简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Canadian Dollar Forecast: CAD/JPY May Resume Rise, Less Dovish BoC Eyed

Abstract:CANADIAN DOLLAR, CAD/JPY, BANK OF CANADA, BANK OF JAPAN – ANALYST PICK - Canadian Dollar may resume broader advance versus the Yen - BoC tapered asset purchases while BoJ remained more dovish - CAD/JPY may revisit March highs, a formidable resistance zone

After a bit of a pause, the Canadian Dollar could be back on track to appreciate from a fundamental standpoint, especially against the Japanese Yen. Last week, the Canadian Dollar rose in the aftermath of the BoC monetary policy announcement. There, the central bank reduced emergency measures, trimming its bond purchase program to CAD3 billion a week from 4 billion, or by 25%.

This makes the BoC one of the early movers amongst developed central banks to begin scaling back some of the extraordinary measures undertaken to cope with the economically damaging effects of the coronavirus. The Federal Reserve, for example, is still continuing with the pace of US$120 billion in monthly asset purchases to stimulate the economy and bolster inflation.

With that in mind, this could leave the Canadian Dollar at an advantage compared to currencies tied to relatively dovish central banks in the long run. The Bank of Japan (BoJ) is one that comes to mind, especially following this weeks monetary policy announcement. The BoJ, while upgrading GDP forecasts, still maintained its dovish stance and left policy settings unchanged.

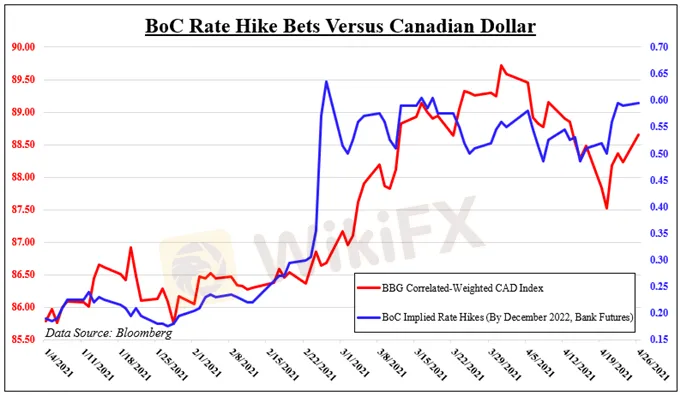

On the chart below, recent strength in the Canadian Dollar has been associated with the markets slightly increasing BoC rate hike bets by the end of 2022. This trend may continue. Having said that, a downside risk for CAD/JPY remains a material downturn in market sentiment given the haven traits of the quote currency. But, a still-dovish Fed this week could continue reducing the downside scope for overall risk appetite.

CAD/JPY closed above a near-term falling trendline from Marchs top, opening the door to revisiting the 88.08 – 88.30 resistance zone. This also followed a bounce off the 50-day Simple Moving Average as it reinstated the dominant focus to the upside. Confirming a subsequent close above the minor 14.6% Fibonacci extension at 86.94 may further bolster the case to the upside.

Still, current 2021 peaks may still hold and send the pair lower. Then the 50-day SMA may come back into play as prices oscillate. Do also keep an eye on RSI, negative divergence could warn of a turn lower. Taking out peaks from March would then expose October 2018 highs. That would make for a critical zone of resistance between 88.93 and 89.21.

CAD/JPY – DAILY CHART

Chart Created in TradingView

╔════════════════╗

Android : cutt.ly/Bkn0jKJ

iOS : cutt.ly/ekn0yOC

╚════════════════╝

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Market Insights | January 15, 2024

U.S. stocks closed mixed. Dow Jones Industrial Average fell 118 points (-0.31%) to 37,592, S&P 500 gained 3 points (+0.08%) to 4,783, and Nasdaq 100 edged up 12 points (+0.07%) to 16,832.

Introducing Nutchaporn Chaowchuen (Tarn) - AUS Global's New Country Manager for Thailand

AUS Global appoints Ms. Nutchaporn Chaowchuen (Tarn) as Country Manager for Thailand. With expertise in trading and exceptional marketing skills, she is set to drive growth in the Thai market. Her victory in the Axi Psyquation 2019 competition underscores her trading prowess. Excited to lead, she vows to nurture partnerships and deliver top-notch services.

GEMFOREX - weekly analysis

Top 5 things to watch in markets in the week ahead

HFM Introduces New Virtual Analyst

The award-winning broker brings markets closer to its clients with the use of artificial intelligence (AI)

WikiFX Broker

Latest News

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

Volkswagen agrees deal to avoid Germany plant closures

Geopolitical Events: What They Are & Their Impact?

Webull Canada Expands Options Trading to TFSAs and RRSPs

CySEC Launches Redesigned Website Packed with New Features

WikiEXPO Global Expert Interview: Simone Martin—— Exploring Financial Regulation Change

TradingView Launches Liquidity Analysis Tool DEX Screener

MultiBank Group Wins Big at Traders Fair Hong Kong 2024

WikiFX Review: Is PU Prime a decent broker?

Currency Calculator