Score

Angel Broking

India|5-10 years|

India|5-10 years| https://www.angelbroking.com/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

India 8.89

India 8.89Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

India

IndiaUsers who viewed Angel Broking also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

angelbroking.com

Server Location

India

Website Domain Name

angelbroking.com

Website

WHOIS.NETWORKSOLUTIONS.COM

Company

NETWORK SOLUTIONS, LLC.

Domain Effective Date

2000-07-17

Server IP

13.233.21.99

Company Summary

Abstract

Angel One, formerly known as Angel Broking, is a prominent brokerage firm in India with a rich history dating back to 1987. As a registered member of BSE, NSE, and MCX, Angel One offers a comprehensive range of online trading services, including equity, derivative, commodity, and currency trading. In addition to trading, Angel One also provides services such as mutual funds, margin trading, and loans against shares.

| Angel Broking | Basic Information |

| Company Name | Angel Broking |

| Founded | 1987 |

| Headquarters | India |

| Regulations | No Regulation |

| Tradable Assets | Equities, Derivatives, Commodities, Currencies, IPOs, Mutual funds, Futures, Options |

| Account Types | Demat Account, Trading Account, Margin Account, Intraday Trading Account, IPO Account, Hybrid Account |

| Minimum Deposit | No account opening charges on new accounts |

| Maximum Leverage | 1:40 |

| Spreads | Flat INR 20 or 0.25% fee (whichever is lower) on pre-executed orders on Intraday, F&O, Commodities, and Currencies |

| Commission | From 0 |

| Deposit Methods | Wire transfer, Bank Cards, Electronic Payment Systems (Skrill, FasaPay) |

| Trading Platforms | Angel Broking App (Mobile Trading App), Angel Broking Trade (Website), Angel SpeedPro (Trading Terminal) |

| customer Support | Phone, Email |

| Education Resources | Training, Hand-holding, Research Reports, Market Analysis |

| Bonus Offerings | None |

Overview of Angel Broking

Angel Broking is a renowned online share trading brokerage firm in India. Established in 1987 by founder Dinesh Thakkar, who currently serves as the CEO, the company operates under the name Angel One Ltd. Its headquarters are located in Mumbai, India, while it has a wide network of over 1,000 offices spread across the country, including cities like Kolkata and Kerala. With a user base exceeding 5 million, Angel Broking offers a diverse range of financial products, covering equities, F&O (futures and options), currencies, and commodities. The company holds memberships with esteemed stock exchanges such as the Bombay Stock Exchange (BSE), National Stock Exchange (NSE), Metropolitan Stock Exchange of India (MSEI), NCDEX, and MCX. Investors can access Angel Broking's target share prices through platforms like Money Control. It's worth mentioning that Angel Broking is a SEBI registered stockbroker and a depository participant affiliated with Central Depository Services Limited (CDSL).

REGULATORY INFORMATION: LICENSE

No valid regulatory information. Please be aware of the risk!

Pros and Cons

The following are the pros and cons of Angel Broking. Please note that it is important to thoroughly assess the advantages and disadvantages of any brokerage firm, including Angel Broking, before opening an account to ensure it aligns with your specific investment needs and preferences.

| Pros | Cons |

| Competitive Brokerage Fees: Angel Broking offers full-service brokerage services at ultra-low brokerage fees, providing cost-effective trading options for investors. | Margin Funding Confusion: The provision of margin funding without notice can lead to major confusion for customers, resulting in hefty interest charges and potential financial burdens. |

| Flat Fee Structure: With a flat fee of Rs 20 per order across segments and exchanges, Angel Broking ensures transparency and affordability. It also offers brokerage-free equity delivery trades, allowing investors to save on transaction costs. | Limited Trading Options: Angel Broking does not offer to trade in SME shares, which may restrict the investment choices for certain investors. |

| Support for Beginners: Angel Broking provides training and hand-holding for beginners, offering guidance and assistance to help them navigate the stock market with confidence. | Cross-Selling Efforts: The Angel RM and sales team may engage in cross-selling other products and services, which can be perceived as a drawback by investors who prefer a more focused approach. |

| Full-Service Brokerage: Angel Broking offers comprehensive brokerage services, catering to the diverse needs of investors at affordable rates. | Lack of GTC/GTT Order Facility: Angel Broking does not provide the GTC/GTT (Good Till Cancelled/Good Till Triggered) order facility, which may inconvenience investors who rely on these types of orders. |

| No Charges for NEFT/Fund Transfers: Angel Broking does not charge for NEFT/fund transfers, saving investors additional costs compared to other brokers who charge around Rs 10 per transaction. | No 3-in-1 Account: Angel Broking does not offer a 3-in-1 account that combines trading, demat, and banking facilities, potentially causing inconvenience for investors who prefer an integrated account. |

Trading Instruments

Angel Broking provides a wide range of trading options for investors, including equities, commodities, currencies, IPOs, mutual funds, futures, and options. When it comes to currency trading, the broker offers trading in four currency pairs: USD/INR, EUR/INR, GBP/INR, and JPY/INR.

In addition to traditional trading options, Angel Broking also supports futures and options trading in agriculture, minerals, and precious metals such as gold and silver. This allows investors to diversify their portfolios and explore opportunities in these specific sectors.

Recently, Angel Broking introduced international investments for Indian traders in partnership with Vested Finance. This new offering enables investors to invest in US stocks, expanding their investment possibilities beyond the Indian market.

With this comprehensive range of trading options and the recent addition of international investments, Angel Broking aims to provide its clients with a diverse set of opportunities to meet their investment goals.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs | Options |

| Angel Broking | No | Yes | No | Yes | No | Yes | Yes | Yes |

| RoboForex | Yes | Yes | Yes | Yes | Yes | Yes | Yes | No |

| Pocket Option | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | No | Yes | No | No |

Account Types:

Angel Broking recognizes the diverse trading and investment needs of individuals and offers a range of account types to accommodate these requirements. The account opening process is quick and straightforward, with no charges for opening new accounts. However, users must adhere to KYC regulations by completing a form and submitting the necessary documentation for identity, address, and other verification purposes.

1. Demat Account:

Angel Broking provides a lifetime free Demat account, allowing traders to hold their shares and securities electronically without paperwork. Multiple Demat accounts can be opened, with a debit transaction charge of INR 20. Non-resident Indians (NRIs) can also open Demat accounts, subject to Foreign Exchange Management Act (FEMA) regulations and an annual maintenance fee of INR 450 plus tax.

2. Trading Account:

The trading account enables investors to buy and sell shares on the stock market. Angel Broking's trading account offers access to trade across various asset classes through a single platform.

3. Margin Account:

For those interested in margin trading, Angel Broking offers a margin account. This account allows trading on margin instead of cash and adheres to SEBI's leverage and margin requirements, with a 40% initial margin and 50% maintenance margin.

4. Intraday Trading Account:

Angel Broking caters to day traders with its Intraday Trading Account, designed for buying and selling securities within a single trading day. The platform provides features specifically tailored for intraday trading, such as 1:10 leverage, 30-day charts, margin calculators, and delivery exposure calculators.

5. IPO Account:

To participate in initial public offerings (IPOs), investors can open an IPO account, which necessitates the simultaneous opening of a Demat account. This account allows investors to invest early in a company and potentially benefit from gains when the shares are listed on the exchange.

6. Hybrid Account:

Angel Broking offers a 2-in-1 account that integrates a Demat and trading account. This integration facilitates the seamless movement of funds between the trading and Demat accounts when purchasing shares. It is important to note that Angel Broking does not provide a 3-in-1 account that combines banking services with the Demat and trading accounts.

With this array of account types, Angel Broking caters to the diverse trading and investment preferences of individuals, providing flexibility and convenience in managing their portfolios.

How to Open an Account?

To open a Free Demat Account with Angel Broking, follow the paperless 4-step account opening process:

Visit Angel Broking's website and locate the “Open Demat Account” option. Click on it. Add your name, and mobile number, and select your city.

2. Enter OTP received on the registered mobile numberEnter personal details

3. Enter the KYC details

4. Get Demat Account details on the registered Email ID

Leverage

Compared to other international brokers, Angel Broking offers generous leverage limits, providing traders with the potential for amplified returns. The leverage limits vary depending on the asset being traded. Additionally, Angel Broking has set relatively low trading margin requirements, which can be beneficial for traders. Here are the leverage limits and margin requirements for different asset classes:

Equity Delivery: Leverage up to 1:20

Equity Intraday: Leverage up to 1:40

Equities Futures: Leverage up to 1:10

Equities Options: Leverage up to 1:10

Commodities CFDs: Leverage up to 1:10

Forex Options Contracts: Leverage up to 1:7

Currency Futures Contracts: Leverage up to 1:5

To assist users in managing their trading positions and understanding the margin requirements, Angel Broking provides a margin calculator. This tool allows traders to calculate the initial margin charges associated with trading futures and options. By offering a margin calculator, Angel Broking aims to reduce risks and ensure accurate information about margins and leverage, particularly in the inherently risky trading environment.

It is important for traders to understand the implications of leverage and margin requirements and exercise caution when using these tools, as they can significantly impact trading outcomes.

Spreads and Commissions (Trading Fees)

Angel Broking implements a simple and transparent fee structure for its brokerage services. Here are the details regarding the charges and fees:

1. Pre-executed Orders:

- Intraday, F&O, commodities, and currencies: Flat INR 20 or 0.25% fee (whichever is lower) per order, irrespective of order size.

- Equity delivery trades: No hidden charges.

2. Zero-Brokerage Plan:

- Angel iTrade Prime Plans offer a zero-brokerage plan on Annual Maintenance Charges (AMC) for the first year of opening an account.

3. Annual Maintenance Charge:

- Demat Account: INR 240 per year.

To assist users in understanding and comparing brokerage charges, Angel Broking offers a calculator tool. This tool enables users to calculate and compare brokerage charges for various transactions, such as commodities, currency, equity futures and options, intraday, and carry forward transactions. It covers different stock and commodity exchanges and takes into account transaction charges, state-wise stamp duty, Securities Transaction Tax (STT), Goods and Services Tax (GST), and other applicable fees.

In line with their commitment to transparency, Angel Broking provides a comprehensive breakdown of additional fees on their terms and conditions and website. Users can access detailed information about tax and regulatory fees, including Security Transaction Tax (STT), SEBI charges, stamp charges, and more. This ensures that users have a clear understanding of the costs involved in their trading activities.

It is advisable for users to review the specific charges and fees associated with their trading activities, as fees may vary based on the type of transaction and prevailing regulations.

Here is a comparison table of commissions charged by different brokers::

| Angel Broking | Upstox | Sharekhan | Zebu Trade | Alice Blue | |

| Trading Account Opening Charges | Rs 0 (Free) | Rs 0 (Free) | Free | ₹0 (Free) | ₹0 (Free) |

| Trading Account AMC Charges | Rs 0 (Free) | Rs 0 (Free) | Free | ₹0 (Free) | ₹0 (Free) |

| Demat Account Opening Charges | Rs 0 (Free) | Rs 0 (Free) | Free | ₹300/- | ₹0 (Free) |

| Demat Account AMC Charges | Rs 240 | Rs 150 | Rs 240 PA | ₹0 (Free) | ₹400/- per annum |

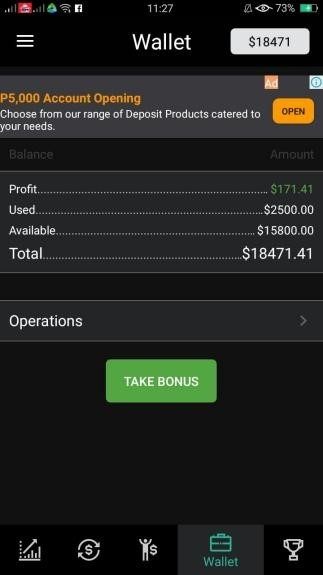

Non-Trading Fees

No account opening fee.

No withdrawal fee.

Monthly account maintenance fee of INR 20.

You can use a debit card to transfer funds, which carries a fee of between INR 10-20. However, you cannot use credit cards to fund your account.

Trading Platforms

Angel Broking provides a range of trading platforms to cater to the diverse needs of its customers. These platforms are available free of charge and offer convenient access to the stock market. Here are the details of the trading platforms offered by Angel Broking:

1. Angel Broking App (Mobile Trading App):

- This mobile application is available for both Android and iOS devices.

- It enables customers to trade in equity, mutual funds, US stocks, commodities, and more.

- The app offers a user-friendly interface and allows customers to stay connected to the stock market on the go.

2. Angel Broking Trade (Website):

- This browser-based trading platform can be accessed through any web browser.

- It provides real-time updates on market rates, facilitating informed decision-making.

- Investors and traders can conveniently access the market from various terminals using this platform.

3. Angel SpeedPro (Trading Terminal):

- Angel SpeedPro is a desktop application designed for the stock market.

- It offers a comprehensive trading experience with advanced features and tools.

- The platform provides a single-window interface for seamless trading and includes trade monitoring capabilities.

These trading platforms cater to different preferences and requirements, allowing customers to choose the most suitable option for their trading activities. Whether using the mobile app, web-based platform, or desktop terminal, customers can access a range of financial instruments and execute trades efficiently.

Deposit and Withdrawal Methods

Deposits:

AMarkets offers a variety of payment options for depositing funds into your trading account. You can choose from wire transfers, bank cards, and electronic payment systems such as Skrill and FasaPay. The good news is that AMarkets does not charge any fees for deposits. In most cases, the processing times for deposits are instant, except for bank transfers, which may take 3 to 5 business days to be processed.

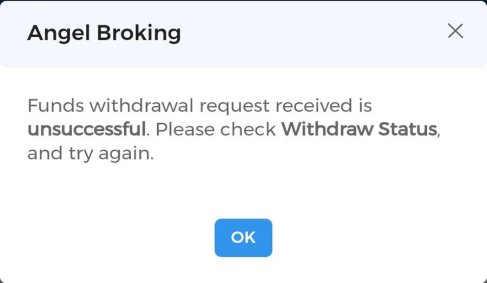

Withdrawals:

When it comes to withdrawals, AMarkets applies different fees depending on the withdrawal method. For Perfect Money and FasaPay, the withdrawal fees start from 0.5%. If you prefer using bank cards, there will be a fee starting from 2.2%. The fees for bank transfers will vary depending on your bank's policies. The minimum withdrawal amount for most methods is 10 USD or EUR. In general, processing times for withdrawals are usually instant. However, for withdrawals to bank cards, it may take a few hours, and for bank transfers, it can take up to 5 days to be processed.

Customer Service

If you have any queries, encounter login problems, or forgot your user ID for Angel Broking's web login, you can get in touch with their customer care team using the following contact details:

Helpline Phone Number: 08047480048

Email Address: support@angelbroking.com

Educational Resources and Community Support:

Angel Broking provides a comprehensive range of educational resources through its knowledge center, catering to the needs of beginners. Additionally, the broker offers research and advisory services to assist users in making informed investment decisions. With its user-friendly interface, Angel Broking ensures a seamless and intuitive trading experience for beginners.

Angel Broking has created a channel to address the curiosity of its customers. The services provided by Angel Broking include:

Announcement of new features and platform upgrades.

Sharing blog links, podcasts, and videos to help customers improve their trading and investing skills.

Initiating and moderating discussions on market events and patterns.

Offering early access to active participants and gathering their feedback.

Facilitating the reporting of bugs and feature requests to the product managers and technical team at Angel Broking.

Through this channel, Angel Broking aims to engage with its customers, provide valuable resources, and gather feedback to enhance its services.

User Experience and Additional Features:

Angel Broking AQR, also known as Angel Quantitative Research, is a specialized service offered by Angel Broking.

The platform utilizes quantitative models and algorithms to analyze market data and generate trading signals. It combines technical analysis, statistical models, and machine learning techniques to provide users with a systematic approach to trading.

Some notable features of Angel Broking AQR include real-time trading signals, backtesting capabilities, risk management tools, and customization options. The platform allows users to test their trading strategies using historical data and provides risk management indicators to help control exposure. It also offers access to research reports and market analysis from Angel Broking's research team.

Angel Broking AQR aims to assist traders in making informed trading decisions based on data-driven insights. However, it's important to remember that trading in financial markets always carries inherent risks. Traders should exercise caution, conduct their own analysis, and consider seeking professional advice before making any investment decisions.

Conclusion

In conclusion, Angel Broking (now known as Angel One) is one of the oldest and leading brokerage firms in India, offering a range of online trading services for equities, derivatives, commodities, and currencies. The company has a large presence across India and boasts a user base of over 5 million. One of the main advantages of Angel Broking is its ultra-low brokerage fees, charging a flat fee of INR 20 per order. The broker also provides training and hand-holding for beginners and offers a variety of trading platforms, including a mobile app and a desktop trading terminal. However, there are some disadvantages to consider. Angel Broking does not offer to trade in SME shares, and their margin funding policy can lead to confusion and high-interest charges for customers. They also lack certain features like GTC/GTT order facilities and 3-in-1 accounts. Additionally, the broker is not regulated, which may be a concern for some investors. It is important for individuals to carefully evaluate their investment needs and consider these pros and cons before opening an account with Angel Broking.

FAQs

Q: Is Angel Broking a regulated broker?

A: No, Angel Broking is not a regulated broker.

Q: What services does Angel Broking offer?

A: Angel Broking offers online equity, derivative, commodity, and currency trading services. It also provides mutual funds, margin trading services, and loans against shares.

Q: What are the account types offered by Angel Broking?

A: Angel Broking offers Demat Account, Trading Account, Margin Account, Intraday Trading Account, IPO Account, and Hybrid Account.

Q: What is the minimum deposit required to open an account with Angel Broking?

A: There are no account opening charges on new accounts, so no minimum deposit is required.

Q: What are the deposit methods accepted by Angel Broking?

A: Angel Broking provides multiple options for depositing funds, including wire transfers, bank cards, and electronic payment systems like Skrill and FasaPay. These payment methods offer flexibility and convenience for users to deposit funds into their trading accounts.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now