简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Scam Alert: Avoid Trading With Cryptocurrency Scam CryptoAllDay

Abstract:Although digital currencies have been around for over a decade, the concept is still foreign to many.

Clients become more vulnerable to fraudsters because of having little or no knowledge about the decentralized economy. This piece highlights a scam broker CryptoAllDay and warns investors to avoid signing up with it.

CrytpoAllDay - A Quick Overview

CryptoAllDay (https://cryptoallday.com/) is an offshore company based in Seychelles. The entity deals in crypto trading services. Instead of providing a trading platform, it offers an investment wallet. The company encourages clients to deposit Bitcoins in its “safe and secure wallet” connected to multiple exchanges worldwide and access deep liquidity. Flexible account types and an educational facility also make part of the company's offerings. While live chat is unavailable, the company mentions a phone number and an email address to reach it.

Is CryptoAllDay Regulated?

No, CryptoAllDay is not a regulated company. The firm claims to be a part of Petrasoul Ltd, registered in Seychelles. However, it hasn't shared any details except listing the company's office address. Importantly, we didn't find it in the Seychelles Company's Register.

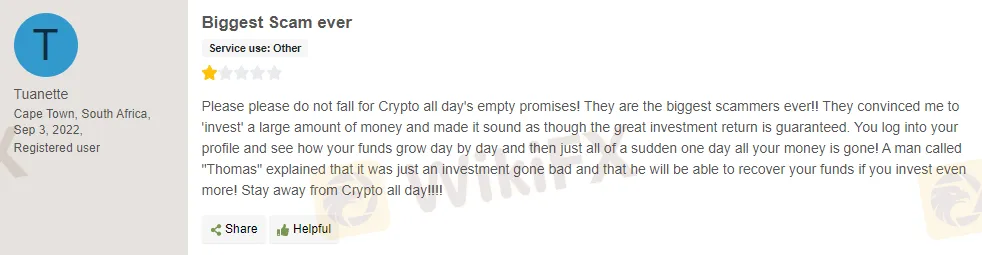

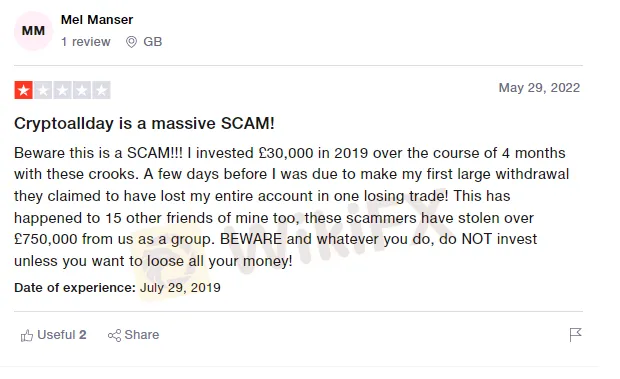

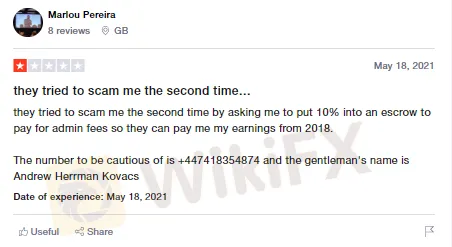

Clients Feedback

CryptoAllDay has a bad clients feedback. WikiFX and other sites have received complaints from clients alleging that the site is fraudulent. Customers claim the company has no investment plan and does not refund deposits. Let us share some screenshots below.

What Makes CyptoAllDay A Scam Entity?

First, the company's website's poor design tells the company's competency level. Except for a landing page, everything seems to be a total mess. Even a newbie can quickly figure out that the people behind the website can't be professionals.

Second, the company claims to have hired a team of expert fund managers to handle your asset portfolio yet not discloses the list of instruments available to invest in.

Third, the company claims to be providing hedging insurance, though the platform's operations are not subject to oversight by any authority. Therefore, the platform in question may be engaging in an offensive activity.

How CryptoAllDay Scam Clients?

This service acts as a crypto wallet into which interested parties may transfer their cryptocurrency. After that, the company pretends to combine clients' funds with other investors and put them into various high-yield investment vehicles.

According to clients, the company entices clients with lucrative bonus offers linked with vague terms and conditions, knowing that anyone barely bothers to read.

After signing up with the company, It doesn't matter how often you request a withdrawal. The company asks you to achieve a specific trading volume before cashing out.

Clients have even reported on WikiFX and other independent reviewers' websites that the company sometimes releases small chunks of money to gain clients' trust and encourage them to add more funds. Once the company realizes you have reached your limit, it either stops corresponding with you or blocks your access to your investment account.

Bottom Line

To sum up, the business practices render it to be untrustworthy. Besides being an unregulated brokerage without proper authorization, the company also lies about having professional staff to look after your investment portfolio. Further, the company holds a poor reputation amongst clients. Therefore, we urge you to stay away from it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Dutch Law Student Arrested for €4.5 Million Crypto Scam

Dutch police arrest a law student for a €4.5M crypto scam, exposing pyramid schemes and investor losses.

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

DICT Pushes for Stronger Cyber Laws to Address Evolving Scams

The DICT is advocating for stronger cybercrime laws to tackle the growing and evolving threat of online scams in the Philippines.

Beware: Pig Butchering Scam Targeting Vulnerable Individuals

Beware of the rising 'investment scam' or 'pig butchering scam,' preying on students, homemakers, and job seekers, causing daily financial losses, warns Union Home Ministry.

WikiFX Broker

Latest News

Attention! Goldman Sachs Cuts Gold Target to $2910

Inflation Rebounds: ECB's Big Rate Cut Now Unlikely

Carney \considering\ entering race to replace Canada\s Trudeau

High-Potential Investments: Top 10 Stocks to Watch in 2025

US Dollar Insights: Key FX Trends You Need to Know

Why Is Nvidia Making Headlines Everywhere Today?

Discover How Your Trading Personality Shapes Success

FINRA Charges UBS $1.1 Million for a Decade of False Trade Confirmations

Pepperstone Sponsored the "Aston Martin Aramco Formula One Team"

ACY Securities Integrates MetaTrader 5 to Enhnace Copy Trading Service

Currency Calculator