Score

Maxi Markets

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://en.maximarkets.net/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Cyprus 2.51

Cyprus 2.51Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Users who viewed Maxi Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

maximarkets.net

Server Location

United States

Website Domain Name

maximarkets.net

Server IP

104.21.92.158

Company Summary

Note: Regrettably, the official website of Maxi Markets, namely https://en.maximarkets.net/, is currently experiencing functionality issues.

| Maxi Markets Review Summary | |

| Founded | 2008 |

| Registered Country/Region | Saint Vincent and the Grenadines |

| Regulation | Unregulated |

| Market Instruments | Forex currency pairs, commodities, indices, shares, cryptocurrencies |

| Demo Account | N/A |

| Leverage | 1:400 |

| EUR/ USD Spread | 2.5 pips (Mini) |

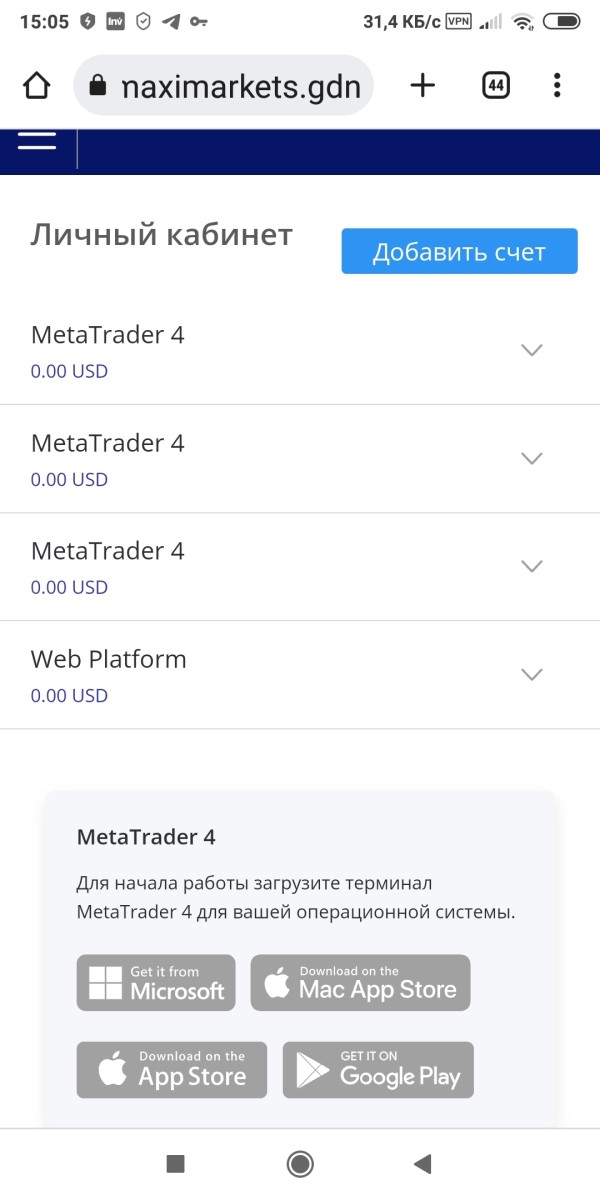

| Trading Platforms | MT4 |

| Minimum Deposit | $500 |

| Customer Support | Phone, email, Facebook, YouTube |

What is Maxi Markets?

Maxi Markets Limited, established in 2008, is a brokerage firm that offers a wide range of financial products and services to retail and institutional investors. They cater to investors such as banks, hedge funds, high-frequency traders, and brokerage companies. Maxi Markets provides trading instruments across various asset classes.

However, it is worth noting that Maxi Markets does not have regulation. Furthermore, there are many risks about it such as the inaccessibility of the official website and reports online about difficulties in withdrawing.

If you are interested, we invite you to continue reading the upcoming article where we will thoroughly assess the broker from various angles and present you with well-organized and succinct information. By the end of the article, we will provide a concise summary to give you a comprehensive overview of the broker's key characteristics.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

Pros of Maxi Markets:

- MT4 Supported: Maxi Markets provides support for the widely-used trading platform MetaTrader 4, which offers a range of advanced tools and features for traders.

- Various Services and Products: Maxi Markets offers a diverse range of services and products including forex currency pairs, commodities, indices, shares, cryptocurrencies, providing traders with different options to suit their specific trading preferences.

Cons of Maxi Markets:

- Lack of Regulation: Maxi Markets is not regulated by any recognized financial authority, which raises concerns about the level of oversight and investor protection provided by the brokerage.

- Inaccessible Website: The official website of Maxi Markets is inaccessible, a significant red flag, as it indicates potential unreliability and raises questions about the transparency and accessibility of the trading platform.

- Reports of Difficulty Withdrawing Funds: There have been reports from users experiencing difficulties in withdrawing their funds with Maxi Markets. This raises concerns about the reliability and trustworthiness of the brokerage.

- Higher Spreads: Maxi Markets is reported to have higher spreads compared to some other brokers. This can potentially impact trading costs and profitability, as higher spreads can eat into potential profits.

- High Minimum Deposit: Maxi Markets requires a high minimum deposit of $500, which will limit accessibility for traders with smaller account sizes. This can make it challenging for novice traders or those with limited capital to get started with the platform.

Is Maxi Markets Safe or Scam?

Maxi Markets operates without any regulatory oversight, which is a significant cause for concern. Additionally, the unavailability of their official website raises doubts about the reliability and credibility of their trading platform. These factors combine to elevate the inherent risks associated with investing in Maxi Markets.

If you are contemplating investing with Maxi Markets, it is of utmost importance to conduct extensive research and diligently assess the potential risks in relation to the potential rewards before reaching a final decision. In general, it is advisable to choose brokers that are duly regulated as a means of safeguarding the security of your funds.

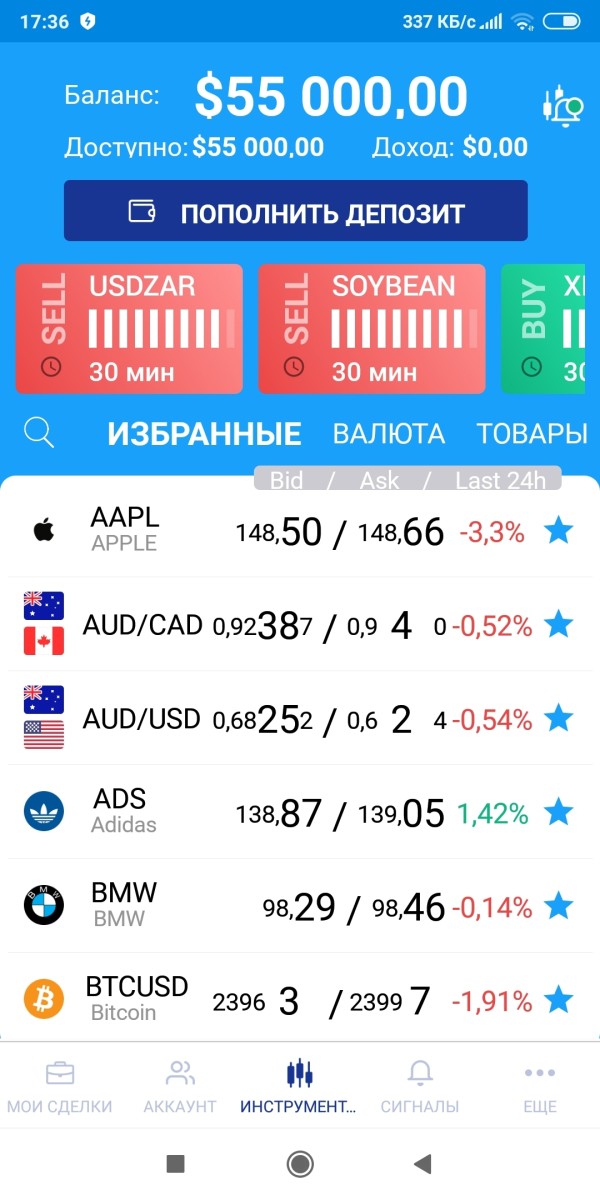

Market Instruments

Maxi Markets offers a diverse range of trading instruments across various asset classes.

Forex currency pairs:

Maxi Markets provides the opportunity to trade in major, minor, and exotic currency pairs. This allows traders to speculate on the movements of global currencies against each other.

Commodities:

Traders have the option to trade commodities such as gold, silver, oil, natural gas, and agricultural products. This enables them to participate in the price movements of these physical commodities.

Indices:

Maxi Markets allows trading on popular stock indices such as the S&P 500, FTSE 100, NASDAQ, DAX, and more. This provides exposure to the performance of multiple stocks from various industries within a specific stock market.

Shares:

The platform also offers trading in shares of various companies listed on global stock exchanges. This allows traders to speculate on the price movements of individual stocks and potentially profit from their predictions.

Cryptocurrencies:

Maxi Markets provides the opportunity to trade popular cryptocurrencies like Bitcoin, Ethereum, Ripple, and more. Traders can speculate on the volatility of these digital currencies without needing to own them physically.

Account Types

Maxi Markets offers four different types of trading accounts for investors with varying levels of trading experience and investment capital.

Mini Account:

- Minimum deposit: $500

- This account type is suitable for new or beginner traders who want to start with a lower investment amount.

- It offers access to a range of trading instruments and basic trading features.

Standard Account:

- Minimum deposit: $5,000

- The Standard account is designed for intermediate-level traders who have more trading experience and a higher investment capital.

- It provides access to a wider range of trading instruments, advanced charting tools, and additional trading features.

Gold Account:

- Minimum deposit: $10,000

- The Gold account is suitable for experienced traders who are looking for more comprehensive trading options and additional benefits.

- It offers access to a broader range of trading instruments across various asset classes.

Platinum Account:

- Minimum deposit: $35,000

- The Platinum account is designed for professional and high-net-worth traders who require increased trading capabilities and exclusive features.

- It provides access to all available trading instruments and advanced trading features.

Leverage

Maxi Markets offers a maximum leverage of 1:400. Leverage is a tool that allows traders to control larger positions in the market with a smaller initial investment. It amplifies both potential profits and losses, as it allows traders to open positions that are larger than the amount of capital they have.

A leverage of 1:400 means that for every $1 of the trader's own capital, they can control $400 in the market. This high leverage ratio can potentially lead to significant returns on investment if the market moves in the trader's favor. For example, a trader with $1,000 of their own capital can open positions worth up to $400,000.

However, it's important to note that while high leverage can magnify profits, it also comes with higher risks. If the market moves against the trader's position, losses can accumulate very quickly. With high leverage, even small changes in the market can result in substantial losses compared to the trader's initial investment.

Spreads & Commissions

| Account type | Average spreads | Commissions |

| Mini | 2.5 pips | N/A |

| Standard | 2 pips | |

| Gold | 1.7 pips | |

| Platinum | 1 pips |

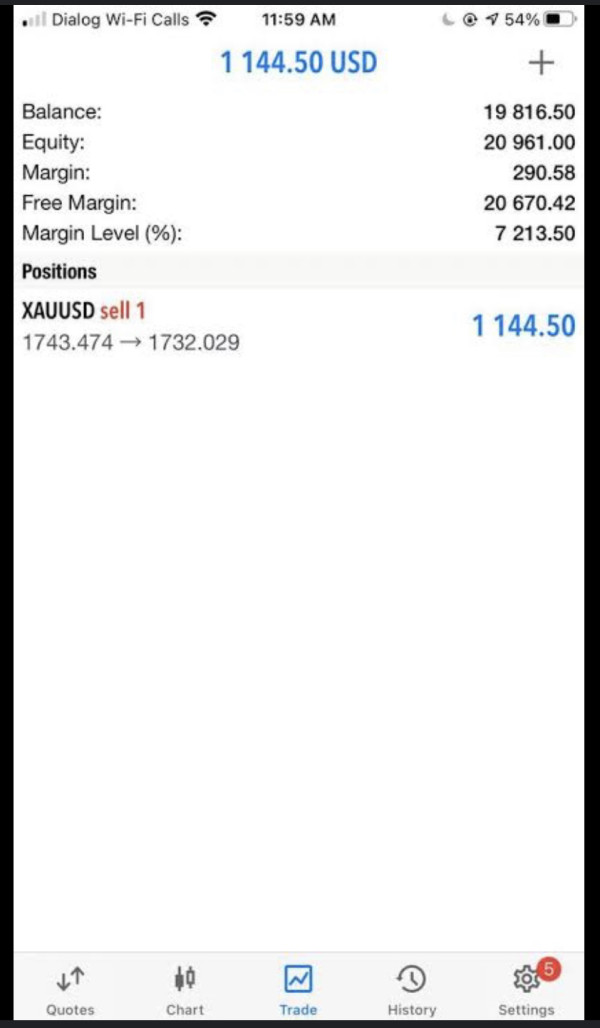

Trading Platforms

Maxi Markets offers its clients the popular trading platform MetaTrader 4 (MT4). MT4 is a robust and user-friendly platform that is widely recognized and used by traders worldwide.

The Maxi Markets MT4 platform provides a range of features and tools designed to enhance the trading experience. It offers real-time price quotes and advanced charting capabilities, allowing traders to analyze market trends and make informed trading decisions. Traders can access a wide range of asset classes, including forex, stocks, commodities, and indices, all within the MT4 platform.

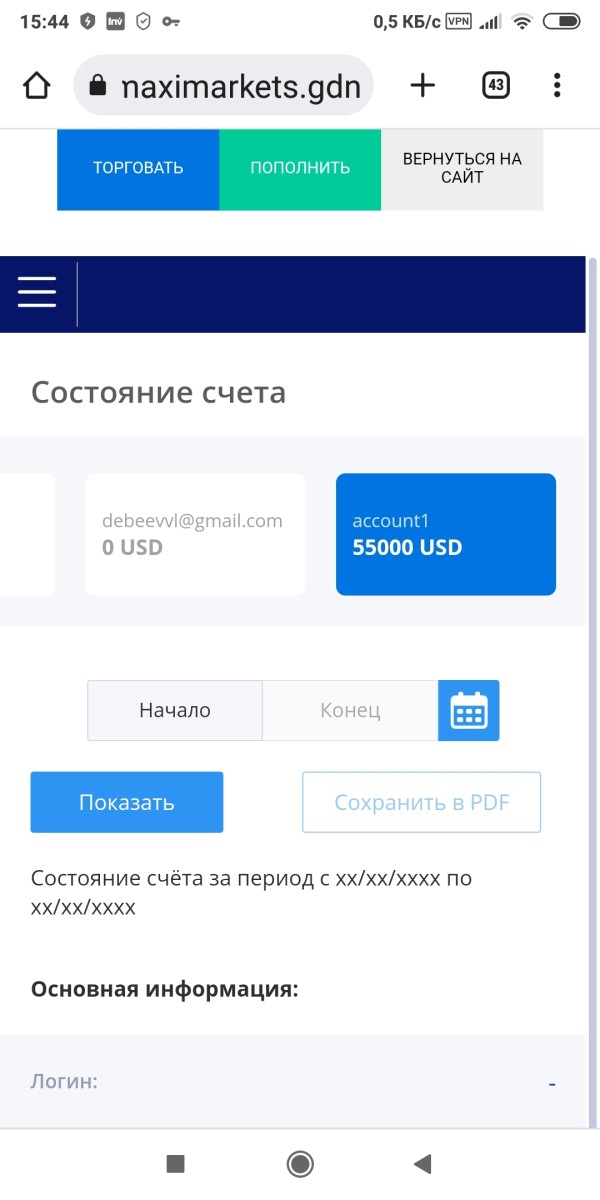

Deposits & Withdrawals

Maxi Markets offers several convenient deposit and withdrawal options to cater to the diverse needs of its clients.

Credit Card (Visa/MasterCard): Maxi Markets accepts deposits and allows withdrawals using Visa and MasterCard credit cards. Clients can securely fund their trading accounts by entering their card details on the platform.

Bank Transfer:

Maxi Markets allows clients to deposit and withdraw funds via bank transfer. To deposit funds, clients need to initiate a bank transfer from their bank account to Maxi Markets' designated bank account.

Online Payment Systems (Neteller, CashU):

Maxi Markets supports popular online payment systems such as Neteller and CashU. Clients can conveniently deposit funds into their trading accounts by selecting Neteller or CashU as their preferred payment method.

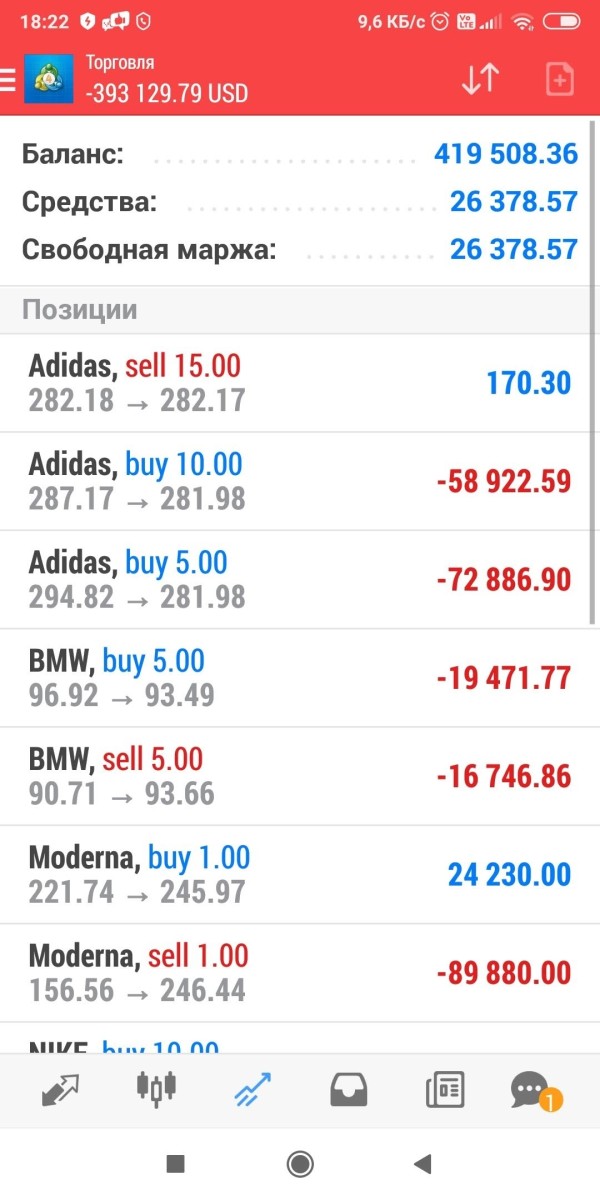

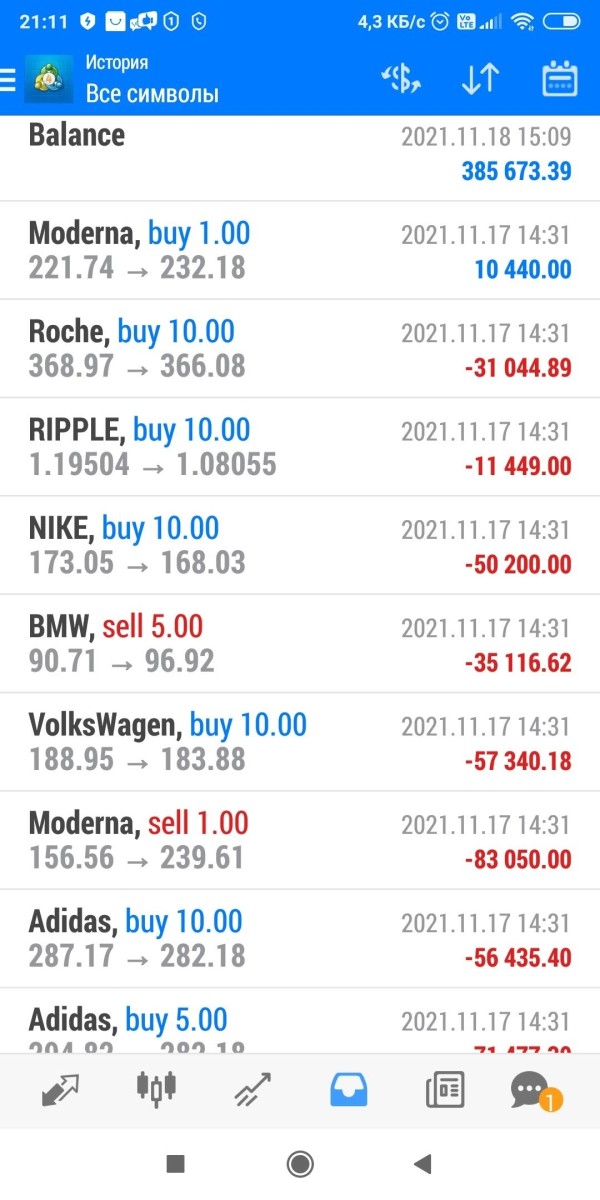

User Exposure on WikiFX

Our website features reports of users being unable to withdraw their funds with Maxi Markets, which suggest that there could be potential risks associated with trading on an unregulated platform.

We recommend checking our platform for information and updates regarding such brokers before making any trades. In the event that users come across fraudulent or unreliable brokers, or have themselves fallen victim to one, we encourage them to report it on our website's Exposure section.

Customer Service

Customers can get in touch with customer service line using the information provided below:

Telephone: +7 (495) 1453496

Email: support@maximarkets.net

Moreover, clients could get in touch with this broker through the social media, such as Facebook and YouTube.

Conclusion

Overall, while Maxi Markets offers a range of products and services on the MT4 with four accounts, their lack of regulation, inaccessible website and the reported issues make them a risky choice for investors seeking a trustworthy trading platform. Investors want to consider alternative brokerages that are regulated and have a reputation for reliability and customer service.

Frequently Asked Questions (FAQs)

| Q 1: | Is Maxi Markets regulated? |

| A 1: | No. It has been verified that this broker currently has no valid regulation. |

| Q 2: | How can I contact the customer support team at Maxi Markets? |

| A 2: | You can contact via telephone: +7 (495) 1453496, email: support@maximarkets.net, Facebook and YouTube. |

| Q 3: | Does Maxi Markets offer the industry leading MT4 & MT5? |

| A 3: | Yes. It offers MT4. |

| Q 4: | What is the minimum deposit for Maxi Markets? |

| A 4: | The minimum initial deposit to open an account is $500. |

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now