Score

HexMarkets

Saint Vincent and the Grenadines|1-2 years|

Saint Vincent and the Grenadines|1-2 years| https://hexmarkets.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed HexMarkets also viewed..

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

hexmarkets.com

Server Location

India

Website Domain Name

hexmarkets.com

Server IP

35.154.34.5

Company Summary

| HexMarkets Review Summary | |

| Founded | Within 1 year |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | CFDs, commodities, cryptos, metals, stocks and indices |

| Demo Account | Available |

| Leverage | 1:400 (Classic account) |

| EUR/ USD Spread | 1.3 pips (Classic account) |

| Trading Platforms | cTrader |

| Minimum Deposit | $200 |

| Customer Support | Phone, email, Twitter, Facebook, Instagram, and YouTube |

What is HexMarkets?

HexMarkets is a trading platform that aims at building trust and loyalty with its customers by providing a systematic trading experience with superior execution. The platform firmly believes in the power of technology to revolutionize trading and offers up-to-date trading platforms that combine advanced features with user-friendly interfaces. HexMarkets offers a diverse range of trading instruments across various asset classes, with six different live account types. The platform is registered in Saint Vincent and the Grenadines and is currently unregulated.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

Pros:

- A range of trading instruments: HexMarkets offers a diverse range of trading instruments across various asset classes, providing traders with multiple options to choose from.

- Flexible leverage: HexMarkets offers different leverage ratios for its various account types, allowing traders to adjust their leverage according to their risk tolerance and trading strategy.

- A range of payment options: HexMarkets provides a variety of payment options, making it convenient for traders to deposit and withdraw funds from their trading accounts.

- Multi-channel support to contact: HexMarkets offers multiple channels for customer support, allowing traders to reach out for assistance via various communication channels, such as phone, email, or online messaging.

Cons:

- Not regulated: HexMarkets is currently unregulated, which means it lacks the oversight and protection that regulated brokers provide. This can potentially increase the risk for traders.

- Higher spreads compared to some other brokers: HexMarkets has higher spreads compared to some other brokers in the market, which can impact the overall cost of trading for traders.

- Regional restrictions: HexMarkets has regional restrictions on its services for the citizens/residents of the United States, Cuba, Iraq, Myanmar, North Korea, Sudan, which could limit access to its trading platforms and services in certain countries or regions.

- Lack of industry experience: As HexMarkets has been operating for less than a year, it may have a relatively limited track record and industry experience compared to more established brokers. This could potentially raise concerns for traders seeking a broker with a longer history of operation.

Is HexMarkets Safe or Scam?

HexMarkets currently has no valid regulation, which means that there is no government or financial authority oversighting their operations. It makes investing with them risky. As there is no regulation, the people running the platform can pocket your money while bearing no responsibility for their criminal actions. They can disappear any time without notice.

If you are considering investing with HexMarkets, it is important to do your research thoroughly and weigh the potential risks against the potential rewards before making a decision. In general, it is recommended to invest with well-regulated brokers to ensure your funds are protected.

Market Instruments

HexMarkets offers a diverse range of trading instruments across various asset classes. CFDs (Contract for Difference):

HexMarkets allows you to trade Contracts for Difference, which are derivative products that enable you to speculate on the price movements of underlying financial assets without owning the actual asset. CFDs can be traded on a wide range of instruments, including stocks, indices, commodities, and cryptocurrencies.

Commodities:

HexMarkets provides trading opportunities in commodities such as oil, gold, silver, natural gas, and agricultural products. Trading commodities offers the ability to speculate on price changes in these physical goods without having to own them directly.

Cryptocurrencies:

HexMarkets offers trading of various cryptocurrencies, including popular options like Bitcoin, Ethereum, Litecoin, Ripple, and more. Trading cryptocurrency CFDs allows you to take advantage of the price volatility in the crypto market without needing to hold the actual digital coins.

Metals:

HexMarkets enables trading of precious metals like gold and silver. These metals have historically been considered store of value assets and can be traded as CFDs to speculate on their price movements.

Stocks:

HexMarkets allows you to trade CFDs based on the stock prices of various companies. This enables you to speculate on the price performance of individual stocks without owning the underlying shares.

Indices:

HexMarkets provides access to global stock market indices like the S&P 500, Nasdaq, Dow Jones, FTSE 100, and more. Trading index CFDs allows you to participate in the performance of a group of stocks from a particular market or sector.

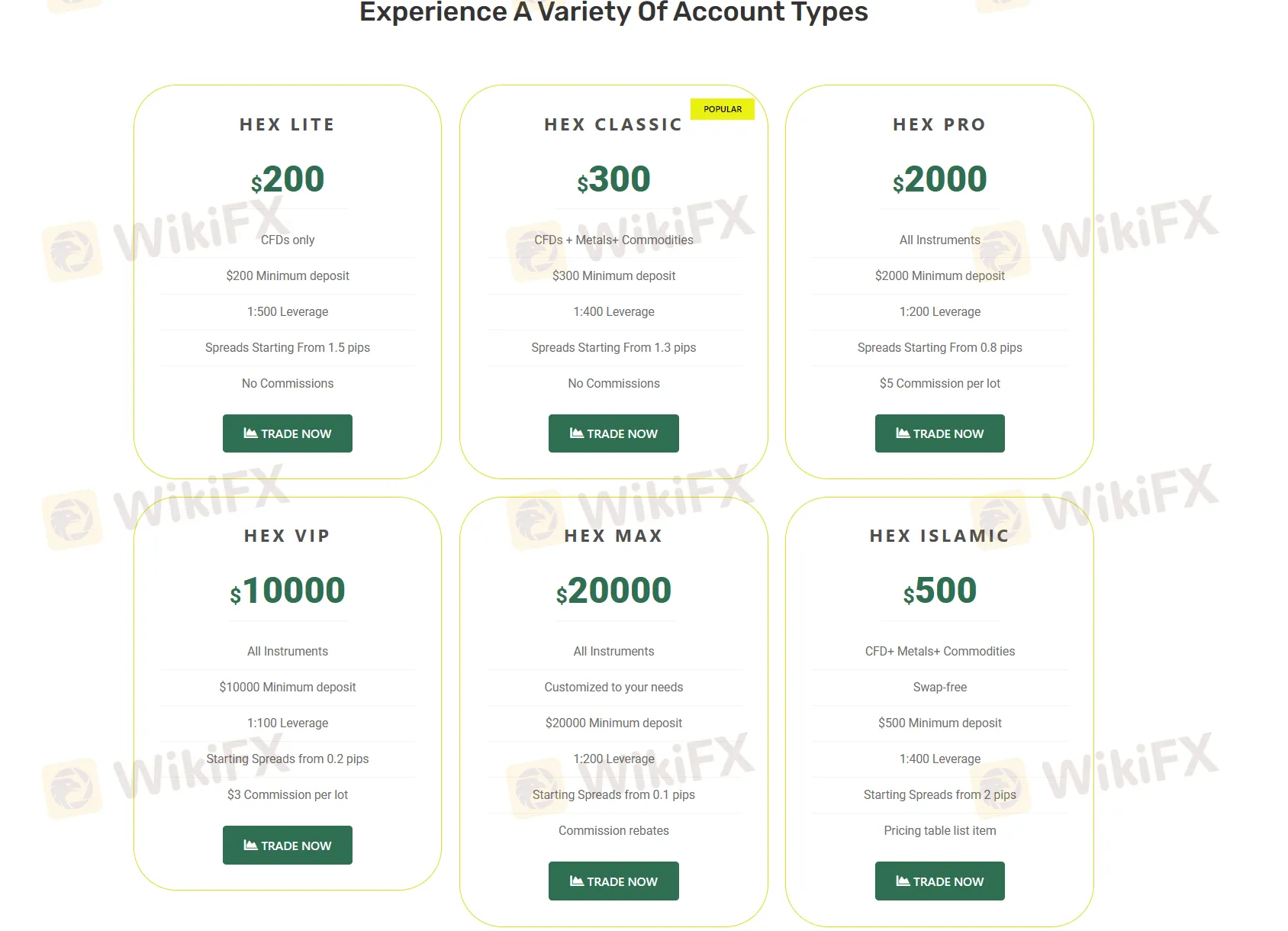

Account Types

HexMarkets offers six different live account types, each with its own benefits and minimum deposit requirements. Each account has its benefits, features, and minimum deposit requirements, providing traders with the flexibility to choose an account type that best suits their trading needs. The details are showed in the following table:

| Account Type | Minimum Deposit | Instruments |

| HEX LITE | $200 | CFDs only |

| HEX CLASSIC | $300 | CFDs, metals, commodities |

| HEX PRO | $2000 | All instruments |

| HEX VIP | $10000 | All instruments |

| HEX MAX | $20000 | All instruments (customized to your needs) |

| HEX ISLAMIC | $500 | CFDs, metals, commodities (swap-free) |

Leverage

HexMarkets offers different leverage ratios for its various account types. The leverage represents the amount of borrowing power provided by the broker to traders. It allows traders to control a larger position in the market with a smaller amount of capital.

For the HEX LITE account, the leverage offered is 1:500. This means that for every $1 deposited, traders can control a position of up to $500.

The HEX CLASSIC account offers a leverage of 1:400. This gives traders the ability to control a position that is 400 times the amount they have deposited.

The HEX PRO account provides a leverage of 1:200, allowing traders to control a larger position compared to their deposit amount.

The HEX VIP account offers a lower leverage of 1:100. While this leverage is lower than the previous accounts, it still provides traders with the ability to control a larger position in the market.

The HEX MAX account has a leverage of 1:200, allowing traders to have increased buying power in the market.

The HEX ISLAMIC account also offers a leverage of 1:400, which provides traders with increased trading opportunities.

Spreads & Commissions

HexMarkets charges spreads and commissions are as follows:

| Account Type | Spreads | Commission |

| HEX LITE | Starting from 1.5 pips | No commissions |

| HEX CLASSIC | Starting from 1.3 pips | No commissions |

| HEX PRO | Starting from 0.8 pips | $5 commission per lot |

| HEX VIP | Starting from 0.2 pips | $3 commission per lot |

| HEX MAX | Starting from 0.1 pips | Commission rebates |

| HEX ISLAMIC | Starting from 2 pips | No commissions |

Trading Platforms

The trading platform offered by HexMarkets is called cTrader. It is a popular and advanced trading platform that provides clients with a comprehensive set of tools and features to trade various financial instruments.

cTrader is available on multiple platforms, making it accessible to a wide range of users. It can be downloaded from the Play Store for Android devices, the App Store for iOS devices, and the Microsoft Store for Windows devices. This allows clients to trade anytime and anywhere using their preferred device.

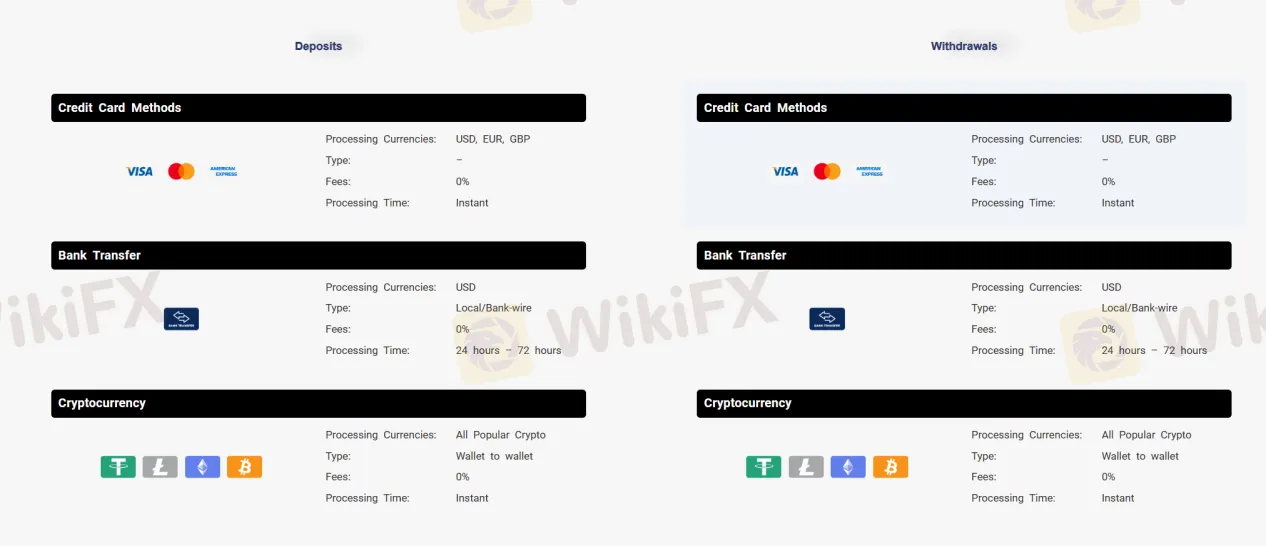

Deposits & Withdrawals

Deposit and Withdrawals Options:

- Credit Card: Visa, MasterCard, American Express (Supported currencies: USD, EUR, GBP)

- Bank Transfer: Local or bank-wire transfer (Processing currency: USD)

- Cryptocurrencies: Tether, Litecoin, Ethereum, Bitcoin

Deposit Timing:

- Credit Card: Instant availability

- Bank Transfer: 24 to 72 hours

- Cryptocurrencies: Instant availability

Withdrawal Timing:

- Credit Card: Instant transfer

- Bank Transfer: 24 to 72 hours

- Cryptocurrencies: Instant transfer

Besides, it is noted that HexMarkets does not charge fees for either deposit and withdrawal.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +44 20 8133 2181

Email: support@hexmarkets.com

Address: 8, Brushfield St, London, E1 6AN, United Kingdom

Suite 305, Griffith Corporate Centre, Kingstown, Saint Vincent and the Grenadines

Moreover, clients could get in touch with this broker through the social media, such as Twitter, Facebook, Instagram, and YouTube.

Whats more, HexMarkets provides a Frequently Asked Questions (FAQ) section on their website to assist their clients with commonly asked questions and provide relevant information. The FAQ section aims to address common queries and concerns that investors may have regarding the company's services, processes, and investment opportunities. By offering this resource, HexMarkets aims to provide transparency and clarity to their clients, helping them make informed decision.

HexMarketsoffers online messaging as part of their trading platform. This allows traders to communicate with customer support or other traders directly through the platform. Online messaging can be a convenient way to get real-time assistance or to engage in discussions with fellow traders.

Conclusion

In conclusion, HexMarkets is an online broker providing a range of trading instruments and services, including multiple account types, payment options, and customer support channels. However, it should be noted that HexMarkets is currently unregulated, which means it may lack the oversight and protection that regulated brokers provide. This could potentially increase the risk for traders.

Frequently Asked Questions (FAQs)

| Q 1: | Is HexMarkets regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at HexMarkets? |

| A 2: | You can contact via telephone: +44 20 8133 2181, email: support@hexmarkets.com and online messaging. |

| Q 3: | What platform does HexMarkets offer? |

| A 3: | It offers cTrader. |

| Q 4: | What is the minimum deposit for HexMarkets? |

| A 4: | The minimum initial deposit to open an account is $200. |

| Q 5: | At HexMarkets, are there any regional restrictions for traders? |

| A 5: | Yes. HexMarkets Limited does not provide services for citizens/residents of the United States, Cuba, Iraq, Myanmar, North Korea, Sudan. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 1-2 years

- Suspicious Regulatory License

- cTrader

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now