简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Reviews Sophie Capital Financial Trading Pty Ltd

Abstract:Explore the alarming case of Sophie Capital Financial Trading Pty Ltd, an unregulated online trading broker that has vanished, leaving clients unable to access their funds, shedding light on the risks associated with unregulated brokers in the financial industry.

Sophie Capital Financial Trading Pty Ltd (Sophie Capital) was a self-proclaimed online trading broker. It offered a range of trading instruments, including forex, CFDs, and stocks. The broker also offered a maximum leverage ratio of 1:500, allowing traders to control larger positions relative to their deposited funds.

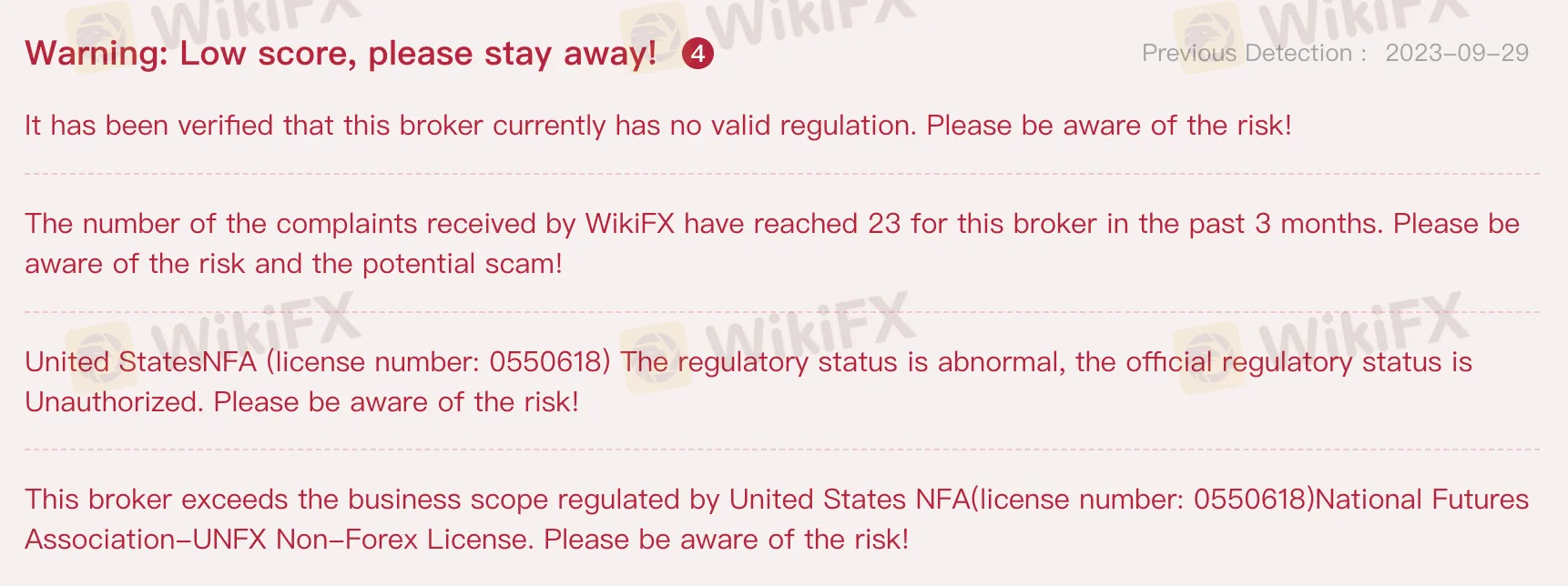

However, Sophie Capital was not regulated by any financial authority. This meant that clients were not protected by any regulatory safeguards, and there was a high risk that they could lose their entire investment.

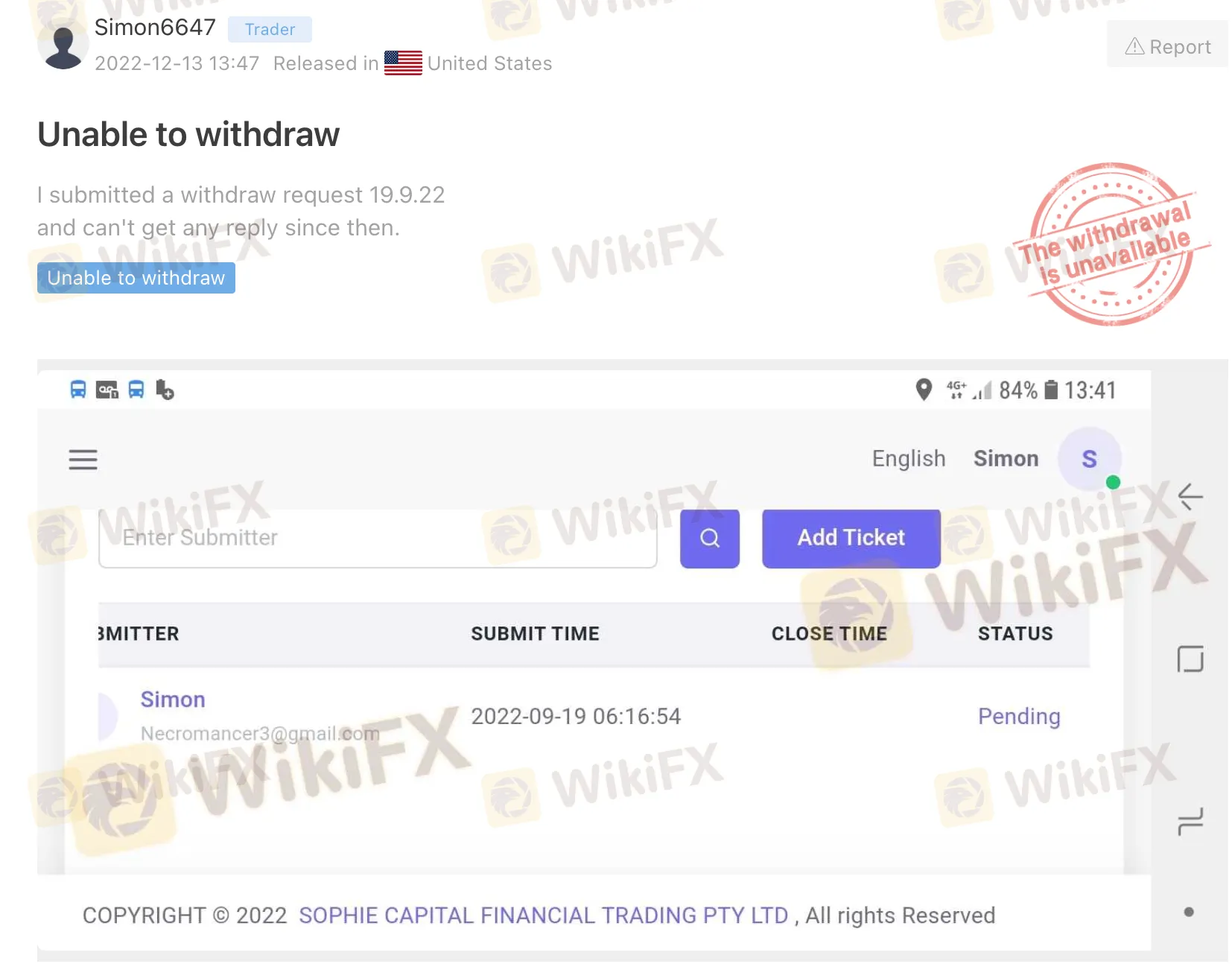

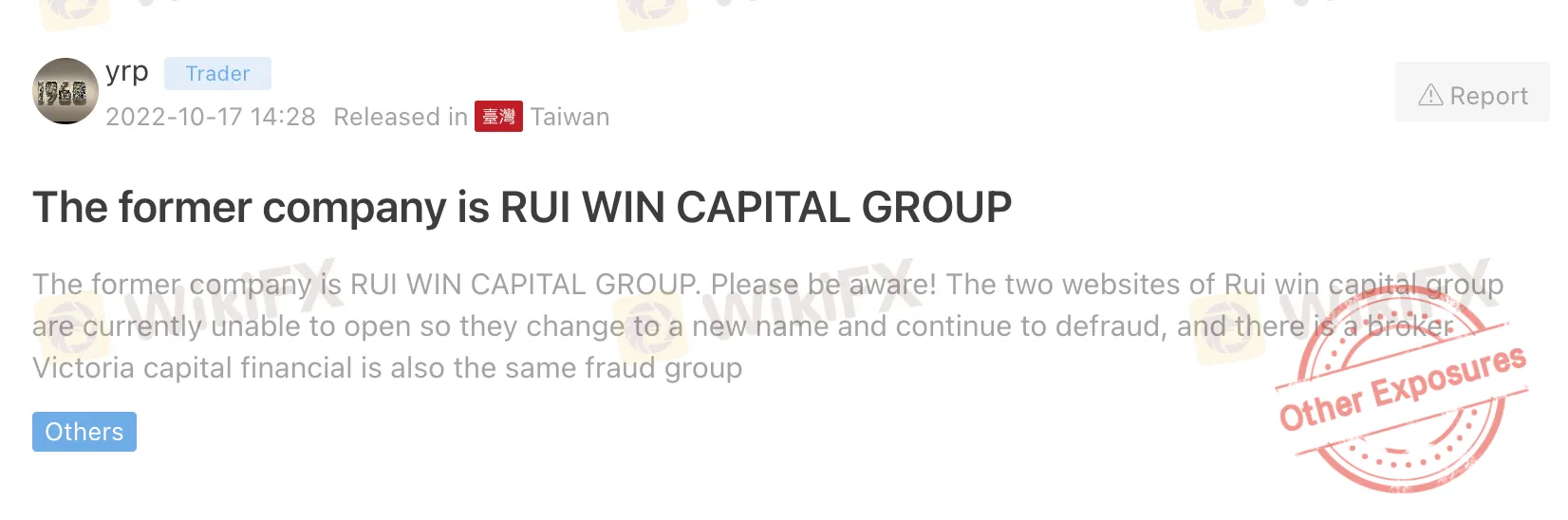

In addition, Sophie Capital has now disappeared from the internet. Its website is no longer accessible, and its customer support channels are unresponsive. Clients of Sophie Capital have reported that they have been unable to withdraw their funds from their accounts. Some clients have also reported that they have been unable to contact the broker's customer support team.

This suggests that Sophie Capital was a fraudulent broker that was operating a scam.

The fact that Sophie Capital is unregulated is a major red flag for investors. Unregulated brokers are not subject to the same oversight and regulations as regulated brokers, and they are therefore more likely to engage in fraudulent or unethical practices.

In the case of Sophie Capital, it appears that the broker has simply disappeared with clients' funds. This is a classic example of a “scam broker.” Scam brokers typically lure investors in with promises of high returns and low risk. However, once investors deposit their funds, the broker disappears or makes it impossible for investors to withdraw their money.

Unregulated brokers pose a significant risk to traders, often resulting in financial losses and frustration. Fortunately, traders now have a powerful ally in their quest for secure trading options: WikiFX. This free application and website offer a comprehensive suite of tools to help traders make informed decisions and avoid falling victim to unscrupulous entities like Sophie Capital.

One of the key features that sets WikiFX apart is its ability to provide users with up-to-date information on the regulatory status of brokers. Let's take Sophie Capital as an example. A user can simply enter the name of the broker into the WikiFX platform, and it will reveal a crucial piece of information - Sophie Capital is not regulated by any financial authority. This initial revelation serves as a glaring red flag, signalling to the user that caution is warranted. Trading with an unregulated broker exposes investors to a multitude of risks, including the potential loss of their hard-earned capital. WikiFX's regulatory status check is the first line of defence against such risks.

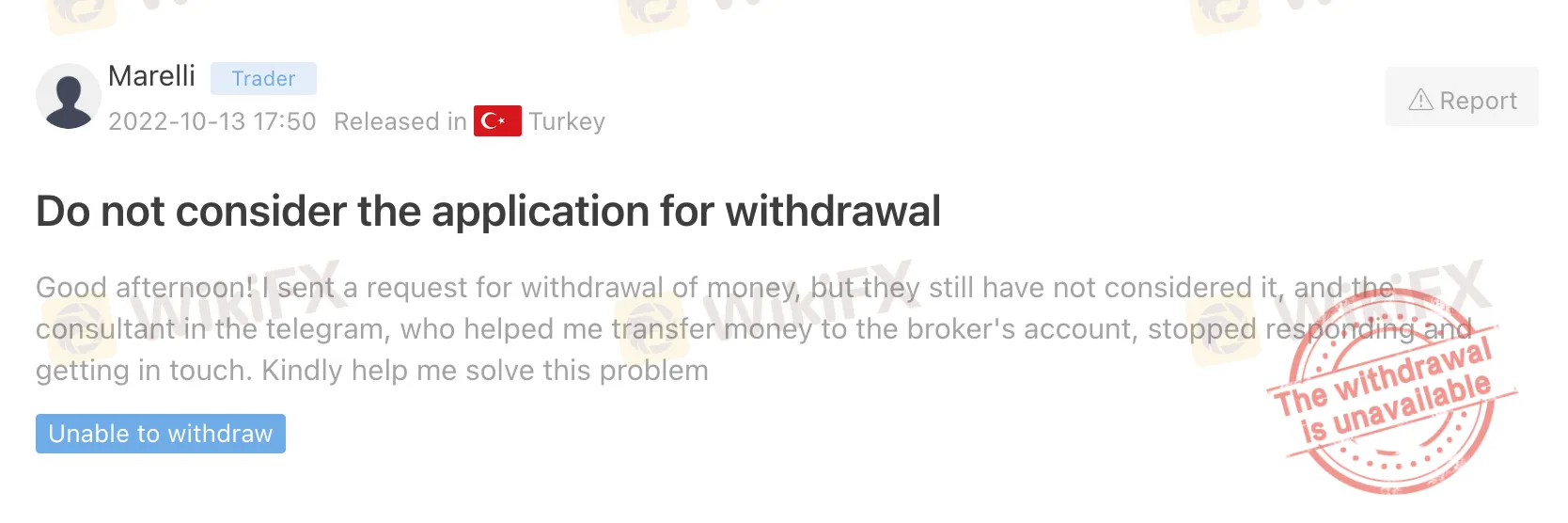

Beyond regulatory status, WikiFX offers users the invaluable resource of real-time trader reviews. These reviews are a treasure trove of insights into the experiences of other traders who have interacted with brokers like Sophie Capital. Traders often report their grievances, and in the case of Sophie Capital, some have revealed that they were unable to withdraw their funds. This serves as yet another red flag for prospective traders. When multiple users report similar issues, it becomes clear that the broker may not have their clients' best interests at heart. WikiFX's user-generated reviews empower traders with collective knowledge, allowing them to make informed decisions and avoid brokers with questionable practices.

To further fortify the defence against unregulated brokers, WikiFX maintains a comprehensive blacklist of fraudulent and unregulated forex brokers. Sophie Capital, in this case, would undoubtedly find its place on this list. When a broker appears on WikiFX's blacklist, it's a crystal-clear warning sign to traders. This list is continuously updated, ensuring that traders stay current with the ever-evolving landscape of financial markets. Utilizing this blacklist, users can confidently steer clear of brokers that have been deemed high-risk by the WikiFX community.

In conclusion, the WikiFX free application and website are invaluable tools for traders seeking to protect their investments in the world of online trading. WikiFX empowers traders with knowledge and insights that can help them avoid falling victim to unregulated brokers like Sophie Capital. In an industry where financial security is paramount, WikiFX stands as a guardian of trust and transparency, ensuring that traders can navigate the markets with confidence and peace of mind.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Malaysian influencer Hu Chang Mun, widely known as Ady Hu, has been detained in Taiwan for his alleged involvement in a fraudulent operation. The 31-year-old, who was reported missing earlier in December, was located by Taiwanese authorities after suspicions arose regarding his activities.

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

Discover how MultiBank Group, a global leader in financial derivatives, secured three prestigious awards at Traders Fair Hong Kong 2024, highlighting its innovative trading solutions and industry excellence.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator