Score

Sure FX

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://sureforex.net/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed Sure FX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

sureforex.net

Server Location

United States

Website Domain Name

sureforex.net

Server IP

104.27.157.56

Company Summary

| Aspect | Information |

| Company Name | Sure FX |

| Registered Country/Area | Colombia |

| Founded Year | 2019 |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Spreads | low as 0 pips |

| Trading Platforms | MT4 |

| Tradable Assets | Forex,commodities |

| Account Types | personal account |

| Demo Account | Available |

| Customer Support | Phone, email |

| Deposit & Withdrawal | Debit card,bank transfer |

Overview of Sure FX

Established in 2019, Sure FX operates as a financial trading platform registered in Colombia, providing avenues for trading in Forex and commodities. Notably unregulated, it aims to entice traders with a minimum deposit set at $100 and competitive spreads as low as 0 pips.

Sure FX operates utilizing the widely acknowledged MetaTrader 4 (MT4) trading platform and provides a single type of trading account – the personal account, while also offering a demo account for those wishing to hone their trading strategies without risking actual funds.

For financial transactions, Sure FX accommodates deposits and withdrawals via debit cards and bank transfers and extends customer support through phone and email, guiding users throughout their trading endeavors. Given the absence of regulatory oversight, prospective clients are encouraged to approach with caution and conduct comprehensive due diligence before engaging in trading activities with Sure FX.

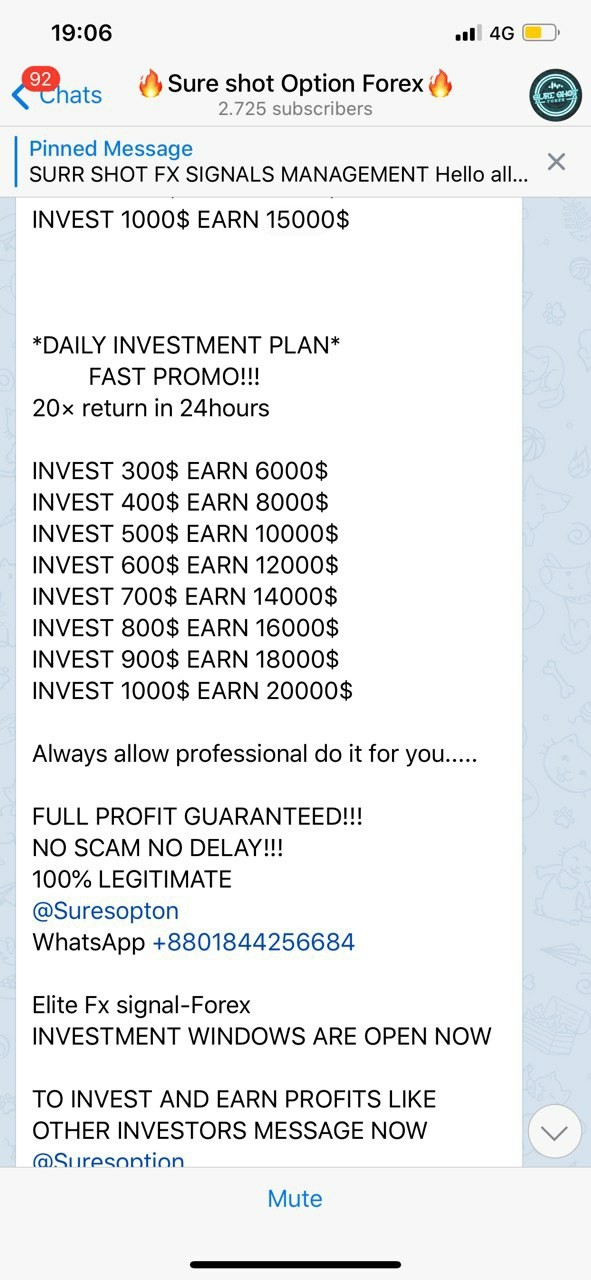

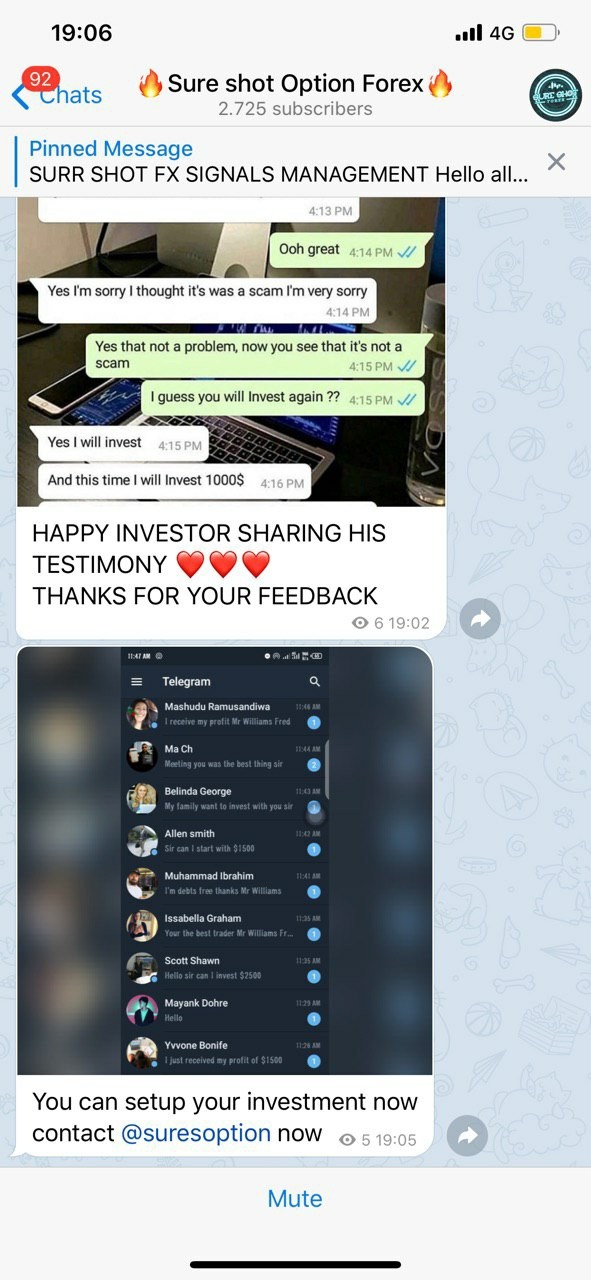

Is Sure FX Legit or a Scam?

Sure FX is unregulated.The lack of regulation for Sure FX can be seen as a red flag in the financial trading industry, where regulation plays a pivotal role in ensuring transparency, reliability, and secure management of client funds.

The unregulated status implies that Sure FX is not bound by specific regulatory standards or jurisdictions, potentially escalating the risk for users in the event of disputes or financial inconsistencies. Therefore, traders contemplating utilizing Sure FX should approach with vigilance and thoroughly assess the platform before deciding to invest, keeping in mind the elevated risk and the potential for loss without clear pathways for dispute resolution or recovery of funds.

Pros and Cons

Pros:

Variety of Assets: Sure FX provides a selection of tradable assets, such as Forex and commodities.

User-friendly Trading Platform: Leveraging the MT4 platform enables users to navigate a familiar and globally recognized trading environment.

Accessible Entry: With a low minimum deposit of $100, Sure FX provides a gateway to trading for various investors.

Demo Account: The availability of a demo account allows users to explore the platform without financial risk.

Payment Options: Providing deposit and withdrawal options through debit card and bank transfer, Sure FX offers convenience in financial transactions.

Cons:

Absence of Regulatory Compliance:The platform operates without regulation, presenting a significant risk as it doesnt adhere to standardized operational norms nor is it subject to oversight by financial authorities, leaving investors without certain protections and recourses.

Restricted Account Options:Sunrise Money solely offers personal account types, neglecting to cater to a diverse range of traders, like institutional investors or those with distinct trading requirements, thereby limiting the variety and scope of its trading conditions and benefits.

Unstable Spread Values: With spreads that can fluctuate between 0.5% and 2%, traders might experience inconsistent trading expenses that could adversely impact their profitability, particularly those who engage in frequent trading activities.

Deficiency in Detailed Transparency:The limited availability of detailed information regarding the platforms operational policies, trading conditions, and other critical aspects can hinder comprehensive evaluation and informed decision-making for potential investors.

Inadequate Customer Support Services:While customer support is available via email and phone, the lack of immediate, real-time support options, such as 24/7 availability or live chat, might impede traders who require instantaneous assistance or those who operate in differing time zones from receiving timely help.

| pros | Cons |

| Variety of MSG Assets | Absence of Regulatory Compliance |

| Accessible Trading Platform | Restricted Account Options |

| Low Minimum Deposit | Unstable Spread Values |

| Demo Account Availability | Deficiency in Detailed Transparency |

| Various Payment Options | Inadequate Customer Support Services |

Market Instruments

Sure FX extends trading possibilities in several market instruments:

Forex (Foreign Exchange)

Currencies: Traders can speculate on the value fluctuations in foreign currency pairs. The Forex market, renowned for its substantial liquidity, encompasses major, minor, and exotic currency pairs.

Commodities

Hard Commodities: This includes natural resources, such as gold and oil, which are mined or extracted, enabling traders to speculate on price movements that global economic and political events influence.

Soft Commodities: Although unconfirmed, if Sure FX provides trading in soft commodities, it would involve agricultural or grown products like coffee or sugar, with traders speculating on prices affected by factors like weather conditions and global demand.

Account Types

Sure FX proffers a Personal Account type, positioning itself as a feasible entry into the world of Forex and commodities trading. With a modest minimum deposit of $100, traders gain access to the globally acclaimed MT4 trading platform, renowned for its robust, user-friendly interface and a myriad of functionalities including manual and automated trading via Expert Advisors.

The account beckons with the allure of low spreads, potentially as low as 0 pips, aiming to provide a cost-effective trading environment. Furthermore, the availability of a demo account empowers traders to simulate strategies and explore the platform risk-free, providing a safe harbor to refine skills before venturing into live markets.

However, it is paramount for traders to approach with meticulous caution due to Sure FX‘s unregulated status, ensuring that a comprehensive understanding of the platform’s offerings, policies, and associated risks is attained prior to engagement, and considering supplementary professional financial advice to navigate through the intricate landscapes of trading securely and prudently.

How to Open an Account?

Heres a generalized 5-step guide in Sure FX:

Visit the Website and Register:Navigate to Sure FX's official website, find the “Sign Up” or “Open Account” button, typically located on the homepage, and provide the required personal details like name, email, and possibly a password during the initial registration process.

Verify Your Identity:Submit verification documents to adhere to potential Know Your Customer (KYC) protocols. This usually includes providing a government-issued ID and a document verifying your address, such as a recent utility bill.

Fund Your Account:Access the “Deposit” section in your newly created account. Choose a preferred payment method, ensuring you meet the minimum deposit requirement of $100, and follow the steps to add funds to your account.

Set Up Your Trading Platform:Choose between MT4 and MT5 trading platforms and establish your trading environment by downloading the necessary software or utilizing a web-based version, preparing your space for active trading.

Start Trading:Navigate through the trading platform to select your desired market instruments and initiate trading by executing buy or sell orders based on your analysis and trading strategy.

Spreads & Commissions

Sure FX makes a pronounced statement in the financial trading arena by touting spreads that can dip as low as 0 pips, ostensibly creating a conducive and economically viable trading landscape for traders to explore the multifaceted world of Forex and commodities.

While this seemingly lean spread has its allure, it is imperative for traders to undertake an incisive exploration into the nuances of the platform's cost-structure, understanding whether Sure FX operates on a spread-only model, where costs are innately embedded within the spread itself, or employs a commission-per-trade model that might be applied alongside the spreads.

Furthermore, the cost-structure could potentially exhibit variations contingent on the specific asset being traded or based on different account types, if available, necessitating traders to navigate through their trading journey with a thorough understanding of all relevant costs and potential financial implications.

Such detailed comprehension of the financial undertakings, alongside an astute awareness of trading risks, particularly in light of Sure FXs unregulated status, becomes a cornerstone in forging a measured and prudent trading pathway in the fluid and often unpredictable trading markets.

Trading Platform

Utilizing the esteemed MT4 trading platform, Sure FX grants traders a reliable and intuitively crafted interface through which they can adeptly maneuver through diverse market conditions. Recognized for its user-friendliness, robust technical analysis tools, and automated trading capabilities, MT4 serves traders across various expertise levels, providing a secure and customizable trading environment.

Deposit & Withdrawal

Sure FX mandates a minimum deposit of $100, presenting a reasonably attainable threshold for traders seeking to explore its myriad of trading options. The platform acknowledges basic avenues for conducting financial transactions, specifically through the use of debit cards and bank transfers.

However, the intricate details pertaining to Sure FXs deposit and withdrawal methods and policies are not overtly delineated . Notably absent are crucial details such as transaction processing durations, any fees that might be applicable, and the availability (or lack thereof) of alternative transaction methods.

The transparent and streamlined management of financial transactions, especially those involving deposits and withdrawals, is integral in assuring an uninterrupted and straightforward trading experience, thereby shielding traders from unforeseen impediments or complexities.

Customer Support

Sure FX, an unregulated trading platform registered in Colombia, extends its customer support to traders.

The platform's website, accessible at https://sureforex.net/, potentially serves as a central hub for accessing information regarding its offerings and may also function as a medium through which traders can initiate contact with Sure FX's customer service, although this is speculative in the absence of specific details.

Conclusion

Sure FX, an unregulated trading platform based in Colombia, presents opportunities for trading in Forex and commodities via the renowned MT4 platform. With a low barrier to entry, evidenced by a $100 minimum deposit and spreads as low as 0 pips, the platform may seem attractive to various traders. However, the lack of regulatory oversight necessitates caution. Prospective traders should conduct thorough due diligence, meticulously scrutinizing all aspects of the platform, from its transaction policies to customer support, to navigate safely through their trading journey.

FAQs

Q: s Sure FX a regulated trading platform?

A: No, Sure FX operates without regulatory oversight, as it is unregulated.

Q: What is the minimum deposit required to start trading with Sure FX?

A: The minimum deposit requirement at Sure FX is $100.

Q: What types of tradable assets are available on Sure FX?

A: Sure FX provides opportunities for trading in Forex and commodities.

Q: Which trading platform does Sure FX utilize for its operations?

A: Sure FX offers trading services through the MetaTrader 4 (MT4) platform.

Q: How can I deposit or withdraw funds with Sure FX?

A: Sure FX supports basic financial transaction methods, including debit cards and bank transfers.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now