Score

Sweet Futures

United States|5-10 years|

United States|5-10 years| https://sweetfutures.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Switzerland 2.66

Switzerland 2.66Contact

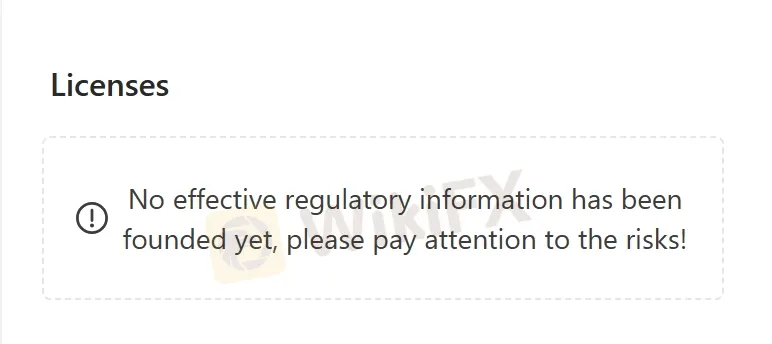

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesUsers who viewed Sweet Futures also viewed..

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

sweetfutures.com

Server Location

United States

Website Domain Name

sweetfutures.com

Server IP

107.180.124.228

Company Summary

| Sweet Futures Review Summary in 6 Points | |

| Founded | 2010 |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Trading Services | Futures and Options, Forex, OTC Structured Products, Multiple FCM Access, Managed Futures, Balance Sheet Margin Financing, Market Research, Global Exchange Access, Technology, Power and Energy Trading |

| Trading Platforms | MT4 and many other platforms |

| Customer Support | Phone, email, address, contact us form, social media |

What is Sweet Futures?

Sweet Futures, an international brokerage firm headquartered in the the United States, provides a broad selection of financial instruments and services to its traders worldwide. These include Futures and Options, Forex, OTC Structured Products, Multiple FCM Access, Managed Futures, Balance Sheet Margin Financing, Market Research, Global Exchange Access, Technology, Power and Energy Trading. However, it's of great importance to note that the company currently operates without valid regulatory oversight, which raises concerns about its legitimacy and liability.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Multiple account types | • Unregulated |

| • Wide range of trading tools | • Fees charges for trading platforms |

| • Demo account available | |

| • Diversified trading platforms including MT4 |

Pros:

Multiple Account Types: Sweet Futures offers a variety of account types tailored to different entities and individuals, providing flexibility and options to meet diverse trading needs and preferences.

Wide Range of Trading Tools: The platform provides a comprehensive range of trading tools for various aspects of trading and investment, including futures quotes, news, contract specifications, margin requirements and more, empowering traders with the tools and resources they need for success.

Demo Account Available: Sweet Futures offers demo accounts from most of its trading platforms, allowing traders to practice trading strategies and familiarize themselves with the platform's features risk-free before committing real funds, enhancing their trading skills and confidence.

Diversified Trading Platforms including MT4: The platform offers a diverse selection of trading platforms, including the popular MT4, each with unique features and pricing structures, satisfying different trader preferences and strategies.

Cons:

Unregulated: Sweet Futures operates in an unregulated environment, which raises concerns regarding transparency, investor protection, and adherence to industry standards.

Fees Charged for Trading Platforms: Sweet Futures imposes fees for using most of its trading platforms, which can increase the overall cost of trading for clients, potentially impacting profitability and investment returns.

Is Sweet Futures Safe or Scam?

When considering the safety of a brokerage like Sweet Futures or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Currently, this broker operates without any legitimate regulatory oversight, raising concerns about transparency and accountability.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: Sweet Futures prioritizes client security with robust privacy policies, ensuring protection of personal data and safeguards clients' confidential information and transactions.

In the end, choosing whether or not to engage in trading with Sweet Futures is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Trading Services

Sweet Futures offers a comprehensive suite of services across various categories in the trading and investment realm:

Futures and Options: Providing commodity clearing, premier brokerage, and execution services for Futures and Options trading.

Forex: Offering Forex trading services for currency markets.

OTC Structured Products: Delivering OTC and commodity risk management solutions.

Multiple FCM Access: Facilitating access to multiple Futures Commission Merchants (FCMs) such as INTL FCStone, Macquarie, and Sucden Financial.

Managed Futures: Partnering with Worldup Advisors, CTA Database, and Sweet Futures Systems Trading to offer managed futures services.

Balance Sheet Margin Financing: Providing margin financing solutions for traders and investors.

Market Research: Offering market research services with ongoing market analysis and forecasting services to address any question you have related to crop production, supply and demand estimates, price outlooks, transportation and storage projections, weather forecasts, agricultural policy, farm programs and long-term agribusiness trends.

Global Exchange Access: Enabling access to global exchanges for trading various financial instruments.

Technology: Providing technology solutions for trading, including high-frequency trading and collocation services.

Power and Energy Trading: Offering trading services in the power and energy markets, leveraging technology-driven solutions.

Through these categories, Sweet Futures satisfies a wide range of trading and investment needs, empowering clients with diverse options and expert support.

How to Open an Account?

Sweet Futures offers a variety of trading account types tailored to different entities and individuals, including U.S. citizens, foreign citizens, trusts, corporations, partnerships, limited liability companies, and managed futures accounts.

Each account type has specific documentation requirements, such as completed and signed account forms, identification documents, legal entity documentation (such as trust agreements or corporate bylaws), and additional letters or certifications as applicable.

Whether opening an individual, U.S. trust, foreign corporation, or managed futures account, clients must ensure compliance with the outlined requirements to initiate trading activities through Sweet Futures.

For detailed requirements, you can visit https://sweetfutures.com/trading-account-types/.

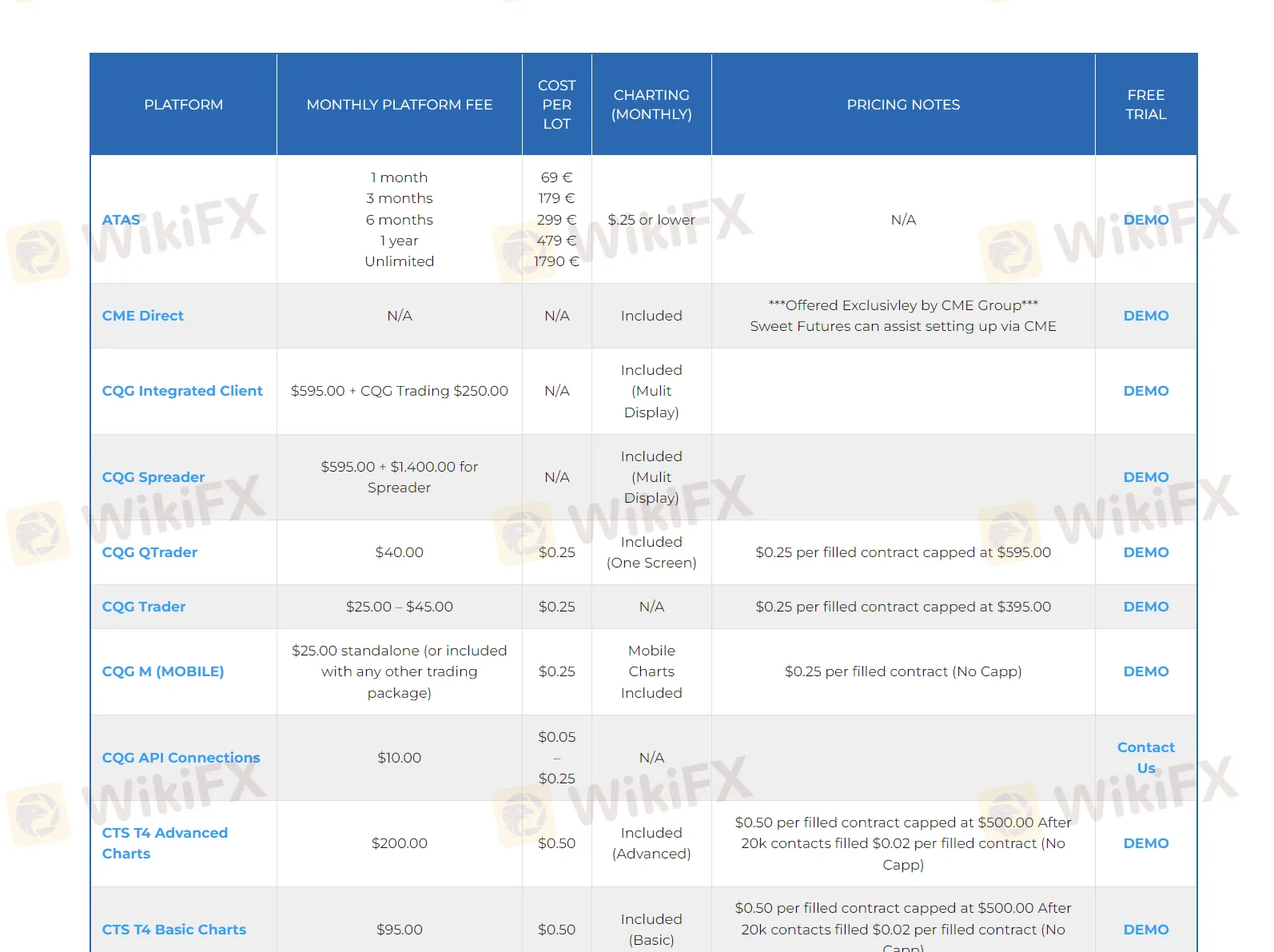

Trading Platforms

Sweet Futures boasts a vast selection of over 50 trading platforms with different fees and functions for diverse trader preferences and strategies.

Among these platforms is MT4, a popular choice, offering a range of features and pricing structures. For instance, MT4 incurs a monthly fee of $20.00 (Variable) per million traded with no extra cost per lot. Additionally, it provides free charting functions and offers tighter spreads for volume traders, enhancing their trading experience.

Importantly, many platforms, including MT4, offer demo accounts, allowing users to practice trading strategies risk-free before committing real funds.

For more details about other platforms, you can visit https://sweetfutures.com/trading-platforms/ or contact with the company directly.

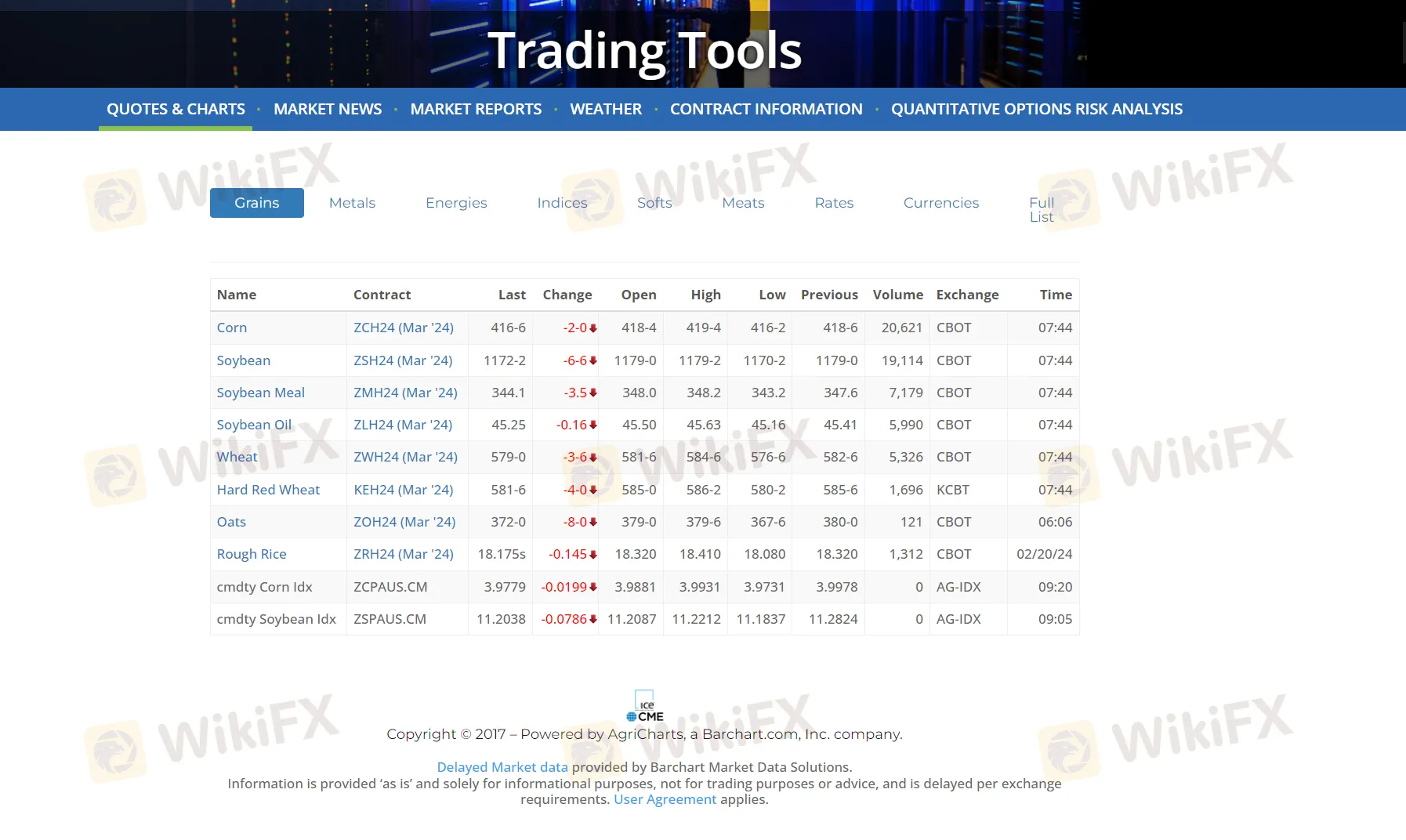

Trading Tools

Sweet Futures equips traders with comprehensive trading tools which serves as indispensable resource, empowering traders to accurately assess various aspects of their trades.

Futures Quotes: Providing real-time or delayed quotes for futures contracts, enabling traders to monitor prices and assess market trends.

News: Delivering relevant news updates and market analysis, helping traders stay informed about events that impact futures markets.

Contract Specifications: Offering detailed information about contract specifications, including contract size, tick size, expiration dates, and trading hours, helping traders in understanding the terms and conditions of futures contracts.

Margin Requirements: Providing information on margin requirements for various futures contracts, helping traders manage risk and assess capital requirements for trading.

Options Risk Analysis: Offering tools or resources for analyzing the risk associated with options trading strategies, assisting traders in evaluating potential outcomes and managing risk effectively.

Deposit & Withdrawal

Sweet Futures offers multiple methods for funding your account, including wire transfer, check, and deposits of Treasury or equity securities. It's crucial to note that the originating account for any deposit must have identical ownership to your trading account.

Sweet Futures does not accept certain forms of payment, such as cash currency, money orders, checks drawn on foreign banks, checks drawn against lines of credit, credit card checks, or drafts from currency exchanges. For more details of account funding instructions for different Futures Clearing Merchant, you can visit https://sweetfutures.com/trading-tools/account-funding/.

Customer Service

Sweet Futures offers customer support via phone, email, physical address, contact us form, and social media channels such as Facebook, Twitter, Google, LinkedIn and YouTube. These accessible methods ensure timely assistance and communication for clients seeking help or information.

Address: Chicago Board of Trade, 141 West Jackson Blvd, Suite 3306, Chicago, IL 60604, USA.

Email: info@sweetfutures.com

Phone: 312.216.5701

Educational Resources

Sweet Futures provides an informative blog page as part of its educational resources, offering valuable insights, market analysis, trading strategies, and updates to help traders stay informed and make informed decisions in the dynamic world of futures trading.

Conclusion

In summary, Sweet Futures is an financial service firm based in the the United States, providing a variety of trading instruments and services such as Futures and Options, Forex, OTC Structured Products, Multiple FCM Access, Managed Futures, Balance Sheet Margin Financing, Market Research, Global Exchange Access, Technology, Power and Energy Trading. It is not regulated by any valid regulatory bodies, which raises concerns about its liability and commitment to client safety.

As such, interested investors should tread cautiously, perform detailed research, and seek alternative financial institutions with regulatory compalince if possible.

Frequently Asked Questions (FAQs)

| Q 1: | Is Sweet Futures regulated? |

| A 1: | No, its been confirmed that the company is currently under no valid regulation. |

| Q 2: | Is Sweet Futures a good financial company for beginners? |

| A 2: | No, it is not a good financial company because its not regulated by any authorities. |

| Q 3: | Does Sweet Futures offer industry leading MT4 & MT5? |

| A 3: | Yes, it offers MT4. |

| Q 4: | Does Sweet Futures offer demo accounts? |

| A 4: | Yes, demo account available for most trading platofmrs. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now