What is XNT?

XNT LTD, founded in 2011 and registered in Japan, is a regulated financial trading company under the supervision of the Malta Financial Services Authority (MFSA), which helps ensure investor protection and adherence to global trading standards.

Pros & Cons

Pros:

Solid Regulation: Regulated by the Malta Financial Services Authority (MFSA), XNT operates under recognized financial regulatory standards, which can provide certain assurance and protection for its traders.

Demo Account Available: The availability of a demo account allows traders to familiarize themselves with the platform and test trading strategies without risking real money.

Wide Range of Tradable Instruments: With more than 1,000,000+ instruments, including Stocks, Currencies, Metals, Futures, Options, Funds, and Bonds, XNT offers traders a wealth of trading options.

Extensive Customer Support: In addition to being reachable 24/7 via telephone, email, and a contact form, XNT provides robust customer support, thereby ensuring that traders' concerns and inquiries are swiftly addressed.

Platform Accessibility: XNT is accessible from various platforms, including desktop, tablet, and mobile, allowing traders to manage their investments anytime, anywhere.

Cons:

Multiple Fees: XNT charges various fees including a withdrawal fee of €30, an inactivity fee of €50, and other unidentified fees, which might increase the cost of trading.

High Minimum Deposit: XNT's minimum deposit of $50,000 is significantly high, potentially creating a bar of entry for traders with less capital at their disposal.

Is XNT Safe or Scam?

Regulatory Sight: XNT is a regulated trading company, holding a Market Making (MM) license (License No: C 52182) sanctioned by the Malta Financial Services Authority. Being regulated by a recognized and reputable regulatory authority such as the Malta Financial Services Authority ensures that XNT adheres to stringent financial standards.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

Market Instruments

Stocks: Users can participate in the global stock market, trading shares of both established and emerging companies.

Currencies: XNT facilitates foreign exchange trading with a vast variety of currency pairs, taking advantage of the high liquidity of forex markets.

Metals: Trading spot metals like gold and silver is an option, which can serve as a hedge against economic uncertainty and inflation.

Futures: XNT offers futures contracts across a range of commodities, providing opportunities for speculation and hedging.

Options: Traders on XNT can also engage in options trading, allowing them a right, but not an obligation, to buy or sell securities at a predetermined price.

Funds: XNT provides access to several types of funds, offering diversified investment opportunities.

Bonds: Trading on a plethora of bonds, from government to corporate, is possible, providing low-risk investment opportunities.

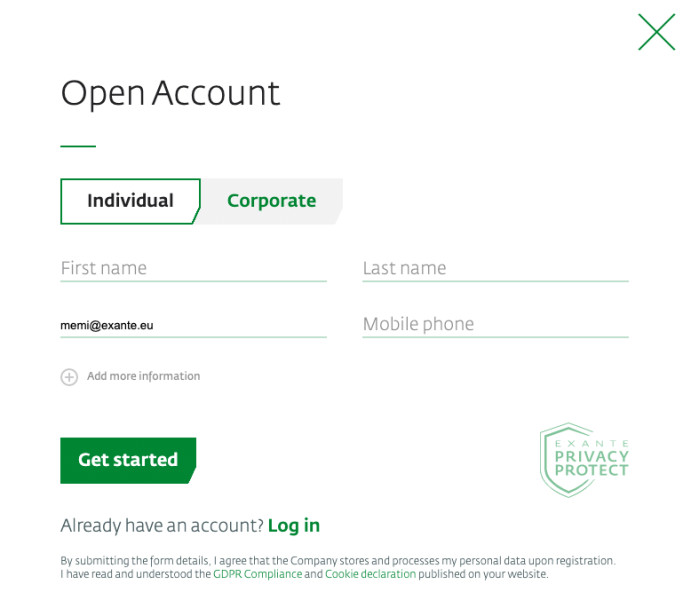

Account Types

XNT offers a unified account type that is tailored to work seamlessly across all exchanges, providing simplicity and convenience to traders. This single account type eliminates the need for traders to manage multiple accounts for different exchanges, facilitating a smooth trading experience across various markets.

In addition, XNT also provides a Demo Account option. This feature is highly beneficial, especially for novice traders, as it allows them to familiarize themselves with the trading platform, practice trading strategies, and gain confidence without risking real money. The demo account simulates real trading conditions, providing a realistic trading experience for its users.

Interest Rates

XNT LTD offers different interest rates across a wide range of trading instruments which can be highly attractive to traders:

Stocks & ETFs: Trading starts from a minimum rate of 0.02 USD, providing cost-effective access to global equity markets.

Currencies: Forex trading commences with a spread starting from 0.3, catering to traders who want to engage in currency exchange with potentially lower trading costs.

Metals: Trading in spot metals such as gold and silver starts at 3 USD.

Futures: Futures markets begin trading from a starting rate of 1.5 USD.

Options: Options trading commences from a minimum rate of 1.5 USD.

Funds: The rate for trading various funds starts from as low as 0.5%.

Bonds: Investors interested in bond trading are facilitated with an advantageous minimal trading rate of 9 basis points (bps).

Fees

XNT's fee structure includes several types of charges:

Overnight Fees: These are applicable for holding short positions and foreign exchange trades, and they can vary based on market conditions. Overnight fees triple from Wednesday to Thursday to cover the weekend. Cryptocurrency funds, specifically, incur enter/exit and safekeeping fees. However, all other instruments are exempt from overnight fees.

Inactivity Fee: If your trading account stays inactive, a fee of 50 EUR is automatically deducted unless you are an authorized trader/agent, your account balance is over 5,000 EUR, your last trade was less than 6 months ago, or you have at least one open position.

Trade Desk Fee: Trading any instrument on the platform via the EXANTE Trade Desk incurs a 90 EUR fee. Additionally, custom reports and documentation requests carry a 90 EUR fee.

Withdrawal Fee: It costs 30 EUR to withdraw funds from your XNT trading account. This fee is applicable each time a withdrawal request is made.

Short Position Fee: Short selling rates start at 12% for easy-to-borrow stocks. The rate can vary depending on the stock's accessibility, the client's trading strategy, and current market conditions. For hard-to-borrow stocks, traders should contact support@xnt.mt for availability and pricing.

Margin Trading: There are no specific margin trading fees for maintaining a margin utilization below 100%. However, if the utilization exceeds 100%, a daily fee equivalent to 100% p.a. is charged on the exceeded value. If a margin call forces manual closure of positions, a 90 EUR fee is applied. The exceeded margin fees are charged daily, and the fees for upcoming weekends are charged from Wednesday to Thursday night.

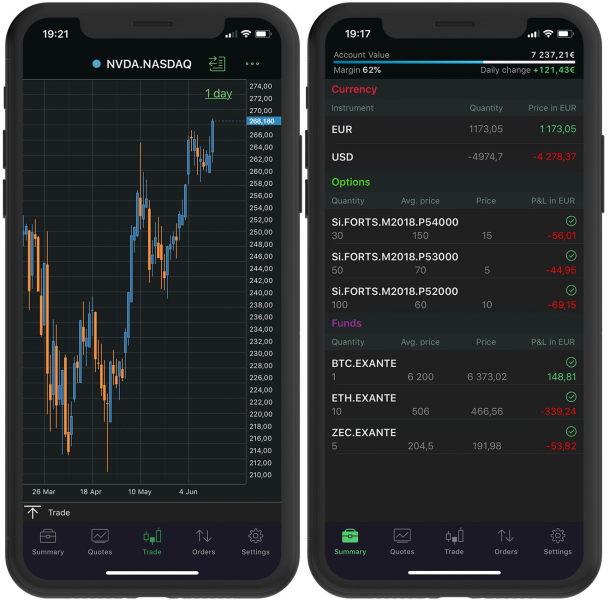

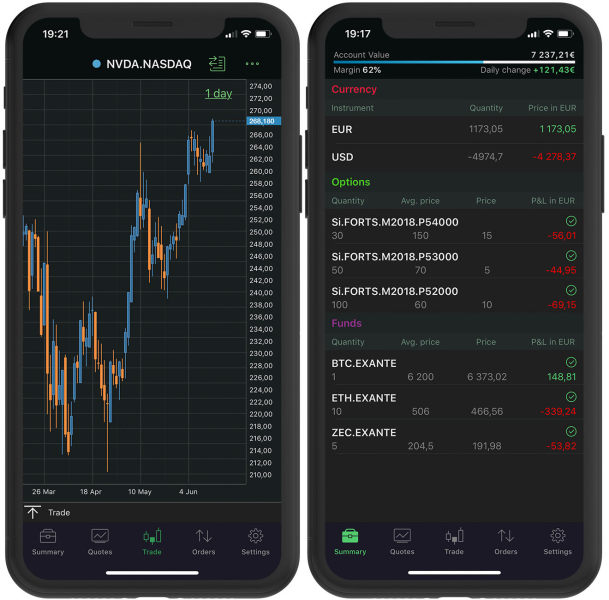

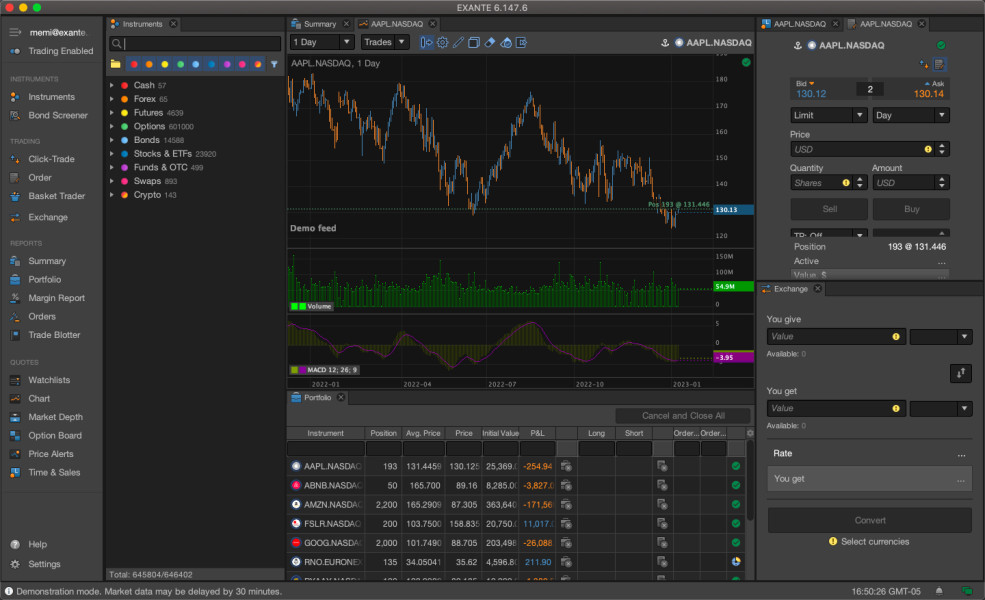

Trading Platform

XNT provides a highly versatile and user-friendly trading platform that is accessible via multiple devices - Desktop, Tablet, and Mobile. This multi-device compatibility ensures that traders can access and manage their trades anytime and anywhere according to their convenience. The robust trading platform provides a comprehensive range of tools and features designed to facilitate efficient trading and analysis. Whether at home, in the office, or on the go, traders can stay connected to the markets and never miss a trading opportunity.

Customer Support

XNT providesaround-the-clock customer support, ensuring that queries and issues of its clients are quickly addressed regardless of the time. Traders can reach out to XNTs support team in several ways: through a contact form available on their website, a telephone call to +356 2015 0000, or by email atinfo@xnt.mt. Their commitment to 24/7 customer service adds greatly to the trader's assistance and convenience. In addition to these, the company's physical address is available for postal inquiries: Portomaso Business Tower, Level 18, St. Julian's, STJ 4011, Malta. This comprehensive approach to customer service demonstrates XNT's dedication to ensuring a positive and supportive trading experience for its users.

Conclusion

Overall, XNT Ltd is a well-regulated trading company overseen by the MFSA, offering a wide variety of market instruments and 24/7 customer support which makes it a competitive choice within the trading industry. However, while it provides a generous sweep of appealing features and tools, its high fees and particularly substantial minimum deposit make it less suitable for smaller-volume investors, hindering its accessibility for a broader clientele.

Frequently Asked Questions (FAQs)

Q: What is the minimum deposit for XNT Ltd?

A: The minimum deposit for starting to trade with XNT Ltd is $50,000.

Q: Does XNT offer demo account trading?

A: Yes, XNT does offer a demo account, allowing traders to familiarize themselves with the platform and test trading strategies risk-free.

Q: Is XNT regulated?

A: Yes, XNT is regulated by the Malta Financial Services Authority (MFSA) and holds a Market Making (MM) license.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.