简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scam broker FXWinning has been forced to shut down.

Abstract:The forex broker FXWinning recently announced a statement. In this statement, FXWinning claimed it will stop offering services from June 22, 2023.

The forex broker FXWinning recently announced a statement. In this statement, FXWinning claimed it will stop offering services from June 22, 2023. It is said that the platform was forced to shut down due to its lack of regulatory authorization and the loss of MT4/5 permissions.

In a significant development for investor protection, the scam broker FXWinning has been compelled to shut down its operations. The closure comes as authorities and regulatory bodies intensify their efforts to combat fraudulent practices in the financial industry.

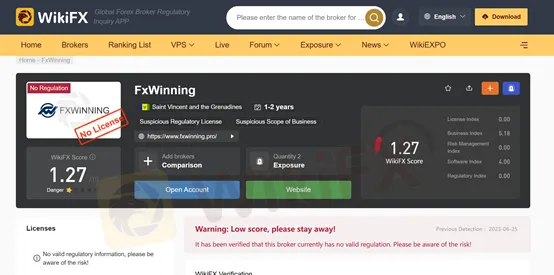

FXWinning on WikiFX

FxWinning is an online forex broker registered in St. Vincent and the Grenadines less than two years ago, and currently under no effective regulation. WikiFX has given this broker a low score of 1.27/10. WikiFX advises you to avoid this broker. It is risky to invest in a broker like FXWinning.

Unveiling the Scam

FXWinning, a previously operating brokerage firm, has come under scrutiny due to multiple reports and complaints from investors regarding suspicious activities and potential fraudulent practices. Authorities, along with concerned regulatory bodies, launched investigations into the operations and business practices of the broker, leading to a string of discoveries that confirmed the existence of fraudulent activities.

In response to the mounting evidence against FXWinning, regulatory authorities stepped up their efforts to protect investors and uphold the integrity of the financial markets. These actions were essential to bring an end to deceptive practices and prevent further harm to unsuspecting individuals. As a result, FXWinning has been forced to shut down.

Implications for Investors

The closure of FXWinning serves as a stern reminder to investors about the importance of due diligence and conducting thorough research before engaging with any brokerage firm. Investors who had accounts with FXWinning may face significant financial losses, as the fraudulent broker may have engaged in activities such as unauthorized withdrawals, misleading investment advice, and manipulation of trading platforms. It is crucial for affected investors to report their grievances to the relevant authorities and seek appropriate legal action to recover their funds, if possible.

The case of FXWinning serves as a cautionary tale, emphasizing the need for investors to remain vigilant and informed. Conducting thorough research, reading reviews, and seeking advice from trusted financial professionals can help identify potential red flags and steer clear of fraudulent brokers. Investor education initiatives should be promoted to enhance awareness of the risks associated with fraudulent schemes and empower investors to make informed decisions.

Importance of Regulatory

The shutdown of FXWinning highlights the crucial role played by regulatory bodies in maintaining the integrity of the financial industry. Through effective monitoring and enforcement of rules and regulations, these bodies strive to protect investors from falling victim to fraudulent schemes. Investors are encouraged to verify the regulatory status of any brokerage firm and ensure they are licensed and authorized by reputable regulatory authorities before entrusting them with their funds.

Conclusion

The closure of scam broker FXWinning is significant in the fight against financial fraud and the protection of investors. The incident serves as a reminder for investors to exercise caution, conduct thorough due diligence, and choose reputable brokers who adhere to regulatory standards. By remaining vigilant and informed, investors can mitigate the risk of falling victim to scams and fraudulent practices, ensuring the safety of their investments. If you invested money in this broker, we advise you to withdraw your money.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

Broker Review: What is FXTM exactly? Is FXTM a Scam?

FXTM is a global forex broker founded in 2011. In today’s article, we are going to show you what FXTM looks like in 2024.

FCA Alerts Traders to New List of Unregulated and Clone Brokers

Protect your investments! Learn about unregulated firms flagged by the FCA and discover how WikiFX helps traders avoid scams and choose legitimate brokers.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator