简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

US Gasoline Price Record Surge Likely to Continue as US Targets Russian Oil

Abstract:Gasoline prices have soared in the United States and elsewhere as Russian sanctions, brought on by its invasion into Ukraine, have effectively removed a large amount of Russia‘s oil from global markets.

GASOLINE, OIL, RUSSIAN OIL IMPORTS, INFLATION - TALKING POINTS

Gasoline prices break all-time record in United States amid Ukraine conflict

Prices likely to rise further as lawmakers take aim at Russian oil imports

Gasoline prices exhibit extreme strength and may soon target $4.00

Despite no official Western sanctions on Russian oil, the situation has cast a cloud of confusion over exporters who have largely stopped shipping barrels out of the countrys ports.

US prices at the pump rose to a national average of 4.065 per gallon on March 7, according to AAA. In the United Kingdom, petrol rose to 155.62 pence per liter, according to RAC fuel watch. That puts a gallon of fuel in the UK at over £7 per gallon. And prices are only expected to rise with surging WTI crude and Brent oil prices. The price of gasoline – a product derived from oil – is expected to rise further in the coming days.

The unprecedented rise in fuel costs has bolstered an already precarious inflation outlook, causing fear that it will eat into consumer demand in the post-Covid era. The Federal Reserves calculus to initiate a rate liftoff on March 16 is also being called into question, serving to inflame uncertainty in the global economy. US breakeven rates – a bond-based inflation outlook metric – have surged, with the 1-year and 10-year rates rising to 5.52% and 2.86%, respectively.

Oil prices, and by effect, gasoline prices are likely to rise further in the coming weeks by all indications. Russia continues its military advance into Ukraine amid reports of heavy fighting, and the White House is considering a ban on Russian oil. The Biden administration is currently speaking with congressional leaders who are pushing through legislation targeted at banning Russian oil imports, a move that has bipartisan support on Capitol Hill.

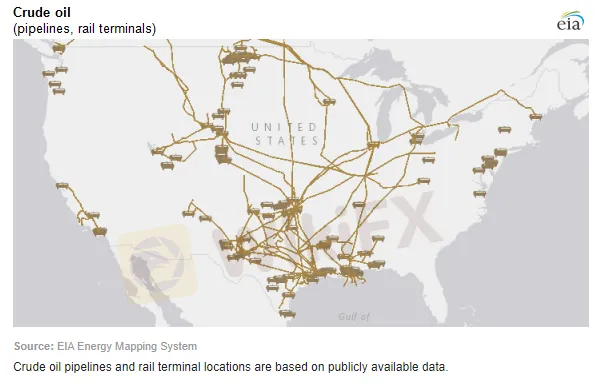

US CRUDE OIL INFRASTRUCTURE CHART

Currently, US producers are rushing to boost domestic production of oil through the Permian Basin, although those increases will come gradually, lagging the pace needed to bridge the gap if the US moves to cut off Russias nearly 200k barrels per day. The US West Coast is most likely to feel the full force of such a move. The Biden administration is reportedly considering easing sanctions on Venezuela to help support global oil markets. The South American county could produce 1.3 million barrels a day in 2019, according to the Energy Information Administration (EIA).

Meanwhile, Russia is threatening to stop the flow of natural gas to Europe by cutting off its Nord Stream 1 pipeline. Germany, an EU country that most heavily relies on Russian energy, is unlikely to join the US ban on Russian imports but says it is taking steps to diversify its energy supply, according to German Chancellor Olaf Scholz. Overall, gasoline prices are likely to continue rising in the short term as long as Western sanctions remain in place.

GASOLINE TECHNICAL FORECAST

US gasoline prices are trading above the 261.8% Fibonacci extension from the 2021 October to December move after prices failed to hold above the level on an intraday basis yesterday. The Relative Strength Index (RSI) is at its highest levels since early 2021, and the MACD oscillator is signaling extreme upward momentum at its highest reading on record. A pullback below the 261.8% Fib level may see prices drop to the 9-day Exponential Moving Average (EMA), but continued strength may see prices quickly target the 4.00 level.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Top 10 Trading Indicators Every Forex Trader Should Know

Master the top 10 Forex trading indicators to analyze real-time Forex quotes, trends, and market signals. Learn strategies to boost accuracy and avoid mistakes.

Geopolitical Events: What They Are & Their Impact?

You've heard many times that geopolitical events have a significant impact on the Forex market. But do you know what geopolitical events are and how they affect the FX market? Let us learn about it today.

Why Do You Feel Scared During Trade Execution?

Trade execution is a pivotal moment for traders. It is when analysis turns into action, and potential profits or losses become reality. However, for many traders, this moment is accompanied by fear. Why does this happen, and how can you address it?

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

In the midst of financial innovation and regulation, WikiGlobal, the organizer of WikiEXPO, stays abreast of industry trends and conducts a series of insightful and distinctive interviews on pivotal topics. We are delighted to have the privilege of inviting Simone Martin for an in-depth conversation this time.

WikiFX Broker

Latest News

Geopolitical Events: What They Are & Their Impact?

Volkswagen agrees deal to avoid Germany plant closures

Top 10 Trading Indicators Every Forex Trader Should Know

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

'Young investors make investment decisions impulsively to keep up with current trends' FCA Reveals

Why Do You Feel Scared During Trade Execution?

CySEC Settles Compliance Case with Fxview Operator Charlgate Ltd

Malaysian Influencer Detained in Taiwan Over Alleged Role in Fraud Scheme

Currency Calculator