简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Pick a Forex Broker ? (with top brokers list attached)

Abstract:6 things to consider when choosing a forex broker

6 crucial things to consider when choosing a forex broker:

1. Security

Before putting your money in a broker, make sure that the broker is a member of regulatory bodies.

Blow is a list of global regulatory agencies.

United States: National Futures Association (NFA); Commodity Futures Trading Commission (CFTC)

United Kingdom: Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA)

Australia: Australian Securities and Investment Commission (ASIC)

Switzerland: Swiss Federal Banking Commission (SFBC)

Germany: Bundesanstalt für Finanzdienstleistungsaufsicht (BaFIN)

France: Autorité des Marchés Financiers (AMF)

Canada: Investment Information Regulatory Organization of Canada (IIROC)

2. Transaction Costs

Every single time you enter a trade, you will have to pay for either the spread or a commission so you may need to sacrifice low transactions for a more reliable broker.

Make sure you know if you need tight spreads for your type of trading, and then review your available options. Its all about finding the correct balance between security and low transaction costs.

3. Deposit and Withdrawal

Good forex brokers will allow you to deposit funds and withdraw your earnings hassle-free.Brokers have no reason to make it hard for you to withdraw your profits because the only reason they hold your funds is to facilitate trading.

4. Trading Platform

When looking for a broker, always check what its trading platform has to offer.Does it offer free news feed? How about easy-to-use technical and charting tools? Does it present you with all the information you will need to trade properly?

5. Execution

It is mandatory that your broker fills you at the best possible price for your orders. Normally there is no reason for your broker to not fill you at, or very close to, the market price you see when you click the“buy”or“sell” button. A few pips difference in price can make that much harder on you to win that trade.

6. Customer Service

Brokers‘customer service aren’t perfect, so you must pick a broker that you could easily contact when problems arise. The competence of brokers when dealing with account or technical support issues is just as important as their performance on executing trades.

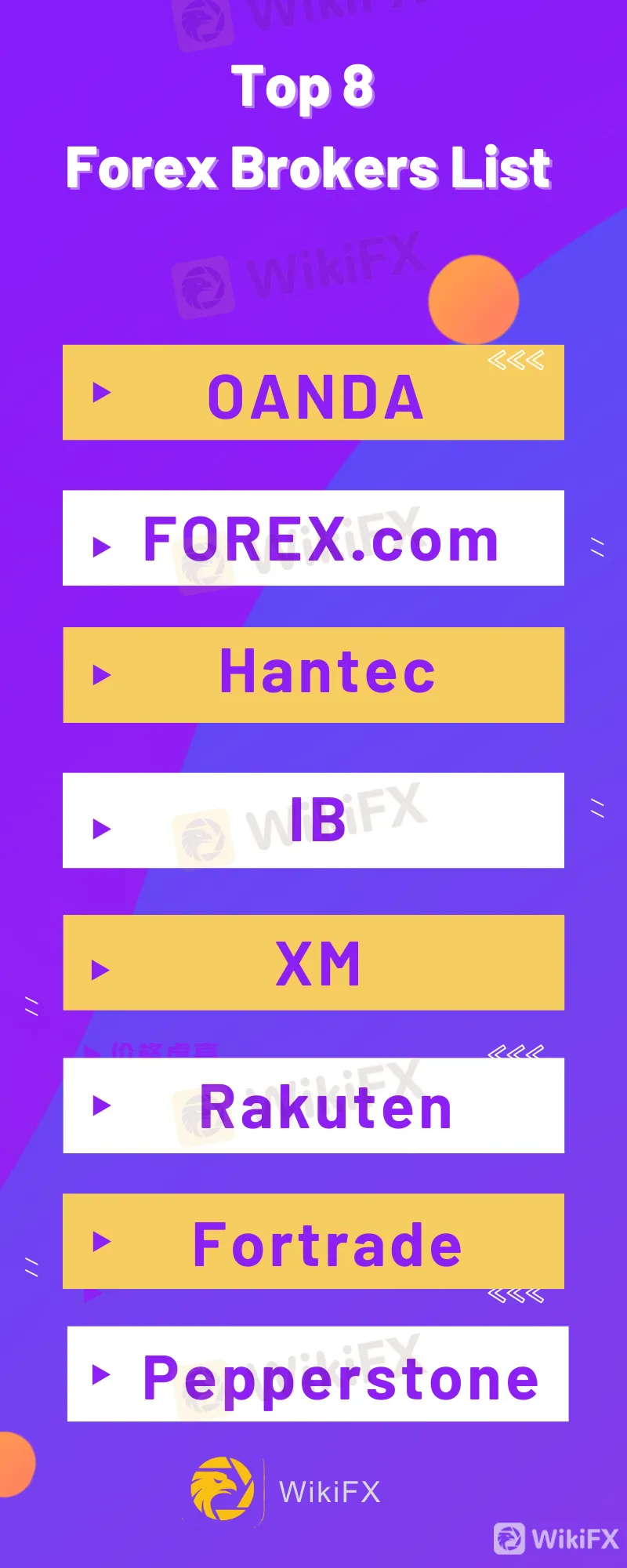

Below is Top 8 Forex Brokers List for your reference. These brokers are recommended by most forex brokers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

These Are How Millionaire Forex Traders Think and Act

It's no secret that in the world of trading, the most difficult thing is realization. Everyone can expect to be a successful trader, a trader who wins a lot of money, to a millionaire trader. But all this could be a dream if they didn't try to chase it.

How to Register Forex Trading, 5 Easy Steps to Follow

Foreign exchange has been developed and turned into something big in all of society. Not just office employees, but also students, kids in school, housewives, and even the unemployed.

Pip In Forex Trading, The Relation to Profitability

Pip or price interest point or percentage in point is a measurement tool associated with the smallest price movement any exchange rate makes. Usually, there is four decimal places used to quote currencies.

Euro Drops to 2-Decade Low on Recession Fears

Worries about how the European Central Bank will react also undermined sentiment after Germany's Bundesbank chairman Joachim Nagel lashed out at the ECB's plans to try and protect heavily indebted countries from sharp increases in lending rates.

WikiFX Broker

Latest News

Spotware Unveils cTrader Store, Global Marketplace for Algo Creators

Elderly Trader Loses RM2.1M in WhatsApp Forex Scam

Gigamax Scam: Tracking Key Suspects in RM7 Million Crypto Fraud

Singaporean Arrested in Thailand for 22.4 Million Baht Crypto Scam

Trader Turns $27 Into $52M With PEPE Coin, Breaking Records

ASIC Sues HSBC Australia Over $23M Scam Failures

CFI Partners with MI Cape Town, Cricket Team

Doo Financial Expands Reach with Indonesian Regulatory Licenses

WikiFX Review: Is IQ Option trustworthy?

5 Questions to Ask Yourself Before Taking a Trade

Currency Calculator