Score

Classic Capitals

United States|1-2 years|

United States|1-2 years| https://classiccapitals.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United States

United StatesAccount Information

Users who viewed Classic Capitals also viewed..

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

classiccapitals.com

Server Location

India

Website Domain Name

classiccapitals.com

Server IP

217.21.84.221

Company Summary

Note: Regrettably, the official website of Classic Capitals, which can be found at https://classiccapitals.com/, is currently not operational. This makes it difficult to access accurate information about the broker directly from their website.

General Information

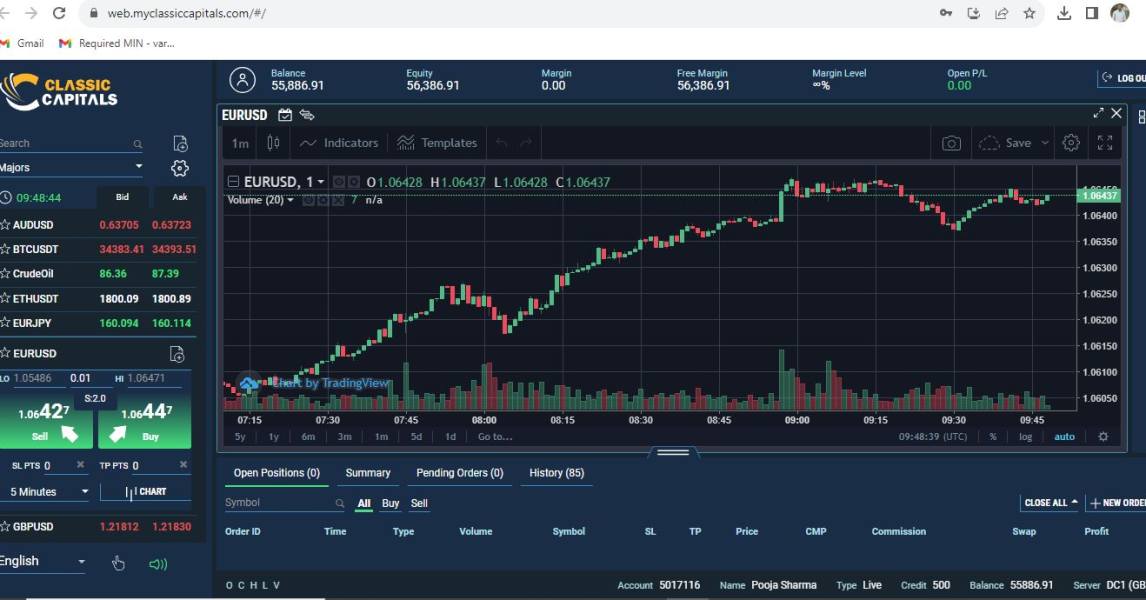

| Classic Capitals Review Summary | |

| Founded | Within 1 year |

| Registered Country/Region | United States |

| Regulation | Unregulated |

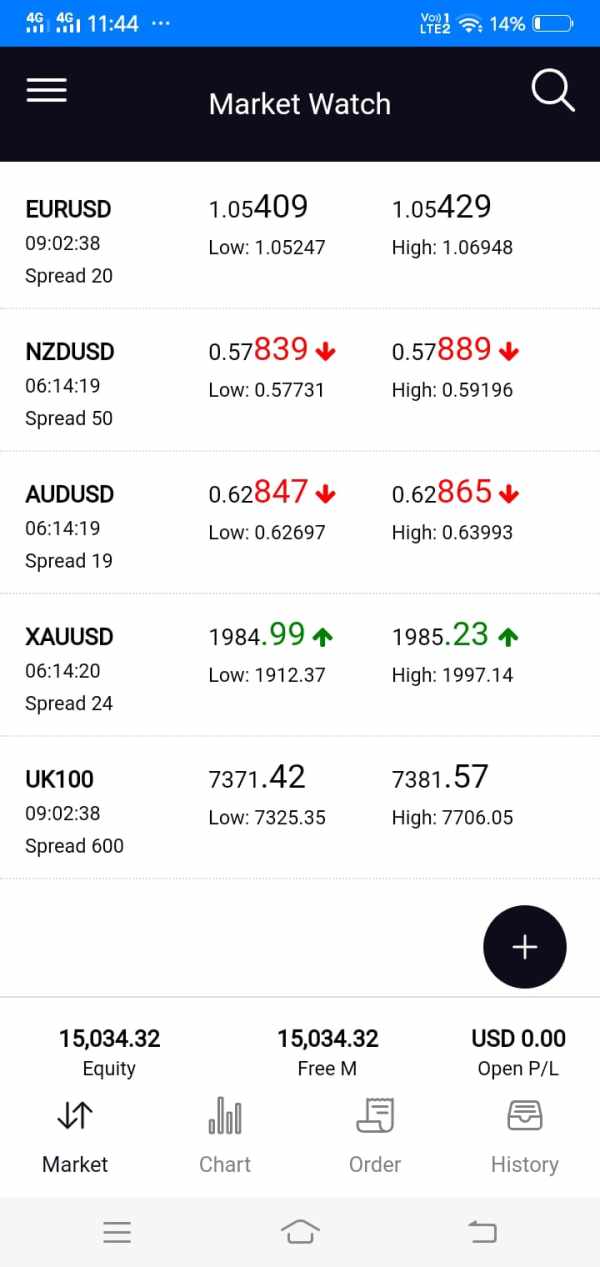

| Market Instruments | Forex, metals, energies, indices |

| Demo Account | Unavailable |

| Leverage | Up to 1:500 |

| Spread | from 1 pip |

| Trading Platforms | MT4 |

| Minimum Deposit | $100 (Silver account) |

| Customer Support | Phone, email |

What is Classic Capitals?

Classic Capitals offers different trading instruments for its clients. However, it is important for traders to be aware of the risks associated with trading on an unregulated platform like Classic Capitals. Reports of scams should be carefully reviewed, and traders should exercise caution when dealing with unregulated brokers.

We would like to extend an invitation to you to read our upcoming article, which will provide a detailed assessment of Classic Capitals from various perspectives. We will offer well-organized and concise information to help you better understand the broker. By the end of the article, we will provide a summary that highlights the key characteristics of Classic Capitals in a clear and comprehensive way.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros of Classic Capitals:

- Offers a wide range of trading instruments, providing traders with diverse options.

Cons of Classic Capitals:

- Lack of regulation: Classic Capitals operates without proper oversight from a financial authority, which can raise concerns about the safety of funds and the reliability of the platform.

- Reports of scams: There have been instances where individuals have reported scams or fraudulent activities related to Classic Capitals, indicating potential risks associated with the broker.

- Website is unavailable: The brokers website is currently unavailable, which limits access to information about their services and features.

Is Classic Capitals Safe or Scam?

Classic Capitals is not regulated, which means there is no oversight from a regulatory body that monitors their business operations. This lack of supervision combined with the unavailability of their official website indicates that the reliability of this trading platform could be questionable. These factors increase the level of risk associated with investing in Classic Capitals. Therefore, if you are considering investing with them, it is essential to conduct comprehensive research and weigh the potential risks against potential rewards carefully. In general, it is advisable to choose brokers that are well-regulated to ensure the safety of your funds.

Market Instruments

Classic Capitals offers a range of trading instruments across different asset classes to cater to the diverse trading needs of its clients. These instruments include:

- Forex: Classic Capitals provides access to the foreign exchange market, allowing traders to buy and sell different currency pairs. This includes major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs.

- Metals: Traders can trade precious metals such as gold, silver, platinum, and palladium. These metals are commonly sought after for their value and act as a hedge against inflation or economic uncertainties.

- Energies: Classic Capitals enables trading in energy commodities such as crude oil and natural gas. These commodities are influenced by factors like geopolitical tensions, supply and demand dynamics, and global economic conditions.

- Indices: Classic Capitals offers trading opportunities in major stock market indices from around the world. Examples of popular indices include the S&P 500, NASDAQ, FTSE 100, DAX, and Nikkei. Trading indices allows investors to speculate on the overall performance of a particular stock market.

Account Types

Classic Capitals offers three live account types to cater to the individual needs and trading preferences of its clients. The account types are as follows:

- Diamond Account:

The Diamond Account is the highest tier account offered by Classic Capitals. It requires a minimum deposit of $500. Diamond account holders usually have access to a wider range of trading instruments and may enjoy additional perks and bonuses.

- Gold Account:

The Gold Account is the mid-tier account offered by Classic Capitals. It requires a minimum deposit of $200.

- Silver Account:

The Silver Account is the entry-level account offered by Classic Capitals. It requires a minimum deposit of $100, making it accessible to traders with a smaller budget. With a Silver Account, traders have access to a selection of trading instruments, standard spreads, and basic customer support.

Leverage

Classic Capitals offers different leverage options for each of its account types. The leverage offered by Classic Capitals is as follows:

The Diamond Account offers a maximum leverage of 1:5. The Gold Account provides a maximum leverage of 1:500. The Silver Account offers a maximum leverage of 1:400.

While not as high as the leverage offered in the Gold Account, it still provides traders with the opportunity to amplify their trading positions. Similar to the other account types, traders with a Silver Account should be aware of the risks involved and trade responsibly. It is crucial to have a thorough understanding of leverage and how it can impact trading outcomes.

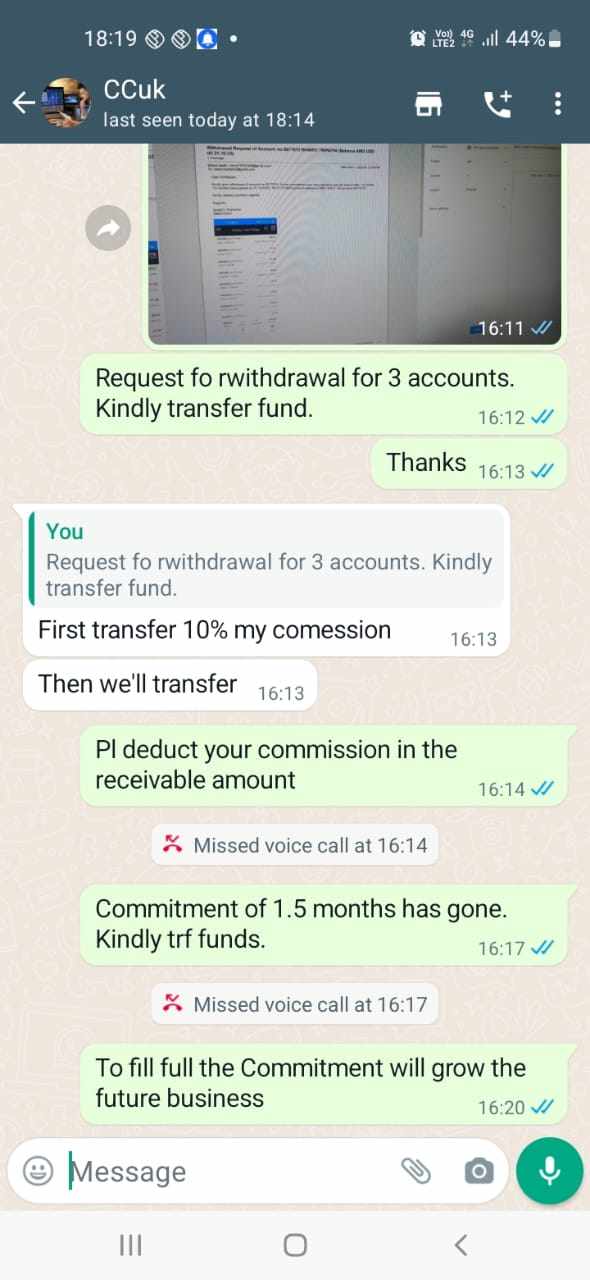

Spreads & Commissions

Classic Capitals offers different spreads and commissions for each of its account types: Diamond, Gold, and Silver.

| Account Type | Spread | Commission |

| Diamond | 1 pip | 5% |

| Gold | 1 pip | 5% |

| Silver | 3 pips | 10% |

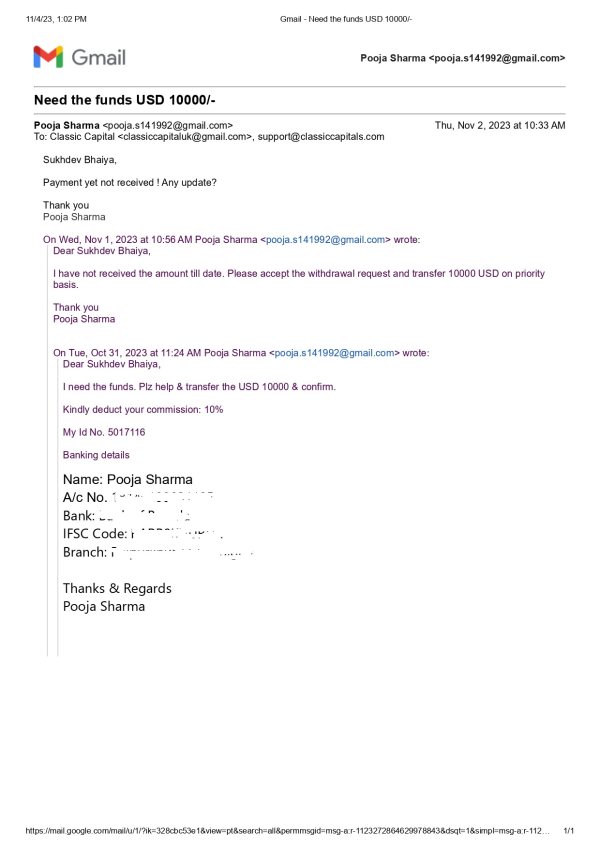

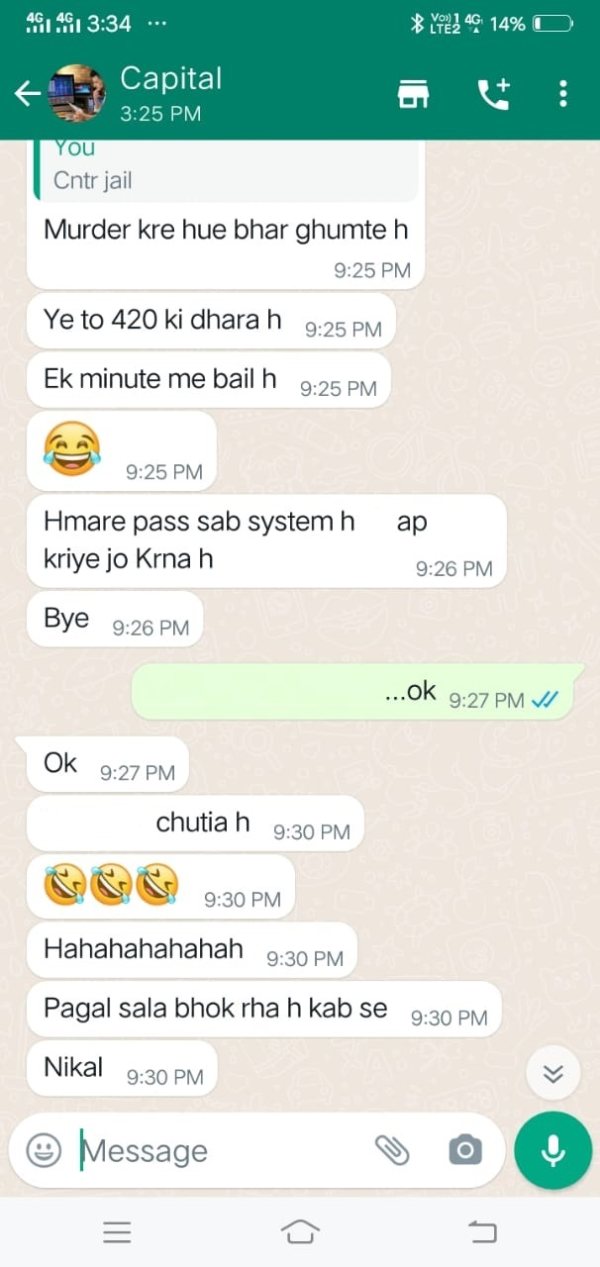

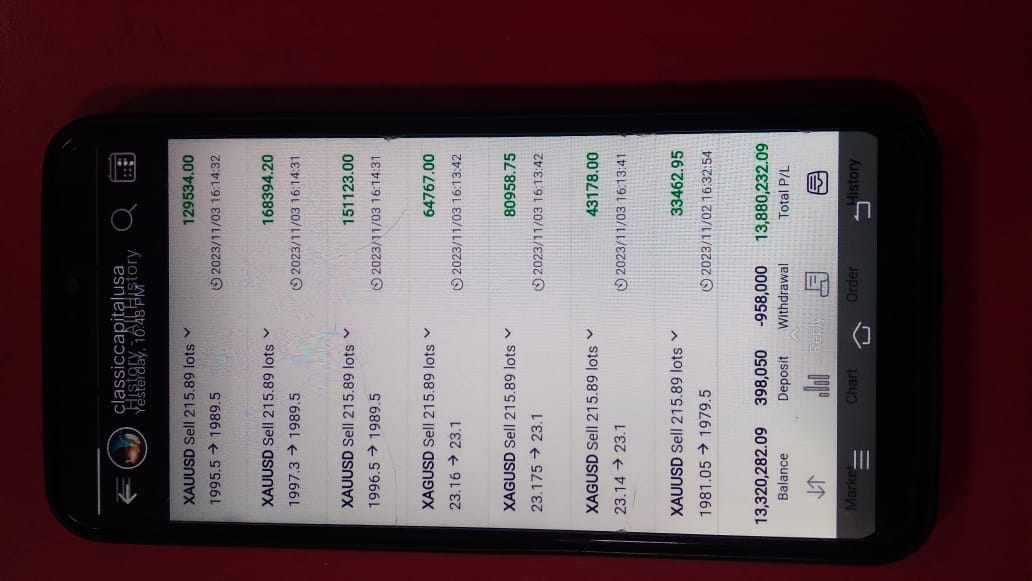

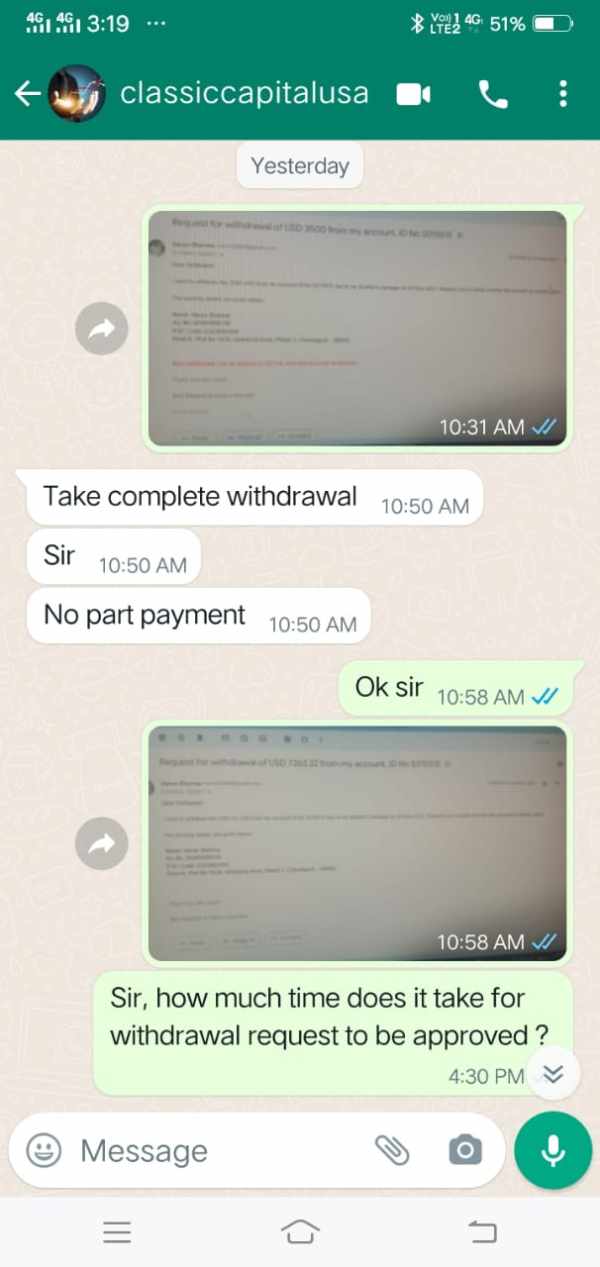

User Exposure on WikiFX

Our website provides reports of scams and advises traders to thoroughly review the available information and assess the risks associated with trading on an unregulated platform. Prior to trading, it is recommended to visit our platform and gather information. If you come across any fraudulent brokers or have fallen victim to one, we encourage you to report the incident in the Exposure section. Our team of experts will make every effort to assist you in resolving the issue.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +1 (786) 936-0393

Email: support@classiccapitals.com

Conclusion

In conclusion, Classic Capitals is a trading platform that offers different account types with varying spreads and commissions. However, it is important to note that Classic Capitals lacks proper regulation, indicating that there is no governmental or financial authority overseeing their activities. This raises concerns about the credibility and reliability of the platform. Traders are advised to carefully consider the risks associated with trading on an unregulated platform and to exercise caution when dealing with Classic Capitals.

Frequently Asked Questions (FAQs)

| Q 1: | Q: Is Classic Capitals a regulated broker? |

| A 1: | No. Classic Capitals is not regulated. |

| Q 2: | Does Classic Capitals offer demo accounts? |

| A 2: | No. |

| Q 3: | Q: How much do I need to deposit to start trading with Classic Capitals? |

| A 3: | It needs $100. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

Exposure User claims- Classic Capital is a Fraud Company

A Classic Capital user from India complaint on WikiFx on November 4, 2023, by stating that I invested $42,000 with Classic Capital in August.

2023-11-08 14:11

Exposure Man Lost his Valuable Money in Forex Fraud

He said, “Classic Capitals is a fraudulent company.” A user lost his hard-earned money with a broker named Classic Capitals. The victim is from India and approached Wikifx.

2023-10-31 18:43

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now