a range of market instruments, including Forex, stocks, commodities, and indices.

8. Q: Can I try CopyFX before investing real money?

A: Yes, CopyFX offers a demo account that allows traders to practice trading and familiarize themselves with the platform before investing real money.

9. Q: Is CopyFX a good investment platform?

A: CopyFX has a range of benefits, including a variety of investment opportunities, advanced trading tools, and reliable customer support. However, like any investment platform, there are risks involved, and it is important to do your research and understand the potential risks before investing.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Regional Brokers

- Clone Firm Belize

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now