Score

HSB

Indonesia|5-10 years|

Indonesia|5-10 years| https://www.hsb.co.id/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Indonesia 7.87

Indonesia 7.87Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic information

Indonesia

IndonesiaA Visit to Hanson in Indonesia -- Finding No Office

The survey team went to Jakarta, Indonesia, to visit the the dealer Hanson and found no office at its regulation address. In other words, the given business address might be fake. Please be prudent when trading with this broker.

Indonesia

IndonesiaA Visit to Hanson in Indonesia -- Finding No Office

The survey team went to Jakarta, Indonesia, to visit the the dealer Hanson and found no office at its regulation address. In other words, the given business address might be fake. Please be prudent when trading with this broker.

Indonesia

IndonesiaAccount Information

Users who viewed HSB also viewed..

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Company Summary

| HSB | Basic Information |

| Registered Country/Region | Registered in Indonesia |

| Founded in | N/A |

| Regulation | BAPPEBTI (Regulatory Authority of Indonesia) |

| Market Instruments | Forex, Commodities, Indices, Shares |

| Minimum Deposit | Not Specific |

| Spreads | From 0.5 pips |

| Commissions | $2 (Deposit $100), $1 ( Deposit $1000), $1 (Deposit $200) |

| Trading Platforms | MetaTrader 5 (MT5),Webtrader, Mobile/Tablet App |

| Account Types | A demo account and a live account |

| Customer Support | Live Chat, Email, and Phone, Social Medias |

| Educational Resources | HSB Academy, Research |

| Bonuses | Offered |

| Offcial Website | https://www.hsb.co.id/ |

*Please note that the information provided is subject to change and it is recommended to visit the official website of HSB for the most up-to-date and accurate details.

Overview of HSB

HSB is a forex broker registered in Indonesia and regulated by BAPPEBTI, the regulatory authority in the country. HSB boasts an extensive range of financial instruments, empowering traders to navigate the dynamic global markets. This encompasses a diverse selection of major and exotic currency pairs, commodities, indices, and precious metals.

Traders on HSB can utilize different trading platforms, including the popular MetaTrader 5 platform. These platforms offer a range of features and tools to assist traders in their analysis and execution of trades. Real-time market data, advanced charting capabilities, and customizable trading strategies are some of the tools available.

In terms of trading accounts, this broker only provides two types of trading accounts, including a demo account and a live account, with the minimum deposit to open a live account not readily available on its official website. Surprisingly, this broker offers a flexible leverage option up to 1:500, which gives traders great flexibility to control their trading.

HSB seems to emphasizes customer support and strives to assist traders promptly and professionally. Traders can reach the customer support team through various channels such as live chat, email, or phone. The support team is available to address inquiries, technical issues, and account-related concerns.

Is HSB legit or a scam?

HSB, a forex broker in Indonesia, operates under the regulatory oversight of BAPPEBTI (Badan Pengawas Perdagangan Berjangka Komoditi) with regulatory license number: 001/BAPPEBTI/SI/5/2018, the country's esteemed regulatory authority.

Furthermore, HSB is a proud member of ICDX (Indonesia Commodity and Derivatives Exchange), which further underscores its commitment to regulatory compliance and industry best practices.

Pros and Cons

HSB, as a regulated forex broker in Indonesia, offers several advantages. It operates under the supervision of BAPPEBTI, ensuring compliance with regulatory standards. HSB provides a diversified range of financial services and utilizes advanced MT5 trading platforms.

However, it's important to note that HSB has limitations, such as a limited range of trading instruments, availability restricted to Indonesian traders, no clear information on minimum deposit, a lack of educational resources, and a limited range of customer support options.

| Pros | Cons |

| Regulated by BAPPEBTI | Limited range of trading instruments |

| Multiple trading platforms, MT5, Webtrader and Mobile App | Availability limited to Indonesian traders |

| Demo account available | Lack of educational resources |

| Online chat supported | No tiered trading accounts |

| Bonuses offered | No clear information on minimum deposit |

| Spreads not competitive | |

| Additional Commission charged |

Market Intruments

HSB, a forex broker registered in Indonesia and regulated by BAPPEBTI, provides traders with a wide array of market instruments to facilitate their trading activities, approximately 45 trading instruments available.

Forex trading stands at the core of HSB's offerings, allowing traders to participate in the world's largest and most liquid financial market. The availability of 17 forex currency pairs, including major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, alongside a selection of exotic currency pairs.

Commodities trading is another prominent feature of HSB's market instruments, enabling traders to engage in the buying and selling of various commodities. Traders can access popular commodities such as gold, silver, oil.

Indices trading is yet another avenue offered by HSB, granting traders exposure to a diverse range of global stock market indices. By tracking the performance of these indices, such as the S&P 500, FTSE 100, and Nikkei 225, traders can speculate on the overall market sentiment and potential price movements.

Share trading is also available. Another offering is shares of well-known companies. Through access to a range of shares from various industries and sectors, traders can participate in stock trading and take positions

Account Types

It seems that the HSB presents traders with a simple account structure. HSB offers two distinct account types: a live account and a demo account. The live account is the gateway to real-time trading in the dynamic forex markets. While specific details regarding the minimum deposit requirement for the live account are not disclosed.

The demo account serves as a valuable educational and practice tool. It allows traders to familiarize themselves with HSB's trading platforms, test various trading strategies, and gain confidence in their trading skills, all within a risk-free simulated trading environment. The demo account mirrors live market conditions, enabling traders to grasp market dynamics and hone their trading techniques without the need to risk real funds.

How to open an account?

Opening an account with HSB, the esteemed forex broker registered in Indonesia and regulated by BAPPEBTI, is a straightforward process.

To open an account with HSB, you can visit the official website at https://www.hsb.co.id/ and locate the account registration section.

2. Then, you will be required to provide essential personal information, including their full name, contact details, and residential address.

3. The registration process may involve verifying identification documents and completing the necessary compliance requirements in line with regulatory standards. Traders should carefully review and agree to the terms and conditions set forth by HSB before finalizing the account creation process.

4. Once the account registration is complete, traders can access their trading account, make deposits, explore the range of financial instruments, and commence their forex trading activities.

Leverage

HSB offers its clients an impressive leverage ratio of up to 1:500. Leverage serves as a powerful tool that enables traders to amplify their trading positions and potentially enhance their trading outcomes. With a leverage ratio of 1:500, traders can exert greater control over their trading capital, allowing them to trade larger volumes of currencies and take advantage of even the smallest market movements.

HSB's generous leverage offering empowers traders to optimize their trading strategies and potentially maximize their profit potential. However, it is important to note that while leverage can amplify profits, it also amplifies risks. Traders must exercise caution and ensure they possess a comprehensive understanding of leverage, risk management techniques, and the potential implications of utilizing high leverage ratios.

Spreads & Commissions (Trading Fees)

It is important to acknowledge that the spreads offered by HSB may not be considered exceptionally competitive when compared to other brokers in the forex industry. Major currency pairs like EUR/USD unveil themselves with typical spreads that commence from 1.1 pips, while GBP/USD exhibits a similar starting point from 1.2 pips, and AUD/USD gracefully starts from 1.1 pips.

In tandem with spreads, HSB employs an additional layer of commissions for clients' trading activities. According to the information at hand on their official website, traders who deposit $100 will encounter a commission charge of $2 per lot traded. For those venturing into the deposit range of $300 to $1,000, a commission charge of $1 per lot becomes applicable.

Non-Trading Fees

In addition to the spreads and commissions associated with trading activities, HSB may also charge some other fees, which extend beyond the realm of trading.

One of the notable non-trading fees offered by HSB is related to deposits and withdrawals. It is important to note that certain payment methods may incur fees. Traders are advised to review the specific details regarding deposit and withdrawal fees on the official HSB website or by consulting with their dedicated account manager.

It is worth mentioning that HSB may also apply inactivity fees for dormant accounts. These fees are designed to encourage active trading and ensure that resources are utilized effectively.

Trading Platform

HSB offers a range of advanced trading platforms designed to cater to the diverse needs of traders. Firstly, HSB provides access to industry-leading platforms such as MetaTrader 5 (MT5), a cutting-edge trading solution renowned for its enhanced features and comprehensive trading capabilities.

The MT5 platform serves as a powerhouse for traders, combining sophisticated tools, advanced charting capabilities, and an intuitive interface. With real-time market data, customizable charting options, and an extensive library of technical indicators, MT5 empowers traders to conduct thorough market analysis and execute trades with precision. The platform also supports automated trading through expert advisors, enabling traders to implement algorithmic trading strategies and take advantage of market opportunities round the clock.

HSB further caters to traders' needs with its web-based trading platform, providing instant access to the markets via any web browser without the need for software installation.

HSB offers mobile and tablet apps for both iOS and Android platforms. These mobile trading apps provide traders with a fully optimized and user-friendly trading experience, enabling them to stay connected to the markets and manage their accounts anytime, anywhere.

Deposit & Withdrawal

The specific minimum deposit requirement is not explicitly stated on the official website. To obtain detailed information regarding the minimum deposit amount, individuals are advised to contact HSB's customer support team.

HSB offers deposit facilities through a selection of banks, including BCA, Bank Mandiri, and BNI. Please note that the availability of deposit and withdrawal methods, as well as any associated fees or processing times, may be subject to change. It is advisable to confirm the latest information directly with the HSB or refer to their official documentation for the most accurate and reliable details.

Bonuses Offered

HSB offers an enticing bonus program that aims to enhance traders' trading experience and provide them with additional trading capital.With HSB's bonus program, new clients have the opportunity to receive bonuses of up to $5000 upon meeting certain criteria. These bonuses can be a valuable boost to traders' initial deposits, allowing them to potentially increase their trading volumes and explore more opportunities in the forex market.

It's important to note that while bonuses can provide additional funds for trading, they come with specific terms and conditions. These conditions typically include requirements such as a minimum deposit, a specified trading volume, and a time limit for fulfilling the bonus conditions. Traders should carefully review and understand the terms and conditions associated with the bonuses to make informed decisions and ensure compliance with the broker's policies.

Customer Support

Clients have multiple channels to access HSB's customer support. The broker offers phone support, allowing clients to directly communicate with a representative who can provide real-time assistance and guidance. Additionally, clients can reach out to the support team via email, providing a convenient and efficient method for inquiries or more detailed discussions.

For instant support and quick responses, HSB provides an online chat feature. This real-time messaging service enables clients to engage in direct communication with a support representative, gaining immediate assistance and resolving queries promptly.

In addition to these traditional support channels, HSB maintains an active presence on various social media platforms. Clients have the opportunity to follow brokers on Twitter, Facebook, Instagram, YouTube, and LinkedIn, and more. Through these platforms, clients can stay updated on the latest news, market insights, educational resources, and promotional offers provided by HSB.

Educational Resources

HSB equips its clients with a wealth of educational resources to enhance their trading knowledge and skills. HSB Academy serves as a cornerstone of the broker's educational offerings. This comprehensive learning center is designed to cater to traders of all levels, from beginners to advanced. Through the HSB Academy, traders gain access to a wide range of educational materials, including interactive courses, e-books, and webinars. These resources cover various aspects of forex trading, from the fundamentals to advanced strategies, risk management techniques, technical analysis, and more.

In addition to the HSB Academy, the broker provides regular forex trading classes conducted by industry experts. These classes offer traders the opportunity to learn directly from experienced professionals who share valuable insights, practical tips, and trading strategies.

Furthermore, HSB maintains a blog section where traders can find insightful articles written by industry experts. These blog posts cover a wide range of topics, including market trends, trading psychology, risk management, and strategies

Conclusion

Overall, HSB provides a diverse range of tradable instruments, including major and exotic currency pairs, commodities, indices, and precious metals, and flexible trading leverage up to 1:500, enabling traders to explore various market opportunities with greater flexibility. The availability of the widely acclaimed MetaTrader 5 platform empowers traders with advanced tools and features for efficient trading.

However, it's essential to note that HSB's services are primarily focused on the Indonesian market, which may limit accessibility for traders from other regions. Besides, it does not disclose minimum deposit to open an account with it, which makes this broker a less suitable option for most traders.

FAQs

Q: Is HSB a regulated forex broker?

A: Yes, HSB is a regulated forex broker registered with and governed by BAPPEBTI, the regulatory authority in Indonesia.

Q: What trading instruments are available with HSB?

A: HSB offers a wide range of trading instruments, including Forex, Commodities, Indices, Shares.

Q: What trading platforms does HSB provide?

A: HSB provides the popular MetaTrader 5 (MT4) platform, known for its user-friendly interface and advanced trading features, as well as a webtrader.

Q: What customer support options are available at HSB?

A: HSB provides customer support through various channels, including email, phone, and live chat. Traders can reach out to their dedicated support team for assistance with any inquiries or issues they may have.

Q: Is HSB suitable for beginner traders?

A: Yes, HSB caters to traders of all levels of experience, including beginners. The broker offers educational resources and a user-friendly trading platform to support and guide new traders.

Keywords

- 5-10 years

- Regulated in Indonesia

- Retail Forex License

- High potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

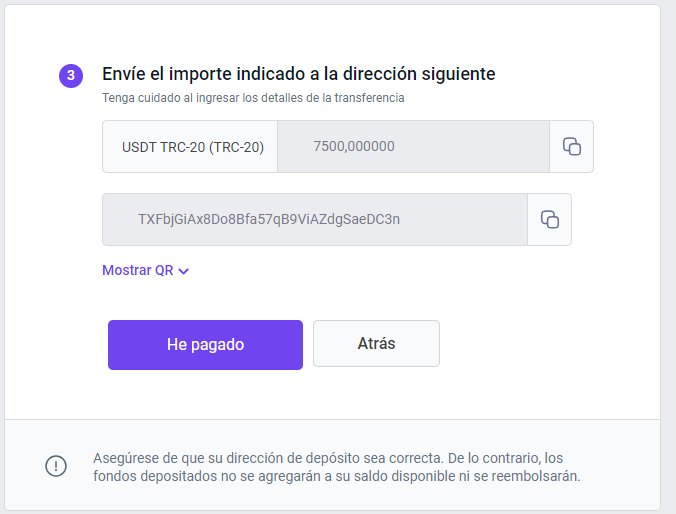

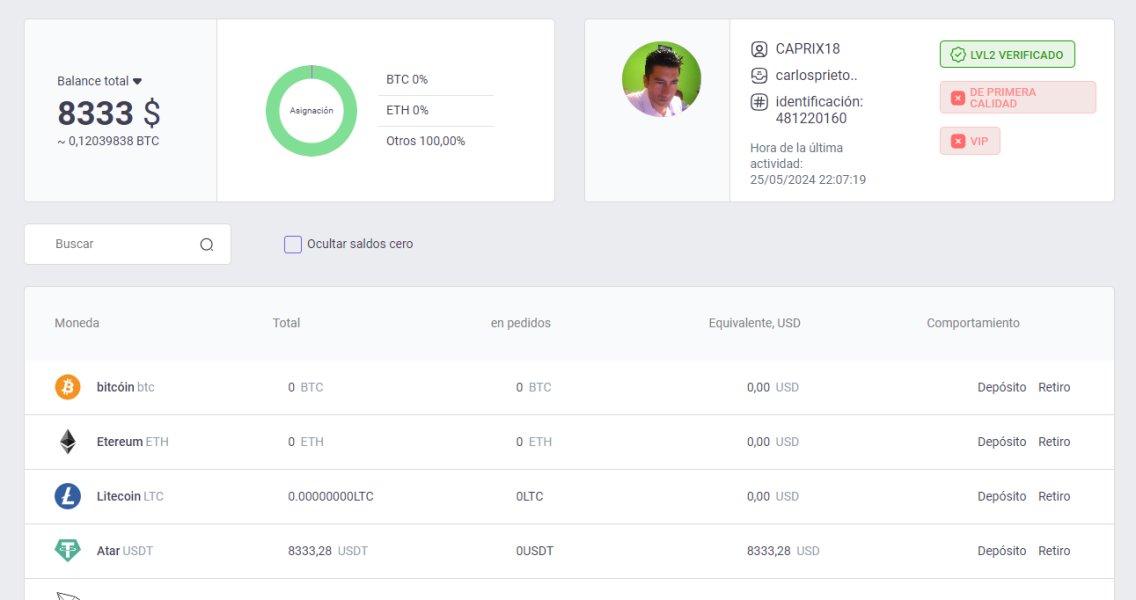

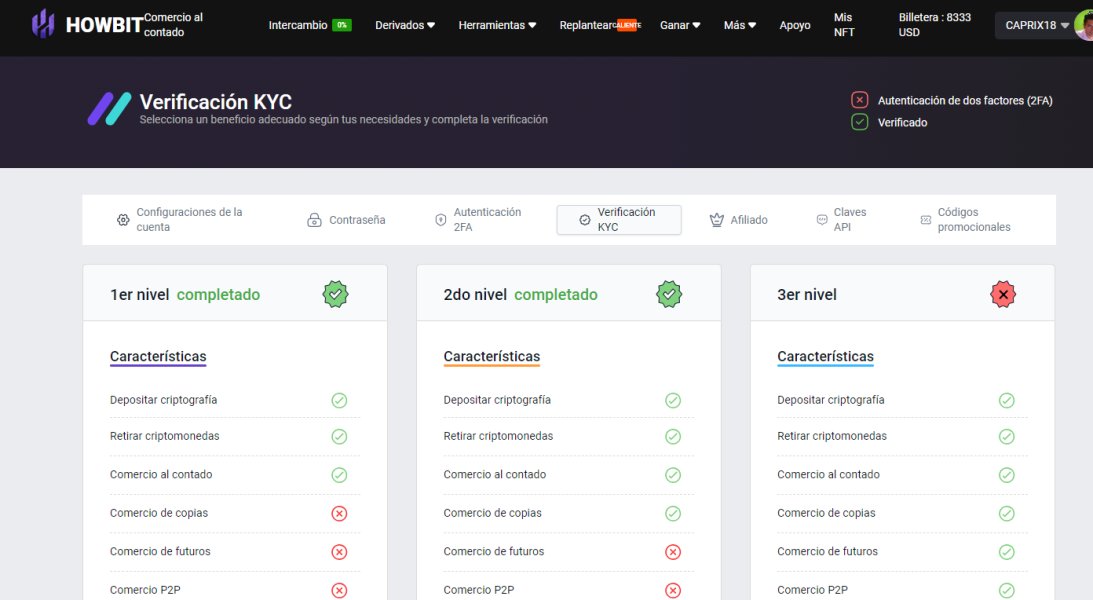

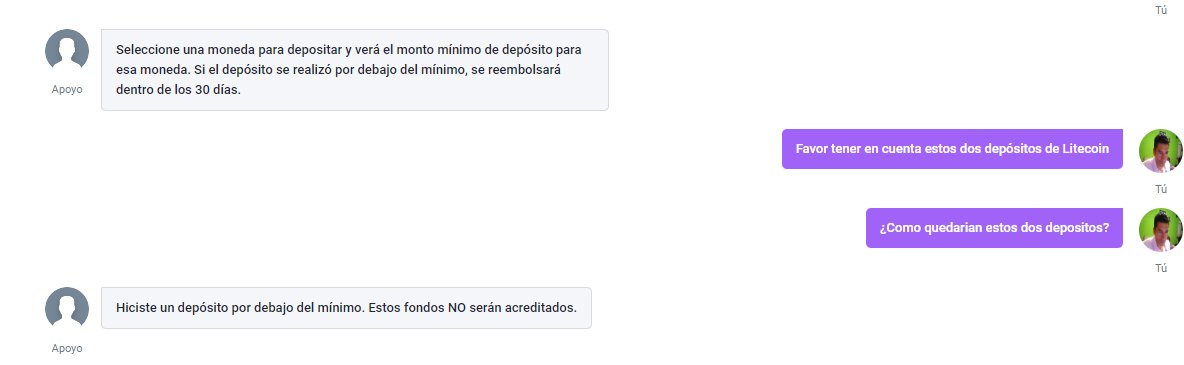

Caprix

Colombia

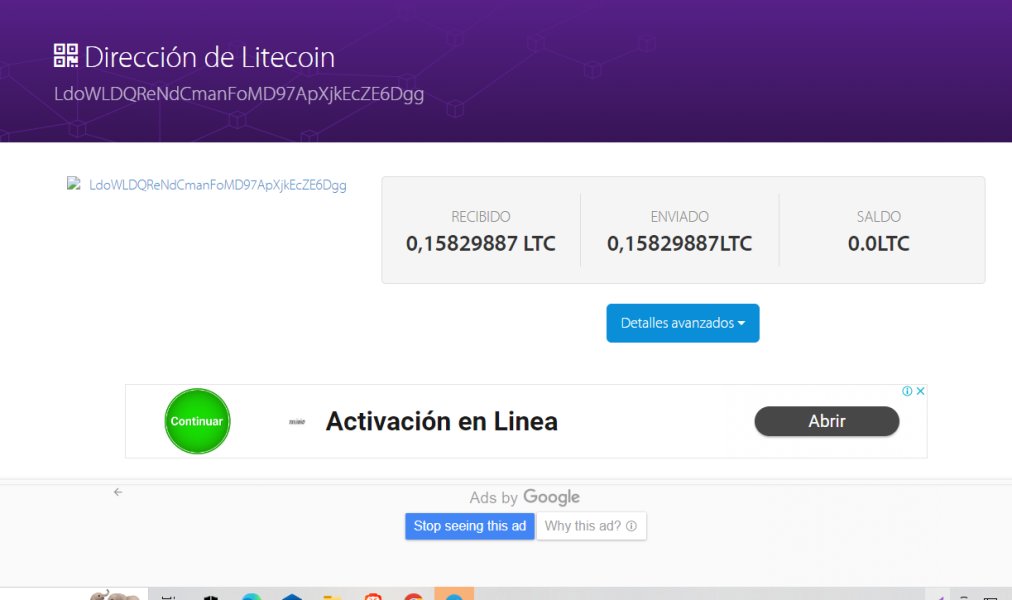

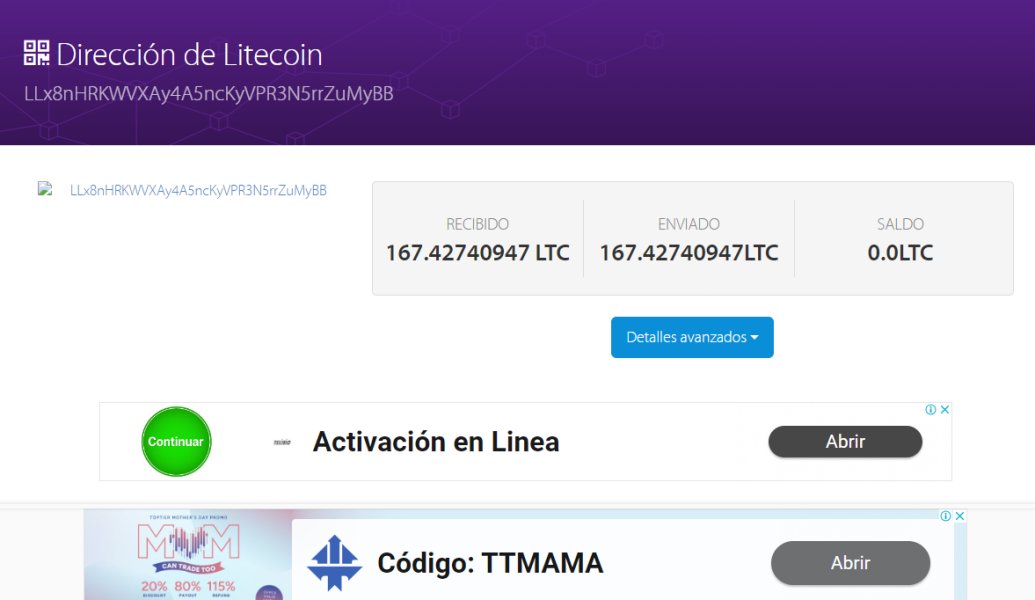

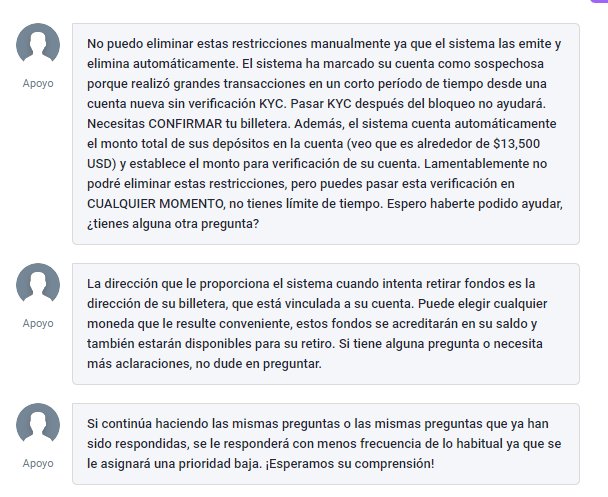

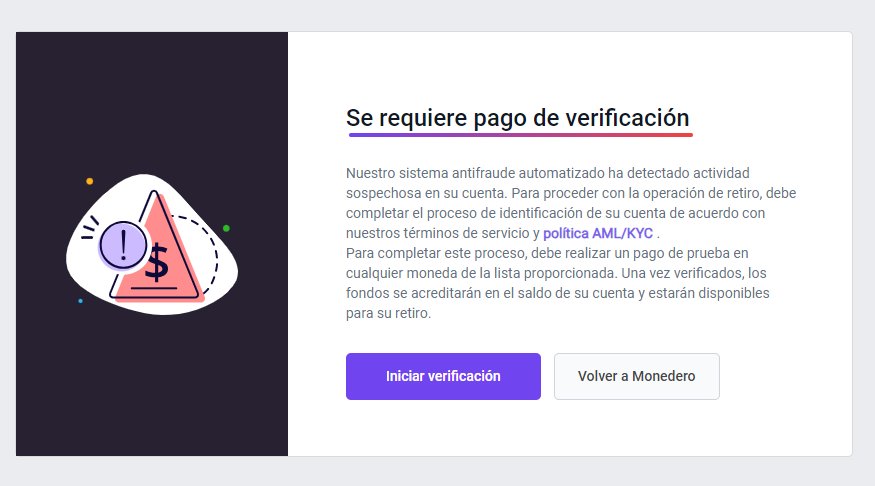

In recent days, after an advertisement on YouTube where they announced the Litecoin trade, selling it more expensively in this broker, I entered an amount worth USD 7,000 = in this currency transferred from Binance and after selling these already in this broker and remained in USDT worth USD 8333 When I want to challenge them, the system tells me that due to KYC I need to deposit to be able to unfreeze the account and have the entire balance. This seems very arbitrary to me since this has never happened to me in any other broker, I don't have this amount to be able to deposit and I doubt if they come up with another requirement to keep everything deposited. I carried out KYC verification, I sent documents and I kept this up to date. I have asked you to please take me into account since I have this capital to work and they left me blocked in my work system, which is the livelihood of my family and my parents who depend on my work. They respond that they cannot do anything since it is the system that does not allow the account to be unfrozen and that after the minimum deposit regardless of the time, the account will be left for withdrawal. I made two more small deposits to see if the account was unlocked and I could withdraw but it was not reflected in the balance after asking about this they answered me that for not depositing the value Minino required, these values would not be credited or it will take a month to do so. The balance reflected in the account does not include the last two deposits. I am very distressed by this situation and I request your collaboration since I have no one else to solve this problem. Please if you can give me a hand with this I would be immensely grateful since I am going through a very complicated situation.

Exposure

05-26

rica776

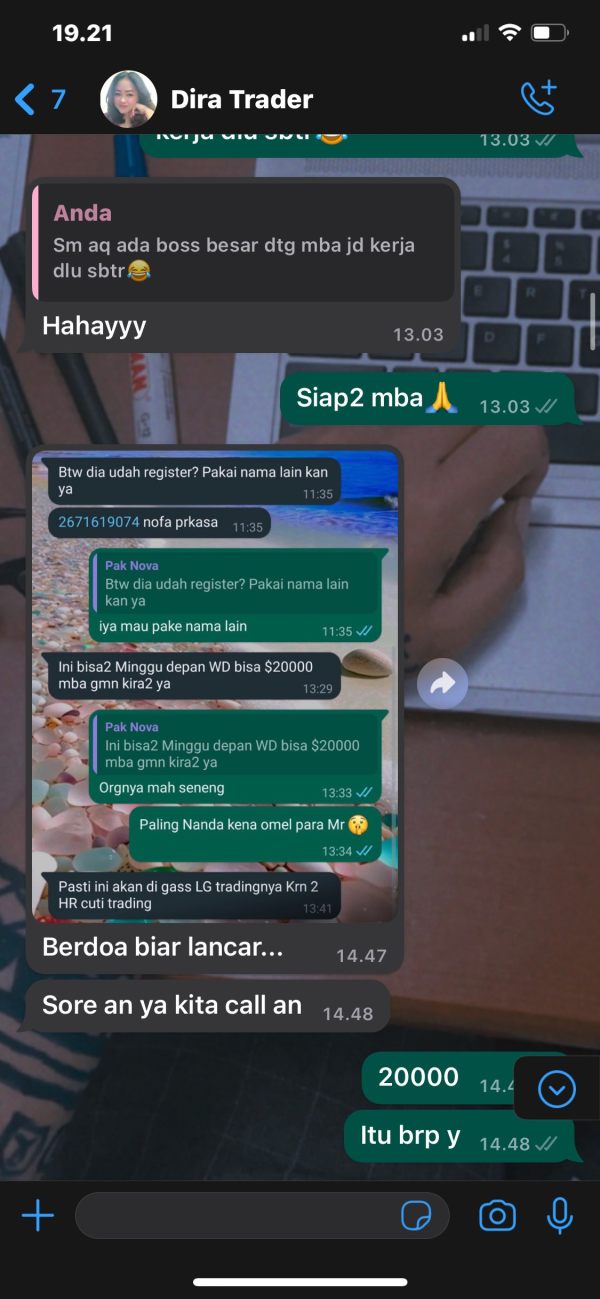

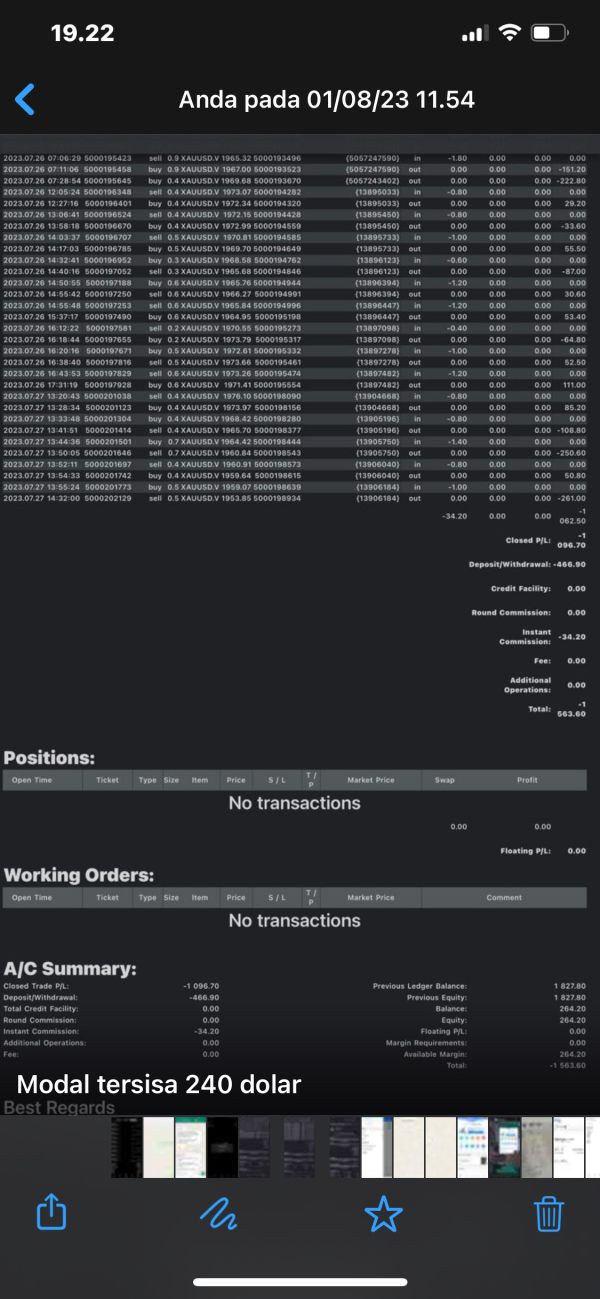

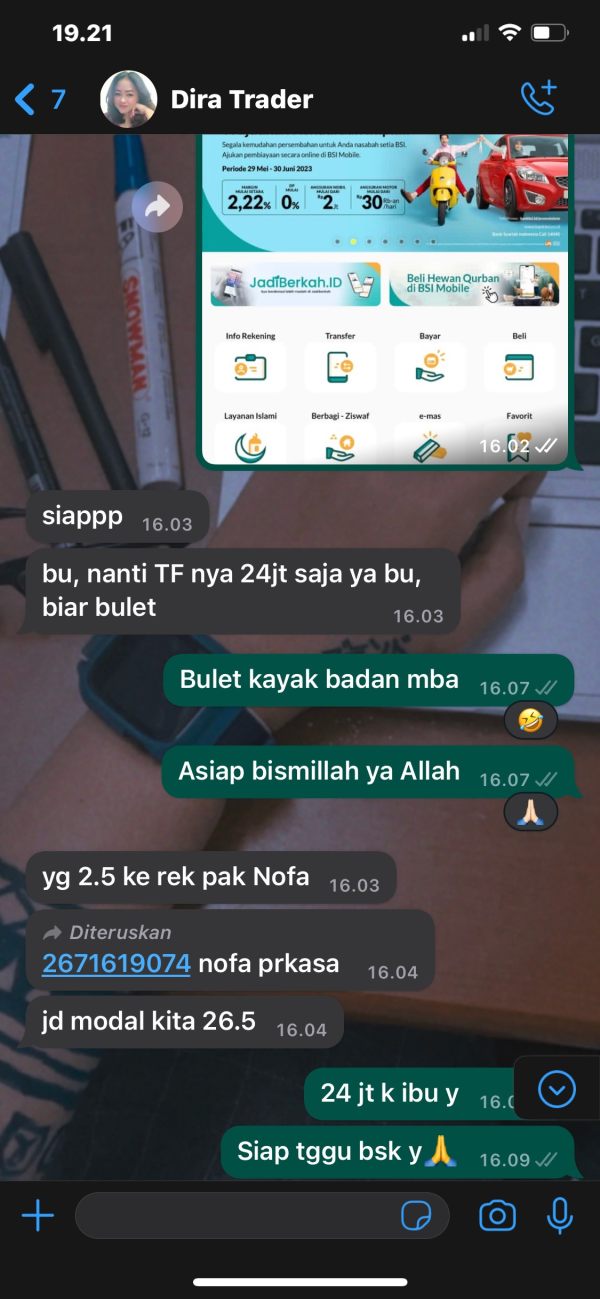

Indonesia

I was invited to join using another account name, lured with profits by copy trading from paid traders, and told to transfer to a broker account to pay for the master system and broker account... left my account to lose because the system had an error, not taught withdraw because preventing customers from withdrawing their funds back, after 2 months of ignoring the broker, my account was played to the point of loss because the market was bad so that these brokers would get a commission from the broker

Exposure

2023-08-31

王1753

South Africa

Actually spreads are not that low as they hyped, actually I traded commodities here, but I quickly made great losses due to sharp slippage. I suspected they artificially manipulate the price…

Neutral

2023-02-16

清晨的太阳

Netherlands

The lucky wheel on their home page looks really attractive, but it looks like a trick to induce people to invest. Opening a live account seems easy, just $100, but I'm afraid it won't be that easy to withdraw.

Neutral

2022-11-23

Hamzah Shahrin

Hong Kong

Their high trading fees are not what you can afford, in my opinion, Indonesian brokers are not always your ideal choices, trading with them is very complicated, by the way, this broker’s customer support also sucks…

Neutral

2022-11-23

Xvette

Pakistan

Payment methods are flexible, accommodating my personal preferences. And leverage levels are flexible, allowing me to adjust based on market conditions.

Positive

08-01

FX1497908099

United States

The platform is user-friendly and offers a diverse range of trading options. I appreciate the educational support which has been crucial for my development as a trader. Quick setup and reasonable deposit requirements also make it accessible

Positive

06-21

A7589

Pakistan

I'm satisfied because the response from the agent was like using one stone to kill two birds.

Positive

05-07