Score

X Charter

Belize|1-2 years|

Belize|1-2 years| https://www.xcharterfx.com/en.html

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Belize

BelizeAccount Information

Users who viewed X Charter also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

xcharterfx.com

Server Location

United States

Website Domain Name

xcharterfx.com

Server IP

104.21.89.31

Company Summary

| X Charter | Basic Information |

| Company Name | X Charter |

| Founded | 2009 |

| Headquarters | Belize |

| Regulations | Unregulated |

| Tradable Assets | Forex, indices, commodities, precious metals |

| Account Types | Micro, Standard, Ultra Low, Shares |

| Minimum Deposit | $5 (Micro/Standard/Ultra Low account) |

| $10,000 (Shares account) | |

| Maximum Leverage | 1:1000 |

| Spreads | From 0.6 pips |

| Commission | None (Micro/Standard/Ultra Low account) |

| Yes (Shares account) | |

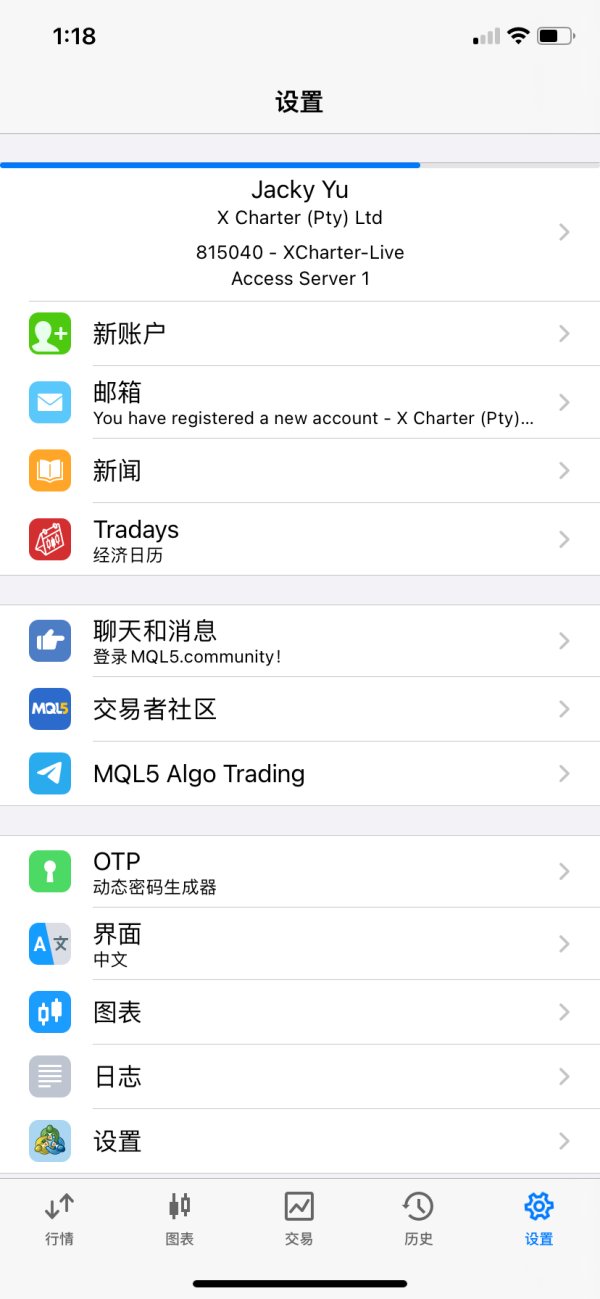

| Trading Platform | MetaTrader 5 (MT5) |

| Payment Methods | Not mentioned |

| Education Resource | Custom automated metrics for VIPs |

| Customer Support | 24/7, email: xcharter3@gmail.com |

X Charter Information

X Charter, established in 2009 and based in Belize, is an unregulated brokerage offering a diverse range of trading instruments, including forex, indices, commodities, and precious metals. X Charter provides traders with four account types, each tailored to different trading needs, with competitive spreads starting from 0.6 pips and leverage up to 1:1000. The broker emphasizes customer support, offering assistance 24/7 via email at xcharter3@gmail.com, and provides exclusive educational resources, including custom automated metrics for VIP subscribers, designed to enhance trading strategies and decision-making.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Is X Charter Legit?

X Charter is unregulated by any authorities like ASIC, or FSA.

Trading Instruments

X Charter offers a broad range of trading instruments including over 50 global currency pairs in forex, major global indices, bulk commodities like sugar, cocoa, and wheat, precious metals such as gold, silver, and palladium, as well as main energy sources including crude oil and natural gas.

Here is a comparison table of trading instruments offered by different brokers:

| Broker | Forex | Metals | Crypto | CFD | Indexes | Stocks | ETFs |

| X Charter | Yes | Yes | No | No | Yes | No | No |

| AMarkets | Yes | Yes | No | Yes | Yes | Yes | No |

| Tickmill | Yes | Yes | Yes | Yes | Yes | Yes | No |

| EXNESS Group | Yes | Yes | Yes | Yes | Yes | Yes | No |

Account Types

X Charter offers four distinct account types:

1. Micro Account: Suitable for small scale traders with contract sizes from 1 lot to 1,000 lots, leverage up to 1:1000, negative balance protection, spreads as low as 1 pip on majors, no commissions, and a minimum deposit of $5.

2. Standard Account: Designed for regular traders, featuring contract sizes from 1 lot to 100,000 lots, leverage up to 1:1000, negative balance protection, low spreads on majors, no commission, and a $5 minimum deposit.

3. X Charter Ultra Low Account: Targeted at traders looking for even lower spreads with contract sizes split between standard (1 lot = 100,000) and micro (0.1 lots), up to 1:1000 leverage, negative balance protection, spreads as low as 0.6 pips, no commissions, and a $5 minimum deposit.

4. Shares Account: Tailored for stock trading with contracts sized per share, no leverage, negative balance protection, commissions on trades, a minimum trade volume of 1 lot, and a higher minimum deposit requirement of $10,000.

All accounts, except for the Shares Account, offer hedging, allow for Islamic account options, and provide swap facilities, with varying restrictions on lot size per ticket.

How to Open an Account?

To open an account with X Charter, follow these steps.

- Visit the X Charter website. Look for the “OPEN AN ACCOUNT” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

X Charter provides leverage up to 1:1000 for its Micro, Standard, and Ultra Low Accounts. The Shares Account does not offer any leverage.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | X Charter | eToro | XM | RoboForex |

| Maximum Leverage | 1:1000 | 1:400 | 1:888 | 1:2000 |

Spreads & Commissions

X Charter offers spreads as low as 1 pip for major currency pairs on Micro and Standard Accounts, and as low as 0.6 pips for the Ultra Low Account. The Shares Account's spreads are based on the underlying exchange. Commissions are absent in Micro, Standard, and Ultra Low Accounts, while the Shares Account does incur a commission.

Trading Platform

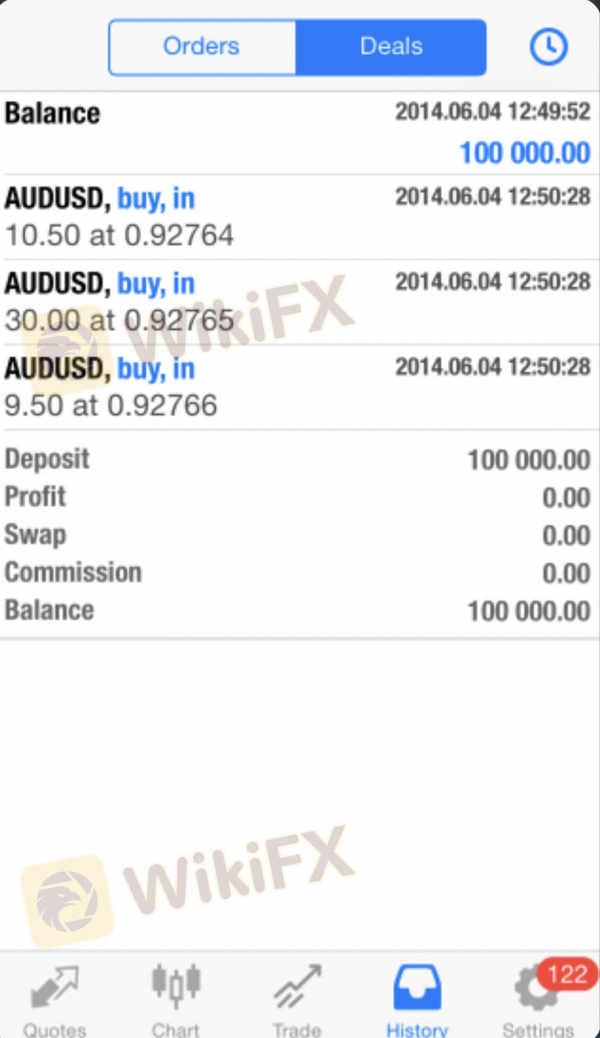

X Charter provides the MetaTrader 5 (MT5) trading platform, which is available on PC and Mac computers, as well as on mobile phones and tablets.

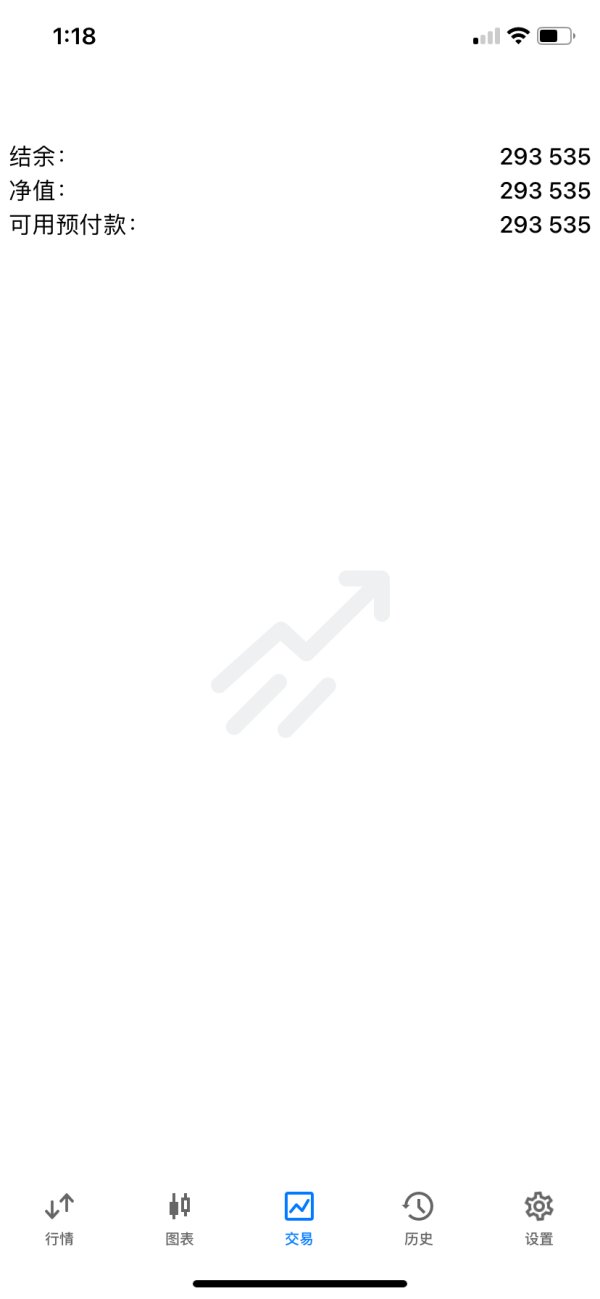

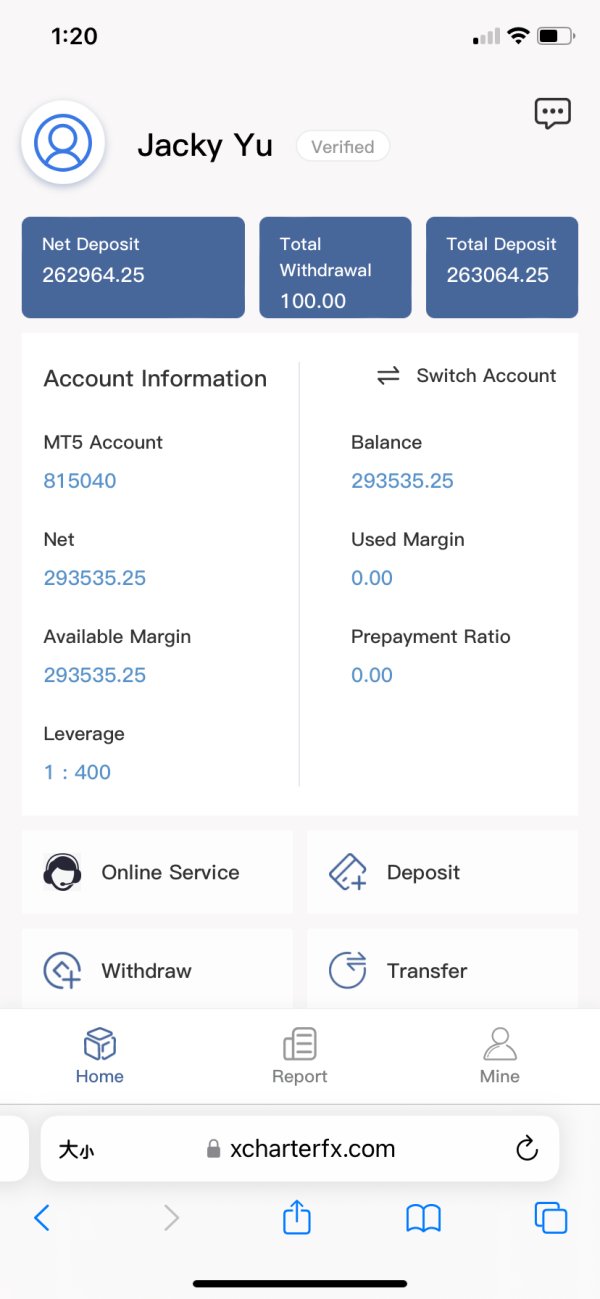

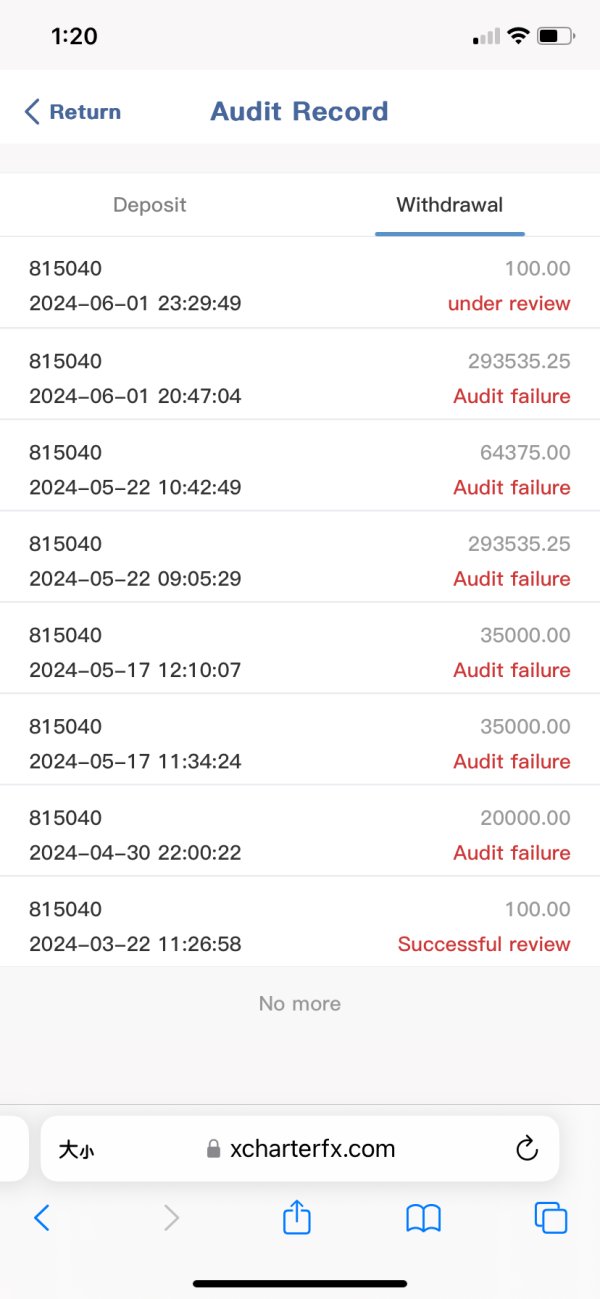

Deposit & Withdrawal

The deposit and withdrawal methods for X Charter are not specific, but the minimum deposit required for starting an account varies: $5 for Micro, Standard, and X Charter Ultra Low Accounts, and $10,000 for a Shares Account.

Customer Support

X Charter provides 24/7 customer support with offline real-time service and can be contacted via email at xcharter3@gmail.com.

Conclusion

In conclusion, X Charter offers a diverse range of trading instruments and is unregulated, which adds a level of credibility. The broker provides 24/7 customer support, catering to the needs of traders globally. However, there are some drawbacks, such as limited information on deposit methods and bonus offerings, as well as a relatively high minimum deposit requirement for the Shares Account. Traders should carefully consider these factors when choosing X Charter as their brokerage.

FAQs

What trading instruments does X Charter offer?

Forex, indices, commodities, and precious metals.

What is the minimum deposit required to open an account with X Charter?

The minimum deposit varies depending on the account type, ranging from $5 to $10,000.

Does X Charter offer bonuses to traders?

There is limited information available on bonus offerings from X Charter.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Jacky4742

Canada

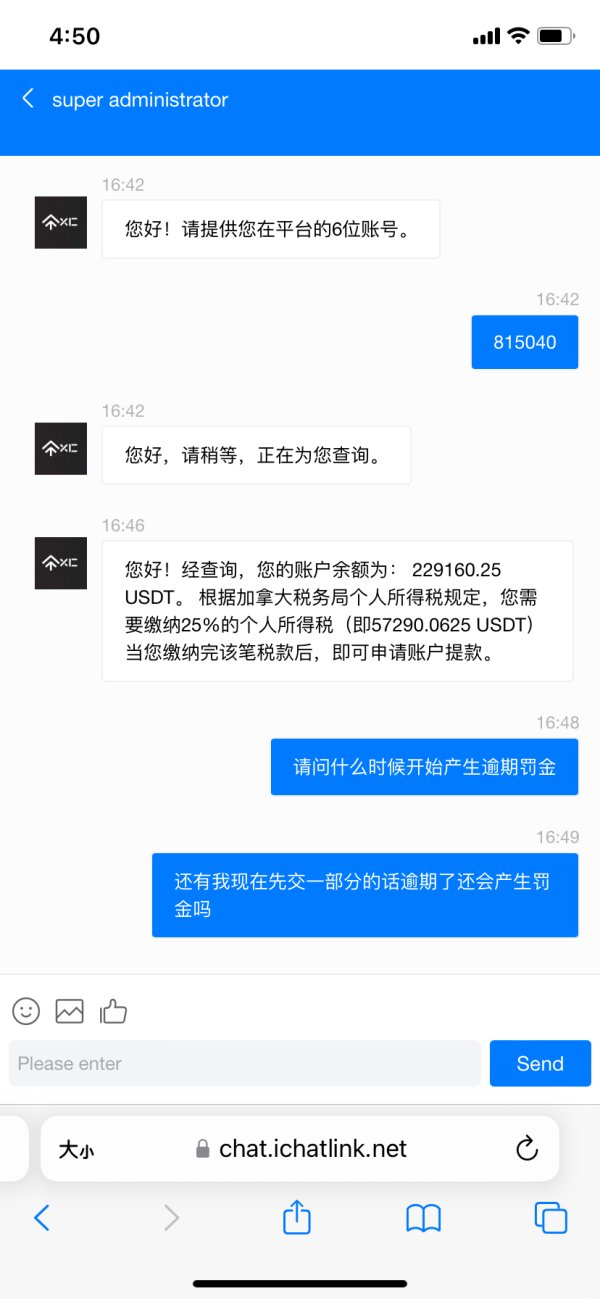

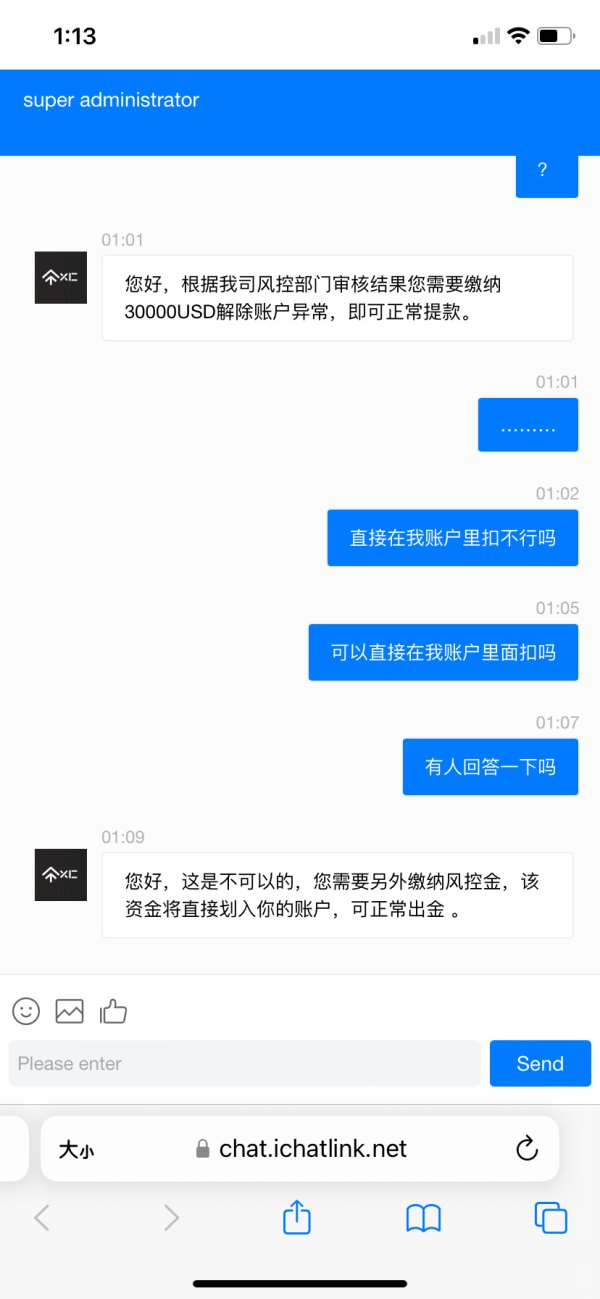

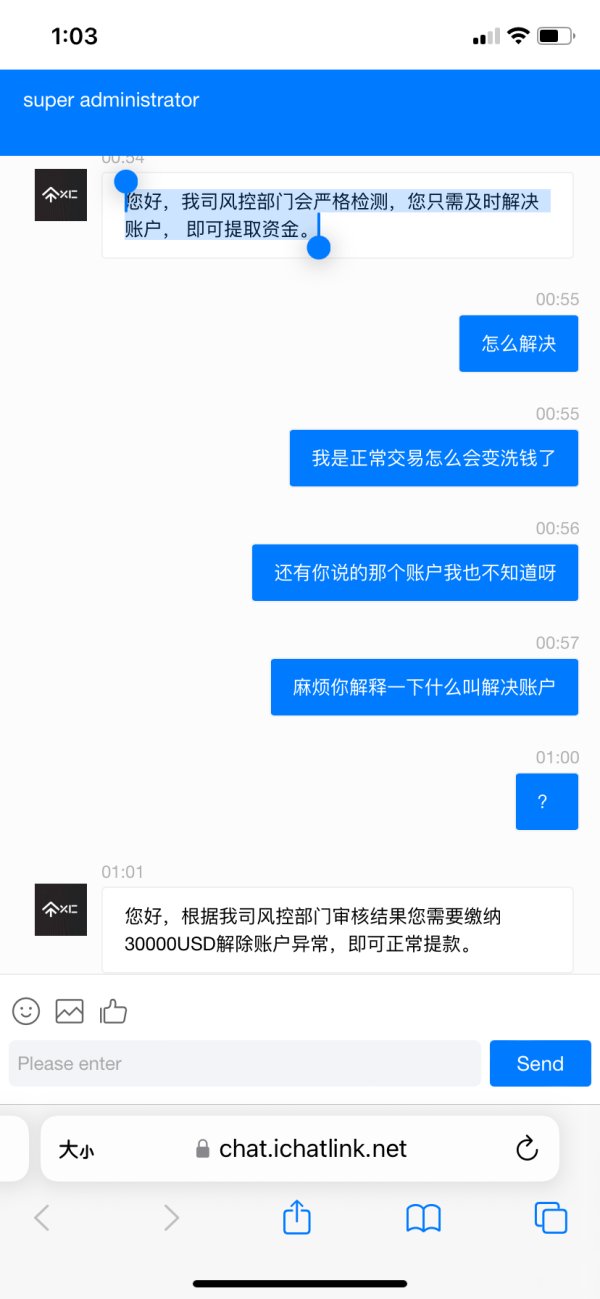

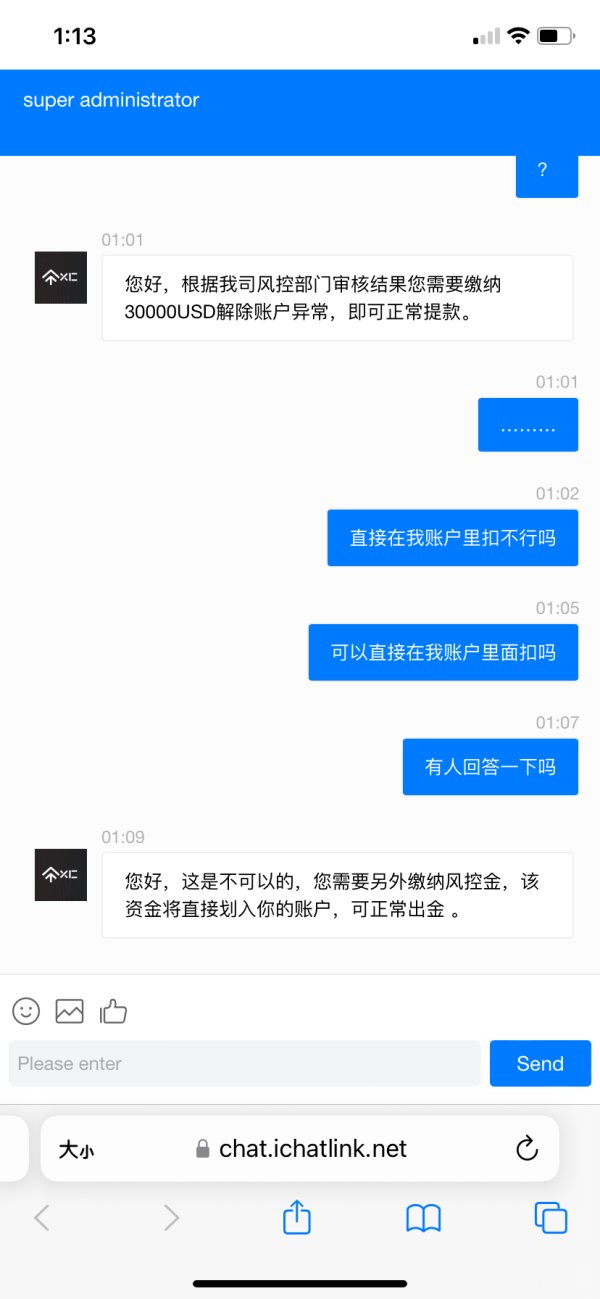

A friend online introduced me to this platform. Since late March, I have gradually invested about $260,000. Including profits, my account has nearly reached $300,000. Initially, I was able to withdraw small amounts without issue. However, when I attempted to make larger withdrawals, the platform started refusing with various excuses, demanding risk control fees, security deposits, and taxes. Now, I can no longer contact that friend. I urgently request the platform's attention and assistance in resolving this matter!

Exposure

07-22

Generation

Malaysia

Fast withdrawals, fast deposit, multiple deposit options including crypto. only problem is most of the time during news release, due to price volatility orders are not filled promptly, other than that, every thing is perfect. very low commission on xauusd and currency pairs, however, i feel commission is slightly higher on indices.

Neutral

08-27

Robins Lu

Singapore

It wasn't bad when I traded with this broker—they had low spreads and great customer service. Later, though, I started to feel more pressure to put in more money. That's not what I earlier thought.

Neutral

08-07

Hugo Moreau

Colombia

Overall, this broker has no big problem. Orders executed quickly and their customer support is great. But the only thing that bothers me is the spreads. I need some stability with those spreads, otherwise it's tough to plan my trades.

Neutral

06-28