Score

UNX Markets

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.unxmarkets.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed UNX Markets also viewed..

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

unxmarkets.com

Server Location

United States

Website Domain Name

unxmarkets.com

Server IP

208.109.65.62

Company Summary

| Aspect | Information |

| Company Name | UNX Markets |

| Registered Country/Area | United Kingdom |

| Years | 1-2 years |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, and Stocks |

| Account Types | Standard Account, Professional Account, and Islamic Account |

| Minimum Deposit | $250 |

| Maximum Leverage | 500:1 |

| Spreads | Starting from 0.2 pips |

| Trading Platforms | MetaTrader 4 or 5 |

| Demo Account | Yes |

| Customer Support | Phone (+44 20 3996 1578+44 20 3996 1583) |

| Deposit & Withdrawal | Bank Transfers, Credit/Debit Cards, e-Wallets |

Overview of UNX Markets

UNX Markets is a relatively new financial company based in the United Kingdom, having been in operation for 1-2 years. The company operates in the markets of Forex, Commodities, Indices, and Stocks. Notably, UNX Markets is currently unregulated.

For traders interested in opening an account, UNX Markets offers a variety of account types, including Standard Account, Professional Account, and Islamic Account. The minimum deposit required to start trading with UNX Markets is $250, and the maximum leverage provided is 500:1. The spreads on trades with UNX Markets start from 0.2 pips.

Traders can access the markets using MetaTrader 4 or 5 as their trading platforms. Additionally, UNX Markets provides a Demo Account, allowing users to practice and get accustomed to the platform before engaging in live trading.

As for deposit and withdrawal methods, UNX Markets supports bank transfers, credit/debit cards, and e-wallets. Potential users need to consider the regulatory status and other factors when evaluating UNX Markets for trading or investment, given its unregulated status.

Regulatory Status

UNX Markets functions as an unregulated trading platform. Traders and investors should understand that the lack of regulatory supervision can bring extra risk.

In environments without regulations, traders might have limited options for resolution and protection if disputes or unforeseen problems arise.

Pros and Cons

| Pros | Cons |

| Various Market Instruments | Unregulated Status |

| Comprehensive Account Types | High Leverage Risks |

| MetaTrader 4 Integration | No Educational Resources |

| Flexible Deposit and Withdrawal Options | Limited History and User Feedback |

| Responsive Customer Support | / |

Pros of UNX Markets:

Various Market Instruments: UNX Markets offers a wide range of market instruments, including Forex, Commodities, Indices, and Stocks, providing traders with various investment options.

Comprehensive Account Types: With Standard, Professional, and Islamic accounts, UNX Markets supports different trading preferences, offering flexibility for traders with various risk tolerances and strategies.

MetaTrader 4 Integration: The inclusion of the MetaTrader 4 trading platform enhances the trading experience, providing users with advanced charting tools, technical indicators, and automated trading capabilities.

Flexible Deposit and Withdrawal Options: UNX Markets supports various deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets, offering convenience for its traders.

Responsive Customer Support: The availability of phone support with dedicated contact numbers demonstrates UNX Markets' commitment to responsive customer service, ensuring direct assistance for traders.

Cons of UNX Markets:

Unregulated Status: One notable drawback is UNX Markets' unregulated status, which may be concerning among some traders as it lacks the oversight of financial regulatory authorities.

High Leverage Risks: The maximum leverage of 500:1 poses potential risks for traders, as it can amplify both profits and losses, requiring careful risk management strategies.

No Educational Resources: UNX Markets does not provide educational resources, limiting the availability of learning materials for traders seeking to enhance their knowledge and skills.

Limited History and User Feedback: With its short operating history, UNX Markets may lack a substantial track record and user feedback. Traders often rely on the experiences of others to assess the reliability of a trading platform, and the limited history of UNX Markets could present a challenge in this regard.

Market Instruments

UNX Markets offers a wide range of market instruments, providing traders with a comprehensive set of options for investment.

Forex (Foreign Exchange): UNX Markets enables traders to engage in the dynamic world of Forex trading. This market involves the exchange of currencies, allowing participants to capitalize on fluctuations in exchange rates. Forex trading is known for its high liquidity and the potential for profit through speculation on currency value changes.

Commodities: Traders on UNX Markets can access the commodities market, which includes valuable resources such as gold, silver, oil, and agricultural products. Commodities trading provides diversification opportunities and allows investors to respond to global economic trends, geopolitical events, and supply-demand dynamics.

Indices: UNX Markets facilitates trading in indices, representing the performance of a group of stocks from a particular market or industry. Indices offer a broader perspective on market trends, allowing traders to make informed decisions based on the overall performance of a segment rather than individual stocks.

Stocks: The platform provides access to a wide array of individual stocks, allowing traders to invest in specific companies. UNX Markets covers stocks from various sectors, providing opportunities for investors to build a diversified portfolio. Stocks are influenced by company performance, industry trends, and broader market conditions.

Account Types

UNX Markets provides a range of account types tailored to suit different trading preferences.

The Standard Account requires a minimum deposit of $250, offering a maximum leverage of up to 400:1 with spreads starting around 0.2 pips. Traders opting for this account may face commissions ranging from $3 to $5.

For those seeking a more advanced trading experience, the Professional Account demands a higher minimum deposit of $5,000 but provides increased leverage of up to 500:1, with spreads around 0.15 pips and commissions ranging from $2 to $4.

Additionally, UNX Markets offers an Islamic Account requiring a minimum deposit of $500, featuring a maximum leverage of up to 200:1, swap-free spreads, and no specified commissions.

| Account Type | Minimum Deposit | Maximum Leverage | Spreads | Commissions |

| Standard Account | $250 | Up to 400:1 | Starts around 0.2 pips | $3-5 |

| Professional Account | $5,000 | Up to 500:1 | Around 0.15 pips | $2-4 |

| Islamic Account | $500 | Up to 200:1 | Swap-free | N/A |

How to Open an Account?

Opening an account with UNX Markets is a straightforward process that can be completed online in minutes. Here's a breakdown of the steps involved:

Choose your account type: UNX Markets offers three accounts, each tailored to different experience levels and trading needs.

Visit the UNX Markets website and click “Open Account.”

Fill out the online application form: The form will request your personal information, financial details, and trading experience. Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: UNX Markets offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the UNX Markets trading platform and start making trades.

Leverage

While a maximum leverage of 500:1 can amplify potential profits, it's crucial to note the associated risks.

High leverage, although offering the opportunity for significant gains, also magnifies the impact of market fluctuations. Traders operating with such high leverage on UNX Markets should be cautious, as it increases the likelihood of substantial losses.

The increased exposure to market volatility means that even small price movements can have a pronounced effect on the trader's capital.

Trading Platform

UNX Markets boasts the renowned MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, providing traders with powerful tools and features for a seamless trading experience.

These platforms offer a user-friendly interface, advanced charting tools, and a variety of technical indicators to aid in market analysis. With real-time price quotes, automated trading capabilities through Expert Advisors (EAs), and extensive back-testing options, both MT4 and MT5 meet the needs of traders of all levels.

Additionally, UNX Markets' integration with these platforms ensures swift execution of trades and access to a range of financial instruments, enhancing the overall trading efficiency of its users.

Deposit & Withdrawal

UNX Markets provides a flexible approach to depositing and withdrawing funds, offering various options.

Users can leverage the reliability of bank transfers, facilitating secure transactions directly from their bank accounts.

Credit and debit cards are also supported, providing a convenient and widely used method for financial transactions.

Additionally, UNX Markets accommodates modern preferences by accepting e-wallets, allowing users to manage their funds electronically with efficiency and ease.

Customer Support

UNX Markets prioritizes customer support with a dedicated phone service, ensuring direct and immediate assistance for traders.

Users can reach out to the customer support team at +44 20 3996 1578 or +44 20 3996 1583, providing a reliable and accessible means of communication.

Whether traders have inquiries, require assistance with account-related matters, or seek clarification on trading processes, the phone support feature offers a personalized and efficient channel for resolving queries.

Conclusion

In conclusion, UNX Markets presents a mixed landscape for traders with its distinct set of pros and cons.

On the positive side, the platform offers an array of market instruments, comprehensive account types, and the integration of the widely acclaimed MetaTrader 4. However, potential drawbacks include unregulated status, posing concerns about oversight and accountability. The high leverage risks, coupled with the absence of educational resources, might be a deterrent for traders looking for a more structured learning environment.

Traders considering UNX Markets should carefully weigh these pros and cons, taking into account their individual preferences, risk tolerance, and the importance of regulatory oversight in their decision-making process.

FAQs

Q: What market instruments does UNX Markets offer for trading?

A: UNX Markets provides a multiple range of market instruments, including Forex, Commodities, Indices, and Stocks.

Q: What account types are available on UNX Markets?

A: UNX Markets offers three main account types: Standard, Professional, and Islamic.

Q: Does UNX Markets support MetaTrader 4 for trading?

A: Yes, UNX Markets integrates MetaTrader 4, a popular trading platform known for its advanced charting tools and automated trading capabilities.

Q: What are the deposit and withdrawal options on UNX Markets?

A: UNX Markets supports flexible deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets.

Q: What are the risks associated with the high leverage offered by UNX Markets?

A: The high leverage of up to 500:1 on UNX Markets can amplify both profits and losses, necessitating careful risk management strategies.

Keywords

- 2-5 years

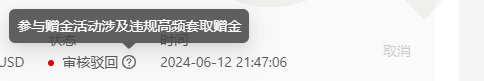

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 1

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now