简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Erdogan Emerges Victorious in Runoff Election, As USD/TRY Soars Past the Psychological 20.0000 Mark

Abstract:Turkish President Recep Tayyip Erdogan has secured another term, extending his rule into a third decade. The victory follows an election marked by economic uncertainty, with the government pledging to tackle ongoing inflation issues and recovery from a major earthquake earlier in the year.

Recep Tayyip Erdogan, President of Turkey, successfully secured a third decade of rule following a runoff election held on Sunday. With a winning tally of 52.14%, Erdogan declared that the nation must concentrate on national objectives and ambitions, moving beyond debates and conflicts.

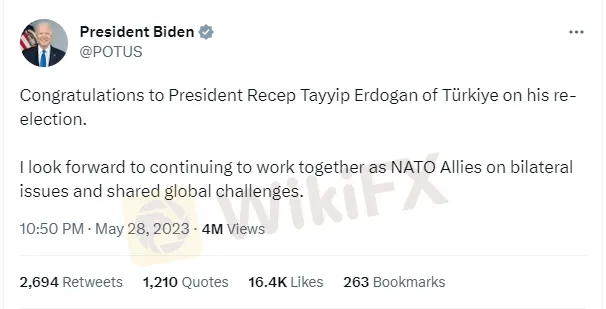

Turkey's Supreme Election Council confirmed Erdogans victory, which has been met with a barrage of congratulatory messages from global leaders including US President Joe Biden and Russia's Vladimir Putin. This victory unfolds against a backdrop of a nation still grappling with the economic aftermath of a disastrous earthquake in February.

Erdogan's Charm Offensive: Key to Victory

Analysts have identified a stark division within the country, with each side fostering divergent visions of Turkey's future. According to Asli Aydintasbas, a Brookings Institution visiting fellow, these electoral outcomes reflect this divide. Erdogan's magnetic personality and his ability to inspire trust in his supporters have been instrumental in his win, opines Hakan Akbas, senior adviser at Albright Stonebridge Group.

Despite the political undercurrents, Erdogan's re-election means his leadership remains unchallenged, even as Turkey confronts several economic hurdles. Erdogan's Government has committed to focusing on curbing inflation and recovering from the earthquake's impact.

Erdogan Supporters

Economic Challenges Post Elections

Inflation has emerged as a key concern over the past two years, as elucidated in our May 16 analysis of the Turkish Lira. Erdogan vowed to address the rising cost of living and inflation issues in his post-victory address.

Erdogan conveyed his intention to counteract the issues caused by price surges and compensate for welfare losses. As the pre-election period saw mounting pressure on Erdogan due to the controversial monetary policies favoring low rates, he emphasized employing alternate policy measures that align with “Liraisation” targets.

However, Erdogan's approach has been heavily criticized for the skyrocketing inflation and the ensuing decline of the lira in the last 20 months, starting from September 2021.

Market Reaction and Future Prospects

Following the elections, the Central Bank is tasked with maintaining the Lira's stability. As expectations for a significant monetary policy shift dwindle, the USD/TRY in early Monday trading rebounded above the 20.0000 mark.

As we navigate the broader picture, market volatility is anticipated to persist in the coming days. Despite the sudden and erratic shifts, USDTRY continues to trend upwards.

USD/TRY Outlook and Final Reflections

In the short term, a resolution on the US debt ceiling may impede the USD/TRY's further rise. However, a hawkish reevaluation of the Federal Reserve's rate hike probabilities could bolster the US dollar, despite the reduction of its safe-haven appeal post the debt ceiling deal.

Unless Erdogan announces a potential change in monetary policy, the Lira is expected to remain weak. The market reaction post the US bank holiday will be intriguing to watch.

If the US dollar's strength persists, it may drive the Lira even further from the critical 20.0000 level, setting new highs. Conversely, any downward shift may find support around the 50-day MA at 19.44, with the 100 and 200-day MA resting lower at 19.1500 and 18.8300, respectively.

USD/TRY DAILY CHART – MAY 29, 2023

Regardless, Turkey's economic future under Erdogan's continued leadership will be closely watched by observers and market participants alike.

To keep abreast of the most recent forex news, download and set up the WikiFX App on your mobile device. You can get the app here: https://social1.onelink.me/QgET/px2b7i8n.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

The Royal Malaysia Police (PDRM) has received 26 reports concerning the Nicshare and CommonApps investment schemes, both linked to a major fraudulent syndicate led by a Malaysian citizen. The syndicate’s activities came to light following the arrest of its leader by Thai authorities on 16 December.

WikiFX Review: Is FxPro Reliable?

Founded in 2006, FxPro is a reputable UK-based broker, trading on various market instruments. In this article, we will help you find the answer to one question: Is FxPro reliable?

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Top 10 Trading Indicators Every Forex Trader Should Know

ASIC Sues Binance Australia Derivatives for Misclassifying Retail Clients

WikiFX Review: Is FxPro Reliable?

Malaysian-Thai Fraud Syndicate Dismantled, Millions in Losses Reported

Trading frauds topped the list of scams in India- Report Reveals

Why Do You Feel Scared During Trade Execution?

Revolut Leads UK Neobanks in the Digital Banking Revolution

Fusion Markets: Safe Choice or Scam to Avoid?

SEC Approves Hashdex and Franklin Crypto ETFs on Nasdaq

Currency Calculator