Score

Eddid Financial

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://www.eddid.com.hk/en/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Hong Kong 5.31

Hong Kong 5.31Contact

Licenses

Licenses

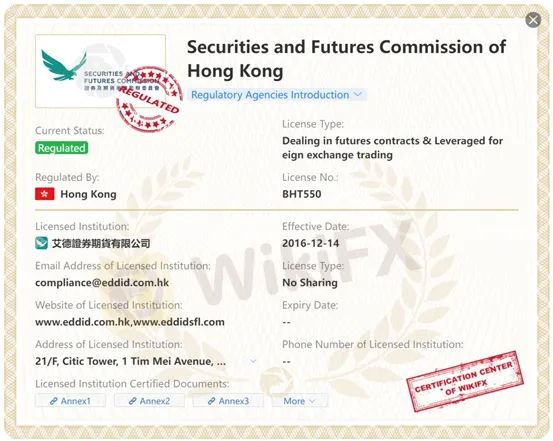

Licensed Institution:Eddid Securities and Futures Limited

License No.:BHT550

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 7 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

Hong Kong

Hong KongUsers who viewed Eddid Financial also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

eddid.com.hk

Server Location

United States

Website Domain Name

eddid.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

8.210.152.228

Company Summary

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Minimum Deposit | N/A |

| Maximum Leverage | N/A |

| Minimum Spreads | N/A |

| Trading Platform | Proprietary trading platform (Android, IOS, PC) |

| Demo Account | Yes |

| Trading Assets | HK Stocks, US Stocks, Futures, Forex, Derivatives, Asset Managment |

| Payment Methods | FPS, Bank Transfers and Check Deposits |

| Customer Support | Phone, Email |

General Information

Eddid Financial, a financial institution established in Hong Kong in 2015, is regulated by the Securities and Futures Commission (SFC), a licensed corporation of the Hong Kong Securities and Futures Commission (Central Number: BHT550). Eddid Financial offers a wide range of services, including FinTech, Asset Management, Investment Banking, Wealth Management, Securities, Futures, Forex Investment, and Alternative Investments to cater to the diverse needs of its clients. This broad spectrum of services enables Eddid Financial to provide holistic support to individuals, corporations, and institutions seeking financial expertise and guidance.

Is Eddid Financial legit or a scam?

Eddid Financial, a securities and futures brokerage firm based in Hong Kong, which takes regulatory compliance seriously, is regulated by the Securities and Futures Commission (SFC) of Hong Kong. As a licensed institution, Eddid Financial holds the license number BHT550, which authorizes it to engage in dealing futures contracts and leveraged foreign exchange trading. The institution's regulatory status is currently active, and it has been regulated by the SFC since its effective date of December 14, 2016.

Eddid Financial operates under the supervision and oversight of the SFC, ensuring compliance with regulatory requirements and standards in Hong Kong. Eddid Financial's regulatory status and licensing by the SFC highlight its commitment to operating within a regulated framework, ensuring client protection and upholding industry standards.

Pros & Cons

Eddid Financial possesses several strengths, including its SFC regulation, diverse range of products and services, easy account-opening process, transparent fee structure, and proprietary trading platform. However, there are limitations to consider, such as the limited language support on the website, restricted payment methods, lack of online chat support and 24/7 customer support, absence of a demo account, and insufficient information on account types, spreads, and minimum deposit requirements. It is advisable for individuals considering Eddid Financial to assess these factors in relation to their specific needs and preferences.

| Pros | Cons |

| SFC-regulated | Only three website supporting languages |

| Diverse range of products and services | Limited payment methods |

| Easy account-opening process | No online chat support |

| Transparent fee structure | No 24/7 customer support |

| Proprietary trading platform | Not offering a demo account |

| lack of essential information on account types, spreads | |

| Minimum deposit requirements not specified |

Products & Services

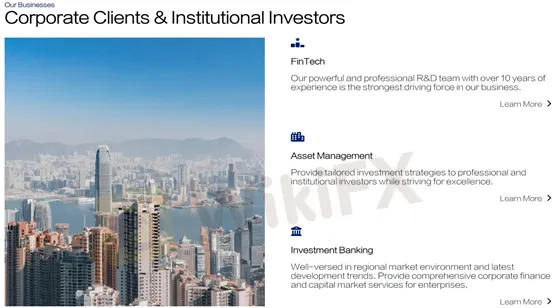

Eddid Financial provides corporate clients and institutional investors with a full range of products, including FinTech, Asset Management, and Investment Banking.

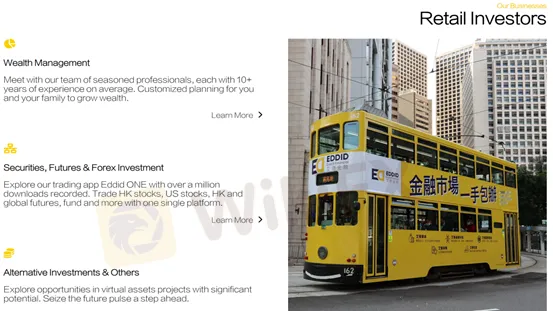

Eddid Financial offers a comprehensive range of products, including Wealth Management, Securities, Futures & Forex Investment, and Alternative Investments to cater to the diverse needs of retail investors.

Eddid Securities offers two categories of financial products, including equities and options. Equities empower individuals to build their portfolio. By investing in equities, one can transform their savings into a consistent stream of dividend income. With a focus on asset allocation and diversification, investors can effectively manage market risks. Furthermore, the liquidity provided by equities offers flexibility, opening doors to seize additional investment opportunities.

Options are powerful tools that provide individuals with leverage and increased flexibility in their investment strategies. With options, investors have the ability to hedge their portfolio against potential losses or generate additional income through strategic trading opportunities. These instruments serve as a strategic investment, allowing users to capitalize on market movements and optimize their overall investment performance.

Commissions and Fees

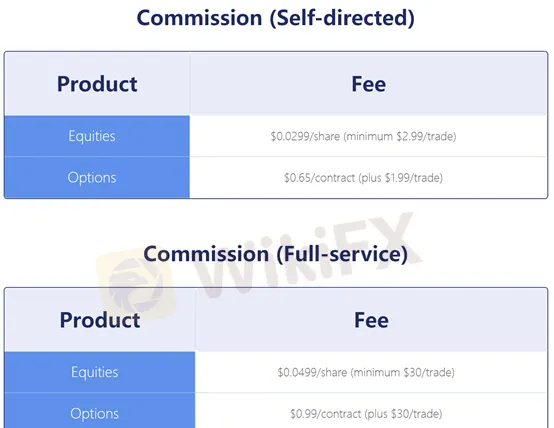

Commission (Self-directed):

For equity trades, the commission is calculated at a rate of $0.0299 per share, with a minimum charge of $2.99 per trade. This means that regardless of the number of shares being traded, a minimum fee of $2.99 will apply for each trade. Additionally, for options trades, there is a commission of $0.65 per contract, along with an additional charge of $1.99 per trade.

Commission (Full-service):

In the case of equity trades, the commission for full-service trading is calculated at a rate of $0.0499 per share, with a minimum fee of $30 per trade. This means that irrespective of the number of shares involved in the trade, a minimum charge of $30 will be applicable. For options trades, there is a commission of $0.99 per contract, along with an additional fee of $30 per trade.

Regulatory Trading Fees and Exchanges Fee

Here are the five ways to calculate trading fees and exchanges fee for Eddid Securities:

1. Regulatory Fee (SEC) - Stock (Sells Only):

Formula: $0.000008 x number of shares x price (Minimum $0.01)

This fee is applied when selling stocks. It is calculated by multiplying the number of shares being sold by the stock price and then multiplying it by a rate of $0.000008. The minimum fee charged is $0.01.

2. Trading Activity Fee (FINRA) - Stock (Sells Only):

Formula: $0.000145 per share (Minimum $0.01, Maximum $7.27)

This fee is applicable for selling stocks. It is calculated by multiplying the number of shares being sold by a fixed rate of $0.000145 per share. The fee cannot be lower than $0.01 or exceed $7.27.

3. Regulatory Fee* (SEC) - Options (Sells Only):

Formula: $0.000008 x number of contracts x 100 x price (Minimum $0.01)

This fee is applied when selling options. It is calculated by multiplying the number of contracts being sold by the option price and then multiplying it by a rate of $0.000008. Additionally, the fee is multiplied by 100 as each options contract typically represents 100 shares. The minimum fee charged is $0.01.

4. Trading Activity Fee (FINRA) - Options (Sells Only):

Formula: $0.00244 per contract (Minimum $0.01)

This fee is applicable for selling options. It is calculated by multiplying the number of contracts being sold by a fixed rate of $0.00244 per contract. The minimum fee charged is $0.01.

5. Options Regulatory Fee (Options Exchanges) - Options (Buys & Sells):

Formula: $0.02905 per contract

This fee is charged for both buying and selling options. It is a fixed rate of $0.02905 per contract, regardless of the number of contracts being traded.

Account Types

Eddid Securities offers the following account types: Individual account, Joint account (Tenants in Common & With Rights of Survivor ship), Entity account (Corporate & Trusts), and International account.

Online Account Opening

To open an account with Eddid Securities USA, you will need to follow the steps outlined below:

1. Visit the Eddid Securities USA website: Go to the Eddid Securities USA website at https://www.eddidusa.com/.

2. Locate the account opening section: Look for a menu option or a link on the website that says “Open an Account” or something similar.

3. Choose the type of account: Eddid Securities USA may offer different types of accounts, such as individual or joint accounts, retirement accounts, or corporate accounts. Select the type of account that suits your needs.

4. Fill out the application form: Click on the “Open an Account” to access the account application form. Provide the requested information, which may include your personal details (name, address, date of birth, etc.), contact information, employment information, and financial information.

5. Complete the required documentation: Eddid Securities USA may require you to submit supporting documentation to verify your identity and financial information. This can include a copy of your identification (passport, driver's license, etc.), proof of address (utility bill, bank statement, etc.), and possibly additional documents depending on the type of account you are opening.

6. Fund your account: After submitting your application, Eddid Securities USA will provide instructions on how to fund your account. This typically involves transferring funds from your bank account to your new Eddid Securities USA account.

7. Account approval and activation: Once your application and funds are received, Eddid Securities USA will review your application.

Trading Software

Eddid provides users with two proprietary platforms: Eddid ONE and Eddid Lite/Pro, both of which are products developed by its team to better meet the needs of users.

Eddid ONE is a one-stop investment platform for securities, futures, Forex, fund, and more. With this single app, traders gain access to thousands of market products, including HK stocks, US stocks, HK and global futures, warrants, Callable Bull/Bear Contracts (CBBC), ETFs, derivatives, and pre-IPO trading. One of the key features of Eddid ONE is its incorporation of leading fintech investment strategies backed by AI technology. Through this integration, traders benefit from 24/7 stock-picking and forecasts powered by AI. The utilization of AI technology aims to simplify and enhance investment decision-making, providing traders with valuable insights and guidance to make informed investment choices.

Eddid Lite and Eddid Pro aredesigned to cater to the needs of futures traders at different levels of expertise. Eddid Lite is a user-friendly futures trading platform, with which traders can easily access the latest trends in the futures and options market. The platform provides real-time data and analysis, empowering traders to stay informed about market movements and make well-informed trading decisions. Eddid Pro offers a comprehensive and professional trading services, catering to the specific needs of experienced traders. Notable features include flash order and chart trading, enabling traders to execute transactions smoothly and efficiently.

Deposits & Withdrawal

Eddid Securities supports traders to deposit funds to their accounts via Wire transfer or ACAT Transfer. You may withdraw funds from your account by requesting a wire transfer or ACH. For domestic wire, please fill out and submit the Domestic Wire Request Form. For international wire, please fill out and submit the International Wire Request Form. For ACH, please fill out and submit the ACH Instructions Form. Please note that there is a fee of $25 for all outbound domestic wires and a fee of $50 for all outbound international wires. There is no fee for outbound ACH.

Customer Support

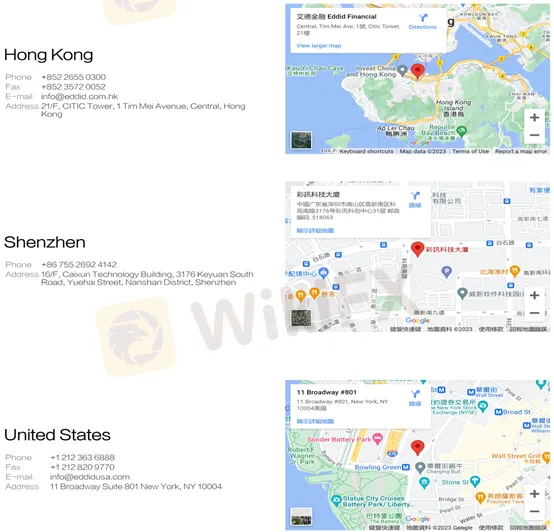

Its customer support is very specific and detailed, which is one of its advantages. Eddid Financial has established offline branches, including Hong Kong, Shen Zhen, and the United States. with the official website prominently displaying the addresses, email contacts, and other relevant contact information for each branch. This transparent approach enables customers to easily reach out to their local branches for assistance.

In addition to offline channels, it understands the importance of modern communication platforms and utilizes social media apps like WeChat and Facebook to connect with its customer service department. By embracing these widely used platforms, the company provides customers with an additional means of contacting and interacting with their support team. However, it is important to note that it may not be available 24/7.

Here are some contact details:

Telephone: +852 2655 0388

Email: cshk@eddidsec.com

Company Address: 21/F, Citic Tower, 1 Tim Mei Avenue, Central, Hong Kong

Frequently Asked Questions (FAQs)

What does Eddid Futures have on offer?

Eddid Futures provides investors with trading services in Hong Kong stocks, U.S. stocks, global futures, leveraged investments, including mutual funds, bond funds, equity-linked notes and other investment products, and also provides customers with investment solutions such as margin stock trading and IPO subscriptions.

what trading software does Eddid Futures provide?

Eddid Futures provides its proprietary platform called Eddie one-stop trading software.

How can I contact Eddid Futures if I have any inquiries?

Clients with inquiries can get in touch with Eddie Futures through telephone, email.

What is HK Stock market trading hours?

The trading hour of HK Stock is listed below:

Keywords

- 5-10 years

- Regulated in Hong Kong

- Dealing in futures contracts & Leveraged foreign exchange trading

- High potential risk

Review 9

Content you want to comment

Please enter...

Review 9

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

小栗子3124

Hong Kong

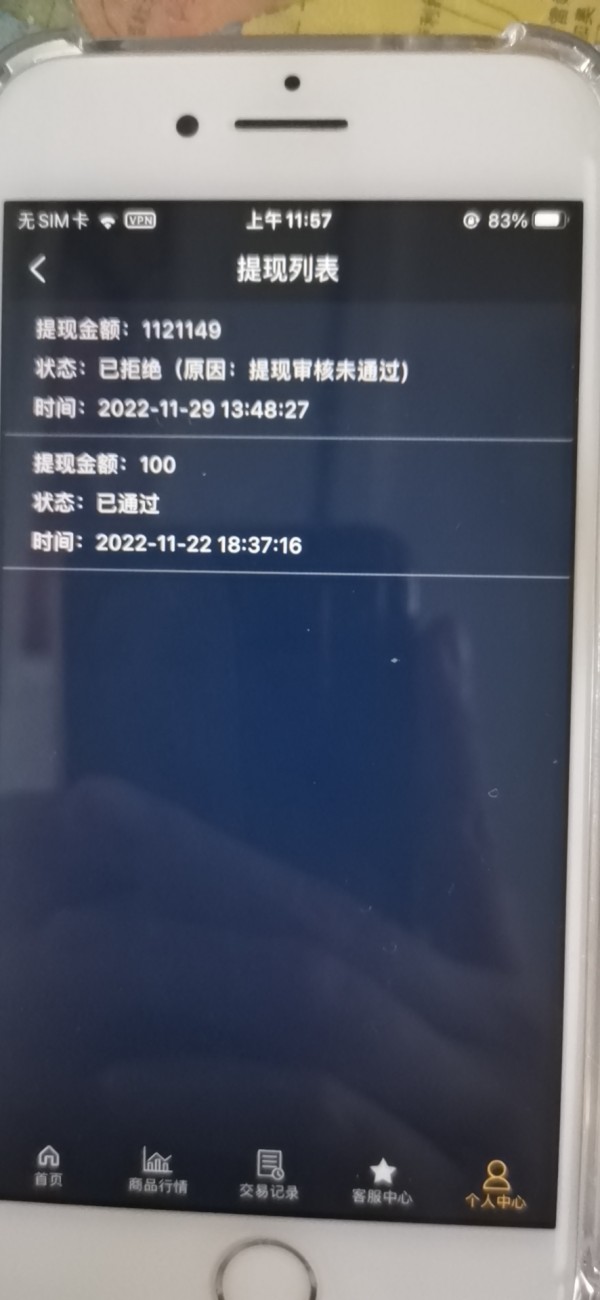

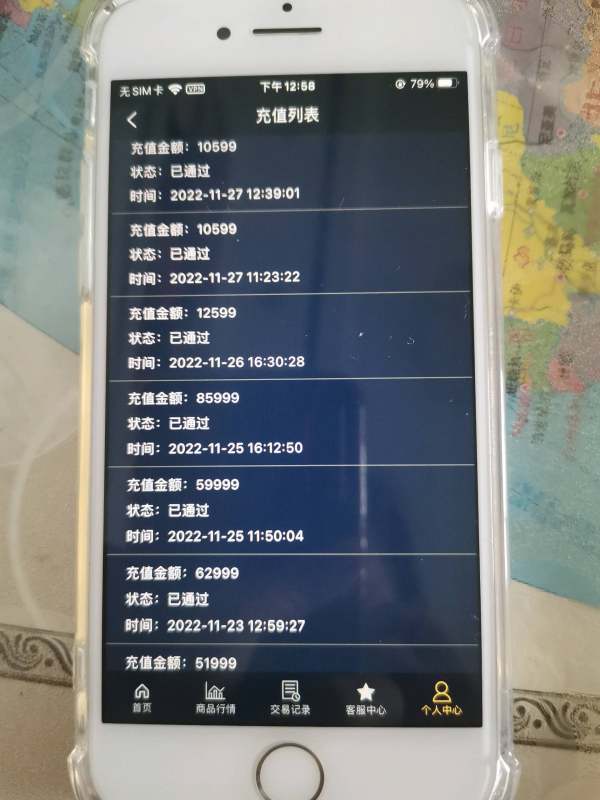

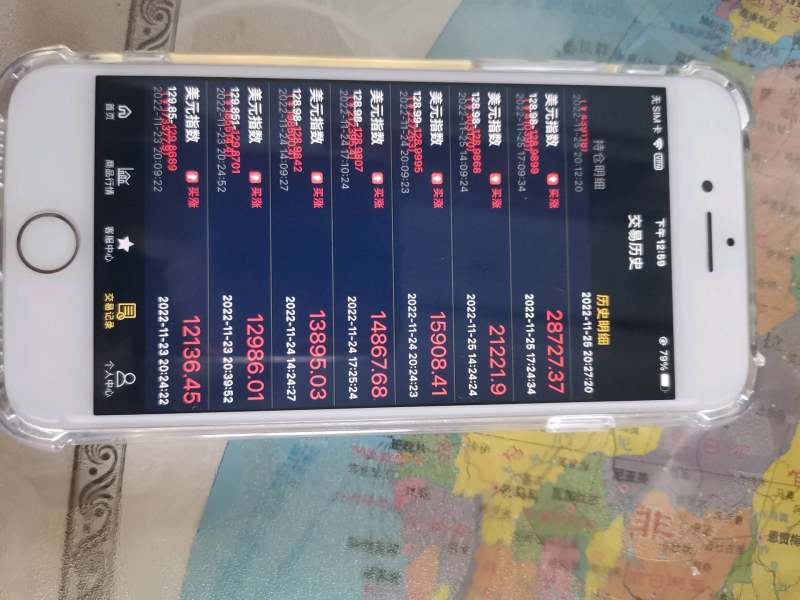

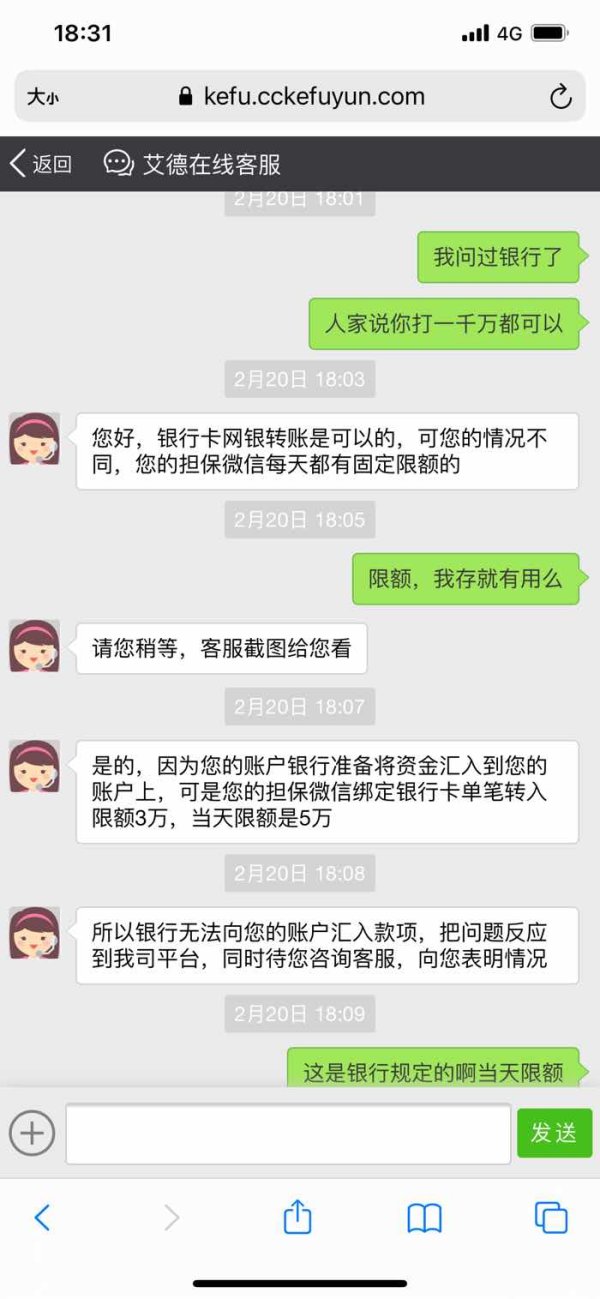

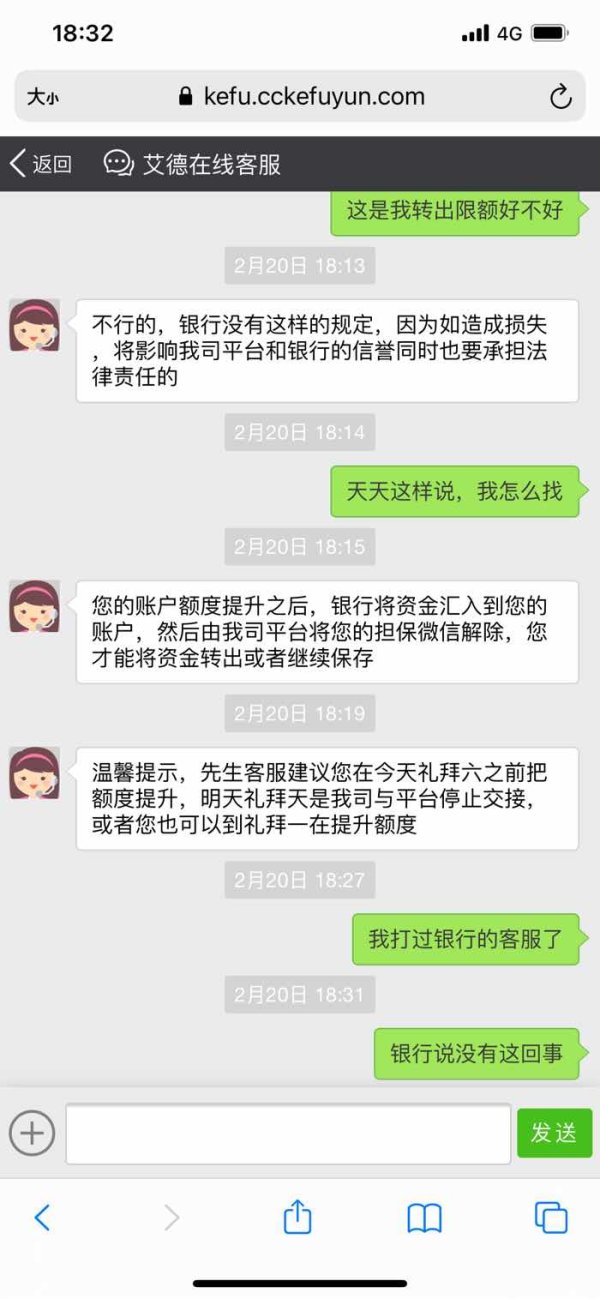

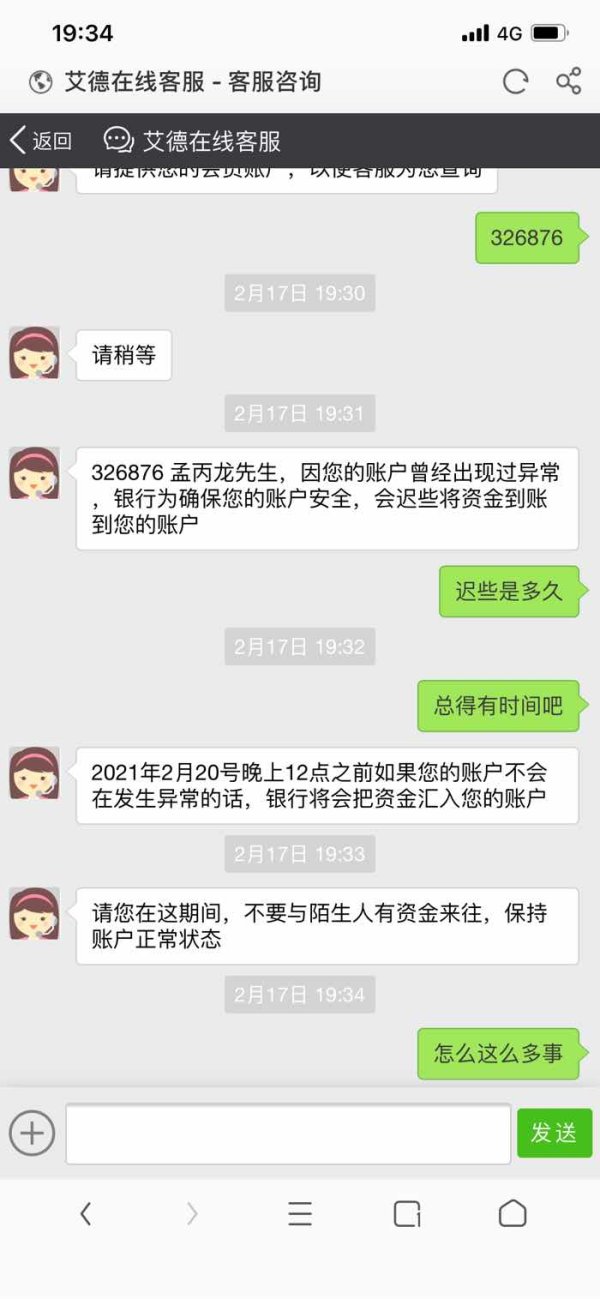

Criminals use Aide Jinye to obtain huge profits and freeze account funds. The company does not act, does not investigate, and does not deal with it

Exposure

2022-12-01

小栗子3124

Hong Kong

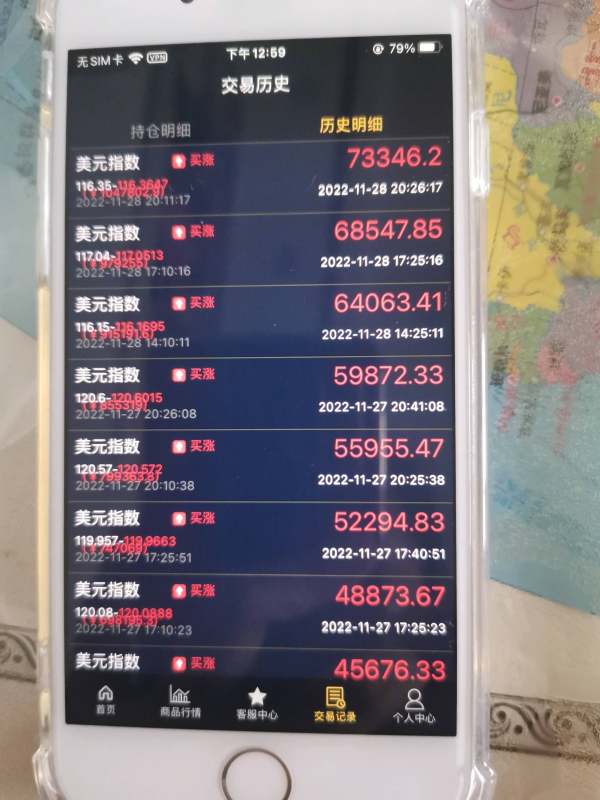

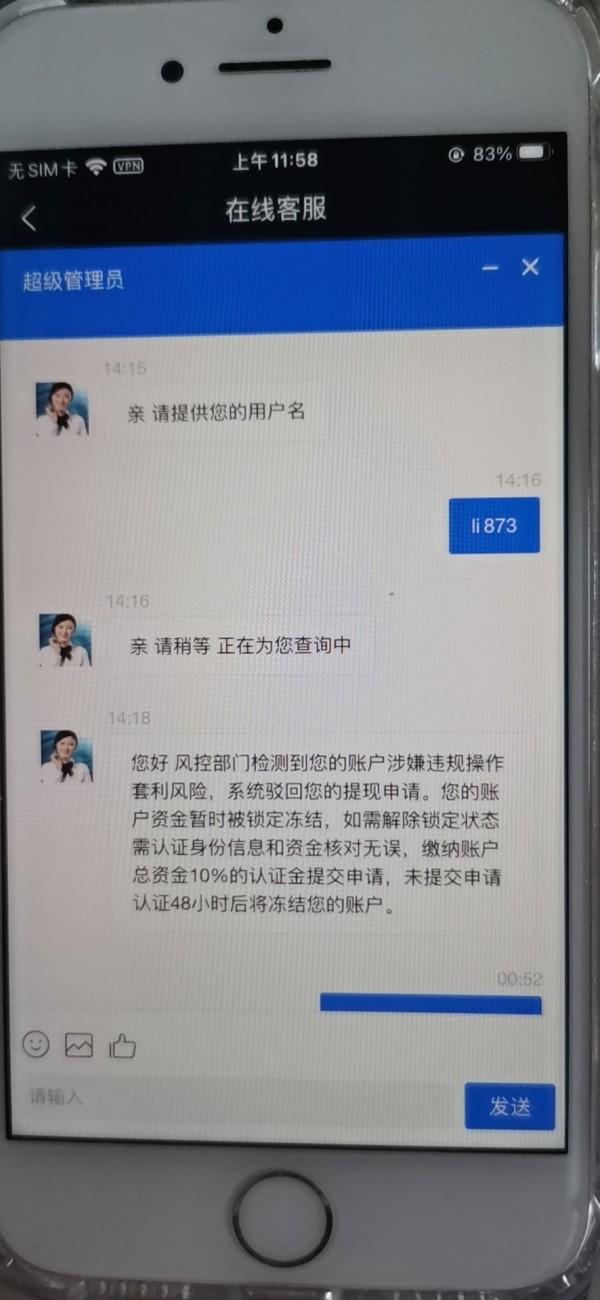

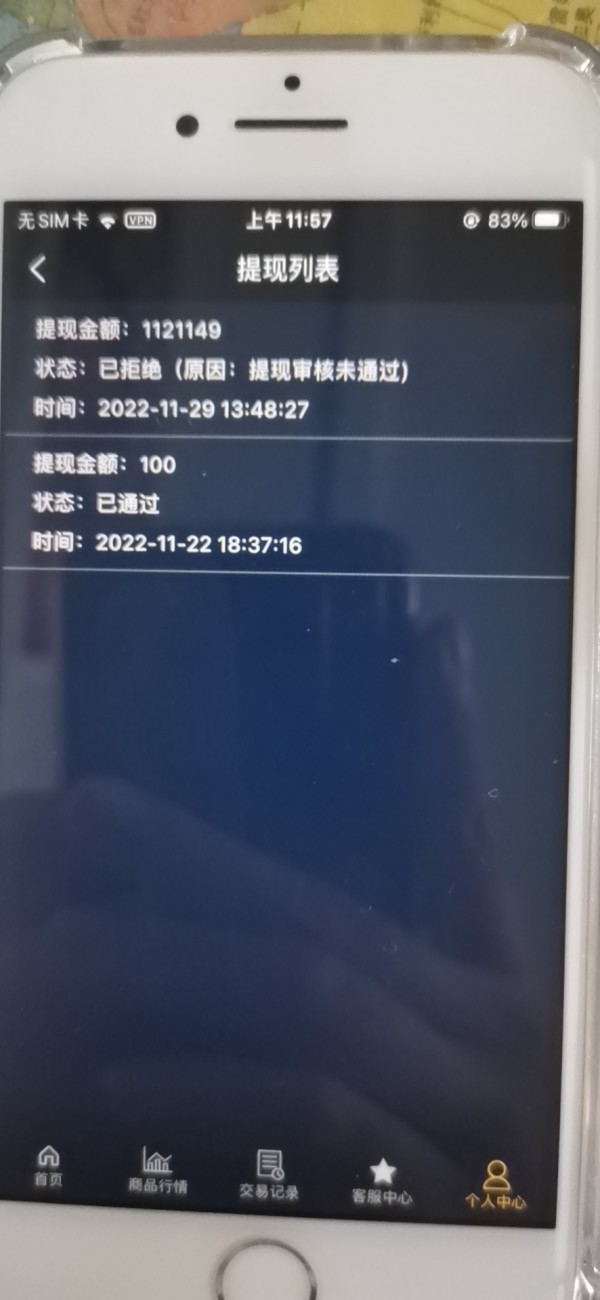

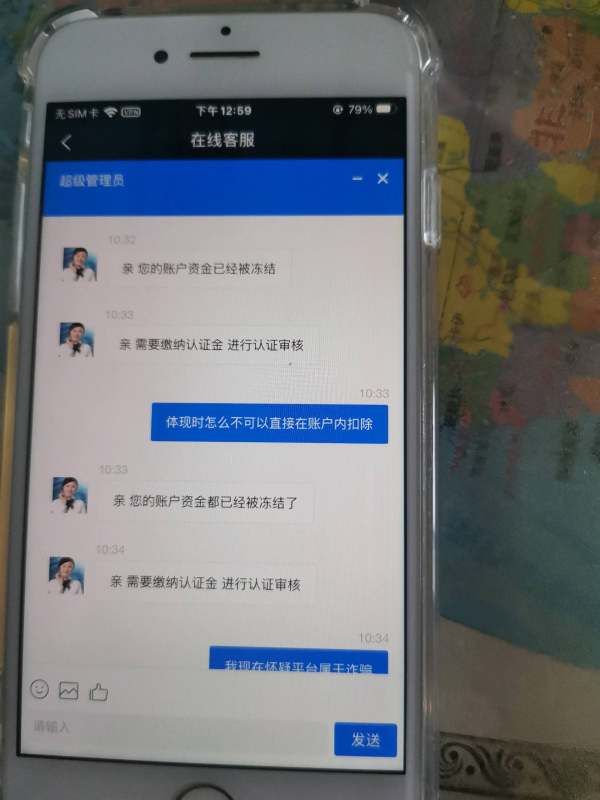

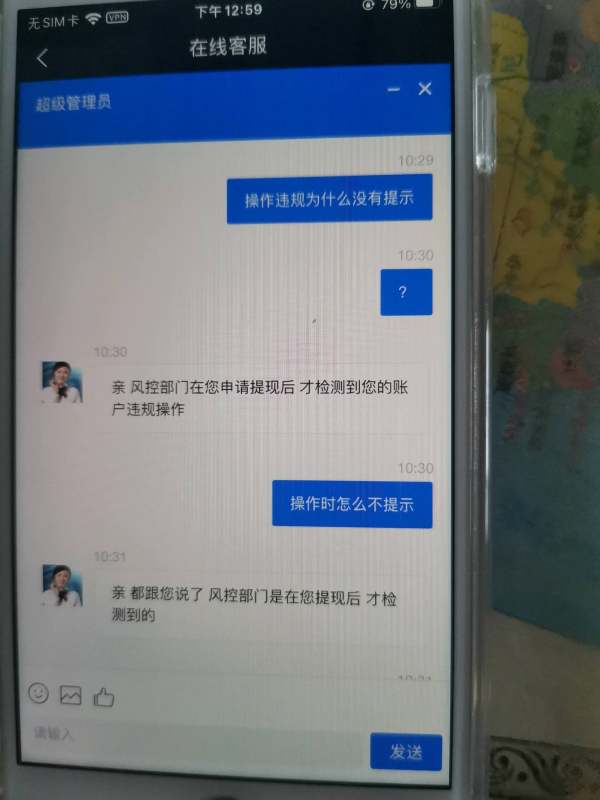

The recharge and purchase are normal, and when the cash is withdrawn, the risk department will be prompted to detect the arbitrage risk of illegal operations in the account, and the system will reject the cash withdrawal application. The account funds are temporarily locked and frozen. If you need to unlock the status, you need to verify your identity information and funds, pay 10% of the total funds in the account and submit the application. If you do not submit the application for authentication, the account will be frozen within 48 hours.

Exposure

2022-11-30

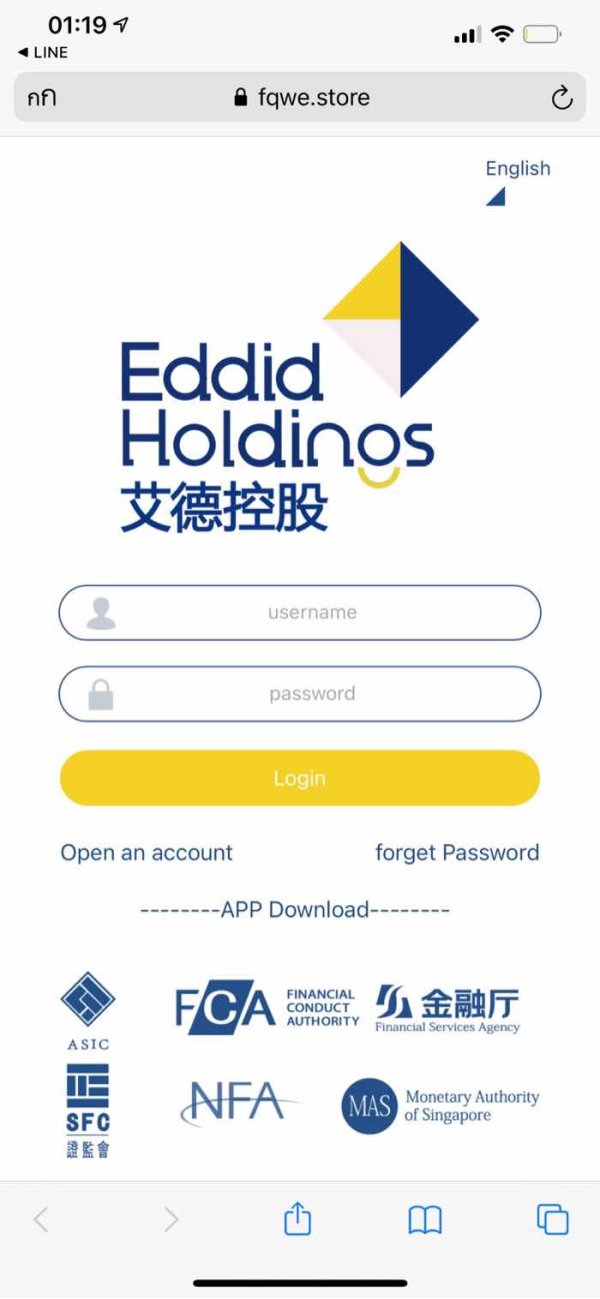

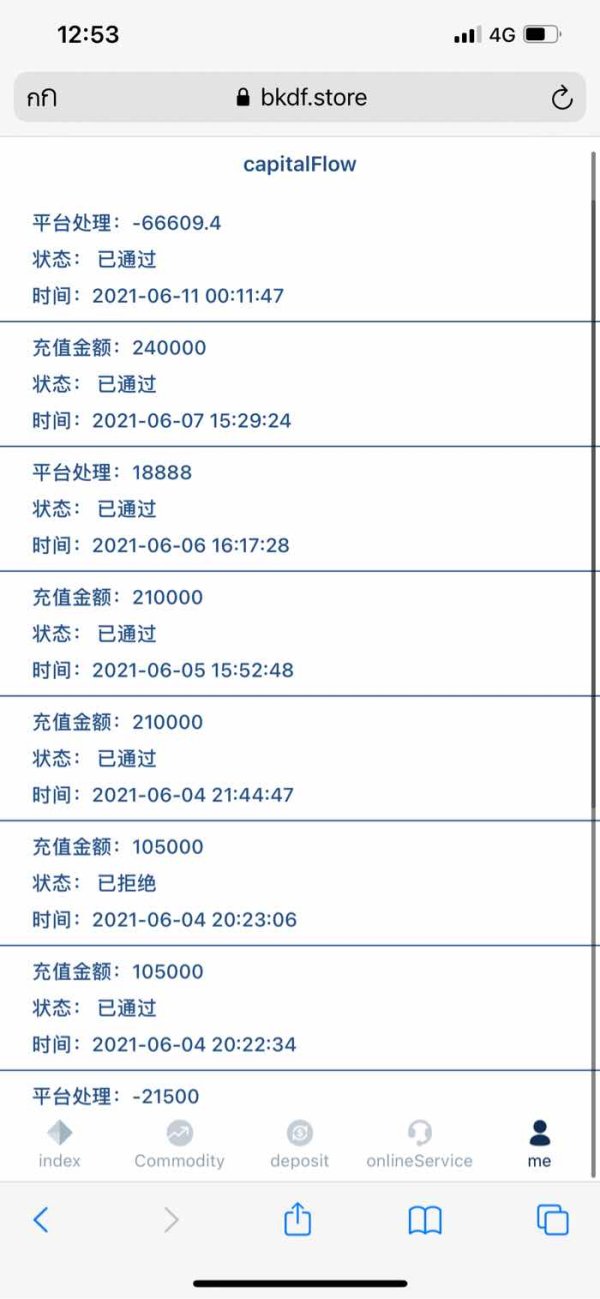

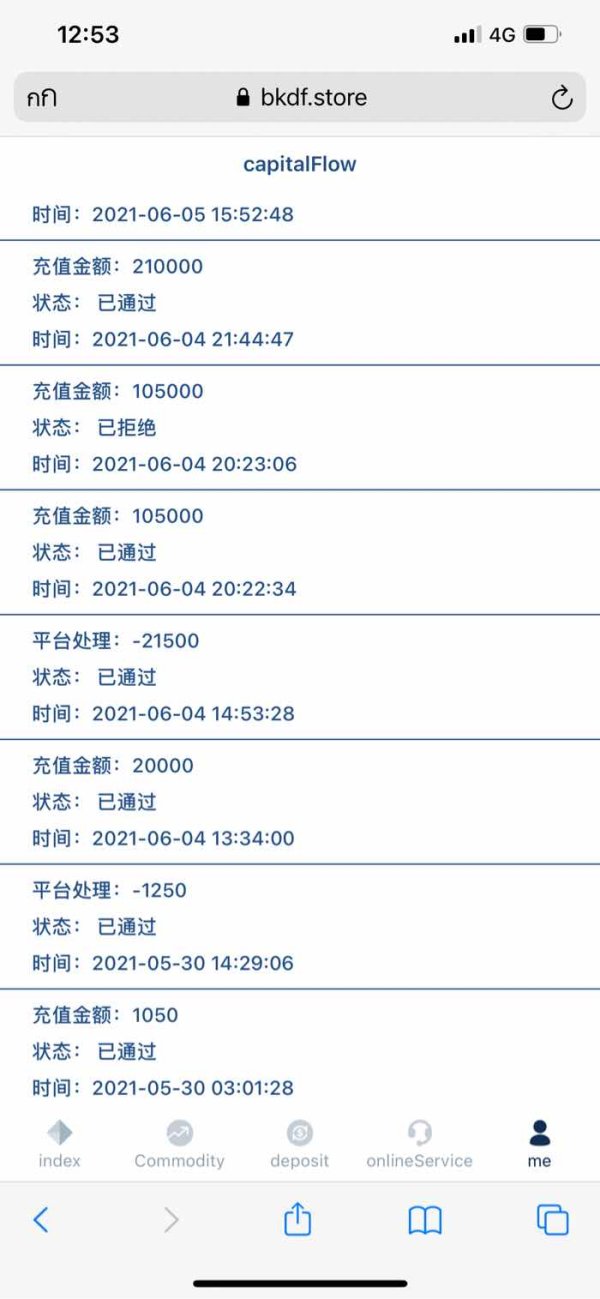

Kanchaya Tamkuan

Thailand

A friend I met via Tinder invited me to invest with him together. However, I can't witdhraw funds now.

Exposure

2021-06-26

梅琳达航航妈妈

Hong Kong

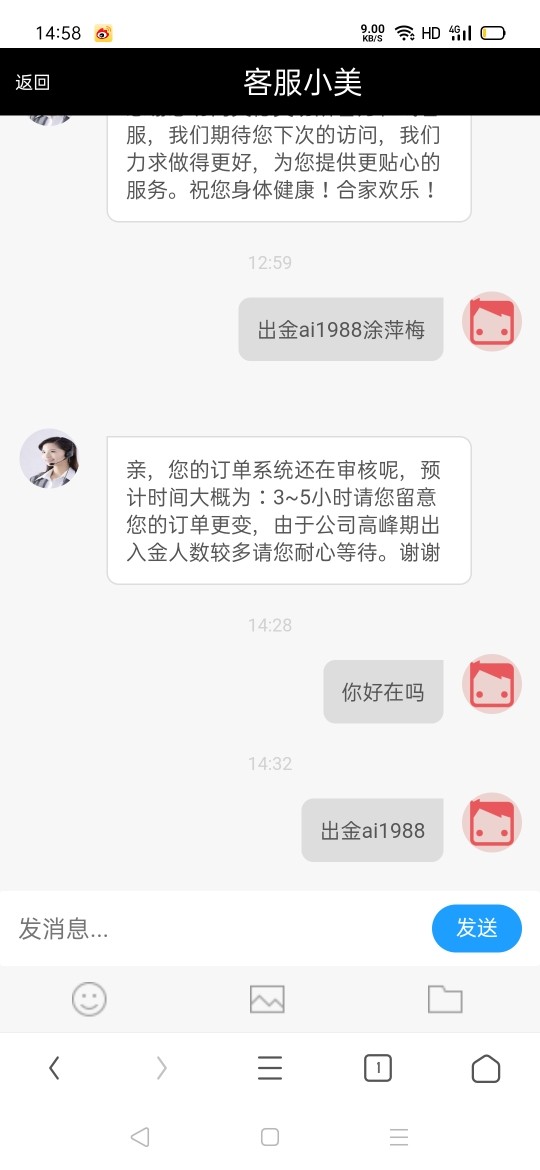

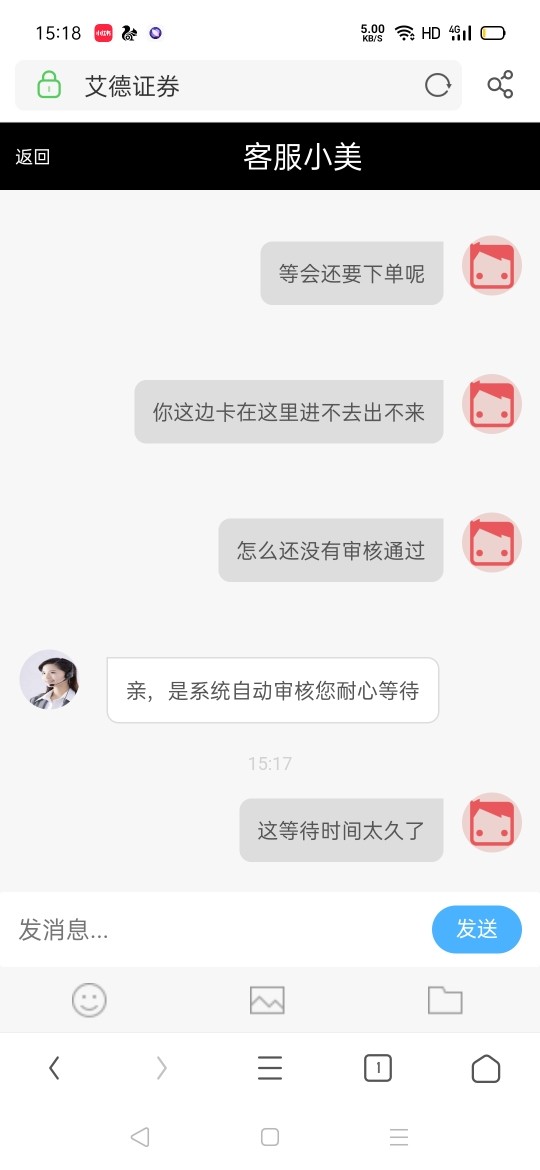

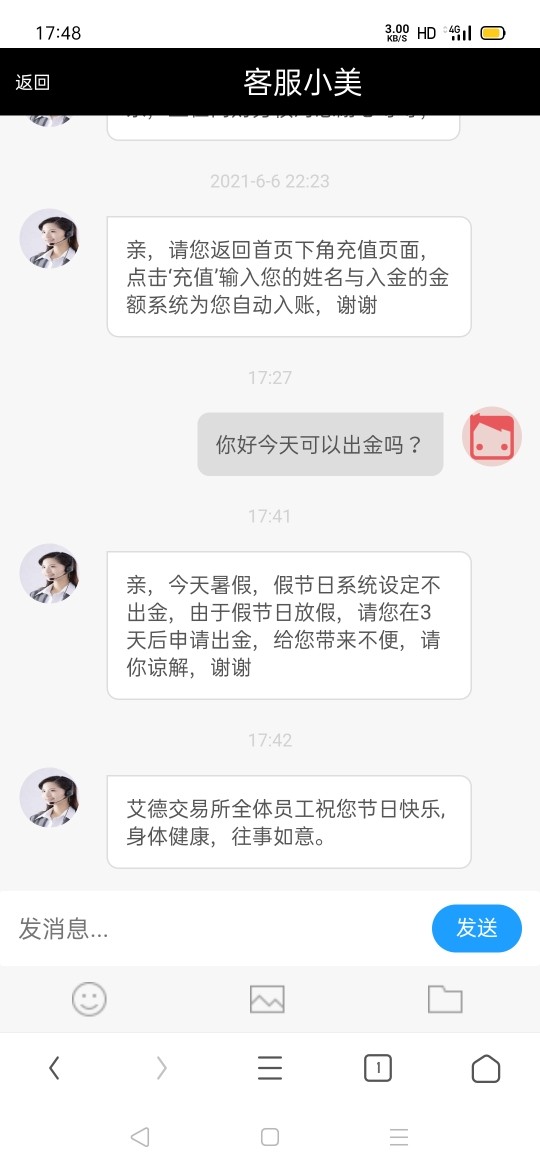

If the withdrawal review fails, the system will be busy for a while, and then it will be on holiday.

Exposure

2021-06-14

FX3263285483

Hong Kong

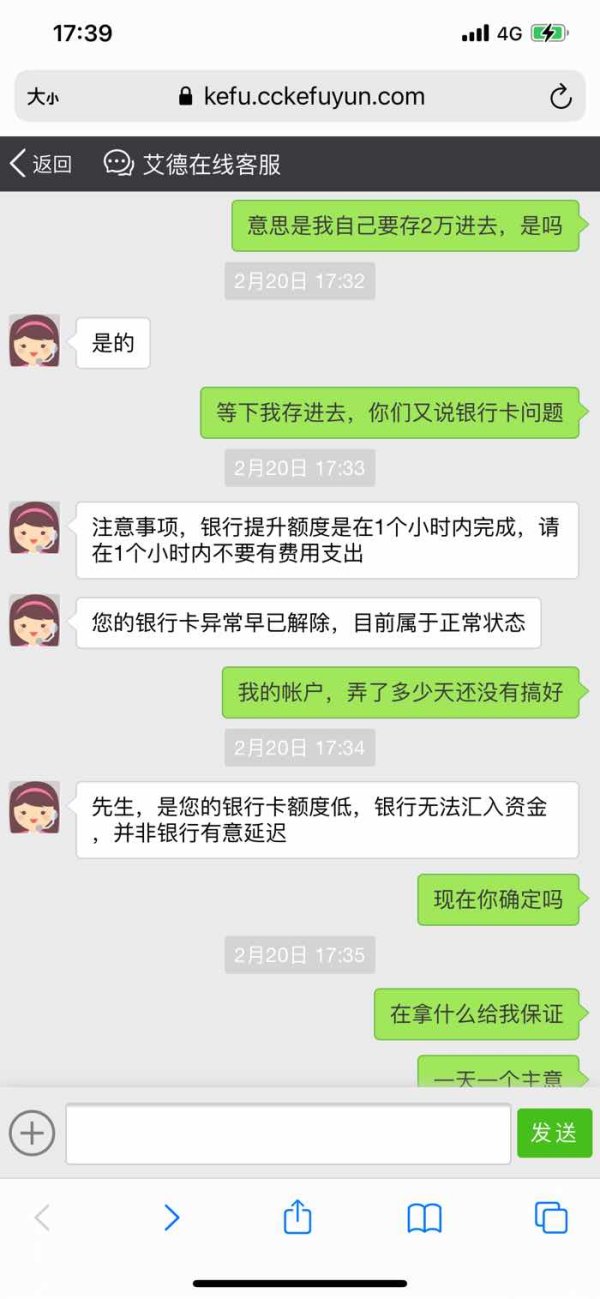

At first freeze your account and ask for money step by step. Now can't withdraw

Exposure

2021-03-05

Jian96812

Taiwan

The fraud platform cheats hard-earned money 1.Ask you to pay tax and cross-boarder handling fee 2.Tell you that your account is abnormal with no reason 3.Pay large amounts of margin 4.The way you withdraw funds is not allowed by SAFE after paying the margin 5.Change the way you withdraw funds and have to make deposits 6.In the end, account will be frozen by recognizing your account is abnormal for depositing frequently 7.Cheat all of your money The fraud platform utterly cheats me so far!

Exposure

2020-11-25

凡人36855

Hong Kong

I deposited 300,000, so I hava a bonus of over 60,000. Then I profited 40,000. So I have over 400,000 in total. I can witdhrawl smal amount of money at first two time. But I can't this time with varied reasons. I was scammed.

Exposure

2020-11-22

風亦飛

Malaysia

Eddid Financial’s trading app is flexible and easy to use. As a stock trader, I love using this company, with a good selection of investment portfolios to choose from. Eddid Financial is really a reliable company.

Neutral

2023-03-02

俊杰

Australia

This company is good so far for me. I have been trading in this company for more than 3 years. I was able to withdraw also for some time. But their new recent platform has some issues. You can't open trades at the time of fluctuations, at this time one can only open trades using (buy/sell stop/limit) orders. Otherwise, everything is good.

Positive

2023-03-21