Score

Hanju capital

Canada|5-10 years|

Canada|5-10 years| http://www.hanjuziben.com/En

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Canada

CanadaUsers who viewed Hanju capital also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

Website

hanjufx.com

Server Location

Hong Kong

Website Domain Name

hanjufx.com

Server IP

47.56.178.105

hanjuziben.com

Server Location

United States

Website Domain Name

hanjuziben.com

Server IP

47.56.178.105

Company Summary

| Aspect | Information |

| Registered Country | Canada |

| Founded Year | 2-5 years ago |

| Company Name | Hanju Capital |

| Regulation | Lack of proper regulation |

| Minimum Deposit | Micro Account: $5, Standard Account: $250, ECN Account: $1,000 |

| Maximum Leverage | Up to 1:1000 on all account types |

| Spreads | Micro Account: 3.0 pips, Standard Account: 0.5 pips, ECN Account: 1.0 pips |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Tradable Assets | Equities (various), Bonds, Derivatives |

| Account Types | Micro Account, Standard Account, ECN Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | QQ: 2372037769, Email: hanju01@hanjuziben.com |

| Payment Methods | Credit/Debit Cards, Bank Transfers, Skrill, Neteller, Perfect Money, China UnionPay |

General Information & Regulation

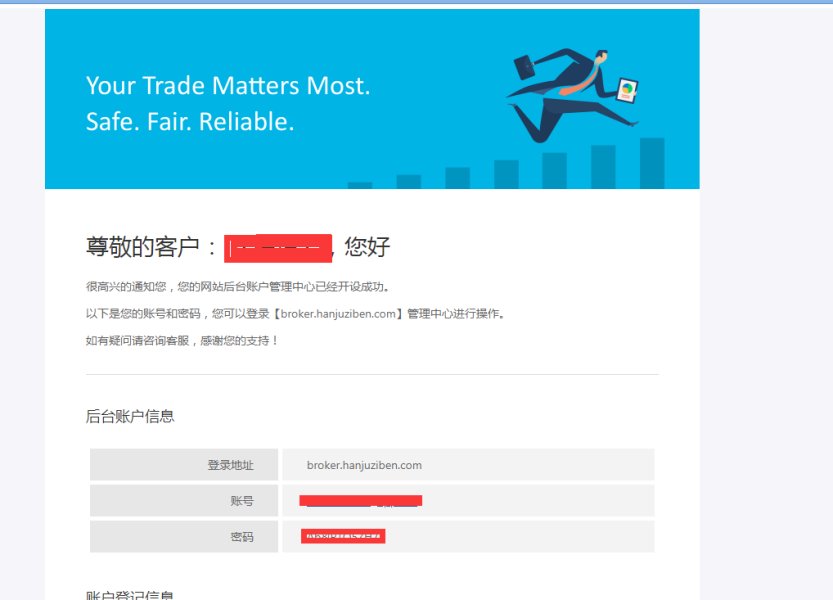

Hanju Global Capital Ltd. is a forex broker registered in Canada and Hanju Market is the trading name of the trader. According to the official website, the trader holds a currency exchange license (No. M20413381) issued by FINTRAC in Canada.

Hanju Capital, a Canada-based online trading platform, has faced a surge in complaints from users, primarily centered around issues related to logging in and withdrawing funds. These complaints have raised significant concerns, suggesting that Hanju Capital may be operating without the necessary regulatory oversight, casting doubts on its legitimacy and security. It is advisable to exercise caution when considering any engagement with this broker.

Hanju Capital offers access to various market instruments, including equities, bonds, and derivatives, such as stock options, stock futures, bond options, bond futures, currency options, and currency futures. The broker provides three types of accounts, namely Micro, Standard, and ECN, each with different minimum deposit requirements and leverage options. Hanju Capital's spreads start from 3.0 pips for Micro accounts, 0.5 pips for Standard accounts, and 1.0 pips for ECN accounts, with no commissions charged on any account type. However, the platform imposes deposit and withdrawal fees, adding to the cost of trading. Reviews from users on WikiFX indicate widespread dissatisfaction and mistrust, citing issues like poor customer service, unexplained account cancellations, withdrawal difficulties, and allegations of fraudulent activities.

Pros and Cons

Hanju Capital presents several advantages and disadvantages worth considering. On the positive side, it offers various account types, including Micro, Standard, and ECN Accounts, along with high leverage and no commissions. Traders also have access to the popular MT4 and MT5 platforms, and a variety of deposit methods. However, concerns arise due to the lack of proper regulation, an accumulation of 8 complaints, limited educational resources, deposit and withdrawal fees, an unavailable main website, and limited customer support options.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

Is Hanju capital Legit?

Hanju Capital lacks proper regulation, as it has been confirmed to operate without valid regulatory oversight. This absence of regulation raises significant concerns about the security and legitimacy of the broker. Additionally, the accumulation of 8 complaints within the past 3 months reported by WikiFX further underscores the potential risks and the possibility of fraudulent activities associated with this broker. Caution is advised when dealing with Hanju Capital.

Market Instruments

EQUITIES:

Hanju Capital provides access to a wide range of equity markets, such as Chinese mainland A shares, Hong Kong H shares, US-listed ADRs, Chinese mainland B shares, GEM shares, and New Third Board shares. They also offer services like cash trading, margin trading, options trading, and futures trading for equities.

BONDS:

Hanju Capital offers a wide range of bond products, including Chinese government bonds, corporate bonds, municipal bonds, asset-backed securities, and collateralized mortgage obligations. They provide services for bond trading, such as cash trading, margin trading, and futures trading.

DERIVATIVES:

Hanju Capital offers various derivative products like stock options, stock futures, bond options, bond futures, currency options, and currency futures.

Pros and Cons

| Pros | Cons |

| Access to Diverse Equity Markets | Lack of transparency regarding pricing and liquidity |

| Wide Range of Bond Products | Limited information on trading volume and market depth |

| Variety of Derivative Products | Lack of specific information on trading conditions and execution quality |

Accounts

Hanju Market has three account types for investors to choose from, namely Micro, Standard, and ECN accounts. The account standards are set in terms of minimum deposit amounts, which range from $5 to $1,000.

MICRO ACCOUNT:

Hanju Capital offers a Micro Account with a minimum deposit requirement of $5. This account type provides leverage of up to 1:1000 and features spreads that start from 3.0 pips. It is designed for beginners and traders with limited capital.

STANDARD ACCOUNT:

The Standard Account at Hanju Capital necessitates a minimum deposit of $250. It offers leverage of up to 1:1000 and features spreads starting from 0.5 pips. This account type is suitable for intermediate traders with a moderate amount of trading capital.

ECN ACCOUNT:

For experienced traders with a higher amount of capital, Hanju Capital provides the ECN Account. It requires a minimum deposit of $1,000 and offers leverage of up to 1:500. Spreads for this account type start from 1.0 pips.

Pros and Cons

| Pros | Cons |

| Low minimum deposit requirements: $5 for Micro Account, $250 for Standard Account, $1,000 for ECN Account | Limited account types available |

| High leverage options: Up to 1:1000 for all account types, Up to 1:500 for ECN Account | Spreads may be relatively high, particularly for Micro Account |

| Suitable for traders with different capital levels and experience levels | Higher minimum deposit required for the ECN Account |

Leverage

The various account types are designed to meet different trading needs, with leverage of up to 1:1000 for Micro and Standard accounts, and a slightly lower 1:500 for ECN accounts.、

Spreads

Hanju Market charges different spreads to different users, starting from 3.0, 0.5 and 1.0 for Micro, Standard and ECN accounts.

Minimum Deposit

Hanju Capital offers three account types with minimum deposit requirements starting from $5 for Micro accounts, $250 for Standard accounts, and $1,000 for ECN accounts.

Trading Platforms

Hanju Capital offers the MetaTrader 4 (MT4) platform, providing traders with a widely recognized and established trading platform for various financial instruments.

In addition to MT4, Hanju Capital also supports the MetaTrader 5 (MT5) platform, which offers an extended range of features and tools for trading, making it suitable for more experienced traders and those looking for additional functionalities.

Payment Methods

Hanju Market does not have detailed disclosure on deposit/withdrawal information, but we can see prominently on the official website the payment methods including VISA/MasterCard, PerfectMoney, Skrill, and bitwallet.

Reviews

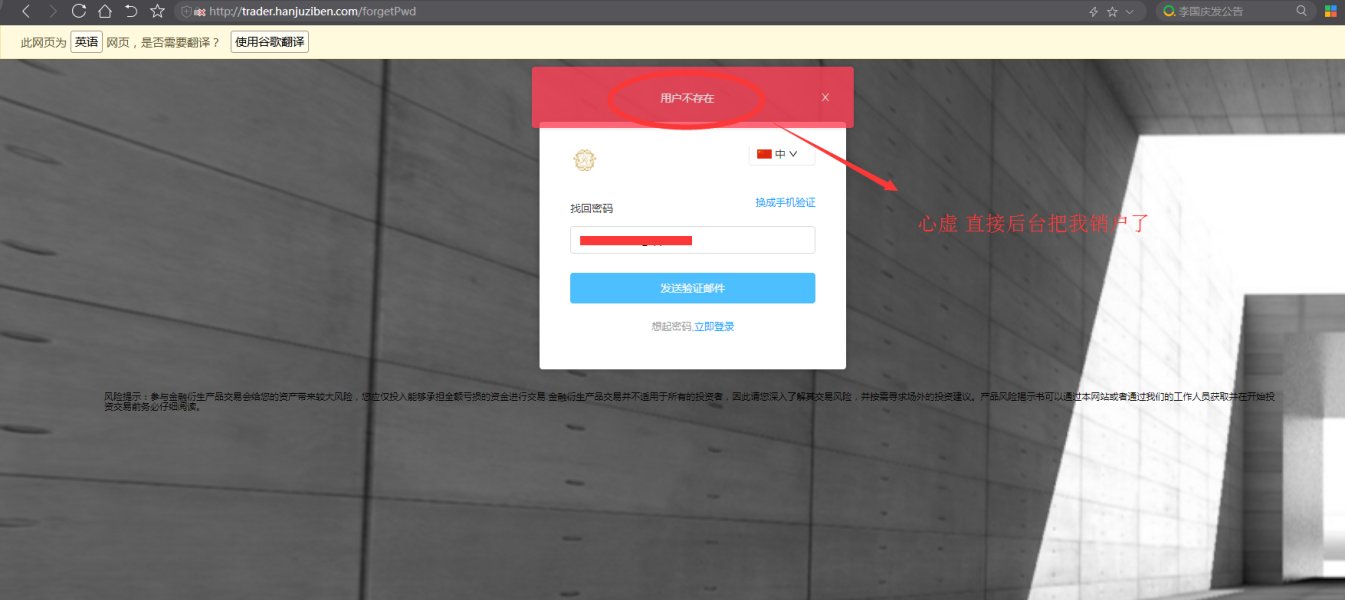

Hanju Capital has received a total of 8 reviews on WikiFX, and the majority of these reviews are highly critical. Users have reported issues related to poor customer service, account cancellations without proper justification, difficulties in withdrawing funds, and accusations of scamming. Some traders mentioned that profits were withheld, and there were allegations of account freezing and manipulation of trading data. These reviews indicate a significant level of dissatisfaction and mistrust among users regarding Hanju Capital's services.

Conclusion

In conclusion, Hanju Capital faces several notable disadvantages. The absence of proper regulation raises significant concerns about the broker's security and legitimacy, particularly with the accumulation of 8 complaints within the past 3 months. Users have reported issues related to poor customer service, account cancellations, difficulties in withdrawing funds, and allegations of fraudulent activities. Additionally, the main website of Hanju Capital has been down, which further adds to the uncertainties surrounding this platform. Traders should exercise caution when considering Hanju Capital as a broker.

FAQs

Q: Is Hanju Capital's main website currently down?

A: There have been reports of Hanju Capital's main website facing issues, including login problems and withdrawal difficulties, potentially indicating issues with the platform's reliability.

Q: Can you provide an overview of Hanju Capital?

A: Hanju Capital is a broker operating in Canada for 2-5 years, but it has garnered complaints related to its operations, particularly concerns about its legitimacy.

Q: Is Hanju Capital a legitimate broker?

A: Hanju Capital lacks proper regulation, raising concerns about its legitimacy and safety. WikiFX has reported 8 complaints in the past 3 months, suggesting potential risks and fraudulent activities.

Q: What market instruments does Hanju Capital offer?

A: Hanju Capital provides access to equities, bonds, and derivatives markets, including various types of shares, bond products, and derivative products.

Q: What are the different account types offered by Hanju Capital?

A: Hanju Capital offers Micro, Standard, and ECN accounts with varying minimum deposit requirements, leverage, and spreads to cater to traders with different levels of experience and capital.

Q: What is the maximum leverage offered by Hanju Capital?

A: Hanju Capital offers a maximum leverage of up to 1:1000 on all its account types.

Q: What are the deposit and withdrawal terms at Hanju Capital?

A: Hanju Capital charges deposit and withdrawal fees, processes deposits within 24 hours, and withdrawals within 3 business days. Various payment methods, including credit/debit cards, bank transfers, and e-wallets, are accepted.

Risk Warning

Several online platforms have received a large number of complaints from Hanju Market, mainly covering the inability to log in and the inability to withdraw funds. Please note that the trader is most likely a black platform.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

微

Hong Kong

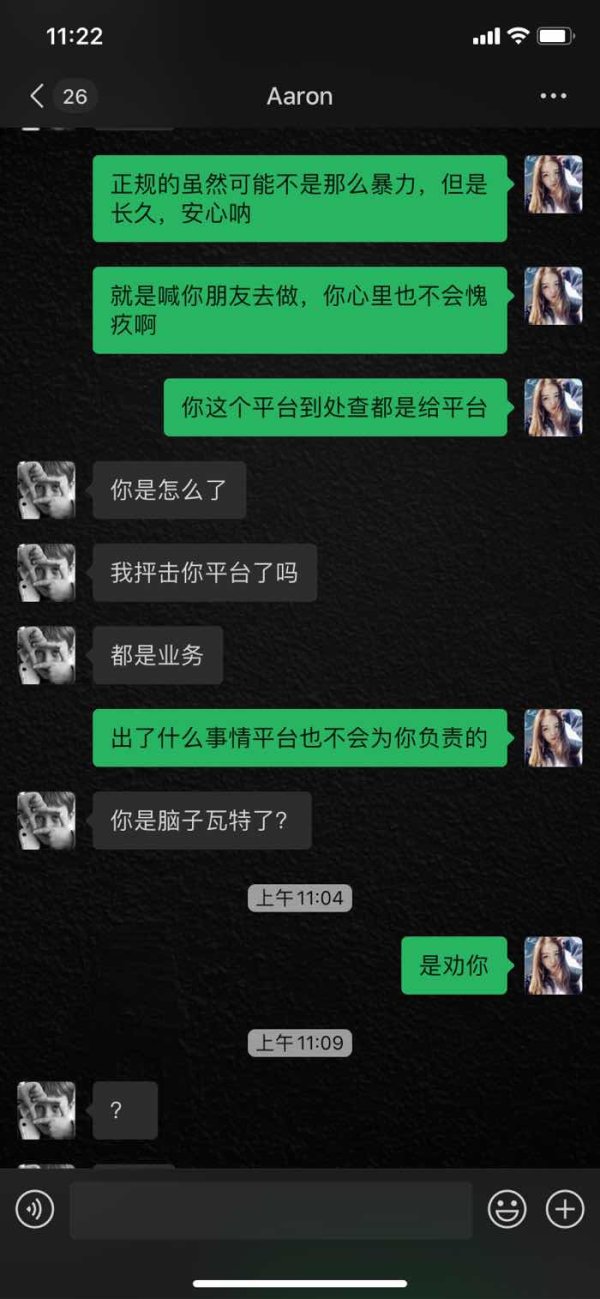

The service on this platform was in bad manner, scolding clients randomly.

Exposure

2020-06-09

阿狸29232

Hong Kong

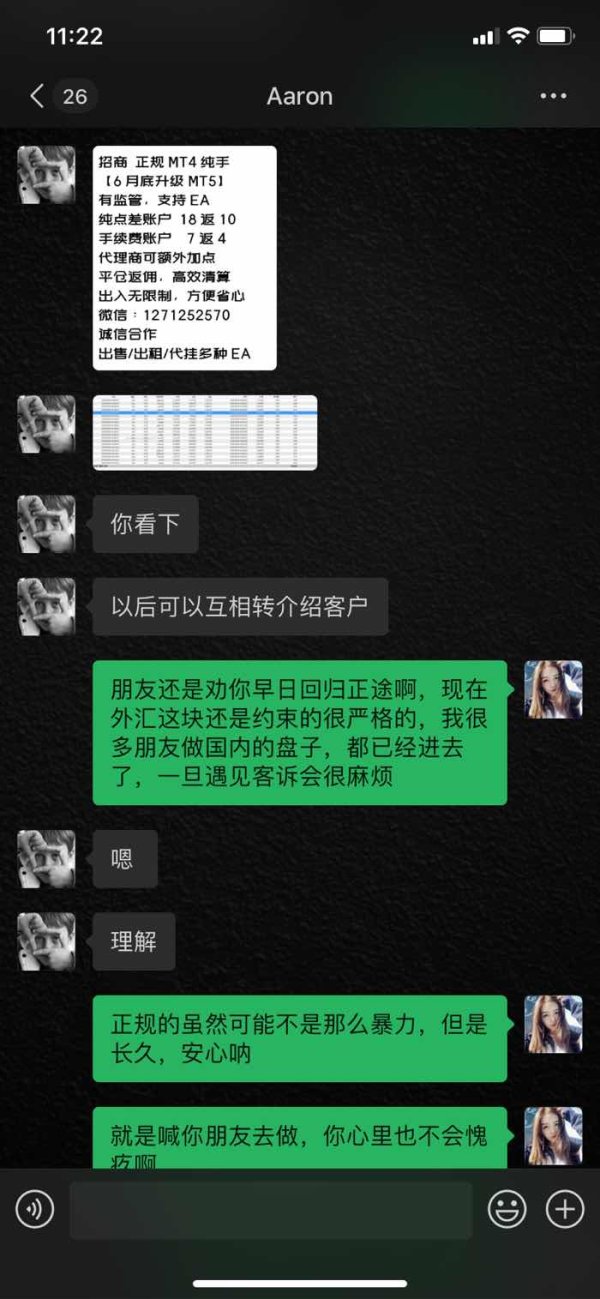

Dare you to be the agent? Please have a look of the screenshots. As long as you questioned them, they would cancel your account directly.

Exposure

2020-04-29

FX4029250120

Hong Kong

Clients’ profits were withheld, while the manager only blamed it on the platform and then gave no reply. I suggest that all agents caution against it, or you can try it yourself.

Exposure

2020-04-29

FX1876720890

Hong Kong

In March, I was induced to deposit on Hanju capital . Having made some losses, I profited in early April. But Hanju capital withheld my profit with the excuse of technical error. Don’t be cheated. As long as you deposit, your fund will be doomed.

Exposure

2020-04-29

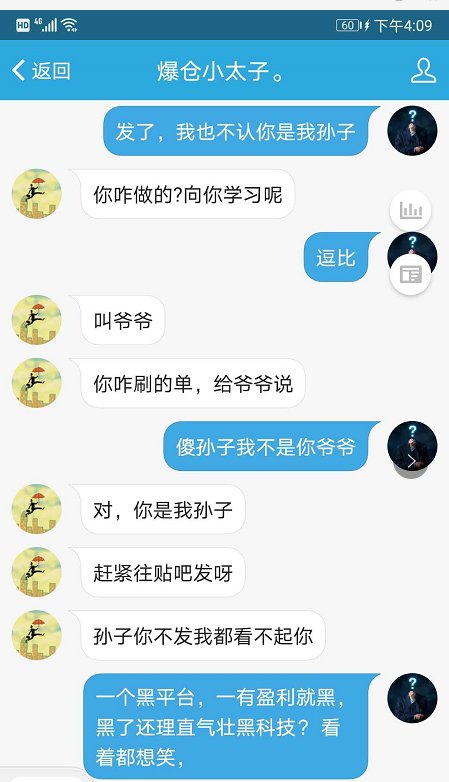

.40364

Hong Kong

I deposited 60 thousand dollars on this broker. As long as I made profits, it would freeze my account. It blackmailed me to delete the complaint, or my account would be canceled. One can see their behavior from the following 3 pics.

Exposure

2020-04-28

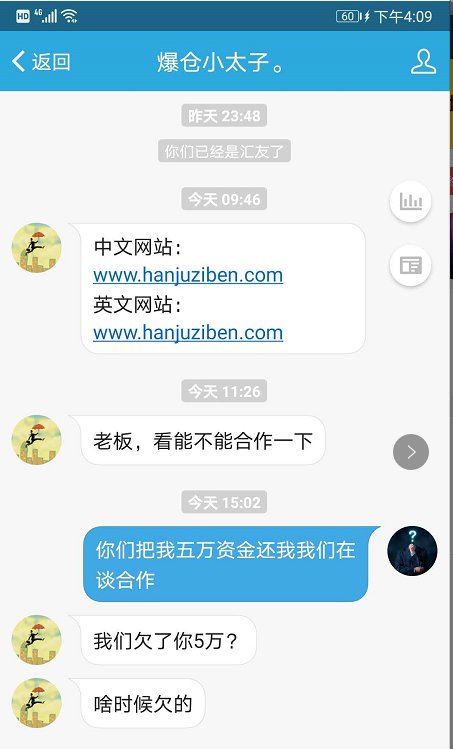

投资者123

Hong Kong

The CRM has been frozen, in which 50 thousand yuan is unavailable. I deposited 30 thousand dollars.

Exposure

2020-04-28

投资者123

Hong Kong

It is easy to deposit but difficult to withdraw. The broker is a rip-off.

Exposure

2020-04-24

FX4029250120

Hong Kong

The platform manipulated on the data and hoarded my profit. Having it be on exposure, I require it to refund me 50 thousand dollars.

Exposure

2020-04-23