简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Vlom-Overview of Minimum Deposit, Spreads & Leverage

Abstract:Vlom is a global brokerage firm who offers its traders with access to market instruments including Currencies, stocks, indices andcommotities. However, it is important to note Vlom is currently not regulated by any recognized financial authorities which raises concerns when trading.

| Vlom Review Summary in 7 Points | |

| Regulation | Unregulated |

| Market Instruments | Currencies, stocks, indices, commotities |

| Demo Account | Not Available |

| Leverage | Up to 1:400 |

| Trading Platforms | VlomTrader |

| Minimum Deposit | USD 100 |

| Customer Support | Phone, Email, live chat, social media, FAQ |

What is Vlom?

Vlom is a global brokerage firm who offers its traders with access to market instruments including Currencies, stocks, indices andcommotities. However, it is important to note Vlom is currently not regulated by any recognized financial authorities which raises concerns when trading.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Wide range of trading instruments across multiple asset classes | • Unregulated |

| • Multiple account types | • Limited info on commissions/spreads/funding methods |

| • Acceptable minimum deposit amount from beginner account | • Reports of unable to withdraw and scam |

| • Segregated funds | • No services in certain countries |

| • High minimum deposit requirement for most account types |

Pros:

Wide Range of Trading Instruments: Vlom offers a diverse selection of trading instruments across various asset classes including Currencies, stocks, indices, commotities, providing traders with ample opportunities to diversify their portfolios and capitalize on market movements.

Multiple Account Types: Vlom satisfy different trader preferences and experience levels by offering 7 account types, each with varying features and benefits to suit individual trading needs.

Acceptable Minimum Deposit Amount: The minimum deposit requirement for the beginner account is USD100, making it accessible to traders with smaller investment budgets.

Segregated Funds: Vlom segregates client funds from its operational funds, providing an additional layer of security and protection against potential risks such as insolvency or misuse of funds.

Cons:

Unregulated: Vlom's unregulated status raises concerns about the lack of oversight and regulatory compliance, exposing clients to higher risks and uncertainties.

Limited Info on Commissions/Spreads/Funding Methods: The lack of comprehensive information on trading costs, including commissions, spreads, and funding methods hinder transparency and informed decision-making for traders.

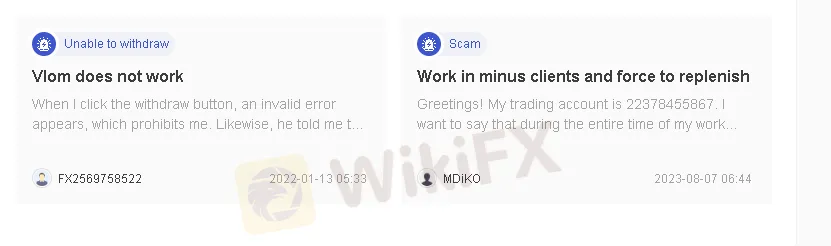

Reports of Unable to Withdraw and scam: Instances of clients encountering difficulties or delays in withdrawing funds and scam from their accounts erode trust and confidence in the platform's reliability and integrity.

No Services in Certain Countries: Vlom's absence of services in Iran, Syria, U.S and North Korea limits accessibility for traders residing in those regions, excluding them from accessing the platform's offerings and services.

High Minimum Deposit Requirement for Most Account Types: Vlom imposes a high minimum deposit requirement for most account types, excluding traders with limited capital from accessing certain features and benefits of higher-tier accounts.

Is Vlom Safe or Scam?

When considering the safety of a brokerage like Vlom or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a brokerage:

Regulatory sight: Its been verified that the broker is currently not regulated by any recognized financial authorities, which means that there is no guarantee that it is a safe platform to trade with.

User feedback: 2 reports of unable to withdraw and scam on WikiFX should be taken into consideration as red flags for traders. It is recommended for you to do thorough research before engaging with any broker or investment platform.

Security measures: Vlom employs robust security measures to safeguard client assets and information. With SSL encryption, all data transmissions are encrypted, ensuring privacy and protection against unauthorized access. Funds are segregated between client funds and company operational funds to enhance security, providing an extra layer of protection for client funds.

Ultimately, the decision of whether or not to trade with Vlom is a personal one. You should weigh the risks and benefits carefully before making a decision.

Market Instruments

Vlom offers a comprehensive selection of market instruments across various asset classes:

Currencies: Vlom provides access to over 100 currency pairs in the forex market, allowing traders to capitalize on fluctuations in exchange rates between major and minor currencies. Traders can benefit from the liquidity and volatility of the currency markets.

Stocks: Vlom enables traders to invest in individual stocks of leading companies listed in global stock exchanges such as NASDAQ, NYSE, and London Stock Exchange.

Indices: Vlom offers trading opportunities in market indices, allowing traders to speculate on the performance of entire stock markets or specific sectors. By trading indices, traders can gain exposure to broad market trends and diversify their investment strategies, leveraging the dynamics of global equity markets.

Commodities: Vlom provides access to various commodities, including precious metals like gold and silver, as well as energy products like crude oil and natural gas. Traders can take advantage of the inherent volatility and hedging properties of commodities, diversifying their portfolios and managing risk in uncertain market conditions

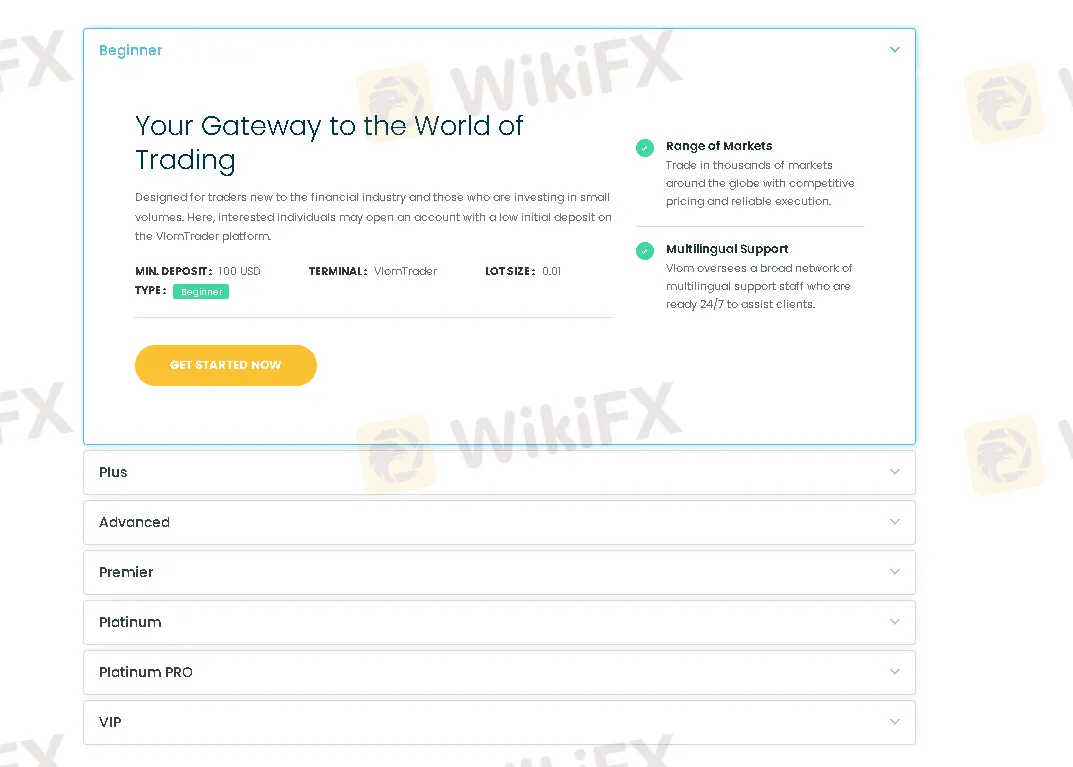

Account Types

Vlom presents a range of account types to accommodate traders at various levels, each with distinct features and minimum deposit requirements.

The Beginner account offers an entry point with a minimum deposit of USD 100, suitable for those new to trading.

As traders progress, the Plus account requires USD 20,000, followed by the Advanced account at USD 50,000 for more experienced individuals.

The Premier account caters to seasoned traders with a minimum deposit of USD 100,000, while the Platinum account demands USD 500,000 and the Platinum PRO USD 1,000,000.

Lastly, the VIP account, with a hefty minimum deposit of USD 10,000,000, is tailored for high-net-worth clients.

Although these tiers offer varied benefits, the high minimum deposits for most account types limit accessibility for traders with smaller investment capital.

How to Open an Account?

To open an account with Vlom, you have to follow below steps:

Visit the Vlom website, locate and click on the 'Sign up'.

Fill in the necessary personal details required.

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

Leverage

Vlom provides traders with the opportunity to use leverage up to 1:400, which can amplify both potential profits and losses. While higher leverage can enhance trading power, it also increases risk significantly.

Traders should employ risk management strategies and fully understand the implications of leveraged trading before using such high leverage levels. It's crucial to ensure that leverage is used wisely and in accordance with one's risk tolerance and trading experience to mitigate the potential for substantial losses.

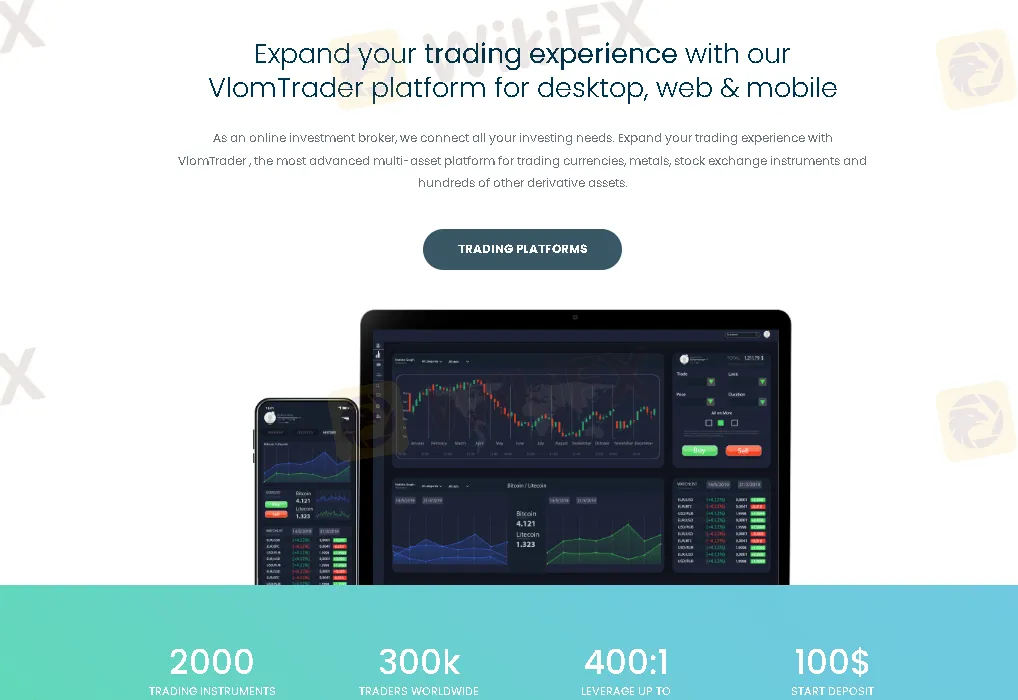

Trading Platforms

VlomTrader is an expansive trading platform accessible across desktop, web, and mobile devices, enhancing your trading experience.

With VlomTrader, you gain access to a sophisticated multi-asset platform, enabling trading in currencies, metals, stock exchange instruments, and numerous derivative assets. The platform supports all types of trade orders, including market and pending orders, and provides advanced market watch and depth features.

Traders benefit from comprehensive charting and analysis options, including 21 timeframes and over 80 analytical tools. VlomTrader also offers algorithmic trading capabilities for automated operations and access to hundreds of markets under one trading account. Additionally, traders can set up trade notifications and alerts to stay informed about important events and never miss a trading opportunity.

User Exposure on WikiFX

On our website, you can see that 2 reports regarding unable to withdraw and scam, which should be marked as red flag. Traders are encouraged to carefully review the available information. You can check our platform for information before trading. If you find such fraudulent brokers or have been a victim of one, please let us know in the Exposure section. We would appreciate it and our team of experts will do everything possible to solve the problem for you.

Customer Service

Vlom prioritizes customer support by offering multiple channels for assistance. Clients can reach out via phone, email, live chat, and social media platforms including Facebook, Twitter and Instagram, ensuring prompt and accessible assistance.

Additionally, an FAQ section provides quick answers to common queries, enhancing overall customer experience and satisfaction.

Phone: +18887785986.

Email: livesupport@vlom.com

Conclusion

According to available information, Vlom is a non-regulated brokerage firm who offers a range of market instruments such as Currencies, stocks, indices, commotitiesas market instruments to traders. However, it is important to consider certain factors such as non-regulated status and 2 reports of unable to withdraw that raise concerns. It is critical for you to be careful, make full investgation and seek up-to-date information directly from Vlom before making any investment decisions.

Frequently Asked Questions (FAQs)

| Q 1: | Is Vlom regulated? |

| A 1: | No, it‘s been verified the broker is currently under no valid regulations. |

| Q 2: | Does Vlom offer the industry leading MT4 & MT5? |

| A 2: | No. |

| Q 3: | Is Vlom a good broker for beginners? |

| A3: | No. it’s not a good broker for beginners because its not properly regulated. |

| Q 4: | Does Vlom offer demo accounts? |

| A 4: | No. |

| Q 5: | What is the minimum deposit for Vlom? |

| A 5: | The minimum initial deposit is 100 USD. |

| Q 6: | Are there any restricted areas from Vlom? |

| A 6: | Yes, Vlom does not accept the provision of services to citizens/residents of Iran, Syria, U.S and or North Korea. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CWG Markets Got FSCA, South Africa Authorisation

Amazon launches Temu and Shein rival with \crazy low\ prices

CySEC Warns Against Unauthorized Investment Firms in Cyprus

Revolut X Expands Crypto Exchange Across Europe, Targeting Pro Traders

Crypto Scammer Pleads Guilty in $73 Million “Pig Butchering” Fraud

Capital.com Shifts to Regional Leadership as CEO Kypros Zoumidou Steps Down

Broker Review: Is Exnova Legit?

Why Even the Highly Educated Fall Victim to Investment Scams?

Warning Against Globalmarketsbull & Cryptclubmarket

FBI Raids Polymarket CEO’s Home Amid 2024 Election Bet Probe

Currency Calculator