Score

Driss IFC

United States|Within 1 year|

United States|Within 1 year| https://driss-ifc.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:Driss IFC Limited

License No.:31000274201881

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 13 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

United States

United StatesUsers who viewed Driss IFC also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

driss-ifc.com

Server Location

United States

Website Domain Name

driss-ifc.com

Server IP

172.66.47.73

Company Summary

| Driss IFC | Basic Information |

| Founded in | 2024 |

| Registered in | United States |

| Regulation | FinCEN |

| Tradable Assets | Cryptos, Forex, Precious Metals, Futures |

| Trading Platform | Trading App |

| Customer Support | Online Chat |

| Promotions | Yes |

Driss IFC Information

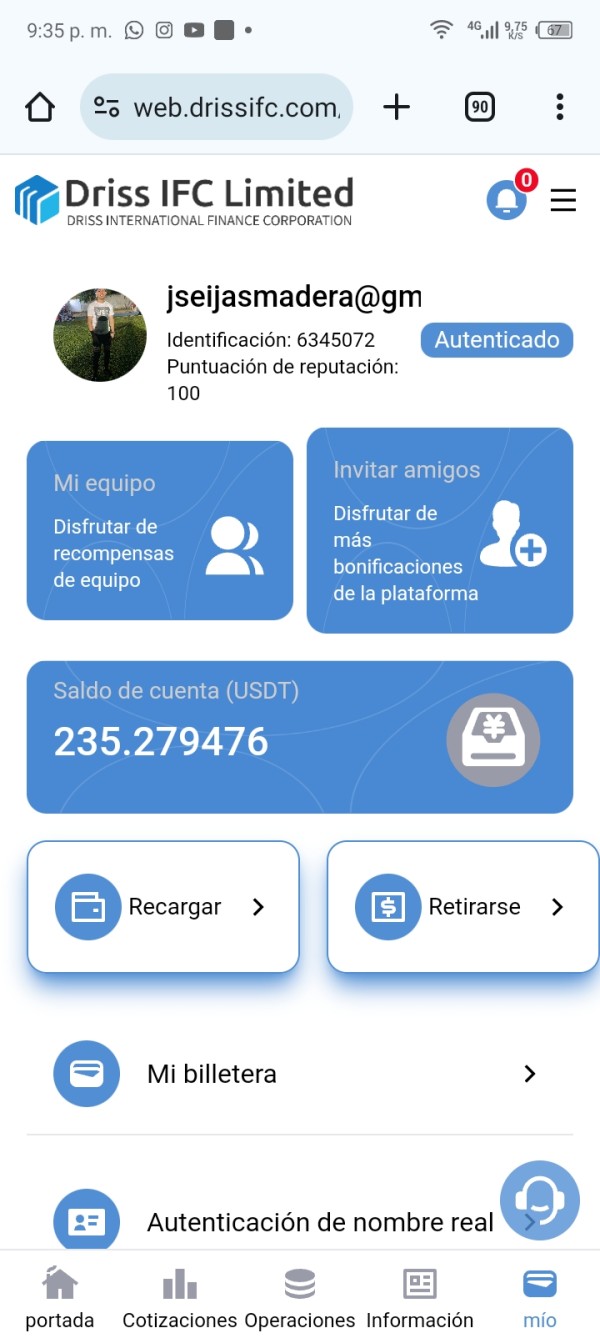

Driss IFC is a newly established brokerage firm founded in 2024 and registered in the United States. The company offers trading in cryptocurrencies, forex, precious metals, and futures through a proprietary trading app.

Is Driss IFC Legit?

Driss IFC is regulated in the United States, authorized by the Financial Crimes Enforcement Network (FinCEN). It holds a Crypto license under license no.31000274201881.

Pros and Cons

| Pros | Cons |

|

|

|

|

| |

|

Pros:

- 350 tradable cryptocurrencies supported: Driss IFC provides access to 350 tradable cryptocurrencies, offering traders a wide range of options in the digital asset space.

- Up to 3 USDT Reward for Certified users: The broker offers a reward of up to 3 USDT for certified users, which could be attractive for new clients.

- Online chat support : Online chat support is available, enabling quick assistance for traders.

- Website available in 10 languages: Driss IFC is available in 10 languages, making it accessible to a global audience.

Cons:

- Trading fees not disclosed: The broker does not disclose its trading fees, making it difficult for potential clients to assess the cost-effectiveness of their services.

- No payment methods: The absence of clear payment methods could pose challenges for fund deposits and withdrawals.

Tradable Assets

Driss IFC offers four classes of tradable assets in total, with a particular focus on cryptocurrencies. The broker provides access to an impressive selection of 350 digital currencies, available for trading across spot, futures, and USDT-margined markets. In addition to its robust crypto selection, Driss IFC extends its asset portfolio to include traditional financial instruments such as forex pairs and precious metals, as well as futures contracts.

Trading Platform

Driss IFC provides a streamlined trading experience through its proprietary trading app, accessible via both web-based and downloadable versions.

Customer Support

For customer support, Driss IFC relies exclusively on an online chat feature, offering real-time assistance to traders. However, the absence of additional contact methods such as phone or email support may limit communication options for users who prefer alternative channels.

Conclusion

In summary, Driss IFC shines with its impressive array of 350 tradable cryptocurrencies and a website that caters to a global audience in 10 languages. However, the glaring absence of regulatory oversight casts a long shadow over the broker's operations, raising problems about trader safety and fund security.

FAQs

Is Driss IFC legit?

Driss operates legally and it is regulated FinCEN in the United States.

Is Driss IFC safe to trade?

The safety of trading with Driss IFC cannot be guaranteed, as online trading always involves many risks.

Is Driss IFC good for beginners?

For beginners, Driss IFC is not a good choice. Specifically, beginners may find it less suited because of insufficient regulation, a lack of educational content, and limited customer support options.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Keywords

- Within 1 year

- Regulated in United States

- Financial Service

- Suspicious Scope of Business

- High potential risk

Review 15

Content you want to comment

Please enter...

Review 15

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX1490236942

Colombia

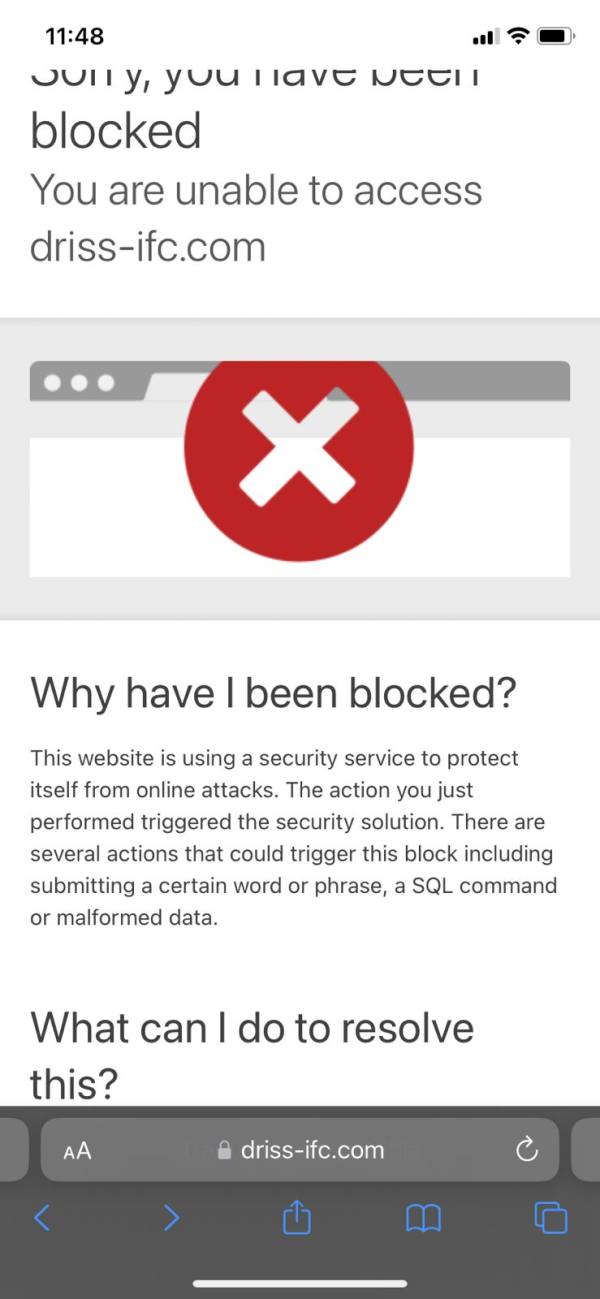

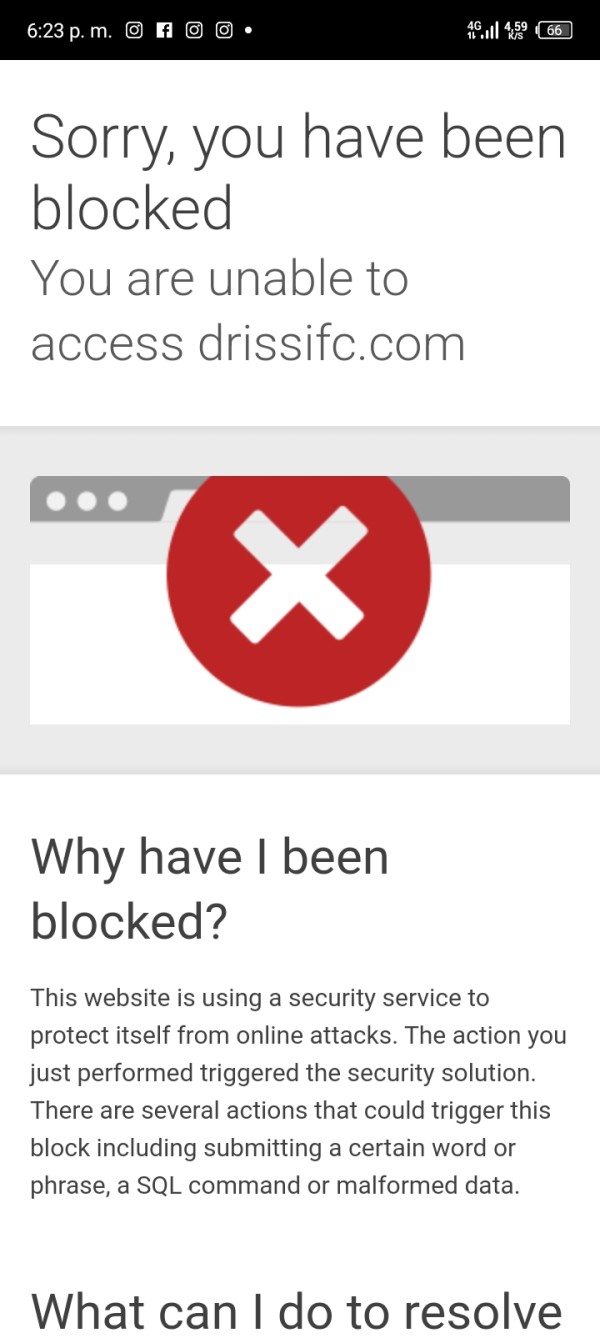

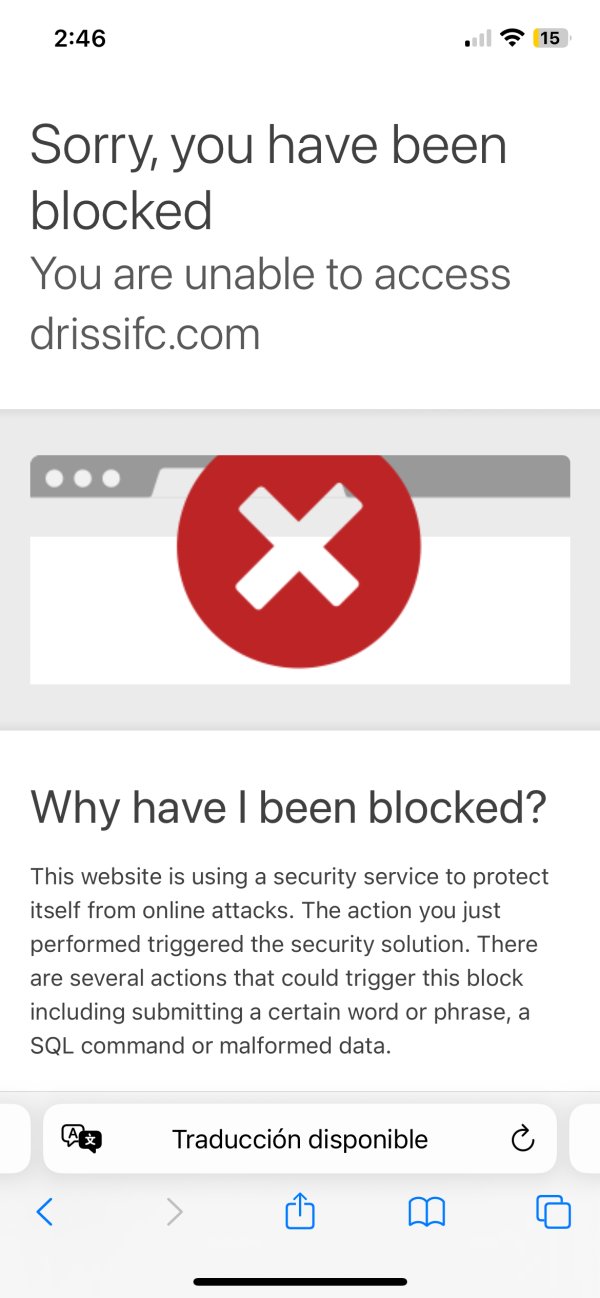

A week and a half of not being able to operate because the page is blocked, I do not have a screenshot of the current balance but I am attaching it, which corresponds to 452 dollars, however, if you need any information to find out, do not hesitate to contact me, I am attaching a screenshot of evidence of the blocked page.

Exposure

08-18

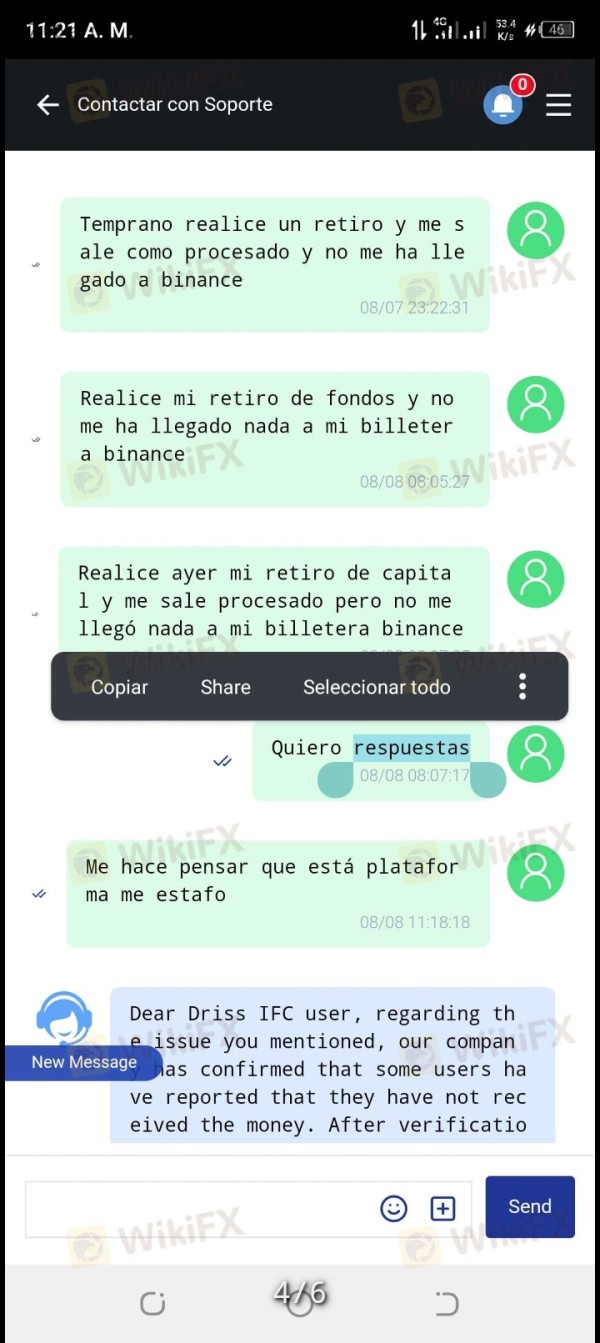

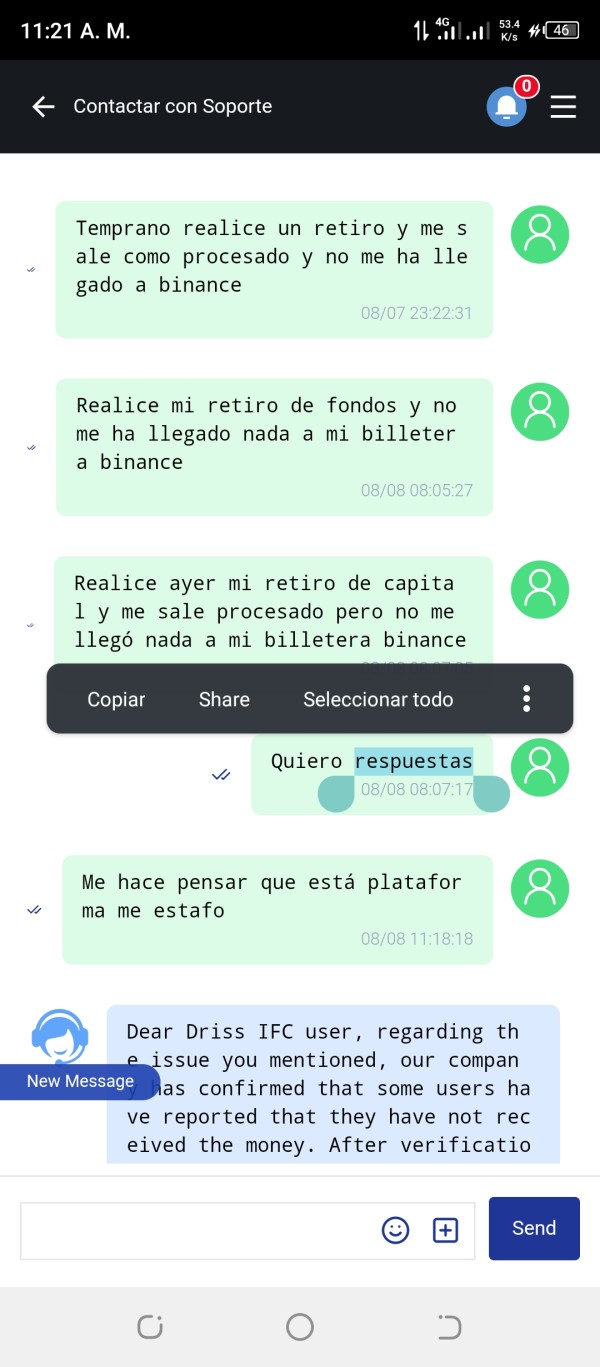

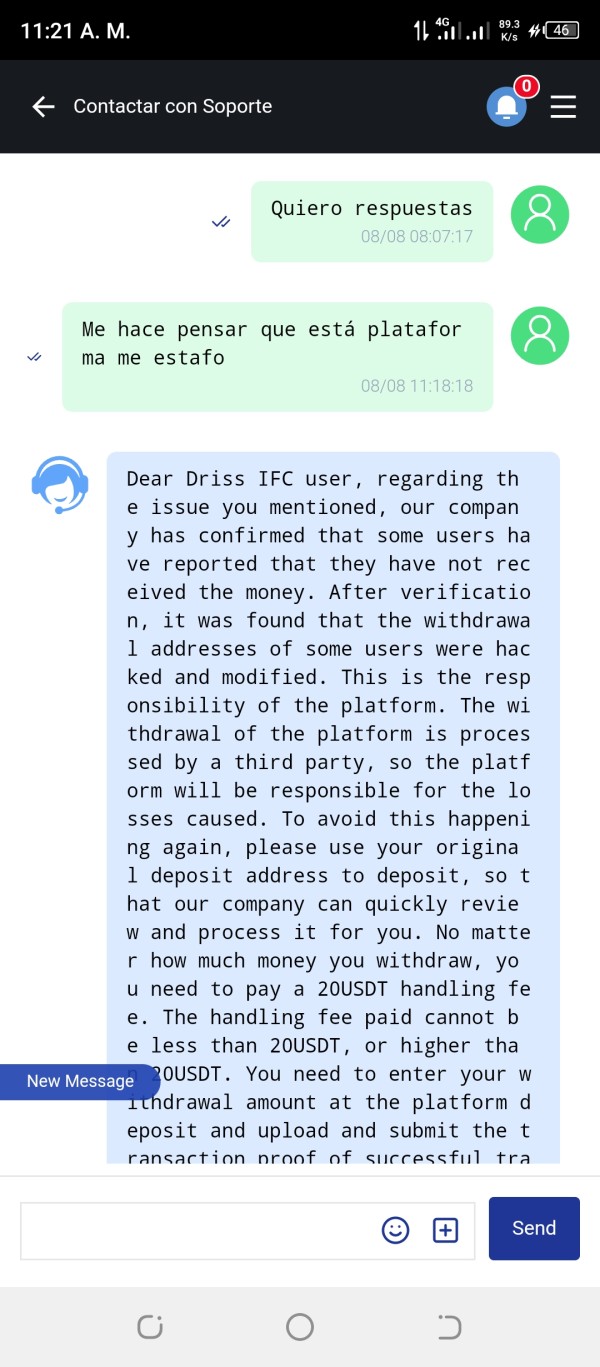

Deilyn Rojas

Venezuela

Good morning, I made a withdrawal on Wednesday and it hasn't been credited to my account. It said it was in process but nothing happened. And now I logged in and the app is not working, it crashed. My money hasn't arrived, the application is not working, they are scammers. They said I should pay 20% of the capital and supposedly the money would be credited, but it didn't happen. They did the same as Deleno, pure scamming.

Exposure

08-13

FX1700452894

Venezuela

Good morning, I made the withdrawal on Thursday and until now the money has not come to me, the platform is already down, it is blank and at no time did I receive the money, it only said in process and nothing arrived, I am making my complaint for the simple fact that my withdrawal never came to me, when it said successful withdrawal, please if you can help me I would really appreciate it

Exposure

08-13

Zoyerlyn González Caña

Colombia

We ask for our money back, I just joined and they already blocked me.

Exposure

08-13

FX8467654492

Venezuela

Suddenly, the application sent a withdrawal request because it was not going to operate in Latin America, only in Malaysia. I made the withdrawal but the money never arrived, it was stolen. It shows as completed but never arrived. And they don't provide any response. They are asking for $20 to return the money.

Exposure

08-12

FX1317587110

Colombia

I expose this fraudulent company as they instructed us to withdraw the funds immediately, however, after the transaction was made, the platform approved the payment which never arrived in our wallets.

Exposure

08-12

MNC

Mexico

First, we woke up to an on-screen announcement telling us that they are leaving Latam and accusing fosterfof of subkackeo. They asked us to withdraw as quickly as possible. We did it and the money didn't arrive in the wallet, when we contacted the help system, it responded, asking for 20 USD to help receive the money.

Exposure

08-12

Lorena231

Colombia

Driss failed for a week and demanded that we withdraw our investments. We made the withdrawals, but the payment never arrived in our wallets. Driss stole our investments and profits. DRISS IS A SCAM. IT DOES NOT ALLOW WITHDRAWALS.

Exposure

08-11

austin6756

Colombia

Thieves stole all my money

Exposure

08-09

Byron154

Colombia

I made a withdrawal on the Driss ifc limited platform; it shows confirmed review, but the funds have not arrived in my wallet. A week ago, I was experiencing difficulties in my operations, and the explanation given was cyber attacks.

Exposure

08-09

techno industrial

Mexico

A withdrawal request was made successfully, but it was not deposited into the wallet. To stop it, $20 dollars must be given.

Exposure

08-09

Connie 4217

Colombia

They indicate that in order to withdraw, we must pay 20 dollars, which seems like a scam to me.

Exposure

08-09

cruz4922

Colombia

First, the withdrawal was rejected. Then it appears confirmed. But it did not reach the wallet.

Exposure

08-08

FX1043915611

Mexico

No, they do not allow us to withdraw our funds. They have already started with the Ponzi fraud, please do not deposit money in this platform anymore, the one who is supposed to be the leader answers nonsense

Exposure

08-08

FX2401950490

Colombia

They couldn't continue to steal from us like Sin Nada Deleno and set up similar websites to deceive people.

Exposure

06-29