Score

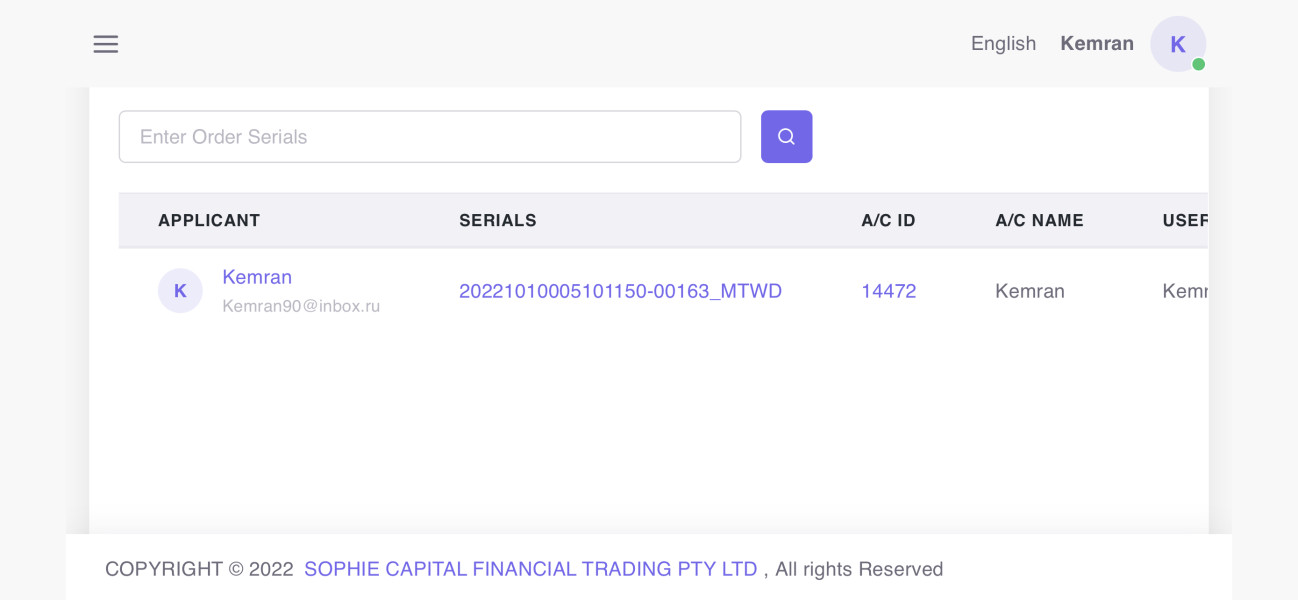

SOPHIE CAPITAL FINANCIAL TRADING PTY LTD

United States|2-5 years|

United States|2-5 years| https://sopabc.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed SOPHIE CAPITAL FINANCIAL TRADING PTY LTD also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

amssda.com

Website Domain Name

amssda.com

Server IP

104.21.69.226

sopabc.com

Website Domain Name

sopabc.com

Server IP

104.21.81.95

goscftl.com

Website Domain Name

goscftl.com

Server IP

104.21.18.102

Company Summary

Risk Warning

Online trading involves huge risks and you can lose all your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained herein is for general information purposes only.

| SOPHIE CAPITAL FINANCIAL | Basic Information |

| Registered Country/Area | Australia |

| Founded year | Unknown |

| Company Name | SOPHIE CAPITAL FINANCIAL TRADING PTY LTD |

| Regulation | No regulation |

| Minimum Deposit | AUD 200 |

| Maximum Leverage | 1:500 |

| Spreads | Unknown |

| Trading Platforms | MT5 |

| Tradable assets | Forex, CFDs, Stocks |

| Account Types | Unknown |

| Demo Account | No |

| Islamic Account | No |

| Customer Support | Email: support@sophietrading.com |

| Payment Methods | Credit cards, debit cards, wire transfer |

| Educational Tools | Trading tutorials, webinars |

General Information

Sophie Capital Financial, operating under the company name Sophie Capital Financial Trading Pty Ltd, is a brokerage based in Australia. While the exact founding year remains unknown, the company offers a range of trading services.

The minimum deposit required by Sophie Capital Financial is set at AUD 200, which may be considered accessible for traders with varying levels of capital. The broker provides a maximum leverage ratio of 1:500, allowing traders to control larger positions relative to their deposited funds. It is important for traders to exercise caution and fully understand the implications of higher leverage, as it amplifies both potential profits and losses.

Specific information about the spreads offered by Sophie Capital Financial is not available, limiting our ability to assess the competitiveness of trading costs. Traders should seek clarification from the broker regarding spreads to make informed decisions about the overall cost structure.

Sophie Capital Financial utilizes the widely recognized MetaTrader 5 (MT5) trading platform. The MT5 platform is known for its comprehensive features and advanced trading capabilities. This includes access to various tradable assets such as forex, CFDs, and stocks. The availability of multiple asset classes offers traders opportunities to diversify their portfolios and engage in different markets according to their investment strategies.

Sophie Capital Financial offers customer support via email, with the provided email address being support@sophietrading.com. This channel serves as a means for traders to seek assistance and address their queries or concerns. Accepted payment methods include credit cards, debit cards, and wire transfers. In terms of educational resources, Sophie Capital Financial provides trading tutorials and webinars.

Is SOPHIE CAPITAL FINANCIAL legit or a scam?

Sophie Capital Financial holds a currency exchange license regulated by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) under license number M20082070. This regulatory oversight by FINTRAC indicates the broker's compliance with anti-money laundering and anti-terrorism financing regulations within the Canadian financial system.

It is important to note that the currency exchange license held by Sophie Capital Financial, regulated by FINTRAC, pertains specifically to currency exchange activities rather than broader financial brokerage services. While this license demonstrates the broker's commitment to compliance in the context of currency exchange, it does not encompass regulatory oversight specific to securities trading or investment services.

Pros and cons

| Pros | Cons |

| MT5 trading platform | Not regulated, raising concerns about investor protection |

| High leverage up to 1:500 | Lack of transparency regarding spreads and trading conditions |

| Unknown account types, limiting options for customization | |

| No demo account available | |

| Absence of Islamic (swap-free) account option | |

| Limited information about the company's background and | |

| trading conditions | |

| No information about spreads and commission rates | |

| Limited customer support options, only email communication | |

| No specific details about non-trading fees | |

| Absence of information about deposit and withdrawal processes | |

| Negative reviews regarding withdrawal problems | |

| Limited availability of customer support | |

| Lack of comprehensive educational resources |

Market Intruments

Sophie Capital Financial offers a limited range of trading assets to its clients, including forex, contracts for difference (CFDs), and stocks. This selection provides traders with the opportunity to engage in various markets and potentially diversify their investment portfolios.

Forex trading allows traders to participate in the global currency market, where they can speculate on the price movements of currency pairs. With access to major, minor, and exotic currency pairs, traders can take advantage of potential opportunities arising from fluctuations in exchange rates.

Additionally, Sophie Capital Financial offers CFD trading, which enables traders to speculate on the price movements of underlying assets without owning the assets themselves. CFDs allow for exposure to a wide range of financial instruments such as commodities, indices, and bonds. This flexibility grants traders the ability to capitalize on market trends across different asset classes.

Sophie Capital Financial also provides access to stock trading, allowing traders to engage in the equity markets. By investing in individual company stocks, traders can potentially benefit from company performance and market developments. Stocks offer an opportunity to participate in the growth of specific companies or industries and potentially earn dividends based on company profitability.

Account Types

Sophie Capital Financial appears to offer a single standard account type to its clients. The available information does not provide details about any alternative or specialized account options that may cater to specific trading preferences or requirements.

Traders interested in opening an account with Sophie Capital Financial would typically have to invest $200 the first time. However, the specific features, benefits, and requirements of this account type are not specified in the available information.

Sophie Capital Financial does not provide a demo account. A demo account is a valuable tool for traders, especially beginners, as it allows them to practice and familiarize themselves with the trading platform and market conditions in a risk-free environment. The absence of a demo account may limit traders' ability to test strategies, gain experience, and build confidence before committing real funds to live trading.

Leverage

Sophie Capital Financial offers leverage to its clients with a maximum ratio of 1:500. Sophie Capital Financial's maximum leverage ratio of 1:500 is relatively high compared to industry standards. This level of leverage may appeal to traders seeking the potential for significant returns on their investments. However, it is important for traders to carefully consider their risk tolerance, trading strategies, and the potential impact of leverage on their overall trading performance.

Spreads & Commissions (Trading Fees)

Specific information about spreads and commissions for Sophie Capital Financial is not provided in the available details. The absence of such information hinders the ability to comprehensively evaluate the cost structure associated with trading on the platform.

Non-Trading Fees

When considering non-trading fees associated with SOPHIE CAPITAL FINANCIAL, it is important to be aware of the potential costs beyond the direct trading activities. While specific details about non-trading fees are not explicitly mentioned, it is advisable for clients to carefully review the terms and conditions, as well as any relevant documentation provided by the broker.

Trading platforms

The MT5 trading platform features powerful charting capabilities, including over 50 different technical indicators and intraday analysis tools. Access from a variety of devices also makes trading easier for users.

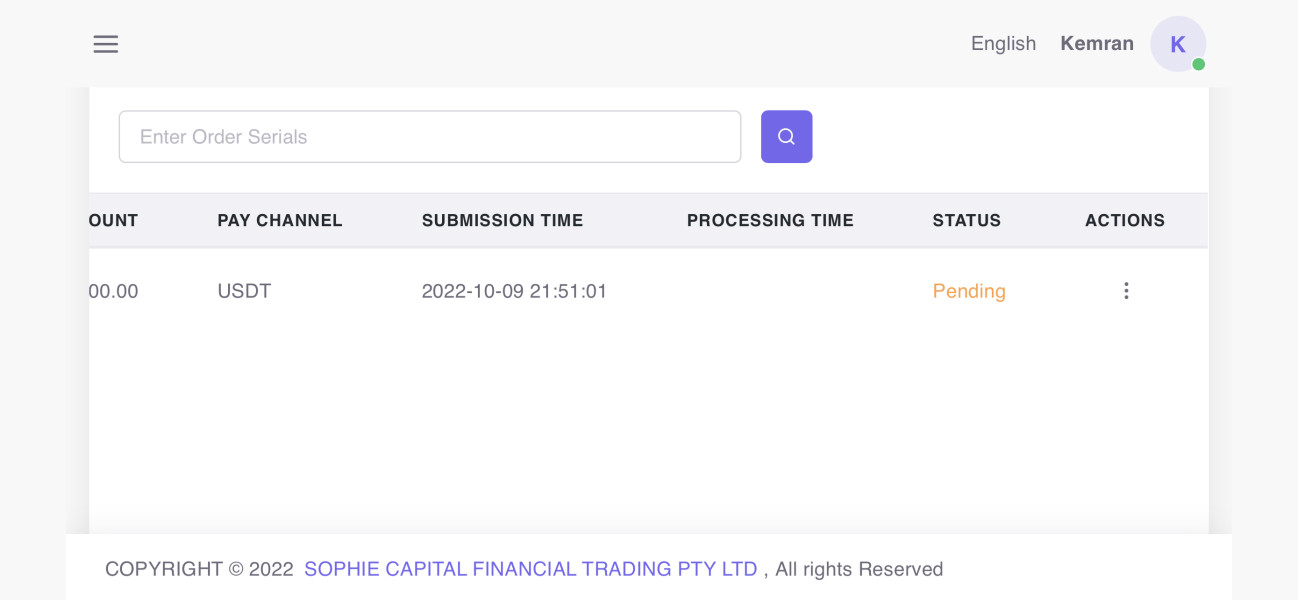

Deposit & Withdrawal

Sophie Capital Financial offers several payment methods for both deposits and withdrawals, providing traders with flexibility in managing their funds. The available payment methods include credit cards, debit cards, and wire transfers. While Sophie Capital Financial offers these payment methods, it is crucial for traders to review and consider any associated fees or limitations imposed by the broker or their respective financial institutions. It is common for financial institutions to impose transaction fees or foreign exchange fees, particularly for wire transfers and credit card transactions involving different currencies. Traders should also be aware of any minimum or maximum deposit and withdrawal limits imposed by Sophie Capital Financial or their chosen payment providers. Understanding these limits can help traders plan their transactions accordingly and avoid any inconveniences.

Customer support

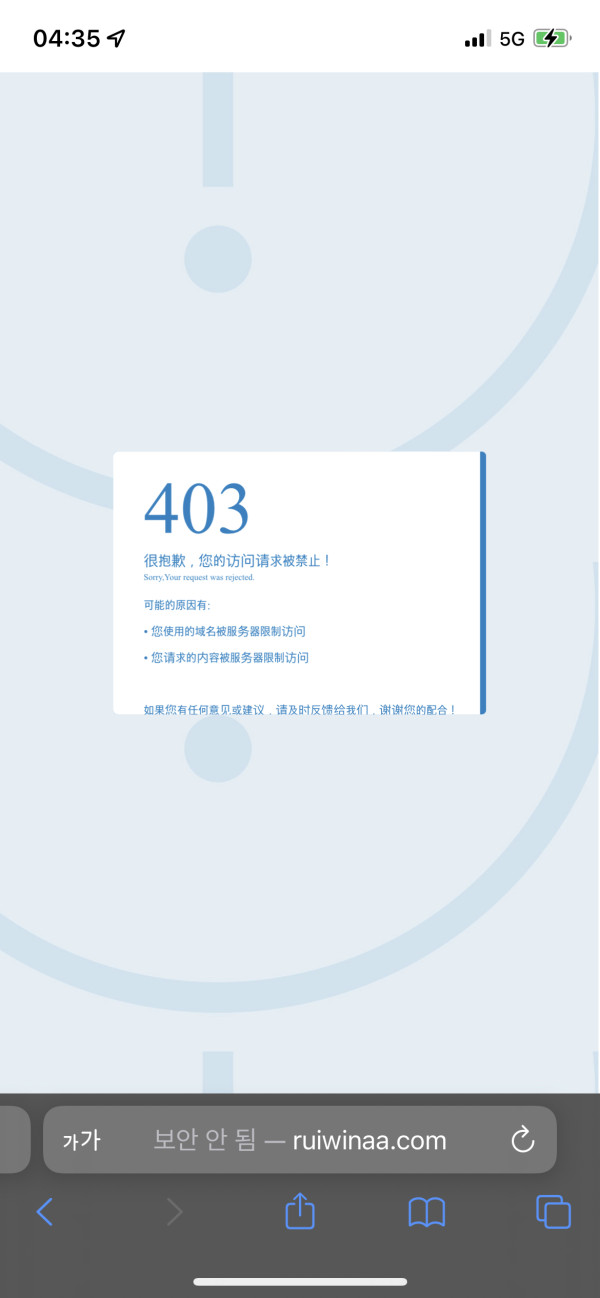

The support service provided by SOPHIE CAPITAL FINANCIAL TRADING PTY LTD is not very extensive. It can only be accessed via email. Since the company's website is not currently open, we do not know if it offers other services such as live chat, callback, FAQ, 24/7 or 24/5 service, etc.

Below are the details about the customer service.

Email: support@sophietrading.com

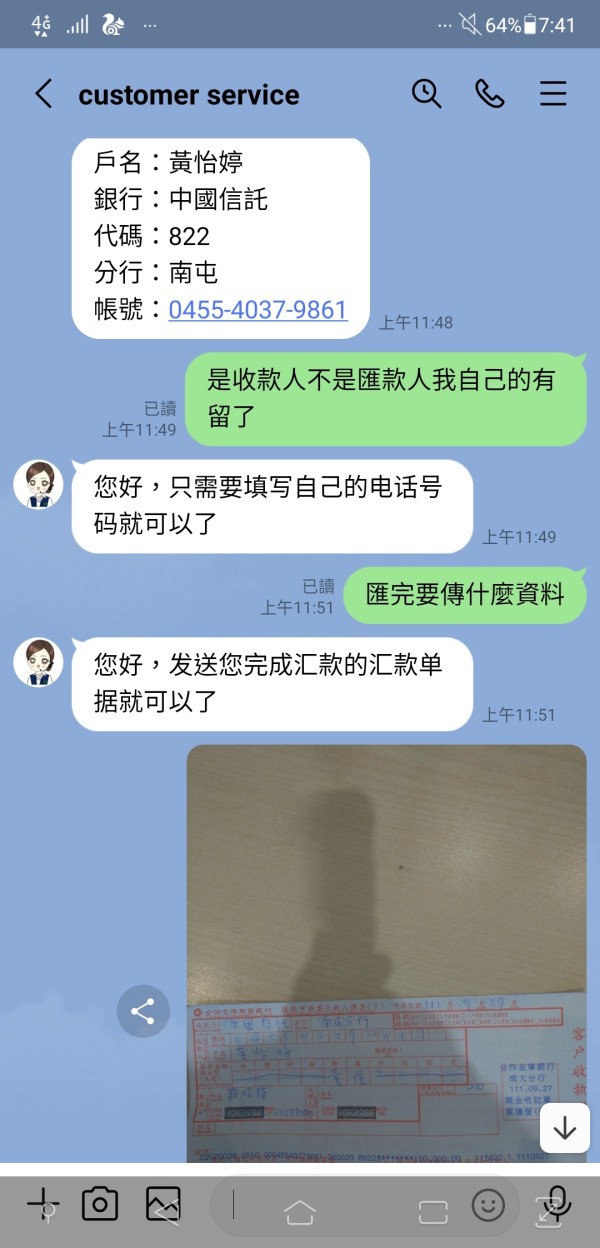

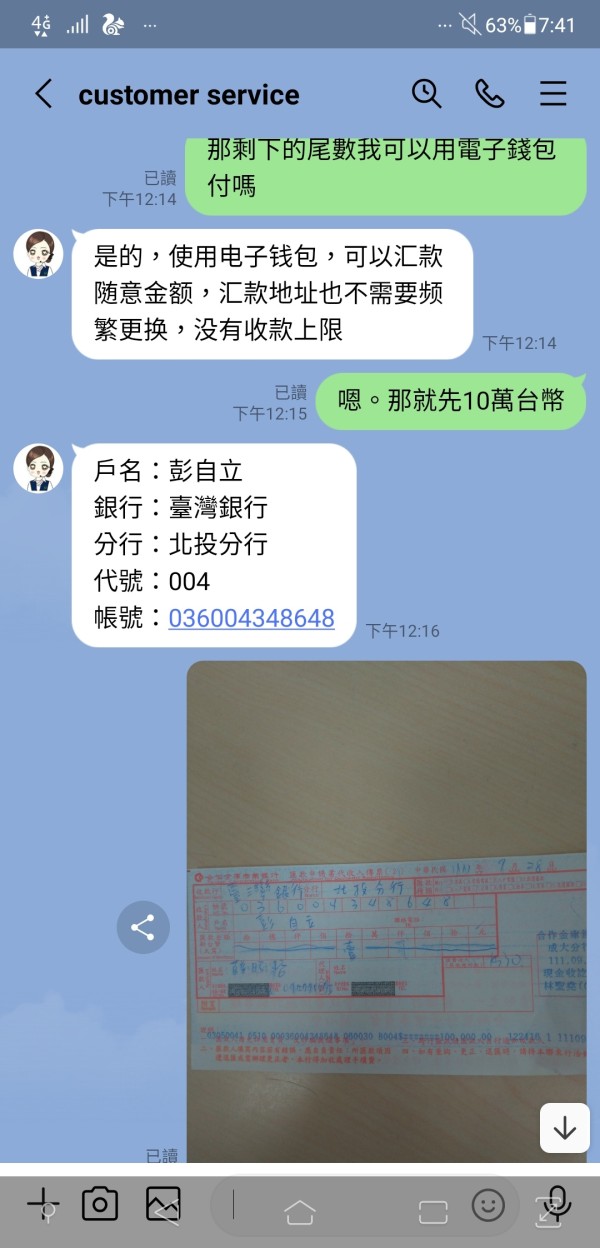

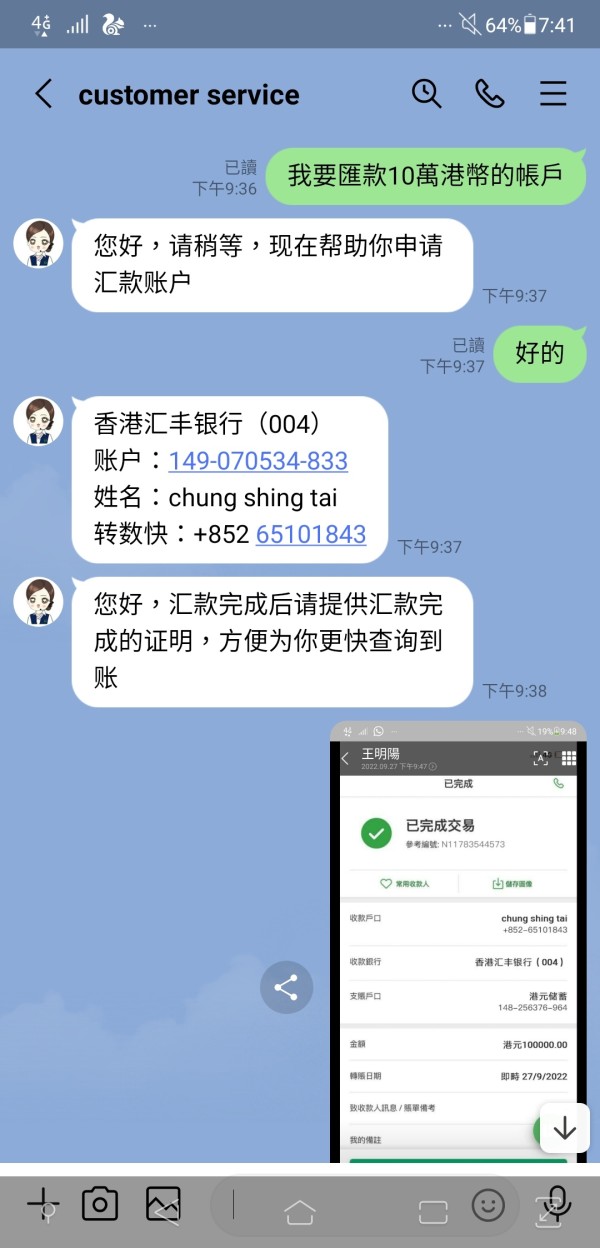

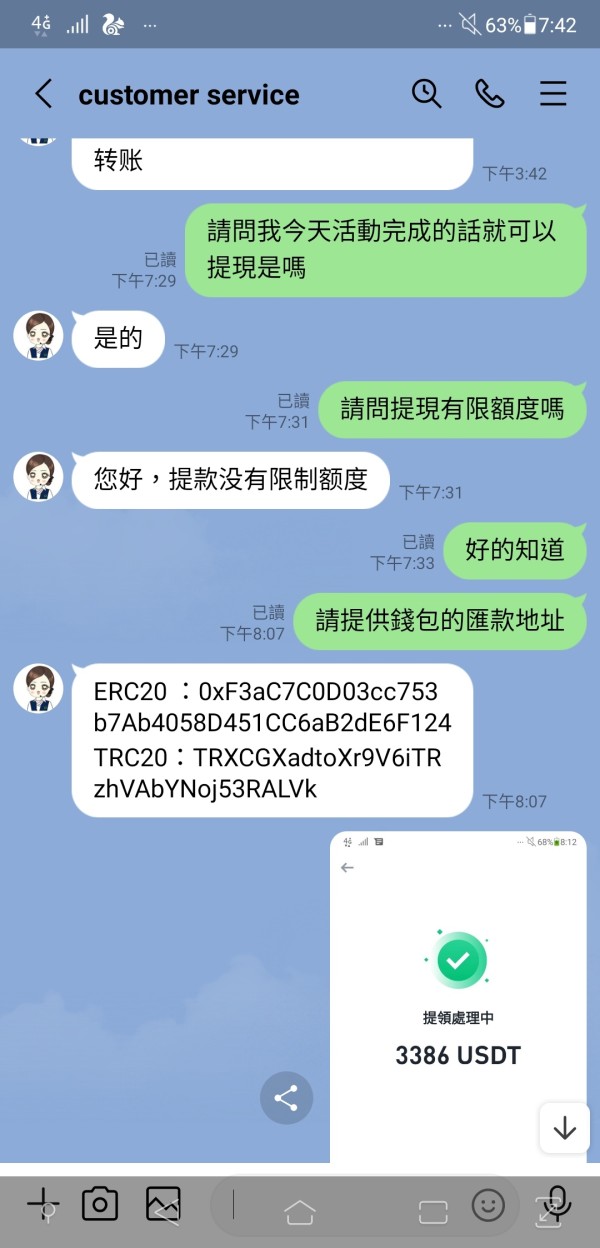

Users exposures

On our website, you can see that some users have reported scams. Please be aware and exercise caution when investing. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section, we would appreciate it and our team of experts will do everything possible to solve the problem for you.

Educational Resources

Sophie Capital Financial provides a range of educational resources to support traders in enhancing their knowledge and understanding of the financial markets. These resources include trading tutorials and webinars, which can serve as valuable tools for traders of various experience levels.

Is SOPHIE CAPITAL FINANCIAL suitable for beginners?

Sophie Capital Financial may not be considered the most suitable option for beginners due to several factors. The limited information available regarding the broker's account types, absence of a demo account, and lack of specific educational resources tailored to beginners make it challenging for novice traders to receive adequate support and guidance.

For beginners, having access to a demo account is highly valuable as it allows them to practice trading strategies, familiarize themselves with the trading platform, and gain confidence without risking real funds. Unfortunately, Sophie Capital Financial does not provide a demo account, which can hinder the learning process for beginners.

Additionally, the absence of specific educational resources aimed at beginners further limits the educational support provided by the broker. Beginners often require comprehensive educational materials, tutorials, and guidance to understand the fundamental concepts of trading, market analysis, risk management, and trading strategies. The lack of such resources may make it more challenging for beginners to acquire the necessary knowledge and skills to navigate the financial markets effectively.

Is SOPHIE CAPITAL FINANCIAL suitable for experienced traders?

Sophie Capital Financial may not be the most suitable choice for experienced traders due to several factors. The lack of regulation and limited information available about the company's background and trading conditions raise concerns about the broker's credibility and transparency.

Experienced traders typically prioritize working with regulated brokers who are subject to oversight and compliance with industry standards. The absence of regulation for Sophie Capital Financial suggests a potential lack of investor protection and oversight, which may deter experienced traders who value the security and accountability provided by regulated entities.

Furthermore, the limited information about the trading conditions, including spreads, commissions, and account types, hinders the ability for experienced traders to assess the competitiveness and suitability of the broker's offerings. Lack of transparency in trading conditions may raise concerns about potential hidden fees, unfavorable trading terms, or limitations that could impact trading strategies.

Experienced traders often seek brokers that offer a wide range of tradable assets, advanced trading tools, and platforms that support their sophisticated trading strategies. Sophie Capital Financial's limited range of tradable assets, use of the MT5 trading platform, and absence of detailed information about account types may not meet the needs and expectations of experienced traders.

Conclusion

In summary, Sophie Capital Financial's lack of regulation, limited information, absence of a demo account, and challenges in transparency and customer support contribute to a cautious stance. Traders should carefully weigh the potential risks and limitations associated with trading on this platform before making any commitments. Exploring alternative brokers with stronger regulatory oversight, transparent trading conditions, and comprehensive support may be a prudent course of action for those seeking a more reliable and robust trading experience.

FAQs

Q: Is SOPHIE CAPITAL FINANCIAL a regulated broker?

A: No, SOPHIE CAPITAL FINANCIAL operates without regulation, which raises concerns about investor protection and the broker's adherence to industry standards.

Q: What is the minimum deposit requirement for SOPHIE CAPITAL FINANCIAL?

A: The minimum deposit required by SOPHIE CAPITAL FINANCIAL is AUD 200. Traders should ensure they meet this requirement before opening an account.

Q: Does SOPHIE CAPITAL FINANCIAL offer a demo account?

A: No, SOPHIE CAPITAL FINANCIAL does not provide a demo account. Traders may find it challenging to practice trading strategies or familiarize themselves with the platform without a risk-free demo environment.

Q: What are the available trading platforms on SOPHIE CAPITAL FINANCIAL?

A: SOPHIE CAPITAL FINANCIAL offers the MT5 trading platform, which provides access to various trading tools, charting capabilities, and order execution features.

Q: What types of tradable assets does SOPHIE CAPITAL FINANCIAL offer?

A: SOPHIE CAPITAL FINANCIAL offers forex, CFDs, and stocks as its primary tradable assets. The range of available assets may be limited compared to other brokers.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 27

Content you want to comment

Please enter...

Review 27

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

yrp

Taiwan

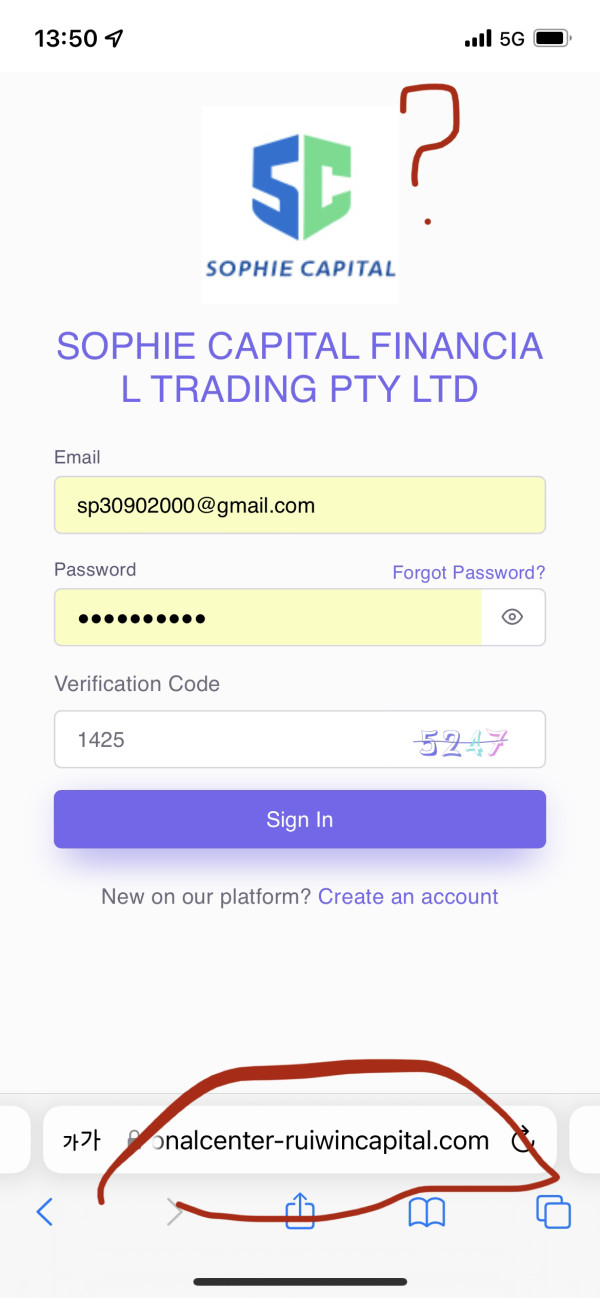

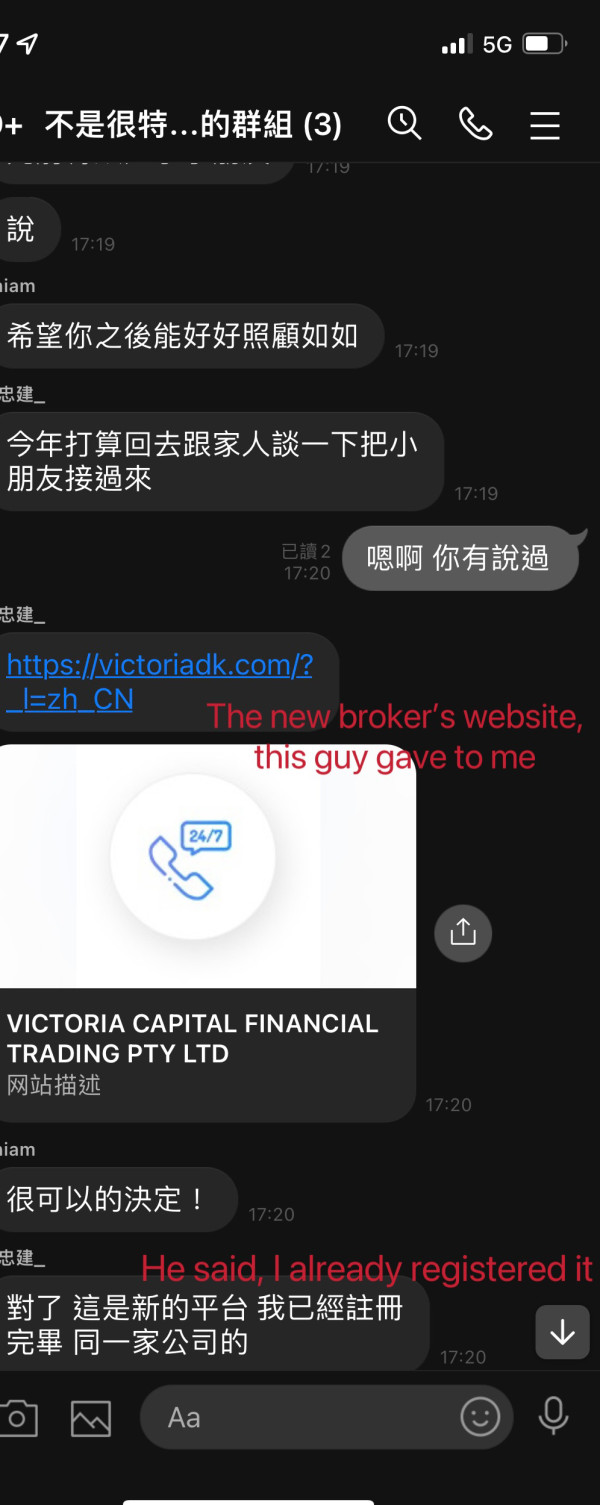

The former company is RUI WIN CAPITAL GROUP. Please be aware! The two websites of Rui win capital group are currently unable to open so they change to a new name and continue to defraud, and there is a broker Victoria capital financial is also the same fraud group

Exposure

2022-10-17

Marelli

Turkey

Good afternoon! I sent a request for withdrawal of money, but they still have not considered it, and the consultant in the telegram, who helped me transfer money to the broker's account, stopped responding and getting in touch. Kindly help me solve this problem

Exposure

2022-10-13

薛薛

Taiwan

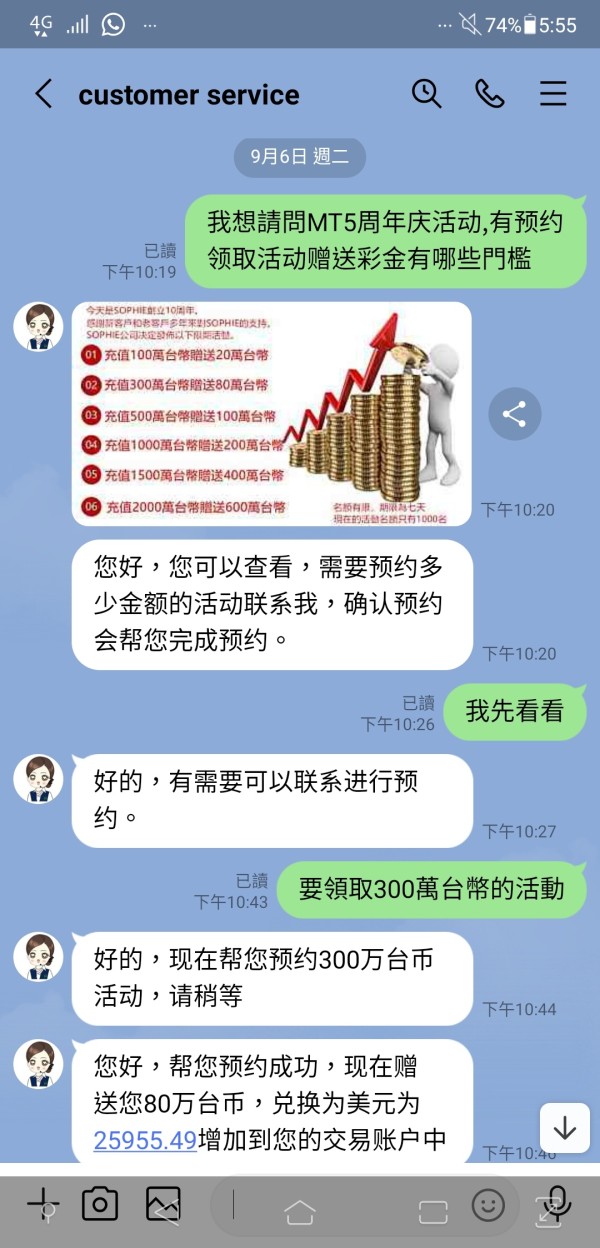

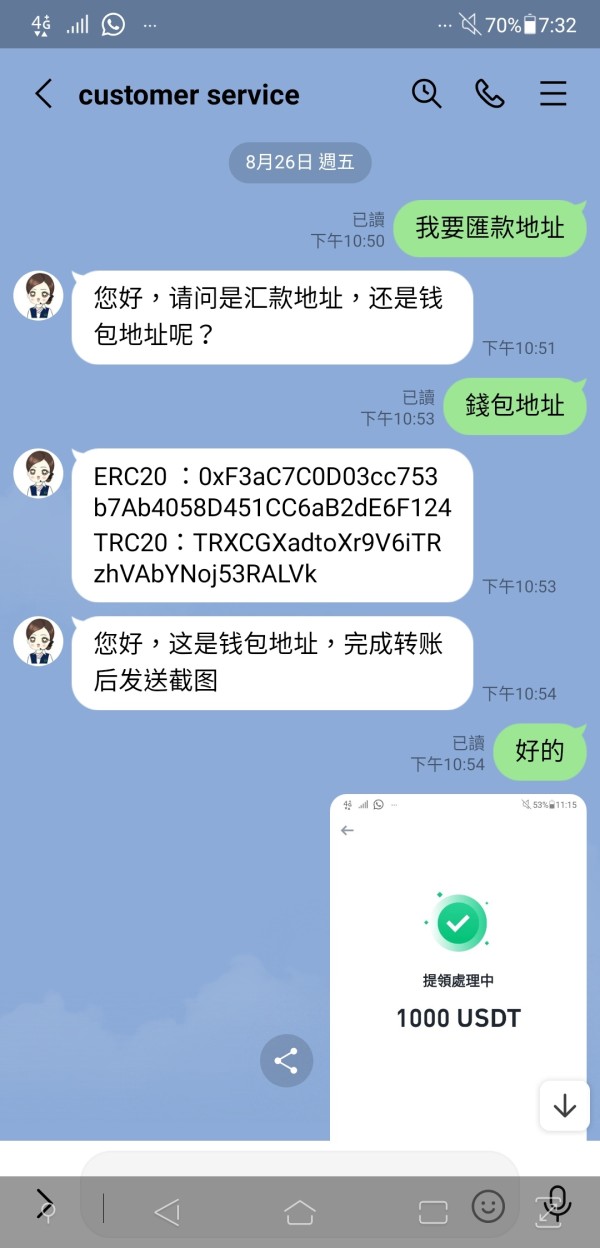

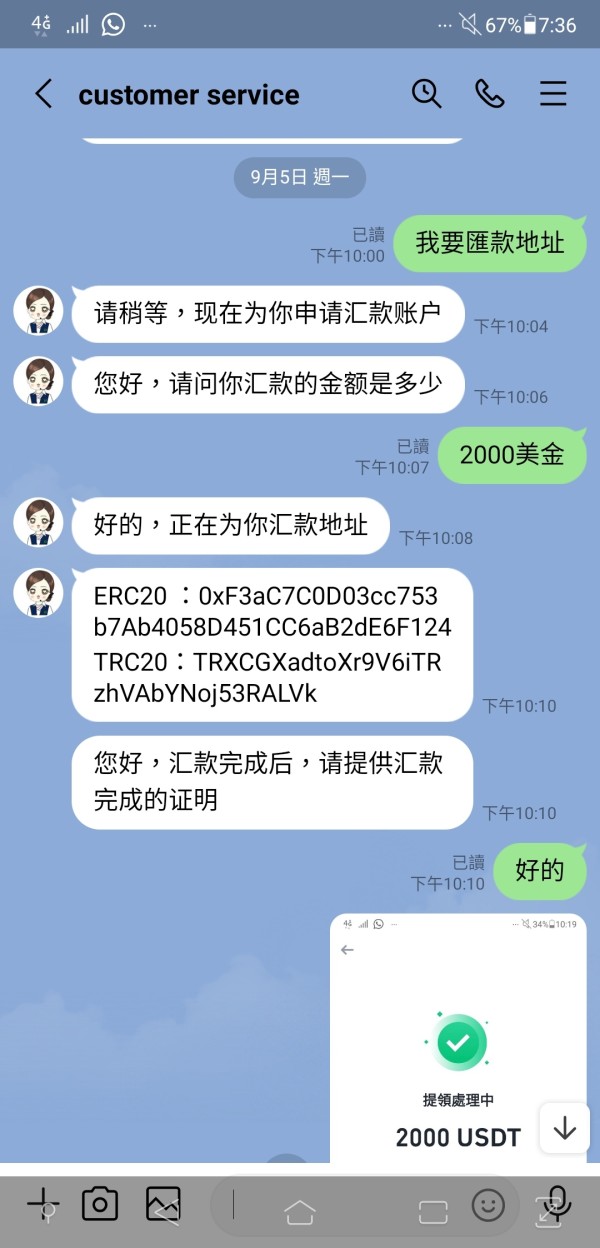

The netizens I know have always told you to have a higher recharge amount at the beginning, saying that you can have a variety of items in foreign exchange and will be stable. Later, when there is a recharge event on the Mid-Autumn Festival, they have been advocating that you ask the customer service for the amount of the event, and the netizen instructed me to choose I got 800,000 Taiwan dollars when I recharged 3 million Taiwan dollars. I immediately applied to the customer service to convert the money into US dollars and put it into my investment account. Afterwards, I regretted participating in this activity and told the customer service that I was maliciously extracting the activity amount. The way to withdraw cash, I checked the investment status of MT5 online. What happened to me was very similar to some cases I complained about. I didn’t pay attention to it. It was almost the end of recharge. Will help me complete the activity together, let me apply for an extension with the customer service and say that I need 1 million Taiwan dollars before the extension can be extended. The netizens helped me to remit it, and I also remitted 250,000 Taiwan dollars one after another. The USDT I bought on Binance also had more than 12,000 US dollars, and netizens also helped me remit more than 76,000 US dollars one after another. As a result, the completion of the event on 9/29 and the customer service application for withdrawal told me that it was related to the postponement of the event, so I couldn’t withdraw and said that there have been many recently. The customer's money laundering caused a lot of losses on the platform. They told me to pay a deposit of 5,000 US dollars to withdraw cash. This is basically a scam. I don't know foreign exchange, causing me and my netizens to lose a lot of money, and just now I went to my account to see that there was nothing before. I don't know if it was deleted or if they modified the website, please help

Exposure

2022-10-10

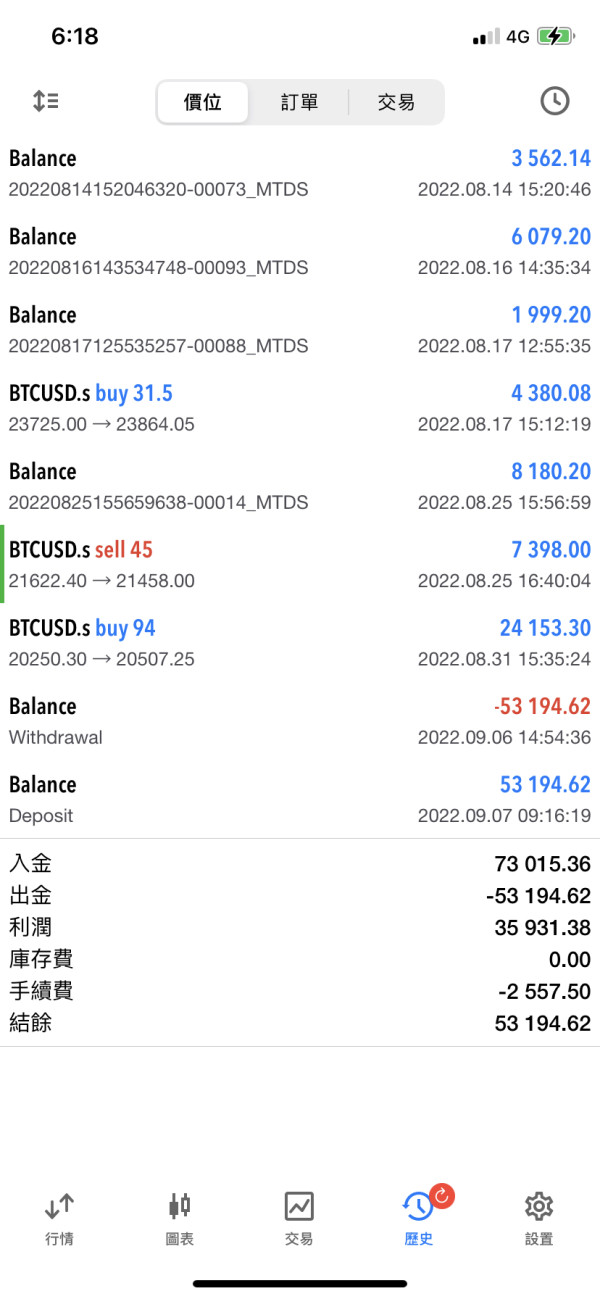

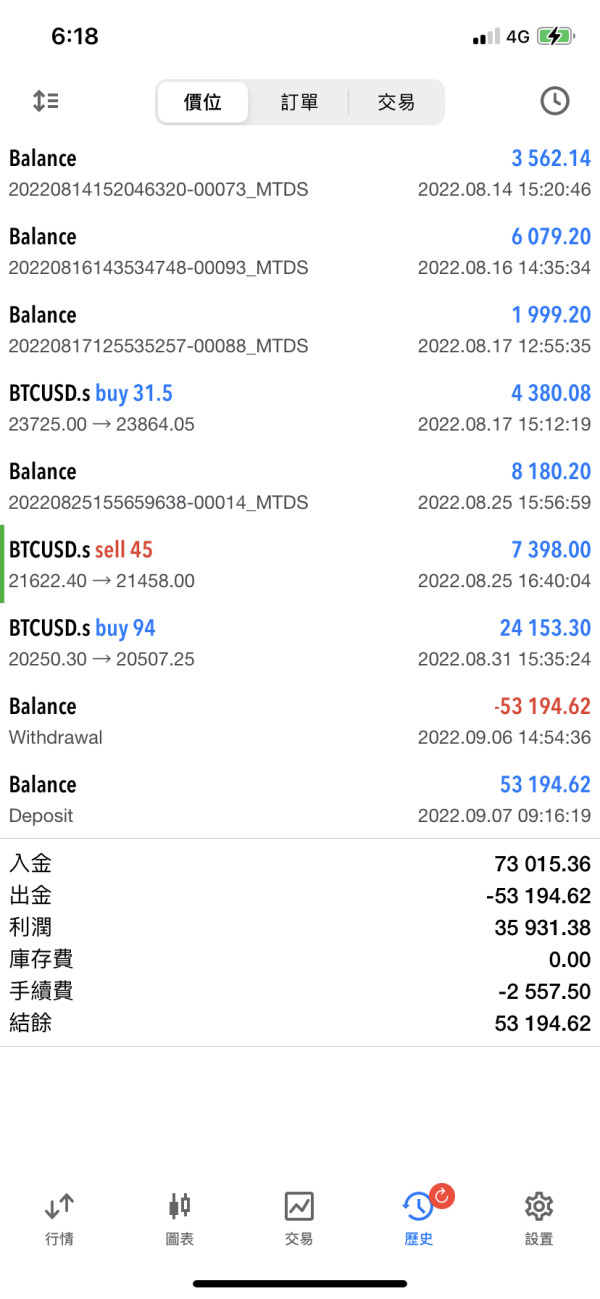

yifang

Taiwan

After marking up for exchange rate difference, the staffs are gone. All the 53194.62 USDT are gone

Exposure

2022-10-08

yifang

Taiwan

After I made up the price difference they asked for, they kept saying please wait a moment. The next day I saw that the MT5 account was disconnected and the money (53194.62u) was not given to me.

Exposure

2022-10-08

fftf

Russia

Hello, as the withdrawal channel is under maintenance, I am deeply pleased for the inconvenience caused to you.

Exposure

2022-10-06

yrp

Taiwan

I was defrauded by RUI WIN CAPITAL GROUP, and now we are now in mediation. When I logged in the website on Oct. 6th, I found it would jump to Sophie Capital's website (another broker). Please be careful.

Exposure

2022-10-06

jan7555

United States

Hello, I requested a withdrawal on this platform. I invested 50,000 US dollars myself. During the process of requesting the withdrawal, the customer service of Sophie Company asked me to pay another nearly 30,000 US dollars to verify and then withdraw the money to me, but I suspect this company is a scam.

Exposure

2022-10-06

Shanti

Taiwan

At first, it said that there would be a fee for remittance. But after I made it up, it said that I was suspected of money laundering. I need to pay security deposit fisrt and then it would allow me to withdraw.

Exposure

2022-10-05

kilian

France

Hello, I want to withdraw 5000USDT from my broker SOPHIE CAPITAL FINANCIAL TRADING PTY LTD. The broker refused my withdrawal because of export taxes. This was never specified during my registration. Please take into account the attached documents and quickly unblock the situation. At this time I would like to withdraw my entire balance. For the taxes the broker can use it without any problem. Thank you for your help

Exposure

2022-10-05

Ranci

Czech Republic

I wanted to withdraw asap my funds in amount 6800USD. I set withdrawal request on CRM system. But more than 2 days no reaction from broker. I sent them several emails, I sen them request w´from web page, I set ticket on brokers CRM system. No reaction. Finaly there is a lost on my accout -10000USD from some crazy trade operated by somebody other. Immediately I received email from support to repay this lost. I asked them again why they did not proceed withdrawal but again no answer. This broker is scam or I was scammed by somebody.. What to do now?

Exposure

2022-10-02

洪翊倫

Taiwan

The customer service claimed that there was a third party involved in money laundering in my account, so refused to withdraw the money, It is necessary to pay 100% of the amount of funds remitted by a third party before it can be reviewed;and the money could only be withdrawn after passing the review. It is true that my account has a loan of 2000 USDT from my friend on the Internet, but I must submit another 2000 USD for review, which inevitably makes people doubt the legitimacy of the platform; whether it is a black platform that everyone calls it!? The platform claims is being regulated by MSB in Canada and the United States, so through this i would like to know what the regulatory effect of MSBs is. Except regulate the money laundering, also works for regulating investor funds?

Exposure

2022-10-01

Shanti

Taiwan

Is it normal to ask me to send money in when I can't withdraw money? Is it true that it is suspected of money laundering?

Exposure

2022-09-29

Simon6647

United States

I submitted a withdraw request 19.9.22 and can't get any reply since then.

Exposure

2022-12-13

Thailand

Advised by Thai people in Tik Tok app, beware of being deceived

Exposure

2022-09-25

Japan

I am rookie to MT5, and I have a lot of things I don’t understand. After I became a node of MT5 under the guidance of a friend the night before yesterday, I contacted the customer service of the SOPHIE CAPITAL FINANCIAL TRADING PTY LTD platform to withdraw 365858USDT, and I sent my cold wallet address. I gave it to the customer service. My cold wallet was newly downloaded. I didn’t know it needed to be activated. I contacted the customer service the next morning. The customer service replied that because my wallet was not activated, I couldn’t transfer USDT. Freeze, now I need to use 10% of the risk fund of the account to unfreeze the account within two working days. If I do not pay the 10% risk fund within two working days, my account will be blacklisted and I will never be able to withdraw cash or trade.

Exposure

2022-09-25

RZ80880

Taiwan

At the beginning of July, I was asked to pay the tax of 29k. At the end of July, I have 3 times the transaction volume of funds and they did not withdraw. The volume was about 7000USDT at the end of August. Until the day before yesterday reply, saying that I did not receive the recharge amount, and the customer service staff resigned for no reason before asking for 45 days before I can withdraw cash or ask me to brush 100,000 volume

Exposure

2022-09-24

三浦

Japan

I started with someone else's introduction, but I was told to pay a fine because I was suspected of money laundering just by depositing funds once in the name of another person, and my withdrawal was refused.

Exposure

2022-09-22

alice74477

Taiwan

The netizen used communication as an excuse, and after seeing my hard life, he kept saying that he wanted to teach me to invest, saying that he was very good at investing in the gold index, and he induced me to buy coins for investment. I have been urging me to join up to 10,000 US dollars, but when I joined more than 7,000 US dollars, I felt that something was wrong and wanted to withdraw. The customer service responded that the system was busy and refused to withdraw. Later, netizens kept saying that I had to trade again before I could withdraw and induce me Participate in the warehousing activity, but the customer service informs that if the activity is not completed, the account will be frozen and the account will not be able to withdraw funds. The previous rules are not clearly explained, because I don’t understand this field at all, I just follow the instructions of netizens.

Exposure

2022-09-20

nate54349

United States

compare the Eightcap TradingView price action to the demo account for this broker.

Exposure

2022-09-20